Epoxy

January 25, 2021

More on Containers

An ‘aggressive’ fight over containers is causing shipping costs to rocket by 300%

Published Sun, Jan 24 20218:58 PM ESTUpdated Mon, Jan 25 20219:53 AM ESTWeizhen Tan@weizentShareKey Points

- Shipping costs have skyrocketed as desperate companies wait weeks for containers and pay premium rates to get them, according to industry watchers.

- Ikea’s Singapore operations called it a “global transport crisis” and estimates 850 of its 8,500 products are affected by shipment delays.

- Chinese tech giant Alibaba’s logistic arm Cainiao launched a container booking service last week in response to the global shortage.

A Chinese worker looks on as a cargo ship is loaded at a port in Qingdao, eastern China’s Shandong province.AFP Contributor | AFP | Getty Images

SINGAPORE — A critical shortage of containers is driving up shipping costs and delays for goods purchased from China.

The pandemic and uneven global economic recovery has led to this problem cropping up in Asia, although other parts of the world have also been hit. Industry watchers said desperate companies wait weeks for containers and pay premium rates to get them, causing shipping costs to skyrocket.

This affects everyone who needs to ship goods from China, but particularly e-commerce companies and consumers, who may bear the brunt of higher costs.

In December, spot freight rates were 264% higher for the Asia to North Europe route, compared with a year ago, according to Mirko Woitzik, risk intelligence solutions manager at supply chain risk firm Resilience360. For the route from Asia to the West Coast of the U.S., rates are up 145% year over year.

Compared with last March’s low prices, freight rates from China to the U.S. and Europe have surged 300%, Mark Yeager, chief executive officer of Redwood Logistics, told CNBC. He said spot rates are up to about $6,000 per container compared with the usual price of $1,200.

Even rates from the U.S. have gone up, though not quite as dramatically, according to Yeager.

“The reason for this is the Chinese are being so aggressive about trying to get empty containers back … that it’s hard to get a container for US exporters,” he wrote in an email to CNBC, adding that 3 out of 4 containers from the U.S. to Asia are “going back empty.”

In fact, the shortage in Asia has also led to a similar crisis in many European countries, such as Germany, Austria and Hungary, as shipping carriers redirect containers to the East as quickly as possible, said Woitzik.

Trade surplus furthers container imbalance

There are a few factors stemming from the pandemic driving this phenomenon.

First, China is sending out a lot more exports to the U.S. and Europe than the other way round. Its economy bounced back faster as the virus situation within its borders was basically under control by the second quarter of last year. As a result, containers are stuck in the West when they are really needed in Asia.watch nowVIDEO03:37Port of Los Angeles executive director on shipping delays and traffic

There are about 180 million containers worldwide, but “they’re in the wrong place,” said Yeager of Redwood Logistics.

“So what’s happening is what was already a trade surplus in China has turned dramatically more severe and the reality is, there’s three containers going out for every container that’s coming in,” he said.

Making matters worse, orders for new containers were largely canceled during the first half of last year as most of the world went into lockdown, according to Alan Ng, PWC’s mainland China and Hong Kong transportation and logistics leader.

“The magnitude and pace of the recovery have caught everyone by surprise,” he said. “The sudden recovery in trade volume has seen virtually all of the major shipping lines needing to add significant container capacity to address the container shortage issue.”

Limited alternative

The shortage is further exacerbated by limited air freight capacity. Some high-value items that would normally be delivered by air, such as iPhones, now have to use containers via sea instead, according to Yeager.

International flight volumes have plunged due to virus and travel restrictions.

“Air freight companies typically use that extra capacity at the belly of a passenger plane. Well, there’s just not very many passenger flights, so not as much air service,” he said. “The lack of options, combined with this crazy amount of demand, has produced this crisis.”watch nowVIDEO02:21Analyst: Deutsche Post will benefit from global shortage in air freight supply

The container crisis affects all companies that need to ship goods. But analysts say the situation has a pronounced effect on e-commerce retailers that primarily offer consumer goods, many of which are made in China.

Ikea’s Singapore operations called it a “global transport crisis” in a mid-January Facebook post:

“The surge in demand worldwide for logistical services at this time has resulted in a global shortage of shipping containers, congested seaports, capacity constraints on vessels, and even lockdown in certain markets, amongst other challenges.”

The furniture giant estimated that about 850 of its 8,500 products sold in Singapore are affected by shipment delays, which Ikea said affects availability and planned promotions.

Redwood Logistics’ Yeager said retailers have to decide: “Do I pay a significant premium, or do I push back delivery substantially and (disappoint) customers?” The related costs are either being absorbed by retailers or passed on to customers, he said.

Race to build new containers

While some new containers have been ordered, PWC’s Ng said they will not be ready right away. He pointed to a report by the Shanghai International Shipping Research Centre released in the fourth quarter last year, which said that the shortage issue is likely to last for another three months or more.

Chinese tech giant Alibaba’s logistic arm Cainiao launched a container booking service last week, citing the global shortage. It said its service would span over 200 ports in 50 countries, and port-to-port shipping fees would be 30% to 40% cheaper, according to Reuters.

But even the race to build more containers could be hobbled by delays, according to Yeager. He said the pandemic has also hit the supply of steel and lumber needed to build containers.

https://www.cnbc.com/2021/01/22/shipping-container-shortage-is-causing-shipping-costs-to-rise.html

January 25, 2021

More on Containers

An ‘aggressive’ fight over containers is causing shipping costs to rocket by 300%

Published Sun, Jan 24 20218:58 PM ESTUpdated Mon, Jan 25 20219:53 AM ESTWeizhen Tan@weizentShareKey Points

- Shipping costs have skyrocketed as desperate companies wait weeks for containers and pay premium rates to get them, according to industry watchers.

- Ikea’s Singapore operations called it a “global transport crisis” and estimates 850 of its 8,500 products are affected by shipment delays.

- Chinese tech giant Alibaba’s logistic arm Cainiao launched a container booking service last week in response to the global shortage.

A Chinese worker looks on as a cargo ship is loaded at a port in Qingdao, eastern China’s Shandong province.AFP Contributor | AFP | Getty Images

SINGAPORE — A critical shortage of containers is driving up shipping costs and delays for goods purchased from China.

The pandemic and uneven global economic recovery has led to this problem cropping up in Asia, although other parts of the world have also been hit. Industry watchers said desperate companies wait weeks for containers and pay premium rates to get them, causing shipping costs to skyrocket.

This affects everyone who needs to ship goods from China, but particularly e-commerce companies and consumers, who may bear the brunt of higher costs.

In December, spot freight rates were 264% higher for the Asia to North Europe route, compared with a year ago, according to Mirko Woitzik, risk intelligence solutions manager at supply chain risk firm Resilience360. For the route from Asia to the West Coast of the U.S., rates are up 145% year over year.

Compared with last March’s low prices, freight rates from China to the U.S. and Europe have surged 300%, Mark Yeager, chief executive officer of Redwood Logistics, told CNBC. He said spot rates are up to about $6,000 per container compared with the usual price of $1,200.

Even rates from the U.S. have gone up, though not quite as dramatically, according to Yeager.

“The reason for this is the Chinese are being so aggressive about trying to get empty containers back … that it’s hard to get a container for US exporters,” he wrote in an email to CNBC, adding that 3 out of 4 containers from the U.S. to Asia are “going back empty.”

In fact, the shortage in Asia has also led to a similar crisis in many European countries, such as Germany, Austria and Hungary, as shipping carriers redirect containers to the East as quickly as possible, said Woitzik.

Trade surplus furthers container imbalance

There are a few factors stemming from the pandemic driving this phenomenon.

First, China is sending out a lot more exports to the U.S. and Europe than the other way round. Its economy bounced back faster as the virus situation within its borders was basically under control by the second quarter of last year. As a result, containers are stuck in the West when they are really needed in Asia.watch nowVIDEO03:37Port of Los Angeles executive director on shipping delays and traffic

There are about 180 million containers worldwide, but “they’re in the wrong place,” said Yeager of Redwood Logistics.

“So what’s happening is what was already a trade surplus in China has turned dramatically more severe and the reality is, there’s three containers going out for every container that’s coming in,” he said.

Making matters worse, orders for new containers were largely canceled during the first half of last year as most of the world went into lockdown, according to Alan Ng, PWC’s mainland China and Hong Kong transportation and logistics leader.

“The magnitude and pace of the recovery have caught everyone by surprise,” he said. “The sudden recovery in trade volume has seen virtually all of the major shipping lines needing to add significant container capacity to address the container shortage issue.”

Limited alternative

The shortage is further exacerbated by limited air freight capacity. Some high-value items that would normally be delivered by air, such as iPhones, now have to use containers via sea instead, according to Yeager.

International flight volumes have plunged due to virus and travel restrictions.

“Air freight companies typically use that extra capacity at the belly of a passenger plane. Well, there’s just not very many passenger flights, so not as much air service,” he said. “The lack of options, combined with this crazy amount of demand, has produced this crisis.”watch nowVIDEO02:21Analyst: Deutsche Post will benefit from global shortage in air freight supply

The container crisis affects all companies that need to ship goods. But analysts say the situation has a pronounced effect on e-commerce retailers that primarily offer consumer goods, many of which are made in China.

Ikea’s Singapore operations called it a “global transport crisis” in a mid-January Facebook post:

“The surge in demand worldwide for logistical services at this time has resulted in a global shortage of shipping containers, congested seaports, capacity constraints on vessels, and even lockdown in certain markets, amongst other challenges.”

The furniture giant estimated that about 850 of its 8,500 products sold in Singapore are affected by shipment delays, which Ikea said affects availability and planned promotions.

Redwood Logistics’ Yeager said retailers have to decide: “Do I pay a significant premium, or do I push back delivery substantially and (disappoint) customers?” The related costs are either being absorbed by retailers or passed on to customers, he said.

Race to build new containers

While some new containers have been ordered, PWC’s Ng said they will not be ready right away. He pointed to a report by the Shanghai International Shipping Research Centre released in the fourth quarter last year, which said that the shortage issue is likely to last for another three months or more.

Chinese tech giant Alibaba’s logistic arm Cainiao launched a container booking service last week, citing the global shortage. It said its service would span over 200 ports in 50 countries, and port-to-port shipping fees would be 30% to 40% cheaper, according to Reuters.

But even the race to build more containers could be hobbled by delays, according to Yeager. He said the pandemic has also hit the supply of steel and lumber needed to build containers.

https://www.cnbc.com/2021/01/22/shipping-container-shortage-is-causing-shipping-costs-to-rise.html

January 23, 2021

Where’s My Container?

Maersk Boxship Loses 750 Containers Overboard in North Pacific

Heavy weather in the North Pacific is being blamed for the loss of containers aboard one of Maersk’s containerships. This is the third container loss incident recently reported in the Pacific.

Maersk is saying that approximately 750 containers were lost overboard from the Maersk Essen, a 148,723 dwt vessel with a capacity of 13,100 TEU. The loss occurred on January 16, but the line did not supply details on the vessel’s location. According to tracking provided by Pole Star, the Maersk Essen was about 430 nautical miles NNE of Honolulu at about 1800 GMT on January 16.

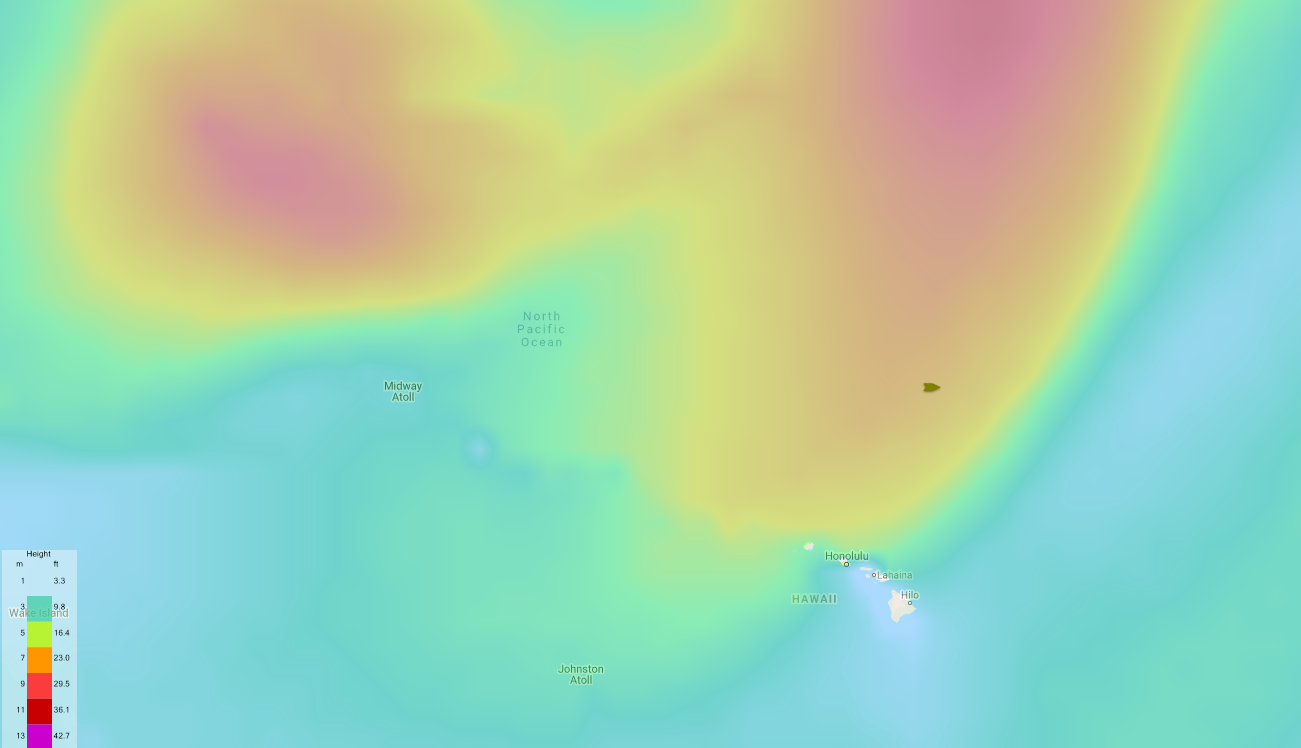

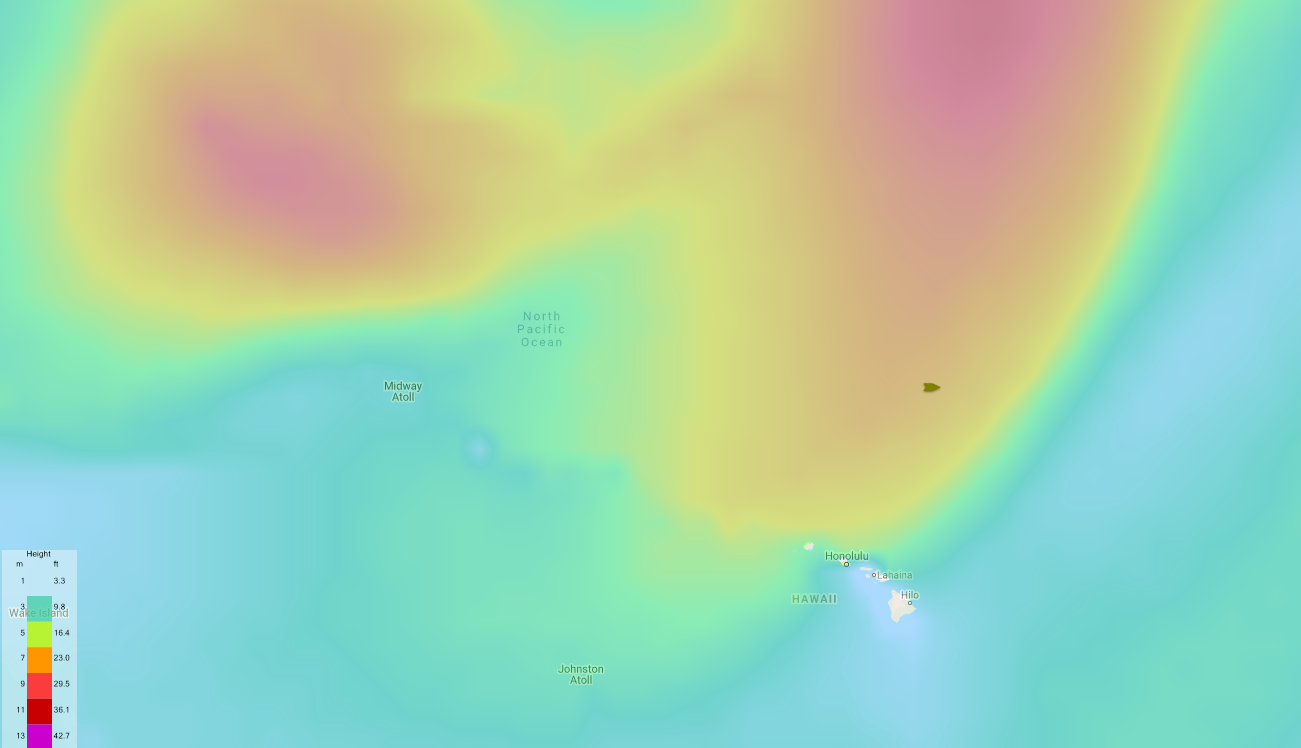

Maersk Essen’s position with significant wave height, January 16, 1800 GMT; orange represents waves of approximately 20 feet (courtesy Pole Star)

The vessel had departed Xiamen, China on December 26 and was due to arrive off Los Angeles on January 22. She operates on Maersk’s TP6 Asia/US West Coast route and as such would have made calls in Vietnam, Hong Kong, and Yantian, China before arriving in Xiamen.

Cargo claims consultancy WK Webster is saying in its initial casualty report, “it is therefore also very likely that some containers will have collapsed or have been damaged in the affected stacks, but remain on board. These containers will need to be removed or repositioned.” Webster reports that it is making arrangements for surveyors to be in place in order to investigate the cause of the incident and to attend to any cargo surveys. They are urging anyone who might have had cargo aboard to make contact to protect their position.

“We view this as a very serious situation which will be investigated promptly and thoroughly,” Maersk said in its statement. They reported that all of the crew was safe and that a detailed cargo assessment is ongoing. In addition, the US Coast Guard, flag state and relevant authorities have been notified.

The Maersk Essen is proceeding to Los Angeles on its scheduled route. Maersk’s vessel tracking system shows that the vessel was scheduled to be on the terminal in Los Angeles from January 28 to February 5 before departing for Yokohama, Japan.

There have been several other incidents in recent month also on the North Pacific. On November 30, the ultra-large containership ONE Apus lost approximately 1,800 containers overboard and damaged scores more during reports of severe weather approximately 1,600 nautical miles northwest of Hawaii. In that incident, the vessel reversed course and sailed to Kobe, Japan, where the recovery operation is still ongoing.

In a third recent incident, at the beginning of November, the ONE Aquila also suffered a container loss in the North Pacific. One Line did not provide details on the number of containers, but WK Webster in its casualty report said that it believed the number exceeded 100 containers. That vessel diverted to Washington state to offload damaged containers and reposition lose containers before proceeding to Long Beach, California.

These recent events are counter to a report issued by the World Shipping Council last summer that said the incidents of containers lost overboard has been on the decline and is a small percentage of the total annual volume. The WSC reported that the three-year moving average was declining, amounting to an average annual loss of 779 containers overboard between 2017 and 2019.

January 23, 2021

Where’s My Container?

Maersk Boxship Loses 750 Containers Overboard in North Pacific

Heavy weather in the North Pacific is being blamed for the loss of containers aboard one of Maersk’s containerships. This is the third container loss incident recently reported in the Pacific.

Maersk is saying that approximately 750 containers were lost overboard from the Maersk Essen, a 148,723 dwt vessel with a capacity of 13,100 TEU. The loss occurred on January 16, but the line did not supply details on the vessel’s location. According to tracking provided by Pole Star, the Maersk Essen was about 430 nautical miles NNE of Honolulu at about 1800 GMT on January 16.

Maersk Essen’s position with significant wave height, January 16, 1800 GMT; orange represents waves of approximately 20 feet (courtesy Pole Star)

The vessel had departed Xiamen, China on December 26 and was due to arrive off Los Angeles on January 22. She operates on Maersk’s TP6 Asia/US West Coast route and as such would have made calls in Vietnam, Hong Kong, and Yantian, China before arriving in Xiamen.

Cargo claims consultancy WK Webster is saying in its initial casualty report, “it is therefore also very likely that some containers will have collapsed or have been damaged in the affected stacks, but remain on board. These containers will need to be removed or repositioned.” Webster reports that it is making arrangements for surveyors to be in place in order to investigate the cause of the incident and to attend to any cargo surveys. They are urging anyone who might have had cargo aboard to make contact to protect their position.

“We view this as a very serious situation which will be investigated promptly and thoroughly,” Maersk said in its statement. They reported that all of the crew was safe and that a detailed cargo assessment is ongoing. In addition, the US Coast Guard, flag state and relevant authorities have been notified.

The Maersk Essen is proceeding to Los Angeles on its scheduled route. Maersk’s vessel tracking system shows that the vessel was scheduled to be on the terminal in Los Angeles from January 28 to February 5 before departing for Yokohama, Japan.

There have been several other incidents in recent month also on the North Pacific. On November 30, the ultra-large containership ONE Apus lost approximately 1,800 containers overboard and damaged scores more during reports of severe weather approximately 1,600 nautical miles northwest of Hawaii. In that incident, the vessel reversed course and sailed to Kobe, Japan, where the recovery operation is still ongoing.

In a third recent incident, at the beginning of November, the ONE Aquila also suffered a container loss in the North Pacific. One Line did not provide details on the number of containers, but WK Webster in its casualty report said that it believed the number exceeded 100 containers. That vessel diverted to Washington state to offload damaged containers and reposition lose containers before proceeding to Long Beach, California.

These recent events are counter to a report issued by the World Shipping Council last summer that said the incidents of containers lost overboard has been on the decline and is a small percentage of the total annual volume. The WSC reported that the three-year moving average was declining, amounting to an average annual loss of 779 containers overboard between 2017 and 2019.

January 22, 2021

Introducing Syntha Group

Piedmont Chemical Industries, Inc. Announces Launch of New Brand and Business Name

Changes reflect the organization’s continued growth and commitment to its iconic family of brands

HIGH POINT, NC: Piedmont Chemical Industries, Inc., a leader in chemical manufacturing, announced today the launch of a new corporate name and brand identity. The organization, a parent company over several unique divisions, will now be known as Syntha Group. The new name and brand identity will help distinguish the parent company and clarify the group as a cohesive family of brands. Among the changes will be a new logo and website (synthagroup.com), effective immediately, which will reflect the organization’s continued growth and commitment to its iconic family of brands. The company’s ownership and staff have not changed.

Vice-Chairman and CSO, Creswell Wilson Calabrese, stated:

“We have been family-owned and operated for 82 years, and we want to maintain that culture within our entities. While we don’t want to lose that emphasis, we have come to realize that within our industry, there is a lack of knowledge that our divisions exist within the same corporation. By rebranding, we are creating a stronger cohesion between our divisions that will give our customers greater awareness of the resources available to them within our entire family of brands.”

Syntha Group consists of five unique subsidiaries within the chemical manufacturing industry:

“Our new name is designed to support the evolution of our company. My grandfather established Piedmont Color and Chemical in 1938 to service the local textile industry. Textiles is still a critical component of our business model but we’ve diversified to serve a wide range of industries from pharmaceuticals to agriculture to cosmetics to food & beverage packaging to recycled materials utility and more” said CEO, Rick Wilson. “The name change is an effort to bring clarity to the fact that all of these proficiencies are available within our organization. We felt that it made sense to differentiate the name of the corporate umbrella from that of a single operating division. We are excited to move forward highlighting the unique capabilities of each of our divisions within Syntha Group.”

Operations, staff, and industry leadership have not changed. The rebranding emphasizes the organization’s continued commitment to the communities, businesses, and families it serves. This exciting change creates clarity and opens the doors to future growth opportunities within the family of businesses.

About Syntha Group

Founded in 1938 by Fred Wilson, Sr. in High Point, NC, Syntha Group is a leading specialty chemical manufacturer. The organization expanded to include five subsidiaries over the course of 82 years and has included four generations of Wilson family involvement. Syntha Group focuses on providing quality products while continuing to lead the way with innovative technologies, custom manufacturing, and close customer partnerships. Offering everything from formulation and R&D to sales and distribution, Syntha Group and its subsidiaries are continually investing in the future of the chemical manufacturing industry. To learn more, visit synthagroup.com.