Urethane Blog

New PO Capacity in China

April 18, 2024

Will Lihuayi Weiyuan Chemical’s New 300ktpa PO Facility Drive Market Prices Downwards?

PUdaily | Updated: April 18, 2024

Lihuayi Weiyuan Chemical Co., Ltd. has recently commenced production of its 300ktpa PO facility, with products passing inspection and now being sold externally. As a crucial extension of the company’s supply chain, the facility uses propylene and hydrogen produced from its propane dehydrogenation unit as raw materials. It maximizes the mutual supply and utilization of raw materials, products, and energy, representing another step in the company’s target of “building, extending, supplementing, and strengthening supply chain”. By enhancing the integrated utilization of materials and heat energy between units, it enables the extension of the industrial chain, further strengthening the chain’s resilience and enhancing the company’s competitiveness.

The start of this large-scale facility by Lihuayi Weiyuan Chemical undoubtedly breaks the current stalemate in Chinese PO market. On April 16, the prevailing offers of PO in Shandong and North China markets stood around CNY 9,050-9,100/tonne EXW in bulk in cash. Those in East China were CNY 9,400-9,500/tonne DEL in bulk in cash. Lihuayi Weiyuan Chemical is offering an ex-factory price of CNY 9,050/tonne, effective from April 16.

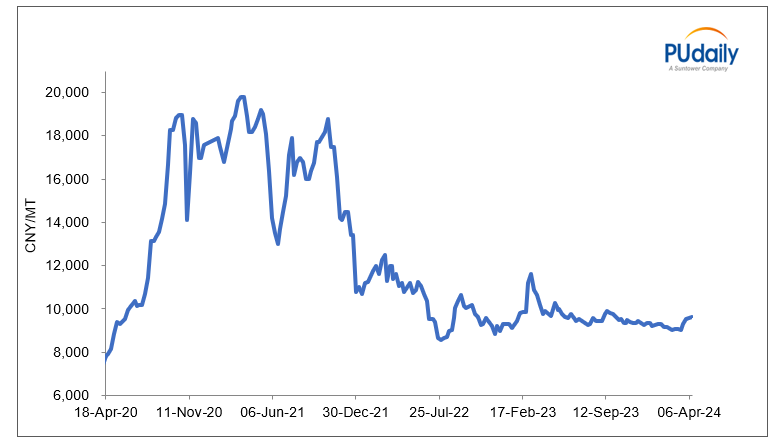

With continuously expanding capacity, China’s PO market is gradually becoming saturated. The additional 300ktpa capacity brought by Lihuayi Weiyuan Chemical further intensifies competition, putting downward pressure on the PO market. Chinese PO prices reached high levels in early 2020, peaking several times at CNY 20,000/tonne. The price increase was largely attributed to China’s growing domestic demand, the expansion of “dual-control” policy and power restrictions, facility maintenance in peripheral countries like Saudi Arabia and Singapore, and force majeure for polyether polyols and PO in the U.S. By the latter half of 2021, China’s downturn in the real estate sector caused PO prices to decline continuously to around CNY 9,000/tonne. The real estate industry, the largest downstream sector for the chemical industry, contributes a significant consumption share. The prosperity or downturn of the real estate sector directly and significantly impacts certain important chemical products. Factors such as the real estate downturn, slower macroeconomic growth, and sluggish industrial activity exert pressure on the PO industry chain.

In 2023, China’s PO capacity reached 6.1mtpa, marking a new high in recent years, according to PUdaily. Lihuayi Weiyuan Chemical’s new 300ktpa PO facility will further aggravate market competition and drive prices downwards.

Figure 2: China PO Price Trend 2022-2024

In general, Lihuayi Weiyuan Chemical’s new 300ktpa PO facility has had a short-term impact on market prices. However, in the long run, it will propel technological advancements and industrial upgrades, injecting new momentum for sustainable industry development. This development serves as a reminder that businesses must innovate continuously and enhance core competencies to secure a strong position in the increasingly competitive market.

Sign Up for Email Updates

Sign Up for Email Updates

Everchem Updates Archive

Everchem Updates Archive

Recent News

May 1, 2024

April 30, 2024

April 30, 2024

April 29, 2024

April 29, 2024