Current Affairs

December 22, 2022

December Chemical Grade Propylene

Falls 1c/lb to $0.305/lb

December 22, 2022

December Chemical Grade Propylene

Falls 1c/lb to $0.305/lb

December 17, 2022

Germany Completes Floating LNG Terminal

Germany opens first LNG terminal as it curbs reliance on Russian gas

17 December 2022

Berlin, Dec 17 (EFE).- Germany launched its first floating Liquefied Natural Gas (LNG) terminal, which was constructed in record time, as the country continues to adapt to cut its dependence on Russian energy sources.

The Hoegh Esperanza specialist vessel, traveling from Spain, docked at the Wilhelmshaven port on Saturday morning amid gelid temperatures and freezing fog.

“It is the first of five LNG terminals planned to replace Russian gas and ensure that no home is left without supply,” Chancellor Olaf Scholz said in a brief statement at the opening of the terminal in the North Sea.

“We have built it in record time, an example of the new ‘German pace’ in decision-making and execution,” he added.

The Hoegh Esperanza, a floating storage and regasification unit, arrived at the German port on Friday carrying 167,000 cubic meters of liquified gas sourced from a plant in eastern Spain.

Scholz’s government named Uniper, a German energy company, as the operator of the terminal which is expected to start providing gas to the nation on December 22.

According to Uniper, each vessel can transport 170,000 m³ of liquefied gas and thereby supply 50,000–90,000 German households, roughly up to 8% of Germany’s annual consumption.

“This goes to show what Germany is capable of and it could be the blueprint for other projects of the energy transition,” Klaus-Dieter Maubach, Uniper CEO, said in a statement.

Once the remaining four terminals, which are still under construction or awaiting a license, are operational, a third of Germany’s energy needs would be met. EFE

December 17, 2022

Germany Completes Floating LNG Terminal

Germany opens first LNG terminal as it curbs reliance on Russian gas

17 December 2022

Berlin, Dec 17 (EFE).- Germany launched its first floating Liquefied Natural Gas (LNG) terminal, which was constructed in record time, as the country continues to adapt to cut its dependence on Russian energy sources.

The Hoegh Esperanza specialist vessel, traveling from Spain, docked at the Wilhelmshaven port on Saturday morning amid gelid temperatures and freezing fog.

“It is the first of five LNG terminals planned to replace Russian gas and ensure that no home is left without supply,” Chancellor Olaf Scholz said in a brief statement at the opening of the terminal in the North Sea.

“We have built it in record time, an example of the new ‘German pace’ in decision-making and execution,” he added.

The Hoegh Esperanza, a floating storage and regasification unit, arrived at the German port on Friday carrying 167,000 cubic meters of liquified gas sourced from a plant in eastern Spain.

Scholz’s government named Uniper, a German energy company, as the operator of the terminal which is expected to start providing gas to the nation on December 22.

According to Uniper, each vessel can transport 170,000 m³ of liquefied gas and thereby supply 50,000–90,000 German households, roughly up to 8% of Germany’s annual consumption.

“This goes to show what Germany is capable of and it could be the blueprint for other projects of the energy transition,” Klaus-Dieter Maubach, Uniper CEO, said in a statement.

Once the remaining four terminals, which are still under construction or awaiting a license, are operational, a third of Germany’s energy needs would be met. EFE

December 9, 2022

Rent Your Space Now

Remote-Work Revolution Has Wiped Out $453 Billion In Commercial Real Estate Value

by Tyler Durden

Thursday, Dec 08, 2022 – 07:20 PM

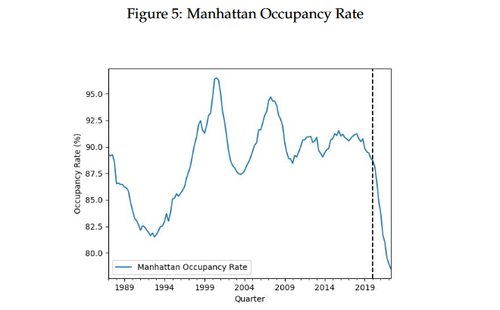

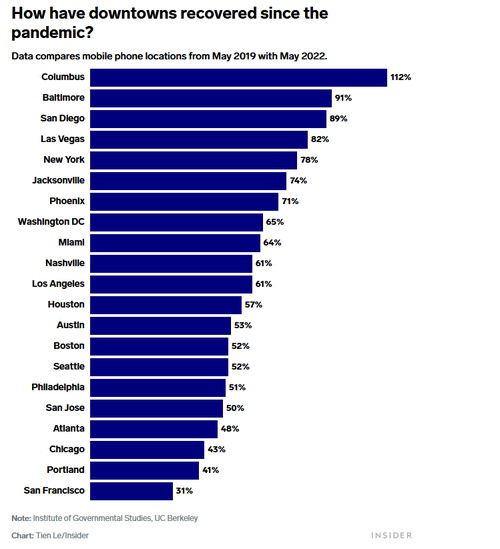

Leading up to the Covid-19 pandemic, roughly 95% of commercial office space was occupied across the United States, according to US National Bureau of Economic Research (NBER) – a nonprofit, non-government organization. By March 2020, occupancy plummeted to 10%, and has only recovered to 47%, according to a new NBER report which claims $453 billion in office commercial real estate value has been wiped out in an “office real estate apocalypse.”

Around the US, that resulted in a 17.5 percent decrease in lease revenue between January 2020, and May 2022, and not only because fewer offices were being occupied, but also because those that are being rented are going for shorter terms, lower prices per month, and a lot less floor space is needed as staff are told they can work from home for most or all the week.

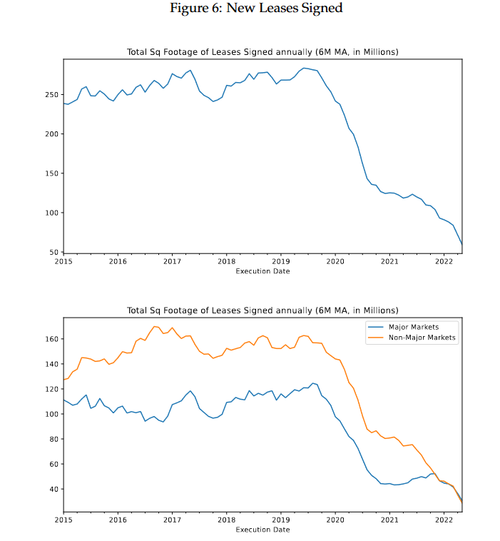

Prior to the pandemic, 253 million square feet were rented per year; as of May 2022, just 59 million square feet had been rented, NBER’s data indicates. “This indicates a massive drop in office demand from tenants who are actively making space decisions,” NBER said. –The Register

What’s more, while vacancy rates have hit a 30-year high, 61.7% of in-force commercial leases haven’t come up for renewal since the pandemic – meaning that “rents may not have bottomed out yet.”

What this means is that commercial real estate – a popular choice for pension fund managers and investors alike – may not be the best idea for the foreseeable future, given the continuing work-from-home options adopted by corporate America.

A common method used to invest in office real estate is commercial mortgage-backed securities (CMBS), which are managed and traded via commercial mortgage-backed indexes (CMBX) made up of pools of CMBSes.

According to NBER, more recent CMBXes tend to include a higher percentage of office collateral than earlier vintages. Those newer, office-heavy CMBXes, NBER said, are what’s losing the most money. -The Register

NBER says that in 2019, commercial real estate assets topped $4.7 trillion – offices being the largest component.

https://www.zerohedge.com/economics/remote-work-revolution-has-wiped-out-453-billion-commercial-real-estate-value