The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

April 24, 2024

Europe styrene output to rise as force majeures lifting in H2 April

A force majeure was declared on polyolefins in March at LyondellBasell’s and Covestro’s jointly-owned propylene oxide styrene monomer (POSM) plant in Maasvlakte, the Netherlands. The POSM plant had been taken offline in mid-December as a preventative measure and came back online in second half February. A spokesperson for LyondellBasell confirmed OPIS Tuesday that the “unit at Maasvlakte is up and running.”

LyondellBasell’s site at Maasvlakte produces 680,000 metric tons/year of styrene, the largest styrene manufacturing unit in Europe, and 313,000 mt/year of propylene oxide, according to data from Chemical Market Analytics (CMA) by OPIS, a Dow Jones company. TotalEnergies produces 600,000 mt/year styrene at Gonfreville, the second largest European production site, CMA data showed.

April 24, 2024

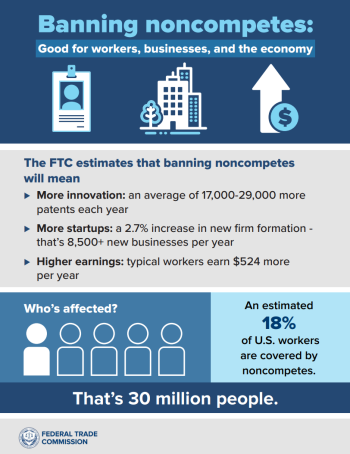

FTC Announces Rule Banning Noncompetes

FTC’s final rule will generate over 8,500 new businesses each year, raise worker wages, lower health care costs, and boost innovation

Today, the Federal Trade Commission issued a final rule to promote competition by banning noncompetes nationwide, protecting the fundamental freedom of workers to change jobs, increasing innovation, and fostering new business formation.

“Noncompete clauses keep wages low, suppress new ideas, and rob the American economy of dynamism, including from the more than 8,500 new startups that would be created a year once noncompetes are banned,” said FTC Chair Lina M. Khan. “The FTC’s final rule to ban noncompetes will ensure Americans have the freedom to pursue a new job, start a new business, or bring a new idea to market.”

The FTC estimates that the final rule banning noncompetes will lead to new business formation growing by 2.7% per year, resulting in more than 8,500 additional new businesses created each year. The final rule is expected to result in higher earnings for workers, with estimated earnings increasing for the average worker by an additional $524 per year, and it is expected to lower health care costs by up to $194 billion over the next decade. In addition, the final rule is expected to help drive innovation, leading to an estimated average increase of 17,000 to 29,000 more patents each year for the next 10 years under the final rule.

Noncompetes are a widespread and often exploitative practice imposing contractual conditions that prevent workers from taking a new job or starting a new business. Noncompetes often force workers to either stay in a job they want to leave or bear other significant harms and costs, such as being forced to switch to a lower-paying field, being forced to relocate, being forced to leave the workforce altogether, or being forced to defend against expensive litigation. An estimated 30 million workers—nearly one in five Americans—are subject to a noncompete.

Under the FTC’s new rule, existing noncompetes for the vast majority of workers will no longer be enforceable after the rule’s effective date. Existing noncompetes for senior executives – who represent less than 0.75% of workers – can remain in force under the FTC’s final rule, but employers are banned from entering into or attempting to enforce any new noncompetes, even if they involve senior executives. Employers will be required to provide notice to workers other than senior executives who are bound by an existing noncompete that they will not be enforcing any noncompetes against them.

In January 2023, the FTC issued a proposed rule which was subject to a 90-day public comment period. The FTC received more than 26,000 comments on the proposed rule, with over 25,000 comments in support of the FTC’s proposed ban on noncompetes. The comments informed the FTC’s final rulemaking process, with the FTC carefully reviewing each comment and making changes to the proposed rule in response to the public’s feedback.

In the final rule, the Commission has determined that it is an unfair method of competition, and therefore a violation of Section 5 of the FTC Act, for employers to enter into noncompetes with workers and to enforce certain noncompetes.

The Commission found that noncompetes tend to negatively affect competitive conditions in labor markets by inhibiting efficient matching between workers and employers. The Commission also found that noncompetes tend to negatively affect competitive conditions in product and service markets, inhibiting new business formation and innovation. There is also evidence that noncompetes lead to increased market concentration and higher prices for consumers.

Alternatives to Noncompetes

The Commission found that employers have several alternatives to noncompetes that still enable firms to protect their investments without having to enforce a noncompete.

Trade secret laws and non-disclosure agreements (NDAs) both provide employers with well-established means to protect proprietary and other sensitive information. Researchers estimate that over 95% of workers with a noncompete already have an NDA.

The Commission also finds that instead of using noncompetes to lock in workers, employers that wish to retain employees can compete on the merits for the worker’s labor services by improving wages and working conditions.

Changes from the NPRM

Under the final rule, existing noncompetes for senior executives can remain in force. Employers, however, are prohibited from entering into or enforcing new noncompetes with senior executives. The final rule defines senior executives as workers earning more than $151,164 annually and who are in policy-making positions.

Additionally, the Commission has eliminated a provision in the proposed rule that would have required employers to legally modify existing noncompetes by formally rescinding them. That change will help to streamline compliance.

Instead, under the final rule, employers will simply have to provide notice to workers bound to an existing noncompete that the noncompete agreement will not be enforced against them in the future. To aid employers’ compliance with this requirement, the Commission has included model language in the final rule that employers can use to communicate to workers.

The Commission vote to approve the issuance of the final rule was 3-2 with Commissioners Melissa Holyoak and Andrew N. Ferguson voting no. Commissioners’ written statements will follow at a later date.

The final rule will become effective 120 days after publication in the Federal Register.

Once the rule is effective, market participants can report information about a suspected violation of the rule to the Bureau of Competition by emailing noncompete@ftc.gov

.

The Federal Trade Commission develops policy initiatives on issues that affect competition, consumers, and the U.S. economy. The FTC will never demand money, make threats, tell you to transfer money, or promise you a prize. Follow the FTC on social media, read consumer alerts and the business blog, and sign up to get the latest FTC news and alerts.

April 18, 2024

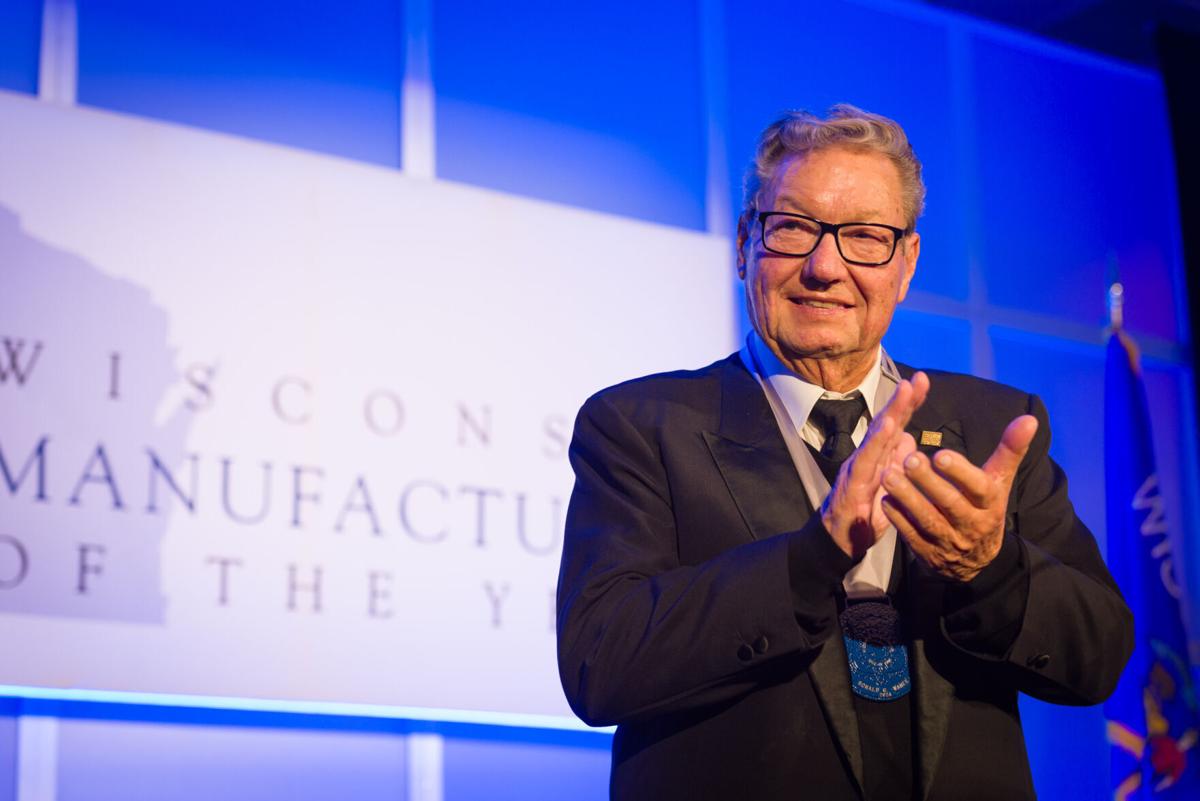

Ashley Furniture founder Ron Wanek first Wisconsin Manufacturing Hall of Fame inductee in 50 years

- RACHEL MERGEN

- Apr 5, 2024

RACHEL MERGEN

All his life, Ashley Furniture Industries founder and chairman Ron Wanek wanted to work in manufacturing.

Now, he is on an exclusive list of those who have made a lasting impact on the sector in Wisconsin.

In February, the Arcadia businessman was inducted into the Wisconsin Manufacturers & Commerce’s Manufacturing Hall of Fame. He was the first inductee added to the Hall of Fame since 1970.

“Wisconsin is a manufacturing state. It’s No. 2 in the United States as far as manufacturing jobs per capita,” Wanek said. “So what I’m saying is there’s a lot of manufacturers in Wisconsin, so I’m very honored.”

He said he did not expect to hear the Hall of Fame was set to expand.

“I was even more surprised when I found out I was the winner of it,” Wanek said.

Manufacturing family

Wanek was raised on a farm without indoor plumbing or electric lights near Lewiston, Minnesota.

“Manufacturing was always something that I wanted to do,” Wanek said.

A number of family members worked in manufacturing in Winona, Minnesota, he said. Eventually, he did too, starting with a job at Winona Industries in 1961.

Fast growth

He was able to learn and thrived at Winona Industries until he discovered an opportunity in 1970 to begin manufacturing occasional tables in Arcadia.

From there, he built Ashley Furniture Industries into the world’s largest manufacturer of home furnishings.

“That’s an impressive legacy for a company that only started 54 years ago,” Wisconsin Manufacturers & Commerce CEO Kurt Bauer said.

Bauer said Ashley Furniture has served as a huge employer and major economic engine in the western part of the state, helping other companies thrive through its supply chain.

The company has about 1,200 stores around the world, Wanek said.

Staying ahead

To stay strong, the company has made many changes through the years.

“We’ve had to constantly rebirth our organization,” Wanek said.

He said the company has implemented major changes to the way it operates 19 times. A big driver of those changes is the company’s mission to keep up with new technology.

Wanek said artificial intelligence and robotics currently are a focus for Ashley Furniture, along with making jobs easier for workers and remaining competitive.

Manufacturing in the US

Ashley Furniture also does all it can to keep its workforce in Wisconsin and the United States, Wanek said.

Philanthropy is also a priority for the Wanek family and Ashley Furniture, with over $45 million in donations since 2017 to science, technology, engineering and mathematics programs throughout the country.

Wanek said supporting diabetes and heart research programs has been a focus, along with planting trees throughout the country.

Wanek joins an impressive list of Hall of Fame inductees, including La Crosse native Reuben Trane, who founded Trane with his father, James.

Family-owned Ashley Furniture continues to grow far beyond its area home

Perfect fit for Hall of Fame

Bauer said Wanek matched the criteria for a rebooted Hall of Fame perfectly.

The Hall of Fame originally was started as the Industrial Hall of Fame in 1958 by the organization’s predecessor, the Wisconsin Manufacturers Association.

Wisconsin Manufacturers & Commerce — which was created when the Manufacturers Association and the Wisconsin State Chamber of Commerce merged — wanted to bring back the Hall of Fame to honor Wisconsin as a manufacturing state, Bauer said.

“We just thought it made sense to honor the history of manufacturing and the fact that it continues in the state of Wisconsin,” he said.

The newly restarted Hall of Fame’s criteria, Bauer said, includes a person’s economic impact, leadership, civic engagement, community philanthropy and enduring legacy.

“Mr. Wanek was at the top of the list in every one of those categories,” Bauer said.

April 18, 2024

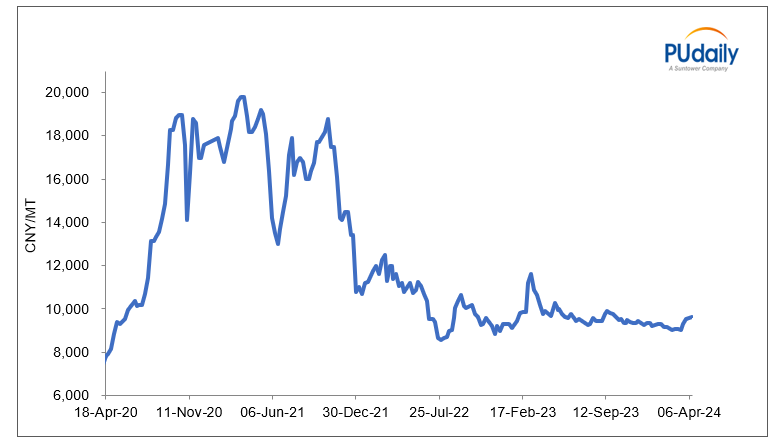

Will Lihuayi Weiyuan Chemical’s New 300ktpa PO Facility Drive Market Prices Downwards?

PUdaily | Updated: April 18, 2024

Lihuayi Weiyuan Chemical Co., Ltd. has recently commenced production of its 300ktpa PO facility, with products passing inspection and now being sold externally. As a crucial extension of the company’s supply chain, the facility uses propylene and hydrogen produced from its propane dehydrogenation unit as raw materials. It maximizes the mutual supply and utilization of raw materials, products, and energy, representing another step in the company’s target of “building, extending, supplementing, and strengthening supply chain”. By enhancing the integrated utilization of materials and heat energy between units, it enables the extension of the industrial chain, further strengthening the chain’s resilience and enhancing the company’s competitiveness.

The start of this large-scale facility by Lihuayi Weiyuan Chemical undoubtedly breaks the current stalemate in Chinese PO market. On April 16, the prevailing offers of PO in Shandong and North China markets stood around CNY 9,050-9,100/tonne EXW in bulk in cash. Those in East China were CNY 9,400-9,500/tonne DEL in bulk in cash. Lihuayi Weiyuan Chemical is offering an ex-factory price of CNY 9,050/tonne, effective from April 16.

With continuously expanding capacity, China’s PO market is gradually becoming saturated. The additional 300ktpa capacity brought by Lihuayi Weiyuan Chemical further intensifies competition, putting downward pressure on the PO market. Chinese PO prices reached high levels in early 2020, peaking several times at CNY 20,000/tonne. The price increase was largely attributed to China’s growing domestic demand, the expansion of “dual-control” policy and power restrictions, facility maintenance in peripheral countries like Saudi Arabia and Singapore, and force majeure for polyether polyols and PO in the U.S. By the latter half of 2021, China’s downturn in the real estate sector caused PO prices to decline continuously to around CNY 9,000/tonne. The real estate industry, the largest downstream sector for the chemical industry, contributes a significant consumption share. The prosperity or downturn of the real estate sector directly and significantly impacts certain important chemical products. Factors such as the real estate downturn, slower macroeconomic growth, and sluggish industrial activity exert pressure on the PO industry chain.

In 2023, China’s PO capacity reached 6.1mtpa, marking a new high in recent years, according to PUdaily. Lihuayi Weiyuan Chemical’s new 300ktpa PO facility will further aggravate market competition and drive prices downwards.

Figure 2: China PO Price Trend 2022-2024

In general, Lihuayi Weiyuan Chemical’s new 300ktpa PO facility has had a short-term impact on market prices. However, in the long run, it will propel technological advancements and industrial upgrades, injecting new momentum for sustainable industry development. This development serves as a reminder that businesses must innovate continuously and enhance core competencies to secure a strong position in the increasingly competitive market.

April 17, 2024

Market Prospects of TPU in Bicycle Tire Applications

PUdaily | Updated: April 11, 2024

Whether in terms of weight reduction or rolling resistance, inner tubes are one of the most cost-effective upgradable components on a bicycle. In response to the demands for weight and resistance reduction, TPU has been considered as a material for inner tubes. TPU inner tubes represent a new technological advancement in recent years. In 2020, Schwalbe introduced its Aerothan TPU Tubes, becoming one of the pioneering companies to launch TPU inner tubes. It also marks the official entry of this material into the commercial bicycle sphere.

Currently, the mainstream materials for inner tubes are butyl rubber, latex, and TPU.

Butyl inner tubes are the most widely used standard inner tubes in cycling. Made from elastic polymers, butyl inner tubes offer good stretch and rebound properties and are the most affordable option. Latex inner tubes fall in the mid-range in terms of cost, mostly produced from natural rubber. Latex rubber is more porous than butyl, meaning latex tubes lose air much more quickly. The price of latex tubes is typically 2-3 times that of butyl tubes.

TPU inner tubes are at the cutting edge and also the most expensive. As a flexible plastic, TPU excels in weight reduction. A typical butyl inner tube weighs around 140 grams (actual weight may vary slightly due to size and valve length), while a latex inner tube reduces that weight to approximately 85 grams. As for TPU inner tubes, the weight drops to just 25 grams. This means that the weight difference between two bicycles made of butyl rubber inner tubes and TPU inner tubes can reach up to 230 grams. This is why many professional cyclists opt for TPU inner tubes when competing.

Another obvious difference among different inner tubes is their rolling resistance. It’s found that the rolling resistance of the best butyl inner tubes still consumes about 3 watts more than TPU inner tubes and 4 watts more than latex inner tubes. In long-distance mountain climbing, a bicycle equipped with TPU inner tubes can increase power by 10 watts, equivalent to reducing weight by 2 kilograms.

Another trend nowadays is tubeless tires, which are tires without inner tubes. Compared to traditional clincher tires with inner tubes, tubeless tires have lower rolling resistance and better puncture protection. However, the high maintenance costs, difficulty in component assembly and replacement, and the risk of air leakage or even tire separation still raise concerns.

China’s bicycle output reached around 100 million units in 2023, reflecting a significant growth potential for TPU inner tubes. Furthermore, Aerothan road tires launched by Schwalbe in July 2023, which replace rubber with nylon-coated TPU material in cover tyres, achieve comprehensive upgrade in puncture protection and weight reduction, potentially opening up new applications for TPU in tires.