Pricing and Markets

December 21, 2023

Chemical Grade Propylene Settles Flat for December

$0.465/lb for December

November 28, 2023

Panama Canal Congestion

Panama Canal Congestion Causes MDI Price Increase in South America

PUdaily | Updated: November 27, 2023

The Panama Canal is Witnessing a Congestion with over 120 Ships Queueing

The Panama Canal Authority said on November 13 that approximately 126 ships were awaiting passage at the canal entrance, with potential waiting times of up to 12 days. To address the backlog of vessels, the authority holds auctions for those wishing to jump to the front of the line. In the latest auction, a Japanese energy group paid nearly USD 4 million to secure the crossing for its liquefied petroleum gas tanker, setting a new record and significantly increasing the transportation cost of transit goods.

El Niño Phenomenon Causes Congestion in the Panama Canal

Since the beginning of this year, the drought caused by the El Niño phenomenon has been affecting the water reservoir system of the Panama Canal, leading to a reduced supply of freshwater necessary for the operation of the locks. As a result, the Panama Canal Authority has repeatedly slashed the number of daily transiting vessels. Additionally, the authority has also lowered the permissible draft of ships, forcing vessels passing through the canal locks to reduce their weight or cargo load. This drove up the delivery time and logistics costs. In August, the canal experienced the first wave of congestion, with 200 vessels were floating at both ends of the dried up canal. Recently, the congestion issue has become more severe, significantly impacting global trade.

Panama Canal Congestion Affects Delivery Times and Costs between North and South America, Asia, and Europe

The Panama Canal, with a total length of 81.3 kilometers, connects the Atlantic Ocean and the Pacific Ocean. It is a lock-type canal where ships need to navigate through a series of locks to raise or lower the water level in order to traverse the canal located between the Central American mountain range. Alongside the Suez Canal, the Panama Canal plays a crucial role in global trade and economic development. The canal currently serves a total of 180 maritime routes that link 1,920 ports across 170 countries, the authority reported. The most significant trade routes serviced by the canal involve the US East Coast-Asia, US East Coast-South America West Coast, and Europe-South America West Coast routes.

MDI Prices are Moving up in South America

South American countries mainly import MDI from U.S., Europe, China, Japan, and South Korea. Due to the congestion in the Panama Canal and recent heavy rainfall in Brazil causing flooding in many ports, ships have been unable to dock, leading to delays in MDI imports and tight supply. As a result, some MDI suppliers have recently raised their quotations. PMDI prices in South America have moved up from the previous USD 1,900/tonne to the current range of USD 1,950-2,000/tonne.

August 31, 2023

Propylene Settles Down 0.5c/lb

August 15, 2023

European Natural Gas Prices Surge

European NatGas Surges 15% As Strike Threats Mount At Australian LNG Plants

by Tyler Durden

Tuesday, Aug 15, 2023 – 10:10 AM

Yet another stunning move in European NatGas on Tuesday as prices soared 15% following last week’s 40% jump due to increasing labor action risks in Australia.

Bloomberg spoke with energy traders who said the Gorgon facility on Barrow Island off the northern coast of Western Australia had reduced sales over the increasing risks of a strike.

Talks were scheduled to take place between union officials and Woodside Energy Group Ltd., one of the two companies operating the affected liquefied natural gas facilities. –BBG

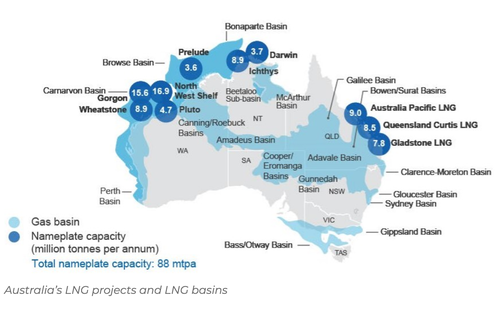

A Goldman Sachs analysis revealed potential strikes at three top LNG sites operated by Chevron and Woodside Energy Group Ltd. could disrupt global supplies. These three locations account for as much as 10% of global LNG exports.

“The potential for strike action at LNG export plants in Australia once again highlights the fact that we are now clearly in a globalised gas market,” ICIS analyst Tom Marzec-Manser told the Financial Times.

“Europe has understandably backfilled Russian pipeline supply with versatile LNG. But that versatility leads to increased price volatility.”

On Monday, Australia’s Fair Work Commission approved workers at Chevron’s Wheatstone offshore platform to vote on possible industrial action. This follows earlier labor action votes for workers at Wheatstone and Gorgon downstream facilities and at Woodside’s North West Shelf.

Australia’s Top Producing LNG Areas

Today’s news sent European benchmark NatGas futures up 15%. Prices soared 40% last week after the first report of potential labor action at various LNG facilities in Australia could threaten global supply.

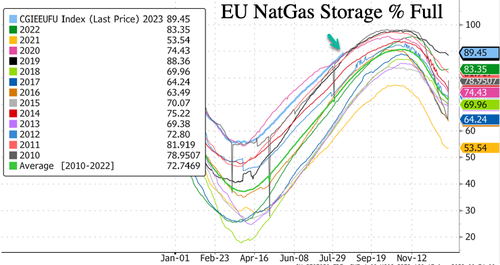

The good news for Europe is that demand for NatGas remains soft. Storage facilities across the continent are 89.45% full, the highest level for this time of year in over a decade.

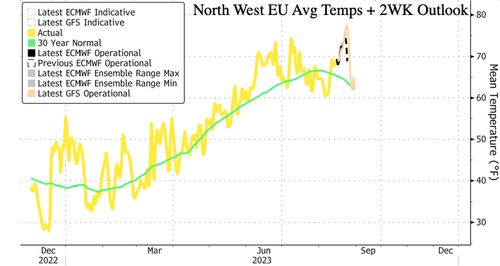

Before Europe and much of the Northern Hemisphere realize it, the heating season will arrive in the next couple of months, driving demand for NatGas higher.

The bad news is that Europe’s decoupling of reliable and cheap NatGas flows from Russia subjects it to sourcing the fuel elsewhere around the globe, making it prone to supply snarls and or what could soon be labor actions in Australia.

“The crisis is not over yet,” the chief executive of E.ON, one of Germany’s biggest utilities, said earlier this month.

“We must continue to work on the issue of austerity. This is the best way to ensure affordability for customers and also to achieve competitiveness of our society and our economy.”

If the CEO of E.ON is talking about austerity—not exactly a popular idea among regular electricity consumers—then the situation must be serious. It suggests there is no great chance of abundant LNG supply and weak competition from Asia that would make the commodity cheaper. That leaves limiting demand as the only choice.

Winter is coming

August 3, 2023

Oil Update

Oil Rebounds After Reports That Saudis Will “Extend, Deepen” Voluntary Production Cuts

by Tyler Durden

Thursday, Aug 03, 2023 – 09:00 AM

Update (0900ET): Well, we appear to have our answer to the most anticipated question for oil traders.

We noted earlier (below): “We see no looming change in the group’s current supply cadence, nor the required production adjustments set to take effect in 2024,” says Helima Croft at RBC Capital Markets, in a note.

“The question that market participants remain focused on is whether Saudi Arabia will sunset its unilateral 1 mb/d cut at summer’s end or roll it over for another month.”

The Saudi Press Agency is reporting:

An official source from the Ministry of Energy announced that the Kingdom of Saudi Arabia will extend the voluntary cut of one million barrels per day, which has gone into implementation in July, for another month to include the month of September that can be extended or extended and deepened.

In effect, the Kingdom’s production for the month of September 2023 will be approximately 9 million barrels per day.

The source also noted that this cut is in addition to the voluntary cut previously announced by the Kingdom in April 2023, which extends until the end of December 2024.

The source confirmed that this additional voluntary cut comes to reinforce the precautionary efforts made by OPEC Plus countries with the aim of supporting the stability and balance of oil markets.

This has prompted gain in WTI, erasing much of yesterday’s DOE-driven dump…

* * *

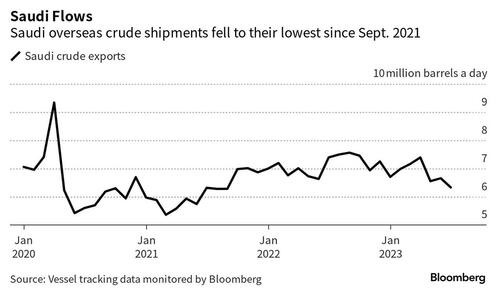

As Bloomberg’s Grant Smith detailed earlier, the biggest question in oil markets is how long Saudi Arabia will extend its 1 million-barrel-a-day supply cut. Riyadh’s handling of a previous strategy offers some guidance — and reassurance — for crude bulls.

The kingdom launched the unilateral cutback last month in a bid to shore up global oil markets, undertaking the solo effort as its comrades in the OPEC+ coalition had already cut output as much as they could bear. It’s had some qualified success, boosting Brent prices to a three-month high above $85 a barrel in London.

The Saudis have committed to extending the measure into August, and OPEC-watchers expect that Riyadh will announce a further continuation into September this week. Traders are bracing for a statement from Saudi state media in the next couple of days, before an OPEC+ monitoring committee convenes to assess markets on Friday.

To understand what the world’s biggest crude exporter may do after that, it’s useful to consider how it handled a similar intervention two years ago.

In January 2021, the Saudis announced a unilateral 1 million-barrel cut to amplify the efforts of its OPEC+ brethren, to take effect in February and March. It was subsequently extended for one more month, and then unwound in stages over the following three months.

One lesson to draw is that the kingdom is prepared to go it alone with supply curbs for a considerable period; it’s quite possible that the restraints adopted in early 2021 could have lasted longer if others in OPEC+ hadn’t been so eager to increase production.

But at the same time, the limited three-month span of the move shows the Saudis won’t make such sacrifices indefinitely. Energy Minister Prince Abdulaziz bin Salman has described this summer’s curbs as a “lollipop” for markets — and at some point all treats must be taken away.

Perhaps the most important final lesson is that, when it comes to restoring shuttered supplies, Riyadh prefers a cautious and gradual approach rather than any sudden moves.

As a result, we may see the latest 1 million-barrel reduction eventually unwound in piece-meal stages. And that ought to give confidence to oil bulls betting that the current rally can go further.

https://www.zerohedge.com/markets/oil-bulls-edge-ahead-saudi-production-cut-extension