Urethane Blog

MDI Overview

March 21, 2023

Global MDI Demand Growth Slow Down, MDI Facilities in Europe & USA Idled

PUdaily | Updated: March 17, 2023

On March 2, 2023, Covestro released its 2022 group report: “Fiscal 2022 was impacted by global challenges that had significant and perceptible effects on Covestro’s business performance. In particular, the sharp rise in energy and raw material prices during the year, especially in Europe, put a strain on the company. This was compounded by continuing adverse effects caused by the coronavirus pandemic in China, high inflation and an overall slowdown in global economic growth.” And according to Covestro’s report, the global MDI demand in 2022 was 8,250 k tons, increased by 0.2% year on year. The global MDI demand growth was slow down.

MDI Facilities in Europe & USA Idled, Global MDI Operating Rate Down

On February 21, 2023, Huntsman Corporation disclosed on its fourth quarter 2022 earnings call:

“Our Asian markets, primarily China, did experience modest volume growth in the quarter due to slightly improved demand in insulation and automotive when compared to the fourth quarter a year ago. Europe demand remained subdued…In the short-run, we are idling our smaller MDI line in Rotterdam for an extended period until end market demand improves…In the U.S., we’re seeing similar conditions due to rising interest rates…Our Geismar Louisiana MDI plant, we have closed one of our three lines that represents about 30% of our output.” The company’s spokesperson estimated that the operating rates are presently around 70% globally, which is lower than normal levels.

Huntsman’s MDI capacity in the Netherlands and the United States has reached 470 ktpa and 500 ktpa respectively. It means the idling capacity of Huntsman’s MDI facilities in Rotterdam and in Geismar totals about 300 ktpa.

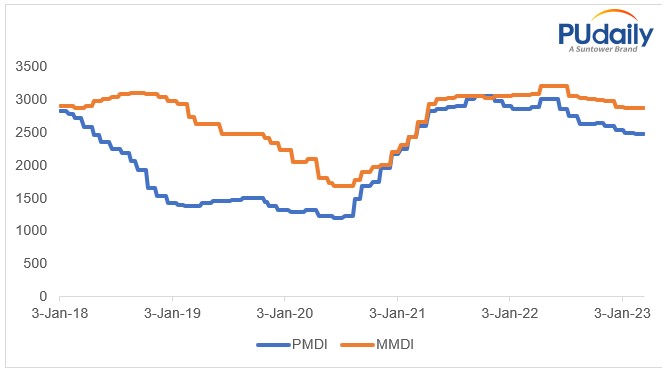

Due to the declining operating rate of MDI facilities in Europe and the United States, as well as the high cost of upstream energy and raw materials, the PMDI market price in Europe is stable. The contract price is €2,400-2,550 /tonne, and the negotiated price is €2,300 /tonne, showing a weak status between supply and demand.

Construction:

Construction is the most important downstream sector for MDI in Europe and the United States. A major MDI supplier saw that two-thirds of their polyurethane Americas business went into construction-related end markets, approximately half into commercial construction, and half into residential, of which 70% was related to new residential builds.

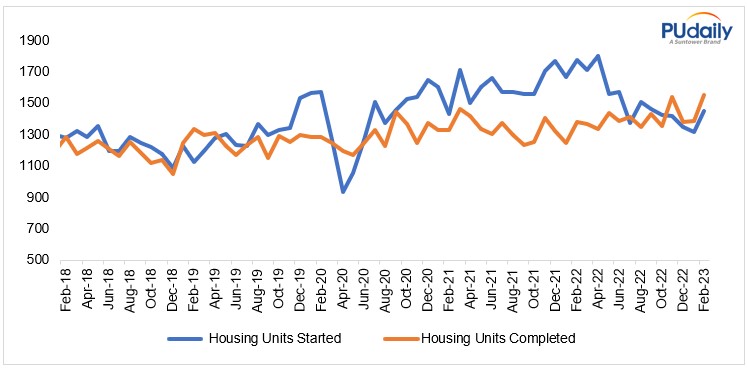

Americas: New housing starts in U.S. totalled 18.67 million in 2022, a year-on-year decrease of 3.1%, according to Federal Reserve Economic Data. From 2020 to 2021, the US housing market revived rapidly amid Covid-19 pandemic and evolved into a real estate boom since the subprime mortgage crisis of 2007. The current housing boom arises from a combined effect of short cycle (post-Covid policy stimulus) and long-term cycle (inventory cycle after the subprime mortgage crisis). Since the Fed tightened monetary policy in 2022, the real estate market has borne the brunt, and drops in indicators such as home sales and market prosperity are comparable to those in the crisis of 2007-2008. Looking ahead to 2023, the U.S. housing market is expected to weaken, while the margin may be small.

New Housing Starts & Completions in U.S., 2018-2023

Europe:

Market instability has been exacerbated by the war in Ukraine and high inflations, which has dampened the intention to invest in new construction projects. In December 2022, construction output in the Euro Area fell by 2.5% month-on-month, reaching the largest decline in the past 18 months, according to Eurostat. Euroconstruct forecasts a significant slowdown in the growth rate of residential construction in Europe to 1.3% in 2024. This results from stagnation trends in both new residential construction and renovation (in 2024, growth is 1.5% and 1.2%, respectively).

Automobile:

Automobile is another major downstream industry for MDI in Europe and U.S.

Europe: On January 18, 2023, the European Automobile Manufacturers’ Association released a report showing that in 2022, as a result of component shortages, the European passenger car market contracted by 4.6% to 9.26 million units, the region’s lowest level since 1993, when 9.2 million units were registered. Agence France-Presse claimed that 2022 is the third difficult year for the European automobile industry. Since the Covid outbreak and the ensuing supply shortages, a large number of factories and showrooms were shuttered. The semiconductor shortage had not eased even after the pandemic stabilized. In 2022, Germany was the only country of the European market to have recorded growth in auto sales, with 1.1% increase. Sales in Italy, France and Spain fell by 9.7%, 7.8% and 5.4% respectively.

Americas:

U.S.A: Many automakers slashed production due to soaring feedstock costs and ongoing shortages of semiconductors and other components, according to Cox Automotive. Full-year 2022 U.S. auto sales are expected to be near 13.9 million units, a decrease of nearly 8.0% from 2021 and down 20% from the market peak in 2016.

Brazil: In contrast, the auto industry in Brazil performed better. The components shortage in Brazil’s auto industry had eased markedly in 2022, driving growth in the country’s auto output, according to Brazilian Association of Automotive Vehicle Manufacturers (Anfavea). Moreover, the increase in Brazilian auto exports to Latin American countries also boosted the rise in the country’s auto industry. Anfavea currently expects that Brazil’s 2023 auto output would rise by 2.2% to 2.42 million units.

http://www.pudaily.com/Home/NewsDetails/35233

Sign Up for Email Updates

Sign Up for Email Updates

Everchem Updates Archive

Everchem Updates Archive

Recent News

May 2, 2024

May 1, 2024

April 30, 2024

April 30, 2024