Company News

April 4, 2024

Arsenal Exits Seal for Life Platform with Sale to Henkel

Arsenal Completes Sale of Seal For Life to Henkel

PR Newswire

Thu, Apr 4, 2024, 8:45 AM EDT3 min read

NEW YORK, April 4, 2024 /PRNewswire/ — Arsenal Capital Partners (“Arsenal”), a private equity firm that specializes in investments in industrial and healthcare companies, announced today it has sold its portfolio company, Seal For Life Industries LLC (“Seal For Life”), to Henkel AG & Co. KGaA (“Henkel”), a publicly traded German manufacturer of industrial and consumer products. The terms of the transaction were not disclosed.

Seal For Life is a specialized supplier of protective coating and sealing solutions for a broad variety of infrastructure markets such as renewable energy, oil & gas, and water. The company employs more than 650 people and has a global production network. Seal For Life offers innovative coating and sealing products such as heat-shrink sleeves, visco-elastic coatings, epoxy & urethane coatings, fire protection, insulation, and sound dampening coatings. The performance and application capabilities of these solutions, marketed under different industry-leading brands including STOPAQ®, CANUSA®, COVALENCE®, and LIFELAST®, are pioneering in the protection and retrofitting of a wide variety of customer infrastructure assets, including onshore and offshore pipelines, jetty piles, storage tanks, valves, flanges, and high- performance industrial flooring.

Arsenal completed its investment in Seal For Life in 2019 and through seven strategic acquisitions, built a global platform in innovative coating and sealing solutions for both existing and new build infrastructure assets. The company’s leading brands and technologies play a critical role in extending the asset life of aging infrastructure with a focus on sustainable materials. During Arsenal’s ownership, Seal For Life significantly invested in technology development and innovation as well as expanded its end market exposure with novel solutions into applications such as district energy and renewable applications for wind and solar infrastructure protection.

Sal Gagliardo, an Operating Partner of Arsenal, said, “We are delighted with the growth achieved during our ownership, with Seal For Life’s sales more than doubling and strengthening of the company’s global market position. Seal For Life’s team, led by Jeff Oravitz, achieved strong organic growth, completed and integrated complementary acquisitions, and created a best-in-class technology platform in the infrastructure coatings sector. We want to thank Jeff and the Seal For Life team for their efforts and leadership that drove to this successful outcome.”

Jeff Oravitz, CEO of Seal For Life, stated, “Arsenal has enabled the transformation of Seal For Life into a unique platform of coatings solutions. The firm brought significant expertise in technologies and applications that drove a focus on where the markets are going and how we can address the long-term trends. We are grateful to the Arsenal team for their partnership and support over the last five years and are excited for the growth opportunities as we join the Henkel organization.”

Roy Seroussi, an Investment Partner of Arsenal, commented, “Arsenal’s close collaboration with Jeff and the team and the success of the Seal For Life platform further strengthens Arsenal’s position as a leading investor and company builder in the coatings, adhesives, sealants, and elastomers sector. We wish the Seal For Life team and Henkel the very best in their future success.”

Arsenal is an active investor in the coatings, adhesives, sealants, and elastomers sector, with current investments including Applied Adhesives, ATP Tapes, Fenzi Group, Meridian Adhesives Group, Polycorp, and Polytek, and with several prior investments in this sector.

J.P. Morgan Securities LLC acted as financial advisor to Seal For Life and Kirkland & Ellis LLP served as legal counsel.

About Arsenal Capital Partners

Arsenal Capital Partners is a leading private equity firm that specializes in investments in industrial growth and healthcare companies. Since its inception in 2000, Arsenal has raised institutional equity investment funds totaling over $10 billion, completed more than 290 platform and add-on acquisitions, and achieved more than 35 realizations. The firm works with management teams to build strategically important companies with leading market positions, high growth, and high value-add. For more information, visit www.arsenalcapital.com.

https://finance.yahoo.com/news/arsenal-completes-sale-seal-life-124500648.html

April 2, 2024

Who Remembers Floppy Disks?

The Rise and Fall of 3M’s Floppy Disk

The high-profile creator of magnetic media gave it up nearly three decades ago

8 hours ago

10 min read

3M’s floppies were not unique, but they were emblematic of an early computing era.

IEEE Spectrum

3m floppycomputer historyaudio tapemasking tape

A version of this post originally appeared onTedium, Ernie Smith’s newsletter, which hunts for the end of the long tail.

If you ask the average person what the company 3M does, odds are if they have a few gray hairs hanging out on their scalp, they might say that the company makes floppy disks. Now, this was once true, but if you look on 3M’s own website, you will see no mention of this legacy—it’s a firm that sells abrasive materials, adhesive tapes, filters, films, personal protective equipment, and medical equipment. (Younger people, if they recognize 3M, it’s probably because of Post-it notes, or more recently its N95 masks)

Floppies have had a surprisingly long life—in January 2024, Japan announced it will no longer require floppy-disk copies of government submissions. But 3M got out of the data-storage business about 28 years ago, when it transferred its floppy disk manufacturing to a spin-off called Imation. Imation is still around, under the name Glassbridge Enterprises, but with a much smaller profile.

3M’s spin-off, Imation, continued producing floppy disks after 3M itself left the business. IEEE Spectrum

Even with that said, those gray-hairs will frequently claim that of the many makers of floppies out there, 3M made the best ones. Given that, I was curious to figure out exactly why 3M became the most memorable brand in data storage during the formative days of computing, and why it abandoned the product.

How 3M Became a Key Innovator in the Production of Magnetic Data Storage

Now, to be clear, 3M did not invent magnetic storage—that was done by Austro-German engineer Fritz Pfleumer, in 1928. He created audio tape, a recording medium that started as broad strips of paper coated with iron-powder granules, and eventually moved to less-fragile cellulose acetate with help from what would become another big name in floppy disks, BASF. At first, the innovation didn’t spread outside of Germany because of World War II.

Nor was 3M the first company to popularize magnetic media— that was Ampex, which commercialized the tape recorder in the late 1940s. That was the point when magnetic tape turned into a major innovation in the world of music—one that, famously, Bing Crosby got to first because he gave financial support to Ampex. Incidentally, Ampex’s later spinoff, Memorex, represented Silicon Valley’s first true startup.

“Of all the businesses 3M has shed over its 100 years, the two seminal decisions that people point to as most significant involved the sale of 3M’s Duplicating Products business to Harris Corporation in Atlanta, Georgia, and the spin-off of 3M’s data-storage and imaging-systems businesses in 1996 creating a new company called Imation in Oakdale, Minnesota…”

Before World War II, one company did attempt to manufacture a tape recorder in the U.S. based on Pfluemer’s magnetic-tape invention. That firm, the Brush Development Co., had developed a device called the Soundmirror, produced by a Hungarian inventor named Semi J. Begun, who was likely something of a competitor to Pfleumer: Also a German, he had moved to the United States and developed a steel-based magnetic tape. The invention was used by the U.S. military during the war, and the company revisited the idea immediately after. But, it needed someone to manufacture magnetic tape for it to use.

As author David Morton noted in his 2006 book Sound Recording: The Life Story of a Technology, 3M was one of the best-suited companies on the market to help Brush out. That’s because the groundbreaking work that the company had done to develop pressure-sensitive adhesive tape was an essential element of making magnetic tape effective.

3M’s adhesive-tape technology transferred readily to magnetic tape. 3M

Strangely enough, Richard Gurley Drew, the inventor of much of 3M’s tape technology, was a musician—he played banjo in a local orchestra—when he took a job with the company. He probably didn’t realize he was inventing a key element of 20th-century recording technology when he observed that auto body shops needed a way to “mask off” areas of vehicles that were being whittled down with sandpaper, but his observation would prove useful to the invention of masking tape.

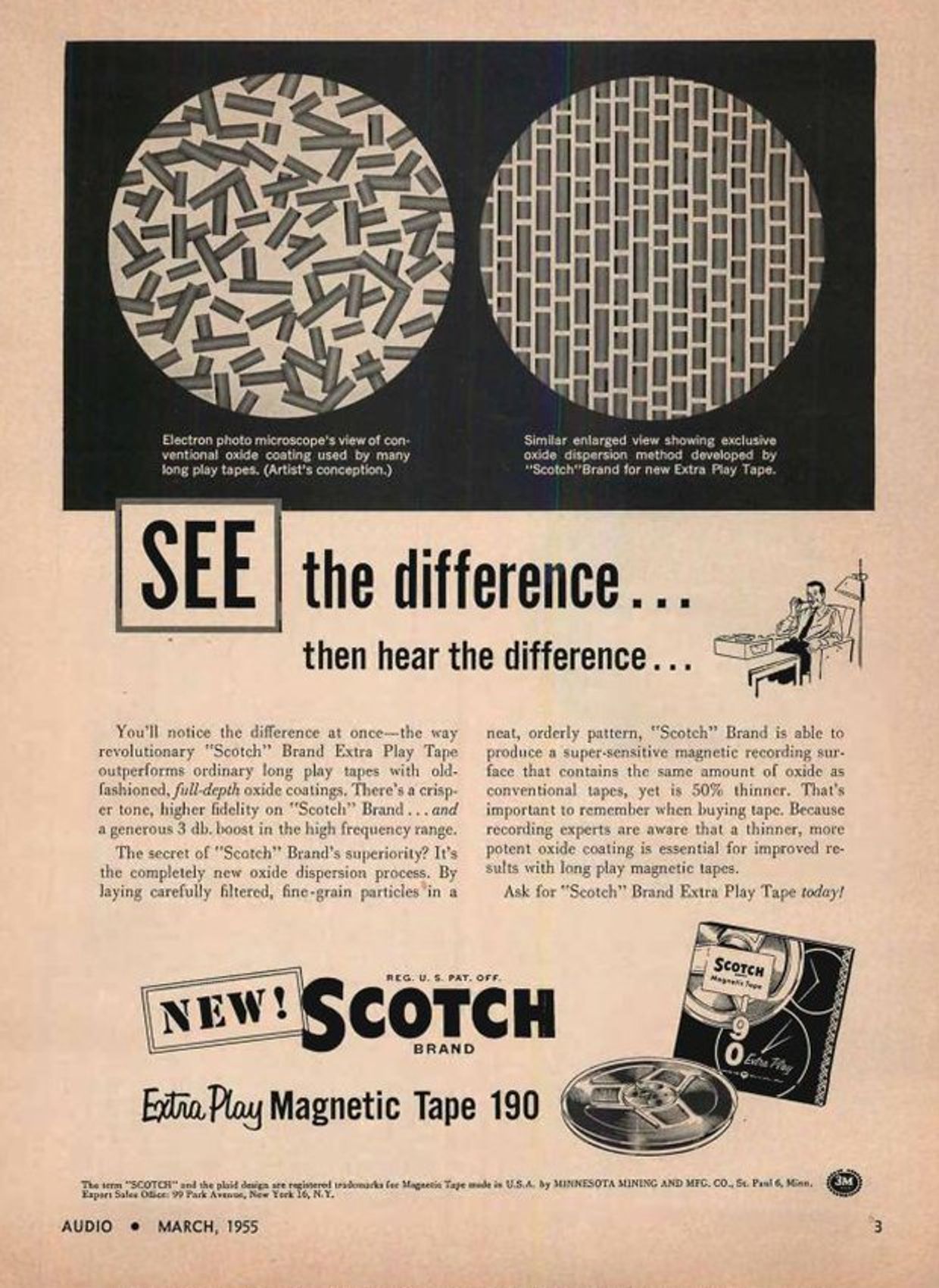

In the mid-1950s, 3M advertised its Scotch audio reel-to-reel tape.Audio Magazine/Internet Archive/Scotch

In the mid-1950s, 3M advertised its Scotch audio reel-to-reel tape.Audio Magazine/Internet Archive/Scotch

As Smithsonian Magazine notes, the formulation he developed, combining cabinetmaker’s glue with glycerin, proved to be just the right level of easy-to-remove adhesive that it became an out-and-out phenomenon. You might know his invention, developed in 1925, as Scotch Tape.

In 1930, he followed it up with another invention that was even more amazing—tape made from cellophane, which by its nature was totally transparent. Another 3M employee developed the tape dispenser, and the two inventions reshaped offices the world over.

So, when Brush looked to others to produce its recording medium, 3M was well positioned to help out due to magnetic tape’s similarity with its Scotch Tape. Brush eventually moved to other manufacturers, like Dupont. But the experience led 3M to continue developing metal-oxide tape technology, leading to the creation of the Scotch 111 reel-to-reel tape, which was one of the most popular types used in recording studios throughout the 1950s, according to the Museum of Magnetic Sound Recording.

I admittedly have long had a fascination with these reel-to-reel tapes. A number of years ago, back when I lived in Milwaukee, I found a couple of blank reel-to-reel tapes created by 3M using the Scotch name. I bought them from a junk store, and maybe paid $2 for them. They managed to follow me through three states and five cities, and now sit on my intentionally organized pile of junk. Based on my analysis of the container and the logotype it uses, they date to the mid-1960s or earlier. (No, I have not tried to record on them.)

I’ve owned this blank Scotch 150 reel-to-reel tape for nearly 20 years. It is 50 to 60 years old. Ernie Smith

For years, 3M’s reel-to-reels had one of the strongest reputations in the music industry; they were built to be of superhigh quality. But you might be wondering, how did 3M make the leap from reel-to-reel tape to floppies? It feels like just as strange a leap as a masking tape company developing reel-to-reel audio tape.

But, again, it happened.

How 3M’s Tapes Went From Music to Data

3M didn’t develop the floppy disk drive, either. IBM did, and Shugart Associates further improved it by making it small enough for regular users.

3M manufactured a signature 5.25-inch floppy disk. IEEE Spectrum

But 3M, much as with mechanical tape, was well positioned to improve on it, leveraging its skills with mechanical media in the budding computing industry. In a way, 3M came to media manufacturing from the opposite direction than its disk-selling competitor Memorex did. Memorex started with computers and gradually came to develop and improve tape-based technology, which eventually evolved into floppy disks. On the other hand, 3M started with the raw materials and the manufacturing processes, and combined those into computing’s greatest commodity item, the floppy disk.

3M got into the floppy disk market around the fall of 1973. It was not the only manufacturer of disks out there—some names from this era include Verbatim, Control Data, Dysan, and BASF. Most of these companies started with computing technology—for example, Dysan worked closely with Shugart Associates on the 5.25-inch floppy. But 3M wasn’t alone in starting with the raw materials. BASF, a German chemical manufacturer, has a somewhat similar corporate history and logo design to fellow thick-Helvetica enthusiast 3M. (Though 3M obviously never associated with the Nazis during World War II, so there’s that.)

3M branched out beyond standard floppy disks with a variety of magnetic-tape storage media.ComputerWorld/Google Books/3M

3M branched out beyond standard floppy disks with a variety of magnetic-tape storage media.ComputerWorld/Google Books/3M

3M didn’t rest on its laurels with the floppy disk either, and tried to push the technology further, most notably with Floptical disk technology, which Jim Adkisson, who helped create the 5.25-inch floppy at Shugart Associates, developed in the 1980s. A partnership of 3M, Maxell, and Iomega created the Floptical disk, which could hold 20 megabytes of data on something that looked a lot like a 3.5-inch floppy. Unfortunately the floptical disk flopped, losing out to products like Iomega’s iconic Zip drives.

3M also worked in more specialized media, developing high-capacity optical disks that fit into standard floppy and optical disk mechanisms, as well as high-end tape drives intended for the server room rather than your cassette player.

In many ways, 3M was out front on one of the most important elements of computing and was making huge profits from it. But by the end of 1995, those days were done. What changed?

https://www.youtube.com/embed/bOHKgENMcGQ?rel=03M advertised its floppy disk as more reliable than the competition in no uncertain terms.

What Led 3M to Kick a Multibillion-Dollar Business to the Curb

By 1995, 3M’s magnetic-media arm had evolved into a US $2.3 billion business, according to Time, which made it a significant chunk of 3M’s overall offering.

But at that time, high technology— especially consumer technology—was starting to look like a bad bet for legacy companies. This was around the same period that AT&T, still smarting from misadventures like the EO Personal Communicator, spun off Bell Labs as Lucent Technologies.

3M’s story, in its own words, suggests a similar crisis of culture. In A Century of Innovation, a book published by the company in 2002, around the time of its 100-year anniversary, the company compared the creation of the spin-off, which it called “the most wrenching decision in its history,” to that of its determination eight years earlier to sell its Duplicating Products Division, which sold copying machines:

Of all the businesses 3M has shed over its 100 years, the two seminal decisions that people point to as most significant involved the sale of 3M’s Duplicating Products business to Harris Corporation in Atlanta, Georgia, and the spin-off of 3M’s data-storage and imaging-systems businesses in 1996 creating a new company called Imation in Oakdale, Minnesota, near 3M headquarters. The two decisions have several elements in common—both involved businesses that 3M created and, in fact, ranked number one in the marketplace for decades. They were “homegrown” businesses—largely created within 3M and commercialized and built with the energy of many internal sponsors and champions. The businesses were risky because the products were based on pioneering technologies. They not only changed the basis of competition; they also created all new, global industries. The businesses were highly profitable for decades, and they represented a significant share of the company’s total annual revenues. They also produced many of 3M’s next generation of leaders.

So what happened? Essentially, despite the company’s success working in industrial and professional settings, doing things for consumers like producing videotapes, floppy disks, and cassettes meant moving out of its comfort zone. These products, initially developed for businesses, grew so popular that they suddenly needed to be available at every big-box store and drugstore alike, and, Post-its aside, retail was not a fit for the kind of company 3M was.

But more significantly, other companies were simply better at undercutting, and per the corporate biography, that required some tough decisions to be made:

While it sold its products for little or no profit, its competition sold their products for even less. Even though the consumer business had huge growth potential, 3M had little experience with a low-cost, low-profit-margin model.

The markings were clear—exit this business, even though 3M invented it. To stay in the “dog fight” meant 3M had to invest enormous amounts of money in order to remain the low-cost producer, with no assurance that profit margins ever would improve. “Exiting it was the right decision,” [former senior vice president Al] Huber said.

Seeing what came after, it’s hard to disagree. While floppies were still a significant medium in the mid-1990s, it was obvious that they would not be enough capacity for the next generation of data hoarders. It would only be a couple of years before Apple would put the first dagger in the heart of the floppy disk with the iMac, breaking with tradition by releasing a personal computer in 1998 with no built-in floppy disk drive.

https://www.youtube.com/embed/3qkQi3zZVhg?rel=0Imation carried on a floppy-disk ad campaign through the late 1990s.

That was a harbinger of what was to come. Within a decade of the decision, floppy drives, compact cassettes, and videotapes—the three key elements of 3M’s move into consumer-driven magnetic media—had fallen by the wayside. Imation, still active today, is owned by O-Jin Corp., a Korean technology company that basically bought it for the its trademarked name.

Five Unusual Types of Products 3M Developed Over the Years

Bondo: While not developed under 3M’s roof, the Bondo brand of automotive body filler, essentially a putty designed to fill in holes and cover visual imperfections, has been owned by 3M since at least 2007. Much like Post-its and Scotch Tape, it has become a generic term for the product line it serves.

Petrifilm: You know petri dishes, the containers used to allow bacteria to grow in a lab? Yep, 3M came up with a better version of them, in the form of Petrifilm, an easy-to-deploy platelike product developed by the company’s food-safety department in 1984. The technology has become hugely important in testing for potential food-safety concerns.

Tartan track: You know how Astroturf is commonly used in sports stadiums as a replacement for grass? Tartan track is sort of the track-and-field version of Astroturf , originally designed for horse tracks. One strange element of the Tartan track story is the fact that the original formulation used mercury, making it much more dangerous than it needed to be. (This kind of problem would later be a theme for 3M, a major chemical manufacturer.)

The typodont: This weirdly named device, associated with dentistry, is essentially a plastic model of the mouth and teeth, intended to make it easier to explain what is happening in a person’s mouth. While 3M didn’t invent the typodont, which has existed since the late 19th century, it is one of the 60,000 products the company makes.

Wind-vortex generators: In 2016, 3M developed a technology to help wind turbines generate airflow more optimally to ensure they work better, in partnership with Smartblade. It’s essentially a piece of carefully placed, high-quality plastic that, when placed correctly, increases energy production on turbines by 2 to 3 percent—a boost that adds up.

Much like its one-time competitor Memorex, Imation is a technology ghost kitchen. Its former corporate parent 3M, meanwhile, has a market cap of $51.33 billion at the time of this writing.

3M’s Magnetic Legacy

In a lot of ways, I think 3M’s persisting deep association with computing, despite the fact that the company left the field decades ago, comes down to the fact that it had a very recognizable logo design during its computer heyday.

My first experience with 3M was seeing its bright red logo on floppy disks used in classrooms with Apple IIe computers in the late 1980s and early ’90s. 3M was instantly recognizable among those responsible for creating the disks we needed to load up Number Munchers and Commander Keen, and as a result, its name is forever imprinted into the brains of retro-tech nerds the world over. It is a memory that gives me warm feelings.

But 3M, for a number of reasons, is not a company that carries a lot of goodwill with younger generations. For example, the company is closely associated with the manufacturing of a variety of chemicals, including PFOS (Perfluorooctane sulfonate), a key ingredient in Scotchguard and other water-resistant materials. It’s one of many PFAS (perfluoroalkyl and polyfluoroalkyl) substances that are believed to be harmful to humans.

The floppy disks that I and other elder millennials associate with a company that was essential to our youthful computing experience are long gone, shuttled away as a non-core business for a giant corporation that is best described as an amalgamation of non-core businesses loosely held together by a logo and backing in chemistry and raw materials.

March 21, 2024

NEW Everpol MEG-380 AMG Initiated Polyether Polyol from Everchem

EVERPOL MEG-380 is an Alpha Methyl Glucoside-initiated polyether polyol polymerized with propylene oxide. The resulting material has a functionality of four and a typical hydroxl of 380. Due to the higher percentage of carbohydrate moieties when compared with sucrose carbohydrates on a similar weight basis, MEG-380 provides enhanced foam charring with improved compression sets. Main applications include low to high density rigid pour-in-place systems, however, EVERPOL MEG-380 may also be included as a component in flexible polyurethane foam formulations to build bio-content.

OVER 25% BIO-BASED | CHAR ENHANCER | 4-FUNCTIONALITY

Everchem has developed a new polyether polyol in conjunction with one of our long-term production partners that will provide unique advantages to your polyurethane formulation challenges.

EVERPOL MEG-380 Benefits:

- – Over 25% Bio Content as Alpha Methyl Glucoside (AMG) carbohydrate to meet the Certi-PUR Bio-Certification program.

- – AMG does not decompose like sugar carbohydrates during the polyol manufacturing process.

- – Improved compression sets with 4-functional structure.

- – Lower viscosity when compared with sugar polyols at similar carbohydrate loading.

- – Char enhancer with a higher percentage of carbohydrate moieties compared with sucrose carbohydrates on a similar weight basis.

EVERPOL MEG-380 Market Applications:

- – Low Density Rigid Systems with high water content – SPF, FIP packaging

- – High Density Rigid Systems with low level Aux Blowing Agents.

- – High Density Flexible Foam grades AND High Density Visco-Foam grades with high Bio-Content demands.

| TYPICAL PROPERTIES | VALUE |

| Hydroxyl Value | 380 mg KOH/g |

| Water Content | < 0.05 % |

| pH | 6.0 |

| Acid Value | < 5.0 mg KOH/g |

| Viscosity (cP) | ~ 6000 cps @ 25 C |

PROBLEM SOLVER MATERIAL

Get a quote or a sample of our new specialty additive MEG-380

March 18, 2024

Purple and Tempur Reach Agreement

PURPLE INNOVATION AND TEMPUR SEALY INTERNATIONAL REACH AGREEMENT

News provided by Purple Innovation, Inc.

12 Mar, 2024, 16:03 ET

Framework for Mattress Firm Partnership and Confirmation of Purple’s Patents

LEHI, Utah, March 12, 2024 /PRNewswire/ — Purple Innovation, Inc. (NASDAQ: PRPL) (“Purple” or the “Company”), a comfort innovation company known for creating the “World’s First No Pressure® Mattress,” today announced that it has entered into a settlement agreement with Tempur Sealy International, Inc. (“Tempur Sealy”). The parties have agreed to a post-acquisition framework for Purple’s partnership with Mattress Firm Inc. (“Mattress Firm”), the nation’s largest mattress specialty retailer, subject to FTC approval of TSI’s acquisition of Mattress Firm, and amicably resolved their various intellectual property disputes. Purple is pleased to reaffirm its valid patent and trademark rights in and to its proprietary Hyper-Elastic Polymer® gel material, the key component in Purple’s GelFlex® Grid.

If the FTC does not object to Tempur Sealy’s acquisition of Mattress Firm, Tempur Sealy agrees that Purple will retain its current relationship with Mattress Firm for a minimum of twelve months, versus the two-month commitment in place previously. According to Rob DeMartini, CEO of Purple Innovation:

“Mattress Firm is an important and respected partner. We believe our Purple brand and products bring a high number of unique consumers into Mattress Firm stores. We appreciate working on an even playing field today and want to continue to work collaboratively with Mattress Firm. This agreement will give us time to explore expansion opportunities.”

Purple and Tempur Sealy have also agreed to amicably resolve all differences regarding their various intellectual property disputes. Although the specific terms of the deal are confidential, Purple retains all control and ownership over its brand, its patented mattress technology and its Hyper-Elastic Polymer and GelFlex Grid marks. That the parties were able to resolve their differences is a strong signal to the marketplace that Purple is an innovator in hybrid mattress technology and deter future threats to Purple’s business. DeMartini adds:

“The marketplace’s interest in gel technology recognizes the strength of what makes Purple’s unmatched sleep innovation disruptive and cutting edge, and the best way of delivering deep, uninterrupted sleep. We are pleased to focus on expanding Purple’s business and bringing the many benefits of our GelFlex Grid to more customers.”

About Purple

Purple is a digitally native vertical brand with a mission to help people feel and live better through innovative comfort solutions. Today Purple markets and sells its products through direct-to-consumer online channels, traditional retail partners, third-party online retailers, and Purple-owned retail showrooms. Purple designs and manufactures a variety of innovative, premium, branded comfort products, including mattresses, pillows, cushions, frames, sheets and more. Its products are the result of over 30 years of innovation and investment in proprietary and patented comfort technologies and the development of our own manufacturing processes. Our proprietary gel technology, Hyper-Elastic Polymer®, underpins many of our comfort products and provides a range of benefits that differentiate our offerings from other competitors’ products. For more information on Purple, visit purple.com.

March 17, 2024

Ashley Acquisition

Ashley and Resident Announce Acquisition

PR Newswire

Expected to Create a Broader Assortment of Home Furnishings to Accelerate Resident’s Growth

TAMPA, Fla., March 5, 2024 /PRNewswire/ — Ashley Home, Inc. and Resident Home Inc. today announced the signing of an agreement, under which Ashley Home, Inc., an affiliate of Ashley Global Retail, LLC (collectively, “Ashley”), will acquire Resident Home Inc. (“Resident”). The transaction, which was unanimously approved by the Board of Directors of both companies, provides Resident, a leading digital retailer and wholesaler of mattresses and bedding accessories, with an opportunity to expand its home furnishings assortment and global footprint. Through Ashley’s affiliate company, Ashley Furniture Industries, LLC (“AFI”), Resident will experience improved sourcing and efficiencies to foster additional growth in both its direct-to-consumer and wholesale businesses.

Through its award-winning Nectar®, DreamCloud®, Awara™, and Siena™ brands, Resident has established itself as a leading online seller of mattresses and bedding accessories. Resident’s success is underpinned by its deep expertise in data science and analytics, performance marketing, and e-commerce technology. In addition to Resident’s digital presence, Resident’s mattresses are sold at over 2,500 retailers nationwide as well as in Canada and the U.K. As part of the transaction, Co-Founders and Co-CEO’s of Resident, Eric Hutchinson and Ran Reske, will remain in their positions post-closing.

“Ran and I are thrilled that Resident will now be part of the Ashley family. This partnership marks a significant milestone for our team and our journey. We believe that together, we can achieve even greater heights and deliver unparalleled value to our customers. Joining forces with Ashley enables new opportunities for growth and our team is excited about the possibilities ahead,” said Hutchinson.

“We are incredibly excited about the possibilities that Resident brings to Ashley. In only a few years, Resident has established itself as a premier destination for mattresses, and we believe this merger will strengthen both companies and accelerate our growth trajectories, together bringing more products to more homes,” said Todd Wanek, CEO of Ashley.

The parties anticipate closing on this transaction March 6, 2024.

In connection with the transaction, BofA Securities served as financial advisor and Holland & Knight LLP acted as legal counsel to Ashley, while Sidley Austin LLP acted as legal counsel for Resident. Avid Capital Advisors LLC also advised Resident on the transaction.

About Ashley

Ashley is committed to being your trusted partner and style leader for the home. This commitment has made Ashley the largest furniture store brand in North America and one of the world’s best-selling home furnishing brands with more than 1,125 locations in 67 countries. Start designing your dream home today. Visit Ashley online at ashley.com and connect on social media through Instagram, Facebook, YouTube, and TikTok, or see our design-focused boards on Pinterest.

About Resident

Resident is an industry-leading, digitally native house of brands that makes inspiring products people love coming home to. A disruptor in the mattress and bedding category, Resident’s success is underpinned by its expertise in data science and e-commerce technology. Resident’s award-winning Nectar®, DreamCloud®, Awara™, and Siena™ mattresses have provided quality and comfort to close to six million happy sleepers. Visit residenthome.com to learn more.

https://finance.yahoo.com/news/ashley-resident-announce-acquisition-204100033.html