Current Affairs

June 1, 2023

EVERCHEM UPDATE: VOL. 11 – Where’s the Competitive Edge?

When we lose business to a better player, do we take it personally? Don Draper from Mad Men wouldn’t take it personally. He would study hard to find what exactly blew the deal, get blackout drunk on bourbon on a few days’ bender at the public house, and the next week hatch himself a revised plan of conquest and redemption. Let’s bring that energy back.

Subscribe to the Urethane blog for more Everchem Updates here

May 31, 2023

Different Topic, Same Chart

Apollo’s Top Economist Says Supply Chain Roller Coaster Over

by Tyler Durden

Wednesday, May 31, 2023 – 03:45 PM

According to a new report from Apollo’s chief economist Torsten Sløk, the global supply chain crisis appears to be over, as there are indications of normalization in shipping rates, delivery capacity, and retailer inventory.

Sløk presents a chart pack that shows the supply chain roller coaster ride of the last three years is over. He shared several charts showing cheaper shipping costs and fewer bottlenecks, which might support disinflation trends.

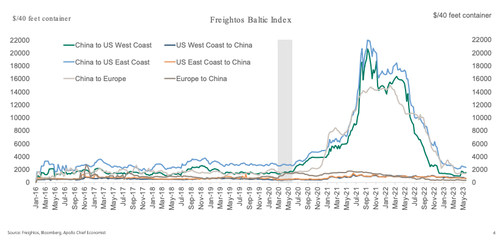

Price of transporting a container from China at pre-pandemic levels

Container freight rates falling: Inflation pressures are easing

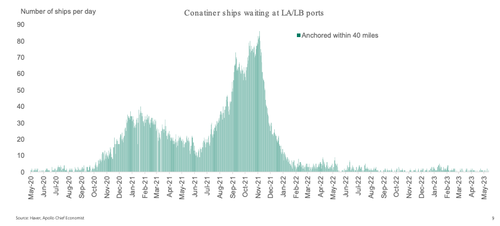

Container ships at America’s largest ports return to pre-pandemic levels

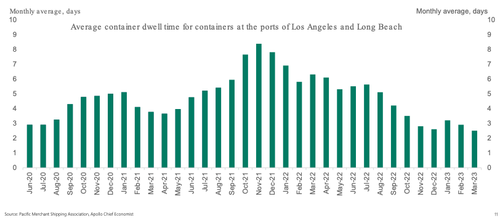

Amount of time a container waits to get picked up at a marine terminal after being unloaded from a vessel

Supply chains have normalized

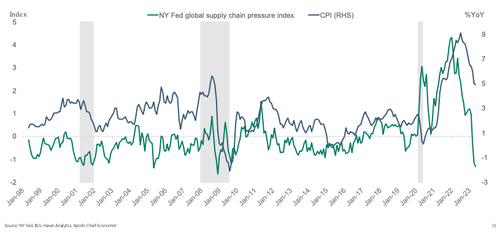

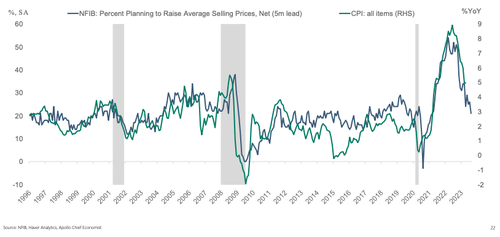

Sløk then argues supply chain normalization has put downward pressure on inflation.

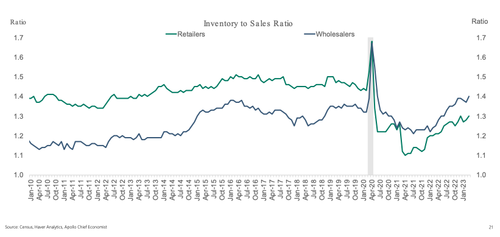

Inventory to sales ratio normalizing

Inflation pressures are gradually easing

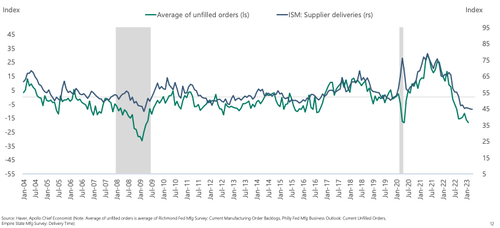

More evidence of supply chain normalization puts downward pressure on inflation

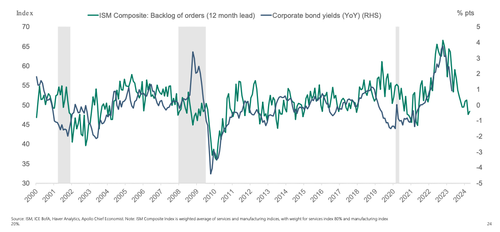

Supply chain bottlenecks correlated with corporate bond yields

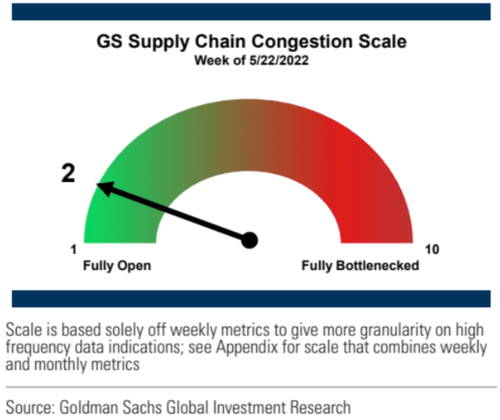

Sløk’s chart pack aligns with Goldman Sachs’ latest data on tracking supply chains showing barely any congestion.

Considering the importance of supply chains, its return to normalcy is more positive news that could help subdue inflation.

In terms of what’s next, A.P. Moller-Maersk A/S, the world’s biggest shipping company, issued a warning several weeks ago about a potential global slowdown.

https://www.zerohedge.com/markets/apollos-top-economist-says-supply-chain-roller-coaster-over

May 30, 2023

CertiPUR-US® Program Adds Enthalpy Analytical as Approved Laboratory

CertiPUR-US® Program Adds Michigan-Based

Enthalpy Analytical as Approved Laboratory

Enthalpy Analytical in Mount Pleasant, Michigan, becomes fourth laboratory

authorized to test foams to meet CertiPUR-US® program requirements

(Rochester Hills, Mich. – May 30, 2023) The CertiPUR-US® foam certification program has approved its fourth testing laboratory for CertiPUR-US® certification of flexible polyurethane foam for use in upholstered furniture and bedding.

Following a rigorous selection and approval process that has spanned more than two years, Enthalpy Analytical has been approved by the Alliance for Flexible Polyurethane Foam’s CertiPUR-US Board of Directors to conduct the content analysis and emissions testing to determine if submitted foams meet the certification program’s requirements as outlined in the program’s Technical Guidelines.

Few labs have the equipment and capacity to do all the testing required, which is one of the conditions for being an approved lab.

“Enthalpy was thoroughly vetted by our board and our Technical Advisory Group and, in addition to having the required equipment, had to pass round-robin testing with sample foams to show results matched results of other approved labs on identical foams,” explained Michael Crowell, CertiPUR-US executive director.

“We are pleased to join the CertiPUR-US program as an approved laboratory,” said Sarah Mack, business development manager for Enthalpy Analytical. Mack elaborated: “We have seen environmental and sustainability initiatives focus on and continue to promote accountability programs such as this and are proud to actively support this important work. It is an honor to assist organizations with their goal of protecting consumers and is a direct complement to our mission to protect the air we breathe, the water we drink, and the soil that feeds us!”

Only one other lab that is approved for testing compliance with the CertiPUR-US program requirements is located in the U.S. Other labs are located in Denmark and Germany. There are now four approved labs worldwide and listed at www.certipur.us/labs.

“We are very pleased to welcome this highly regarded company with a solid reputation,” said Crowell. “Adding another U.S.-based testing facility provides more choices for the more than 90 foam producers participating in the program and certifying more than 200 foam families on an annual basis.”

Certified flexible polyurethane foam products are analyzed by these independent, accredited testing laboratories and are certified to be made without ozone depleters, made without lead and heavy metals, made without formaldehyde, made without phthalates regulated by the Consumer Product Safety Commission and screened for relevant chemicals (including flame retardants) classified as carcinogenic, mutagenic or reprotoxic (see Technical Guidelines at certipur.us/technicalguidelines for details). Foams are also tested for emissions and must be low VOC (Volatile Organic Compound) emissions for indoor air quality (less than 0.5 parts per million).

In addition to foam producers submitting foams for testing, the CertiPUR-US program itself uses the approved labs to conduct testing of foam samples acquired through random on-site foam production plant checks of participating producers.

Enthalpy Analytical LLC is a wholly owned subsidiary of Montrose Environmental Group Inc., providing environmental laboratory services as part of Montrose’s Measurement and Analysis division. Enthalpy operates a network of accredited laboratories across the U.S. Within the network, Enthalpy has laboratories that specialize in analysis of air, soil, water and sediment.

# # #

May 16, 2023

Old Cars are the Best

Average Age Of American Cars Hits Record High

by Tyler Durden

Monday, May 15, 2023 – 08:00 PM

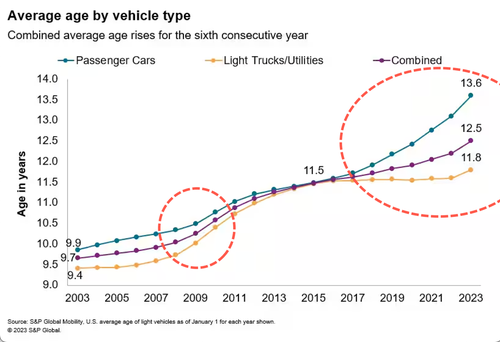

For the sixth consecutive year, the average age of vehicles in the US has risen, indicating that Americans are holding onto their cars for longer than ever before.

According to data collected by S&P Global Mobility, the average age of passenger vehicles on the road has reached a record high of 12.5 years. This trend, which began in 2017, has accelerated in a post-Covid world as new car prices soared due to shortages, and more recently, borrowing costs have skyrocketed, causing an affordability crisis. However, this trend might also suggest automobile manufacturers are producing higher-quality vehicles that break down less often.

“This is the sixth straight year of increase in the average vehicle age of the US fleet. It also reflects the highest yearly increase since the 2008-2009 recession, which caused an acceleration in average age beyond its traditional rate due to the sharp decline in new-vehicle sales demand,” S&P Global Mobility pointed out.

Todd Campau, associate director of aftermarket solutions for S&P Global Mobility, noted a confluence of factors from the pandemic supply chain snarls to soaring interest rates in 2022 “would provide further upward pressure on the average vehicle age.”

S&P Global Mobility forecasts new vehicle sales will be 14.5 million units in 2023, which is expected to slow the average age growth rate in the coming year.

“While pressure will remain on average age in 2023, we expect the curve to begin to flatten this year as we look toward returning to historical norms for new vehicle sales in 2024,” Campau said.

A plethora of used cars on roadways will benefit the vehicle service industry. An aging fleet means vehicles will require more repairs. Campau said:

“Traditionally, the ‘sweet spot’ for aftermarket repair was considered 6-11 years of age, but with average age at 12.5 years, the sweet spot for aftermarket repair is growing.

“There are almost 122 million vehicles in operation over 12 years old.”

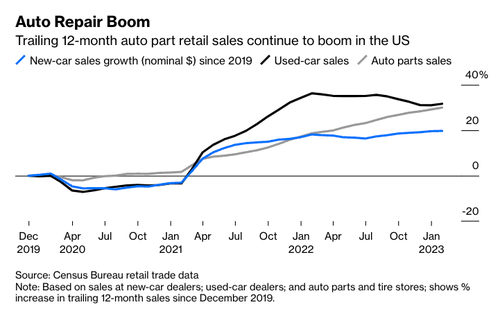

As the Bloomberg chart shows below, only the auto parts business continues to register steadily higher top-line revenue.

Wall Street has priced in the auto parts boom as shares of AutoZone Inc have gone parabolic.

The auto parts industry is benefiting from America’s aging fleet of vehicles.

https://www.zerohedge.com/markets/average-age-american-cars-hits-record-high

May 10, 2023

Inflation Overview

Headline CPI Dips To 2-Year Low; Shelter Costs Roll Over

by Tyler Durden

Wednesday, May 10, 2023 – 08:39 AM

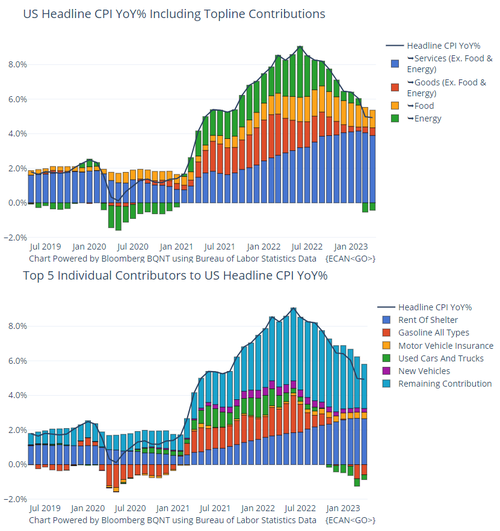

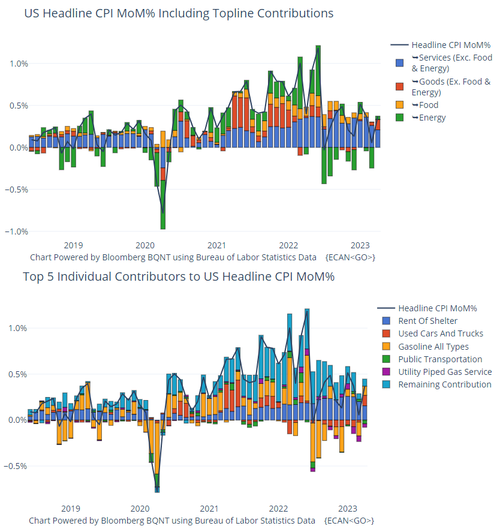

Another month, another inflation print to jawbone over. The Fed’s new favorite signal from The BLS is Core Services CPI Ex-Shelter, and this morning’s print is ‘good’ news with the YoY growth at the slowest since May 2022….

Source: Bloomberg

Headline CPI was expected to accelerate in April (+0.4% MoM exp), and met expectations with the drop in YoY CPI slowing dramatically (though the 4.9% print was slightly cooler than the 5.0% YoY exp)…

Source: Bloomberg

The all items index increased 4.9 percent for the 12 months ending April; this was the smallest 12-month increase since the period ending April 2021.

Energy (and Gasoline) was the main drivers to the downside while Shelter costs remain high…

The headline print is below pretty much all the major f0orecast:

- 5.1% – Goldman Sachs

- 5.1% – Citigroup

- 5.1% – JP Morgan Chase

- 5.1% – Morgan Stanley

- 5.0% – Barclays

- 5.0% – Bank of America

- 5.0% – Credit Suisse

- 5.0% – Bloomberg Economics

- 5.0% – HSBC

- 5.0% – UBS

- 5.0% – Wells Fargo

Core CPI was also expected to rise by 0.4% MoM in April, and met that expectation with YoY up 5.2% – very sticky.

The energy index decreased 5.1 percent for the 12 months ending April, and the food index increased 7.7 percent over the last year.

Source: Bloomberg

The index for all items less food and energy rose 0.4 percent in April, as it did in March.

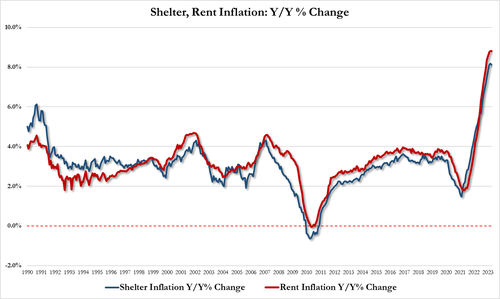

- The shelter index increased 0.4 percent over the month after rising 0.6 percent in March.

- The index for rent rose 0.6 percent in April, and the index for owners’ equivalent rent rose 0.5 percent over the month.

- The index for lodging away from home decreased 3.0 percent in April after rising in each of the previous four months.

The shelter index was the largest factor in the monthly increase in the index for all items less food and energy… as we noted last month, the shelter index has now topped out…

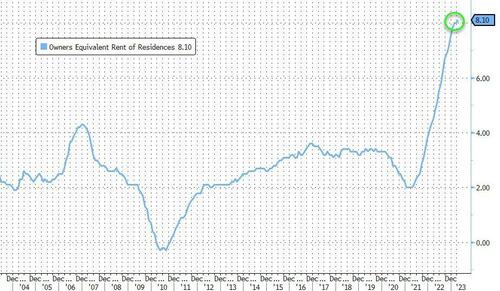

But, just to add some confusion to the pot, Owners Equivalent Rent rose 8.1% YoY – a new record high…

Among the other indexes that rose in April was the index for used cars and trucks, which increased 4.4 percent, and the index for motor vehicle insurance which increased 1.4 percent. The indexes for recreation, household furnishings and operations, personal care, apparel, and education also increased in April.

Several indexes declined in April, led by the airline fares index which fell 2.6 percent over the month after rising in February and March.

- The index for new vehicles declined 0.2 percent and the index for communication decreased 0.1 percent in April.

- The medical care index was unchanged in April, after falling 0.3 percent the previous month.

- The index for hospital services rose 0.5 percent over the month, after a 0.4-percent decline in March.

- The prescription drugs index increased 0.3 percent in April, while the physicians’ services index was unchanged.

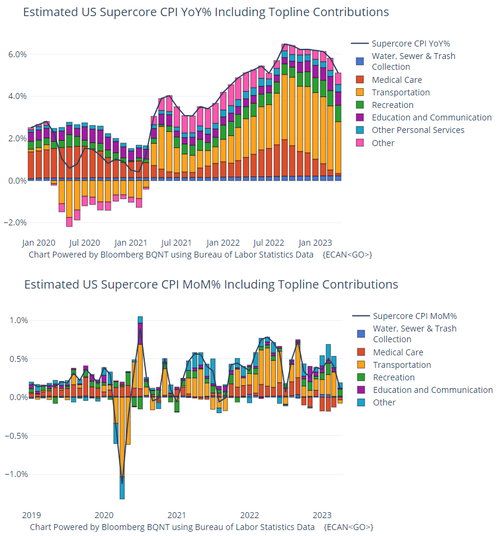

The so-called SuperCore inflation also slowed to 5.0% YoY with Transport and Medical Care costs dropping MoM…

Is M2 signaling that the ‘stickiness’ is over and a tsunami of deflation is about to hit?

Source: Bloomberg

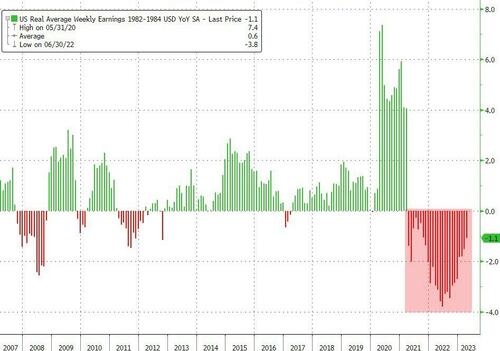

Finally, inflation continues to outpace Americans’ rising wages – for the 25th straight month…

Source: Bloomberg