Urethane Blog

Inflation Overview

February 22, 2023

Inflation a Bit Warmer, Still Stubborn

Dan North | February 2023

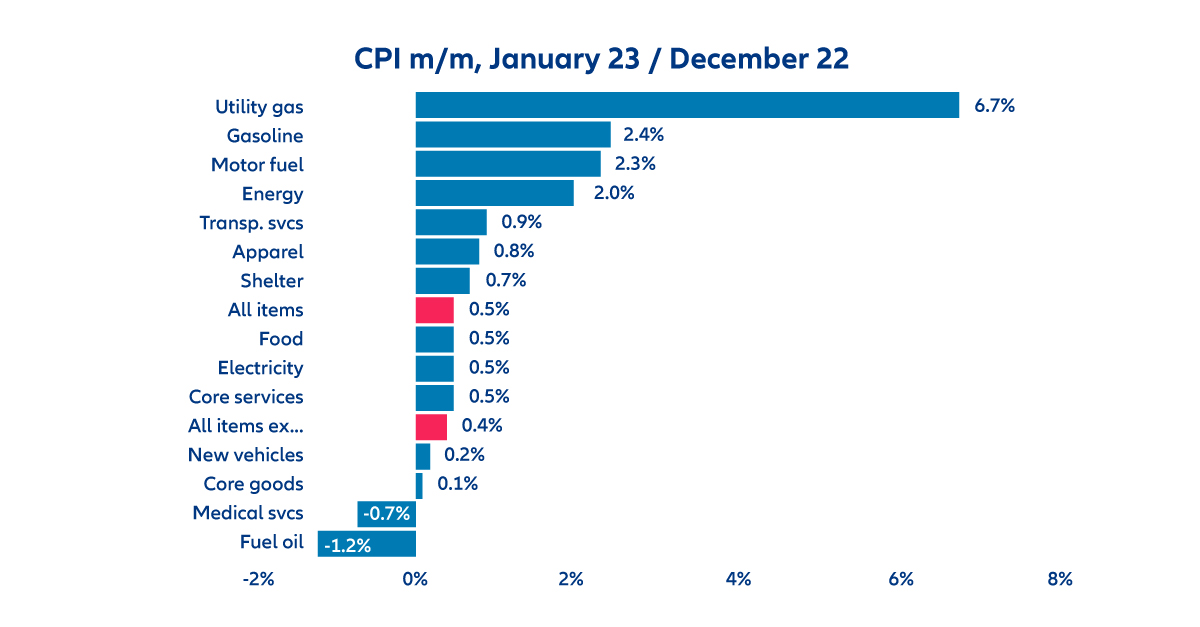

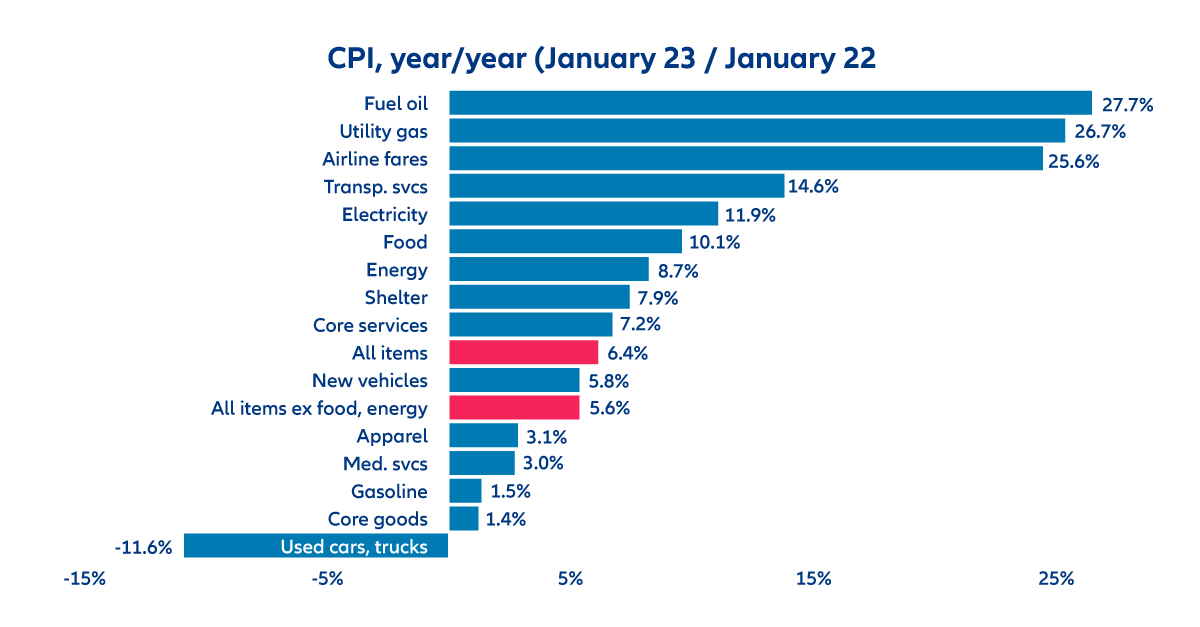

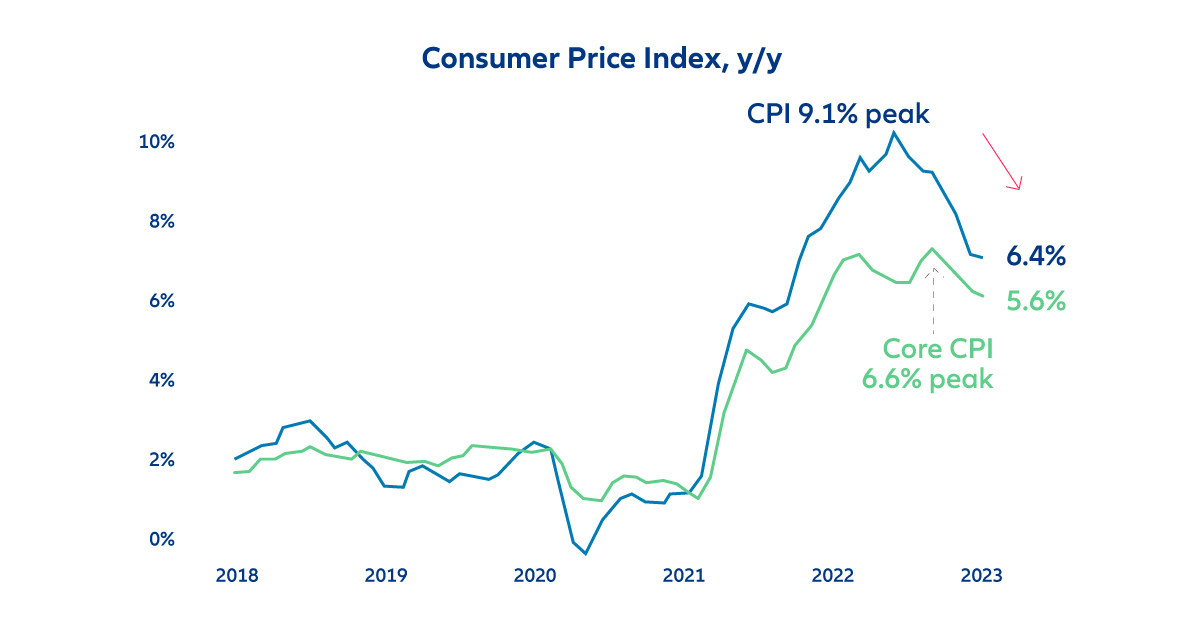

Inflation was a little warmer than expected in January. The headline Consumer Price Index (CPI) rose 0.5% m/m which was a bit higher than expectations of 0.4%. The y/y rate landed at 6.4, which was higher than expectations of 6.2%, and also only a slight improvement from last month’s 6.5%. The core rate, which strips out volatile food and energy prices, rose 0.4% m/m, again exceeding expectations of 0.3%, while the y/y rate came in at 5.6%, just above expectations of 5.5% and again also only a slight improvement from last month’s 5.7%. Energy prices drove the m/m increase with a 6.7% increase in utility gas and a notable 2.4% increase in gasoline prices. On a y/y basis, fuel out and utility gas have been big drivers, while gasoline has only risen 1.5%. Used cars and truck prices which were driven up in the pandemic due to scarcity, have now fallen 11.6% over the past year.

By the way, December’s report, which showed the first m/m decline in the headline CPI in the post Covid-era at -0.1%, was revised back up to +0.1% in this report.

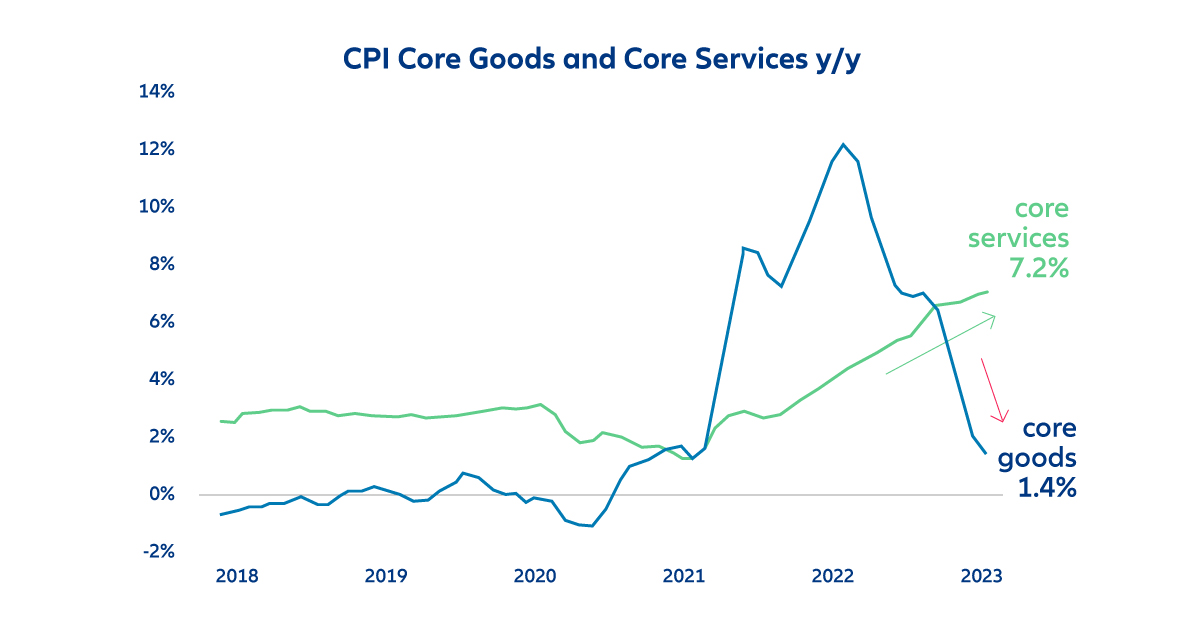

As shown in the first chart below, the headline y/y rate has fallen for seven consecutive months, dropping a total of 2.6% from June’s peak of 9.1%. However, the core rate has been more stubborn and has only fallen for four consecutive months, from the September peak, and has only dropped 1%. That is worrisome for the Fed since it focuses on core inflation. More worrisome still is that while core goods inflation is falling rapidly, core services inflation continues to rise and is now running at a very hot 7.2% y/y rate, the highest in over 40 years. The Fed is now concentrating more on services because 1. it is far outstripping goods inflation, and 2. services are more likely to be driven by labor costs, which in theory the Fed could influence more easily than the cost of goods.

Finally, the Fed has been focusing on “super core” inflation, which is core services excluding housing. Housing accounts for about one-third of the overall index, but it does not include all rental prices, only those that are signed in the month. Since those normally take a year to renew, housing inflation in the CPI lags market prices. And since market prices are falling, so will housing in the CPI going forward. In a sense then, housing inflation is already taken care of, so it makes sense to strip it out to see what’s happening underneath. Super core inflation is now running at 4% y/y, twice the Fed’s 2% target.

So the overall report was a bit warmer than expected, the core is being stubborn, core services are very high and rising, and super core isn’t good either. This report will keep the Fed on track for another 25 bps hike in March.

https://www.allianz-trade.com/en_US/insights/inflation-a-bit-warmer.html

Sign Up for Email Updates

Sign Up for Email Updates

Everchem Updates Archive

Everchem Updates Archive

Recent News

April 18, 2024

April 18, 2024

April 17, 2024

April 17, 2024

April 16, 2024