The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

July 26, 2022

New Home Sales & Prices Plunged In June As Pulte Admits Order Cancellations Are Soaring

by Tyler DurdenTuesday, Jul 26, 2022 – 10:06 AM

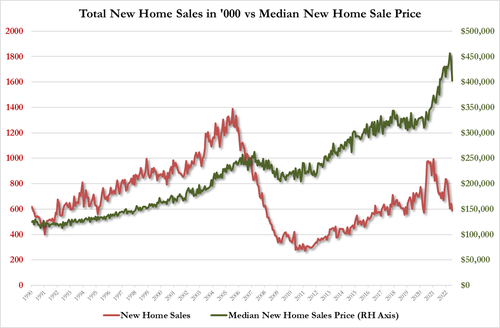

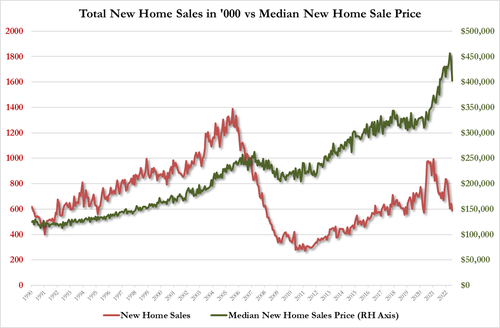

Amid a plunge in homebuilder confidence, record low affordability, tumbling single-family starts and permits, and multi-decade lows in mortgage applications, it is no surprise that analysts expected a 5.9% MoM plunge in new home sales in June (especially after the surprise 10.7% MoM panic-buying surge in May). The consensus was right in direction but off in magnitude as new home sales plunged 8.1% MoM in June and the 10.7% surge in May was revised down to just +6.3% MoM…

Source: Bloomberg

New Home Sales have fallen for 5 of the last 6 months and the last few months have seen a one-way street of downwards revisions…

The New Home Sales SAAR has tumbled to its lowest since the nadir of the COVID lockdowns in April 2020…

Source: Bloomberg

A potential silver lining is that inventory is finally on the rise with 9.3 months of supply seen in June, up from 8.4 in the prior month.

And the best news of all – the median new home price tumbled 9.5% MoM to $402,400…

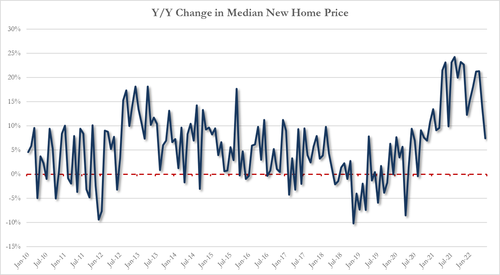

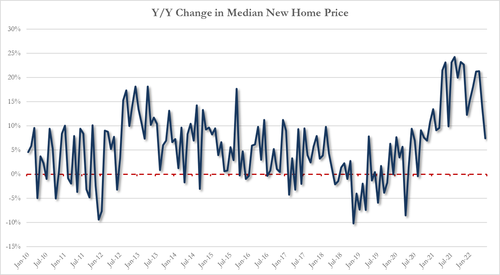

With median home price gains slowing dramatically YoY…

This new home sales print comes on the day that Pulte Homes admits buyers have hit a wall and is “dialling back” its spec-home-starts, noting that the homebuilder’s cancellation rate more than doubled to 15% in Q2 from 7% in the year-ago quarter, as soaring home prices and mortgage rates hinder affordability.

“The recent 200-basis point increase in mortgage rates has impacted affordability, but we continue to believe the desire for homeownership is high and the long-term outlook for housing remains positive,” said CEO and President Ryan Marshall.

Source: Bloomberg

Most notably perhaps was Marshall’s admission that the uptick in cancellations has been in the last 30-60 days, perhaps mirroring the plunge in homebuilder confidence (and Walmart) as the ‘strong American consumer’ appears to have pulled back into its shell.

July 26, 2022

New Home Sales & Prices Plunged In June As Pulte Admits Order Cancellations Are Soaring

by Tyler DurdenTuesday, Jul 26, 2022 – 10:06 AM

Amid a plunge in homebuilder confidence, record low affordability, tumbling single-family starts and permits, and multi-decade lows in mortgage applications, it is no surprise that analysts expected a 5.9% MoM plunge in new home sales in June (especially after the surprise 10.7% MoM panic-buying surge in May). The consensus was right in direction but off in magnitude as new home sales plunged 8.1% MoM in June and the 10.7% surge in May was revised down to just +6.3% MoM…

Source: Bloomberg

New Home Sales have fallen for 5 of the last 6 months and the last few months have seen a one-way street of downwards revisions…

The New Home Sales SAAR has tumbled to its lowest since the nadir of the COVID lockdowns in April 2020…

Source: Bloomberg

A potential silver lining is that inventory is finally on the rise with 9.3 months of supply seen in June, up from 8.4 in the prior month.

And the best news of all – the median new home price tumbled 9.5% MoM to $402,400…

With median home price gains slowing dramatically YoY…

This new home sales print comes on the day that Pulte Homes admits buyers have hit a wall and is “dialling back” its spec-home-starts, noting that the homebuilder’s cancellation rate more than doubled to 15% in Q2 from 7% in the year-ago quarter, as soaring home prices and mortgage rates hinder affordability.

“The recent 200-basis point increase in mortgage rates has impacted affordability, but we continue to believe the desire for homeownership is high and the long-term outlook for housing remains positive,” said CEO and President Ryan Marshall.

Source: Bloomberg

Most notably perhaps was Marshall’s admission that the uptick in cancellations has been in the last 30-60 days, perhaps mirroring the plunge in homebuilder confidence (and Walmart) as the ‘strong American consumer’ appears to have pulled back into its shell.

July 25, 2022

Wm. T. Burnett & Co. Acquires Flex Foam

Baltimore, MD, June 16, 2022-Wm. T. Burnett & Co., headquartered in Baltimore, Maryland, has acquired Flex Foam, the first polyurethane foam manufacturer in Arizona. Financial details of the transaction were not disclosed.

“The addition of Flex Foam to Wm. T. Burnett marks an important milestone in the 137-year history of the company,” said Richard B.C. Tucker, Jr., chief executive officer of the Burnett Group. “Like Burnett, Flex Foam was a family-owned business with which we share common values, including a commitment to provide the highest levels of quality and customer service. We look forward to building on our legacy of innovation in the polyurethane industry with broader reach in the western United States.”

Flex Foam was founded in Phoenix in 1978 by Russ Cortright and his sons Mike and Steve Cortright. The company specializes in producing polyurethane foam for use in bedding, furniture, packaging, carpet underlay, medical components, sports equipment, and acoustic performance products.

Wm. T. Burnett is no stranger to Phoenix, as the company currently operates one of its nonwovens manufacturing facilities in the city. Burnett’s urethane foam division is headquartered in Jessup, Maryland, while the nonwovens division is based in Statesville, North Carolina.

https://www.floordaily.net/flooring-news/wm-t-burnett-co-acquires-flex-foam

July 25, 2022

Wm. T. Burnett & Co. Acquires Flex Foam

Baltimore, MD, June 16, 2022-Wm. T. Burnett & Co., headquartered in Baltimore, Maryland, has acquired Flex Foam, the first polyurethane foam manufacturer in Arizona. Financial details of the transaction were not disclosed.

“The addition of Flex Foam to Wm. T. Burnett marks an important milestone in the 137-year history of the company,” said Richard B.C. Tucker, Jr., chief executive officer of the Burnett Group. “Like Burnett, Flex Foam was a family-owned business with which we share common values, including a commitment to provide the highest levels of quality and customer service. We look forward to building on our legacy of innovation in the polyurethane industry with broader reach in the western United States.”

Flex Foam was founded in Phoenix in 1978 by Russ Cortright and his sons Mike and Steve Cortright. The company specializes in producing polyurethane foam for use in bedding, furniture, packaging, carpet underlay, medical components, sports equipment, and acoustic performance products.

Wm. T. Burnett is no stranger to Phoenix, as the company currently operates one of its nonwovens manufacturing facilities in the city. Burnett’s urethane foam division is headquartered in Jessup, Maryland, while the nonwovens division is based in Statesville, North Carolina.

https://www.floordaily.net/flooring-news/wm-t-burnett-co-acquires-flex-foam

July 21, 2022

Dow, Inc. (DOW) CEO James Fitterling on Q2 2022 Results – Earnings Call Transcript

Jul. 21, 2022 11:14 AM ETDow Inc. (DOW)1 Comment1 Like

Dow, Inc. (NYSE:DOW) Q2 2022 Earnings Conference Call July 21, 2022 8:00 AM ET

Company Participants

Pankaj Gupta – VP, IR

James Fitterling – Chairman & CEO

Howard Ungerleider – President & CFO

James Fitterling

Thank you, Pankaj. Beginning with Slide 3. In the second quarter team Dow delivered top line growth both year-over-year and sequentially. These results reflect the strength of our diverse global portfolio, our focus on execution and our proactive pricing actions. As such, our team was able to navigate dynamic market conditions, the impacts of pandemic lockdowns in China, continued logistics constraints, and higher energy and raw material costs.

Sales increased 13% year-over-year with gains in all operating segments and regions. Sequentially, sales were up 3% with gains in all regions except Asia Pacific. Local price increased in all operating segments, businesses and regions, up 16% compared to the prior year period, and up 6% sequentially, with gains in all operating segments and regions.

Volume was consistent with the prior year as growth in packaging and specialty plastics was primarily offset by declines in industrial intermediates and infrastructure. Sequentially, volume declined 2% primarily due to lower demand in Europe and China in the quarter.

With a low cost position and industry-leading feedstock and derivative flexibility, we generated cash flow from operations of $1.9 billion and free cash flow of $1.4 billion. Our disciplined and balanced approach to capital allocation enabled us to further strengthen our balance sheet. We redeemed $750 million of outstanding notes in the quarter, lowering our annual interest expense by $27 million. As a result, we have no substantial long-term debt maturities due until 2027.

We also returned more than $1.3 billion to shareholders in the quarter, including $800 million in share repurchases and $505 million through our industry leading dividend. Furthering our commitment to transparency and accountability, this quarter we also published our annual integrated ESG report intersections. The report highlights our ESG leadership advancements and aligns our data and disclosures with key ESG frameworks.

Notably, this year’s report features convenient access to data, as well as enhanced disclosures and carbon emission reporting for Scope 1 and 2, intensity metrics and full TCFD implementation. Key highlights from the report include executing our plan to decarbonize and grow, accelerating sustainability investments to enable design for recyclability and more circular plastics, taking deliberate actions to drive inclusion, diversity and equity, and improving governance, transparency and accountability.

Dow’s report is one of the few in our industry to receive limited assurance against formal standards by its external audit firm. And with our latest report, we added our Scope 1 and 2 emissions reporting in accordance with greenhouse gas protocol reporting to the assurance review. We’re proud of our progress. And if you haven’t already accessed the report, we welcome you to do so through the link included in this presentation or on our website.

Howard Ungerleider

In the Industrial Intermediates & Infrastructure segment, while industrial activity and infrastructure spending in the U.S remain resilient, we expect inflation to continue impacting global consumer durables demand, including furniture and bedding and appliance end markets. Industry supply recovery of propylene oxide in China will likely drive higher global polyol and other PO derivative supply and combined with higher energy costs in Europe will likely result in an approximately $125 million headwind.

Jeffrey Zekauskas

Thanks very much. Since the end of the first quarter, oil prices have been relatively stable at about $105 a barrel, but naphtha prices have moved down globally. What do you make of that? And do you think that’s changing? In your MDI business, are spreads getting worse? And then for Howard, in your Slide 10, you estimate your underfunded pension at $3 billion as of the second quarter. Was that $6 billion in — as of the end of 2021? And you have gas field investments. Are those ever going to be big? Or it’s all small numbers? Thank you.

James Fitterling

Thanks, Jeff. I will tackle the first two and let Howard handle the last two. On oil price, we are still bullish oil, and we expect that these oil-to-gas spreads are going to stay in that $70 to $80 a barrel of oil equivalent in the back half. The reason I say that is there’s less than 2 million barrels per day of available capacity and oil derivative demand has been very strong. And so we don’t see that abating, and we don’t see that the supply is picking up fast enough to close that gap. A little bit of effort and you’ve seen a little bit of movement in China towards coal. You’ve seen it in the energy industry. You’ve also seen it in coal to chemicals, that’s probably taken a little bit off of the naphtha demand. China, Northeast Asia would be some of the largest naphtha demand that’s out there. So my guess is that’s why you’ve seen the oil naphtha correlation change a bit.

MDI fundamentals, to your point, are still strong. Our operating rate outlook for MDI through 2025 and 2026 is continuing to increase year-over-year, every year. So I don’t think we are going to see any issues with MDI spreads. If byproducts come off a little bit, a lot of byproduct goes into production of MDI. If oil byproducts come off a little bit from the refineries, then that could be actually positive. Howard?

Arun Viswanathan

Great. Thanks for taking my questions. Good morning. I guess I have just two quick follow ups on polyethylene and polyurethane. So in polyethylene, do you expect ethane to kind of stay in the $0.40 to $0.60 per gallon range and that kind of provides some support to pricing? Or do you expect pricing to kind of maybe decline $0.03 to $0.06 per pound over the next couple of quarters? And then similarly on PU, now that we are running slower, or running a little bit at BASF Geismar and some of the other facilities that were down, do you expect MDI prices to kind of moderate over the next couple of quarters, especially given what you said on durables demand slowing? Thanks.

James Fitterling

Yes, I do expect that ethane will bounce around. There’s plenty of ethane in rejection, so it’s not a supply driven issue. I think events have caused the prices to move around. Frac spreads right now are about $1.25. And they’ve ranged in from $1 to $1.50, so that’s kind of that $0.40 to $0.60 range at today’s natural gas prices. So I think that’s a reasonable expectation. As gas production improves, we might see it come off.

You’ve got to remember, you had the ONEOK plant fire in July, which put some upward pressure on prices. You’ve got a couple of startups of crackers in the second half here, which are going to put a pull on demand. But I think it’s a reasonable range and we will watch natural gas and what happens with natural gas because that could pull the prices down a little bit.