Epoxy

April 27, 2021

Feedstock Pricing Outlook

Americas petrochemicals outlook, w/c April 26

- Author

- Mary Hogan Staff

- Editor

- Manish Parashar

US polypropylene

US polypropylene exports are expected to continue to trend downward in the short term amid improved availability, sources said.

The homopolymer assessment fell 13.5 cents/lb in the week ended April 24 amid talks of railcars available much lower for the period. S&P Global Platts assessed the homopolymer injection at $2,249-$2,271/mt April 23 on a FAS Houston basis. Ramp-ups by suppliers recovering from the February cold weather disruptions that hit the US Gulf Coast were expected to continue through the end of the month. Talks of normal production were expected to resume in June, sources said. Many buyers were still buying on allocations by producers. Despite the drop, participants deemed pricing too high to export to traditional import markets like Latin America amid competitive pricing from key global sellers. Still, there was talk that pricing would continue to dip on expected decreases in feedstock propylene contract price. Domestic market participants were eying a potential decrease as downstream contract settlements typically follow a monomer plus formula.

US olefins

US spot polymer-grade propylene is expected to continue rising in the week started April 25 on strong downstream polypropylene demand, sources said. April domestic PGP contracts are expected to settle in the week started April 25 between 10 and 16 cents lower.

US spot ethylene is expected to fall amid steam cracker restarts.

US vinyls

US spot export polyvinyl chloride prices were expected to remain at an all-time high of $1,800/mt FAS Houston in the week started April 25 as producers assess whether they will be able to offer volumes for May export. While all plants that shut amid sustained subfreezing temperatures in mid February have since restarted, turnarounds that were slightly delayed by the freeze shutdowns and more slated for May has kept output tight. Market participants do not expect output to resume normal levels until June. Upstream, caustic soda prices could inch up on growing demand in the pulp and paper industry as offices slowly reopen to workers, particularly in the US, with COVID-19 vaccinations becoming more available.

US aromatics

Benzene prices are expected to continue falling from the almost seven-year high of 503 cents/gal DDP USG reached April 20. While some sources said the decline in prices in the latter half of the week ended April 24 was simply a correction, the week of April 25 started with even lower spot ranges, including May benzene bid and offered at 410-485 cents/gal DDP HTC. May benzene had closed April 23 at 460 cents/gal DDP USG, up 35 cents on the week. Price movements through April 28 may prove influential in the settlement of the May CP, expected by the end of the week. May spot prices in recent weeks show the settlement should be sharply higher than the April CP of 301 cents/gal. Downstream, US styrene prices may see support from producers raising offers to account for higher feedstock prices as CP estimates clarify margins, as well as demand from Europe amid skyrocketing benzene costs in that region. May styrene closed April 23 at $1,520/mt FOB USG, up $50/mt on the week.

Stability is expected in the lower liquidity US aromatics markets of toluene and xylenes. While no spot trading was reported in the week of April 19-23, one market participant said the final days of April could usher in offers from producers who have otherwise been uncharacteristically quiet in the spot market since the mid-February Texas freeze derailed refining operations and supply chains. Sharp increases in benzene prices have improved economics for toluene disproportionation, allowing operators to increase STDP unit run rates, one trader said. Prompt nitration-grade toluene closed April 23 at 273 cents/gal FOB USG, up 3 cents week on week, while mixed xylenes gained 1 cent on the week at 249 cents/gal FOB USG.

April 25, 2021

Housing Gone Crazy

Home Prices Soar 18% To An All Time High; A Record 58% Of Houses Sell Within Two Weeks Of Listing

by Tyler DurdenSunday, Apr 25, 2021 – 05:25 PM

As if the official government data on soaring home prices wasn’t crazy enough, the latest monthly data from RedFin shows that in April, homes sold at their fastest pace on record with nearly half off-market within one week.

“There has been an ongoing debate at Redfin about whether fear of coronavirus infection was keeping homeowners from selling. With a third of American adults now fully vaccinated and still hardly any homes being listed for sale, we’re close to settling that debate,” said Redfin Chief Economist Daryl Fairweather.

(A quick note on the base effect in the housing market: at this time last year, pandemic stay-at-home orders halted homebuying and selling, which makes year-over-year comparisons unreliable for select housing metrics. As such, this report has been broken into two sections: metrics that are OK to compare to the same period in 2020, and metrics for which it makes more sense to compare to the same period in 2019.)

Metrics to compare to 2020:

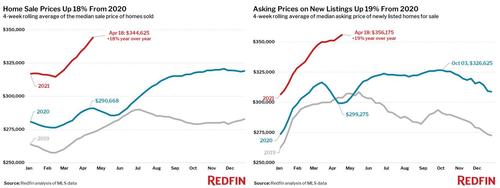

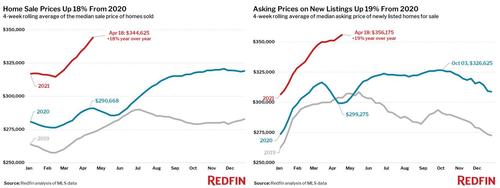

- The median home-sale price increased 18% year over year to $344,625, an all-time high. Asking prices reached an all-time high of $356,175.

- Homes that sold during the period were on the market for a median of 21 days, the shortest time on market since 2012. This was 16 days fewer than the same period in 2020.

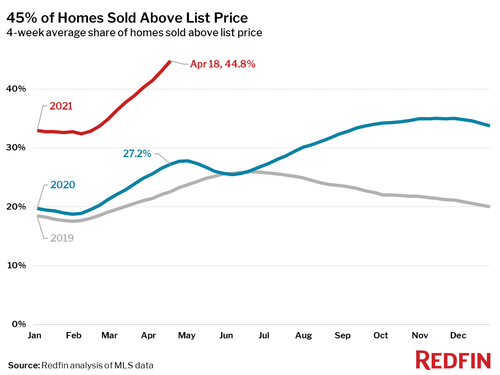

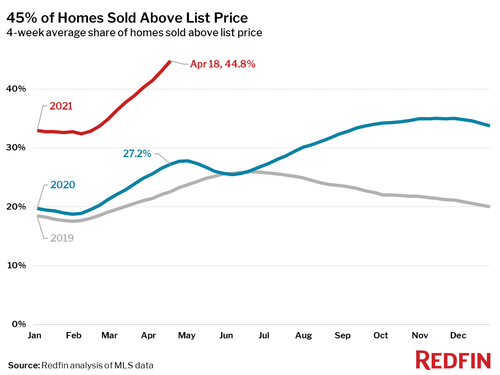

- 45% of homes sold for more than their list price, an all-time high. This was 18 percentage points higher than the same period a year earlier.

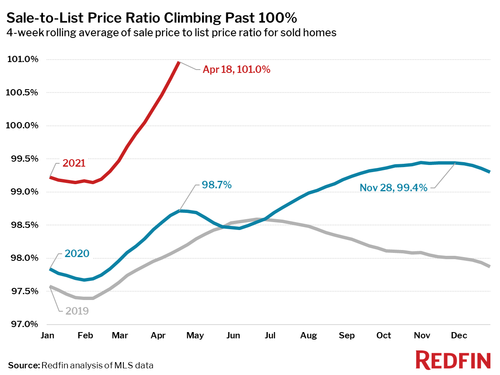

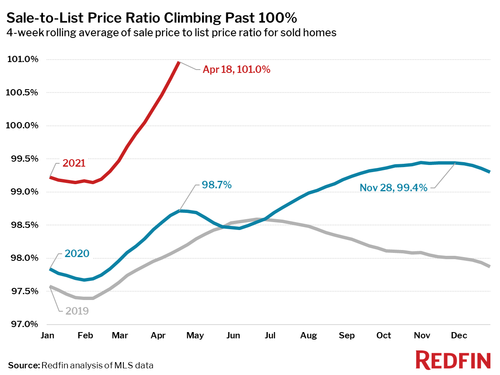

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, increased 2.3 percentage points year over year to an all-time high of 101.0%, meaning the average home sold for 1% more than its asking price.

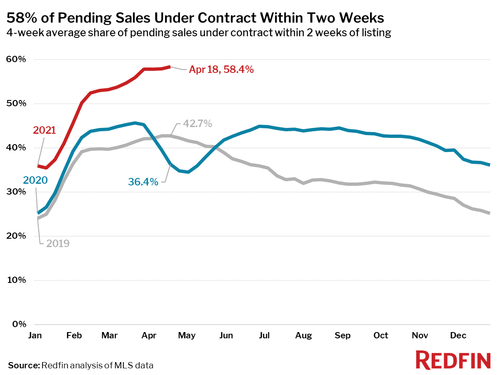

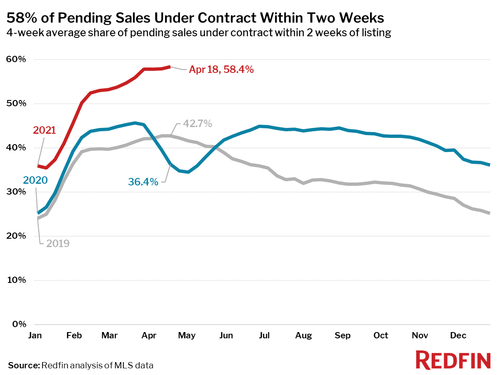

- 58% of homes that went under contract had an accepted offer within the first two weeks on the market. This was a new all-time high (Redfin’s data for this measure goes back to 2012).

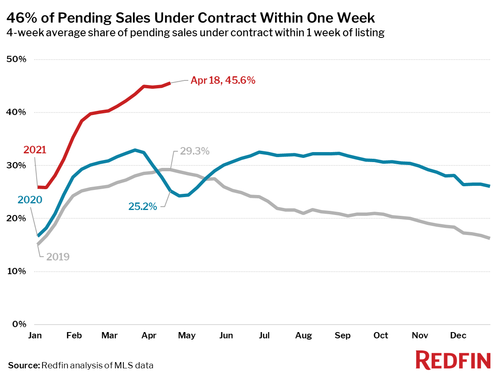

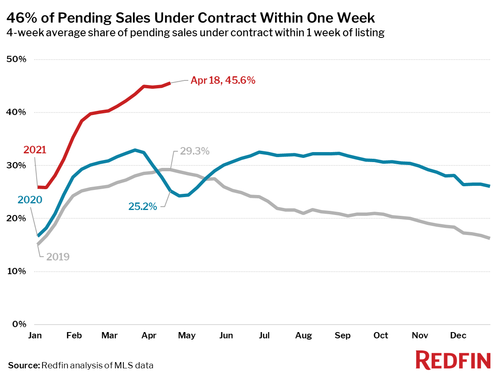

- 46% of homes that went under contract had an accepted offer within one week of hitting the market, an all-time high.

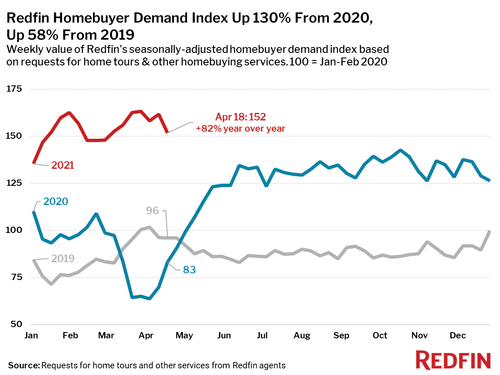

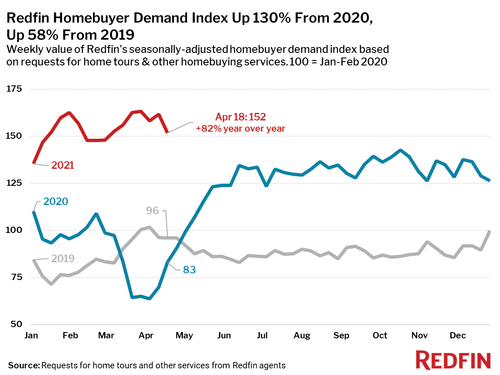

- Meanwhile, with supply at record lows, demand remains near record highs thanks to fiscal stimulus, an exodus from rental units and near-record low mortgage rates.

Metrics to compare to 2019:

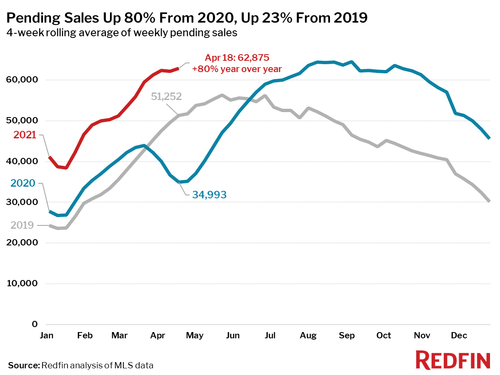

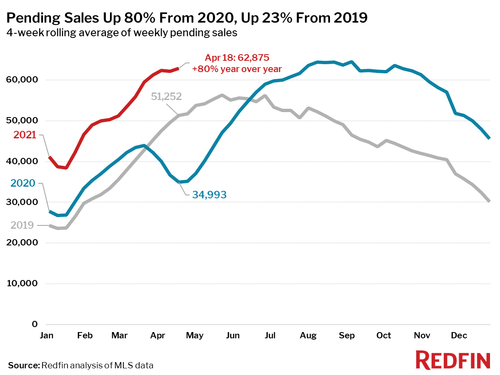

- Pending home sales were up 23% from the same period in 2019.

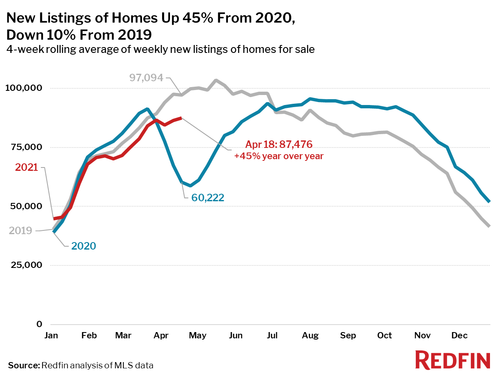

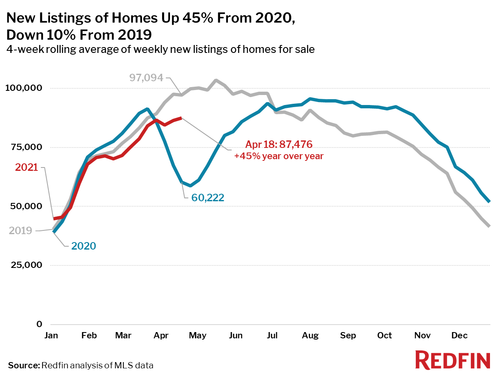

- New listings of homes for sale were down 10% from the same period in 2019.

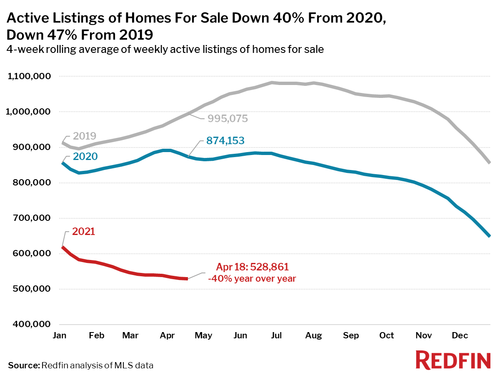

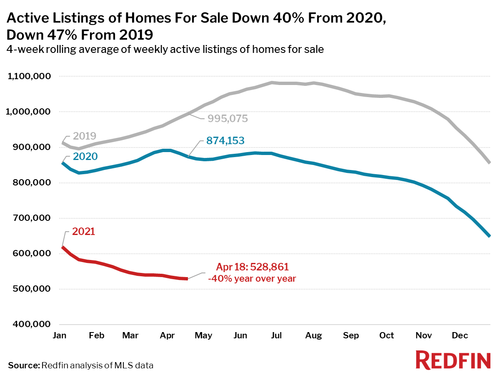

- Active listings (the number of homes listed for sale at any point during the period) fell 47% from the same period in 2019 to a new all-time low.

Fairweather’s conclusion: “Homeowners are staying put because if they move and buy another home they will face a very competitive housing market as buyers, and they don’t need to sell to take advantage of record low mortgage rates. They can just refinance their current home. On top of that, builders are struggling to construct new homes given an ongoing lumber shortage. Without more homeowners listing, buyers are scrambling to compete for the limited number of homes on the market, which continues to drive prices up to new heights.”

April 25, 2021

Housing Gone Crazy

Home Prices Soar 18% To An All Time High; A Record 58% Of Houses Sell Within Two Weeks Of Listing

by Tyler DurdenSunday, Apr 25, 2021 – 05:25 PM

As if the official government data on soaring home prices wasn’t crazy enough, the latest monthly data from RedFin shows that in April, homes sold at their fastest pace on record with nearly half off-market within one week.

“There has been an ongoing debate at Redfin about whether fear of coronavirus infection was keeping homeowners from selling. With a third of American adults now fully vaccinated and still hardly any homes being listed for sale, we’re close to settling that debate,” said Redfin Chief Economist Daryl Fairweather.

(A quick note on the base effect in the housing market: at this time last year, pandemic stay-at-home orders halted homebuying and selling, which makes year-over-year comparisons unreliable for select housing metrics. As such, this report has been broken into two sections: metrics that are OK to compare to the same period in 2020, and metrics for which it makes more sense to compare to the same period in 2019.)

Metrics to compare to 2020:

- The median home-sale price increased 18% year over year to $344,625, an all-time high. Asking prices reached an all-time high of $356,175.

- Homes that sold during the period were on the market for a median of 21 days, the shortest time on market since 2012. This was 16 days fewer than the same period in 2020.

- 45% of homes sold for more than their list price, an all-time high. This was 18 percentage points higher than the same period a year earlier.

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, increased 2.3 percentage points year over year to an all-time high of 101.0%, meaning the average home sold for 1% more than its asking price.

- 58% of homes that went under contract had an accepted offer within the first two weeks on the market. This was a new all-time high (Redfin’s data for this measure goes back to 2012).

- 46% of homes that went under contract had an accepted offer within one week of hitting the market, an all-time high.

- Meanwhile, with supply at record lows, demand remains near record highs thanks to fiscal stimulus, an exodus from rental units and near-record low mortgage rates.

Metrics to compare to 2019:

- Pending home sales were up 23% from the same period in 2019.

- New listings of homes for sale were down 10% from the same period in 2019.

- Active listings (the number of homes listed for sale at any point during the period) fell 47% from the same period in 2019 to a new all-time low.

Fairweather’s conclusion: “Homeowners are staying put because if they move and buy another home they will face a very competitive housing market as buyers, and they don’t need to sell to take advantage of record low mortgage rates. They can just refinance their current home. On top of that, builders are struggling to construct new homes given an ongoing lumber shortage. Without more homeowners listing, buyers are scrambling to compete for the limited number of homes on the market, which continues to drive prices up to new heights.”

April 24, 2021

A Sign of the Times

“That’s How Crazy The Market Is” – A “Virtually Unheard Of Trade” Spotted In Lumber

by Tyler DurdenFriday, Apr 23, 2021 – 08:40 PM

On Monday we highlighted a remarkable fact about the buying frenzy in the US lumber market: lumber futures were up for 16 consecutive days, a stretch without a down day since March 26, and while they did dip on Tuesday, the have more than recovered this latest decline, and are now up 19 of the past 20 days.

This surge in lumber prices to record highs, which was driven by an unprecedented shortages coupled with soaring demand by homebuilders…Lumber prices compared to last year and long term averages; source: @forexlive

… has also translated to unprecedented events in the supply chain, with Bloomberg today reporting a remarkable episode showing how extreme America’s shortage of lumber has become: For the first time in recent memory, a lumberyard was the one selling wood to a supplier.

Needless to say, this kind of trade – where a customer sells goods to its traditional supplier – is virtually unheard of.

MaterialsXchange, a Chicago-based digital trading platform for physical wood products, reports that the trade involved a lumberyard selling about 30,000 square feet of oriented strand board, or OSB ( a cheaper stand-in for plywood that is widely used to make house floors and walls).

“Building materials are moving from company to company in nontraditional flows,” said MaterialsXchange co-founder and CEO Mike Wisnefski. He added that prices have gotten so high that some homebuilders are being forced to cancel projects, leaving certain lumberyards with a little “excess inventory.”

On Wednesday, his company brokered another OSB sale involving a US East Coast lumberyard selling to another one in Arkansas at $1,500 per 1,000 square feet, surpassing a record $999 that was reached at the end of March, based on Random Lengths pricing.

For those confused, Bloomberg explains: in a normal world, wholesale distributors buy lumber from sawmills and sell that to the yards that homebuilders frequent. But lumber markets today are anything but normal with futures surging by more than 60% to record levels this year as the entire timber supply chain collapses under the weight of soaring demand from people renovating their homes and buying bigger ones. As a result, sawmills can’t keep up with orders. Truck shipments have been delayed. And distributors are running short on product.

“That’s how crazy the marketplace is,” said RCM Alternatives lumber analyst Brian Leonard, who has covered the industry for 35 years and had previously never heard of lumberyards selling to distributors. “Obviously it shouldn’t happen. You never push product back up the chain but you can today because of the volatility of the market.”

Furthermore, “reverse” trades like the one that occurred earlier this month will push wood prices even higher. Distributors buying back supply from yards will inevitably mark up prices to the customers they resell to, “potentially creating a vicious cycle that continues to stoke what has already proven to be an unrelenting lumber rally”, according to Bloomberg.

And, as we discussed earlier this week, soaring lumber prices are directly translating into much higher prices for new homes, making housing – where prices have already exploded thanks to the Biden stimulus and the Fed’s ZIRP – even more unaffordable.

https://www.zerohedge.com/markets/thats-how-crazy-market-virtually-uneard-trade-spotted-lumber

When you can make more money selling your inventory than other alternatives . . . buy back later when prices fall.

April 24, 2021

A Sign of the Times

“That’s How Crazy The Market Is” – A “Virtually Unheard Of Trade” Spotted In Lumber

by Tyler DurdenFriday, Apr 23, 2021 – 08:40 PM

On Monday we highlighted a remarkable fact about the buying frenzy in the US lumber market: lumber futures were up for 16 consecutive days, a stretch without a down day since March 26, and while they did dip on Tuesday, the have more than recovered this latest decline, and are now up 19 of the past 20 days.

This surge in lumber prices to record highs, which was driven by an unprecedented shortages coupled with soaring demand by homebuilders…Lumber prices compared to last year and long term averages; source: @forexlive

… has also translated to unprecedented events in the supply chain, with Bloomberg today reporting a remarkable episode showing how extreme America’s shortage of lumber has become: For the first time in recent memory, a lumberyard was the one selling wood to a supplier.

Needless to say, this kind of trade – where a customer sells goods to its traditional supplier – is virtually unheard of.

MaterialsXchange, a Chicago-based digital trading platform for physical wood products, reports that the trade involved a lumberyard selling about 30,000 square feet of oriented strand board, or OSB ( a cheaper stand-in for plywood that is widely used to make house floors and walls).

“Building materials are moving from company to company in nontraditional flows,” said MaterialsXchange co-founder and CEO Mike Wisnefski. He added that prices have gotten so high that some homebuilders are being forced to cancel projects, leaving certain lumberyards with a little “excess inventory.”

On Wednesday, his company brokered another OSB sale involving a US East Coast lumberyard selling to another one in Arkansas at $1,500 per 1,000 square feet, surpassing a record $999 that was reached at the end of March, based on Random Lengths pricing.

For those confused, Bloomberg explains: in a normal world, wholesale distributors buy lumber from sawmills and sell that to the yards that homebuilders frequent. But lumber markets today are anything but normal with futures surging by more than 60% to record levels this year as the entire timber supply chain collapses under the weight of soaring demand from people renovating their homes and buying bigger ones. As a result, sawmills can’t keep up with orders. Truck shipments have been delayed. And distributors are running short on product.

“That’s how crazy the marketplace is,” said RCM Alternatives lumber analyst Brian Leonard, who has covered the industry for 35 years and had previously never heard of lumberyards selling to distributors. “Obviously it shouldn’t happen. You never push product back up the chain but you can today because of the volatility of the market.”

Furthermore, “reverse” trades like the one that occurred earlier this month will push wood prices even higher. Distributors buying back supply from yards will inevitably mark up prices to the customers they resell to, “potentially creating a vicious cycle that continues to stoke what has already proven to be an unrelenting lumber rally”, according to Bloomberg.

And, as we discussed earlier this week, soaring lumber prices are directly translating into much higher prices for new homes, making housing – where prices have already exploded thanks to the Biden stimulus and the Fed’s ZIRP – even more unaffordable.

https://www.zerohedge.com/markets/thats-how-crazy-market-virtually-uneard-trade-spotted-lumber

When you can make more money selling your inventory than other alternatives . . . buy back later when prices fall.