Urethane Blog

China Coal

October 19, 2021

China Jawbones Coal Markets With Meaningless “Market Intervention” Headlines As It Becomes Desperate

by Tyler DurdenTuesday, Oct 19, 2021 – 05:45 PM

What’s wrong with communism? The latest example comes from China, where central planners told state-owned energy companies to panic buy coal which sent prices to the moon. Now the communist government is battling market forces with meaningless headlines to jawbone prices lower.

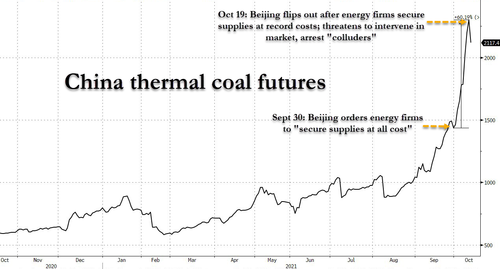

Just as thermal coal futures on the Zhengzhou Commodity Exchange catapulted to new heights, the National Development and Reform Commission (NDRC), China’s top economic planner, announced in the Tuesday overnight Asian session that it has a plan to intervene in coal markets to halt the rally, according to Bloomberg.

The headlines were empty and meaningless. It may suggest that Beijing is running out of options to stymie the price rally ahead of the Northern Hemisphere winter, where national stockpiles of fossil fuels are at extremely low seasonal levels. NDRC said it would examine various measures to intervene in markets. It said it had a “zero tolerance” for market participants spreading fake news or conspiring with others to push prices higher.

Here’s NDRC’s most desperate headline:

“The current price increase has completely deviated from the fundamentals of supply and demand,” NDRC said in a statement published on WeChat.

Seriously? The reason prices are sky-high is because of supply and demand dynamics. The agency went on to say it “will study-specific measures to intervene in coal prices and promote the return of coal prices to a reasonable range,” adding that it would increase coal output to 12 million per day and give coal transportation through ports and railroads the highest priority.

Beijing even sent Vice Premier Han Zheng on China National Radio Tuesday to praise the “powerful measures to curb speculation and hoarding in energy markets.” Still, we have no idea how the communist government plans to intervene in markets – just jawboning markets at this point.

What caused the latest leg up in coal prices was when Beijing’s state-asset regulator last month ordered state-owned energy companies to acquire coal supplies at all costs. This forced coal prices higher and resulted in more power blackouts across the country.

China derives 50% of its power from coal. If prices continue to rise, local authorities will have to continue shutting down energy-intensive industries to protect the grid. In return, this will weigh on not just the domestic economy but also the global economy.

Central planners have already told state-owned mines in Yulin, a major coal hub in Shaanxi province, to reduce coal prices by 100 yuan per ton less than spot.

An analyst with Daiwa Capital Markets told clients in a note that favorable supply and demand dynamics suggest elevated coal prices will remain through winter. More or less, whatever Beijing has up its sleeves, could be uneventful in reigning in coal prices back to normal levels.

China has also taken additional steps to alleviate the energy crunch by allowing coal-fired power prices to fluctuate by up to 20%, enabling power plants to pass on more of the high costs of generation to commercial and industrial end-users.

The bottom line is that Beijing is throwing the proverbial “kitchen sink” to reign in coal prices with meaningless statements that may fail to arrest prices in the months ahead as supply and demand dynamics show central planning is the wrong way to manage an economy.

https://www.zerohedge.com/commodities/coal-prices-drop-beijing-studies-market-interventions

Sign Up for Email Updates

Sign Up for Email Updates

Everchem Updates Archive

Everchem Updates Archive

Recent News

April 24, 2024

April 24, 2024

April 18, 2024

April 18, 2024

April 17, 2024