Epoxy

September 1, 2021

BASF Increases Polyetheramines

BASF to increase prices for select polyetheramines in North America

FLORHAM PARK, NJ, September 1, 2021 – Effective October 1, 2021 or as existing contracts permit, BASF will increase its prices in North America for select polyetheramines sold under the brand name Baxxodur®.

Product Price Increase

Polyetheramine D230 (Baxxodur® EC 301) $0.19 / lb.

Polyetheramine D2000 (Baxxodur® EC 303) $0.24 / lb.

Polyetheramine T403 (Baxxodur® EC 310) $0.19 / lb.

Isophorone diamine (Baxxodur® EC 201) $0.23 / lb.

Under the brand name Baxxodur®, BASF markets a diversified portfolio of amine-based curing components for the professional and application-oriented processing of epoxy resins. BASF’s Baxxodur products are featured in many applications as highly efficient curing agents in various coating applications and sealing compounds, for the wind energy, electrical industry as well as in composites, adhesives and flooring.

August 31, 2021

More Backlog, Although This Too Will End, Just a Question of When

California Port Pileup Shatters Record And Imports Still Haven’t Peaked

by Tyler DurdenTuesday, Aug 31, 2021 – 07:30 PM

By Greg Miller of FreightWaves

From anchorage stats to forward arrivals, ocean bookings, and inventory-to-sales numbers, all the latest data paints the same picture: The U.S. congestion crisis has never been more severe than it is now — and it’s getting worse.

Hope for any relief this year has vanished. French carrier CMA CGM is the latest in a long line of market participants to push back its timeline on normalization. Capacity constraints “are expected to continue until the first half of 2022,” CMA CGM warned on Friday.

Alarmingly, America’s import system — which is already stretched to the limit — looks like it will have to handle even higher volumes next month. The likely outcome: Carriers will be forced to cancel more sailings as terminal berths max out and ships get stuck at anchor, even more cargo will get “rolled” (pushed to a future sailing), and importers will face even longer delays and even less slot availability as they scramble to build inventories for holiday sales.

More ships stuck at anchor than ever before

According to the Marine Exchange of Southern California, there were 47 container ships at anchor or drifting off the ports of Los Angeles and Long Beach on Sunday, a new all-time high. The earlier high of 40 at anchor was set on Feb. 1 and matched several times last week. The tally rose to 44 on Friday and stood at 46 on Monday.

Pre-COVID, an average of 16 container ships were at berths or at anchor on any given day (with any ships at anchor being a rare occurrence). On Sunday, there were 76 box ships either at berths, at anchor or drifting — 4.8 times the pre-COVID level.(Chart data: American Shipper based on data from Marine Exchange of Southern California. Data bi-monthly Jan 2019-Nov 2020; daily Dec 2020-present)

There are now almost 60% more container ships at anchor than at berth. The Marine Exchange data shows that Los Angeles/Long Beach terminals accommodated an average of 28 ships each day this month. All the rest is overflow that heads to the so-called “parking lot” in San Pedro Bay.

Automatic identification system (AIS) ship-positioning data from MarineTraffic revealed extreme congestion in Southern California on Monday, with more than a half-dozen ships forced to drift because anchorage spots were full.Container-ship positions as of Monday afternoon (Map: MarineTraffic)

Even higher volumes on the way

“The expected spike in imports generated by the peak season and pre-shipped cargo is already here, making the operation more complex,” said Hapag-Lloyd on Friday, referring to congestion in Los Angeles and Long Beach. Hapag-Lloyd said that it does not expect California anchorages to clear in 2021.

The Port of Los Beach’s WAVE report, which estimates future arrivals, predicts volumes will rise in the weeks ahead. It forecast loaded import volumes of 120,928 twenty-foot equivalent units for the last week of September, up 34% from the estimated 89,980 TEUs of imports due to arrive next week.

Signal, the Port of Los Angeles’ planning tool, shows the same upward trend, with import volumes of 178,426 TEUs expected the week of Sept. 12-18, up 49% from an estimated 120,070 TEUs this week.

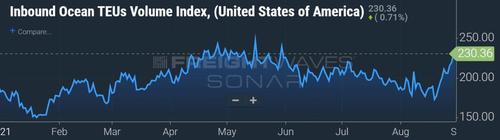

Another forward indicator is a proprietary index of shippers’ bookings on FreightWaves’ SONAR platform. The index has risen sharply in recent weeks, implying higher volumes arriving at U.S. ports in late September and into October.

Inventories not even close to being replenished

Despite record imports in the first eight months of this year, U.S. retail sales continue to outpace inventory replenishment. Assuming sales don’t collapse and businesses seek to reach pre-COVID inventory-to-sales levels, imports still have a long way to run due to restocking.

The Institute for Supply Management (ISM) produces a monthly report that includes an index of sentiment on customer inventories. That index fell to 25 points in July, the lowest level in its history.(Chart: FreightWaves SONAR)

The Bureau of Economic Analysis publishes detailed monthly data on retail inventories and inventory-to-sales ratios. While there is a lag — the June numbers were published on Friday — the data underscores the magnitude of America’s inventory restocking challenge.

Jason Miller, associate professor of supply chain management at Michigan State University’s Eli Broad College of Business, provided inflation-adjusted BEA figures excluding motor vehicles and automotive parts (which skew the data). This data shows that retail inventories are now substantially higher than pre-COVID, but sales have been so high that the inventory-to-sales ratio is far below where it was pre-COVID. The level of inventory to sales actually fell slightly in June, to 0.94 months of sales.(Chart: Jason Miller)

Miller also compared the June sales and inventory figures for specific categories of wholesale and retail imports. (Chart: Jason Miller)

The rise in sales far outpaced the rise in inventories — in some categories, inventories fell — which helps explain the ongoing flood of cargo into U.S. ports and the unprecedented pileup of ships at anchor off Los Angeles/Long Beach.

August 31, 2021

More Backlog, Although This Too Will End, Just a Question of When

California Port Pileup Shatters Record And Imports Still Haven’t Peaked

by Tyler DurdenTuesday, Aug 31, 2021 – 07:30 PM

By Greg Miller of FreightWaves

From anchorage stats to forward arrivals, ocean bookings, and inventory-to-sales numbers, all the latest data paints the same picture: The U.S. congestion crisis has never been more severe than it is now — and it’s getting worse.

Hope for any relief this year has vanished. French carrier CMA CGM is the latest in a long line of market participants to push back its timeline on normalization. Capacity constraints “are expected to continue until the first half of 2022,” CMA CGM warned on Friday.

Alarmingly, America’s import system — which is already stretched to the limit — looks like it will have to handle even higher volumes next month. The likely outcome: Carriers will be forced to cancel more sailings as terminal berths max out and ships get stuck at anchor, even more cargo will get “rolled” (pushed to a future sailing), and importers will face even longer delays and even less slot availability as they scramble to build inventories for holiday sales.

More ships stuck at anchor than ever before

According to the Marine Exchange of Southern California, there were 47 container ships at anchor or drifting off the ports of Los Angeles and Long Beach on Sunday, a new all-time high. The earlier high of 40 at anchor was set on Feb. 1 and matched several times last week. The tally rose to 44 on Friday and stood at 46 on Monday.

Pre-COVID, an average of 16 container ships were at berths or at anchor on any given day (with any ships at anchor being a rare occurrence). On Sunday, there were 76 box ships either at berths, at anchor or drifting — 4.8 times the pre-COVID level.(Chart data: American Shipper based on data from Marine Exchange of Southern California. Data bi-monthly Jan 2019-Nov 2020; daily Dec 2020-present)

There are now almost 60% more container ships at anchor than at berth. The Marine Exchange data shows that Los Angeles/Long Beach terminals accommodated an average of 28 ships each day this month. All the rest is overflow that heads to the so-called “parking lot” in San Pedro Bay.

Automatic identification system (AIS) ship-positioning data from MarineTraffic revealed extreme congestion in Southern California on Monday, with more than a half-dozen ships forced to drift because anchorage spots were full.Container-ship positions as of Monday afternoon (Map: MarineTraffic)

Even higher volumes on the way

“The expected spike in imports generated by the peak season and pre-shipped cargo is already here, making the operation more complex,” said Hapag-Lloyd on Friday, referring to congestion in Los Angeles and Long Beach. Hapag-Lloyd said that it does not expect California anchorages to clear in 2021.

The Port of Los Beach’s WAVE report, which estimates future arrivals, predicts volumes will rise in the weeks ahead. It forecast loaded import volumes of 120,928 twenty-foot equivalent units for the last week of September, up 34% from the estimated 89,980 TEUs of imports due to arrive next week.

Signal, the Port of Los Angeles’ planning tool, shows the same upward trend, with import volumes of 178,426 TEUs expected the week of Sept. 12-18, up 49% from an estimated 120,070 TEUs this week.

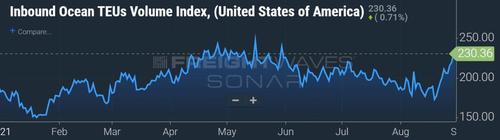

Another forward indicator is a proprietary index of shippers’ bookings on FreightWaves’ SONAR platform. The index has risen sharply in recent weeks, implying higher volumes arriving at U.S. ports in late September and into October.

Inventories not even close to being replenished

Despite record imports in the first eight months of this year, U.S. retail sales continue to outpace inventory replenishment. Assuming sales don’t collapse and businesses seek to reach pre-COVID inventory-to-sales levels, imports still have a long way to run due to restocking.

The Institute for Supply Management (ISM) produces a monthly report that includes an index of sentiment on customer inventories. That index fell to 25 points in July, the lowest level in its history.(Chart: FreightWaves SONAR)

The Bureau of Economic Analysis publishes detailed monthly data on retail inventories and inventory-to-sales ratios. While there is a lag — the June numbers were published on Friday — the data underscores the magnitude of America’s inventory restocking challenge.

Jason Miller, associate professor of supply chain management at Michigan State University’s Eli Broad College of Business, provided inflation-adjusted BEA figures excluding motor vehicles and automotive parts (which skew the data). This data shows that retail inventories are now substantially higher than pre-COVID, but sales have been so high that the inventory-to-sales ratio is far below where it was pre-COVID. The level of inventory to sales actually fell slightly in June, to 0.94 months of sales.(Chart: Jason Miller)

Miller also compared the June sales and inventory figures for specific categories of wholesale and retail imports. (Chart: Jason Miller)

The rise in sales far outpaced the rise in inventories — in some categories, inventories fell — which helps explain the ongoing flood of cargo into U.S. ports and the unprecedented pileup of ships at anchor off Los Angeles/Long Beach.

August 31, 2021

Power Grid is the Issue Post Ida

Hardest-hit areas in Louisiana could be without power for weeks – Entergy

Author: Adam Yanelli

2021/08/31

HOUSTON (ICIS)–Power outages continue to exist for about 840,000 customers across the state of Louisiana and parts of Mississippi after Hurricane Ida made landfall on Sunday. The main power distributor in the state said the hardest-hit areas could experience outages “for weeks”.

Entergy – the main power distributor for the state of Louisiana – is still assessing the damage, which included damage to major transmission lines that deliver power to numerous Louisiana parishes, which remain out of service.

The number of outages has dropped slightly from Monday.

“The worst damage seen so far is in the south, southeast, Baton Rouge and New Orleans metro regions, with significant flooding reported in the southeast region,” the company said in an update around mid-day on Tuesday.

“Because of the extent of damage and rebuilding required, we expect recovery to be difficult and challenging, and customers in the hardest-hit areas should expect extended power outages lasting for weeks,” the company said.

Power outages can shut down operations at chemical plants and delay their restart.

Many companies shut down plants in anticipation of the storm. These plants make many plastics and chemicals that are in short supply. If they stay idled long enough, the shutdowns will further tighten markets.

PLANT SHUTDOWNS

The following table shows chemical plants and refineries in the region that have shut down.

| Company | Site | Products | Status |

| NOVA | Geismar, Louisiana | Ethylene, propylene | Shutdown |

| Pinnacle Polymers | Garyville, Louisiana | PP | FM |

| Cornerstone | Waggaman, Louisiana | ACN, melamine | FM |

| Shintech | Addis, Louisiana | Ethylene, chlorine, caustic soda, EDC, VCM, PVC | Shutdown |

| Shintech | Plaquemine, Louisiana | Ethylene, chlorine, caustic soda, EDC, VCM, PVC | Shutdown |

| Rubicon | Geismar, Louisiana | MDI, polyether polyols, aniline, nitrobenzene | Shutdown |

| ExxonMobil | Baton Rouge, Louisiana | Gasoline, refinery-grade propylene (RGP), benzene, toluene | Shutdown |

| Marathon Petroleum | Garyville, Louisiana | Gasoline, refined products | Shutdown |

| Olin | Plaquemine, Louisiana | Caustic soda, chlorine | Shutdown |

| Olin | St Gabriel, Louisiana | Caustic soda, chlorine | Shutdown |

| Valero | Meraux, Louisiana | Gasoline, refined products, propylene, propylene upgrade | Shutdown |

| Valero | St Charles, Louisiana | Gasoline, refined products, propylene, propylene upgrade | Shutdown |

| Dow | Taft, Louisiana | Oxo-alcohols (IBA, NBA) | Shutdown |

| Phillips 66 | Belle Chasse, Louisiana | Refined products, aromatics, propylene | Shutdown |

| Formosa Plastics | Baton Rouge, Louisiana | PVC, VCM | Shutdown |

| ExxonMobil | Baton Rouge, Louisiana | Olefins, aromatics, IPA, polyolefins, base oils | Shutdown |

| Westlake | Geismar, Louisiana | Caustic soda, EDC, PVC, VCM | Shutdown |

| Westlake | Plaquemine, Louisiana | Caustic soda, EDC, PVC, VCM | Shutdown |

| Dow | Taft, Louisiana | Olefins, acetic acid, acrylic acid, acrylic acid esters, ethanolamines, EO, glycol ethers, LLDPE, oxo-alcohols | Shutdown |

| Dow | Plaquemine, Louisiana | Olefins, aromatics, EO, glycol ethers, LDPE, LLDPE, PG, PO | Shutdown |

| BASF | Geismar, Louisiana | BDO, EO, MDI, TDI, polyols | Shutdown |

| Phillips 66 | Belle Chasse, Louisiana | Refined products, aromatics, propylene | Shutdown |

| Shell | Norco, Louisiana | Olefins | Shutdown |

| Shell | Geismar, Louisiana | LAO, EG, EO, linear alcohols, glycol ethers | Shutdown |

| Cornerstone | Waggaman, Louisiana | ACN, melamine | Shutdown |

The products made at many of these plants are already in short supply and the shutdowns could impact availability.

In the US fertilizer markets, CF Industries confirmed late Monday that the initial assessment of its Louisiana Donaldsonville Complex did not present significant damage from Hurricane Ida and production will resume as soon as possible.

The company shut down all production on 28 August, as the category 4 storm neared landfall. The complex includes six ammonia plants, five urea plants, four nitric acid plants and three urea ammonium nitrate (UAN) plants.

RAIL UPDATE

The New Orleans Flood Protection Authority has closed the area’s floodgates, which will disrupt all eastward and westward rail routes going through New Orleans, including interchange routes on other carriers.

On Monday, Norfolk Southern said the intermodal terminal in New Orleans will remain closed through Tuesday. Customers with shipments destined to hurricane areas or through them should expect delays of 48-72 hours.

On Monday, BNSF said its main line between Lafayette, Louisiana, and New Orleans remains out of service and it does not know when it could reopen.

BNSF said interchange with other carriers in New Orleans remains suspended, with an embargo in effect for all traffic destined to enter and leave the city.

Kansas City Southern has suspended rail operations on a portion of its line because of excessive rain and wind caused by Hurricane Ida, the company said on Monday.

Mainline operations and interchanges from New Orleans to Baton Rouge in Louisiana have been suspended, as well as Gulfport/Hattiesburg, Mississippi, Kansas City Southern said.

The company cannot conduct maintenance until water has receded.

Once the line has reopened, customers expect delays until Kansas City Southern works through backlogs and until it can resume normal speeds in the areas hit by Hurricane Ida.

On Monday, Union Pacific said engineering crews have started to inspect railroad tracks to assess any storm damage. Because the floodgates are closed, there is no interchange to eastern carriers, so Union Pacific is continuing to review options for rerouting traffic.

Union Pacific had suspended operations at its intermodal terminal in Avondale, Louisiana.

On Friday, CSX said it was taking steps to prepare for Hurricane Ida. It did not announce any suspensions.

In the US, chemical railcar loadings represent about 20% of chemical transportation by tonnage, with trucks, barges and pipelines carrying the rest.

MISSISSIPPI RIVER

A Coast Guard spokesperson said the department is still in the early stages of assessing the navigability of the waterway, but that no blockages had been reported as of Tuesday morning.

OIL SHUT-INS

Nearly all US oil and natural gas production has been shut in because of Hurricane Ida, the US Bureau of Safety and Environmental Enforcement (BSEE) said on Monday. The data is updated daily around mid-day.

Producers have shut in nearly 96% of oil production and nearly 94% of gas production.

PORT RESTRICTIONS, SHUTDOWNS

Ports threatened by Hurricane Ida have either restricted operations or shut them down.

| Port | Status | Condition |

| New Orleans, Louisiana | Closed | Zulu |

| Plaquemines, Louisiana | Closed | Zulu |

| South Louisiana, Louisiana | Closed | Zulu |

| St Bernard, Louisiana | Closed | Zulu |

| Baton Rouge, Louisiana | Closed | Zulu |

| Pascagoula, Mississippi | Closed | Zulu |

| Biloxi, Mississippi | Closed | Zulu |

| Gulfport, Mississippi | Closed | Zulu |

| Mobile, Alabama | Open with Restrictions | Yankee |

| Pensacola, Florida | Open with Restrictions | X-Ray |

| Panama City, Florida | Open with Restrictions | X-Ray |

The Louisiana Offshore Oil Port (LOOP) has paused deliveries of crude until Hurricane Ida subsides, it said on Sunday.

The Louisiana Offshore Oil Port is the nation’s only deepwater oil port for supertankers. Some 50% of the nation’s refining capacity can be supplied by LOOP, which moves 12% of the nation’s annual crude oil imports.

POTENTIAL FOR DAMAGE

Ida’s size, strength and path could cause billions of dollars worth of damage.

The property data firm CoreLogic estimated on Friday that Ida’s storm surge is threatening 941,392 homes. If all of these homes were destroyed and replaced, CoreLogic estimates that the cost would be $220.37bn.

The reconstruction cost value represents a worst-case scenario, CoreLogic said. For reference, the firm estimated in 2020 that Hurricane Laura may have caused $8bn-12bn in insurable losses.

Home repairs, remodelling and construction make up an important end market for several chemicals and polymers.

The white pigment titanium dioxide (TiO2) is used in paints.

Solvents used in paints and coatings include butyl acetate (butac), butyl acrylate (butyl-A), ethyl acetate (etac), glycol ethers, methyl ethyl ketone (MEK) and isopropanol (IPA).

Blends of aliphatic and aromatic solvents are also used to make paints and coatings.

For polymers, expandable polystyrene (EPS) and polyurethane (PU) foam are used in insulation.

Polyurethanes are made of methylene diphenyl diisocyanate (MDI), toluene diisocyanate (TDI) and polyols.

High-density polyethylene (HDPE) is used in pipe. Polyvinyl chloride (PVC) is used to make cladding, window frames, wires and cables, flooring and roofing membranes.

Unsaturated polyester resins (UPR) are used to make coatings and composites.

Vinyl acetate monomer (VAM) is used to make paints and adhesives.

Additional reporting by Al Greenwood, Annalise Porter, Janet Miranda

August 31, 2021

Power Grid is the Issue Post Ida

Hardest-hit areas in Louisiana could be without power for weeks – Entergy

Author: Adam Yanelli

2021/08/31

HOUSTON (ICIS)–Power outages continue to exist for about 840,000 customers across the state of Louisiana and parts of Mississippi after Hurricane Ida made landfall on Sunday. The main power distributor in the state said the hardest-hit areas could experience outages “for weeks”.

Entergy – the main power distributor for the state of Louisiana – is still assessing the damage, which included damage to major transmission lines that deliver power to numerous Louisiana parishes, which remain out of service.

The number of outages has dropped slightly from Monday.

“The worst damage seen so far is in the south, southeast, Baton Rouge and New Orleans metro regions, with significant flooding reported in the southeast region,” the company said in an update around mid-day on Tuesday.

“Because of the extent of damage and rebuilding required, we expect recovery to be difficult and challenging, and customers in the hardest-hit areas should expect extended power outages lasting for weeks,” the company said.

Power outages can shut down operations at chemical plants and delay their restart.

Many companies shut down plants in anticipation of the storm. These plants make many plastics and chemicals that are in short supply. If they stay idled long enough, the shutdowns will further tighten markets.

PLANT SHUTDOWNS

The following table shows chemical plants and refineries in the region that have shut down.

| Company | Site | Products | Status |

| NOVA | Geismar, Louisiana | Ethylene, propylene | Shutdown |

| Pinnacle Polymers | Garyville, Louisiana | PP | FM |

| Cornerstone | Waggaman, Louisiana | ACN, melamine | FM |

| Shintech | Addis, Louisiana | Ethylene, chlorine, caustic soda, EDC, VCM, PVC | Shutdown |

| Shintech | Plaquemine, Louisiana | Ethylene, chlorine, caustic soda, EDC, VCM, PVC | Shutdown |

| Rubicon | Geismar, Louisiana | MDI, polyether polyols, aniline, nitrobenzene | Shutdown |

| ExxonMobil | Baton Rouge, Louisiana | Gasoline, refinery-grade propylene (RGP), benzene, toluene | Shutdown |

| Marathon Petroleum | Garyville, Louisiana | Gasoline, refined products | Shutdown |

| Olin | Plaquemine, Louisiana | Caustic soda, chlorine | Shutdown |

| Olin | St Gabriel, Louisiana | Caustic soda, chlorine | Shutdown |

| Valero | Meraux, Louisiana | Gasoline, refined products, propylene, propylene upgrade | Shutdown |

| Valero | St Charles, Louisiana | Gasoline, refined products, propylene, propylene upgrade | Shutdown |

| Dow | Taft, Louisiana | Oxo-alcohols (IBA, NBA) | Shutdown |

| Phillips 66 | Belle Chasse, Louisiana | Refined products, aromatics, propylene | Shutdown |

| Formosa Plastics | Baton Rouge, Louisiana | PVC, VCM | Shutdown |

| ExxonMobil | Baton Rouge, Louisiana | Olefins, aromatics, IPA, polyolefins, base oils | Shutdown |

| Westlake | Geismar, Louisiana | Caustic soda, EDC, PVC, VCM | Shutdown |

| Westlake | Plaquemine, Louisiana | Caustic soda, EDC, PVC, VCM | Shutdown |

| Dow | Taft, Louisiana | Olefins, acetic acid, acrylic acid, acrylic acid esters, ethanolamines, EO, glycol ethers, LLDPE, oxo-alcohols | Shutdown |

| Dow | Plaquemine, Louisiana | Olefins, aromatics, EO, glycol ethers, LDPE, LLDPE, PG, PO | Shutdown |

| BASF | Geismar, Louisiana | BDO, EO, MDI, TDI, polyols | Shutdown |

| Phillips 66 | Belle Chasse, Louisiana | Refined products, aromatics, propylene | Shutdown |

| Shell | Norco, Louisiana | Olefins | Shutdown |

| Shell | Geismar, Louisiana | LAO, EG, EO, linear alcohols, glycol ethers | Shutdown |

| Cornerstone | Waggaman, Louisiana | ACN, melamine | Shutdown |

The products made at many of these plants are already in short supply and the shutdowns could impact availability.

In the US fertilizer markets, CF Industries confirmed late Monday that the initial assessment of its Louisiana Donaldsonville Complex did not present significant damage from Hurricane Ida and production will resume as soon as possible.

The company shut down all production on 28 August, as the category 4 storm neared landfall. The complex includes six ammonia plants, five urea plants, four nitric acid plants and three urea ammonium nitrate (UAN) plants.

RAIL UPDATE

The New Orleans Flood Protection Authority has closed the area’s floodgates, which will disrupt all eastward and westward rail routes going through New Orleans, including interchange routes on other carriers.

On Monday, Norfolk Southern said the intermodal terminal in New Orleans will remain closed through Tuesday. Customers with shipments destined to hurricane areas or through them should expect delays of 48-72 hours.

On Monday, BNSF said its main line between Lafayette, Louisiana, and New Orleans remains out of service and it does not know when it could reopen.

BNSF said interchange with other carriers in New Orleans remains suspended, with an embargo in effect for all traffic destined to enter and leave the city.

Kansas City Southern has suspended rail operations on a portion of its line because of excessive rain and wind caused by Hurricane Ida, the company said on Monday.

Mainline operations and interchanges from New Orleans to Baton Rouge in Louisiana have been suspended, as well as Gulfport/Hattiesburg, Mississippi, Kansas City Southern said.

The company cannot conduct maintenance until water has receded.

Once the line has reopened, customers expect delays until Kansas City Southern works through backlogs and until it can resume normal speeds in the areas hit by Hurricane Ida.

On Monday, Union Pacific said engineering crews have started to inspect railroad tracks to assess any storm damage. Because the floodgates are closed, there is no interchange to eastern carriers, so Union Pacific is continuing to review options for rerouting traffic.

Union Pacific had suspended operations at its intermodal terminal in Avondale, Louisiana.

On Friday, CSX said it was taking steps to prepare for Hurricane Ida. It did not announce any suspensions.

In the US, chemical railcar loadings represent about 20% of chemical transportation by tonnage, with trucks, barges and pipelines carrying the rest.

MISSISSIPPI RIVER

A Coast Guard spokesperson said the department is still in the early stages of assessing the navigability of the waterway, but that no blockages had been reported as of Tuesday morning.

OIL SHUT-INS

Nearly all US oil and natural gas production has been shut in because of Hurricane Ida, the US Bureau of Safety and Environmental Enforcement (BSEE) said on Monday. The data is updated daily around mid-day.

Producers have shut in nearly 96% of oil production and nearly 94% of gas production.

PORT RESTRICTIONS, SHUTDOWNS

Ports threatened by Hurricane Ida have either restricted operations or shut them down.

| Port | Status | Condition |

| New Orleans, Louisiana | Closed | Zulu |

| Plaquemines, Louisiana | Closed | Zulu |

| South Louisiana, Louisiana | Closed | Zulu |

| St Bernard, Louisiana | Closed | Zulu |

| Baton Rouge, Louisiana | Closed | Zulu |

| Pascagoula, Mississippi | Closed | Zulu |

| Biloxi, Mississippi | Closed | Zulu |

| Gulfport, Mississippi | Closed | Zulu |

| Mobile, Alabama | Open with Restrictions | Yankee |

| Pensacola, Florida | Open with Restrictions | X-Ray |

| Panama City, Florida | Open with Restrictions | X-Ray |

The Louisiana Offshore Oil Port (LOOP) has paused deliveries of crude until Hurricane Ida subsides, it said on Sunday.

The Louisiana Offshore Oil Port is the nation’s only deepwater oil port for supertankers. Some 50% of the nation’s refining capacity can be supplied by LOOP, which moves 12% of the nation’s annual crude oil imports.

POTENTIAL FOR DAMAGE

Ida’s size, strength and path could cause billions of dollars worth of damage.

The property data firm CoreLogic estimated on Friday that Ida’s storm surge is threatening 941,392 homes. If all of these homes were destroyed and replaced, CoreLogic estimates that the cost would be $220.37bn.

The reconstruction cost value represents a worst-case scenario, CoreLogic said. For reference, the firm estimated in 2020 that Hurricane Laura may have caused $8bn-12bn in insurable losses.

Home repairs, remodelling and construction make up an important end market for several chemicals and polymers.

The white pigment titanium dioxide (TiO2) is used in paints.

Solvents used in paints and coatings include butyl acetate (butac), butyl acrylate (butyl-A), ethyl acetate (etac), glycol ethers, methyl ethyl ketone (MEK) and isopropanol (IPA).

Blends of aliphatic and aromatic solvents are also used to make paints and coatings.

For polymers, expandable polystyrene (EPS) and polyurethane (PU) foam are used in insulation.

Polyurethanes are made of methylene diphenyl diisocyanate (MDI), toluene diisocyanate (TDI) and polyols.

High-density polyethylene (HDPE) is used in pipe. Polyvinyl chloride (PVC) is used to make cladding, window frames, wires and cables, flooring and roofing membranes.

Unsaturated polyester resins (UPR) are used to make coatings and composites.

Vinyl acetate monomer (VAM) is used to make paints and adhesives.

Additional reporting by Al Greenwood, Annalise Porter, Janet Miranda