Epoxy

October 23, 2021

Metals Primer

All The Metals Mined In One Visualization

by Tyler DurdenFriday, Oct 22, 2021 – 08:00 PM

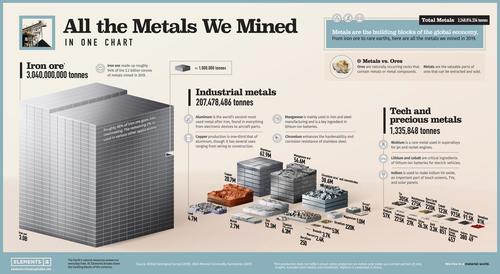

Metals are all around us, from our phones and cars to our homes and office buildings. While we often overlook the presence of these raw materials, they are an essential part of the modern economy. But, as Visual Capitalist’s Govind Bhutada details below, obtaining these materials can be a complex process that involves mining, refining, and then converting them into usable forms.

So, how much metal gets mined in a year?

Metals vs Ores

Before digging into the numbers, it’s important that we distinguish between ores and metals.

Ores are naturally occurring rocks that contain metals and metal compounds. Metals are the valuable parts of ores that can be extracted by separating and removing the waste rock. As a result, ore production is typically much higher than the actual metal content of the ore. For example, miners produced 347 million tonnes of bauxite ore in 2019, but the actual aluminum metal content extracted from that was only 62.9 million tonnes.

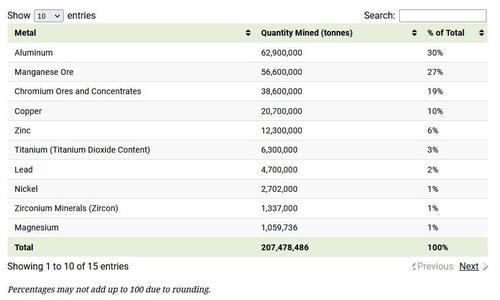

Here are all the metals and metal ores mined in 2019, according to the British Geological Survey:

Miners produced roughly three billion tonnes of iron ore in 2019, representing close to 94% of all mined metals. The primary use of all this iron is to make steel. In fact, 98% of iron ore goes into steelmaking, with the rest fulfilling various other applications.

Industrial and technology metals made up the other 6% of all mined metals in 2019. How do they break down?

Industrial Metals

From construction and agriculture to manufacturing and transportation, virtually every industry harnesses the properties of metals in different ways.

Here are the industrial metals we mined in 2019.

It’s no surprise that aluminum is the most-produced industrial metal. The lightweight metal is one of the most commonly used materials in the world, with uses ranging from making foils and beer kegs to buildings and aircraft parts.

Manganese and chromium rank second and third respectively in terms of metal mined, and are important ingredients in steelmaking. Manganese helps convert iron ore into steel, and chromium hardens and toughens steel. Furthermore, manganese is a critical ingredient of lithium-manganese-cobalt-oxide (NMC) batteries for electric vehicles.

Although copper production is around one-third that of aluminum, copper has a key role in making modern life possible. The red metal is found in virtually every wire, motor, and electrical appliance in our homes and offices. It’s also critical for various renewable energy technologies and electric vehicles.

Technology and Precious Metals

Technology is only as good as the materials that make it.

Technology metals can be classified as relatively rare metals commonly used in technology and devices. While miners produce some tech and precious metals in large quantities, others are relatively scarce.

Tin was the most-mined tech metal in 2019, and according to the International Tin Association, nearly half of it went into soldering.

It’s also interesting to see the prevalence of battery and energy metals. Lithium, cobalt, vanadium, and molybdenum are all critical for various energy technologies, including lithium-ion batteries, wind farms, and energy storage technologies. Additionally, miners also extracted 220,000 tonnes of rare earth elements, of which 60% came from China.

Given their rarity, it’s not surprising that gold, silver, and platinum group metals (PGMs) were the least-mined materials in this category. Collectively, these metals represent just 2.3% of the tech and precious metals mined in 2019.

A Material World

Although humans mine and use massive quantities of metals every year, it’s important to put these figures into perspective.

According to Circle Economy, the world consumes 100.6 billion tonnes of materials annually. Of this total, 3.2 billion tonnes of metals produced in 2019 would account for just 3% of our overall material consumption. In fact, the world’s annual production of cement alone is around 4.1 billion tonnes, dwarfing total metal production.

The world’s appetite for materials is growing with its population. As resource-intensive megatrends such as urbanization and electrification pick up the pace, our material pie will only get larger.

https://www.zerohedge.com/markets/all-metals-mined-one-visualization

October 22, 2021

Epoxy Highlights from Olin’s Investors Call

Olin Corporation (OLN) CEO Scott Sutton on Q3 2021 Results – Earnings Call Transcript

Oct. 22, 2021 1:06 PM ETOlin Corporation (OLN)

Q3: 2021-10-21 Earnings Summary

EPS of $2.40 beats by $0.42 | Revenue of $2.34B (62.78% Y/Y) misses by $36.32M

Olin Corporation (NYSE:OLN) Q3 2021 Earnings Conference Call October 22, 2021 9:00 AM ET

Company Participants

Steve Keenan – Director of Investor Relations

Scott Sutton – Chairman, President and Chief Executive Officer

Pat Dawson – Executive Vice President and President, Epoxy and International

Scott Sutton

Yes. Thanks, Steve, and hello to everybody. I’m pleased to report the Olin team has once again proved to be the most unique and agile in the industry in meeting the clear expectation of our shareholders. Again, I just have to say that the solid performance by the complete team sets me up to be able to focus on the items that drive our future, which are enhancing our contrarian value model, turning our ratchet on undervalued products, parlaying to grow, accretive capital allocation, building out our interlink matrix of activation knobs, growing shooting sports participation and lifting all Olin people. This is a company that is focused on continuing to grow adjusted EBITDA and coupling that with balanced capital management to deliver more than $10 of earnings per share in the near future.

So I’ll make some brief commentary on a few slides and get to the Q&A quickly. 2021 is expected to be a solid result for Olin for the reasons shown on Slide #3. While the longer-term fundamental of demand that grows faster than supply is starting to be exposed here in 2021, our leading actions to get a higher value for our scarce resources is proving to be successful. Current highlights of that success are that we continue to exit business that was based on non-negotiated pricing, align our product chain mix with the intended impact from purposeful settings of our interlinked matrix of activation nodes, start accelerating the value capture of epichlorohydrin and driving expansion in shooting sports participation with our Shoot United movement. While there may be some end of year holiday slowdowns, which are really supply driven, not demand-driven, and some seasonality that result in a sequentially flattish fourth quarter result, we still expect 2022 to exceed 2021. The reason thematic for better results in 2022 is shown on Slide # 4.

The minor reason in our thematic is that the previously mentioned demand growth versus supply growth dynamic just gets better and better across all our businesses. More people are enjoying shooting sports, demanding clean wind energy and expanding their home stats. The major reason in our thematic is that all of Olin’s activities are designed around a foundational, cultural principle of only selling into value. We know who we are.

In October, we took the decision to close some more undervalued assets and simultaneously used other existing global asset and product liquidity to grow Olin’s value. As our own ECU assets are getting rightsized, we are a global buyer of ECUs to satisfy our higher-value products demand. Even though we have grown earnings for 5 consecutive quarters and delivered a levered free cash flow that is approaching 20%, we still must show that our performance will continue to improve. But maybe more importantly, we must demonstrate our ability to manage uncertainty and volatility.

Slide #5 is an illustration. Olin has 3 substantial businesses, each with a meaningful contribution to segment earnings. For reasons that we previously discussed, the Winchester, which is shown in red on the slide, consumer and defense business offers solid and sustainable growth. For reasons we will discuss in just a moment, the Epoxy, which is shown in green on the slide, engineered materials offer differentiated growth as we expand margins in that business. The Chlor Alkali Products and Vinyls Industrial Essentials are our largest organic and inorganic growth opportunity. We expect the Chlor Alkali segment results to be slightly volatile across a brief transitional window when we have a model profile shift between the relative strengths on the 2 sides of the ECU. We think of the net company volatility as ripples on a deep ocean, not waves on a shallow lagoon. We should control our destiny here.

Continuing with the theme of good fundamentals on Slide #6, our perceived old world chemistry has new world application and value. I won’t read all these megatrend multipliers as I’m sure they’re familiar to you, but instead jump to Slide #7 and hit on the differentiated growth profile of epoxy. Epoxy sets itself apart from other engineered materials by offering nearly non-substitutable performance. Almost every end-use category is growing faster than global GDP. Consider the outlook for more and larger wind turbines for clean energy, consider the outlook for electrical laminates for the new mobility trends and broad electrification trends, consider the outlook for infrastructure expansion and replacement and so on. Even though we recognized the value of this business in epoxy resin sales and in epoxy systems sales, the value driver is really epichlorohydrin. And we will be expounding on our globally leading epichlorohydrin position in future earnings calls. We expect it won’t be long before our Epoxy business delivers greater than $1 billion of EBITDA and carries the same enterprise value that all of Olin carries today, more representative of a highly engineered materials company.

Hassan Ahmed

Scott, I wanted to touch on some of these natural gas price escalations that we’ve seen, not just in the U.S. but globally as well. So on the U.S. side of it, if you could sort of talk through how you guys have dealt in what was a pretty tricky quarter and continues to be a tricky 4Q in terms of the hikes we’ve seen in natural gas prices? And if you could also talk about what you guys are seeing in terms of cost curve impact with natural gas price escalation in Europe and the power curtailments we’re seeing in China as well?

Scott Sutton

Yes. I mean, sure. For us, we have a couple strategies to manage the local issue. I mean, 1 is, we have a pretty strong hedging program, where we have some amount of it hedged out into the future, which helps protect those. The rest of it is absolutely 100% covered in product pricing. And every day, we get more ability to recover that on an instantaneous basis as we get out of some of these contracts that keep us in handcuffs. I think the more important 1 is maybe your second one, I mean rising global energy costs, it’s actually a plus for Olin and that’s because trade flows get more expensive and trade movements get more volatile. And that just fits right into our model of lifting the value of these Olin scarce resources.

Aleksey Yefremov

Scott, you mentioned epi renegotiations in the slides. Can you provide any details what percent of your merchant business is out for renegotiations but also maybe size up the merchant epi business as a percent of revenue or percent of your capacity?

Scott Sutton

Yes. So I think I heard your question. I mean, at least on the chlorine side, we continue to make progress getting that opened up. And we expect at least by 2023, that that’s essentially opened up. But we’ll have to see how discussions go over the next quarter for us. We haven’t really shared just how big our epi business is in relation to the rest of it because it’s not that important, the size of the epi business. What is important is that it is the linchpin that sets value across our whole epoxy chain. And Olin is focused every day on lifting the value of that scarce resource. Pat, would you have anything else to add about epichlorohydrin?

Pat Dawson

Yes. I think the other thing to keep in mind about epi is, we have a lot of flexibility between the merchant market and our captive production. We have multiple knobs on epi that we can activate to bring more value to that whole epoxy value chain.

John Roberts

It seems like The Dow contract is still 1 of the largest opportunities going forward. Does that contract all open up at once? Or does it open up in phases over time? And if it’s the latter, could you talk about how far out the longest part of that contract goes?

Scott Sutton

Well, I won’t give too many specifics on arrangements with a particular supplier or customer. But what I will say, because it’s in the public domain already, and it is a material item is that our major ECU supply that we’re doing at cost ends in 2025. And so there’ll be options and each and every option will be cash accretive to Olin.

Aleksey Yefremov

Could you discuss parlaying activity for EDC as well? What is involved here? And how would you describe this opportunity?

Scott Sutton

Yes. Yes. I mean Damian will make some comments on parlaying of EDC. Just on the broader topic, I would just say we’re continuing to be successful developing that program. And if you think about many of our products, chlorine, caustic, bleach, EDC, epoxy and epichlorohydrin, in the third quarter, we had success at parlaying activities around all those.

Kevin McCarthy

Scott, you’ve talked about in Epoxy segment margin goal of 30% in the past and this morning, I think you threw out $1 billion as an EBITDA goal for the segment. What do you need to do in that business to get there from here? What are the 2 or 3 sources of incremental improvement, recognizing that the business has already come a long way? What additional runway do you see in ’22 and beyond for upside in Epoxy?

Scott Sutton

Yes. I mean we just need to keep the activities going that we’ve already started. But Pat can expand on those a little bit.

Pat Dawson

Yes. Kevin, Epoxy, I would say, is really it’s — Epoxy is at the right time, at the right place. And what I mean by that is if you look at the megatrends and you look at the demand for Epoxy in these different segments, right place, right time, right? So you look at composites and light-weighting. Epoxy enables that. You look at blend, wind systems, decarbonization right place, right time, electrical laminates, e-mobility, adhesives that are used in e-batteries, Epoxy, right place, right time. So I think what you’re seeing is we’ve got the infrastructure in place. We’ve got the commercial organization in place. And really, we can go across the whole globe around these applications, extracting value where we see value can best be extracted. But Kevin, I think we’re in a great position to be able to complement what we have already been doing and to keep building value around a lot of these megatrends that play right in the wheelhouse of how Epoxy brings value to the market.

Kevin McCarthy

Okay. So it sounds like it’s less strategic and more just riding the sources of demand improvement that you outlined, Pat.

Pat Dawson

Well, I’d say strategically, make no mistake that epichlorohydrin and the scarcity of epichlorohydrin and the multiple knobs we have there is much more strategic going forward than it has been in the past. And I would say that we even have opportunities in aromatics in what we do in phenol and acetone and cumene to bring this contrarian model into play. So that could be very strategic to our future as well.

Steve Byrne

Yes. You have this slide that illustrates the relative value between chlorine and caustic. And I appreciate the concept that your business is still complex. It’s clear that, that chlorine value is not a data point on here, but likely a very wide range. Epi, for example, perhaps a year ago might have been at the bottom end of that range and value to you of chlorine. Is it fair to say that it is now among the highest value end markets for chlorine for you? The reason I ask is, is it getting to the point where you think there is risk of capacity expansions of epi in the market, either competitors’ or customers’ backed entity?

Scott Sutton

Yes, thanks. I mean, look, a lot of chlorine and chlorine derivatives have moved up. I would say we have a long way to move epi because it’s certainly not at the high end of that range today. Could it move up to a point where it supports reinvestment economics? It’s certainly not impossible. Do we expect to see expansions out in the future, whether it’s in epi or even on the ECU side of the business? Yes, we expect to see some things get announced because otherwise, the world is not going to have enough of those scarce products. Once those expansions are announced, I’d keep in mind that there’s still likely a 4-year gap where demand continues to grow faster than supply. So the only way that changes is if there are just multiple announcements of multiple expansions that continue over the next 10 years.

Mike Leithead

That’s great. And then maybe just for a follow-up, just digging into the Epoxy strategy a bit. If I look at Slide 7, there’s a lot of talk or discussion around engineered solutions. Is it fair to say that you’re trying to kind of ultimately sell less of [the volume], more commodities, liquid epoxies and try to push it more downstream with the kind of hardeners, epoxy dispersions, things like that? If you could just flesh out kind of where the strategy for Epoxy, that’d be great?

Pat Dawson

Yes, Mike, this is Pat. And when you look at the Epoxy value chain, we make money across that whole chain and it’s very interlinked as to how we make our money there. So with our epichlorohydrin, like I say, we have multiple knobs on how we monetize that epi, whether it’s selling it into the merchant market. If we get value there or we back out of the merchant market and we take that epi and convert it more to liquid epoxy resin to monetize it or we can take that liquid epoxy resin and further convert it to a solid epoxy resin or other converted resins or we can take that liquid epoxy resin and systematize it into things like wind systems or formulated products or blends. So Mike, we need that strategically, we need that whole chain to be able to have the maximum value over volume choices. That’s really what we’ve been doing, and we’ll continue to do in the future.

October 22, 2021

Epoxy Highlights from Olin’s Investors Call

Olin Corporation (OLN) CEO Scott Sutton on Q3 2021 Results – Earnings Call Transcript

Oct. 22, 2021 1:06 PM ETOlin Corporation (OLN)

Q3: 2021-10-21 Earnings Summary

EPS of $2.40 beats by $0.42 | Revenue of $2.34B (62.78% Y/Y) misses by $36.32M

Olin Corporation (NYSE:OLN) Q3 2021 Earnings Conference Call October 22, 2021 9:00 AM ET

Company Participants

Steve Keenan – Director of Investor Relations

Scott Sutton – Chairman, President and Chief Executive Officer

Pat Dawson – Executive Vice President and President, Epoxy and International

Scott Sutton

Yes. Thanks, Steve, and hello to everybody. I’m pleased to report the Olin team has once again proved to be the most unique and agile in the industry in meeting the clear expectation of our shareholders. Again, I just have to say that the solid performance by the complete team sets me up to be able to focus on the items that drive our future, which are enhancing our contrarian value model, turning our ratchet on undervalued products, parlaying to grow, accretive capital allocation, building out our interlink matrix of activation knobs, growing shooting sports participation and lifting all Olin people. This is a company that is focused on continuing to grow adjusted EBITDA and coupling that with balanced capital management to deliver more than $10 of earnings per share in the near future.

So I’ll make some brief commentary on a few slides and get to the Q&A quickly. 2021 is expected to be a solid result for Olin for the reasons shown on Slide #3. While the longer-term fundamental of demand that grows faster than supply is starting to be exposed here in 2021, our leading actions to get a higher value for our scarce resources is proving to be successful. Current highlights of that success are that we continue to exit business that was based on non-negotiated pricing, align our product chain mix with the intended impact from purposeful settings of our interlinked matrix of activation nodes, start accelerating the value capture of epichlorohydrin and driving expansion in shooting sports participation with our Shoot United movement. While there may be some end of year holiday slowdowns, which are really supply driven, not demand-driven, and some seasonality that result in a sequentially flattish fourth quarter result, we still expect 2022 to exceed 2021. The reason thematic for better results in 2022 is shown on Slide # 4.

The minor reason in our thematic is that the previously mentioned demand growth versus supply growth dynamic just gets better and better across all our businesses. More people are enjoying shooting sports, demanding clean wind energy and expanding their home stats. The major reason in our thematic is that all of Olin’s activities are designed around a foundational, cultural principle of only selling into value. We know who we are.

In October, we took the decision to close some more undervalued assets and simultaneously used other existing global asset and product liquidity to grow Olin’s value. As our own ECU assets are getting rightsized, we are a global buyer of ECUs to satisfy our higher-value products demand. Even though we have grown earnings for 5 consecutive quarters and delivered a levered free cash flow that is approaching 20%, we still must show that our performance will continue to improve. But maybe more importantly, we must demonstrate our ability to manage uncertainty and volatility.

Slide #5 is an illustration. Olin has 3 substantial businesses, each with a meaningful contribution to segment earnings. For reasons that we previously discussed, the Winchester, which is shown in red on the slide, consumer and defense business offers solid and sustainable growth. For reasons we will discuss in just a moment, the Epoxy, which is shown in green on the slide, engineered materials offer differentiated growth as we expand margins in that business. The Chlor Alkali Products and Vinyls Industrial Essentials are our largest organic and inorganic growth opportunity. We expect the Chlor Alkali segment results to be slightly volatile across a brief transitional window when we have a model profile shift between the relative strengths on the 2 sides of the ECU. We think of the net company volatility as ripples on a deep ocean, not waves on a shallow lagoon. We should control our destiny here.

Continuing with the theme of good fundamentals on Slide #6, our perceived old world chemistry has new world application and value. I won’t read all these megatrend multipliers as I’m sure they’re familiar to you, but instead jump to Slide #7 and hit on the differentiated growth profile of epoxy. Epoxy sets itself apart from other engineered materials by offering nearly non-substitutable performance. Almost every end-use category is growing faster than global GDP. Consider the outlook for more and larger wind turbines for clean energy, consider the outlook for electrical laminates for the new mobility trends and broad electrification trends, consider the outlook for infrastructure expansion and replacement and so on. Even though we recognized the value of this business in epoxy resin sales and in epoxy systems sales, the value driver is really epichlorohydrin. And we will be expounding on our globally leading epichlorohydrin position in future earnings calls. We expect it won’t be long before our Epoxy business delivers greater than $1 billion of EBITDA and carries the same enterprise value that all of Olin carries today, more representative of a highly engineered materials company.

Hassan Ahmed

Scott, I wanted to touch on some of these natural gas price escalations that we’ve seen, not just in the U.S. but globally as well. So on the U.S. side of it, if you could sort of talk through how you guys have dealt in what was a pretty tricky quarter and continues to be a tricky 4Q in terms of the hikes we’ve seen in natural gas prices? And if you could also talk about what you guys are seeing in terms of cost curve impact with natural gas price escalation in Europe and the power curtailments we’re seeing in China as well?

Scott Sutton

Yes. I mean, sure. For us, we have a couple strategies to manage the local issue. I mean, 1 is, we have a pretty strong hedging program, where we have some amount of it hedged out into the future, which helps protect those. The rest of it is absolutely 100% covered in product pricing. And every day, we get more ability to recover that on an instantaneous basis as we get out of some of these contracts that keep us in handcuffs. I think the more important 1 is maybe your second one, I mean rising global energy costs, it’s actually a plus for Olin and that’s because trade flows get more expensive and trade movements get more volatile. And that just fits right into our model of lifting the value of these Olin scarce resources.

Aleksey Yefremov

Scott, you mentioned epi renegotiations in the slides. Can you provide any details what percent of your merchant business is out for renegotiations but also maybe size up the merchant epi business as a percent of revenue or percent of your capacity?

Scott Sutton

Yes. So I think I heard your question. I mean, at least on the chlorine side, we continue to make progress getting that opened up. And we expect at least by 2023, that that’s essentially opened up. But we’ll have to see how discussions go over the next quarter for us. We haven’t really shared just how big our epi business is in relation to the rest of it because it’s not that important, the size of the epi business. What is important is that it is the linchpin that sets value across our whole epoxy chain. And Olin is focused every day on lifting the value of that scarce resource. Pat, would you have anything else to add about epichlorohydrin?

Pat Dawson

Yes. I think the other thing to keep in mind about epi is, we have a lot of flexibility between the merchant market and our captive production. We have multiple knobs on epi that we can activate to bring more value to that whole epoxy value chain.

John Roberts

It seems like The Dow contract is still 1 of the largest opportunities going forward. Does that contract all open up at once? Or does it open up in phases over time? And if it’s the latter, could you talk about how far out the longest part of that contract goes?

Scott Sutton

Well, I won’t give too many specifics on arrangements with a particular supplier or customer. But what I will say, because it’s in the public domain already, and it is a material item is that our major ECU supply that we’re doing at cost ends in 2025. And so there’ll be options and each and every option will be cash accretive to Olin.

Aleksey Yefremov

Could you discuss parlaying activity for EDC as well? What is involved here? And how would you describe this opportunity?

Scott Sutton

Yes. Yes. I mean Damian will make some comments on parlaying of EDC. Just on the broader topic, I would just say we’re continuing to be successful developing that program. And if you think about many of our products, chlorine, caustic, bleach, EDC, epoxy and epichlorohydrin, in the third quarter, we had success at parlaying activities around all those.

Kevin McCarthy

Scott, you’ve talked about in Epoxy segment margin goal of 30% in the past and this morning, I think you threw out $1 billion as an EBITDA goal for the segment. What do you need to do in that business to get there from here? What are the 2 or 3 sources of incremental improvement, recognizing that the business has already come a long way? What additional runway do you see in ’22 and beyond for upside in Epoxy?

Scott Sutton

Yes. I mean we just need to keep the activities going that we’ve already started. But Pat can expand on those a little bit.

Pat Dawson

Yes. Kevin, Epoxy, I would say, is really it’s — Epoxy is at the right time, at the right place. And what I mean by that is if you look at the megatrends and you look at the demand for Epoxy in these different segments, right place, right time, right? So you look at composites and light-weighting. Epoxy enables that. You look at blend, wind systems, decarbonization right place, right time, electrical laminates, e-mobility, adhesives that are used in e-batteries, Epoxy, right place, right time. So I think what you’re seeing is we’ve got the infrastructure in place. We’ve got the commercial organization in place. And really, we can go across the whole globe around these applications, extracting value where we see value can best be extracted. But Kevin, I think we’re in a great position to be able to complement what we have already been doing and to keep building value around a lot of these megatrends that play right in the wheelhouse of how Epoxy brings value to the market.

Kevin McCarthy

Okay. So it sounds like it’s less strategic and more just riding the sources of demand improvement that you outlined, Pat.

Pat Dawson

Well, I’d say strategically, make no mistake that epichlorohydrin and the scarcity of epichlorohydrin and the multiple knobs we have there is much more strategic going forward than it has been in the past. And I would say that we even have opportunities in aromatics in what we do in phenol and acetone and cumene to bring this contrarian model into play. So that could be very strategic to our future as well.

Steve Byrne

Yes. You have this slide that illustrates the relative value between chlorine and caustic. And I appreciate the concept that your business is still complex. It’s clear that, that chlorine value is not a data point on here, but likely a very wide range. Epi, for example, perhaps a year ago might have been at the bottom end of that range and value to you of chlorine. Is it fair to say that it is now among the highest value end markets for chlorine for you? The reason I ask is, is it getting to the point where you think there is risk of capacity expansions of epi in the market, either competitors’ or customers’ backed entity?

Scott Sutton

Yes, thanks. I mean, look, a lot of chlorine and chlorine derivatives have moved up. I would say we have a long way to move epi because it’s certainly not at the high end of that range today. Could it move up to a point where it supports reinvestment economics? It’s certainly not impossible. Do we expect to see expansions out in the future, whether it’s in epi or even on the ECU side of the business? Yes, we expect to see some things get announced because otherwise, the world is not going to have enough of those scarce products. Once those expansions are announced, I’d keep in mind that there’s still likely a 4-year gap where demand continues to grow faster than supply. So the only way that changes is if there are just multiple announcements of multiple expansions that continue over the next 10 years.

Mike Leithead

That’s great. And then maybe just for a follow-up, just digging into the Epoxy strategy a bit. If I look at Slide 7, there’s a lot of talk or discussion around engineered solutions. Is it fair to say that you’re trying to kind of ultimately sell less of [the volume], more commodities, liquid epoxies and try to push it more downstream with the kind of hardeners, epoxy dispersions, things like that? If you could just flesh out kind of where the strategy for Epoxy, that’d be great?

Pat Dawson

Yes, Mike, this is Pat. And when you look at the Epoxy value chain, we make money across that whole chain and it’s very interlinked as to how we make our money there. So with our epichlorohydrin, like I say, we have multiple knobs on how we monetize that epi, whether it’s selling it into the merchant market. If we get value there or we back out of the merchant market and we take that epi and convert it more to liquid epoxy resin to monetize it or we can take that liquid epoxy resin and further convert it to a solid epoxy resin or other converted resins or we can take that liquid epoxy resin and systematize it into things like wind systems or formulated products or blends. So Mike, we need that strategically, we need that whole chain to be able to have the maximum value over volume choices. That’s really what we’ve been doing, and we’ll continue to do in the future.

October 22, 2021

Import Delays

A Record $22 Billion Worth Of Cargo Is Now Stuck On Container Ships Off California

by Tyler DurdenFriday, Oct 22, 2021 – 08:31 AM

By Greg Miller of FreightWaves,

There was fleeting hope that Southern California port congestion had turned the corner. The number of container ships waiting offshore dipped to the low 60s and high 50s from a record high of 73 on Sept. 19, trans-Pacific spot rates plateaued, the Biden administration unveiled aspirations for 24/7 port ops, and electricity shortages curbed Chinese factory output.

The reality is that the port congestion crisis in Southern California is not getting any better.Container ships off Los Angeles/Long Beach on Wednesday. Map: MarineTraffic

The time ships are stuck waiting offshore continues to lengthen. There are simply too many vessels arriving with too much cargo for terminals, trucks, trains and warehouses to handle. There were 103 container ships at Los Angeles/Long Beach terminals or waiting offshore on Wednesday, an all-time high.

Offshore, the number of ships at anchor or in holding patterns is once again nearing record territory. According to the Marine Exchange of Southern California, 70 container ships were waiting off Los Angeles and Long Beach on Monday, 67 on Tuesday and 71 Wednesday (not including other cargo ships that are loaded with boxes).Chart: American Shipper based on data from Marine Exchange of Southern California. Data bi-monthly April-Nov 2020; daily Dec 2020-present

Massive value of cargo stuck offshore

Marine Exchange data shows that ships waiting offshore on Tuesday — including container ships, general cargo vessels and other ships carrying containers — had aggregate capacity of 512,843 twenty-foot equivalent units. To put that in perspective, that is 10% more than the Port of Los Angeles imported during the entire month of September.

Assuming ships are at capacity, how much cargo value is out there in the “floating warehouse”? What’s in each box, and its value, varies dramatically — it can be worth a few thousand dollars or several hundred thousand dollars. But Port of Los Angeles stats provide a good guide.

The total customs value of the Port of Los Angeles’ containerized imports in 2020 was $211.9 billion. Given that imports totaled 4,827,040 TEUs, this equates to an average of $43,899 per import TEU. (Several other sources also estimated average cargo value at around $40,000 per TEU.)

This suggests that the cargo currently waiting off the ports of Los Angeles and Long Beach is worth around $22 billion, roughly the equivalent of the annual revenues of McDonald’s or the GDP of Iceland.

Imports trapped on ships for over a month

Data from the Signal platform shows that wait time from anchorage to a berth in Los Angeles rose to an all-time high 13 days on Wednesday, up 65% from the beginning of September.Chart: American Shipper based on data from Los Angeles Signal. Note: Average is 30-day trailing average.

But the average wait time doesn’t tell the full story. Ships have been sitting in San Pedro Bay for more than twice that long.

Most of the vessels that still have no terminal berth assignments despite extended wait times are small ships operated by Chinese players such as BAL Container Line that entered the trans-Pacific market for the first time this year. Some of the ships stuck in the queue have been chartered at exorbitant rates, raising the question of whether charterers accounted for such lengthy delays.

American Shipper was contacted by a U.S. manufacturer who has over 100 containers of goods trapped aboard the Chinese-owned Zhong Gu Jiang Su. The ship has been waiting offshore for over five weeks, since Sept. 13, and has yet to obtain a berth assignment, according to the Marine Exchange master queuing list.

The U.S. manufacturer, who booked through a freight forwarder, spoke on condition of anonymity. “This is really impacting our production,” he said, noting that the trapped goods are “a major component” in his company’s manufacturing process.

“We can’t get any type of help or get any type of escalation from anyone,” he said. He was told that the ship operator “hadn’t negotiated with the terminals for a berth” before arrival, which led to the extended delay.

Among the Chinese-linked ships with no berth assignment stuck in the queue, the Martinique has been waiting the longest, since Sept. 9. Loadstar reported that it is on charter to Transfer, which is owned by a Chinese logistics provider that is in turn partially owned by Chinese e-commerce giant Alibaba.

The BAL Peace has been waiting without a berth assignment since Sept. 25, as has the S Santiago.

According to Alphaliner, BAL is chartering the S Santiago for around $125,000 a day. An industry source told American Shipper the rate was $135,000 per day. So far, that ship has been waiting — and not loading any more revenue-generating cargo — for 26 days straight.

https://www.zerohedge.com/economics/22-billion-worth-cargo-now-stuck-container-ships-california

October 22, 2021

Import Delays

A Record $22 Billion Worth Of Cargo Is Now Stuck On Container Ships Off California

by Tyler DurdenFriday, Oct 22, 2021 – 08:31 AM

By Greg Miller of FreightWaves,

There was fleeting hope that Southern California port congestion had turned the corner. The number of container ships waiting offshore dipped to the low 60s and high 50s from a record high of 73 on Sept. 19, trans-Pacific spot rates plateaued, the Biden administration unveiled aspirations for 24/7 port ops, and electricity shortages curbed Chinese factory output.

The reality is that the port congestion crisis in Southern California is not getting any better.Container ships off Los Angeles/Long Beach on Wednesday. Map: MarineTraffic

The time ships are stuck waiting offshore continues to lengthen. There are simply too many vessels arriving with too much cargo for terminals, trucks, trains and warehouses to handle. There were 103 container ships at Los Angeles/Long Beach terminals or waiting offshore on Wednesday, an all-time high.

Offshore, the number of ships at anchor or in holding patterns is once again nearing record territory. According to the Marine Exchange of Southern California, 70 container ships were waiting off Los Angeles and Long Beach on Monday, 67 on Tuesday and 71 Wednesday (not including other cargo ships that are loaded with boxes).Chart: American Shipper based on data from Marine Exchange of Southern California. Data bi-monthly April-Nov 2020; daily Dec 2020-present

Massive value of cargo stuck offshore

Marine Exchange data shows that ships waiting offshore on Tuesday — including container ships, general cargo vessels and other ships carrying containers — had aggregate capacity of 512,843 twenty-foot equivalent units. To put that in perspective, that is 10% more than the Port of Los Angeles imported during the entire month of September.

Assuming ships are at capacity, how much cargo value is out there in the “floating warehouse”? What’s in each box, and its value, varies dramatically — it can be worth a few thousand dollars or several hundred thousand dollars. But Port of Los Angeles stats provide a good guide.

The total customs value of the Port of Los Angeles’ containerized imports in 2020 was $211.9 billion. Given that imports totaled 4,827,040 TEUs, this equates to an average of $43,899 per import TEU. (Several other sources also estimated average cargo value at around $40,000 per TEU.)

This suggests that the cargo currently waiting off the ports of Los Angeles and Long Beach is worth around $22 billion, roughly the equivalent of the annual revenues of McDonald’s or the GDP of Iceland.

Imports trapped on ships for over a month

Data from the Signal platform shows that wait time from anchorage to a berth in Los Angeles rose to an all-time high 13 days on Wednesday, up 65% from the beginning of September.Chart: American Shipper based on data from Los Angeles Signal. Note: Average is 30-day trailing average.

But the average wait time doesn’t tell the full story. Ships have been sitting in San Pedro Bay for more than twice that long.

Most of the vessels that still have no terminal berth assignments despite extended wait times are small ships operated by Chinese players such as BAL Container Line that entered the trans-Pacific market for the first time this year. Some of the ships stuck in the queue have been chartered at exorbitant rates, raising the question of whether charterers accounted for such lengthy delays.

American Shipper was contacted by a U.S. manufacturer who has over 100 containers of goods trapped aboard the Chinese-owned Zhong Gu Jiang Su. The ship has been waiting offshore for over five weeks, since Sept. 13, and has yet to obtain a berth assignment, according to the Marine Exchange master queuing list.

The U.S. manufacturer, who booked through a freight forwarder, spoke on condition of anonymity. “This is really impacting our production,” he said, noting that the trapped goods are “a major component” in his company’s manufacturing process.

“We can’t get any type of help or get any type of escalation from anyone,” he said. He was told that the ship operator “hadn’t negotiated with the terminals for a berth” before arrival, which led to the extended delay.

Among the Chinese-linked ships with no berth assignment stuck in the queue, the Martinique has been waiting the longest, since Sept. 9. Loadstar reported that it is on charter to Transfer, which is owned by a Chinese logistics provider that is in turn partially owned by Chinese e-commerce giant Alibaba.

The BAL Peace has been waiting without a berth assignment since Sept. 25, as has the S Santiago.

According to Alphaliner, BAL is chartering the S Santiago for around $125,000 a day. An industry source told American Shipper the rate was $135,000 per day. So far, that ship has been waiting — and not loading any more revenue-generating cargo — for 26 days straight.

https://www.zerohedge.com/economics/22-billion-worth-cargo-now-stuck-container-ships-california