Company News

September 12, 2022

Appliance Crisis

Alarm Bells Sound As World’s Second Largest Appliance Company Reports Demand Plunge

by Tyler Durden

Monday, Sep 12, 2022 – 09:28 AM

Swedish appliance maker Electrolux AB announced a cost reduction program after reporting a plunge in demand for its home appliances across Europe and the US.

The world’s second-largest home appliances manufacturer after Whirlpool said, “market demand for core appliances in Europe and the US so far in the third quarter is estimated to have decreased at a significantly accelerated pace compared with the second quarter, driven by the impact of high inflation on consumer durables purchases and low consumer confidence.”

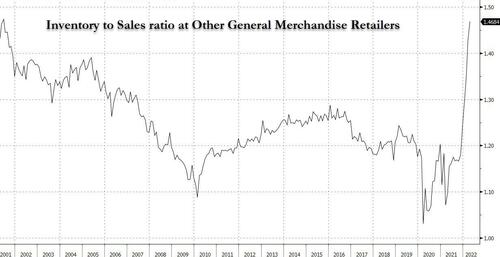

It noted: “High retailer inventory levels have amplified the impact of the slowdown in consumer demand.”

Remember, there’s a massive inventory glut of consumer goods at retailers.

Electrolux warned a combination of snarled supply chains had pressured the company, which is expected to report an even more significant operating loss in the third quarter.

“In combination with supply chain imbalances resulting in significant production inefficiencies and increased costs, the third quarter earnings for the Group are expected to decline significantly compared to the second quarter 2022 also excluding the one-time cost to exit the Russia market. This has been driven mainly by Europe and North America. Business Area North America is expected to report an operating loss in the third quarter exceeding the loss in the second quarter.”

Waning consumer demand, retailer inventory building, and mounting losses for the Swedish company forced its board to “initiate a Group-wide cost reduction program addressing both variable and structural costs.” Electrolux explained more about the cost reductions:

“The program, which starts immediately, will focus on reducing variable costs, with special attention to eliminating cost inefficiencies in our supply chain and production. The structural cost reductions will primarily take place in Europe and North America and include prioritization and efficiency measures leveraging recent organizational changes which took effect July 1. The measures include increasing productivity in operations as well as optimizing the R&D portfolio, administration, sales and marketing activities.”

The souring outlook for Electrolux initially sent shares down 7% but have since recovered most losses late in the European session.

Electrolux’s CEO Jonas Samuelson said consumer confidence is expected to stay depressed in Europe, adding, “I think people will hold on to their wallets quite hard.” The same is likely true in the US — consumers have backed off buying durables goods and focused on purchasing staple products as the highest inflation in decades has sent wage growth deeply negative for more than a year. Households on both sides of the Atlantic are struggling.

September 6, 2022

Evonik Invests in Allentown

- 05 September, 2022

- Anna Larionova

Evonik opens new Innovation Hub in Pennsylvania

MOSCOW (MRC) — Evonik, one of the world’s leading specialty chemicals companies, has opened a new Innovation Hub at its Allentown, Pa., site, said the company.

The Hub consists of several state-of-the-art testing and processing labs as well as a pilot plant. It also features a newly designed collaboration space to support a hybrid and creative work environment. The expansion will create 50 highly paid jobs for scientists, engineers, and lab technicians in the Lehigh Valley region around Allentown.

The Innovation Hub is part of a broader globalization strategy for Research, Development & Innovation (RD&I) at the Germany-based company. “We are strengthening regional RD&I hubs in Asia and North America to benefit from innovative ideas outside of Europe and be closer to our customers in those regions,” said Evonik Chief Financial Officer Ute Wolf at the Ribbon Cutting Ceremony for the Allentown Innovation Hub. “The new Hub will transform the Allentown site into our premier center for research, business, and innovation in North America.”

By 2030, Evonik aims to invest more than USD3 billion in Next Generation Solutions – products with superior sustainability benefits. Evonik will invest an additional USD700 million in Next Generation Technologies to optimize production processes and infrastructure and avoid CO2 emissions.

North America is an essential growth market for Evonik. The region contributed roughly a quarter (23%) to Evonik’s annual sales in 2021, making it the second-largest revenue source after Europe (EMEA). Evonik has invested several billion dollars in North America since 2017, when the company acquired the specialty additives business of Allentown-based industrial gas producer Air Products.

Evonik currently employs 300 people at the Allentown site, which is close to Philadelphia, New York City, and many premier research institutions.

Evonik’s new High Performance Polymers lab in Allentown allows the processing and testing of plastics for 3D printing, medical implants, or performance foams in airplanes or cars. Another lab enables the formulation and testing of additives for industrial coatings. Allentown’s best-in-class polyurethane spray foam testing and emission chamber helps Evonik customers meet environmental and emission standards.

The Innovation Hub also features a flexible collaboration space to support and enhance a hybrid work environment. The uniquely designed space offers open areas for employees to work onsite without needing individual offices. Employees have access to cutting-edge technology like digital whiteboards or tools for video conferencing.

The continued expansion of the Allentown site underscores Evonik’s commitment to the Lehigh Valley community, which goes beyond creating job opportunities. Evonik has recently donated $100,000 to support the Women in Science & Engineering (WISE) initiative of the Da Vinci Science Center, Allentown’s award-winning science museum. WISE was established as part of the Science Center’s broader commitment to supporting women and girls in STEM (Science, Technology, Engineering, and Math). The donation highlights Evonik’s ongoing support of education and diversity in STEM fields.

We remind, Evonik Coating Additives business expands production capacity in Taiwan. MOSCOW (MRC) — Business line Coating Additives of Evonik Industries AG (Essen, Germany) is expanding production capacity of ACEMATT precipitated matting agents at its Taiwan manufacturing facility. The significant capacity increase will help meet growing demand for matting agents in Asia, with the capacity expansion expected to be completed by the second half of 2023.

https://www.mrchub.com/news/403907-evonik-opens-new-innovation-hub-in-pennsylvania

September 6, 2022

Evonik Invests in Allentown

- 05 September, 2022

- Anna Larionova

Evonik opens new Innovation Hub in Pennsylvania

MOSCOW (MRC) — Evonik, one of the world’s leading specialty chemicals companies, has opened a new Innovation Hub at its Allentown, Pa., site, said the company.

The Hub consists of several state-of-the-art testing and processing labs as well as a pilot plant. It also features a newly designed collaboration space to support a hybrid and creative work environment. The expansion will create 50 highly paid jobs for scientists, engineers, and lab technicians in the Lehigh Valley region around Allentown.

The Innovation Hub is part of a broader globalization strategy for Research, Development & Innovation (RD&I) at the Germany-based company. “We are strengthening regional RD&I hubs in Asia and North America to benefit from innovative ideas outside of Europe and be closer to our customers in those regions,” said Evonik Chief Financial Officer Ute Wolf at the Ribbon Cutting Ceremony for the Allentown Innovation Hub. “The new Hub will transform the Allentown site into our premier center for research, business, and innovation in North America.”

By 2030, Evonik aims to invest more than USD3 billion in Next Generation Solutions – products with superior sustainability benefits. Evonik will invest an additional USD700 million in Next Generation Technologies to optimize production processes and infrastructure and avoid CO2 emissions.

North America is an essential growth market for Evonik. The region contributed roughly a quarter (23%) to Evonik’s annual sales in 2021, making it the second-largest revenue source after Europe (EMEA). Evonik has invested several billion dollars in North America since 2017, when the company acquired the specialty additives business of Allentown-based industrial gas producer Air Products.

Evonik currently employs 300 people at the Allentown site, which is close to Philadelphia, New York City, and many premier research institutions.

Evonik’s new High Performance Polymers lab in Allentown allows the processing and testing of plastics for 3D printing, medical implants, or performance foams in airplanes or cars. Another lab enables the formulation and testing of additives for industrial coatings. Allentown’s best-in-class polyurethane spray foam testing and emission chamber helps Evonik customers meet environmental and emission standards.

The Innovation Hub also features a flexible collaboration space to support and enhance a hybrid work environment. The uniquely designed space offers open areas for employees to work onsite without needing individual offices. Employees have access to cutting-edge technology like digital whiteboards or tools for video conferencing.

The continued expansion of the Allentown site underscores Evonik’s commitment to the Lehigh Valley community, which goes beyond creating job opportunities. Evonik has recently donated $100,000 to support the Women in Science & Engineering (WISE) initiative of the Da Vinci Science Center, Allentown’s award-winning science museum. WISE was established as part of the Science Center’s broader commitment to supporting women and girls in STEM (Science, Technology, Engineering, and Math). The donation highlights Evonik’s ongoing support of education and diversity in STEM fields.

We remind, Evonik Coating Additives business expands production capacity in Taiwan. MOSCOW (MRC) — Business line Coating Additives of Evonik Industries AG (Essen, Germany) is expanding production capacity of ACEMATT precipitated matting agents at its Taiwan manufacturing facility. The significant capacity increase will help meet growing demand for matting agents in Asia, with the capacity expansion expected to be completed by the second half of 2023.

https://www.mrchub.com/news/403907-evonik-opens-new-innovation-hub-in-pennsylvania

September 6, 2022

Foam Fabrication Rollup Started

Tecum stakes foam fabricator in Derry

By Patty Tascarella – Senior Reporter, Pittsburgh Business Times Sep 6, 2022

One of Pittsburgh’s biggest private equity firms has invested in a 39-year-old firm that fabricates custom foam products for multiple industries.

Tecum Capital of Wexford teamed with Valley Ridge Investment Partners to acquire the former Keystone Foam Corp., based in Derry. Tecum and Valley Ridge partnered with Centerfield Capital Partners and Petra Capital Partners. Financial terms were not disclosed but Tecum said its investment was in the middle of its target range of $8 million to $25 million.

The investors’ stake augments the Quinn family, Keystone’s founders and senior management team, in pursuing strategic growth opportunities.

Now known as Keystone Foam PA LLC, the company does not disclose sales. It employs 120 and is led by CEO Brian Quinn and COO Gerald “Jeep” Quinn, sons of the founder. The new money is growth capital for expansion to meet customer demand and to increase product offerings. Keystone’s customized foam solutions serve industry sectors including medical, packaging and furniture. It uses conventional polyurethane, polyethylene, viscoelastic foams, latex and other components

“The infusion of capital will allow us to continue our family’s focus of re-investment into our valued people, our equipment and facilities,” Jeep Quinn said in a prepared statement. “With our third generation of Quinn family members entering the business in leadership roles, the investment of capital creates a wonderful opportunity to build upon our heritage here in western Pennsylvania.”

There are opportunities for add-ons, Stephen Gurgovits Jr., Tecum managing partner, said.

“But for now, there is a nice organic growth opportunity,” he said.

The deal was the seventh platform investment out of Tecum’s $305 million SBIC fund and marked its second local deal. In February, Tecum led a syndicate of investors buying Automotive Systems Warehouse LLC, based in Hampton Township, in an eight-figure transaction.

But it also did transactions in the second half of 2021 from its prior fund, investing in JD Palatine LLC in Wexford and in DelGrosso Foods, near Altoona.

”We always prefer deals closer to home, but I believe our successful track record of working directly with family/founder owned businesses is a primary reason we get local opportunities,” Gurgovits said.

Tecum expects to finish its first full year of operations for the newest SBIC fund, its third, with close to $100 million invested. SBIC, short for Small Business Investment Company, means the U.S. Small Business Administration is matching the money raised up to the SBA’s cap of $175 million. Some 21 banks are investors in the fund.

“We are excited about the excellent start and pace of investment in Fund III so far,” Gurgovits said.

Tecum Capital Partners is Pittsburgh’s fourth-largest private equity firm according to capital under management, which is $750 million. The $28 million it invested in 2021 in local companies was the highest disclosed amount of any private equity or venture capital firm based in the 10-county Pittsburgh metro, according to The List published by the Business Times on April 22. Separate from the SBIC fund, Tecum is also doing deals with family offices.

Recommended

Tecum’s team for the Keystone deal consisted of Matt Harnett, Dave Bonvenuto, Paul Oris and Carter Henderson. Clearfield-based CNB Bank provided senior debt financing. McGuireWoods and Jones Day provided legal services to the investor group and CohnReznick LLP provided accounting, tax, and quality of earnings advice. Dinan Capital Advisors represented Keystone as its exclusive financial advisor and Williams Coulson provided legal counsel.

https://www.bizjournals.com/pittsburgh/news/2022/09/06/tecum-stakes-foam-firm-derry.html

September 6, 2022

Foam Fabrication Rollup Started

Tecum stakes foam fabricator in Derry

By Patty Tascarella – Senior Reporter, Pittsburgh Business Times Sep 6, 2022

One of Pittsburgh’s biggest private equity firms has invested in a 39-year-old firm that fabricates custom foam products for multiple industries.

Tecum Capital of Wexford teamed with Valley Ridge Investment Partners to acquire the former Keystone Foam Corp., based in Derry. Tecum and Valley Ridge partnered with Centerfield Capital Partners and Petra Capital Partners. Financial terms were not disclosed but Tecum said its investment was in the middle of its target range of $8 million to $25 million.

The investors’ stake augments the Quinn family, Keystone’s founders and senior management team, in pursuing strategic growth opportunities.

Now known as Keystone Foam PA LLC, the company does not disclose sales. It employs 120 and is led by CEO Brian Quinn and COO Gerald “Jeep” Quinn, sons of the founder. The new money is growth capital for expansion to meet customer demand and to increase product offerings. Keystone’s customized foam solutions serve industry sectors including medical, packaging and furniture. It uses conventional polyurethane, polyethylene, viscoelastic foams, latex and other components

“The infusion of capital will allow us to continue our family’s focus of re-investment into our valued people, our equipment and facilities,” Jeep Quinn said in a prepared statement. “With our third generation of Quinn family members entering the business in leadership roles, the investment of capital creates a wonderful opportunity to build upon our heritage here in western Pennsylvania.”

There are opportunities for add-ons, Stephen Gurgovits Jr., Tecum managing partner, said.

“But for now, there is a nice organic growth opportunity,” he said.

The deal was the seventh platform investment out of Tecum’s $305 million SBIC fund and marked its second local deal. In February, Tecum led a syndicate of investors buying Automotive Systems Warehouse LLC, based in Hampton Township, in an eight-figure transaction.

But it also did transactions in the second half of 2021 from its prior fund, investing in JD Palatine LLC in Wexford and in DelGrosso Foods, near Altoona.

”We always prefer deals closer to home, but I believe our successful track record of working directly with family/founder owned businesses is a primary reason we get local opportunities,” Gurgovits said.

Tecum expects to finish its first full year of operations for the newest SBIC fund, its third, with close to $100 million invested. SBIC, short for Small Business Investment Company, means the U.S. Small Business Administration is matching the money raised up to the SBA’s cap of $175 million. Some 21 banks are investors in the fund.

“We are excited about the excellent start and pace of investment in Fund III so far,” Gurgovits said.

Tecum Capital Partners is Pittsburgh’s fourth-largest private equity firm according to capital under management, which is $750 million. The $28 million it invested in 2021 in local companies was the highest disclosed amount of any private equity or venture capital firm based in the 10-county Pittsburgh metro, according to The List published by the Business Times on April 22. Separate from the SBIC fund, Tecum is also doing deals with family offices.

Recommended

Tecum’s team for the Keystone deal consisted of Matt Harnett, Dave Bonvenuto, Paul Oris and Carter Henderson. Clearfield-based CNB Bank provided senior debt financing. McGuireWoods and Jones Day provided legal services to the investor group and CohnReznick LLP provided accounting, tax, and quality of earnings advice. Dinan Capital Advisors represented Keystone as its exclusive financial advisor and Williams Coulson provided legal counsel.

https://www.bizjournals.com/pittsburgh/news/2022/09/06/tecum-stakes-foam-firm-derry.html