Urethane Blog

Inflation Overview

May 10, 2023

Headline CPI Dips To 2-Year Low; Shelter Costs Roll Over

by Tyler Durden

Wednesday, May 10, 2023 – 08:39 AM

Another month, another inflation print to jawbone over. The Fed’s new favorite signal from The BLS is Core Services CPI Ex-Shelter, and this morning’s print is ‘good’ news with the YoY growth at the slowest since May 2022….

Source: Bloomberg

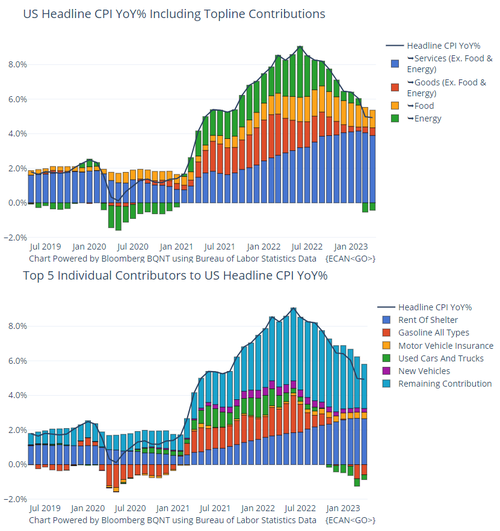

Headline CPI was expected to accelerate in April (+0.4% MoM exp), and met expectations with the drop in YoY CPI slowing dramatically (though the 4.9% print was slightly cooler than the 5.0% YoY exp)…

Source: Bloomberg

The all items index increased 4.9 percent for the 12 months ending April; this was the smallest 12-month increase since the period ending April 2021.

Energy (and Gasoline) was the main drivers to the downside while Shelter costs remain high…

The headline print is below pretty much all the major f0orecast:

- 5.1% – Goldman Sachs

- 5.1% – Citigroup

- 5.1% – JP Morgan Chase

- 5.1% – Morgan Stanley

- 5.0% – Barclays

- 5.0% – Bank of America

- 5.0% – Credit Suisse

- 5.0% – Bloomberg Economics

- 5.0% – HSBC

- 5.0% – UBS

- 5.0% – Wells Fargo

Core CPI was also expected to rise by 0.4% MoM in April, and met that expectation with YoY up 5.2% – very sticky.

The energy index decreased 5.1 percent for the 12 months ending April, and the food index increased 7.7 percent over the last year.

Source: Bloomberg

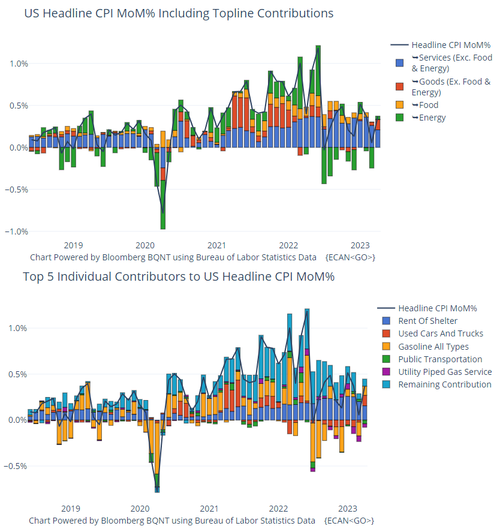

The index for all items less food and energy rose 0.4 percent in April, as it did in March.

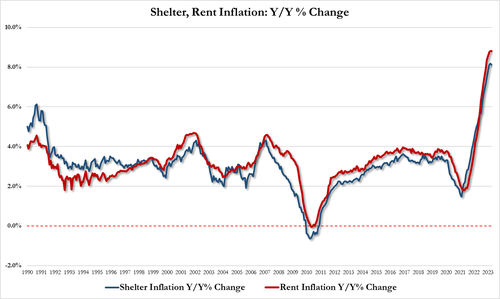

- The shelter index increased 0.4 percent over the month after rising 0.6 percent in March.

- The index for rent rose 0.6 percent in April, and the index for owners’ equivalent rent rose 0.5 percent over the month.

- The index for lodging away from home decreased 3.0 percent in April after rising in each of the previous four months.

The shelter index was the largest factor in the monthly increase in the index for all items less food and energy… as we noted last month, the shelter index has now topped out…

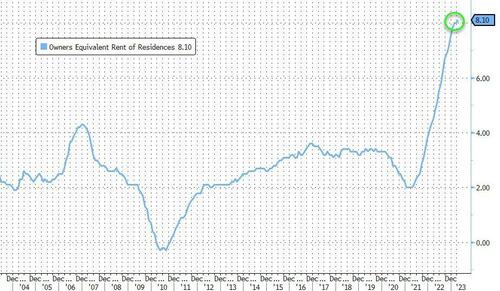

But, just to add some confusion to the pot, Owners Equivalent Rent rose 8.1% YoY – a new record high…

Among the other indexes that rose in April was the index for used cars and trucks, which increased 4.4 percent, and the index for motor vehicle insurance which increased 1.4 percent. The indexes for recreation, household furnishings and operations, personal care, apparel, and education also increased in April.

Several indexes declined in April, led by the airline fares index which fell 2.6 percent over the month after rising in February and March.

- The index for new vehicles declined 0.2 percent and the index for communication decreased 0.1 percent in April.

- The medical care index was unchanged in April, after falling 0.3 percent the previous month.

- The index for hospital services rose 0.5 percent over the month, after a 0.4-percent decline in March.

- The prescription drugs index increased 0.3 percent in April, while the physicians’ services index was unchanged.

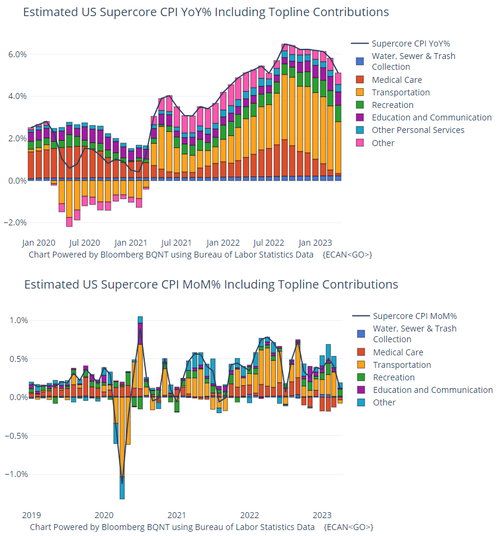

The so-called SuperCore inflation also slowed to 5.0% YoY with Transport and Medical Care costs dropping MoM…

Is M2 signaling that the ‘stickiness’ is over and a tsunami of deflation is about to hit?

Source: Bloomberg

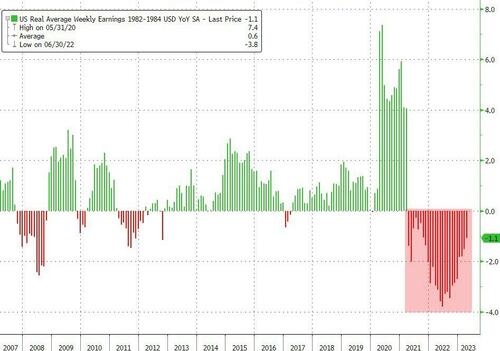

Finally, inflation continues to outpace Americans’ rising wages – for the 25th straight month…

Source: Bloomberg

Sign Up for Email Updates

Sign Up for Email Updates

Everchem Updates Archive

Everchem Updates Archive

Recent News

April 18, 2024

April 18, 2024

April 17, 2024

April 17, 2024

April 16, 2024