Uncategorized

June 21, 2023

Chinese Propylene Oxide Market

Zero Tax Rebate? Technical Limitations? Reasons for China’s Extremely Rare Propylene Oxide Exports

PUdaily | Updated: June 19, 2023

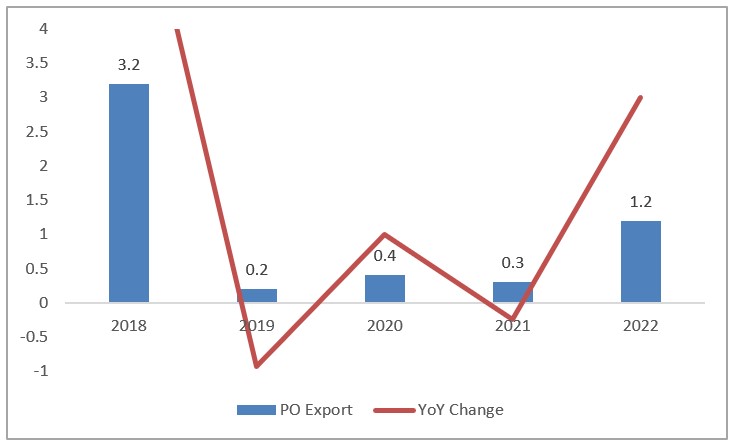

China rarely exports propylene oxide (PO). The country’s PO exports in the past five years only amounted to 53,000 tonnes. In addition to short supply in the domestic market, there are another three reasons for China’s extremely rare PO exports.

Data Source: PUdaily

1. Zero Tax Rebate

China has kept updating its tax rebate policies and accelerated the tax-rebate process in recent years, which has played a positive role in stabilizing foreign trade. Except for high energy-consuming, highly polluting and resource-based commodities, all exported goods have been completely relieved the tax burden, improving the competitiveness of Chinese goods in the international market. However, Chinese PO suppliers have been paid zero tax rebates since 2007.

2. Technical Limitations

China clearly stated that “controlling the export of high energy-consuming, highly polluting and resource-based commodities… and promoting the upgrading of domestic industries” in Outline of the 11th Five Year Plan for National Economy and Society Development (2005). This proposition is to balance internal and external economic development, guide enterprises to gradually reduce their over-reliance on foreign markets, rely more on and develop the domestic market to achieve endogenous growth; optimize the industrial structure, promote industrial upgrading; strengthen tax incentives to promote resource conservation, emission reduction, environmental protection, and accelerate the transformation of economic development mode.

Due to problems such as severe equipment corrosion and large production wastewater, the chlorohydrin process was included in the Guide Catalogue for Industrial Structural Adjustment (2019) under the restricted category, and constructing new chlorohydrin-based facilities has been prohibited since 2015. At that time, the chlorohydrin process accounted for 58.1% of PO production volume in China, while as of now, the proportion has been reduced to 27.1%.

In the Announcement No.54 (2020) on amending the catalogue of prohibited products in processing trade, it was mentioned that only the hydrogen peroxide to propylene oxide (HPPO) process is allowed to produce exported propylene oxide, and the others are still under the prohibited list. The note on the prohibited export commodities has been modified to “allow HPPO and co-oxidation processes to produce exported propylene oxide, and the others are still under the prohibited list”.

3. Limited Chemical Tankers

A chemical tanker is a type of tanker ship designed to transport liquid chemicals in bulk, including various toxic, flammable, volatile, or corrosive chemicals. PO belongs to Class 3 dangerous goods as a flammable liquid, with a low flashpoint and high danger. So it requires high packaging strength (Packing group I). To ship PO by sea for export, it is necessary to do shipside loading. If the ship docks at an outer port, the goods need to be sent to the hazardous chemicals warehouse.

Since July 2011, China’s chemical tanker market has entered a period of strict capacity control, with limited new capacity added each year. From 2012 to 2018, China’s average annual increase in maritime transportation capacity was only 21,371.43 deadweight tonnages (DWT). Under the strict capacity monitoring system, the total expansion of chemical tanker industry has been relatively slow, and the industry size has been regulated. Under the survival of the fittest mechanism, the industry maintains orderly growth. As of 2022, there were a total of 287 provincial chemical tankers in China (including dual-purpose tankers for oil and chemicals), with a total capacity of 1.399 million dwt, an increase of 3 tankers and 110,000 dwt YoY, with a tonnage increase of 8.5%. In 2022, 28 tankers with a total of 188,000 dwt were added, and 25 tankers with a total capacity of 76,000 dwt were retired from the market ahead of schedule.

With continually growing production capacity, Chinese PO suppliers will face higher sales pressure in the domestic market. While gradually reducing dependence on imported sources, the opening of the export market seems inevitable, but it is unclear whether tax rebates will be available once again.

April 17, 2023

Asian TDI Overview

China TDI Market Rebounds Under Continuous Supply Contraction

PUdaily | Updated: April 14, 2023

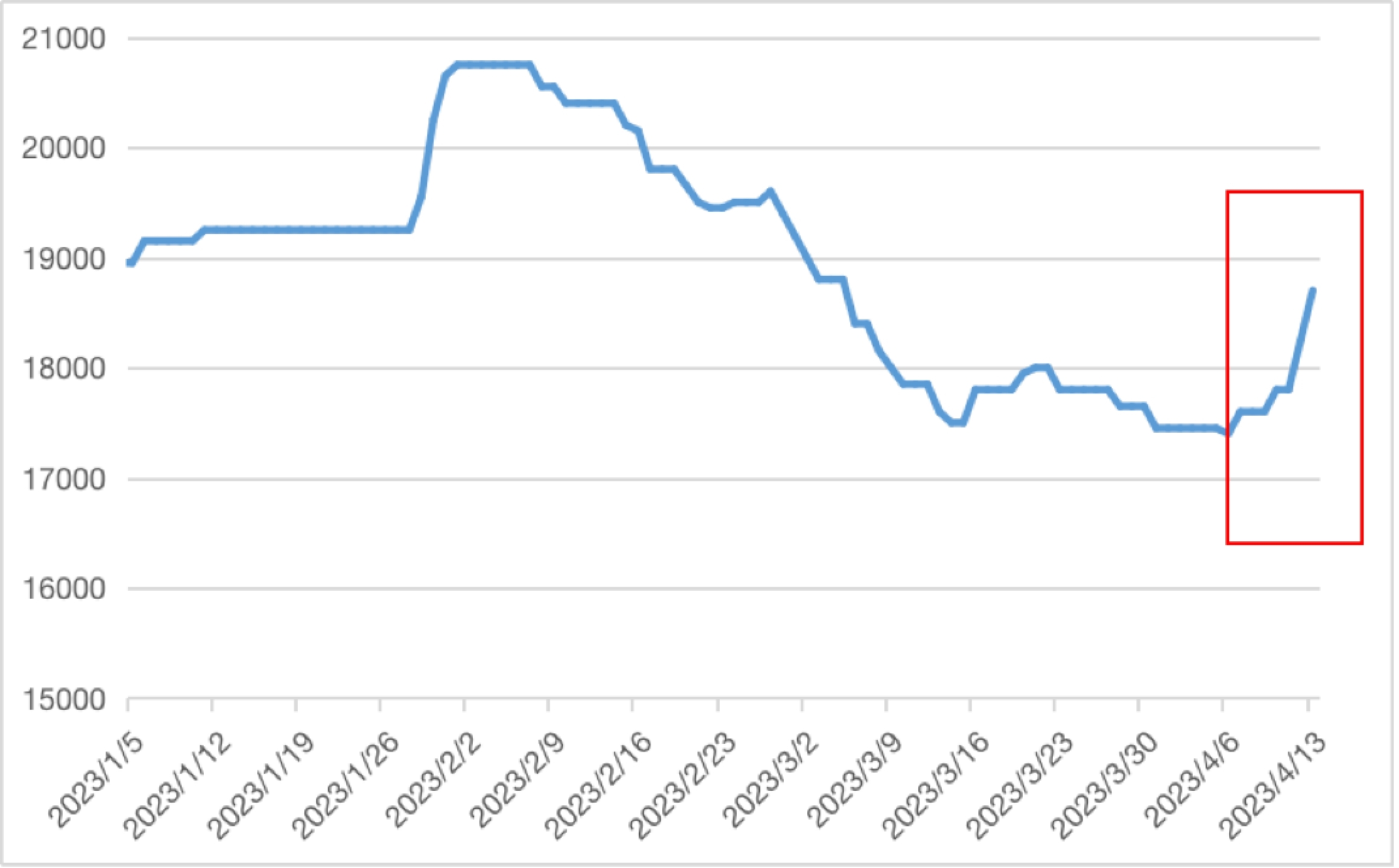

China’s TDI market has rebounded rapidly since last Thursday. As of April 13, TDI prices in East China stood around CNY 18,400-19,000/tonne, an increase of over CNY 1,000/tonne compared to last week.

Figure 1: China TDI Price Trend in 2023 (CNY/tonne)

Although China’s TDI market remained strong at the beginning of 2023, with the arrival of the Spring Festival, downstream manufacturers gradually went on holiday, and the trading atmosphere was generally sluggish. After Spring Festival holidays, the TDI market opened with a jump in prices, as not only did Gansu Yinguang Chemical not restart TDI facility, but existing capacity also continued to decline: a 100 ktpa facility in Fujian was shut down permanently from February 1; Covestro and Juli Chemical had significantly reduced operation loads due to equipment issues; and other suppliers did not increase output into the market either. As a result, the TDI spot supply remained relatively tight, with traders raising their quotes, and market prices quickly climbing to quarterly highs. However, due to weaker-than-expected demand, the high market prices were difficult to sustain, and under sales pressure, the market began a lingering downtrend. Despite continuous support from suppliers’ pricing policies, and overall low operating rates, weak purchasing power continued to drag down the market, leading to repeated price declines.

After entering April, the 150 ktpa TDI facility of Juli Chemical has undergone maintenance, while Yinguang Chemical still has not resumed normal production. Previously, due to market expectations that prices would continue to decline after the release of new capacities from Yinguang Chemical and Wanhua Chemical’s Fujian plant, many market participants kept a cautious and wait-and-see attitude. However, it’s reported that there is still no consensus on whether Yinguang Chemical will release its products into the market in April, and the spot market is becoming increasingly tight. Moreover, since the shutdown of TDI facilities by BASF in Europe, Asian TDI suppliers led by BASF in South Korea have provided extensive support for exports. Starting from April 15, Hanwha’s TDI unit in South Korea will also enter maintenance, which will further tighten the supply of Korean TDI exports. This gives more opportunities for Chinese TDI suppliers to increase their overseas market supplies, reduces domestic sales pressure, and provides indirect support for the recent rapid rebound of TDI prices.

February 14, 2023

Chinese Polyol Balances

China Import and Export of Other Polyether Polyols in Primary Forms 2022

PUdaily | Updated: February 9, 2023

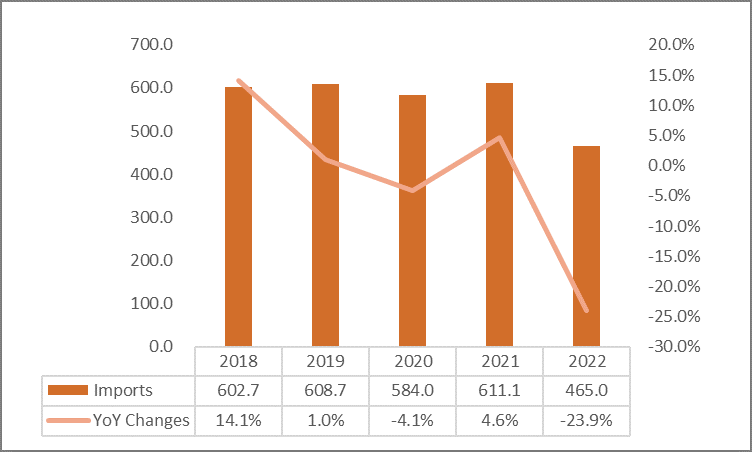

China’s polyether polyols are unbalanced in structure and highly dependent on imports for raw materials. In order to meet domestic demand, China imports high-quality polyethers from foreign suppliers. Dow’s plant in Saudi Arabia and Shell in Singapore are still the main import sources of polyethers for China. China’s import of other polyether polyols in primary forms in 2022 totalled 465,000 tonnes, a year-on-year decrease of 23.9%. Import sources included a total of 46 countries or regions, led by Singapore, Saudi Arabia, Thailand, South Korea and Japan, according to China customs.

China Imports of Other Polyether Polyols in Primary Forms & YoY Changes, 2018-2022 (kT, %)

With liberalized anti-epidemic measures and continuously increasing consumer demand, Chinese polyether suppliers had gradually expanded their production capacity. China’s polyether polyols import-dependency ratio decreased significantly in 2022. Meanwhile, Chinese polyether polyol market saw significant structural excess capacity and fierce price competition. Many suppliers in China turned to target overseas markets to solve the prickly issue of overcapacity.

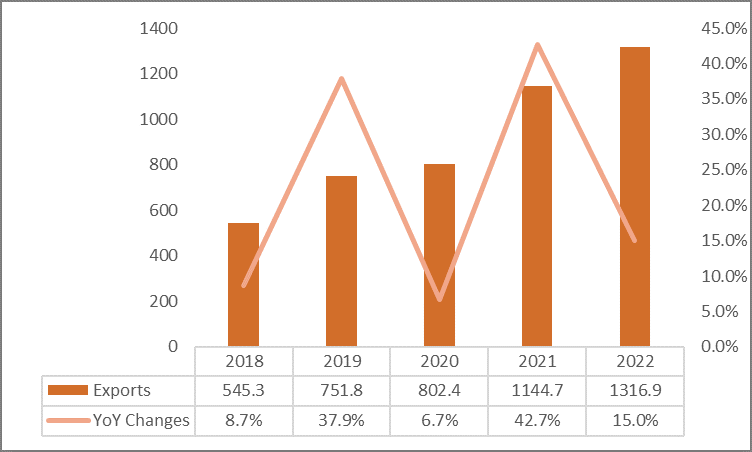

China’s polyether polyol exports kept rising from 2018 to 2022, at a CAGR of 24.7%. In 2022, China’s export of other polyether polyols in primary forms totalled 1.32 million tonnes, a year-on-year increase of 15%. Export destinations included a total of 157 countries or regions. Vietnam, the United States, Turkey and Brazil were the main export destinations. Rigid polyols were mostly exported.

China Exports of Other Polyether Polyols in Primary Forms & YoY Changes, 2018-2022 (kT, %)

China’s economic growth is expected to reach 5.2% in 2023, according to IMF’s latest forecast in January. The boost of macro policies and the strong momentum of development reflect the resilience of China’s economy. With increased consumer confidence and revived consumption, the demand for high-quality polyethers has grown, thus China’s polyether imports will witness a slight increment. In 2023, thanks to capacity expansion plans of Wanhua Chemical, INOV, Jiahua Chemicals and other suppliers, China’s new polyether polyols capacity is projected to reach 1.72 million tonnes per annum, and the supply will further increase. However, due to limited domestic consumption, Chinese suppliers are considering going global. China’s fast economy recovery will drive the global economy. IMF predicts that global growth would reach 3.4% in 2023. The development of downstream industries will inevitably push up the demand for polyether polyols. Therefore, China’s polyether polyols export is expected to further increase in 2023.

January 31, 2023

German Energy Costs

The “Price Shock” is Just Starting: German Industry To Pay 40% More For Energy Than Pre-Crisis

by Tyler Durden

Tuesday, Jan 31, 2023 – 08:55 AM

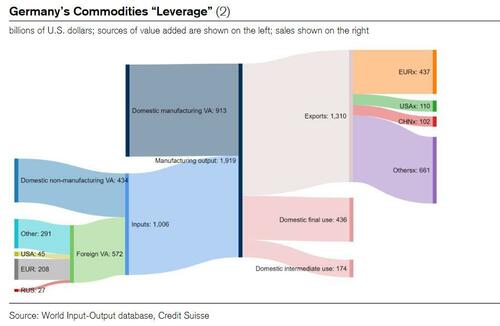

Back in August 2022, repo plumbing guru Zoltan Pozsar published a fascinating chart showing how “$2 Trillion Of German Value Depends On $20 Billion Of Russian Gas” or specifically, how Germany had applied some 100x leverage – much more than Lehman – on cheap commodities, and mostly Russian gas, to cheaply run its export-driven economic miracle for decades.

And with Russia’s cheap gas now gone for the foreseeable future, so is Germany’s tremendous operating leverage. Which means profit margins will be hammered for years to come.

As proof look no further than a study published Monday by Allianz Trade which cited contract expiries and delayed wholesale pricing effects, and which according to Reuters found that German industry is set to pay about 40% more for energy in 2023 than in 2021, before the energy crisis triggered by Russia’s invasion of Ukraine.

“The large energy-price shock still lies ahead for European corporates,” said Allianz Trade, the credit insurer that changed its name from Euler Hermes last year.

As a reminder, in 2022, higher corporate utility bills were contained as long pass-through times from wholesale markets and government interventions mitigated the immediate hit from surging prices as Russia curbed fuel exports to the West. The resulting budget deficits were promptly funded by the ECB, which meant that for all the posturing, Christine Lagarde was directly funding Putin’s cash build up.

But the pass-throughs are ending, which means that price increases will soon hit corporate profits across Europe by 1-1.5% and lead to lower investment, which in Germany’s case would amount to 25 billion euros ($27 billion), Allianz Trade estimated.

The silver lining is that German companies’ finances are robust, while a state-imposed gas price cap would help (unless it makes things much worse).

At the same time, fears the crisis could lead to de-industrialisation and a loss of competitiveness against the United States were overdone, because labor costs and exchange rates have a bigger impact on manufacturing than energy prices, the study said. Also, while exporters were losing market shares in areas such as agrifood, machinery, electrical equipment, metals and transport, the relative beneficiaries tended to be Asian, Middle Eastern and African, not American, it added.

Meanwhile, the economic ministry said on Saturday that the German government’s one-off payment to help private households and small businesses with gas prices – the first stage of a package that will be complemented with retroactive price caps kicking in in March – has cost 4.3 billion euros so far.

Berlin has earmarked 12 billion euros for the payment, but the ministry said 4.3 billion euros was not the final cost as many eligible firms had not yet applied for the aid. They have until the end of February to apply; and judging by the huge losses they still face, they will.

November 10, 2022

EVERCHEM UPDATE: VOL. 05 – Trade Shows

Speeches can be streamed, exhibit booths can be power-pointed and screen-shared, but it all pales in comparison to in-person networking. Trade shows are back!

Subscribe to the Urethane blog for more Everchem Updates here