Asian Markets

October 16, 2023

TDI in China

TDI Market is Poised to Take Off Amidst Intensive Maintenance Plans

PUdaily | Updated: October 13, 2023

Not long after the restart of Wanhua Chemical’s facility in Yantai, several TDI facilities have started or are about to undergo maintenance. The maintenance plans of TDI suppliers in the fourth quarter of this year are intensively scheduled.

Table 1: Recent TDI Facility Maintenance Plans in China and South Korea

| Juli Chemical | Maintenance started on September 25, expected to last about 40 days. |

| Wanhua Chemical | Rumored to start maintenance on October 6, expected to last about 15 days. |

| Yinguang Chemical | Temporary shutdown for maintenance on October 9. |

| Hanwha | Maintenance started on October 13, expected to last about 25 days. |

| Cangzhou Dahua | Maintenance scheduled to start on October 20, expected to last for 1 month. |

| Covestro Shanghai | Maintenance to start in mid-November, expected to last about 40 days. |

| BASF Korea | Maintenance to start on November 17, expected to last about 25 days. |

Although TDI suppliers have typically concentrated their maintenance plans in the fourth quarter in previous years, this year the maintenance at Wanhua Chemical and Yinguang Chemical have exceeded industry expectations, and Cangzhou Dahua did not undergo maintenance last year. The maintenance duration of the facilities at Juli Chemical and Covestro is also longer than in previous years.

Amidst the contradiction between intensive maintenance plans and the recovery of demand, TDI suppliers, especially Covestro, have frequently raised their guide prices:

- On October 7, Covestro raised its opening price for October and only offered 50% of supplies to distributors in November, while providing 80% to direct customers.

- On October 8, Covestro stopped trading due to strong demand and extremely low inventory.

- On October 9, the price offered by the North China plant was raised to CNY 20,000/tonne. Covestro raised its fixed price to CNY 19,200/tonne.

- As of the latest update on October 11, Covestro has stopped trading again due to tight supply…

Looking back at October last year, the price of TDI surged from CNY 19,000/tonne to surpass CNY 26,000/tonne due to tight supply. And in the same period this year, with the same supply significantly reduced, the price level remains the same… Stay tuned for the subsequent market trend!

October 12, 2023

Shell Fire at Singapore POSM Plant

Shell’s Singapore Petrochemical Unit Puts Out Fire; Styrene Impact Likely — OPIS Update

Provided by Dow Jones

Oct 11, 2023 9:39 AM EDT

Singapore’s Shell Jurong Island (SJI) has extinguished a fire that broke out at one of its petrochemical unit manufacturing site on Jurong Island, according to market sources.

The fire occurred at around 3:00 hours Singapore time on Oct.10 and was extinguished with no reported casualties, according to the source.

Market sources said that the fire would most likely impact Shell’s styrene monomer (SM) production.

“The specific impact of the styrene plant is still being evaluated by Shell. We will have to wait and see how serious the damages are,” said a China-based SM broker.

A Shell spokesperson confirmed the incident and said no injuries were reported.

“Our emergency response team is currently monitoring the situation closely. Safety is a key priority to Shell,” the spokesperson said.

At its site, SJI can produce a total of 1,040 million metric ton (mt) per year of SM and 490,000 mt/year propylene oxide (PO) between its two POSM lines, according to its website.

Operations at Shell’s cracker on the same site do not appear to have been disrupted, sources said.

“Besides PO and SM, there should be no disruption to the other chemical production,” added the SM broker.

This content was created by Oil Price Information Service, which is operated by Dow Jones & Co. OPIS is run independently from Dow Jones Newswires and The Wall Street Journal.

–Reporting by Hazel Kumari, hkumari@opisnet.com; Editing by Hanwei Wu, hwu@opisnet.com

October 10, 2023

Chinese PMDI Import and Export Flows

China PMDI Import & Export in August 2023

PUdaily | Updated: October 5, 2023

PMDI Export

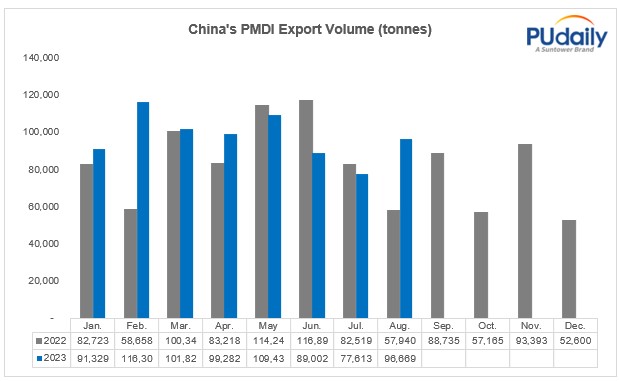

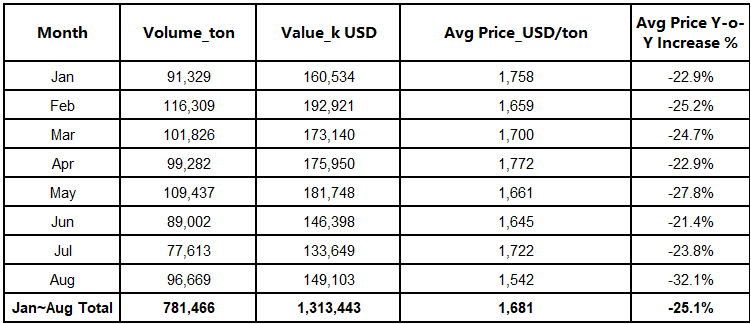

According to China customs data, in August 2023, China’s polymeric MDI exports were 96,700 tons, down 12.8% from the previous month and up 24.6% year-on-year. From January to August 2023, China’s polymeric MDI accumulated exports of 781,500 tons, compared with January to August last year, an increase of 12.2%.

Average export price:

The average export price of polymeric MDI in August was US $1,542/ton, down 32.1% year-on-year, the decline widened.

Table: China’s polymeric MDI export volume and average export price from January to August 2023

From January to August, the United States was the largest export destination of China’s polymeric MDI, and the cumulative PMDI export volume from China to the United States was 184 thousand tons, an increase of 8.4%. In August, PMDI export from China to the United States were 22.5 thousand tons, up 77.3% year-on-year and up 22.6% month-on-month. Secondly, the main destinations of China’s polymeric MDI from January to August are Russia, the Netherlands, Belgium and Turkey.

PMDI Import

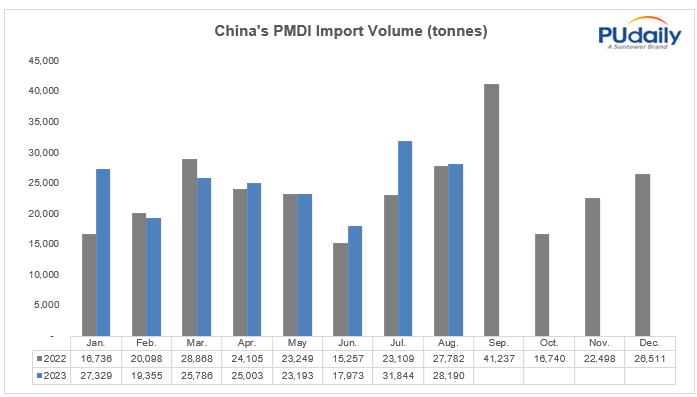

According to China customs data, in August 2023, China’s polymeric MDI (including crude MDI) imports of 28.2 thousand tons, down 11.5% month-on-month, an increase of 66.8%. From January to August 2023, China’s aggregate MDI cumulative imports of 199 thousand tons, compared with January to August last year, an increase of 10.9%.

In August, China imported 8,238 tons of polymeric MDI from the Netherlands and 7,004 tons of polymeric MDI from Saudi Arabia. The polymeric MDI and crude MDI imported from Japan was 6,885 tons, and the 200 ktpa MDI facility of Tosoh Japan has shut down for maintenance from early September, so their supply to China market was tight again.

October 5, 2023

Tosoh Plans MDI Splitter in Vietnam

Japan’s Tosoh to build MDI splitter in Vietnam

Published date: 02 October 2023

Japanese petrochemical producer Tosoh plans to build a methylene diphenyl diisocyanate (MDI) splitter in south Vietnam’s Ba Ria–Vung Tau province, targeting to begin commercial operations by October 2026.

Tosoh plans to operate the splitter, which will have manufacturing capacity of 100,000 t/yr of monomeric and polymeric MDIs, using crude MDI as a feedstock. MDI is used as feedstock to produce polyurethane. It aims to start construction from November 2024 and complete the splitter by June 2026.

The company will bring the crude MDI from Japan to the splitter in Vietnam. Tosoh produces 400,000 t/yr of crude MDI at its Nanyo plant in south Japan’s Yamaguchi prefecture.

Tosoh has an 85,000 t/yr splitter in China and another at its Nanyo plant of undisclosed output capacity, although its said annual production is 400,000t. Its MDI production will be unchanged even after the launch of the Vietnamese splitter, as Tosoh plans to modify manufacturing in Japan and China based on demand.

It also plans to set up a wholly-owned subsidiary Tosoh Vietnam Polyurethane by January next year to enhance MDI sales in southeast Asia.

By Nanami Oki

September 28, 2023

HPPO Propylene Oxide Process Issues

Frequent Explosion Accidents: What are the Dangers of Hydrogen Peroxide?

PUdaily | Updated: September 21, 2023

Following the explosion occurred at the hydrogen peroxide production area of Luxi Chemical, a subsidiary of Sinochem Holdings, on May 1, which resulted in 9 deaths, 1 injury, and 1 person missing, another explosion occurred in the hydrogen peroxide workshop at Risun Chemical on September 14. It is the second major hydrogen peroxide accident that has occurred within China in 2023.

Why is hydrogen peroxide so dangerous?

Electrolysis, anthraquinone (AQ), isopropanol oxidation, electrochemical cathode reduction of oxygen, and auto-oxidation (AO) are commonly used in the production of hydrogen peroxide. The AQ method is currently the most mature method, and over 99% of hydrogen peroxide plants in China use this technology. The AQ process for hydrogen peroxide production has a high hazard coefficient. It involves using hazardous raw materials and going through hazardous processes to produce a hazardous product.

The first reaction in the production process of hydrogen peroxide, namely hydrogenation, is a hazardous chemical process that is subject to strict regulation. It has the following hazardous characteristics: (a) The reactants have explosiveness, and the explosion limit of hydrogen gas is 4-75%, making it highly flammable and explosive. (b) Hydrogenation is an exothermic reaction, and when hydrogen gas comes into contact with steel under high temperature and pressure, carbon molecules in the steel can react with hydrogen gas to form hydrocarbons, reducing the strength of the steel equipment and causing hydrogen embrittlement. (c) The regeneration and activation of catalysts can easily cause explosions. (d) The exhaust gas from the hydrogenation reaction contains unreacted hydrogen gas and other impurities, which can easily cause ignition or explosion during discharge. The second reaction in the hydrogen peroxide production – oxidation – is also a hazardous chemical process that is subject to strict regulation. It’s hazardous because that the peroxidation process has a strong risk of decomposition and explosion due to the presence of peroxide groups (-O-O-).

Hydrogen peroxide is currently an important raw material for the production of propylene oxide. The concentration of hydrogen peroxide products in China is mainly 27.5%. However, in recent years, there has been an increasing demand for high concentration products (>50%), as the use of high concentration hydrogen peroxide can effectively improve the production efficiency and product quality. The HPPO process often uses hydrogen peroxide with a concentration of 50% to 70%.

Currently, the key players in China’s HPPO-based propylene oxide industry are Jilin Shenhua and Sinopec Changling. In 2011, Jilin Shenhua introduced HPPO technology from Degussa and Uhde, with an investment of CNY 2.5 billion, and built the first and largest HPPO plant in China with a scheduled capacity of 300 ktpa. The plant started operations in July 2014. In 2013, Sinopec planned to adopt independently developed HPPO technology and invested about CNY 1.28 billion to build a 100 ktpa industrial plant at the company’s Changling Branch. The plant was completed in July 2014, and successful trial operation was conducted on December 6 of the same year. This marked Sinopec as the third company in the world to own the patent for producing propylene oxide using hydrogen peroxide technology, breaking the monopoly of foreign countries on this technology.

In addition to the aforementioned two producers, Taixing Yida Chemical (independent R&D), Qixiang Tengda (authorized by Evonik and ThyssenKrupp Uhde), Jincheng Petrochemical (independently developed by China Tianchen Engineering), and Jiahong New Material (using the process owned by China Catalyst Holding Co., Ltd) have also successfully operated their HPPO facilities in recent years. The current production capacity of HPPO (Hydrogen Peroxide to Propylene Oxide) plants in China has reached 1.55 mtpa.

However, the current stability of HPPO facilities is poor, with frequent shutdowns and maintenance issues. Although there are many newly completed or planned HPPO projects, there are still significant uncertainties and obstacles. The main reasons are as follows:

1) Inadequate hydrogen peroxide supply: Due to its unstable and highly explosive nature, hydrogen peroxide cannot be transported over long distances. It has a limited sales radius (300-500 km). Currently, hydrogen peroxide production in China is mainly concentrated in East China (63%), North China (6%), and Central China (14%), primarily located in chemical-intensive provinces such as Shandong, Hubei, Jiangsu, and Zhejiang. Southwest (4%), northwest (2%), and northeast (6%) regions have minimal production capacity, resulting in an imbalance between production layout and market size. On one hand, in some areas with concentrated downstream industries, there is a supply shortage of hydrogen peroxide, resulting in high transportation costs. On the other hand, some regions have excessive production facilities, with capacity far exceeding demand. Therefore, the issue of hydrogen peroxide supply needs to be addressed. The construction of new hydrogen peroxide plants requires sufficient hydrogen resources and faces difficulties in approval due to the classification of hydrogen peroxide as a hazardous chemical.

2) The production requires high-concentration hydrogen peroxide, while the preparation of high-concentration hydrogen peroxide presents certain difficulties. Currently, in Jilin Shenhua’s plant, the required 70% hydrogen peroxide is supplied by Evonik. The high cost leads to poor profitability of the plant.

3) In the HPPO process, hydrogen peroxide has high activity and can produce some aldehyde impurities during the production process, which can have an impact on downstream production.