Urethane Blog

Mattress Market Issues

January 3, 2020

Chinese ‘dumping’ has slashed mattress prices, but at a cost to the U.S. bedding industry

Bought a crazy-cheap mattress in the last few years?

You might have purchased one that a bipartisan agency of U.S. trade officials says was “dumped” here by Chinese manufacturers accused of cheating international trade conventions to gain a foothold in American bedrooms.

Dozens of Chinese companies flooded the American market with super-low-priced mattresses in recent years, selling them to retailers for as low as $18 in a bid to grab market share quickly, according to trade officials and mattress makers.

Consumers purchased the mattresses under brands like MLily and Linenspa at household national chains, online businesses, local retailers and mattress stores.

The dumping has further roiled an industry that has been bedeviled by disruption in recent years, including thousands of job losses, multiple bankruptcies and hundreds of store closures. While overexpansion and American bed-in-a-box companies have been widely blamed for the industry’s upheaval, the dumping case suggests that ultra-cheap Chinese mattresses have also played a significant role in undermining American businesses and jobs.

In 2018, about 5 million mattresses were shipped to the U.S. by Chinese manufacturers that are now accused of having built their businesses on aggressive price cuts, according to the results of a United States International Trade Commission (USITC) investigation. That number is equivalent to about one-third of total mattress production capacity in the United States.

Bed-in-box opens Pandora’s box

The surge by Chinese manufacturers was made possible in part by the mattress industry’s shift toward bed-in-a-box-style foam mattresses that can be easily shipped overseas.

Many consumers scored amazing deals because of this development. At least 12 importers reported average mattress values of less than $100 from 2016 through 2018, according to the USITC. Experts agree that the quality of the typically entry-level mattresses was fine.

Now, the USITC is cracking down in a bipartisan fashion, imposing massive tariffs on Chinese mattresses ranging up to more than 1,700%. That means the price of importing a Chinese mattress that previously cost a wholesaler $18 to bring into the U.S. would rise to more than $300, potentially pricing them out of the American market.

It also means deals on Chinese mattresses could dry up if the anti-dumping duties have their intended effect.

“That (tariff figure) gives you some incredible insight into how severe the dumping situation” has been, said Jerry Epperson, a mattress industry veteran and managing director of investment banking and corporate advisory firm Mann, Armistead & Epperson.

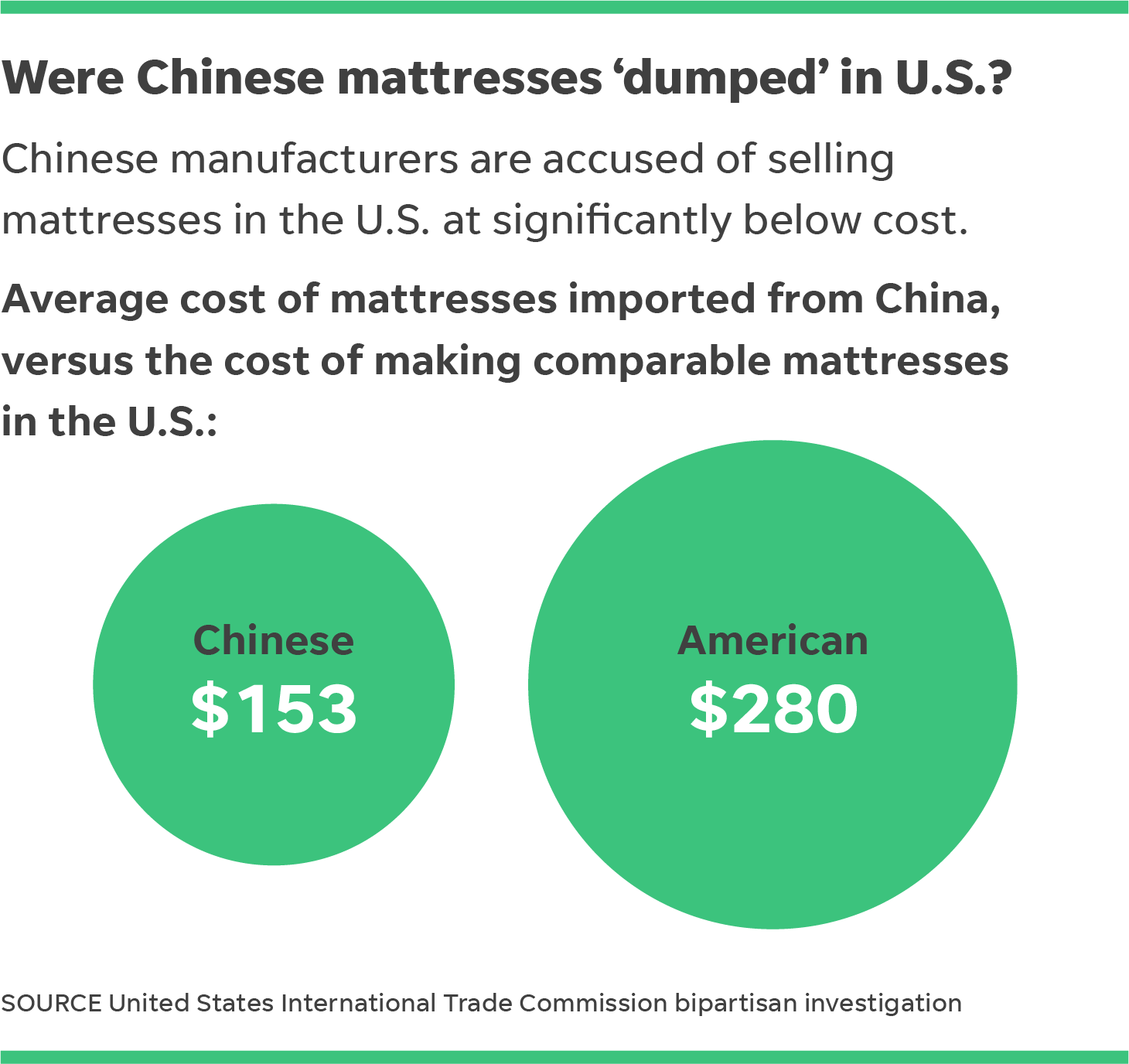

The average Chinese mattress imported to the U.S. in the first half of 2019 was priced at $153, according to the results of a USITC investigation. That compares to an average of $280 for similar U.S.-made mattresses.

The Chinese manufacturers are being unfairly treated, said Eric Emerson, an attorney at Steptoe who represented many of the Chinese mattress companies in the anti-dumping case brought before the USITC.

The costs of mattress production as “calculated by the U.S. Department of Commerce do not fairly represent the Chinese producers’ actual cost of production or their profitability,” he said.

While the lower cost of manufacturing products in China can account for some of the price difference, the USITC and mattress companies alleged that the Chinese manufacturers should be subject to anti-dumping duties under the Tariff Act of 1930.

‘Absurdly low’ prices

The “absurdly low” prices enabled the Chinese manufacturers to boost their market share from virtually nothing to double digits within a few years, said Yohai Baisburd, an attorney for Cassidy Levy Kent who filed an international trade petition against the Chinese makers on behalf of several U.S. mattress companies, including Tempur Sealy and Serta Simmons.

“It’s ludicrous,” Baisburd said. “The Chinese were dumping from the beginning. They had a rocket ship of growth fueled by the low prices.”

During that same time period, U.S. mattress makers suffered as the industry dealt with multiple challenges, including the Chapter 11 bankruptcy of the nation’s largest mattress retailer, Mattress Firm, hundreds of store closures and surging competition from upstart bed-in-a-box makers like Casper.

The dumped mattresses were available at a wide variety of brick-and-mortar retailers, including national chains like Walmart, and online sellers like Amazon and Wayfair, placing them in direct competition with American-made beds, according to industry experts and people familiar with the case.

Scott Thompson, CEO of Tempur Sealy, which does not import any mattresses, said Amazon and Wayfair accounted for “a lot” of those sales at “significantly below” the manufacturer’s true cost. But he said Tempur Sealy will continue to sell mattresses on Amazon and Wayfair despite tension over the matter.

“It can be a complicated relationship,” he said.

Walmart referred questions to Emerson, and Wayfair did not respond to a request seeking comment. Amazon had no comment by press time.

The deals from Chinese mattresses may soon evaporate, and that’s bad for consumers, said Emerson, the attorney who represented Chinese companies.

“As a result of this action, it’s going to become increasingly more expensive for U.S. consumers,” he said. “They’re really choking U.S. customers’ choice in the purchase of these mattresses.”

Sign Up for Email Updates

Sign Up for Email Updates

Everchem Updates Archive

Everchem Updates Archive

Recent News

April 24, 2024

April 24, 2024

April 18, 2024

April 18, 2024

April 17, 2024