Asian Markets

September 7, 2022

Currency Fluctuations

Japan, China On Edge After Record Dollar Surge Sparks “Explosive” Yen Plunge; China’s Yuan Not Far Behind

by Tyler DurdenWednesday, Sep 07, 2022 – 02:04 PM

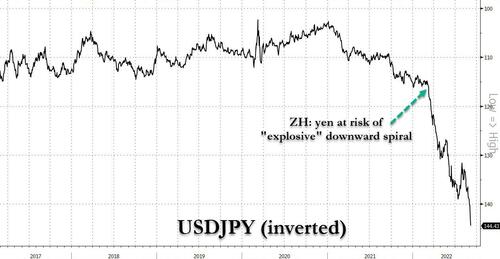

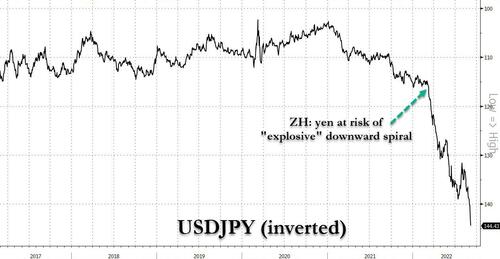

Back in late March, when USDJPY was at 121, we warned that the “Yen Was At Risk Of “Explosive” Downward Spiral With Kuroda Trapped… And Why China May Soon Devalue“, and since then the yen has… well, see for yourselves:

In short, we were right.

Having been in freefall for months, due to the “impossible dilemma” facing the BOJ which can’t have i) a stable currency and ii) yield curve control at the same time, the BOJ has clearly picked an interest rate cap instead of intervening in the yen, and containing the record freefall in the Japanese currency which is set for its worst annual drop on record – the yen this morning plunged as low as 144.99, the lowest level since 1998 and there is no end in sight to the drop.

Furthermore, and just to make it very clear that the BOJ sees nothing wrong with the precipitous drop in the yen which makes Japan seem like a B-grade emerging market, overnight the BOJ said it would buy 550BN yen of 5-10 year bonds at the latest scheduled operation, up from 500BN previously to protect the YCC yield caps; as Goldman notes, “BOJ is really the odd man out in global policy and it seems the market is piling on pressure into the yen ahead of the BOJ meeting at the end of this month.”

To be sure, the ongoing crash in the yen is not exactly shocking and is a result of Japan’s widening yield and policy divergence with the US. Still, the move which could unleash an inflationary shock across the otherwise sleepy, deflationary and demographically doomed islands, has prompted politicians to intervene if only verbally, and overnight, Japan’s top spokesman Hirokazu Matsuno said he was concerned about recent rapid, one-sided moves in yen and the government would need to take necessary action if these movements continue.

“We’re concerned about the rapid and one-sided moves being seen recently in foreign exchange markets,” Matsuno said at a press conference in Tokyo adding that “the government will continue to watch forex market moves with a high sense of urgency, and take necessary responses if this sort of move continues.”

Of course, it’s not just the yen that is getting demolished: with the Bloomberg dollar index hitting another, and another, and another all time high day after day with the Fed clearly oblivious of the impact its supertighte monetary policy is having on the world…

… it was China’s yuan that also got hammered overnight, and with the offshore currency trading just shy of 7.00, it forced the PBOC to scramble and stem the currency depreciation with a yuan fixing that was set at a record 454 pips stronger than the average estimate!

The good news is that as Bloomberg’s Simon Flint notes, the yuan tends to be rather dull after big gaps between offshore levels and the fix. To wit: “historical experience is that the yuan stabilizes after a similarly high premium is hit. Selecting for days with a similar (average) premium, I find 78 individual days when this occurred and more than 20 clusters since Bloomberg started to collect fixing consensus data. The average change in USD/CNH and CNH-CFETS was less than 0.1% one day, five days and 21 days after this premium was hit. It seems like a combination of the PBOC’s ability to pick tops in the dollar (as implied by stability in CFETS) and their resistance to appreciation is sufficient to stop the rot. Furthermore, the maximum range of outcomes over these periods is narrower than the series average. Of course, this episode may not be “average”. PBOC resistance has hit record breaking levels, suggesting a greater disconnect that the premium alone indicates.”

The bad news is that according to Goldman, it is only a matter of time before we trade through 7.00, for one simple reason: the collapse in China’s trade demands it and the export data in particular is a concern as the large trade surplus had been one of the main pushbacks to USDCNH going higher (the August surplus declined to 79.3BN vs 101BN last month). As Goldman concludes, “At this juncture it seems inevitable that China will have to accept a weaker currency to support trade/growth.“

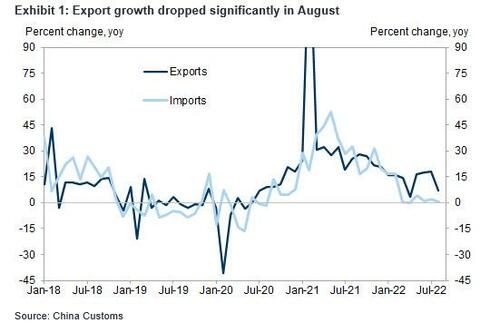

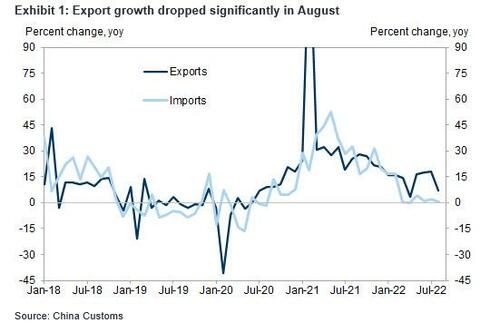

For those who missed it, overnight China reported that export growth slowed more than expected in August, as the entire world careens into a recession. Specifically, China’s export growth dropped to +7.1% Y/Y in August, well below consensus expectations of a 13% increase and a sharp drop from the 18.0% in July. Import growth decelerated to +0.3% Y/Yin August, also missing the consensus estimate of 1.1%, and down from 2.3% in July.

According to Goldman, the large deceleration of year-over-year export growth was partially driven by a high base last August, when the adverse impact from Typhoon In-fa unwound. Trade surplus in August fell to US$79.4bn on weaker-than-expected exports.

That said – when setting the stage for a 7.00 yuan print – Goldman says that it isn’t such a big deal, and explains why:

In Aug 2019, when USDCNY first traded above 7, the PBoC issued comment that “7 is not the age of man”, by which they meant it is not a number from which there is no return. The PBoC has made it clear in the press conference earlier this week that China’s monetary policy is mainly serving domestic purpose and they still have ample room. The RMB weakness is mainly due to USD strength, with RMB outperforming non-USD majors and so far there has not been meaningful spillover impact from currency depreciation on other Chinese assets (SHCOMP has been outperforming SPX of late). Another indicator to look at is onshore 1m risk reversal, which came off the highs. All these suggest there is not much to worry onshore about the PBoC allowing USDCNY to trade above 7.0 amid continued USD strength.

All of the above is why Goldman has shifted its USDCNH target to 7.20 area.

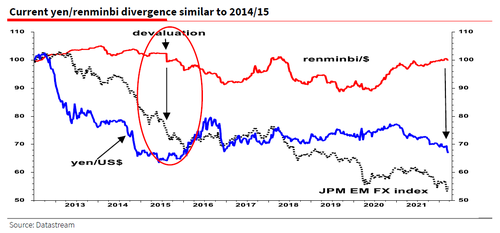

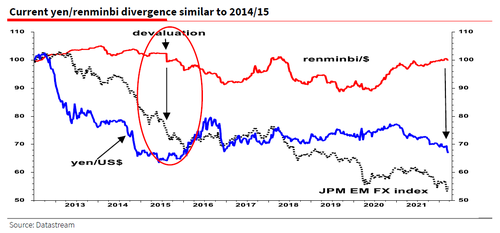

But perhaps an even bigger question is how China will react to the absolute monkeyhammering that the yen has taken in recent months, and as Albert Edwards noted back in March, maybe China will react just like they did in August 2015 when the PBoC devalued: “Back then persistent yen weakness had dragged down other competing regional currencies and left the renminbi overvalued.”

Wait, yen weakness leading to China devaluation? According to Edwards, that indeed was the sequence: as he shows in the chart below, the super weak yen of 2013-15, by driving down other competing Asian currencies, ultimately led us to the August 2015 renminbi devaluation.

Fast forward to today when the aggressive relentless easing by the BoJ – which is terrified of losing control over the JGB curve – comes at a time when the PBoC has resolutely refused to join the global tightening posture and instead is shifting towards an easier stance (after all, China has an imploding property sector it must stabilize at any cost).

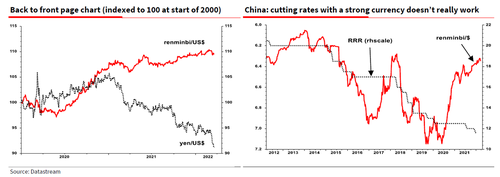

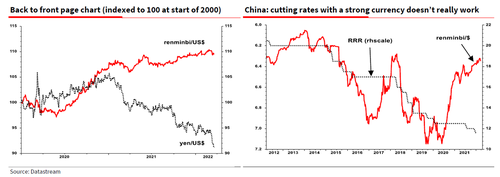

Edwards concluded that the one thing to watch out for, especially in the current febrile geopolitical environment, is if China once again is ‘forced’ to devalue because of the weak yen. Economists will tell you that cutting interest rates or the reserve requirement ratio (RRR- r/h chart below) is neutralized when you have a strong currency.

https://www.zerohedge.com/markets/japan-china-edge-after-record-dollar-surge-sparks-explosive-yen-plunge-chinas-yuan-not-far

September 7, 2022

Currency Fluctuations

Japan, China On Edge After Record Dollar Surge Sparks “Explosive” Yen Plunge; China’s Yuan Not Far Behind

by Tyler DurdenWednesday, Sep 07, 2022 – 02:04 PM

Back in late March, when USDJPY was at 121, we warned that the “Yen Was At Risk Of “Explosive” Downward Spiral With Kuroda Trapped… And Why China May Soon Devalue“, and since then the yen has… well, see for yourselves:

In short, we were right.

Having been in freefall for months, due to the “impossible dilemma” facing the BOJ which can’t have i) a stable currency and ii) yield curve control at the same time, the BOJ has clearly picked an interest rate cap instead of intervening in the yen, and containing the record freefall in the Japanese currency which is set for its worst annual drop on record – the yen this morning plunged as low as 144.99, the lowest level since 1998 and there is no end in sight to the drop.

Furthermore, and just to make it very clear that the BOJ sees nothing wrong with the precipitous drop in the yen which makes Japan seem like a B-grade emerging market, overnight the BOJ said it would buy 550BN yen of 5-10 year bonds at the latest scheduled operation, up from 500BN previously to protect the YCC yield caps; as Goldman notes, “BOJ is really the odd man out in global policy and it seems the market is piling on pressure into the yen ahead of the BOJ meeting at the end of this month.”

To be sure, the ongoing crash in the yen is not exactly shocking and is a result of Japan’s widening yield and policy divergence with the US. Still, the move which could unleash an inflationary shock across the otherwise sleepy, deflationary and demographically doomed islands, has prompted politicians to intervene if only verbally, and overnight, Japan’s top spokesman Hirokazu Matsuno said he was concerned about recent rapid, one-sided moves in yen and the government would need to take necessary action if these movements continue.

“We’re concerned about the rapid and one-sided moves being seen recently in foreign exchange markets,” Matsuno said at a press conference in Tokyo adding that “the government will continue to watch forex market moves with a high sense of urgency, and take necessary responses if this sort of move continues.”

Of course, it’s not just the yen that is getting demolished: with the Bloomberg dollar index hitting another, and another, and another all time high day after day with the Fed clearly oblivious of the impact its supertighte monetary policy is having on the world…

… it was China’s yuan that also got hammered overnight, and with the offshore currency trading just shy of 7.00, it forced the PBOC to scramble and stem the currency depreciation with a yuan fixing that was set at a record 454 pips stronger than the average estimate!

The good news is that as Bloomberg’s Simon Flint notes, the yuan tends to be rather dull after big gaps between offshore levels and the fix. To wit: “historical experience is that the yuan stabilizes after a similarly high premium is hit. Selecting for days with a similar (average) premium, I find 78 individual days when this occurred and more than 20 clusters since Bloomberg started to collect fixing consensus data. The average change in USD/CNH and CNH-CFETS was less than 0.1% one day, five days and 21 days after this premium was hit. It seems like a combination of the PBOC’s ability to pick tops in the dollar (as implied by stability in CFETS) and their resistance to appreciation is sufficient to stop the rot. Furthermore, the maximum range of outcomes over these periods is narrower than the series average. Of course, this episode may not be “average”. PBOC resistance has hit record breaking levels, suggesting a greater disconnect that the premium alone indicates.”

The bad news is that according to Goldman, it is only a matter of time before we trade through 7.00, for one simple reason: the collapse in China’s trade demands it and the export data in particular is a concern as the large trade surplus had been one of the main pushbacks to USDCNH going higher (the August surplus declined to 79.3BN vs 101BN last month). As Goldman concludes, “At this juncture it seems inevitable that China will have to accept a weaker currency to support trade/growth.“

For those who missed it, overnight China reported that export growth slowed more than expected in August, as the entire world careens into a recession. Specifically, China’s export growth dropped to +7.1% Y/Y in August, well below consensus expectations of a 13% increase and a sharp drop from the 18.0% in July. Import growth decelerated to +0.3% Y/Yin August, also missing the consensus estimate of 1.1%, and down from 2.3% in July.

According to Goldman, the large deceleration of year-over-year export growth was partially driven by a high base last August, when the adverse impact from Typhoon In-fa unwound. Trade surplus in August fell to US$79.4bn on weaker-than-expected exports.

That said – when setting the stage for a 7.00 yuan print – Goldman says that it isn’t such a big deal, and explains why:

In Aug 2019, when USDCNY first traded above 7, the PBoC issued comment that “7 is not the age of man”, by which they meant it is not a number from which there is no return. The PBoC has made it clear in the press conference earlier this week that China’s monetary policy is mainly serving domestic purpose and they still have ample room. The RMB weakness is mainly due to USD strength, with RMB outperforming non-USD majors and so far there has not been meaningful spillover impact from currency depreciation on other Chinese assets (SHCOMP has been outperforming SPX of late). Another indicator to look at is onshore 1m risk reversal, which came off the highs. All these suggest there is not much to worry onshore about the PBoC allowing USDCNY to trade above 7.0 amid continued USD strength.

All of the above is why Goldman has shifted its USDCNH target to 7.20 area.

But perhaps an even bigger question is how China will react to the absolute monkeyhammering that the yen has taken in recent months, and as Albert Edwards noted back in March, maybe China will react just like they did in August 2015 when the PBoC devalued: “Back then persistent yen weakness had dragged down other competing regional currencies and left the renminbi overvalued.”

Wait, yen weakness leading to China devaluation? According to Edwards, that indeed was the sequence: as he shows in the chart below, the super weak yen of 2013-15, by driving down other competing Asian currencies, ultimately led us to the August 2015 renminbi devaluation.

Fast forward to today when the aggressive relentless easing by the BoJ – which is terrified of losing control over the JGB curve – comes at a time when the PBoC has resolutely refused to join the global tightening posture and instead is shifting towards an easier stance (after all, China has an imploding property sector it must stabilize at any cost).

Edwards concluded that the one thing to watch out for, especially in the current febrile geopolitical environment, is if China once again is ‘forced’ to devalue because of the weak yen. Economists will tell you that cutting interest rates or the reserve requirement ratio (RRR- r/h chart below) is neutralized when you have a strong currency.

https://www.zerohedge.com/markets/japan-china-edge-after-record-dollar-surge-sparks-explosive-yen-plunge-chinas-yuan-not-far

August 25, 2022

Wanhua Cracker Project

- 25 August, 2022

- Anna Larionova

Wanhua received regulatory approval for cracker project

MOSCOW (MRC) — Wanhua Chemical has obtained approval from Shandong provincial development and reform commission for its No 2 cracker with 1.2m tonne/year capacity and downstream polyolefin project at Yantai, said the company announced.

Major derivatives will include a 250,000 tonnes/year of low-density polyethylene (LDPE) plant, two polyolefin elastomer (POE) units each at 200,000 tonnes/year of capacity, a 200,000 tonne/year butadiene (BD), a 400,000 tonnes/year of aromatics extraction, and a 550,000 tonne/year cracked gasoline hydrogenation plant.

Constructions are estimated to take three years.

The timeline is not revealed.

As per MRC, Wanhua Chemical, a major petrochemical producer in China, says it will spend USD3.6 billion to build a chemical complex in Penglai, China, by 2024. The project’s centerpiece will be a propane dehydrogenation plant (PDH) with 900,000 metric tons per year of capacity. The complex will also make propylene oxide, polyether polyols, ethylene oxide, acrylic acid, polypropylene (PP), and other products.

https://www.mrchub.com/news/403737-wanhua-received-regulatory-approval-for-cracker-project

August 25, 2022

Wanhua Cracker Project

- 25 August, 2022

- Anna Larionova

Wanhua received regulatory approval for cracker project

MOSCOW (MRC) — Wanhua Chemical has obtained approval from Shandong provincial development and reform commission for its No 2 cracker with 1.2m tonne/year capacity and downstream polyolefin project at Yantai, said the company announced.

Major derivatives will include a 250,000 tonnes/year of low-density polyethylene (LDPE) plant, two polyolefin elastomer (POE) units each at 200,000 tonnes/year of capacity, a 200,000 tonne/year butadiene (BD), a 400,000 tonnes/year of aromatics extraction, and a 550,000 tonne/year cracked gasoline hydrogenation plant.

Constructions are estimated to take three years.

The timeline is not revealed.

As per MRC, Wanhua Chemical, a major petrochemical producer in China, says it will spend USD3.6 billion to build a chemical complex in Penglai, China, by 2024. The project’s centerpiece will be a propane dehydrogenation plant (PDH) with 900,000 metric tons per year of capacity. The complex will also make propylene oxide, polyether polyols, ethylene oxide, acrylic acid, polypropylene (PP), and other products.

https://www.mrchub.com/news/403737-wanhua-received-regulatory-approval-for-cracker-project

August 4, 2022

Wanhua Results

Wanhua Chemical posts 23% decrease on H1 profit

MOSCOW (MRC) — China’s Wanhua Chemical said on Friday that its net profit in the first half of 2022 dropped by over 23% amid rising feedstock and energy costs, said the company.

Revenue increased by 31.7% on surging prices and sales. Feedstocks costs rose steeply. In the first six months, average prices of benzene and coal increased by 30% and 52% year on year, respectively. Contract prices of propane and butane were 47% and 54% higher than the same period in previous year.

Polyurethane (PU) sector saw rebounding operating rates and high inventories. Supply and demand were basically balanced, but demand growth slowed down amid rising costs, manufacturing slump and high inflation.

Petrochemicals faced squeezed margins. Prices of oil and gas rallied fast and were highly volatile, major overseas economies suffered from inflation pressure, while domestic downstream consumptions of petrochemicals were curbed or delayed by sporadic outbreaks of COVID-19.

We remind, Wanhua Chemical posted a 49.56% decrease in net profits in the first half of 2021, as sales and prices both took a hit from the coronavirus pandemic. Slump in oil prices also dampened demand and prices of its products.

Prices of pure methylene diphenyl diisocyanate (MDI), its major product, decreased to CNY15,800-CNY18,700 in the first half year from CNY23,700-CNY27,200 in the same period of 2019. Prices of petrochemical products the company makes also recorded a double-digit drop.

https://www.mrchub.com/news/403310-wanhua-chemical-posts-23-percent-decrease-on-h1-profit