Urethane Blog

Chinese Propylene Oxide Update

July 23, 2018

Will the High PO Price in H1 2018 Continue into the Future?

2018-07-20 [Source:PUdaily]

share:

PUdaily, Shanghai– Recently, the price of propylene oxide has been rising as demand exceeded supply, with low offer barely heard. At this special point of midyear, PUdaily would like to take the opportunity to summarize the PO market in the first half of the year and share our views on the market outlook.

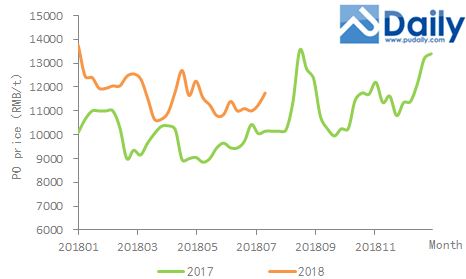

Figure 1 2017-2018 China PO Price

As shown in Figure 1, the PO price in 2017 mostly fluctuated around RMB 10,000 yuan. As the government’s extensive environmental inspection resulted in lower loads for PO facilities in China, the high price used to be seen in September and October (peak season) was seen in advance in the middle of August. However, the price dropped soon after the buyers stocked enough inventories and therefore demand decreased.

In the first half of 2018, the PO price consistently stayed above RMB 10,000 yuan and was significantly higher than that of 2017. According to PUdaily, the average price for PO in the first half of the year increased by 18% year over year. The price rebounded due to the sudden shutdown of a plant in Shandong after it fell in early March. In early June, as the SCO Summit was held, the transportation of dangerous chemicals was banned and the facility loads of major PO manufacturers declined. As a result, the price rose slightly again. Recently, on the arrival of the good news that some plants in Shandong and northeast China were shut down for maintenance, the PO price rose even if downstream demand was modest.

Overall, in H1 2018, the PO price was driven up several times by multiple positive factors such as facility overhaul and reduced loads by PO manufacturers. However, as the government carried out the action of “revisit” as part of its environmental inspection campaign, downstream small sponge and paint manufacturers had to close their plants or reduce facility loads, which resulted in sluggish demand for polyether polyols. This in turn affected the demand for PO. Although the inspection is coming to an end, the general trend toward environmentally-friendly business will not change. Rectification of downstream small environmentally-unfriendly manufacturers will continue. Thus, the demand for upstream polyether polyols and further PO will continue to be sluggish.

Looking ahead, PUdaily expects that in the second half of the year, new PO facilities in China with a combined capacity of 200k t/a will come on-stream, including Hongbaoli’s 120k t/a facility and CITIC Guoan Chemical Company Limited’s 80k t/a facility. Meanwhile, S-Oil’s new 300k t/a facility is also likely to supply the market in mainland China. After new plants are put into production, the landscape of supply and demand is bound to change. Though it is reasonable to have certain expectation for the peak season of September and October, the market is expected not to be as strong as it was in the past.

It is worth noting that the period from this year to 2021 will witness a large number of newly-built PO plants in China. PUdaily estimates that over the next four years, new PO facilities with a combined capacity of over 2.4 million t/a will be put into production. As for the production processes, most of the new plants will adopt more environmentally- friendly processes such as cooxidation process and direct oxidation proccess. PUdaily believes that such move is in line with the trend toward environmental-friendly production as required by the environmental inspection teams, and it is such trend that will lead to the transformation and upgrading of the PO industry. The PO industry will have a brighter future.

http://www.pudaily.com/News/NewsView.aspx?nid=72823

Sign Up for Email Updates

Sign Up for Email Updates

Everchem Updates Archive

Everchem Updates Archive

Recent News

April 24, 2024

April 24, 2024

April 18, 2024

April 18, 2024

April 17, 2024