Epoxy

July 20, 2021

Carlisle to Acquire Henry Co.

Carlisle Cos. inks agreement for $1.6B California acquisition

In This Article

By Brandon Brown – Reporter, Phoenix Business Journal Jul 19, 2021, 6:30pm EDT

Global manufacturing firm Carlisle Cos. Inc. (NYSE: CSL) announced Monday that it has entered into an agreement to acquire a building envelope systems (BES) provider for $1.575 billion.

Carlisle will purchase El Segundo, California-based Henry Co. from private equity firm American Securities LLC. BES products help keep the weather on the outside of the building and the conditioned environment inside — everything from the roof and walls to underground waterproofing measures. Henry, which was founded more than 80 years ago, provides products that control the flow of water, vapor, air and energy in commercial and residential buildings.

Henry employs more than 600 people and has 15 manufacturing facilities across the U.S. and Canada. Carlisle said it will keep Henry’s current leadership in place after the acquisition is finalized.

Henry will now be part of Carlisle’s construction materials (CCM) portfolio of businesses. Carlisle already manufactures dozens of building envelope solutions products.

The deal is expected to close in the third quarter of 2021.

Headquartered in Phoenix along the western edge of Scottsdale since 2016 after relocating from Charlotte, North Carolina, Carlisle manufactures all sorts of products at 180 different sites across the globe. In 2020, the company generated $4.2 billion in revenue.

That transaction was done in cash and represented more than 10-times Henry’s adjusted EBITDA for the twelve-month period of June 1, 2020, to May 31, 2021.

The Henry acquisition plays a few roles in Carlisle’s larger goals, Chairman, President and CEO Chris Koch said in a statement. Carlisle wants to get achieve $8 billion in annual revenue and $15 of earnings per share by 2025. Carlisle plans on achieving that goal through a process of strategic and synergistic acquisitions.

Koch also said this acquisition helps with Carlisle’s ambitious environmental, social and governance – or ESG – goals.

“More than half of Henry’s revenue is derived from products that improve energy efficiency, elevating Carlisle’s existing ESG narrative,” Koch said in a statement. “By acquiring Henry and leveraging the Carlisle Experience across the business, I am confident that we will create significant value for all our stakeholders.”

Despite the global selloff that struck Wall Street due to concerns over the spread of Covid-19 variants amid worries about gaps in vaccination coverage, Carlisle shares were relatively unscathed Monday on the news of the acquisition, losing $2.25 or 1.1% to close at $191.33. The stock was trending slightly higher in early after-hours trading. Track the stock here.

https://www.bizjournals.com/phoenix/news/2021/07/19/carlisle-cos-makes-1-6b-acquisition.html

July 20, 2021

Carlisle to Acquire Henry Co.

Carlisle Cos. inks agreement for $1.6B California acquisition

In This Article

By Brandon Brown – Reporter, Phoenix Business Journal Jul 19, 2021, 6:30pm EDT

Global manufacturing firm Carlisle Cos. Inc. (NYSE: CSL) announced Monday that it has entered into an agreement to acquire a building envelope systems (BES) provider for $1.575 billion.

Carlisle will purchase El Segundo, California-based Henry Co. from private equity firm American Securities LLC. BES products help keep the weather on the outside of the building and the conditioned environment inside — everything from the roof and walls to underground waterproofing measures. Henry, which was founded more than 80 years ago, provides products that control the flow of water, vapor, air and energy in commercial and residential buildings.

Henry employs more than 600 people and has 15 manufacturing facilities across the U.S. and Canada. Carlisle said it will keep Henry’s current leadership in place after the acquisition is finalized.

Henry will now be part of Carlisle’s construction materials (CCM) portfolio of businesses. Carlisle already manufactures dozens of building envelope solutions products.

The deal is expected to close in the third quarter of 2021.

Headquartered in Phoenix along the western edge of Scottsdale since 2016 after relocating from Charlotte, North Carolina, Carlisle manufactures all sorts of products at 180 different sites across the globe. In 2020, the company generated $4.2 billion in revenue.

That transaction was done in cash and represented more than 10-times Henry’s adjusted EBITDA for the twelve-month period of June 1, 2020, to May 31, 2021.

The Henry acquisition plays a few roles in Carlisle’s larger goals, Chairman, President and CEO Chris Koch said in a statement. Carlisle wants to get achieve $8 billion in annual revenue and $15 of earnings per share by 2025. Carlisle plans on achieving that goal through a process of strategic and synergistic acquisitions.

Koch also said this acquisition helps with Carlisle’s ambitious environmental, social and governance – or ESG – goals.

“More than half of Henry’s revenue is derived from products that improve energy efficiency, elevating Carlisle’s existing ESG narrative,” Koch said in a statement. “By acquiring Henry and leveraging the Carlisle Experience across the business, I am confident that we will create significant value for all our stakeholders.”

Despite the global selloff that struck Wall Street due to concerns over the spread of Covid-19 variants amid worries about gaps in vaccination coverage, Carlisle shares were relatively unscathed Monday on the news of the acquisition, losing $2.25 or 1.1% to close at $191.33. The stock was trending slightly higher in early after-hours trading. Track the stock here.

https://www.bizjournals.com/phoenix/news/2021/07/19/carlisle-cos-makes-1-6b-acquisition.html

July 19, 2021

Akrochem Acquires Bech Chem

Akrochem Acquires Bech Chem, Expands Into the Paint and Coatings Industry

Acquisition positions Akrochem for future growth while providing enhanced support levels for Bech Chem customers Press Release – updated: Jul 19, 2021 08:00 EDT

AKRON, Ohio, July 19, 2021 (Newswire.com) – Akrochem, a leading provider of rubber chemicals and compounding materials, today announced the acquisition of Bech Chem, LLC, a company with more than 25 years of experience in the worldwide chemical supply chain. The transaction is effective immediately, and Akrochem will continue to operate under its current name.

The purchase of Bech Chem, based in Houston, Texas, enables Akrochem to expand into new industries, as well as provide more extensive support services for Bech Chem customers.

“The acquisition of Bech Chem allows us to bring our over 90 years of experience in chemical distribution to new markets, specifically paints, coatings, and lubricants,” said Akrochem President and CEO Jay Silver. “With our experienced, 15-person technical sales staff and over 120 personnel in support roles, we will improve our value to Bech Chem customers while positioning Akrochem for future growth.”

Bech Chem served a number of markets, including paint and coatings, grease and lubricants, plastics, and chemical processing. Bech Chem’s outstanding reputation within the specialty chemical distribution industry was based on the exceptional service the company provided throughout the ordering process, as well as its exemplary technical sales and support. The result was strong relationships with high-quality suppliers throughout the world.

“Becoming part of the Akrochem family allows us to introduce our unique specialty product line to a much larger customer base,” said Bech Chem President Henrik Bech Poulsen. “We believe that we’ll be a perfect complement to Akrochem’s core markets.”

Akrochem’s broad line of rubber compounding products and innovative technical experience contribute to the success of organizations throughout the world. Akrochem works with its customers to optimize cure systems, improve chemical dispersion, and produce better batch uniformity to help companies become more profitable.

About Akrochem

Based in Akron, Ohio, Akrochem serves companies globally in the rubber, plastic, paint, coatings, and lubricant markets. Since the company’s founding in 1929, Akrochem’s goal has been to improve productivity for each of it customers. Akrochem provides a comprehensive assortment of compounding materials and color concentrates—from the basic to the most complex and customized—all supported by the industry’s best technical expertise and service. Akrochem promotes professionalism through its ISO-9001-2015 and National Association of Chemical Distributors (NACD) accreditations. Visit www.akrochem.com for more information.

July 19, 2021

Akrochem Acquires Bech Chem

Akrochem Acquires Bech Chem, Expands Into the Paint and Coatings Industry

Acquisition positions Akrochem for future growth while providing enhanced support levels for Bech Chem customers Press Release – updated: Jul 19, 2021 08:00 EDT

AKRON, Ohio, July 19, 2021 (Newswire.com) – Akrochem, a leading provider of rubber chemicals and compounding materials, today announced the acquisition of Bech Chem, LLC, a company with more than 25 years of experience in the worldwide chemical supply chain. The transaction is effective immediately, and Akrochem will continue to operate under its current name.

The purchase of Bech Chem, based in Houston, Texas, enables Akrochem to expand into new industries, as well as provide more extensive support services for Bech Chem customers.

“The acquisition of Bech Chem allows us to bring our over 90 years of experience in chemical distribution to new markets, specifically paints, coatings, and lubricants,” said Akrochem President and CEO Jay Silver. “With our experienced, 15-person technical sales staff and over 120 personnel in support roles, we will improve our value to Bech Chem customers while positioning Akrochem for future growth.”

Bech Chem served a number of markets, including paint and coatings, grease and lubricants, plastics, and chemical processing. Bech Chem’s outstanding reputation within the specialty chemical distribution industry was based on the exceptional service the company provided throughout the ordering process, as well as its exemplary technical sales and support. The result was strong relationships with high-quality suppliers throughout the world.

“Becoming part of the Akrochem family allows us to introduce our unique specialty product line to a much larger customer base,” said Bech Chem President Henrik Bech Poulsen. “We believe that we’ll be a perfect complement to Akrochem’s core markets.”

Akrochem’s broad line of rubber compounding products and innovative technical experience contribute to the success of organizations throughout the world. Akrochem works with its customers to optimize cure systems, improve chemical dispersion, and produce better batch uniformity to help companies become more profitable.

About Akrochem

Based in Akron, Ohio, Akrochem serves companies globally in the rubber, plastic, paint, coatings, and lubricant markets. Since the company’s founding in 1929, Akrochem’s goal has been to improve productivity for each of it customers. Akrochem provides a comprehensive assortment of compounding materials and color concentrates—from the basic to the most complex and customized—all supported by the industry’s best technical expertise and service. Akrochem promotes professionalism through its ISO-9001-2015 and National Association of Chemical Distributors (NACD) accreditations. Visit www.akrochem.com for more information.

July 16, 2021

More Congestion

Union Pacific Halts Shipments From West Coast To Chicago To Ease “Significant Congestion”

by Tyler DurdenFriday, Jul 16, 2021 – 12:17 PM

Brace for even more shortages.

Union Pacific is temporarily suspending eastbound service from West Coast port terminals to its Global IV intermodal facility in Chicago to help ease “significant congestion” at inland terminals, especially Chicago, and at the ports, Freight Waves reports. The suspension is aimed at helping ocean carriers reduce backlogs.Union Pacific plans to temporarily suspend eastbound service from West Coast ports to its Global IV intermodal facility in Chicago. (Photo: Jim Allen/FreightWaves)

UP hopes this suspension, which will start on Sunday and last for about seven days, will not only help relieve port backlogs for Chicago-bound container traffic but also ultimately help address backlogs for containers destined to other markets. The suspension applies to UP-served terminals at the ports of Los Angeles, Long Beach and Oakland, California, and Tacoma, Washington.

FreightWaves has been told that the suspension reportedly entails customers shipping IPI 20-foot or 40-foot equipment, not customers using domestic 53-foot equipment.

“This week we reached out to the ocean carriers to take more positive steps to improve fluidity and throughput in the Los Angeles Basin and our Global IV facility in Chicago. … We believe this change will allow the transportation supply chain to begin working off the backlog of Global IV-destined trains while freeing up railcar assets to support import loading needs on the West Coast,” UP said in an advisory provided to FreightWaves.

“We are working closely with the ocean carriers and collaborating wherever possible to improve the health of the supply chain.”

UP, along with other supply chain partners including Class I railroads, have been grappling with congestion at the West Coast ports as the economic recovery and robust e-commerce activity have kept U.S. import levels brisk.

Container processing at Southern California port terminals has increased while UP’s rail shipments to and from the ports “are near record highs,” UP said.

FreightWaves SONAR shows that intermodal outbound tender rejections, or outbound intermodal tender transactions rejected in the last seven days, grew in June after dipping to lows in March through mid-May.

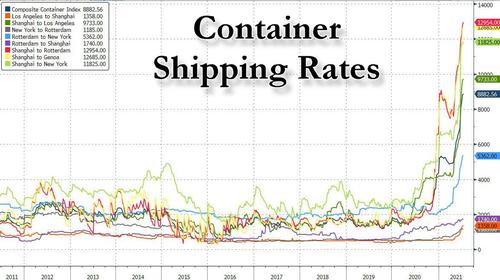

Some shippers have expressed concern anecdotally about how the supply chain will handle fall peak, especially amid reports that containers have been waiting to move to multiple destinations for weeks, if not months. The reasons given for the congestion at the ports have ranged from chassis and labor shortages to railcar shortages. As a result of complete supply-chain collapse, container shipping rates have soared to record highs, and this last week hit a new all time high.

UP said it recently held a symposium with ocean carriers in order to determine how to gate out boxes at inland terminals more quickly. From those efforts, UP has capped its storage fees at the Global IV facility for loaded units that are stacked and awaiting out-gate to help ocean carriers and drayage companies, and UP has opened its Global III facility as an interim import container storage location.

“We believe these positive steps will alleviate some of the considerable challenges supply chain participants are facing,” UP said, much to the imminent fury of Chicago residents.