Urethane Blog

Chinese Propylene Oxide Market

June 21, 2023

Zero Tax Rebate? Technical Limitations? Reasons for China’s Extremely Rare Propylene Oxide Exports

PUdaily | Updated: June 19, 2023

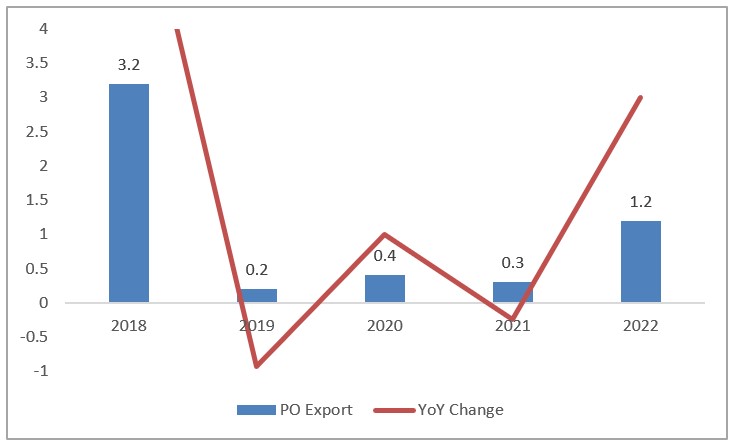

China rarely exports propylene oxide (PO). The country’s PO exports in the past five years only amounted to 53,000 tonnes. In addition to short supply in the domestic market, there are another three reasons for China’s extremely rare PO exports.

Data Source: PUdaily

1. Zero Tax Rebate

China has kept updating its tax rebate policies and accelerated the tax-rebate process in recent years, which has played a positive role in stabilizing foreign trade. Except for high energy-consuming, highly polluting and resource-based commodities, all exported goods have been completely relieved the tax burden, improving the competitiveness of Chinese goods in the international market. However, Chinese PO suppliers have been paid zero tax rebates since 2007.

2. Technical Limitations

China clearly stated that “controlling the export of high energy-consuming, highly polluting and resource-based commodities… and promoting the upgrading of domestic industries” in Outline of the 11th Five Year Plan for National Economy and Society Development (2005). This proposition is to balance internal and external economic development, guide enterprises to gradually reduce their over-reliance on foreign markets, rely more on and develop the domestic market to achieve endogenous growth; optimize the industrial structure, promote industrial upgrading; strengthen tax incentives to promote resource conservation, emission reduction, environmental protection, and accelerate the transformation of economic development mode.

Due to problems such as severe equipment corrosion and large production wastewater, the chlorohydrin process was included in the Guide Catalogue for Industrial Structural Adjustment (2019) under the restricted category, and constructing new chlorohydrin-based facilities has been prohibited since 2015. At that time, the chlorohydrin process accounted for 58.1% of PO production volume in China, while as of now, the proportion has been reduced to 27.1%.

In the Announcement No.54 (2020) on amending the catalogue of prohibited products in processing trade, it was mentioned that only the hydrogen peroxide to propylene oxide (HPPO) process is allowed to produce exported propylene oxide, and the others are still under the prohibited list. The note on the prohibited export commodities has been modified to “allow HPPO and co-oxidation processes to produce exported propylene oxide, and the others are still under the prohibited list”.

3. Limited Chemical Tankers

A chemical tanker is a type of tanker ship designed to transport liquid chemicals in bulk, including various toxic, flammable, volatile, or corrosive chemicals. PO belongs to Class 3 dangerous goods as a flammable liquid, with a low flashpoint and high danger. So it requires high packaging strength (Packing group I). To ship PO by sea for export, it is necessary to do shipside loading. If the ship docks at an outer port, the goods need to be sent to the hazardous chemicals warehouse.

Since July 2011, China’s chemical tanker market has entered a period of strict capacity control, with limited new capacity added each year. From 2012 to 2018, China’s average annual increase in maritime transportation capacity was only 21,371.43 deadweight tonnages (DWT). Under the strict capacity monitoring system, the total expansion of chemical tanker industry has been relatively slow, and the industry size has been regulated. Under the survival of the fittest mechanism, the industry maintains orderly growth. As of 2022, there were a total of 287 provincial chemical tankers in China (including dual-purpose tankers for oil and chemicals), with a total capacity of 1.399 million dwt, an increase of 3 tankers and 110,000 dwt YoY, with a tonnage increase of 8.5%. In 2022, 28 tankers with a total of 188,000 dwt were added, and 25 tankers with a total capacity of 76,000 dwt were retired from the market ahead of schedule.

With continually growing production capacity, Chinese PO suppliers will face higher sales pressure in the domestic market. While gradually reducing dependence on imported sources, the opening of the export market seems inevitable, but it is unclear whether tax rebates will be available once again.