Urethane Blog

Good News for Urethanes

August 14, 2024

Mortgage Refi Activity Jumps Most Since 2020 As Lenders See Gloom Ending

by Tyler Durden

Wednesday, Aug 14, 2024 – 03:25 PM

Mortgage lenders have endured a brutal 2.5-year period of the Federal Reserve’s interest rate hiking cycle, with a high rate environment pressuring refinance applications to multi-decade lows. However, those lenders who weathered the downturn—dodging widespread layoffs, industry consolidation, and scraped by on Ramen Noodles and Zyn pouches—are now seeing a serious surge in activity as mortgage rates slide on rising recession probabilities.

For the week ending August 9, the Mortgage Bankers Association’s refinancing index jumped a whopping 34.5% to a more than two-year high of 889.3.

The refinancing index’s weekly change recorded the biggest weekly change since the first week of March 2020, a period in time when the Fed slammed interest rates to the zero lower bound in response to the China virus.

Even more impressive is the refinancing index’s two-week move, up 55% (though obviously off a very low ‘low’).

MBA mortgage applications to purchase a home increased by 2.8% in the same week, the largest advance since the first week of June.

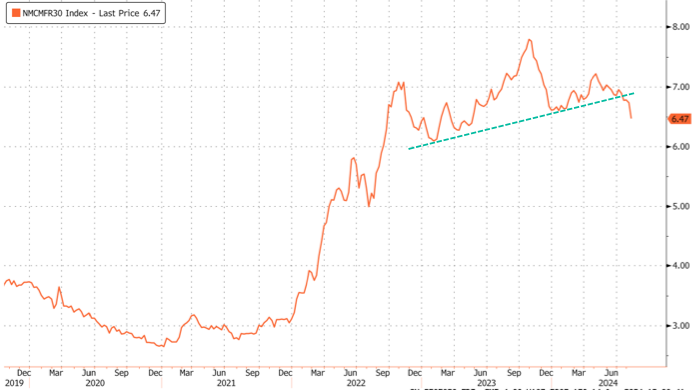

Freddie Mac data shows the 30-year fixed mortgage rate has dropped to around 6.47%, the lowest since May 2023. While this is a far cry from the October 2023 high of 7.79%, it remains well above Covid levels of 2.68%.

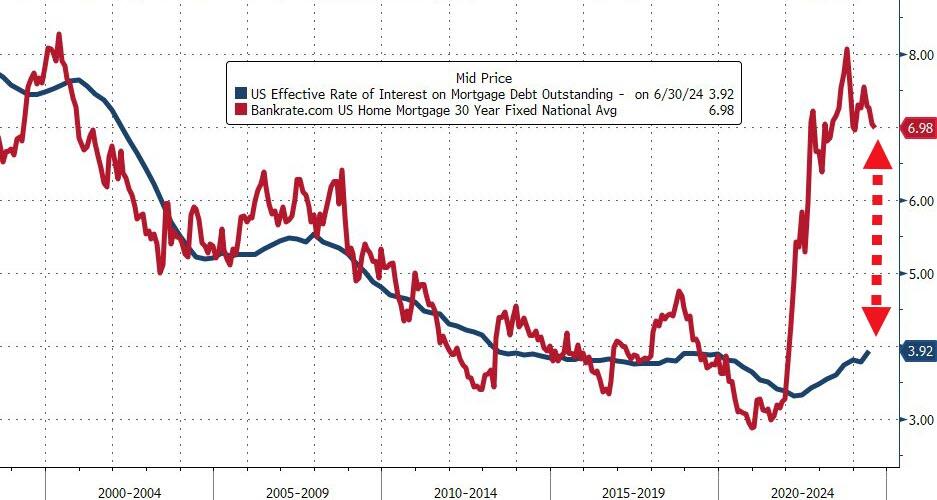

Despite the decline in mortgage rates, new costs of homeownership are dramatically higher than the average current mortgage cost. Until that gap closes (more), the housing market will remain drastically out of reach for most Americans in search of their dream.

Mortgage rates track US government bonds relatively closely, and the yield on the 10-year Treasury note has fallen sub 4% on increasing recession odds amid the consumer downturn fears.

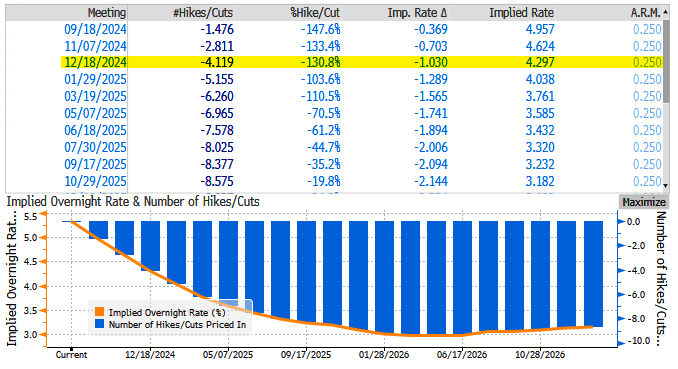

Although weaker consumer trends remain a major near-term headwind, Goldman forecasts three 25bps Fed rate cuts this year and four in 2025. With the cut cycle imminent, the refinancing index and mortgage applications will likely have further room to run.

Here’s the latest snapshot as of Wednesday, showing what traders expect the Fed’s move to be. Four 25bps cuts by the end of the year…

“We’ve experienced several head fakes regarding potential rate cuts during the Fed’s hiking cycle, as reflected in interest rate swaps over the last few years. But this time, it seems more concrete as recession risks build,” said Lewis Sogge, a senior loan officer at Freedom Mortgage Corporation.

Congratulations to all the millennial lenders who managed to weather the Fed’s interest rate hiking storm—you might have made it to the other side. What does this all mean? Simply put, your industry is highly cyclical.

https://www.zerohedge.com/markets/mortgage-refi-activity-jump-most-2020-lenders-see-gloom-ending

Sign Up for Email Updates

Sign Up for Email Updates

Everchem Updates Archive

Everchem Updates Archive

Recent News

August 14, 2024

August 13, 2024

August 12, 2024

August 12, 2024

August 9, 2024