Urethane Blog

Chinese TDI Update

June 10, 2024

China TDI Market Review & Outlook (May-June 2024)

PUdaily | Updated: June 5, 2024

Market Review – May 2024

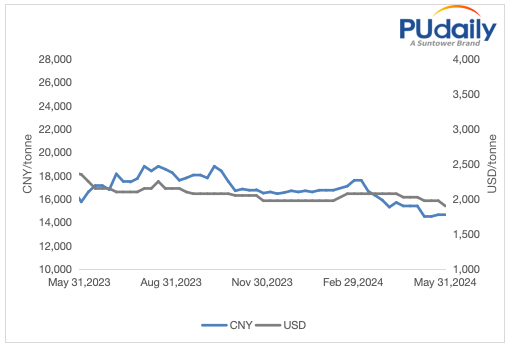

China TDI market remained range-bound in May, showing weakness followed by a slight strengthening. Due to suppliers’ settlement prices for April being close to market trends and mostly lower than market expectations, coupled with weak demand, traders actively offered discounts to stimulate sales. Post the May Day holiday, the market continued its weakness with prices falling rapidly. As TDI prices hit their lowest level dating to 2021 and approached some TDI suppliers’ cost lines, inquiries and purchases increased. Downstream manufacturers sought lower-priced goods. TDI prices stabilized in early May. With subsequent supply controls or trading halt by major suppliers such as Wanhua Chemical and Covestro, low-priced goods reduced and traders slightly raised their offers. However, low prices disappeared after a slight rebound following the bottoming out of the TDI market. Purchasing enthusiasm waned, resulting in narrow market fluctuations. Towards the end of the month, impacted by suppliers’ bullish stance and tightening supply, traders adopted a cautious approach and made small price increases. Despite this, the trading atmosphere was still tepid. Besides, the demand was pent up in the off season. Transactions were sluggish, resulting in a market stalemate.

Market Outlook – June 2024

China TDI market is expected to remain subdued and stable in June. In terms of supply, BASF Shanghai commenced facility maintenance on May 22 for 25 days, resulting in no inventory pressures. Its settlement price for May is also slightly higher than market expectations, providing a mild boost to the market. But other suppliers are running steadily without short-term maintenance plans. Besides, June is the traditional off-season for downstream industries like foam. And there is no significant increase in overseas demand. Consequently, it is expected that the market will remain relatively loose in June, with downstream manufacturers’ acceptance of high prices being low. Barring unforeseen circumstances such as force majeure, a significant price surge is unlikely to occur. Nonetheless, with persistently high production costs for TDI arising from high toluene prices, the current prices for TDI are nearing the cost lines of some suppliers and hitting record highs in recent years. The likelihood of a significant price decline is also low. It is forecasted that Chinese TDI market will remain subdued and stable in June, with prices experiencing narrow fluctuations.

Sign Up for Email Updates

Sign Up for Email Updates

Everchem Updates Archive

Everchem Updates Archive

Recent News

July 11, 2024

July 9, 2024

July 9, 2024