Asian Markets

April 18, 2024

New PO Capacity in China

Will Lihuayi Weiyuan Chemical’s New 300ktpa PO Facility Drive Market Prices Downwards?

PUdaily | Updated: April 18, 2024

Lihuayi Weiyuan Chemical Co., Ltd. has recently commenced production of its 300ktpa PO facility, with products passing inspection and now being sold externally. As a crucial extension of the company’s supply chain, the facility uses propylene and hydrogen produced from its propane dehydrogenation unit as raw materials. It maximizes the mutual supply and utilization of raw materials, products, and energy, representing another step in the company’s target of “building, extending, supplementing, and strengthening supply chain”. By enhancing the integrated utilization of materials and heat energy between units, it enables the extension of the industrial chain, further strengthening the chain’s resilience and enhancing the company’s competitiveness.

The start of this large-scale facility by Lihuayi Weiyuan Chemical undoubtedly breaks the current stalemate in Chinese PO market. On April 16, the prevailing offers of PO in Shandong and North China markets stood around CNY 9,050-9,100/tonne EXW in bulk in cash. Those in East China were CNY 9,400-9,500/tonne DEL in bulk in cash. Lihuayi Weiyuan Chemical is offering an ex-factory price of CNY 9,050/tonne, effective from April 16.

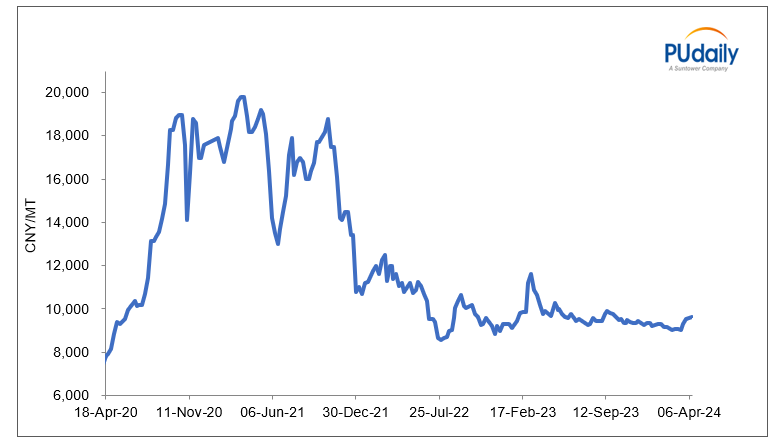

With continuously expanding capacity, China’s PO market is gradually becoming saturated. The additional 300ktpa capacity brought by Lihuayi Weiyuan Chemical further intensifies competition, putting downward pressure on the PO market. Chinese PO prices reached high levels in early 2020, peaking several times at CNY 20,000/tonne. The price increase was largely attributed to China’s growing domestic demand, the expansion of “dual-control” policy and power restrictions, facility maintenance in peripheral countries like Saudi Arabia and Singapore, and force majeure for polyether polyols and PO in the U.S. By the latter half of 2021, China’s downturn in the real estate sector caused PO prices to decline continuously to around CNY 9,000/tonne. The real estate industry, the largest downstream sector for the chemical industry, contributes a significant consumption share. The prosperity or downturn of the real estate sector directly and significantly impacts certain important chemical products. Factors such as the real estate downturn, slower macroeconomic growth, and sluggish industrial activity exert pressure on the PO industry chain.

In 2023, China’s PO capacity reached 6.1mtpa, marking a new high in recent years, according to PUdaily. Lihuayi Weiyuan Chemical’s new 300ktpa PO facility will further aggravate market competition and drive prices downwards.

Figure 2: China PO Price Trend 2022-2024

In general, Lihuayi Weiyuan Chemical’s new 300ktpa PO facility has had a short-term impact on market prices. However, in the long run, it will propel technological advancements and industrial upgrades, injecting new momentum for sustainable industry development. This development serves as a reminder that businesses must innovate continuously and enhance core competencies to secure a strong position in the increasingly competitive market.

April 17, 2024

The Holy Grail (Not Bikes, but Cars, and Not Just Tubes)

Market Prospects of TPU in Bicycle Tire Applications

PUdaily | Updated: April 11, 2024

Whether in terms of weight reduction or rolling resistance, inner tubes are one of the most cost-effective upgradable components on a bicycle. In response to the demands for weight and resistance reduction, TPU has been considered as a material for inner tubes. TPU inner tubes represent a new technological advancement in recent years. In 2020, Schwalbe introduced its Aerothan TPU Tubes, becoming one of the pioneering companies to launch TPU inner tubes. It also marks the official entry of this material into the commercial bicycle sphere.

Currently, the mainstream materials for inner tubes are butyl rubber, latex, and TPU.

Butyl inner tubes are the most widely used standard inner tubes in cycling. Made from elastic polymers, butyl inner tubes offer good stretch and rebound properties and are the most affordable option. Latex inner tubes fall in the mid-range in terms of cost, mostly produced from natural rubber. Latex rubber is more porous than butyl, meaning latex tubes lose air much more quickly. The price of latex tubes is typically 2-3 times that of butyl tubes.

TPU inner tubes are at the cutting edge and also the most expensive. As a flexible plastic, TPU excels in weight reduction. A typical butyl inner tube weighs around 140 grams (actual weight may vary slightly due to size and valve length), while a latex inner tube reduces that weight to approximately 85 grams. As for TPU inner tubes, the weight drops to just 25 grams. This means that the weight difference between two bicycles made of butyl rubber inner tubes and TPU inner tubes can reach up to 230 grams. This is why many professional cyclists opt for TPU inner tubes when competing.

Another obvious difference among different inner tubes is their rolling resistance. It’s found that the rolling resistance of the best butyl inner tubes still consumes about 3 watts more than TPU inner tubes and 4 watts more than latex inner tubes. In long-distance mountain climbing, a bicycle equipped with TPU inner tubes can increase power by 10 watts, equivalent to reducing weight by 2 kilograms.

Another trend nowadays is tubeless tires, which are tires without inner tubes. Compared to traditional clincher tires with inner tubes, tubeless tires have lower rolling resistance and better puncture protection. However, the high maintenance costs, difficulty in component assembly and replacement, and the risk of air leakage or even tire separation still raise concerns.

China’s bicycle output reached around 100 million units in 2023, reflecting a significant growth potential for TPU inner tubes. Furthermore, Aerothan road tires launched by Schwalbe in July 2023, which replace rubber with nylon-coated TPU material in cover tyres, achieve comprehensive upgrade in puncture protection and weight reduction, potentially opening up new applications for TPU in tires.

April 16, 2024

Naptha Price Increases Impact Korean Production Costs

Korean petrochemical industry on alert as naphtha price soars

0

|

| [Graphics by Song Ji-yoon] |

| <이미지를 클릭하시면 크게 보실 수 있습니다> |

South Korea’s petrochemical industry is closely monitoring the developments in the Middle East as the price of petrochemical raw materials could soar further on intensifying tension.

According to the Ministry of Trade, Industry and Energy on Monday, the price of naphtha stood at $717 per ton as of April 5, up 8.3 percent from February.

Naphtha is a key raw material that accounts for a significant portion of the cost of petrochemical products.

The Korean petrochemical industry uses naphtha generated during the oil refining process to produce basic products such as ethylene and propylene.

For ethylene, about 80 percent of the selling price is used to procure naphtha.

The recent upward trend in oil prices has been blamed for the rise in naphtha prices.

According to the Korea International Trade Association, prices of the country’s benchmark Dubai crude reached $90.48 per barrel, marking the highest level since October 2023.

Prices rose by 11.3 percent from the average price of $81.3 in the first quarter of 2024.

Dubai crude oil prices are projected to rise to more than $100 per barrel if the Israel-Hamas conflict escalates.

The Strait of Hormuz, which Iran could blockade, is also a major export route for Saudi Arabia, which accounted for 31 percent of Korea‘s crude oil imports in 2023.

The petrochemical industry is concerned that rising costs will hurt profitability.

“In a supply-driven market, we can pass on cost increases to selling prices to maintain profitability,” said an industry insider. “But now it is the other way around. We are in a situation of oversupply. Any increase in production costs will immediately lead to a deterioration in profitability.”

China has ramped up its production capacity to become self-sufficient in petrochemical products, contributing to a global oversupply of more than 13 million tons over the past three years.

Global production gained 23.2 million tons from 2021 to 2023 while demand added only 10.21 million tons.

이 기사의 카테고리는 언론사의 분류를 따릅니다.

http://news.zumst.com/articles/90048175

April 2, 2024

Rigid Foam Used in LNG Carriers

China’s Accelerated Construction of LNG Carriers and Receiving Terminals Drives Demand for Rigid Foam

PUdaily | Updated: March 29, 2024

4 Carriers Built Simultaneously in the Same Dock in Shanghai, Accelerating Construction of Large LNG Carriers

On March 24, inside the No. 2 dock of the Changxing shipbuilding base at China State Shipbuilding Corp’s Hudong-Zhonghua Shipbuilding (Group) Co., Ltd, four LNG carriers under construction were densely arranged. Two of these carriers were launched on the same day, while the other two were half-floated. Huadong-Zhonghua Shipbuilding is for the first time building four 174,000-cbm liquefied natural gas (LNG) carriers simultaneously in the same dock. This milestone signifies a new record in LNG carrier construction for the company, set to become a regular practice in the future. 2024 is a crucial year for the shipbuilder’s plans to double LNG carrier production capacity. Hudong-Zhonghua currently has more than 50 LNG carriers on order, including more than 30 fifth-generation vessels, with delivery dates stretching until 2028, positioning it as a pioneer in global LNG carrier sector.

Continued Surge in Global Demand for LNG

Global trade in LNG reached 404 million tonnes in 2023, up from 397 million tonnes in 2022, showing a 1.76% year-on-year increase, with tight supplies of LNG constraining growth, according to Shell LNG Outlook 2024. Natural gas demand has already peaked in some regions like Europe, Japan and Australia, but globally is set to continue growing. Shell predicts that global demand for LNG will rise by more than 50% by the year of 2040, reaching around 625-685 million tonnes per year. Looking at the phased growth, China is poised to dominate LNG demand growth this decade as its industry seeks to cut carbon emissions by switching from coal to gas. Over the following decade, declining domestic gas production in parts of South Asia and South-east Asia could drive a surge in demand for LNG as these economies increasingly need fuel for gas-fired power plants or industry. However, countries in South Asia and South-east Asia would need significant investments in gas import infrastructure.

China’s LNG Outputs and Imports Both Grew, with Robust Expansion of LNG Receiving Capacity

As the transition from coal to gas in its industry accelerates and the push for net zero emissions continues, the share of natural gas in China’s energy mix is steadily rising, making China a key driving force for global natural gas industry growth. China’s natural gas output reached 230 billion cubic meters in 2023, maintaining an annual increase of 10 Bcm for seven consecutive years, according to National Energy Administration. In the same year, China’s LNG imports totaled 71.32 million tonnes, a 12.6% year-on-year increase (source: General Administration of Customs of China), surpassing Japan once again to become the world’s largest LNG importer.

On the other hand, China achieved a historical high in newly added LNG receiving capacities. There were six LNG terminals projects, including new and expansion projects, which started operations in 2023, adding a capacity of 18.8mtpa, bringing China’s total LNG receiving capacity to 116mtpa at the end of 2023, with 28 LNG receiving terminals were operational. China is expected to add ten LNG receiving terminals in 2024, most of which are scheduled to commence operations by year-end, raising China’s LNG receiving capacity to 170.29mtpa, an increase of 40.75mtpa from 2023.

Polyurethane Application in LNG

The growth in demand for LNG carriers, onshore LNG storage facilities (such as LNG-FSRUs – Floating Storage and Regasification Units, LNG-FPSOs – Floating Production Storage and Offloading Units), and a series of transportation and storage facilities has boosted the demand for PU insulation materials, especially reinforced PU insulated panels. For example, in the construction of LNG carriers, as shipowners increasingly focus on reducing evaporation to decrease LNG losses, LNG containment systems are transitioning from traditional GTT-NO96 membrane technology to new structures such as NO96-L-03+, MARK-III, and MARK-III Flex. Insulation materials are also transitioning from insulation boxes filled with expanded perlite to fiberglass-reinforced PU panels. Moreover, PU insulation materials are also used in LNG pipelines and storage facilities. The consumption of PU rigid foam in Chinese LNG sector saw a growth of over 30% in 2023, according to PUdaily.

February 25, 2024

Yantai’s Push for Sustainability

Yantai ascends beyond trillion yuan milestone with eye on sustainable innovation

In a landmark achievement for 2023, Yantai’s GDP soared to 1.02 trillion yuan (approximately $141.31 billion), making it the third city in Shandong and the 26th in China to surpass 1 trillion yuan.

The city’s ambitious strategy for acquiring projects has yielded remarkable results, with 485 projects signed into effect and 89 policies implemented in 2023, both record highs. These achievements have notably improved Yantai’s business environment, earning it a spot among the top 10 cities in China in terms of business climate.

Innovation is at the core of Yantai’s economic agenda, with significant investments made in critical sectors like aviation, nuclear power, and marine equipment.

The Yantai Chemical Industrial Park, nestled in the Huang-Bohai New Area, epitomizes the city’s ambition for upscale, sustainable production. The park has outlined an annual investment of 40 billion yuan across 40 city-level industrial projects, all of which have kicked off construction, with 11 billion yuan already invested, providing a strong foundation towards meeting this year’s objectives.

Home to global industrial giants, the park is poised to exceed 200 billion yuan in output within the next five years, highlighting Yantai’s dedication to green, low-carbon development and innovation.

The Wanhua Chemical in Yantai Huang-Bohai New Area. [Photo by Guo Chuanyi for chinadaily.com.cn]

Yantai’s commitment to sustainability is further demonstrated by the Laishan floating photovoltaic power station, China’s first sea-based floating solar power facility. This groundbreaking project, developed by CIMC Raffles, marks a significant leap forward in clean energy, with the capacity to power numerous homes and underscoring Yantai’s leadership in renewable energy innovation.

An aerial view of the “Genghai No 1” marine ranch complex located in the waters of the Laishan district. [Photo by Yu Fengyuan for chinadaily.com.cn]

In Longkou city, there has been a noticeable shift towards high-end manufacturing, as the traditional automotive industry transitions to new energy vehicles and other advanced sectors. The rapid growth of China’s automobile exports is evident in this area, with pure car and truck carriers manufactured at the CIMC Raffles Longkou base recently shipped from Longkou Port to Shenzhen via Yantai. They were carrying over 5,000 domestically produced new energy vehicles destined for Europe.

The shipyard production line of CIMC Raffles is engaged in the manufacturing of pure car and truck carriers. [Photo by Xie Hongyu for chinadaily.com.cn]

Yantai’s industrial strength and innovative spirit position it for continued success, solidifying its status as a leading city both regionally and nationally.

With a vision set on becoming a central city in the Huang-Bohai region by 2035, Yantai is fast-tracking the development of a green, low-carbon, and high-quality development model city, marking a new chapter of ambitious goals and sustainable growth.