Current Affairs

March 2, 2023

EVERCHEM UPDATE: VOL. 08 – Return of the Traveling Salesman

It takes a certain type, a certain essence, a certain logos to appreciate the beauty amidst the grind of business travel. Don’t let the allure of a first-class ticket fool you, the road can be rough for the uninitiated.

Subscribe to the Urethane blog for more Everchem Updates here

March 1, 2023

Bankruptcies Spike

US Bankruptcy Filings Surge At Fastest Pace Since 2009

by Tyler Durden

Wednesday, Mar 01, 2023 – 07:45 AM

For the past year, both the Biden White House and the Fed have been desperate to usher in a (mild) recession in the US to break the back of runaway inflation and the wage-price spiral with little success. But judging by the surge in bankruptcy filings, they are about to get their wish.

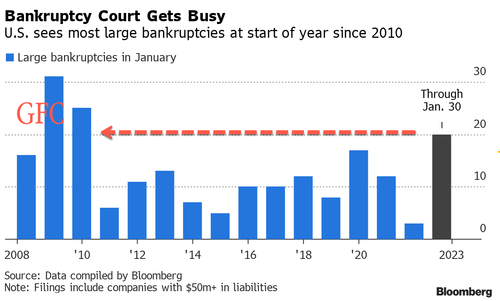

One month ago, when looking at the recent pace of large bankruptcy filings (those with more than $50MM in liabilities), we noted a troubling trend: in the first month of the year, the number of US bankruptcies topped 20, the highest in any other January dating back to 2010. Back then, 25 filings were seen as the economy was still reeling from the aftermath of the GFC.

The spike in defaults was not a fluke, and according to Bloomberg data, one month later – as of the end of February – no less than 39 large companies had filed for bankruptcy in the US so far this year, as February’s pace matches that of January; the YTD total represents the fastest pace of companies filing for bankruptcy since the immediate aftermath of the global financial crisis in 2009. By comparison, US bankruptcy courts had seen 63 large filings at this point in 2009.

Last week’s seven large filings — those tied to at least $50 million of liabilities — include the liquidation of generic drugmaker Akorn and the Chapter 11 filing of Covid-19 testmaker Lucira Health

This year, some of the most notable bankruptcy filings have been festive retailer Party City Holdco Inc, mattress maker Serta Simmons Bedding LLC, and cryptocurrency lender Genesis Global Holdco.

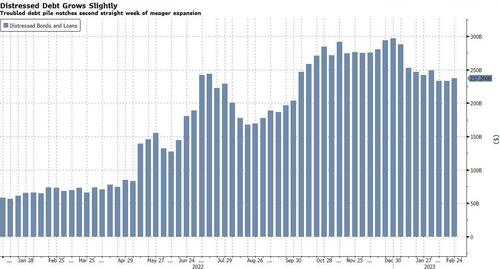

The pile of dollar-denominated corporate bonds and loans in the Americas trading at distressed levels rose to $237.2 billion in the week ended Friday, about a 1.63% increase from $233.4 billion a week earlier, according to BBG data.

Some more details from Bloomberg:

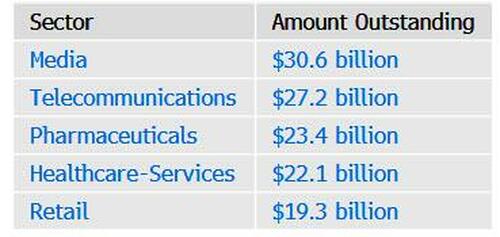

- The US accounts for the greatest volume of distressed debt in the Americas

- The media sector had the greatest amount of distressed debt as of the latest week

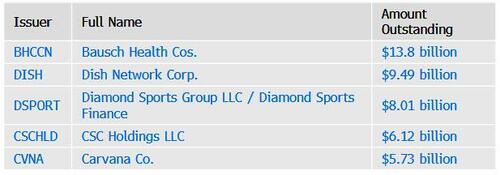

- Bausch Health Cos. had the most distressed debt outstanding of any issuer as of Feb. 17, data compiled by Bloomberg shows

https://www.zerohedge.com/economics/us-bankruptcy-filings-surge-fastest-pace-2009

February 28, 2023

Lithium and China

Lithium Industry Reeling After China Shutters 10% Of Global Supply

by Tyler Durden

Monday, Feb 27, 2023 – 06:00 PM

That’s a nice little EV industry you got over there in the US, it’s be a shame if suddenly it found itself without the most important commodity.

That’s one way to interpret what just happened in China; another – a less cynical – is the way Bloomberg described it, namely that China’s lithium industry itself is reeling as its top production hub – responsible for around a 10th of the world’s supply – faces sweeping closures amid a government probe of environmental infringements.

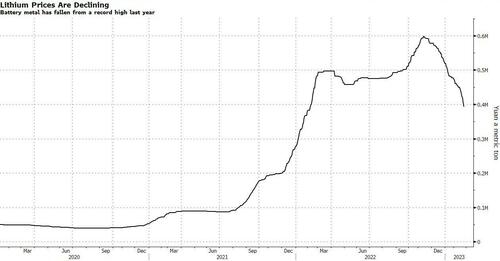

The crackdown in Yichun, Jiangxi province, also known as the country’s “Lithium capital” follows a local lithium frenzy over the past year as miners raced to feed rampant demand for the battery material — and to benefit from record global prices. Now, they’re grappling with a close-up inspection by environment officials sent from Beijing.

According to Yicai newspaper, ore-processing operations in Yichun have been ordered to stop as investigators probe alleged violations at lithium mines. That, Bloomberg notes, threatens somewhere between 8% and 13% of global supply, according to various analyst estimates, although it’s unclear for how long the immediate shutdowns will last.

The sudden probe injects a big dose of uncertainty into a lithium market that has seen prices drop, bringing some relief to EV manufacturers, as more global output emerges. Jiangxi province was expected to be a big source of extra supply, from a lithium-bearing mineral known as lepidolite.

“This supervision may mean that the inspection and control over lepidolite mining in China will be more stringent in the future,” said Susan Zou, analyst at Rystad Energy. Companies with operations in Yichun include major battery manufacturers Contemporary Amperex Technology Co. and Gotion High-Tech Co., whose shares both fell more than 1% on Monday.

Due to the ongoing probe, all lepidolite mining in Yichun aside from those by a state-owned company have been suspended, but refineries are still operational, Daiwa analysts Dennis Ip and Leo Ho said.

Global lithium prices soared to a record high last year as demand from China’s booming electric-vehicle industry outstripped production. And, as so often happens in commodities, where the cure to high prices is more supply, leading to lower prices, this high-profit, high-demand environment has encouraged miners to skirt regulations.

Some companies had already been targeted for infringements, including incidents of pollution, over the past year. This is a much wider crackdown, and involves officials from central government departments including the Ministry of Natural Resources.

Yucai added that Beijing will mainly look at violations at lithium mines and seek to guide the “healthy development” of the industry; they will largely target those mining without permits or with expired licenses.

Curiously, a recent Goldman report found that the Chinese car industry’s demand for lithium has fallen by more than half in recent months, a dramatic reversal that will drive a further slump in the market. Meanwhile, Chinese prices have dropped more than 30% from last year’s peak.

According to calculations form Citic Securities analyst Bai Junfei, a month-long mining halt in Yichun would reduce lithium output by an amount equivalent to around 13% of the world’s total. Rystad Energy, a consultancy, estimated the amount at 8%.

“At present, the market speculation is that the probe may stop after the two sessions in China next month,” Rystad’s Zou said, referring to the annual parliamentary meetings due early March.

https://www.zerohedge.com/markets/lithium-industry-reeling-after-china-shutters-10-global-supply

February 27, 2023

Home Sales

US Pending Home Sales Explode Higher In January

by Tyler Durden

Monday, Feb 27, 2023 – 10:07 AM

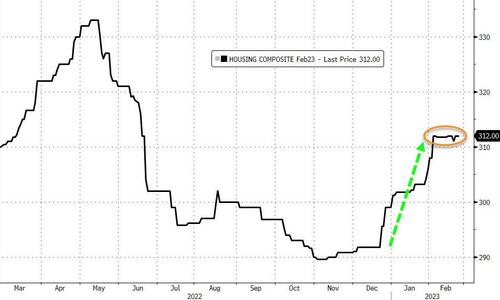

Existing home sales plunged, new home sales surged… so today’s pending home sales print will be the decider over what level of bloodbathery is really occurring in the US housing market. After a surprise jump in December (after 6 straight declining months), analysts expected a modest 1.0% MoM jump in pending home sales in January but were blown away by an 8.1% MoM explosion in sales (though Dec was revised down from +2.5% to +1.1%)….

Source: Bloomberg

“Home sales activity looks to be bottoming out in the first quarter of this year, before incremental improvements will occur,” Lawrence Yun, NAR’s chief economist, said in a statement.

That is the biggest MoM jump since June 2020, pushing the index to its highest since August 2022…

Source: Bloomberg

“Buyers responded to better affordability from falling mortgage rates in December and January,” said NAR Chief Economist Lawrence Yun.

Sorry Larry… that’s history!

This surge in pending sales is unlikely to continue since mortgage rates have surged since the period these sales were ‘pending’ for.

We also note that while housing futures have surged in recent months, the last week or two have seen them stagnate as mortgage rates soared…

Signings rose in all four regions in the month, led by a more than 10% gain in the West.

“An extra bump occurred in the West region because of lower home prices, while gains in the South were due to stronger job growth in that region,” Yun said.

Even with the surge at the start of the year, contract signings were still down 22.4% from January 2022 on an unadjusted basis.

https://www.zerohedge.com/markets/us-pending-home-sales-explode-higher-january

February 22, 2023

Inflation Overview

Inflation a Bit Warmer, Still Stubborn

Dan North | February 2023

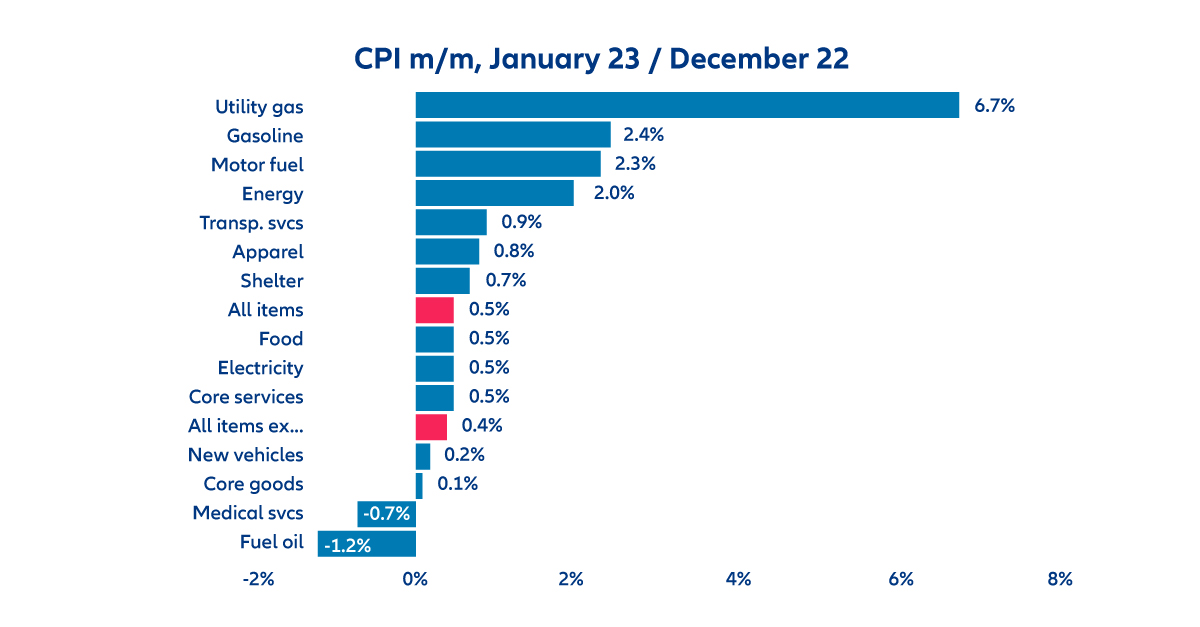

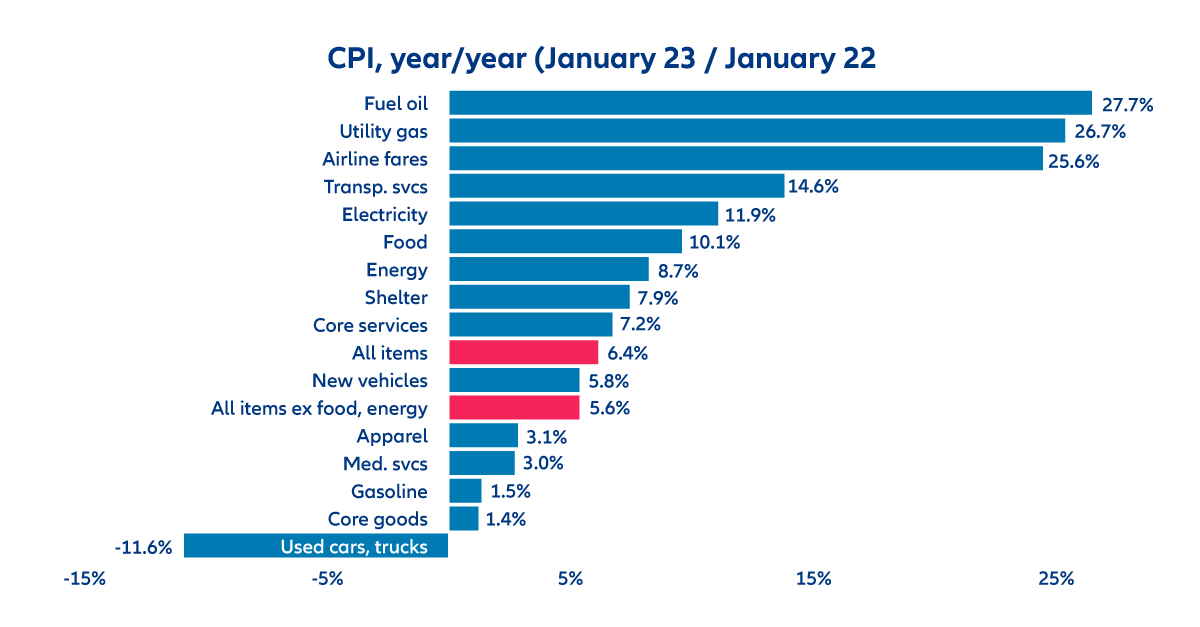

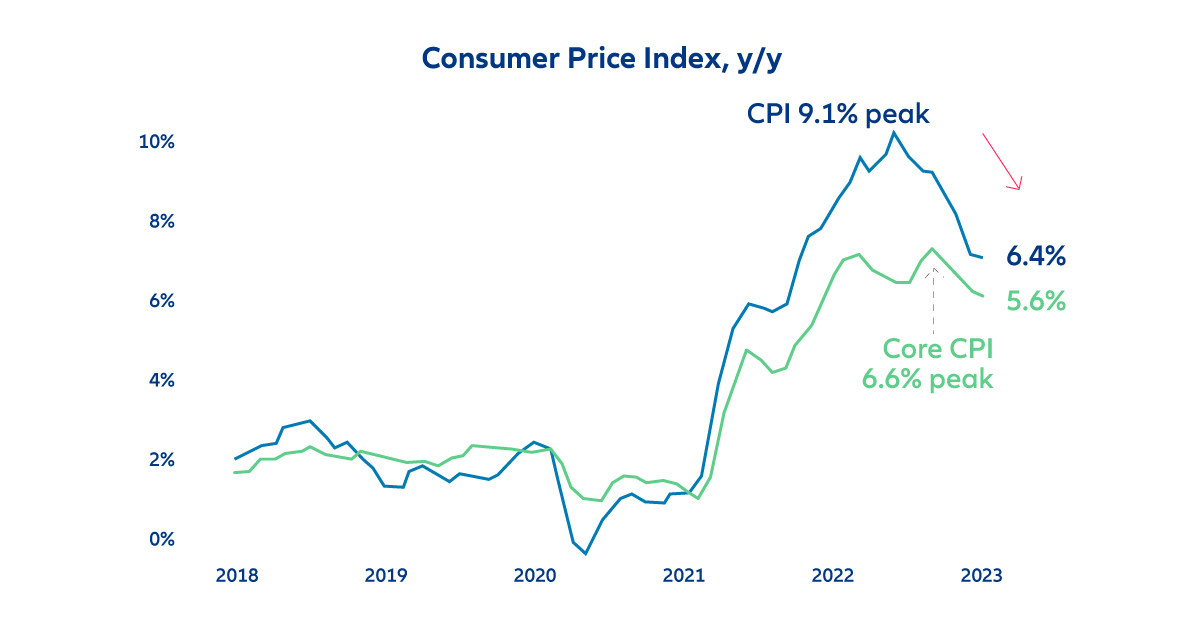

Inflation was a little warmer than expected in January. The headline Consumer Price Index (CPI) rose 0.5% m/m which was a bit higher than expectations of 0.4%. The y/y rate landed at 6.4, which was higher than expectations of 6.2%, and also only a slight improvement from last month’s 6.5%. The core rate, which strips out volatile food and energy prices, rose 0.4% m/m, again exceeding expectations of 0.3%, while the y/y rate came in at 5.6%, just above expectations of 5.5% and again also only a slight improvement from last month’s 5.7%. Energy prices drove the m/m increase with a 6.7% increase in utility gas and a notable 2.4% increase in gasoline prices. On a y/y basis, fuel out and utility gas have been big drivers, while gasoline has only risen 1.5%. Used cars and truck prices which were driven up in the pandemic due to scarcity, have now fallen 11.6% over the past year.

By the way, December’s report, which showed the first m/m decline in the headline CPI in the post Covid-era at -0.1%, was revised back up to +0.1% in this report.

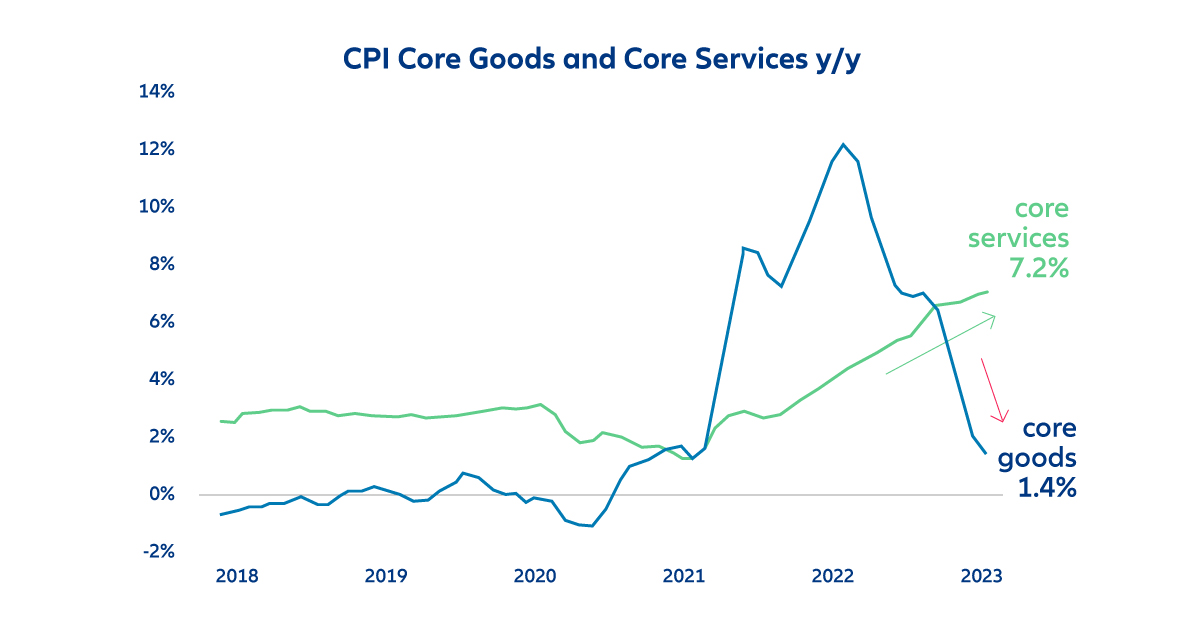

As shown in the first chart below, the headline y/y rate has fallen for seven consecutive months, dropping a total of 2.6% from June’s peak of 9.1%. However, the core rate has been more stubborn and has only fallen for four consecutive months, from the September peak, and has only dropped 1%. That is worrisome for the Fed since it focuses on core inflation. More worrisome still is that while core goods inflation is falling rapidly, core services inflation continues to rise and is now running at a very hot 7.2% y/y rate, the highest in over 40 years. The Fed is now concentrating more on services because 1. it is far outstripping goods inflation, and 2. services are more likely to be driven by labor costs, which in theory the Fed could influence more easily than the cost of goods.

Finally, the Fed has been focusing on “super core” inflation, which is core services excluding housing. Housing accounts for about one-third of the overall index, but it does not include all rental prices, only those that are signed in the month. Since those normally take a year to renew, housing inflation in the CPI lags market prices. And since market prices are falling, so will housing in the CPI going forward. In a sense then, housing inflation is already taken care of, so it makes sense to strip it out to see what’s happening underneath. Super core inflation is now running at 4% y/y, twice the Fed’s 2% target.

So the overall report was a bit warmer than expected, the core is being stubborn, core services are very high and rising, and super core isn’t good either. This report will keep the Fed on track for another 25 bps hike in March.

https://www.allianz-trade.com/en_US/insights/inflation-a-bit-warmer.html