Urethane Blog

Chinese TDI Export Flow

July 13, 2018

Three Charts Show China’s TDI Exports and How They Went in 2017

PUdaily, Shanghai–China’s TDI exports totaled 124,000 tons in 2017, down 8.6% from previous year. This is mainly due to the high domestic TDI price in 2017. Except Fujian Southeast Electrochemical, whose TDI exports increased significantly, most TDI manufacturers have little enthusiasm for export. Next, using three charts PUdaily will carry out an analysis of the TDI exports and how they went in 2017.

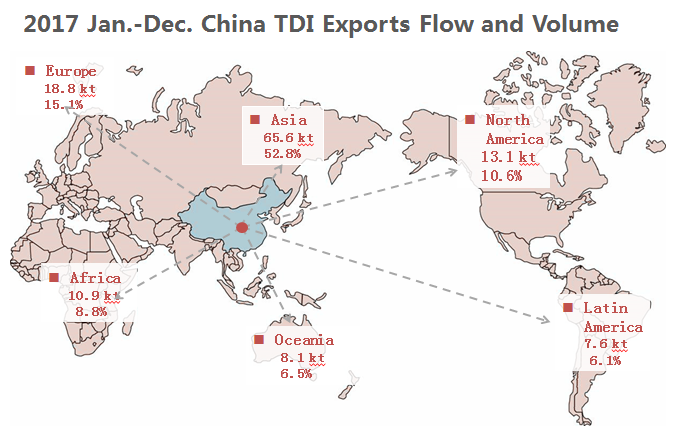

How China’s TDI exports went in 2017

①Data for 2017 shows that China’s TDI exports mainly went to Asia, which accounted for 52.8% of China’s total exports. Domestic TDI manufacturers were also gaining a foothold in markets in Europe and North America. In 2017, China’s adipic acid exports to the two regions accounted for 15.1% and 10.6% of China’s total exports, respectively.

②In 2017, Asian countries importing TDI from China include Taiwan (China), India, Pakistan, Indonesia, the Philippines, Vietnam, Thailand, Hong Kong (China), Sri Lanka, Saudi Arabia and other countries and regions. The top 10 countries/regions accounted for 92.1% of China’s total exports to Asia.

③In 2017, European countries importing TDI from China include Germany, Belgium, Albania and the United Kingdom. Of which Germany and Belgium accounted for 98.5 per cent of China’s total exports to Europe.

Top 10 Countries/regions importing TDI from China in 2017 (In tons)

①The top 10 countries/regions accounted for 70% of China’s total TDI exports. Of which the United States made up 11%, followed by Germany and Taiwan, which made up 8.5% and 7.7%, respectively.

②Covestro is the major supplier exporting TDI to Germany, the United States, India and Belgium.

③Major suppliers exporting TDI to Taiwan are Covestro, Yantai Juli and Fujian Southeast Electrochemical. Of which Covestro accounted for 99% of the total exports.

④The main suppliers exporting TDI to Pakistan include Fujian Southeast Electrochemical, Cangzhou Dahua, Covestro, BASF and Yantai Juli. Among them, Southeast Electrochemical made up 34 percent, Cangzhou Dahua 21.6 percent, Covestro 21 percent, BASF 20.8 percent, and Yantai Juli 2.7 percent of the total exports to the country.

⑤The major suppliers exporting TDI to Indonesia are Covestro, Dow Chemical and Southeast Electrochemical. Among them, Covestro accounted for 97% of the total exports.

⑥The main suppliers exporting the same chemical to Australia are Covestro, Yantai Juli and Southeast Electrochemical. Of which Covestro accounted for 93% of the total exports.

⑦The major suppliers exporting this product to the Philippines are Covestro and Yantai Juli. Of which Covestro accounted for 96% of the total exports.

⑧The main suppliers exporting TDI to Vietnam are Covestro and Southeast Electrochemical. Of which Covestro accounted for 88% of the total exports.

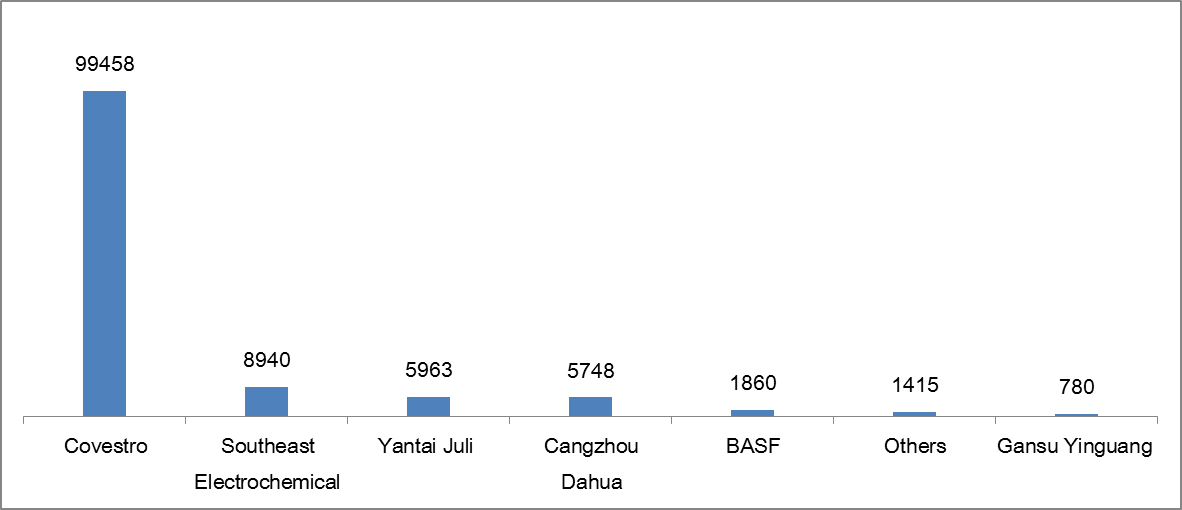

TDI exporters in China in 2017 (In tons)

①Covestro remained the largest TDI exporter in China. The company exported 99,458 tons of TDI in 2017, accounting for 80% of China’s total TDI exports. The top five exporters accounted for 98% of the total exports.

②Costco’s main export destinations include the United States, Germany, Taiwan (China), India, Belgium, Indonesia, the Philippines, Australia, Vietnam, Thailand and other countries and regions. The top 10 countries/regions accounted for 81.6% of its total exports.

③In terms of BASF, in 2017 it exported only 1,860 tons of TDI, down sharply from 2016. And its main export destination is Pakistan, which is partially a result of Pakistan’s preferential tariff on TDI imports from China.

④As for Fujian Southeast Electrochemical, it exported 8,940 tons of TDI in 2017, increasing significantly from 2016. Its main export destinations are Asia, Africa and Latin America, with little TDI exported to Europe and Oceania. Its TDI exports to the Asia accounted for 58 per cent of its total exports.

Postscript: created by PUdaily, “Everyday News on PU” is a column providing high-quality and original contents, covering the review of PU raw material market, the forecast of future price movement and the operation status of manufacturers’ facilities, etc. Thank you! If you have different views, please feel free to leave a message or contact PUdaily for discussion via mobile phone 18221824746!

http://www.pudaily.com/News/NewsView.aspx?nid=72658

Sign Up for Email Updates

Sign Up for Email Updates

Everchem Updates Archive

Everchem Updates Archive

Recent News

April 18, 2024

April 18, 2024

April 17, 2024

April 17, 2024

April 16, 2024