Government Regulation

September 28, 2021

More on China Energy Programs

China’s crackdown on intensive energy use ripples across petrochemical sector

Highlights

Cracker, PDH plants mull output cuts, hikes amid impact on margins

Coal shortage further constrains operations in coal-olefin sector

Bigger producers can gain — if they manage energy costs

China’s increasingly strident efforts to curb intensive energy use and hasten carbon emission cuts are prompting petrochemical makers using LPG or naphtha as feedstock to adjust run rates in response to the various impacts the move is having across the petrochemical sector.

The crackdown comes at a time when prices of LNG, a cleaner but costlier alternative to coal as a generating fuel, are rallying ahead of winter and coal usage by households for heating is being prioritized over industrial requirements amid low stockpiles and concerns over generation capacity.

The coal shortage is constraining operations in the coal-olefin industry, while higher LNG costs for generation are impacting the economics of petrochemical plants that use other feedstocks.

China’s total electricity consumption rose 13.8% over January-August, outpacing an 11.3% increase in power generation over the same period, National Development and Reform Commission data showed.

The coal-olefin sector has cut runs to reduce intense power usage after the Yuan 126 billion ($19.6 billion) coal-olefins plant in northwest Shaanxi province was suspended for flouting energy consumption limits.

That sector is estimated to account for 20%-25% of China’s polypropylene production. The rest is estimated to come from oil — mainly naphtha cracking at steam crackers — at 55%, with LPG cracking at propane and mixed alkane dehydrogenation plants accounting for 12%-14% and methanol around 6%, according to data from domestic information provider Longzhong and industry sources.

LPG demand from the chemical and petrochemical sectors was estimated to account for more than half of China’s total LPG demand in 2020, Longzhong data showed.

Coal-fired power plants generate around 50% of China’s electricity supply.

Lower PP output

Reduced PP production from coal-olefin plants could result in higher PP margins, which could theoretically provide more market share for the LPG cracking sector, including PDH plants and boost LPG demand by 10%, a trade source with China Gas said.

However, operating rates at some PDH plants, especially those in eastern Jiangsu and southern Guangdong provinces, are also expected to be affected by local governments’ power-rationing policies, market sources said.

The NDRC has alerted 10 provinces or regions including Guangdong, Jiangsu, Yunnan, Fujian, Shaanxi, Guangxi, Ningxia, Qinghai, Xinjiang and Hubei that they have not met energy-consumption targets for the first half of 2021.

Guangdong recently imposed a new round of power rationing on industrial users, cutting their power supply for 4-5 days a week, according to a report by the province’s development and reform commission Sept. 25.

Dongguan Juzhengyuan in Guangdong shut its PDH plant for four days in September due to power rationing, reducing its operating rate to 69.75% from full capacity in August, according to domestic energy information provider JLC.

Jiangsu has also enforced power rationing on industrial users, supplying power for two days and cutting supply for two days, local media reported.

Oriental Energy has lowered the operating rate at its Zhangjiagang PDH plant in Jiangsu in September due to power rationing, market sources said.

Crunching margins were also constraining operating rates at many PDH plants. Their LPG feedstock import costs have risen significantly in recent months, while the domestic price of their propylene has lagged far behind amid weak demand from downstream plants.

Chemical and petrochemical plants are also considered energy-intensive enterprises and their operating rates have been limited or cut by some local governments, domestic media reported.

“We are still watching for more government announcements regarding the power cut issue,” an industry source said. “So far we are not expecting much impact on the PDH side, more on the coal-to-olefin side. As for crackers/PDH plants, as long as they are not under maintenance or facing technical issues, they will be running at maximum rates.”

LPG demand boost

But another trade source said power cuts by provinces and shrinking margins had prompted SP Chemical to lower operating rates at its 700,000 mt/year LPG-based cracker at Taixing in Jiangsu to 60-70% of capacity, while a company source said Jiangsu Sailboat Petrochemical was delaying the restart of its methanol-to-olefins plant.

The trade source said major petrochemical producers that were able to afford and procure alternative generating fuel such as LNG or Russian piped gas – as happened in 2018 – could boost operating rates at PDH plants or steam crackers to leverage the prospects of higher PP margins.

Soaring LNG prices have encouraged some factories, mostly ceramic makers, to switch to LPG as burning fuel from natural gas. This was expected to lift LPG demand to a limited extent, a trade source in Shanghai said.

Natural gas demand from the power generation sector was estimated to comprise 16% of China’s total gas demand in 2020, National Energy Administration data showed.

Regional LPG prices hovering near seven-year highs have prompted some ethylene producers to switch to cheaper naphtha as feedstock, though this is estimated to reduce LPG demand by less than 10%, another source said.

“The strength of naphtha is because of expensive LPG. There is more demand from petrochemical producers as they are cutting their use of butane and propane in cracking,” a Singapore-based naphtha trader said.

But one Chinese petrochemical source said trading firm Unipec was heard buying less naphtha than in previous years, and increasing imports of light crude.

September 27, 2021

Dual Control System

China says to firmly control energy-hungry and high-emission projects CGTN

China’s National Development and Reform Commission issues a plan to improve the country’s “dual control system” on energy consumption and energy intensity, September 11, 2021. /CFP

China will firmly control energy-hungry and high-emission projects, the National Development and Reform Commission said in a recently issued plan, according to a notice released on Thursday.

The plan aims to improve China’s “dual control system” on energy consumption and energy intensity, or the amount of energy consumed per unit of GDP.

The dual control system, first set in the country’s 11th Five-Year Plan (2006-2010), has taken on added significance since Chinese President Xi Jinping in September 2020 committed the country to peaking carbon emissions by 2030 and becoming carbon neutral by 2060.

According to the plan, China will set a five-year target of energy consumption and energy intensity for different provinces, autonomous regions and municipalities, in an effort to reasonably manage indicators of total energy consumption and energy intensity.

The plan also clarified a series of phased goals of China.

By 2025, the dual control system will be more complete, with a more reasonable allocation of energy resources and sharply improved energy utilization efficiency.

By 2030, with a further improved dual control system, the intensity of energy consumption will continue to drop significantly, the total energy consumption be reasonably controlled and the energy structure be more optimized.

By 2035, the optimal allocation of energy and the comprehensive conservation system of resources will be more mature and finalized, which will strongly support the achievement of the goal of steadily reducing carbon emissions after reaching the peak.

September 27, 2021

Dual Control System

China says to firmly control energy-hungry and high-emission projects CGTN

China’s National Development and Reform Commission issues a plan to improve the country’s “dual control system” on energy consumption and energy intensity, September 11, 2021. /CFP

China will firmly control energy-hungry and high-emission projects, the National Development and Reform Commission said in a recently issued plan, according to a notice released on Thursday.

The plan aims to improve China’s “dual control system” on energy consumption and energy intensity, or the amount of energy consumed per unit of GDP.

The dual control system, first set in the country’s 11th Five-Year Plan (2006-2010), has taken on added significance since Chinese President Xi Jinping in September 2020 committed the country to peaking carbon emissions by 2030 and becoming carbon neutral by 2060.

According to the plan, China will set a five-year target of energy consumption and energy intensity for different provinces, autonomous regions and municipalities, in an effort to reasonably manage indicators of total energy consumption and energy intensity.

The plan also clarified a series of phased goals of China.

By 2025, the dual control system will be more complete, with a more reasonable allocation of energy resources and sharply improved energy utilization efficiency.

By 2030, with a further improved dual control system, the intensity of energy consumption will continue to drop significantly, the total energy consumption be reasonably controlled and the energy structure be more optimized.

By 2035, the optimal allocation of energy and the comprehensive conservation system of resources will be more mature and finalized, which will strongly support the achievement of the goal of steadily reducing carbon emissions after reaching the peak.

September 27, 2021

Chinese Energy Woes

Millions Of Chinese Residents Lose Power After Widespread, “Unexpected” Blackouts; Power Company Warns This Is “New Normal”

by Tyler DurdenMonday, Sep 27, 2021 – 12:40 PM

Just yesterday we warned that a “Power Supply Shock Looms” as the energy crisis gripping Europe – and especially the UK – was set to hammer China, and just a few hours later we see this in practice as residents in three north-east Chinese provinces experienced unannounced power cuts as the electricity shortage which initially hit factories spreads to homes.

People living in Liaoning, Jilin and Heilongjiang provinces complained on social media about the lack of heating, and lifts and traffic lights not working.

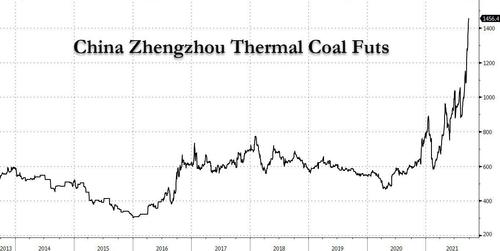

Local media in China – which is highly dependent on coal for power – said the cause was a surge in coal prices leading to short supply. As shown in the chart below, Chinese thermal coal futures have more than doubled in price in the past year.

There are several reasons for the surge in thermal coal, among them already extremely tight energy supply globally (that’s already seen chaos engulf markets in Europe); the sharp economic rebound from COVID lockdowns that has boosted demand from households and businesses; a warm summer which led to extreme air condition consumption across China; the escalating trade spat with Australia which had depressed the coal trade and Chinese power companies ramping up power purchases to ensure winter coal supply. Then there is Beijing’s pursuit of curbing carbon emissions – Xi Jinping wants to ensure blue skies at the Winter Olympics in Beijing next February, showing the international community that he’s serious about de-carbonizing the economy – that has led to artificial bottlenecks in the coal supply chain.

The coal price surge prompted the China Electricity Council to publish a statement saying that “to ensure winter coal supply, power companies continue to increase market purchases *regardless of cost* under the situation of substantial losses.”

Whatever the reason, it’s just getting started: as BBC reported, one power company said it expected the power cuts to last until spring next year, and that unexpected outages would become “the new normal.” Its post, however, was later deleted.

At first, the energy shortage affected factories and manufacturers across the country, many of whom have had to curb or stop production in recent weeks. In the city of Dongguan, a major manufacturing hub near Hong Kong, a shoe factory that employs 300 workers rented a generator last week for $10,000 a month to ensure that work could continue. Between the rental costs and the diesel fuel for powering it, electricity is now twice as expensive as when the factory was simply tapping the grid.

“This year is the worst year since we opened the factory nearly 20 years ago,” said Jack Tang, the factory’s general manager. Economists predicted that production interruptions at Chinese factories would make it harder for many stores in the West to restock empty shelves and could contribute to inflation in the coming months.

Three publicly traded Taiwanese electronics companies, including two suppliers to Apple and one to Tesla, issued statements on Sunday night warning that their factories were among those affected. Apple had no immediate comment, while Tesla did not respond to a request for comment.

But over the weekend residents in some cities saw their power cut intermittently as well, with the hashtag “North-east electricity cuts” and other related phrases trending on Twitter-like social media platform Weibo.

The extent of the blackouts is not yet clear, but nearly 100 million people live in the three provinces.

In Liaoning province, a factory where ventilators suddenly stopped working had to send 23 staff to hospital with carbon monoxide poisoning.

There were also reports of some who were taken to hospital after they used stoves in poorly-ventilated rooms for heating, and people living in high-rise buildings who had to climb up and down dozens of flights of stairs as their lifts were not functioning. Some municipal pumping stations have shut down, prompting one town to urge residents to store extra water for the next several months, though it later withdrew the advice.

One video circulating on Chinese media showed cars travelling on one side of a busy highway in Shenyang in complete darkness, as traffic lights and streetlights were switched off. City authorities told The Beijing News outlet that they were seeing a “massive” shortage of power.

Social media posts from the affected region said the situation was similar to living in neighboring North Korea.

The Jilin provincial government said efforts were being made to source more coal from Inner Mongolia to address the coal shortage.

As noted previously, power restrictions are already in place for factories in 10 other provinces, including manufacturing bases Shandong, Guangdong and Jiangsu.

Of course, a key culprit behind China’s shocking blackouts is Xi Jinping’s recent pledge that his country will reach peak carbon emissions within nine years. As a reminder, two-thirds of China’s electricity comes from burning coal, which Beijing is trying to curb to address climate change. While coal prices have surged along with demand, because the government keeps electricity prices low, particularly in residential areas, usage by homes and businesses has climbed regardless.

Faced with losing more money with each additional ton of coal they burn, some power plants have closed for maintenance in recent weeks, saying that this was needed for safety reasons. Many other power plants have been operating below full capacity, and have been leery of increasing generation when that would mean losing more money, said Lin Boqiang, dean of the China Institute for Energy Policy Studies at Xiamen University.

“If those guys produce more, it has a huge impact on electricity demand,” Professor Lin said, adding that China’s economic minders would order those three industrial users to ease back.

Meanwhile, even as it cracks down on conventional fossil fuels, China still does not have a credible alternative “green” source of energy. Adding insult to injury, various regions have been criticized by the government for failing to make energy reduction targets, putting pressure on local officials not to expand power consumption, the BBC’s Stephen McDonell reports.

And while the blackouts starting to hit household power usage are at most an inconvenience, if one which may soon result in even more civil unrest if these are not contained, a bigger worry is that the already snarled supply chains could get even more broken, leading to even greater supply-disruption driven inflation.

As Source Beijing reports, several chip packaging service providers of Intel and Qualcomm were told to shut down factories in Jiangsu province for several days amid what could be the worst power shortage in years.

The blackout is expected to affect global semiconductor supplies – which as everyone knows are already highly challenged – if the power cuts extend during winter.

The NYT confirms as much, writing today that the electricity shortage is starting to make supply chain problems worse. The sudden restart of the world economy has led to shortages of key components like computer chips and has helped provoke a mix-up in global shipping lines, putting in the wrong places too many containers and the ships that carry them.

Nationwide power shortages have prompted economists to reduce their estimates for China’s growth this year. Nomura, a Japanese financial institution, cut its forecast for economic expansion in the last three months of this year to 3 percent, from 4.4 percent.

It is not clear how long the power crunch will last. Experts in China predicted that officials would compensate by steering electricity away from energy-intensive heavy industries like steel, cement and aluminum, and said that might fix the problem. State Grid, the government-run power distributor, said in a statement on Monday that it would guarantee supplies “and resolutely maintain the bottom line of people’s livelihoods, development and safety.”

Maybe China should just blame bitcoin miners for the crisis to avoid public anger… alas, it can’t do that since it already banned them and drove most of its technological innovators out of the country.

September 27, 2021

Chinese Energy Woes

Millions Of Chinese Residents Lose Power After Widespread, “Unexpected” Blackouts; Power Company Warns This Is “New Normal”

by Tyler DurdenMonday, Sep 27, 2021 – 12:40 PM

Just yesterday we warned that a “Power Supply Shock Looms” as the energy crisis gripping Europe – and especially the UK – was set to hammer China, and just a few hours later we see this in practice as residents in three north-east Chinese provinces experienced unannounced power cuts as the electricity shortage which initially hit factories spreads to homes.

People living in Liaoning, Jilin and Heilongjiang provinces complained on social media about the lack of heating, and lifts and traffic lights not working.

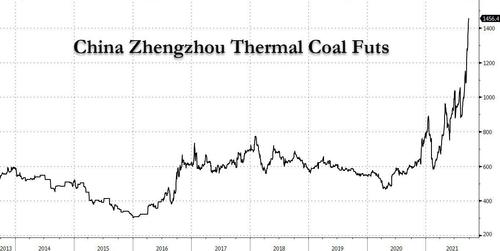

Local media in China – which is highly dependent on coal for power – said the cause was a surge in coal prices leading to short supply. As shown in the chart below, Chinese thermal coal futures have more than doubled in price in the past year.

There are several reasons for the surge in thermal coal, among them already extremely tight energy supply globally (that’s already seen chaos engulf markets in Europe); the sharp economic rebound from COVID lockdowns that has boosted demand from households and businesses; a warm summer which led to extreme air condition consumption across China; the escalating trade spat with Australia which had depressed the coal trade and Chinese power companies ramping up power purchases to ensure winter coal supply. Then there is Beijing’s pursuit of curbing carbon emissions – Xi Jinping wants to ensure blue skies at the Winter Olympics in Beijing next February, showing the international community that he’s serious about de-carbonizing the economy – that has led to artificial bottlenecks in the coal supply chain.

The coal price surge prompted the China Electricity Council to publish a statement saying that “to ensure winter coal supply, power companies continue to increase market purchases *regardless of cost* under the situation of substantial losses.”

Whatever the reason, it’s just getting started: as BBC reported, one power company said it expected the power cuts to last until spring next year, and that unexpected outages would become “the new normal.” Its post, however, was later deleted.

At first, the energy shortage affected factories and manufacturers across the country, many of whom have had to curb or stop production in recent weeks. In the city of Dongguan, a major manufacturing hub near Hong Kong, a shoe factory that employs 300 workers rented a generator last week for $10,000 a month to ensure that work could continue. Between the rental costs and the diesel fuel for powering it, electricity is now twice as expensive as when the factory was simply tapping the grid.

“This year is the worst year since we opened the factory nearly 20 years ago,” said Jack Tang, the factory’s general manager. Economists predicted that production interruptions at Chinese factories would make it harder for many stores in the West to restock empty shelves and could contribute to inflation in the coming months.

Three publicly traded Taiwanese electronics companies, including two suppliers to Apple and one to Tesla, issued statements on Sunday night warning that their factories were among those affected. Apple had no immediate comment, while Tesla did not respond to a request for comment.

But over the weekend residents in some cities saw their power cut intermittently as well, with the hashtag “North-east electricity cuts” and other related phrases trending on Twitter-like social media platform Weibo.

The extent of the blackouts is not yet clear, but nearly 100 million people live in the three provinces.

In Liaoning province, a factory where ventilators suddenly stopped working had to send 23 staff to hospital with carbon monoxide poisoning.

There were also reports of some who were taken to hospital after they used stoves in poorly-ventilated rooms for heating, and people living in high-rise buildings who had to climb up and down dozens of flights of stairs as their lifts were not functioning. Some municipal pumping stations have shut down, prompting one town to urge residents to store extra water for the next several months, though it later withdrew the advice.

One video circulating on Chinese media showed cars travelling on one side of a busy highway in Shenyang in complete darkness, as traffic lights and streetlights were switched off. City authorities told The Beijing News outlet that they were seeing a “massive” shortage of power.

Social media posts from the affected region said the situation was similar to living in neighboring North Korea.

The Jilin provincial government said efforts were being made to source more coal from Inner Mongolia to address the coal shortage.

As noted previously, power restrictions are already in place for factories in 10 other provinces, including manufacturing bases Shandong, Guangdong and Jiangsu.

Of course, a key culprit behind China’s shocking blackouts is Xi Jinping’s recent pledge that his country will reach peak carbon emissions within nine years. As a reminder, two-thirds of China’s electricity comes from burning coal, which Beijing is trying to curb to address climate change. While coal prices have surged along with demand, because the government keeps electricity prices low, particularly in residential areas, usage by homes and businesses has climbed regardless.

Faced with losing more money with each additional ton of coal they burn, some power plants have closed for maintenance in recent weeks, saying that this was needed for safety reasons. Many other power plants have been operating below full capacity, and have been leery of increasing generation when that would mean losing more money, said Lin Boqiang, dean of the China Institute for Energy Policy Studies at Xiamen University.

“If those guys produce more, it has a huge impact on electricity demand,” Professor Lin said, adding that China’s economic minders would order those three industrial users to ease back.

Meanwhile, even as it cracks down on conventional fossil fuels, China still does not have a credible alternative “green” source of energy. Adding insult to injury, various regions have been criticized by the government for failing to make energy reduction targets, putting pressure on local officials not to expand power consumption, the BBC’s Stephen McDonell reports.

And while the blackouts starting to hit household power usage are at most an inconvenience, if one which may soon result in even more civil unrest if these are not contained, a bigger worry is that the already snarled supply chains could get even more broken, leading to even greater supply-disruption driven inflation.

As Source Beijing reports, several chip packaging service providers of Intel and Qualcomm were told to shut down factories in Jiangsu province for several days amid what could be the worst power shortage in years.

The blackout is expected to affect global semiconductor supplies – which as everyone knows are already highly challenged – if the power cuts extend during winter.

The NYT confirms as much, writing today that the electricity shortage is starting to make supply chain problems worse. The sudden restart of the world economy has led to shortages of key components like computer chips and has helped provoke a mix-up in global shipping lines, putting in the wrong places too many containers and the ships that carry them.

Nationwide power shortages have prompted economists to reduce their estimates for China’s growth this year. Nomura, a Japanese financial institution, cut its forecast for economic expansion in the last three months of this year to 3 percent, from 4.4 percent.

It is not clear how long the power crunch will last. Experts in China predicted that officials would compensate by steering electricity away from energy-intensive heavy industries like steel, cement and aluminum, and said that might fix the problem. State Grid, the government-run power distributor, said in a statement on Monday that it would guarantee supplies “and resolutely maintain the bottom line of people’s livelihoods, development and safety.”

Maybe China should just blame bitcoin miners for the crisis to avoid public anger… alas, it can’t do that since it already banned them and drove most of its technological innovators out of the country.