Urethane Blog

PO Trade Flows in the Future

May 29, 2023

Will Shutdown of Dow’s PO Plant in U.S. Change Asian Trade Flow?

PUdaily | Updated: May 29, 2023

The end-users of propylene oxide (PO) include industries such as real estate, automobiles, furniture, refrigerators, and freezers, which are closely related to the development of the national economy. An increase in demand for polyurethane due to the rise in the prosperity of these industries will stimulate polyols suppliers to increase production, thereby increasing the demand for PO and driving up prices.

On May 16, it was reported that Dow Chemical plans to close its PO plant in Freeport, Texas, by the end of 2025.

The decision to close the PO plant arose from the fact that the plant is approaching its end-of-life, and the overall chemical industry is not prosperous due to the slowing global economic growth and various uncontrollable factors. The demand from most end-users is weakening, and polyurethane suppliers are paying more attention to higher value-added segments. Therefore, the decision to close the plant is part of Dow Chemical’s efforts to optimize costs and supply conditions.

Dow’s PO plant in Freeport will continue to operate until the end of 2025, while downstream polyether polyol plants will continue to operate after the PO plant is shut down. After 2025, Dow will use resources from other regions or third-party suppliers to supply PO to its polyol plants. Dow is also investing in logistics capabilities, such as PO tanks, pipelines, and new barges to ensure the normal supply.

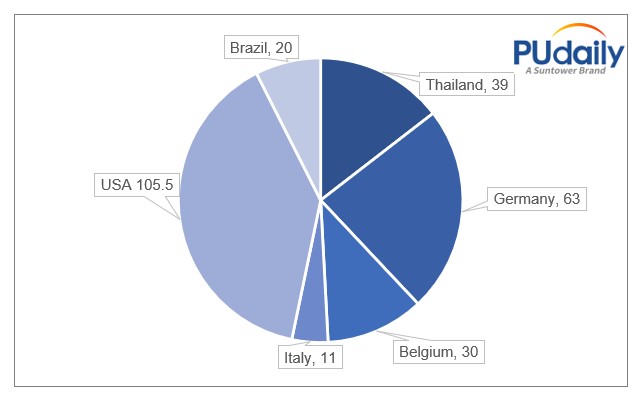

Currently, Dow Chemical is the world’s largest PO producer with an extensive layout of plants in the U.S., Germany, Brazil, Belgium, and Thailand. Its total capacity is 2.685 mtpa, contributing 20.24% of the global PO output.

Dow Chemical’s PO Capacity Layout (10kT)

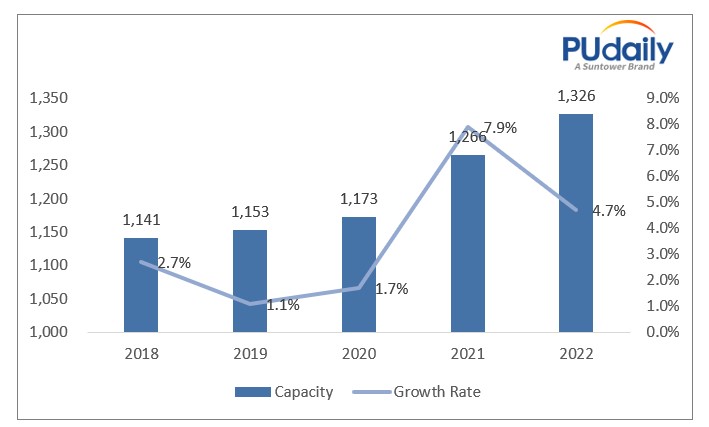

Global PO Capacity & YoY Changes, 2018-2022 (10kT, %)

Dow’s PO production uses the chlorohydrin process technology. The patent owners of the chlorohydrin process are mainly Dow in U.S., Asahi Glass, Mitsui Toatsu and Showa Denko in Japan. The chlorohydrin process was industrialized as early as 1931 and has the advantages of mature technology, short process, low purity requirements for raw materials, and low investment. The key of this technology is the chlorohydrin reactor, and Dow Chemical’s tubular reactor is representative of the chlorohydrin process.

But the chlorohydrin process causes severe environmental pollution, and under the background of increasingly stringent environmental regulations, the use of chlorohydrin technology faces enormous challenges. The US government has already eliminated chlorohydrin technology in 2000, and China has also listed chlorohydrin process as a restricted item in the Guidance Catalogue for Industrial Structure Adjustment (2011), and new facilities cannot adopt this technology.

The shutdown of Dow’s PO plant in the U.S. will cause a supply gap. Part of the gap will be filled by LyondellBasell (In March of this year, LyondellBasell successfully started up the world’s largest PO and TBA plant in Texas. These new assets on the U.S. Gulf Coast have an annual capacity of 470,000 tonnes of PO and 1 million tonnes of TBA and its derivatives). Some PO suppliers in countries such as South Korea, Saudi Arabia, and Thailand will also increase exports to the U.S. China’s PO export is constrained by process requirements and lack of export tax refunds. The tax rebate rate for downstream products of PO, such as polyether polyols, propylene glycol, and propylene glycol methyl ether, has been increased to 13%, further enhancing their export competitiveness.

Sign Up for Email Updates

Sign Up for Email Updates

Everchem Updates Archive

Everchem Updates Archive

Recent News

April 24, 2024

April 24, 2024

April 18, 2024

April 18, 2024

April 17, 2024