Urethane Blog

Epoxy Resin Anti-dumping Analysis

September 8, 2024

Epoxy Resin Anti-dumping in an Era of Keen Economic Protectionism

Jane Denny : Aug 19, 2024 2:35:26 PM

Petrochemical TrendsNorth American Chemical MarketEpoxy Resin

European and US-based epoxy resin producers have triggered anti-dumping investigations against Asian producers in a bid to stop cheap imports. Meanwhile, India—the subject in the US complaint—claims to be a victim of dumping activity, too.

Last month, US-based chemical manufacturing companies Olin and Westlake and Spolchemie—based in the Czech Republic—submitted data to the European Commission (EC) outlining uncompetitive practice. Following the complaint, the EC initiated investigations into trading by producers in China, South Korea, Taiwan, and Thailand.

The move follows the initiation of a probe into the same countries—with the addition of Indian epoxy resin producers—by the US Department of Commerce and the US International Trade Commission in April 2024.

India’s Ministry of Commerce meanwhile, has initiated an anti-dumping investigation into liquid epoxy resin imports from the same countries as those under European Union (EU) and US scrutiny, and Saudi Arabia too.

Source: ResourceWise

What Is Anti-dumping?

Dumping occurs when imported products are made available to buyers at prices lower than fair market value. Investigations are triggered when domestic producers raise concerns about the prices of foreign goods sold in their domestic markets.

Under EU conditions, there is a two-step test to ascertain whether dumping has occurred. Firstly, the export price of a product must be lower than its selling price in the exporting country. Secondly, the product’s availability in the market must have been injurious to the domestic producer community’s business.

If investigators find that dumping has occurred, measures are put in place to mitigate the problem.

China’s Capacity Growth Key

China’s Capacity Growth Key

Jennifer Hawkins, Chemicals Sector Business Manager at ResourceWise, points to China’s significant increase in epoxy resin capacity in recent years, as shown in the infographic above.

“The growth in China’s domestic capacity has forced producers in South Korea and Taiwan to export their epoxy resins to other markets outside China—their erstwhile customer. At the same time, China, historically a net importer of epoxy resins, has started to export volumes to other regions too,” says Hawkins.

White Paper Download

Download Hawkins’ analysis of EU and US ADD investigations and International Trade Commission conference submissions, including insight from her epoxy resin market contacts.

In our 2022 blog post, How Will New Capacities Reshape the Epoxy Resin Market?, we explored China’s extra epoxy resin production capacity. With more of that planned expansion now realized, an oversupply scenario has replaced the tightness in global supply that triggered the expansions.

Back then, we predicted that “a supply glut… will undoubtedly create fierce competition, drive prices down, and possibly encourage a rise in exports.” This has now come to fruition.

Source: ResourceWise

China’s current spot liquid and solid epoxy resin prices are close to their lowest price point over the past near-decade, back in 2016. And even then, the drop was relatively fleeting. Both products have remained low and relatively flat since the close of 2023, as they have in Northeast Asia.

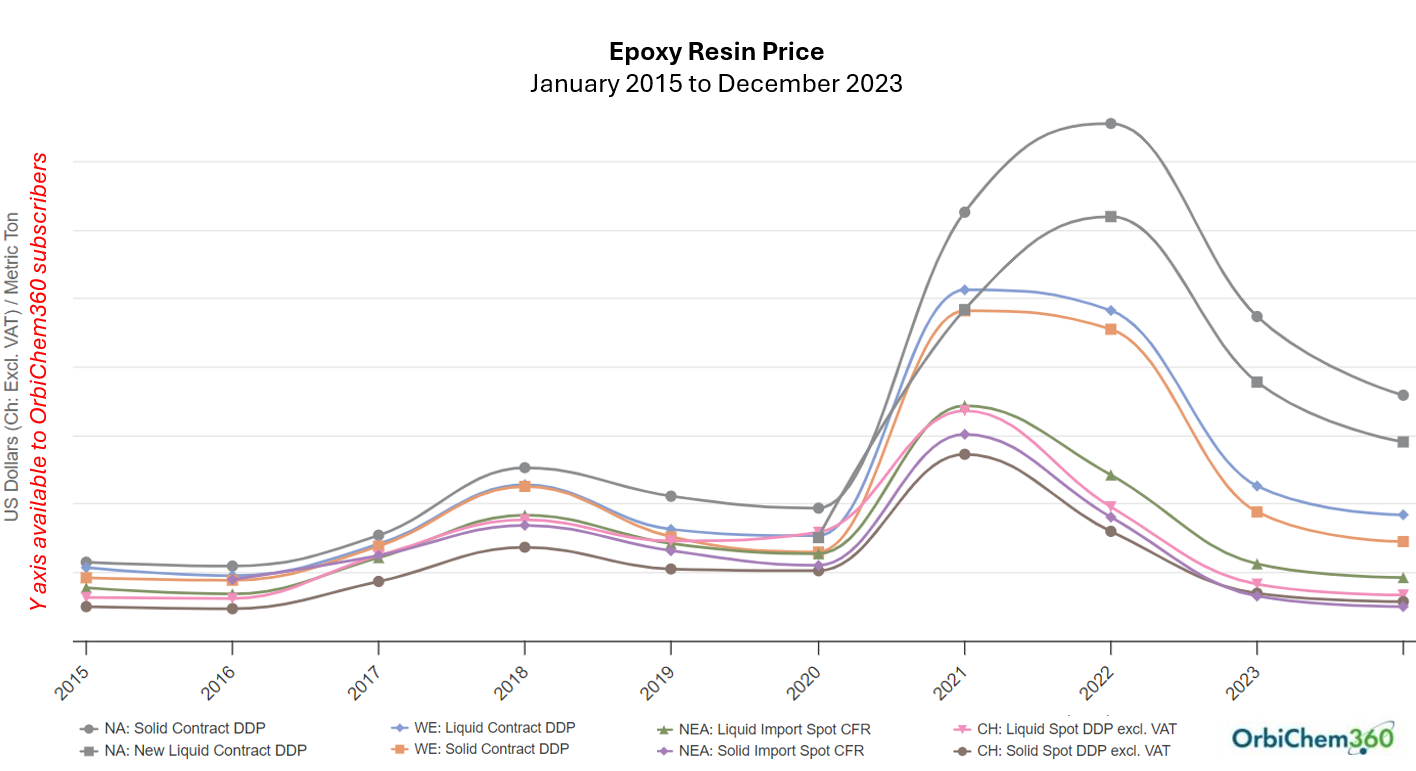

Modest rises have been seen in North American and European pricing structures this year. However, as the graph below shows, North American prices alone did not see any significant increase up to the end of 2023, which producers there have maintained to this day.

Measures to Protect

Anti-dumping duties are imposed by authorities within the country—in the case of the US—or region—such as the EU trading block. They are designed to level up the prices of incoming goods with those produced and sold domestically.

In the EU, producers selling into the region may be taxed according to transaction value or per specific amount of the product. The exporter may even agree to sell products at a minimum price.

In both Europe and the US, complainants sought an investigation into the level of dumping by China, South Korea, Taiwan, and Thailand. They seek adjudication on the question of whether dumped imports have caused material injury to the domestic epoxy resin industry.

The US-focused scrutiny was initiated following a complaint by Olin and Westlake. Unlike the EU complaint, the US complaint requests an investigation of India’s alleged dumping activities.

European Epoxy Resin Anti-dumping

In the EU-focused complaint—in which Spolchemie is a complainant alongside Olin and Westlake—it is alleged that exporting producers from Asian countries have injured European epoxy resin producers. The countries claim that they are selling products in the EU market at unfairly low prices, which significantly undercuts the prices of European producers.

| Country | Dumping margins alleged |

| China | From 140% |

| Korea | From 10% |

| Taiwan | From 20% |

| Thailand | From 60% |

∗ See our free-to-download white paper for upper margins alleged

Epoxy Resins Plant Shutdowns

Speaking to the EU complaint, Olin Epoxy & International president Florian Kohl president said: “Although this issue is not unique to epoxy, nor to the EU, the significant volume of what we believe are unfairly dumped imports of epoxy resin have a seriously negative impact on the EU.”

In March 2023, Olin announced plans to cease operations at its Cumene facility in Terneuzen, Netherlands. and solid epoxy resin production at its facilities in Gumi, South Korea, and Guaruja, Brazil.

At the time, the company described it as a “step to right-size our global epoxy asset footprint to the most cost-effective asset base to support our strategic operating model.” However, as part of that announcement, Olin referenced the softness of global epoxy demand and the surplus supply in the market.

Source: ResoureWise

Market Dynamics At Play

In the US-focused complaint, the country’s Department of Commerce has been asked to assess allegations involving exponentially higher margins.In part, the elevated price tags attached to epoxy resins in the US account for the significant price gap compared to all other regions.

In fact, global epoxy resin price graphs from the chemicals business intelligence platform OrbiChem360 indicate the price differential between North American products and Asian output is several thousand dollars. With Asian producers subject to lower output costs, that price gap creates an opportunity for exports to US buyers.

| Trading Partner | Dumping Margin alleged |

| China | From 266.37% |

| India | From 9.92% |

| Korea | From 35.29% |

| Taiwan | From 91.15% |

| Thailand | From 143.73% |

∗ See our free-to-download white paper for upper margins alleged

Subsidized Industry and Anti-competition

According to a report by the US International Trade Administration (ITA), all countries under investigation for anti-dumping (except Thailand) will also be tested for Countervailing Duties (CVD). Also termed anti-subsidy duties, they are designed to counter the negative effects of subsidies.

The suggestion is that within all the countries named in the US complaint except Thailand, respective governments are propping up the epoxy resin sector with incentives. Established under World Trade Organization (WTO) rules, a subsidy includes grants, loans or tax credits.

Anti-dumping Duties: A Trending Solution

Anti-dumping measures are being implemented with increasing frequency as companies—and nations—seek to protect regional and local market shares.

In 2023, the EC proposed duties of between 6.6% and 24.2% for Chinese polyethylene terephthalate (PET) producers found to be importing goods at uncompetitive prices.

Similarly, the EC’s recent initiation of provisional anti-dumping duties against the majority of China’s biodiesel and hydrotreated vegetable oil (HVO) exporters has rocked natural product markets. Our blog post, Oleochemicals Volatility on the Horizon, explores the impacts.

Countries also rely on other means to halt the import of goods from competitor nations. In a blog post, India Halts Imports For Key Intermediate Chemical From China, we explored the Bureau of Indian Standards ruling, which has halted China’s PTA imports.

Future-gazing: Epoxy Resin Supply Chain

China continues to roll out expansion plans that were set in motion before the current downturn. Those expansions are rendering deals formerly made between China and countries such as South Korea and Taiwan unnecessary today. Producers that previously found buyers in China are now looking further afield.

China’s producers, who are faced with a weak domestic market, are also looking for customers in Europe and the US. If offering products at prices significantly lower than domestic producers wins the sale, they will likely do that.

If epoxy resins are subject to provisional anti-dumping duties after the investigations, how will Asia respond? Will the region’s producers still offer products at prices that bear the duty charge and remain attractive to buyers?

Only time will tell…