Asian Markets

November 8, 2021

Covestro in China

Covestro announces new investment plan during CIIE debut

Zhu Shenshen 13:58 UTC+8, 2021-11-08 China International Import Expo

3 Photos | View Slide Show ›

The Germany-based company Covestro announced a plan to invest in a new manufacturing facility in Shanghai and secured the first deal for renewable attributed MDI (methylene diphenyl diisocyanate) in the Asia-Pacific region, the company said during its debut appearance at the China International Import Expo (CIIE).

MDI can be used in apparel, automotive interior materials, and thermal insulation for refrigeration appliances and buildings.

Covestro plans to build a new plant for polyurethane elastomer systems in Shanghai with an investment of “tens of millions of euros” amid rising global demand, especially in the Asia-Pacific region. The special chemical materials are used in industries from solar power to offshore wind energy and material handling.

The plant is expected to begin operation in 2023 at the Covestro Integrated Site Shanghai, with a total investment of 3.5 billion euros (US$4.04 billion).

“We believe our elastomers and other high-tech materials solutions can contribute to the nation’s sustainable development and carbon neutral ambitions,” Holly Lei, president of Covestro China, said at its CIIE booth.

Lei was also joined by Markus Steilemann, CEO of Covestro, who gave an online speech for CIIE.

During CIIE, Covestro also secured its first commercial order in the Asia Pacific region for a professional polyurethane raw material MDI with Huafon Group.

Covestro also signed partnership agreements at CIIE with universities and researchers including the Shanghai Institute of Organic Chemistry (SIOC) and Tongji University.

http://www.shine.cn/biz/company/2111087825/

October 22, 2021

Wanhua Updates

Wanhua Chemical deploys new high-end chemical materials

Echemi 2021-10-22

01 Strategic cooperation with Hikvision

On October 13, Wanhua Chemical Group Co., Ltd. and Hangzhou Hikvision Digital Technology Co., Ltd. signed a strategic cooperation agreement at the global headquarters of Wanhua Chemical Group in Yantai.

Based on their respective deep accumulations in the industrial and technological fields, the two parties have reached strategic cooperation in the following two aspects:

Research and development of new high-end chemical materials

Wanhua Chemical will continue to cooperate with Hikvision on the structural material upgrade of hardware products.

02 Chemical safety production control

Hikvision regards chemical companies as providing AI-based production assistance, safety control and perception solutions, and using technological integration and innovation to help Wanhua Chemical’s digital and intelligent transformation.

Under the dual carbon goal, China’s chemical industry is in the process of replenishing and strengthening the chain. As a new chemical material company operating globally, Wanhua Chemical can rely on continuous innovation of core technology, industrialized equipment and efficient operation mode to promote the research and development and mass production of new high-end chemical materials, and help the development of high-tech products in structural materials. upgrade.

Green development and artificial intelligence have become important engines for the high-quality development of the chemical industry. The chemical industry is accelerating digitalization and continuously promoting innovation. The Internet of Things + AI has become an important bridge to realize digital transformation. As a builder of full-stack spectrum IoT capabilities and a partner in enterprise digital transformation, Hikvision can help users in the chemical industry realize scene IoT and intelligent perception, reduce the risk of enterprise accidents, and improve the company’s daily security and production safety early warning capabilities .

The cooperation agreement signed by the two parties this time can be said to be very strategic.

02 Jointly with Hillhouse to invest in Shanghai Leju

On October 12, Shanghai Leju Technology Co., Ltd. announced the completion of its B round of over 100 million yuan financing. This round of financing was jointly invested by Wanhua Chemical and Hillhouse Ventures. Leju had previously received Series A financing from Sinopec and Shangnan Group. It is understood that the funds raised by Le Orange in this round of financing will be mainly used for system algorithm research and development, packaging material technology investment and reverse logistics system construction.

Leju was established in 2018 and positioned as a supply chain infrastructure service company based on smart packaging and smart logistics. Leo Orange has products such as Yelopack Le Orange Yunguo, Yelotour Le Orange Yuntu, Yelolife Le Orange Newborn, and Yeloant Le Orange Carbon Ant. Its packaging products are recycled in accordance with national standards, aiming to promote the recycling of plastic products. Protect the natural environment to the limit and save resources.

In the context of the “first year of carbon neutrality” in 2021, Leju provides solutions to help customers achieve carbon neutrality goals and propose effective solutions from the three aspects of intelligence, renewable raw materials, and carbon reduction.

I believe that Wanhua Chemical’s investment in Leju will also help us realize our mission of chemistry and a better life.

03 Expansion of 250,000 tons/year TDI project

On September 23, the Fuzhou Municipal Bureau of Ecology and Environment announced the environmental impact assessment document for Wanhua Chemical (Fujian) Co., Ltd.’s expansion of the 250,000 tons/year TDI project (replacement of the existing 100,000 tons and approved 150,000 tons of TDI capacity).

Introduction to the basic situation of the project

1. Project name: Wanhua Chemical (Fujian) Co., Ltd. expands 250,000 tons/year TDI project;

2. Construction unit: Wanhua Chemical (Fujian) Co., Ltd.;

3. Construction nature: reconstruction;

4. Project construction site: Jiangyin Gangcheng Economic Zone, Fuzhou;

5. Project investment: The total investment of the project is 1927.3779 million yuan;

6. Floor area: The total land area is 62,313 square meters;

7. Estimated construction period: 2 years.

Introduction to the use of TDI

Toluene diisocyanate (TDI) is the basic raw material of polyurethane, which is mainly used to produce flexible polyurethane foam (soft foam, sponge), polyurethane elastomer, coating, adhesive, sealant and elastic polyether. Among them, flexible polyurethane foam, as the traditional consumption field of TDI, is widely used in furniture mattresses, carpets, internal components of vehicles, trains and airplanes, toys, etc., accounting for more than 70% of the total TDI consumption. Different raw materials used and changes in formula can be made into soft, semi-rigid polyurethane foam and other varieties.

In less than a month, Wanhua Chemical can be said to be constantly moving in different fields. Regardless of whether it is cooperation, investment or expansion, I believe Wanhua Chemical is a comprehensive consideration of integrating its own development into the development trend of the times.

October 22, 2021

Wanhua Updates

Wanhua Chemical deploys new high-end chemical materials

Echemi 2021-10-22

01 Strategic cooperation with Hikvision

On October 13, Wanhua Chemical Group Co., Ltd. and Hangzhou Hikvision Digital Technology Co., Ltd. signed a strategic cooperation agreement at the global headquarters of Wanhua Chemical Group in Yantai.

Based on their respective deep accumulations in the industrial and technological fields, the two parties have reached strategic cooperation in the following two aspects:

Research and development of new high-end chemical materials

Wanhua Chemical will continue to cooperate with Hikvision on the structural material upgrade of hardware products.

02 Chemical safety production control

Hikvision regards chemical companies as providing AI-based production assistance, safety control and perception solutions, and using technological integration and innovation to help Wanhua Chemical’s digital and intelligent transformation.

Under the dual carbon goal, China’s chemical industry is in the process of replenishing and strengthening the chain. As a new chemical material company operating globally, Wanhua Chemical can rely on continuous innovation of core technology, industrialized equipment and efficient operation mode to promote the research and development and mass production of new high-end chemical materials, and help the development of high-tech products in structural materials. upgrade.

Green development and artificial intelligence have become important engines for the high-quality development of the chemical industry. The chemical industry is accelerating digitalization and continuously promoting innovation. The Internet of Things + AI has become an important bridge to realize digital transformation. As a builder of full-stack spectrum IoT capabilities and a partner in enterprise digital transformation, Hikvision can help users in the chemical industry realize scene IoT and intelligent perception, reduce the risk of enterprise accidents, and improve the company’s daily security and production safety early warning capabilities .

The cooperation agreement signed by the two parties this time can be said to be very strategic.

02 Jointly with Hillhouse to invest in Shanghai Leju

On October 12, Shanghai Leju Technology Co., Ltd. announced the completion of its B round of over 100 million yuan financing. This round of financing was jointly invested by Wanhua Chemical and Hillhouse Ventures. Leju had previously received Series A financing from Sinopec and Shangnan Group. It is understood that the funds raised by Le Orange in this round of financing will be mainly used for system algorithm research and development, packaging material technology investment and reverse logistics system construction.

Leju was established in 2018 and positioned as a supply chain infrastructure service company based on smart packaging and smart logistics. Leo Orange has products such as Yelopack Le Orange Yunguo, Yelotour Le Orange Yuntu, Yelolife Le Orange Newborn, and Yeloant Le Orange Carbon Ant. Its packaging products are recycled in accordance with national standards, aiming to promote the recycling of plastic products. Protect the natural environment to the limit and save resources.

In the context of the “first year of carbon neutrality” in 2021, Leju provides solutions to help customers achieve carbon neutrality goals and propose effective solutions from the three aspects of intelligence, renewable raw materials, and carbon reduction.

I believe that Wanhua Chemical’s investment in Leju will also help us realize our mission of chemistry and a better life.

03 Expansion of 250,000 tons/year TDI project

On September 23, the Fuzhou Municipal Bureau of Ecology and Environment announced the environmental impact assessment document for Wanhua Chemical (Fujian) Co., Ltd.’s expansion of the 250,000 tons/year TDI project (replacement of the existing 100,000 tons and approved 150,000 tons of TDI capacity).

Introduction to the basic situation of the project

1. Project name: Wanhua Chemical (Fujian) Co., Ltd. expands 250,000 tons/year TDI project;

2. Construction unit: Wanhua Chemical (Fujian) Co., Ltd.;

3. Construction nature: reconstruction;

4. Project construction site: Jiangyin Gangcheng Economic Zone, Fuzhou;

5. Project investment: The total investment of the project is 1927.3779 million yuan;

6. Floor area: The total land area is 62,313 square meters;

7. Estimated construction period: 2 years.

Introduction to the use of TDI

Toluene diisocyanate (TDI) is the basic raw material of polyurethane, which is mainly used to produce flexible polyurethane foam (soft foam, sponge), polyurethane elastomer, coating, adhesive, sealant and elastic polyether. Among them, flexible polyurethane foam, as the traditional consumption field of TDI, is widely used in furniture mattresses, carpets, internal components of vehicles, trains and airplanes, toys, etc., accounting for more than 70% of the total TDI consumption. Different raw materials used and changes in formula can be made into soft, semi-rigid polyurethane foam and other varieties.

In less than a month, Wanhua Chemical can be said to be constantly moving in different fields. Regardless of whether it is cooperation, investment or expansion, I believe Wanhua Chemical is a comprehensive consideration of integrating its own development into the development trend of the times.

October 21, 2021

China Conundrum

No Surprises in China’s Slowdown

Q3 GDP growth was largely in line with long-running trends.

By Fisher Investments Editorial Staff, 10/18/2021 Share

Chinese GDP growth slowed to 4.9% y/y in Q3, with most pundits agreeing the problems at Evergrande and associated real estate woes, combined with September’s electricity shortage, took a big bite out of the economy. While we agree those issues did have some negative effects, most of today’s coverage overstated them and ignored a simple but important point: Q3’s growth rate is right in line with the long-running trend. In our view, that makes these results a return to pre-pandemic normal, not a sign of sudden big problems in the world’s second-largest economy—a fine backdrop for stocks.

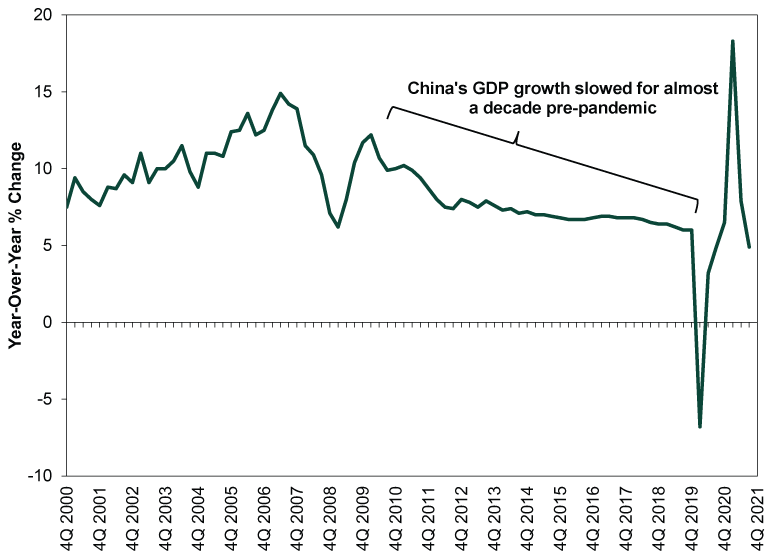

Also lost in most coverage: Chinese GDP is so far on track to meet the government’s full-year target of at least 6%, as it is up 9.8% year to date from 2020’s first three quarters.[i] Obviously there is some COVID skew there, but according to China’s National Bureau of Statistics’ (NBS) press release, the compound growth rate over the past two years is 5.2%.[ii] That is very much in line with pre-pandemic growth rates. So is Q3’s 4.9% growth, as Exhibit 1 shows—it largely extends the decade-long slowdown from the double-digit growth rates of old.

Exhibit 1: Slowing Growth Is the Norm in China

Source: FactSet, as of 10/18/2021.

Much of the sour sentiment today stemmed not from the headline GDP figure, but from September data—specifically industrial production and real estate. The former slowed to 3.1% y/y, the lowest rate since last year’s lockdowns, which pundits interpreted as a sign that the energy crunch is taking a big toll on factories.[iii] Yet slow growth isn’t contraction. Take this with a grain of salt or two, as the accuracy of seasonal adjustments is an open question, but industrial production was about flat month-over-month (up 0.05%, according to the NBS).[iv] Even if reality was a bit worse than that, it doesn’t point to electricity shortages sucker punching heavy industry. Rather, it points to the sector overall doing what it could in the face of a stiff headwind.

Reading into any one month as a sign of things to come is generally an error, but we think that is especially true of September’s industrial production. The electricity crunch is a one-off negative, not a permanent state. Over the past several days, the government has taken a number of steps to ease the electricity shortage, including easing price controls and beefing up coal production. That suggests the power shortage should ease sooner rather than later, giving factories a shot in the arm.

In our view, reading too much into September’s real estate data is similarly shortsighted. Yes, home sales fell -16.9% y/y in the month.[v] But is that any wonder, what with uncertainty over Evergrande and other property developers weighing on sentiment? And with regulators directing banks to restrict credit for developers and home buyers? Those restrictions are already easing, which should help sales stabilize looking forward. Plus, even with the late-summer swoon, home sales are up a whopping 17.8% year to date through September versus 2020’s first 9 months.[vi] Meanwhile, residential real estate investment fell a much milder -1.6% y/y in the month and is up 10.9% year to date.[vii] Here too, we wouldn’t read into one month, but the sharp divide between September’s sales and investment activity shows Evergrande’s woes aren’t representative of the property sector as a whole. The central bank’s recent measures easing liquidity for property developers should further support stability.

At a philosophical level, we think the heightened focus on heavy industry and real estate shows that the West broadly has an inaccurate view of China’s economy. Several outlets have claimed real estate is responsible for 29% of Chinese GDP, which they calculate by folding in furniture sales, construction and anything tangentially related to the sale of a home. In our view, all the assumptions folded into that figure are debatable, making it more accurate to look at pure real estate only. That figure—real estate, renting and leasing activities—was just north of 10% of GDP pre-pandemic, which is bigger than the US but not the driving economic force.[viii] Even if you fold construction into that—which includes a lot of things unrelated to residential and commercial real estate—you wind up at 17%, not nearly 30%.

Similarly, while manufacturing is more important economically in China than in more developed countries, it was still only about 39% of pre-pandemic GDP.[ix] Services, which gets far less attention, now generates the majority of Chinese GDP—53.1% pre-pandemic and in 2020.

China’s economy isn’t in perfect shape, but last we checked, no economy in the history of the world was ever perfect. All economies have pockets of strength and weakness at any given time. China’s weaker pockets are getting all the attention right now, but the stronger areas are more than offsetting them and helping the world’s second-largest economy continue adding to global GDP. That is a just-fine economic environment for stocks globally, in our view.

https://www.fisherinvestments.com/en-us/marketminder/no-surprises-in-chinas-slowdown

October 21, 2021

China Conundrum

No Surprises in China’s Slowdown

Q3 GDP growth was largely in line with long-running trends.

By Fisher Investments Editorial Staff, 10/18/2021 Share

Chinese GDP growth slowed to 4.9% y/y in Q3, with most pundits agreeing the problems at Evergrande and associated real estate woes, combined with September’s electricity shortage, took a big bite out of the economy. While we agree those issues did have some negative effects, most of today’s coverage overstated them and ignored a simple but important point: Q3’s growth rate is right in line with the long-running trend. In our view, that makes these results a return to pre-pandemic normal, not a sign of sudden big problems in the world’s second-largest economy—a fine backdrop for stocks.

Also lost in most coverage: Chinese GDP is so far on track to meet the government’s full-year target of at least 6%, as it is up 9.8% year to date from 2020’s first three quarters.[i] Obviously there is some COVID skew there, but according to China’s National Bureau of Statistics’ (NBS) press release, the compound growth rate over the past two years is 5.2%.[ii] That is very much in line with pre-pandemic growth rates. So is Q3’s 4.9% growth, as Exhibit 1 shows—it largely extends the decade-long slowdown from the double-digit growth rates of old.

Exhibit 1: Slowing Growth Is the Norm in China

Source: FactSet, as of 10/18/2021.

Much of the sour sentiment today stemmed not from the headline GDP figure, but from September data—specifically industrial production and real estate. The former slowed to 3.1% y/y, the lowest rate since last year’s lockdowns, which pundits interpreted as a sign that the energy crunch is taking a big toll on factories.[iii] Yet slow growth isn’t contraction. Take this with a grain of salt or two, as the accuracy of seasonal adjustments is an open question, but industrial production was about flat month-over-month (up 0.05%, according to the NBS).[iv] Even if reality was a bit worse than that, it doesn’t point to electricity shortages sucker punching heavy industry. Rather, it points to the sector overall doing what it could in the face of a stiff headwind.

Reading into any one month as a sign of things to come is generally an error, but we think that is especially true of September’s industrial production. The electricity crunch is a one-off negative, not a permanent state. Over the past several days, the government has taken a number of steps to ease the electricity shortage, including easing price controls and beefing up coal production. That suggests the power shortage should ease sooner rather than later, giving factories a shot in the arm.

In our view, reading too much into September’s real estate data is similarly shortsighted. Yes, home sales fell -16.9% y/y in the month.[v] But is that any wonder, what with uncertainty over Evergrande and other property developers weighing on sentiment? And with regulators directing banks to restrict credit for developers and home buyers? Those restrictions are already easing, which should help sales stabilize looking forward. Plus, even with the late-summer swoon, home sales are up a whopping 17.8% year to date through September versus 2020’s first 9 months.[vi] Meanwhile, residential real estate investment fell a much milder -1.6% y/y in the month and is up 10.9% year to date.[vii] Here too, we wouldn’t read into one month, but the sharp divide between September’s sales and investment activity shows Evergrande’s woes aren’t representative of the property sector as a whole. The central bank’s recent measures easing liquidity for property developers should further support stability.

At a philosophical level, we think the heightened focus on heavy industry and real estate shows that the West broadly has an inaccurate view of China’s economy. Several outlets have claimed real estate is responsible for 29% of Chinese GDP, which they calculate by folding in furniture sales, construction and anything tangentially related to the sale of a home. In our view, all the assumptions folded into that figure are debatable, making it more accurate to look at pure real estate only. That figure—real estate, renting and leasing activities—was just north of 10% of GDP pre-pandemic, which is bigger than the US but not the driving economic force.[viii] Even if you fold construction into that—which includes a lot of things unrelated to residential and commercial real estate—you wind up at 17%, not nearly 30%.

Similarly, while manufacturing is more important economically in China than in more developed countries, it was still only about 39% of pre-pandemic GDP.[ix] Services, which gets far less attention, now generates the majority of Chinese GDP—53.1% pre-pandemic and in 2020.

China’s economy isn’t in perfect shape, but last we checked, no economy in the history of the world was ever perfect. All economies have pockets of strength and weakness at any given time. China’s weaker pockets are getting all the attention right now, but the stronger areas are more than offsetting them and helping the world’s second-largest economy continue adding to global GDP. That is a just-fine economic environment for stocks globally, in our view.

https://www.fisherinvestments.com/en-us/marketminder/no-surprises-in-chinas-slowdown