Technology

January 17, 2024

Mattress Tagging in Europe

Euro bedding giant Aquinos to tag a million mattresses by 2027, starting next year

January 17, 2024

US materials science and digital identification company Avery Dennison is working with European mattress manufacturer Aquinos Group to tag bedding products from 2024 with radio frequency identification (RFID) technology so fewer go to waste, and the company plays an active role in the circular economy, according to a press statement. The project will make Aquinos the first company in its sector to comply with new European Union (EU) Digital Product Passport (DPP) rules.

Avery Dennison makes labeling materials, bonding solutions, and tagging solutions for industrial, medical, and retail applications. It has engaged RFID specialist TripleR on the project. Aquinos Group is one of Europe’s largest mattress manufacturers and operates 20 European factories. It sells products under the BEKA, Lattoflex, Schlaraffia, Sembella, Superba, and Swissflex mattress brands. It forecasts RFID tags will be used in one million of its mattresses by 2027, and “usher in a new era of transparency and circularity” for the firm.

Data from the RFID tags will connect to Avery Dennison’s atma.io platform via RFID readers as they are scanned, creating a digital twin of their whereabouts and history. Data will show information about the origins and materials used in the production of the mattresses. They will also be scanned at recycling centres so that “product dismantlers” can separate materials from the mattresses more efficiently for recycling, and reuse. Consumers will also be able to scan QR codes with smartphones to access product information before and after purchase.

The EU’s new DPP rules will deliver information about products’ environmental sustainability, accessible by scanning a data carrier. Data will include attributes such as the durability and reparability, the recycled content or the availability of spare parts of a product. The DPP scheme is due to come into force for mattresses in 2027. By then, it will have already shipped a million tagged units, it reckons. DPP rules for mattresses will be active sooner in certain European markets, such as Belgium (by 2025), where Aquinos is based.

Aquinos said it will be the “first producer to comply with the DPP scheme at a pan-EU scale”. Aquinos and TripleR are in alliance with the Belgian industry association Valumat as part of a collaboration that also includes product dismantlers.

Benjamin Marien, international commercial director for bedding at Aquinos, said: “DPP sets the next important step in circularity. By being the first in the industry to begin compliance, we want to lead by example to inspire the markets, our industry partners, and the bedding sector to advance environmentally responsible practices…. We will use the power of [our] brands to raise external awareness of the importance of DPPs… We are moving bedding sustainability beyond niche implementation to mainstream. This will be crucial to put an end to bedding materials going to waste.”

Michael Goller, senior director for atma.io at Avery Dennison, said: “We are proud to be working on this project with Aquinos and TripleR. Mattresses are complex and bulky products that require a highly sophisticated sorting and dismantling process. To date, it has proven difficult to do this in a cost-efficient manner – leading to millions of mattresses going to landfill each year. This is precisely why DPPs have been established and we are excited to push boundaries with our partners towards greater traceability, efficiency, and circularity.”

Stefaan Cognie, co-founder at TripleR, commented: “This project is an important milestone and sets a benchmark for how the DPP scheme will operate across Europe to enable sustainability and circularity. We have already developed a digital Identification standard in the bedding industry in Belgium and are engaging with extended producer responsibility (EPR) bodies and mattress associations in different European countries, as well as with the overarching European Mattress Association EBIA to bring DPP compliance to fruition.”

November 30, 2023

Chlorohydrin Process Propylene Oxide in China

The Evolution of Chlorohydrination Process for Manufacturing PO

PUdaily | Updated: November 30, 2023

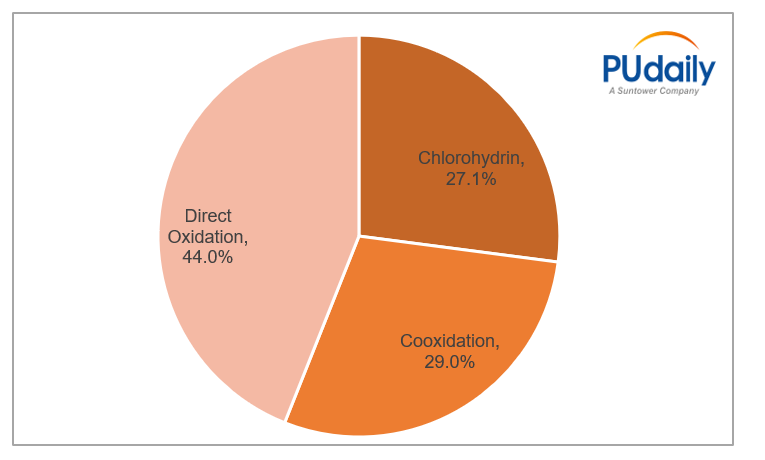

On July 14, the National Development and Reform Commission issued the National Industrial Restructuring Guidance Catalogue (2023 Edition) to seek public comments. In the new edition of the Catalogue, PO projects using chlorohydrination process based on calcium saponification are included in the eliminated category for the petrochemical and chemical industries (such projects are required to be eliminated by December 31, 2025). Restrictions on PO projects using chlorohydrination process can be traced back to the National Industrial Restructuring Guidance Catalogue (2011 edition).By the end of 2022, the share of PO projects using chlorohydrination process in China had decreased to 27.1%.

In chlorohydrination process, PO is manufactured using propylene and chlorine as the raw materials through chlorohydrination, saponification and rectification. Firstly, excess propylene is added to the mixture of water and chlorine to produce chloropropanol through chlorohydrination. The remaining propylene as well as hydrogen chloride and some organic chlorides (such as dichloropropane) produced in the reaction are discharged from the top of the reactor. and the hydrogen chloride and organic chlorides are removed through condensation for recovering the propylene. The chloropropanol solution containing 4% hydrochloric acid was discharged from the bottom of the reactor. Secondly, saponifier is added (caustic soda, instead of lime milk used in the traditional chlorohydrination process, is used in modified chlorohydrination process) to saponify chloropropanol for making crude PO. Thirdly, crude PO is transferred to the rectification column for separation and refining. The chlorohydrination process is composed of chlorohydrination, saponification and rectification.

As a mature technology, chlorohydrination process features production of a single product, easy operation of the facilities, low purity requirement for propylene and low building costs for the facilities. But it consumes a large amount of lime, chlorine and water, and results in a large amount of waste water and residue, which not only pollute the environment, but also cause corrosion to the equipment. Over the past decades, many firms at home and abroad have refined the process in different ways, represented by

1. Dow Chemical: The company replaces lime milk (Ca(OH)2) with electrolyte NaOH (mass fraction between 10% and 20%) in the saponification to significantly reduce the mass concentration of propanediol and dichloropropane in the saponified waste liquid and thus obtain relatively pure saline solution (NaCl and H2O). The saline solution is refined to make it saturated one, which is then transferred to the electrolytic bath for electrolysis that produces chlorine, hydrogen and sodium hydroxide. The chlorine is used as a raw material for the chlorohydrination process, and the sodium hydroxide is again used in the saponification. The recycling makes the process more economical. This refinement dramatically reduces the amount of waste water and residues (mainly composed of CaCl2) produced from saponification and as a result reduces the pollution of soil and water sources. However, the electrolytic process is energy-intensive.

2.ABB Lummus Global: The company comes up with the concept of closed-loop circulation, in which Cl2 and NaOH react with isobutanol to produce butyl hypochlorate as the chlorohydrating agent to reduce the use of Cl2; butyl hypochlorate react with propylene in the organic solvent to produce isobutanol and chloropropanol;and chloropropanol is saponified with the electrolyte to manufacture propylene oxide. Compared with the traditional chlorohydrination process, this refined process greatly reduces industrial wastewater, waste gases and residues. With a high mass concentration, the saline solution produced from saponification can be transferred to the electrolytic plant for electrolysis. The produced Cl2 and NaOH can be reused. But the process also has drawbacks, including large consumption of isobatyalcohol and high building costs for the facility.

A domestic firm has also developed its own environmentally friendly process for manufacturing PO, in which the recovered lime milk is saponified with the waste water and CaCl2 in the residual liquid. This process has been industrialized, producing significant social, environmental and economic benefits.

September 28, 2023

HPPO Propylene Oxide Process Issues

Frequent Explosion Accidents: What are the Dangers of Hydrogen Peroxide?

PUdaily | Updated: September 21, 2023

Following the explosion occurred at the hydrogen peroxide production area of Luxi Chemical, a subsidiary of Sinochem Holdings, on May 1, which resulted in 9 deaths, 1 injury, and 1 person missing, another explosion occurred in the hydrogen peroxide workshop at Risun Chemical on September 14. It is the second major hydrogen peroxide accident that has occurred within China in 2023.

Why is hydrogen peroxide so dangerous?

Electrolysis, anthraquinone (AQ), isopropanol oxidation, electrochemical cathode reduction of oxygen, and auto-oxidation (AO) are commonly used in the production of hydrogen peroxide. The AQ method is currently the most mature method, and over 99% of hydrogen peroxide plants in China use this technology. The AQ process for hydrogen peroxide production has a high hazard coefficient. It involves using hazardous raw materials and going through hazardous processes to produce a hazardous product.

The first reaction in the production process of hydrogen peroxide, namely hydrogenation, is a hazardous chemical process that is subject to strict regulation. It has the following hazardous characteristics: (a) The reactants have explosiveness, and the explosion limit of hydrogen gas is 4-75%, making it highly flammable and explosive. (b) Hydrogenation is an exothermic reaction, and when hydrogen gas comes into contact with steel under high temperature and pressure, carbon molecules in the steel can react with hydrogen gas to form hydrocarbons, reducing the strength of the steel equipment and causing hydrogen embrittlement. (c) The regeneration and activation of catalysts can easily cause explosions. (d) The exhaust gas from the hydrogenation reaction contains unreacted hydrogen gas and other impurities, which can easily cause ignition or explosion during discharge. The second reaction in the hydrogen peroxide production – oxidation – is also a hazardous chemical process that is subject to strict regulation. It’s hazardous because that the peroxidation process has a strong risk of decomposition and explosion due to the presence of peroxide groups (-O-O-).

Hydrogen peroxide is currently an important raw material for the production of propylene oxide. The concentration of hydrogen peroxide products in China is mainly 27.5%. However, in recent years, there has been an increasing demand for high concentration products (>50%), as the use of high concentration hydrogen peroxide can effectively improve the production efficiency and product quality. The HPPO process often uses hydrogen peroxide with a concentration of 50% to 70%.

Currently, the key players in China’s HPPO-based propylene oxide industry are Jilin Shenhua and Sinopec Changling. In 2011, Jilin Shenhua introduced HPPO technology from Degussa and Uhde, with an investment of CNY 2.5 billion, and built the first and largest HPPO plant in China with a scheduled capacity of 300 ktpa. The plant started operations in July 2014. In 2013, Sinopec planned to adopt independently developed HPPO technology and invested about CNY 1.28 billion to build a 100 ktpa industrial plant at the company’s Changling Branch. The plant was completed in July 2014, and successful trial operation was conducted on December 6 of the same year. This marked Sinopec as the third company in the world to own the patent for producing propylene oxide using hydrogen peroxide technology, breaking the monopoly of foreign countries on this technology.

In addition to the aforementioned two producers, Taixing Yida Chemical (independent R&D), Qixiang Tengda (authorized by Evonik and ThyssenKrupp Uhde), Jincheng Petrochemical (independently developed by China Tianchen Engineering), and Jiahong New Material (using the process owned by China Catalyst Holding Co., Ltd) have also successfully operated their HPPO facilities in recent years. The current production capacity of HPPO (Hydrogen Peroxide to Propylene Oxide) plants in China has reached 1.55 mtpa.

However, the current stability of HPPO facilities is poor, with frequent shutdowns and maintenance issues. Although there are many newly completed or planned HPPO projects, there are still significant uncertainties and obstacles. The main reasons are as follows:

1) Inadequate hydrogen peroxide supply: Due to its unstable and highly explosive nature, hydrogen peroxide cannot be transported over long distances. It has a limited sales radius (300-500 km). Currently, hydrogen peroxide production in China is mainly concentrated in East China (63%), North China (6%), and Central China (14%), primarily located in chemical-intensive provinces such as Shandong, Hubei, Jiangsu, and Zhejiang. Southwest (4%), northwest (2%), and northeast (6%) regions have minimal production capacity, resulting in an imbalance between production layout and market size. On one hand, in some areas with concentrated downstream industries, there is a supply shortage of hydrogen peroxide, resulting in high transportation costs. On the other hand, some regions have excessive production facilities, with capacity far exceeding demand. Therefore, the issue of hydrogen peroxide supply needs to be addressed. The construction of new hydrogen peroxide plants requires sufficient hydrogen resources and faces difficulties in approval due to the classification of hydrogen peroxide as a hazardous chemical.

2) The production requires high-concentration hydrogen peroxide, while the preparation of high-concentration hydrogen peroxide presents certain difficulties. Currently, in Jilin Shenhua’s plant, the required 70% hydrogen peroxide is supplied by Evonik. The high cost leads to poor profitability of the plant.

3) In the HPPO process, hydrogen peroxide has high activity and can produce some aldehyde impurities during the production process, which can have an impact on downstream production.

August 7, 2023

The Fine Print

Privacy Storm Brewing As Zoom’s Updated Terms Greenlight AI Model Training With User Data

by Tyler Durden

Monday, Aug 07, 2023 – 12:25 PM

Zoom has added a clause to its Terms-of-Service (TOS) which allows the video conferencing company to use customer-generated content for any purpose they see fit, including to train artificial intelligence (AI) models, with no opt-out.

Zoom’s TOS, last revised on July 26th, conceals a concerning caveat. Nestled within section 10.4, for those brave enough to venture, is language that confers upon Zoom a carte blanche right to exploit what it coins as “Service Generated Data” (SGD). This expansive designation encompasses a cornucopia of user-generated information – from innocuous telemetry data to incisive diagnostic insights – all grist for the AI mill.

Section 10.4 also describes the company’s use of Customer Content (defined as “data, content, files, documents, or other materials”), not just telemetry data and the like, which it can use “for the purpose of product and service development, marketing, analytics, quality assurance, machine learning, artificial intelligence, training, testing, improvement of the Services, Software, or Zoom’s other products, services, and software, or any combination thereof.”

The company makes clear that it will be using data for, among other things, fine-tuning AI models and algorithms. The potential consequences are manifold, raising red flags for privacy pundits and sparking debates over the boundaries of user consent.

Zoom’s data net is cast even wider with a perpetual, worldwide, non-exclusive, royalty-free, sublicensable, and transferable license. This legal carte blanche emboldens Zoom to undertake a multitude of actions that span the entire data lifecycle. From reconstituting, republishing, and accessing user content to the deep recesses of data modification, redistribution, and algorithmic processing, the breadth of Zoom’s dominion over user-generated data now defies conventional comprehension.

Zoom contends that these data maneuvers are vital to service provision, bolstering software quality, and enhancing the broader Zoom ecosystem. The augmentation of AI capabilities, epitomized by Zoom IQ, has been touted as a beacon of collaboration, promising efficient meeting summaries, task automation, and optimized follow-ups, all enabled by the seamless integration of user data.

“With the introduction of these new capabilities in Zoom IQ, an incredible generative AI assistant, teams can further enhance their productivity for everyday tasks, freeing up more time for creative work and expanding collaboration,” said Zoom chief product officer, Smita Hashim. “There is no one-size-fits-all approach to large language models, and with Zoom’s federated approach to AI, we are able to bring powerful capabilities to our customers and users through Zoom’s own models as well as our partners’ models.”

In 2021, Zoom agreed to settle a class-action privacy lawsuit for $86 million, after plaintiffs accused the company of violating the privacy of millions of users by sharing personal data with Facebook, LinkedIn and Google.

The controversial section of the TOS reads (emphasis ours):

Customer License Grant. You agree to grant and hereby grant Zoom a perpetual, worldwide, non-exclusive, royalty-free, sublicensable, and transferable license and all other rights required or necessary to redistribute, publish, import, access, use, store, transmit, review, disclose, preserve, extract, modify, reproduce, share, use, display, copy, distribute, translate, transcribe, create derivative works, and process Customer Content and to perform all acts with respect to the Customer Content: (i) as may be necessary for Zoom to provide the Services to you, including to support the Services; (ii) for the purpose of product and service development, marketing, analytics, quality assurance, machine learning, artificial intelligence, training, testing, improvement of the Services, Software, or Zoom’s other products, services, and software, or any combination thereof; and (iii) for any other purpose relating to any use or other act permitted in accordance with Section 10.3. If you have any Proprietary Rights in or to Service Generated Data or Aggregated Anonymous Data, you hereby grant Zoom a perpetual, irrevocable, worldwide, non-exclusive, royalty-free, sublicensable, and transferable license and all other rights required or necessary to enable Zoom to exercise its rights pertaining to Service Generated Data and Aggregated Anonymous Data, as the case

June 13, 2023

Butanediol in China

BDO Market Booms with Growing Demand in Traditional and Emerging Industries

ECHEMI2023-06-12

1,4-butanediol (BDO) is an influential organic and fine chemical raw material, widely used in textile, chemical and other fields. Demand for BDO has formed a significant driving force in recent years with the expansion of applications in emerging fields such as biodegradable plastics and lithium batteries, as well as the recovery of traditional downstream industries such as spandex and PBT plastics.

According to SteelHome, the BDO market is currently extremely hot, with prices rising sharply. The benchmark price of BDO in the East China market has exceeded 11000-11100 yuan/ton, with a growth to the past week. According to research by Shenwan Hongyuan Securities, China’s apparent BDO consumption is expected to reach about 4.47 million tons per year by 2025, and the compound annual growth rate of BDO demand from 2020 to 2025 will be 26.5 percent.

BDO’s traditional application areas are primarily spandex and PBT engineered plastics, with BDO’s downstream applications in the spandex industry chain and PBT engineered plastics reaching 51% and 26% respectively. The spandex market is extremely hot, with product prices up nearly 200 percent, as demand for textiles and clothing recovers and export orders rise. The PBT plastics sector is also showing a clear trend of growth, with increasing applications in new energy vehicles and charging devices.

In addition to traditional application areas, BDO is rapidly expanding its applications in emerging areas such as biodegradable plastics and lithium batteries. With the frequent introduction of domestic plastic reduction policies, the demand for biodegradable plastics is about to enter a period of explosive growth, and PBAT is expected to lead the way in the agricultural plastic film and packaging materials and other biodegradable plastic markets with well-established production technologies and high cost-effectiveness. As a major feedstock for PBAT, PBAT is expected to generate approximately 2.5 million tonnes/year of new demand for BDO by 2025. At the same time, BDO is an essential raw material in the hottest lithium battery industry chain, and its downstream NMP is an important solvent in the production process of lithium battery cathodes, as well as a cleaning agent for semiconductors and integrated circuits.

Due to the long-term low BDO product prices, companies can only barely maintain a break-even point, and the industry’s sluggish business environment severely hinders new capital expenditures. Currently, the d Chinese annual production capacity of BDO is about 1.45 million tons, and the demand gap exceeds 200,000 tons. Only two A-share listed companies, Zhongtai Chemical and Shaanxi Black Cat, have BDO production capacity, with a combined annual capacity of only 330,000 tons. The huge gap between supply and demand has attracted a group of domestic companies to ramp up production on a regular basis. More than 1.5 million tons of new BDO capacity are currently planned in China, but the construction of BDO capacity usually takes about two years and there is a certain commissioning period after completion to achieve stable production. The fastest new capacity will gradually enter the production release period in the second half of 2022. Many industry insiders believe that the mismatch between new capacity and downstream demand growth will keep this cycle of BDO shortages going for more than two years, and that the BDO business environment will continue to improve as a result.

Recently, the world’s largest BDO project with an annual production capacity of 900,000 tons was settled in Fujian. The project will help boost China’s new energy and environmental protection industries by using the large amount of hydrogen produced as a by-product of propane dehydrogenation to produce BDO, a new chemical material that can be used to produce lithium batteries, high-end spandex, fully biodegradable plastics and other products. The move is an important boost for China’s plasticization industry and will help promote the transformation and upgrading of the country’s chemical industry, as well as the development of new energy and environmental protection industries.

https://www.echemi.com/cms/1416474.html

Polybutylene adipate terephthalate

From Wikipedia, the free encyclopedia

PBAT (short for polybutylene adipate terephthalate) is a biodegradable random copolymer, specifically a copolyester of adipic acid, 1,4-butanediol and terephthalic acid (from dimethyl terephthalate). PBAT is produced by many different manufacturers and may be known by the brand names ecoflex, Wango, Ecoworld, Eastar Bio, and Origo-Bi. It is also called poly(butylene adipate-co-terephthalate) and sometimes polybutyrate-adipate-terephthalate[1] (a misnomer) or even just “polybutyrate”.[2] It is generally marketed as a fully biodegradable alternative to low-density polyethylene, having many similar properties including flexibility and resilience, allowing it to be used for many similar uses such as plastic bags and wraps.[3] It is depicted as a block co-polymer here due to the common synthetic method of first synthesizing two copolymer blocks and then combining them. However, it is important to note that the actual structure of the polymer is a random co-polymer of the blocks shown.

Read more here: https://en.wikipedia.org/wiki/Polybutylene_adipate_terephthalate