Current Affairs

April 24, 2024

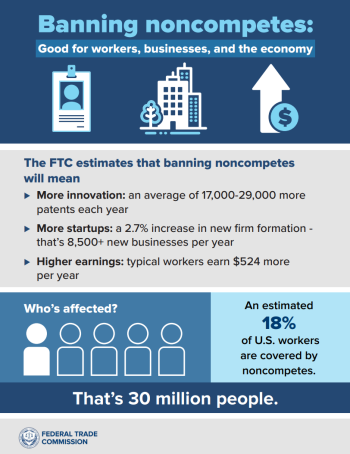

FTC Bans Noncompetes

FTC Announces Rule Banning Noncompetes

FTC’s final rule will generate over 8,500 new businesses each year, raise worker wages, lower health care costs, and boost innovation

Today, the Federal Trade Commission issued a final rule to promote competition by banning noncompetes nationwide, protecting the fundamental freedom of workers to change jobs, increasing innovation, and fostering new business formation.

“Noncompete clauses keep wages low, suppress new ideas, and rob the American economy of dynamism, including from the more than 8,500 new startups that would be created a year once noncompetes are banned,” said FTC Chair Lina M. Khan. “The FTC’s final rule to ban noncompetes will ensure Americans have the freedom to pursue a new job, start a new business, or bring a new idea to market.”

The FTC estimates that the final rule banning noncompetes will lead to new business formation growing by 2.7% per year, resulting in more than 8,500 additional new businesses created each year. The final rule is expected to result in higher earnings for workers, with estimated earnings increasing for the average worker by an additional $524 per year, and it is expected to lower health care costs by up to $194 billion over the next decade. In addition, the final rule is expected to help drive innovation, leading to an estimated average increase of 17,000 to 29,000 more patents each year for the next 10 years under the final rule.

Noncompetes are a widespread and often exploitative practice imposing contractual conditions that prevent workers from taking a new job or starting a new business. Noncompetes often force workers to either stay in a job they want to leave or bear other significant harms and costs, such as being forced to switch to a lower-paying field, being forced to relocate, being forced to leave the workforce altogether, or being forced to defend against expensive litigation. An estimated 30 million workers—nearly one in five Americans—are subject to a noncompete.

Under the FTC’s new rule, existing noncompetes for the vast majority of workers will no longer be enforceable after the rule’s effective date. Existing noncompetes for senior executives – who represent less than 0.75% of workers – can remain in force under the FTC’s final rule, but employers are banned from entering into or attempting to enforce any new noncompetes, even if they involve senior executives. Employers will be required to provide notice to workers other than senior executives who are bound by an existing noncompete that they will not be enforcing any noncompetes against them.

In January 2023, the FTC issued a proposed rule which was subject to a 90-day public comment period. The FTC received more than 26,000 comments on the proposed rule, with over 25,000 comments in support of the FTC’s proposed ban on noncompetes. The comments informed the FTC’s final rulemaking process, with the FTC carefully reviewing each comment and making changes to the proposed rule in response to the public’s feedback.

In the final rule, the Commission has determined that it is an unfair method of competition, and therefore a violation of Section 5 of the FTC Act, for employers to enter into noncompetes with workers and to enforce certain noncompetes.

The Commission found that noncompetes tend to negatively affect competitive conditions in labor markets by inhibiting efficient matching between workers and employers. The Commission also found that noncompetes tend to negatively affect competitive conditions in product and service markets, inhibiting new business formation and innovation. There is also evidence that noncompetes lead to increased market concentration and higher prices for consumers.

Alternatives to Noncompetes

The Commission found that employers have several alternatives to noncompetes that still enable firms to protect their investments without having to enforce a noncompete.

Trade secret laws and non-disclosure agreements (NDAs) both provide employers with well-established means to protect proprietary and other sensitive information. Researchers estimate that over 95% of workers with a noncompete already have an NDA.

The Commission also finds that instead of using noncompetes to lock in workers, employers that wish to retain employees can compete on the merits for the worker’s labor services by improving wages and working conditions.

Changes from the NPRM

Under the final rule, existing noncompetes for senior executives can remain in force. Employers, however, are prohibited from entering into or enforcing new noncompetes with senior executives. The final rule defines senior executives as workers earning more than $151,164 annually and who are in policy-making positions.

Additionally, the Commission has eliminated a provision in the proposed rule that would have required employers to legally modify existing noncompetes by formally rescinding them. That change will help to streamline compliance.

Instead, under the final rule, employers will simply have to provide notice to workers bound to an existing noncompete that the noncompete agreement will not be enforced against them in the future. To aid employers’ compliance with this requirement, the Commission has included model language in the final rule that employers can use to communicate to workers.

The Commission vote to approve the issuance of the final rule was 3-2 with Commissioners Melissa Holyoak and Andrew N. Ferguson voting no. Commissioners’ written statements will follow at a later date.

The final rule will become effective 120 days after publication in the Federal Register.

Once the rule is effective, market participants can report information about a suspected violation of the rule to the Bureau of Competition by emailing noncompete@ftc.gov

.

The Federal Trade Commission develops policy initiatives on issues that affect competition, consumers, and the U.S. economy. The FTC will never demand money, make threats, tell you to transfer money, or promise you a prize. Follow the FTC on social media, read consumer alerts and the business blog, and sign up to get the latest FTC news and alerts.

April 2, 2024

U.S. Auto Sales

April 1, 2024

March Propylene Settles Up 3c/lb

Chemical Grade propylene settles up 3c/lb to $0.565/lb . . .

March 26, 2024

Durable Goods Rise

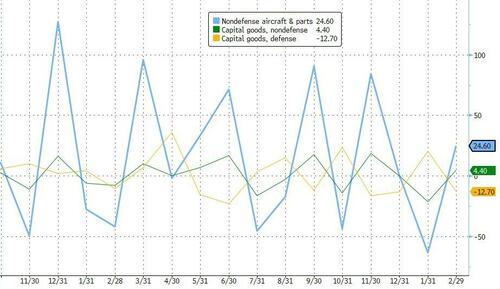

Durable Goods Orders Rebound In Feb From January Collapse, Defense Spending Slides

by Tyler Durden

Tuesday, Mar 26, 2024 – 08:38 AM

After crashing in January (driven by the collapse in Boeing orders), durable goods orders (preliminary) for February rose 1.4% MoM (better than the +1.0% MoM exp), and notably swinging from a downwardly revised 6.9% MoM plunge in January (from -6.2%)…

Source: Bloomberg

That dragged the headline orders up 4.6% YoY. Ex-Transports also beat, rising 0.5% MoM (vs +0.4% exp) and up 1.3% YoY.

Non-defense aircraft orders jumped 24.6% MoM as it seems people are ordering Boeings again? Defense spending tumbled 12.7% MoM…

Source: Bloomberg

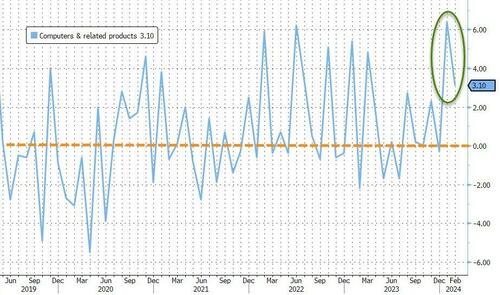

Computer & related products saw another big MoM rise as perhaps this is the AI cycle showing up in the data…

Source: Bloomberg

On the bright side, core capital goods shipments, a figure that is used to help calculate equipment investment in the government’s gross domestic product report, continued its strong bounce back from YoY contraction in December. However, on a seasonally-adjusted basis, core capital goods shipments fell 0.4% MoM

Source: Bloomberg

The YoY rebound is not exactly a signal that portends rate cuts!

March 19, 2024

Housing Starts

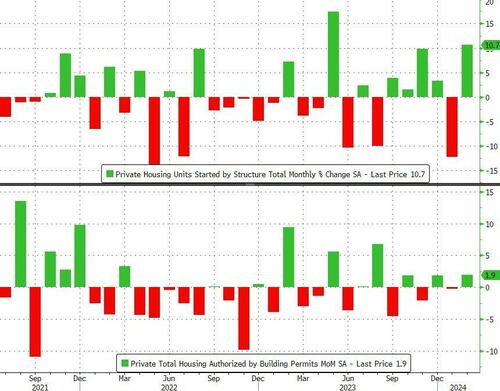

Housing Starts And Permits Surged In February (Despite Plunging Rate-Cut Odds)

by Tyler Durden

Tuesday, Mar 19, 2024 – 08:44 AM

Housing Starts and Permits rebounded firmly in February from an ugly January.

Starts soared 10.7% MoM (+8.2% exp) recovering some of the 12.3% MoM decline in January and Permits jumped 1.9% (+0.5% exp) from the upwardly revised -0.3% MoM decline in January…

Source: Bloomberg

That was the biggest monthly jump in Starts since May and biggest permits rise since August.

With weather being blamed for January’s decline, February seems like a return to post-COVID lower norms…

Source: Bloomberg

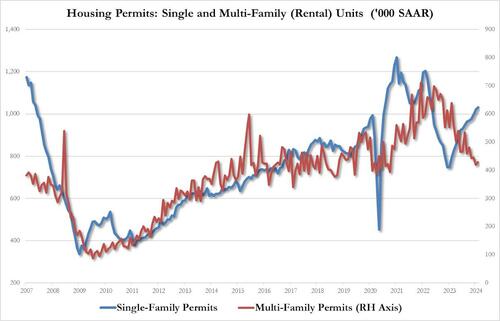

Under the hood, rental unit housing permits outpaced single-family units

- Single-Family: up 1.0% to 1.031MM from 1.021MM

- Rentals: up 2.4% to 429K from a four year low of 419K

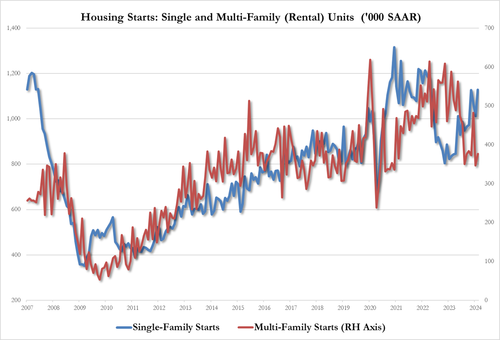

On the Housing Starts side, single-family units rose more (but both saw signifiant rises):

- Single-Family: up 11.6% to 1.129MM, highest since April 2022, from 1.012MM

- Rentals: up 8.6% to 377K from 347K

All good news for the meager supply out there. The question is – with rate-cut odds plummeting, has homebuilder confidence, which recently spiked back above 50, got too far over their skis on expectations of The Fed saving the day.

If they build it, will home buyers come?