Government Regulation

April 24, 2024

FTC Bans Noncompetes

FTC Announces Rule Banning Noncompetes

FTC’s final rule will generate over 8,500 new businesses each year, raise worker wages, lower health care costs, and boost innovation

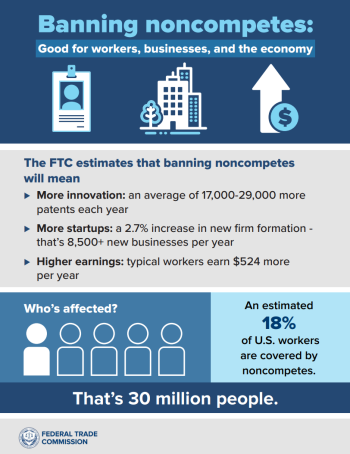

Today, the Federal Trade Commission issued a final rule to promote competition by banning noncompetes nationwide, protecting the fundamental freedom of workers to change jobs, increasing innovation, and fostering new business formation.

“Noncompete clauses keep wages low, suppress new ideas, and rob the American economy of dynamism, including from the more than 8,500 new startups that would be created a year once noncompetes are banned,” said FTC Chair Lina M. Khan. “The FTC’s final rule to ban noncompetes will ensure Americans have the freedom to pursue a new job, start a new business, or bring a new idea to market.”

The FTC estimates that the final rule banning noncompetes will lead to new business formation growing by 2.7% per year, resulting in more than 8,500 additional new businesses created each year. The final rule is expected to result in higher earnings for workers, with estimated earnings increasing for the average worker by an additional $524 per year, and it is expected to lower health care costs by up to $194 billion over the next decade. In addition, the final rule is expected to help drive innovation, leading to an estimated average increase of 17,000 to 29,000 more patents each year for the next 10 years under the final rule.

Noncompetes are a widespread and often exploitative practice imposing contractual conditions that prevent workers from taking a new job or starting a new business. Noncompetes often force workers to either stay in a job they want to leave or bear other significant harms and costs, such as being forced to switch to a lower-paying field, being forced to relocate, being forced to leave the workforce altogether, or being forced to defend against expensive litigation. An estimated 30 million workers—nearly one in five Americans—are subject to a noncompete.

Under the FTC’s new rule, existing noncompetes for the vast majority of workers will no longer be enforceable after the rule’s effective date. Existing noncompetes for senior executives – who represent less than 0.75% of workers – can remain in force under the FTC’s final rule, but employers are banned from entering into or attempting to enforce any new noncompetes, even if they involve senior executives. Employers will be required to provide notice to workers other than senior executives who are bound by an existing noncompete that they will not be enforcing any noncompetes against them.

In January 2023, the FTC issued a proposed rule which was subject to a 90-day public comment period. The FTC received more than 26,000 comments on the proposed rule, with over 25,000 comments in support of the FTC’s proposed ban on noncompetes. The comments informed the FTC’s final rulemaking process, with the FTC carefully reviewing each comment and making changes to the proposed rule in response to the public’s feedback.

In the final rule, the Commission has determined that it is an unfair method of competition, and therefore a violation of Section 5 of the FTC Act, for employers to enter into noncompetes with workers and to enforce certain noncompetes.

The Commission found that noncompetes tend to negatively affect competitive conditions in labor markets by inhibiting efficient matching between workers and employers. The Commission also found that noncompetes tend to negatively affect competitive conditions in product and service markets, inhibiting new business formation and innovation. There is also evidence that noncompetes lead to increased market concentration and higher prices for consumers.

Alternatives to Noncompetes

The Commission found that employers have several alternatives to noncompetes that still enable firms to protect their investments without having to enforce a noncompete.

Trade secret laws and non-disclosure agreements (NDAs) both provide employers with well-established means to protect proprietary and other sensitive information. Researchers estimate that over 95% of workers with a noncompete already have an NDA.

The Commission also finds that instead of using noncompetes to lock in workers, employers that wish to retain employees can compete on the merits for the worker’s labor services by improving wages and working conditions.

Changes from the NPRM

Under the final rule, existing noncompetes for senior executives can remain in force. Employers, however, are prohibited from entering into or enforcing new noncompetes with senior executives. The final rule defines senior executives as workers earning more than $151,164 annually and who are in policy-making positions.

Additionally, the Commission has eliminated a provision in the proposed rule that would have required employers to legally modify existing noncompetes by formally rescinding them. That change will help to streamline compliance.

Instead, under the final rule, employers will simply have to provide notice to workers bound to an existing noncompete that the noncompete agreement will not be enforced against them in the future. To aid employers’ compliance with this requirement, the Commission has included model language in the final rule that employers can use to communicate to workers.

The Commission vote to approve the issuance of the final rule was 3-2 with Commissioners Melissa Holyoak and Andrew N. Ferguson voting no. Commissioners’ written statements will follow at a later date.

The final rule will become effective 120 days after publication in the Federal Register.

Once the rule is effective, market participants can report information about a suspected violation of the rule to the Bureau of Competition by emailing noncompete@ftc.gov

.

The Federal Trade Commission develops policy initiatives on issues that affect competition, consumers, and the U.S. economy. The FTC will never demand money, make threats, tell you to transfer money, or promise you a prize. Follow the FTC on social media, read consumer alerts and the business blog, and sign up to get the latest FTC news and alerts.

April 18, 2024

Trade Action on Epoxy Resin

Olin Among U.S. Epoxy Resin Producers Filing Trade Cases Against Five Countries

News provided by Olin Corporation

Apr 03, 2024, 16:05 ET

CLAYTON, Mo., April 3, 2024 /PRNewswire/ — Olin Corporation (NYSE: OLN) today announced the filing of antidumping and countervailing duty petitions against five countries related to certain epoxy resins, as part of the U.S. Epoxy Resin Producers Ad Hoc Coalition. The petitions charge that unfairly traded imports of certain epoxy resins from China, India, South Korea, Taiwan, and Thailand are causing material injury to the domestic epoxy resin industry. The petitions further charge that significant subsidies have been provided to the foreign producers by the governments of China, India, South Korea, and Taiwan. The U.S. producers in the Coalition, including Olin, produce epoxy resins, an essential component for which there are no practical substitutes, for various customer applications, including critical U.S. industries such as Aerospace, Automotive, Defense, Electrical Transmission, Semiconductors, and Wind Energy. Having domestically produced epoxy resins is vital to ensuring that the U.S. manufacturing industry is capable of meeting domestic preference requirements contained in important U.S. legislation like The Inflation Reduction Act (IRA), the Bipartisan Infrastructure Law, and the CHIPS and Science Act. The availability of domestic epoxy production is also important to ensure U.S. industry has supply chain resiliency.

“We have been facing a significant volume of what we believe are unfairly dumped and subsidized imports of epoxy resin into this country,” said Florian Kohl, President, Olin Epoxy. “These unfairly traded imports have seriously impacted pricing in the U.S. market, which has resulted in a significant negative effect on our production, sales, and earnings. Without relief under U.S. law, unfairly traded imports will undermine the sustainability of U.S. producers and the welfare of their workers and local communities.”

The petitions were filed today with the U.S. Department of Commerce (“Commerce Department”) and the U.S. International Trade Commission (“USITC”). The five countries covered by the antidumping petitions and the dumping margins alleged by the domestic industry are as follows:

| COUNTRY | DUMPING MARGINS ALLEGED |

| China | 264.87% – 351.97% |

| India | 11.43% – 17.50% |

| South Korea | 30.01% – 69.42% |

| Taiwan | 87.19% – 136.02% |

| Thailand | 163.94% – 205.63% |

The petitions also allege that the foreign producers benefit from numerous countervailable subsidies. The petitions were filed in response to large volumes of low-priced imports of epoxy resins from the subject countries over the past three years that have injured the domestic epoxy resin producers.

The petitions allege that producers in the subject countries have injured the U.S. epoxy resin producers by selling their products at unfairly low prices that significantly undercut the prices of U.S. producers. As a result, imports of epoxy resins have captured an increasing share of the U.S. market at the direct expense of the U.S. industry. The price declines that U.S. producers have suffered are likely to continue if duties are not imposed to level the playing field.

Antidumping duties are intended to offset the amount by which a product is sold at less than fair value, or “dumped,” in the United States. The margin of dumping is calculated by the Commerce Department. Estimated duties in the amount of the dumping are collected from importers at the time of importation. Countervailing duties are intended to offset unfair subsidies that are provided by foreign governments and benefit the production of a particular good. The USITC, an independent agency, will determine whether the domestic industry is materially injured or threatened with material injury by reason of the unfairly traded imports.

OLIN COMPANY DESCRIPTION

Olin Corporation is a leading vertically integrated global manufacturer and distributor of chemical products and a leading U.S. manufacturer of ammunition. The chemical products produced include chlorine, caustic soda, vinyls, epoxies, chlorinated organics, bleach, hydrogen, and hydrochloric acid. Winchester’s principal manufacturing facilities produce and distribute sporting ammunition, law enforcement ammunition, reloading components, small caliber military ammunition and components, industrial cartridges, and clay targets.

January 17, 2024

Mattress Tagging in Europe

Euro bedding giant Aquinos to tag a million mattresses by 2027, starting next year

January 17, 2024

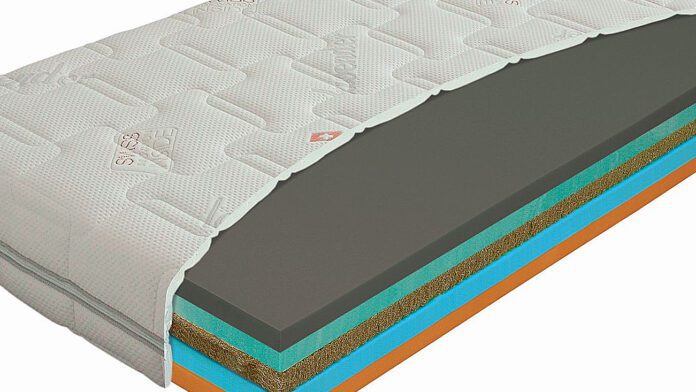

US materials science and digital identification company Avery Dennison is working with European mattress manufacturer Aquinos Group to tag bedding products from 2024 with radio frequency identification (RFID) technology so fewer go to waste, and the company plays an active role in the circular economy, according to a press statement. The project will make Aquinos the first company in its sector to comply with new European Union (EU) Digital Product Passport (DPP) rules.

Avery Dennison makes labeling materials, bonding solutions, and tagging solutions for industrial, medical, and retail applications. It has engaged RFID specialist TripleR on the project. Aquinos Group is one of Europe’s largest mattress manufacturers and operates 20 European factories. It sells products under the BEKA, Lattoflex, Schlaraffia, Sembella, Superba, and Swissflex mattress brands. It forecasts RFID tags will be used in one million of its mattresses by 2027, and “usher in a new era of transparency and circularity” for the firm.

Data from the RFID tags will connect to Avery Dennison’s atma.io platform via RFID readers as they are scanned, creating a digital twin of their whereabouts and history. Data will show information about the origins and materials used in the production of the mattresses. They will also be scanned at recycling centres so that “product dismantlers” can separate materials from the mattresses more efficiently for recycling, and reuse. Consumers will also be able to scan QR codes with smartphones to access product information before and after purchase.

The EU’s new DPP rules will deliver information about products’ environmental sustainability, accessible by scanning a data carrier. Data will include attributes such as the durability and reparability, the recycled content or the availability of spare parts of a product. The DPP scheme is due to come into force for mattresses in 2027. By then, it will have already shipped a million tagged units, it reckons. DPP rules for mattresses will be active sooner in certain European markets, such as Belgium (by 2025), where Aquinos is based.

Aquinos said it will be the “first producer to comply with the DPP scheme at a pan-EU scale”. Aquinos and TripleR are in alliance with the Belgian industry association Valumat as part of a collaboration that also includes product dismantlers.

Benjamin Marien, international commercial director for bedding at Aquinos, said: “DPP sets the next important step in circularity. By being the first in the industry to begin compliance, we want to lead by example to inspire the markets, our industry partners, and the bedding sector to advance environmentally responsible practices…. We will use the power of [our] brands to raise external awareness of the importance of DPPs… We are moving bedding sustainability beyond niche implementation to mainstream. This will be crucial to put an end to bedding materials going to waste.”

Michael Goller, senior director for atma.io at Avery Dennison, said: “We are proud to be working on this project with Aquinos and TripleR. Mattresses are complex and bulky products that require a highly sophisticated sorting and dismantling process. To date, it has proven difficult to do this in a cost-efficient manner – leading to millions of mattresses going to landfill each year. This is precisely why DPPs have been established and we are excited to push boundaries with our partners towards greater traceability, efficiency, and circularity.”

Stefaan Cognie, co-founder at TripleR, commented: “This project is an important milestone and sets a benchmark for how the DPP scheme will operate across Europe to enable sustainability and circularity. We have already developed a digital Identification standard in the bedding industry in Belgium and are engaging with extended producer responsibility (EPR) bodies and mattress associations in different European countries, as well as with the overarching European Mattress Association EBIA to bring DPP compliance to fruition.”

September 24, 2023

Mattress Recall

48,000 mattresses sold at Costco recalled for mold risk

Lara Bonatesta

20 hours ago

(WHTM) — The United States Consumer Product Safety Commission has announced that 48,000 mattresses that were sold exclusively as Costco have been recalled by FXI Inc. due to the risk of mold exposure.

The recalled mattresses include Novaform ComfortGrande 14-inch and Novaform DreamAway 8-inch mattresses.

The ComfortGrande 14-inch mattress has a blue base with “Novaform” written in white letters.

The DreamAway 8-inch mattress has a gray base with “Novaform” written in white letters.

The item number can also be found on the mattress box and on the law tag attached to the mattress. Only mattresses with the following model/item numbers and manufactured at FXI’s San Bernardino, California facility between January 2, 2023, and April 28, 2023, are included in the recall:

| ComfortGrande 14″ Mattress | ||

| ITM/ART # | Price | |

| King | 1413200 | $700 |

| Cal King | 1413201 | $700 |

| Queen | 1413202 | $580 |

| Full | 1413203 | $500 |

| Twin | 1413204 | $400 |

| King | 1413200 | $750 |

| Queen | 1413202 | $600 |

| DreamAway 8″ Mattress | ||

| ITM/ART # | Price | |

| Twin | 1698562 | $160 |

| Full | 1698564 | $210 |

| Twin | 1698562 | $150 |

| Full | 1698564 | $200 |

FXI has received 541 reports of mold on the mattresses. No injuries have been reported.

The recalled mattresses were sold at Costco in the Northwest United States and in the San Francisco Bay area and online at www.costco.com from January 2023 to June 2023 for between $150 and $750.

Consumer Contact

FXI Inc. toll-free at 888-886-2057 from 8 a.m. to 8 p.m. ET, Monday through Friday, or online at https://novaformcomfort.com/pages/recall or https://novaformcomfort.com and click Product Recall on the site for more information.

September 17, 2023

Advertising and Direct Mail May Take A Hit

IRS Halts Pandemic-Era Small-Business Tax Break Following ‘Flood’ Of Potential Fraud Claims

by Tyler Durden

Sunday, Sep 17, 2023 – 11:40 AM

Authored by Naveen Athrappully via The Epoch Times (emphasis ours),

The Internal Revenue Service (IRS) has announced pausing a small-business tax credit program from the pandemic era for the remainder of the year following worries that ineligible claims are being filed.

The Employee Retention Credit (ERC) was instituted during the COVID-19 pandemic to encourage small businesses to retain their employees on payroll. It offered a refundable tax credit for businesses that paid employees while being shut down due to lockdowns and other restrictions. More than three years later, applications for ERC claims continue to pour in at the agency.

Amid “rising concerns about a flood of improper Employee Retention Credit claims,” the IRS announced an immediate moratorium on the program on Sept. 14 that is valid through “at least the end of the year.”

With the moratorium in effect, it would mean that new claims for ERC would not be processed. However, the agency would continue working on previously submitted ERC claims, it said. Processing times may be longer due to fraud concerns.

The moratorium was ordered by IRS Commissioner Danny Werfel due to worries that third parties or “promoters” were aggressively pressuring ineligible businesses to file for ERC claims. Such third parties can charge hefty fees for services, which can go up to 25 percent of the ERC refund.

Even though promoters advertise that ERC claim-submissions as “risk free,” businesses filing such claims face “significant risks” as the agency increases its audit and criminal investigation into the matter.

According to the IRS, any business that improperly files for ERC claims must pay back the received credit together with potential interest and penalties.

“A business or tax-exempt group could find itself in a much worse financial position if it has to pay back the credit than if the credit was never claimed in the first place,” the IRS stated.

The agency has received around 3.6 million ERC claims over the course of the program, which is roughly a fourth of the total number of U.S. businesses that file tax returns annually.

The IRS has already referred thousands of ERC claims for audit. Hundreds of claims have been referred to the IRS’s Criminal Investigation division which is “actively working to identify fraud and promoters of fraudulent claims for potential referral for prosecution to the Justice Department.”

As of July 31, the division has initiated 252 investigations related to potential ERC claim fraud worth over $2.8 billion.

Out of these 252 cases, 15 have resulted in federal charges. And among the federally charged cases, six have ended in convictions and four have reached the sentencing phase. The average sentencing is 21 months.

“The IRS is increasingly alarmed about honest small-business owners being scammed by unscrupulous actors, and we could no longer tolerate growing evidence of questionable claims pouring in,” Mr. Werfel said.

“The further we get from the pandemic, the further we see the good intentions of this important program abused. The continued aggressive marketing of these schemes is harming well-meaning businesses and delaying the payment of legitimate claims, which makes it harder to run the rest of the tax system. This harms all taxpayers, not just ERC applicants.”

Tax Credits and Fraud

When the program was initially introduced during the pandemic, the tax credit offered to businesses was 50 percent of a qualified employee’s wages, limited to $10,000 per year.

As such, a qualifying business could receive a credit of up to $5,000 per employee per annum. The credit was later updated to 70 percent of wages, limited to $10,000 in wages per quarter.

To qualify for ERC, a business should have shut down due to a government-imposed restriction during 2020 or during the first three quarters of 2021. Businesses that experienced a decline in gross receipts during this period may also qualify. These employers must have paid wages to their employees during the period to claim ERC.

Like the Sept. 14 warning, the IRS had issued a similar alert about ERC fraud back in March. At the time, acting IRS Commissioner Doug O’Donnell advised businesses that “if the tax professional they’re using raises questions about the accuracy of the Employee Retention Credit claim, people should listen to their advice.”

“People need to think twice before claiming this,” he said.

Despite ERC being only applicable to businesses that were shut down or saw a steep decline in revenue during the pandemic, fraudsters entice business owners by claiming that most businesses qualify for the credit.

During an interview an with The Washington Post, Laurel Blatchford, a Treasury Department official, said that the extensive ERC fraud should prompt Congress to consider new legislation to tackle the issue.

An IRS spokesperson said that the agency has paid over $230 billion in ERC claims, which far exceeds the original congressional estimate for the program.

The IRS advised businesses who have not yet filed for their ERC claim to consider reviewing the guidelines and wait to file for the credit.

“The IRS believes many of the applications currently filed are likely ineligible, and tax professionals note anecdotally that they are seeing instances where 95 percent or more of claims coming in recent months are ineligible as promoters continue to aggressively push people to apply regardless of the rules.” the agency said.