The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

October 25, 2022

Wanhua Chemical Group Co., Ltd. Reports Earnings Results for the Nine Months Ended September 30, 2022

10/24/2022 | 07:53am EDT

Wanhua Chemical Group Co., Ltd. reported earnings results for the nine months ended September 30, 2022. For the nine months, the company reported sales was CNY 130,420.44 million compared to CNY 107,318.46 million a year ago. Net income was CNY 13,608.25 million compared to CNY 19,541.76 million a year ago.

Basic earnings per share from continuing operations was CNY 4.33 compared to CNY 6.22 a year ago.

October 25, 2022

Wanhua Chemical Group Co., Ltd. Reports Earnings Results for the Nine Months Ended September 30, 2022

10/24/2022 | 07:53am EDT

Wanhua Chemical Group Co., Ltd. reported earnings results for the nine months ended September 30, 2022. For the nine months, the company reported sales was CNY 130,420.44 million compared to CNY 107,318.46 million a year ago. Net income was CNY 13,608.25 million compared to CNY 19,541.76 million a year ago.

Basic earnings per share from continuing operations was CNY 4.33 compared to CNY 6.22 a year ago.

October 25, 2022

Home Prices Plunge Most Since 2009, Pulte CEO Fears “Financial & Psychological Hurdles” Ahead For Homebuyers

by Tyler Durden

Tuesday, Oct 25, 2022 – 09:06 AM

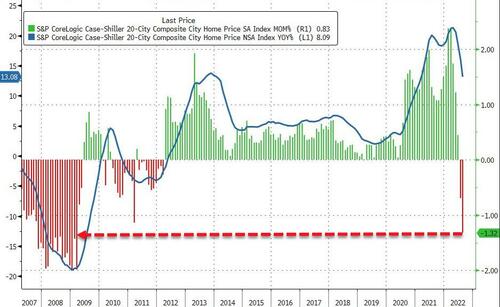

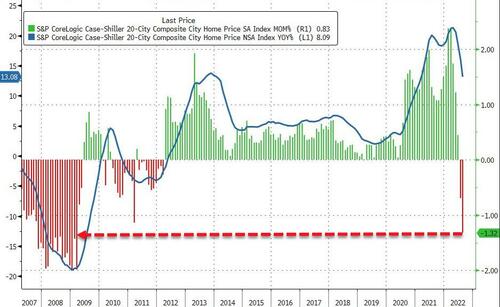

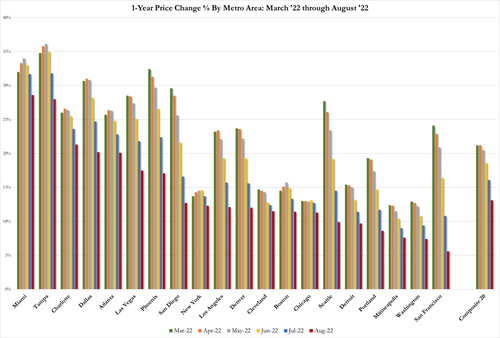

After tumbling for the first time since 2012 in July, Case-Shiller’s 20-City Composite Home Price index was expected to drop even faster in August (the latest data available) as mortgage rates soared, crushing affordability. Analysts were right as the 20-City Composite index plunged 1.32% MoM (far larger than the 0.8% drop expected), diving the YoY growth in the 20-City Composite to 13.08% (well down from the 14.0% exp)

Source: Bloomberg

That is the biggest MoM drop since March 2009 and the slowest YoY growth since Feb 2021.

“The forceful deceleration in U.S. housing prices that we noted a month ago continued,” Craig J. Lazzara, managing director at S&P Dow Jones Indices, said in statement.

“Price gains decelerated in every one of our 20 cities. These data show clearly that the growth rate of housing prices peaked in the spring of 2022 and has been declining ever since.”

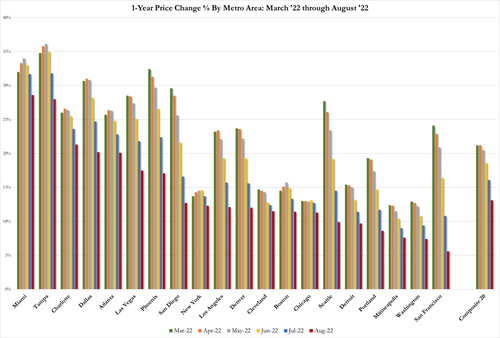

Miami, Tampa, Charlotte reported highest year-over-year gains among 20 cities surveyed, while on a seasonally-adjusted basis, prices fell the most in August (MoM) in San Francisco (-4.3%), Seattle (-3.9%), San Diego (-2.8%), and Los Angeles (-2.3%).

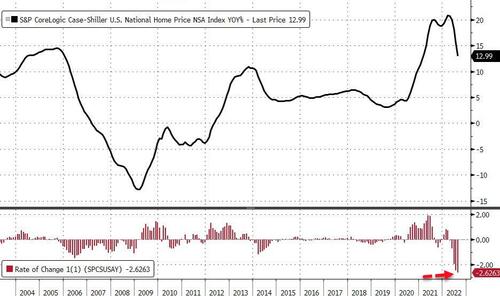

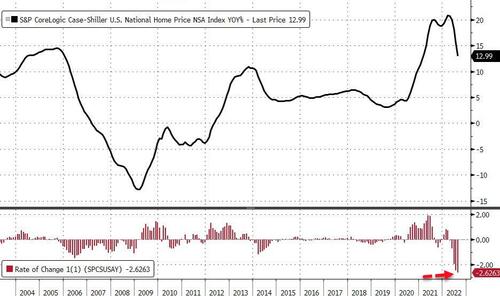

The growth in the national home price index has now slowed for 5 straight months (now below 13% YoY for the first time since Feb 2021). The absolute drop in the growth rate of 2.62 percentage points is the largest ever…

Source: Bloomberg

Finally, given the unprecedented explosion in mortgage rates, just where will home prices end?

Source: Bloomberg

We would like to think Powell’s plan does not involve that kind of collapse… or maybe it is – since prices will have to fall considerably more to become affordable for the average American to follow his ‘dream’.

As Lazzara previously concluded, “as the Federal Reserve continues to move interest rates upward, mortgage financing has become more expensive, a process that continues to this day. Given the prospects for a more challenging macroeconomic environment, home prices may well continue to decelerate.”

And by way of example, Pulte Homes today, during their earnings conference call, said that it was expanding incentives, including price-cuts, as sales slump.

“Demand clearly slowed in the period as dramatically higher interest rates created financial and psychological hurdles for potential homebuyers,” Ryan Marshall, PulteGroup’s president and chief executive officer, said in the statement.

Additionally, contracts were canceled in 24% of deals in the period, up from 15% in the second quarter, the Atlanta-based builder said in a statement Tuesday. Purchase contracts fell 28% from a year earlier to 4,924, missing the average estimate of 5,715 from analysts surveyed by Bloomberg. And bear in mind that this is for Q3 (after the heavily lagged Case-Shiller Index) with Pulte warning in today’s call that “demand got even more challenging in October”.

October 25, 2022

Home Prices Plunge Most Since 2009, Pulte CEO Fears “Financial & Psychological Hurdles” Ahead For Homebuyers

by Tyler Durden

Tuesday, Oct 25, 2022 – 09:06 AM

After tumbling for the first time since 2012 in July, Case-Shiller’s 20-City Composite Home Price index was expected to drop even faster in August (the latest data available) as mortgage rates soared, crushing affordability. Analysts were right as the 20-City Composite index plunged 1.32% MoM (far larger than the 0.8% drop expected), diving the YoY growth in the 20-City Composite to 13.08% (well down from the 14.0% exp)

Source: Bloomberg

That is the biggest MoM drop since March 2009 and the slowest YoY growth since Feb 2021.

“The forceful deceleration in U.S. housing prices that we noted a month ago continued,” Craig J. Lazzara, managing director at S&P Dow Jones Indices, said in statement.

“Price gains decelerated in every one of our 20 cities. These data show clearly that the growth rate of housing prices peaked in the spring of 2022 and has been declining ever since.”

Miami, Tampa, Charlotte reported highest year-over-year gains among 20 cities surveyed, while on a seasonally-adjusted basis, prices fell the most in August (MoM) in San Francisco (-4.3%), Seattle (-3.9%), San Diego (-2.8%), and Los Angeles (-2.3%).

The growth in the national home price index has now slowed for 5 straight months (now below 13% YoY for the first time since Feb 2021). The absolute drop in the growth rate of 2.62 percentage points is the largest ever…

Source: Bloomberg

Finally, given the unprecedented explosion in mortgage rates, just where will home prices end?

Source: Bloomberg

We would like to think Powell’s plan does not involve that kind of collapse… or maybe it is – since prices will have to fall considerably more to become affordable for the average American to follow his ‘dream’.

As Lazzara previously concluded, “as the Federal Reserve continues to move interest rates upward, mortgage financing has become more expensive, a process that continues to this day. Given the prospects for a more challenging macroeconomic environment, home prices may well continue to decelerate.”

And by way of example, Pulte Homes today, during their earnings conference call, said that it was expanding incentives, including price-cuts, as sales slump.

“Demand clearly slowed in the period as dramatically higher interest rates created financial and psychological hurdles for potential homebuyers,” Ryan Marshall, PulteGroup’s president and chief executive officer, said in the statement.

Additionally, contracts were canceled in 24% of deals in the period, up from 15% in the second quarter, the Atlanta-based builder said in a statement Tuesday. Purchase contracts fell 28% from a year earlier to 4,924, missing the average estimate of 5,715 from analysts surveyed by Bloomberg. And bear in mind that this is for Q3 (after the heavily lagged Case-Shiller Index) with Pulte warning in today’s call that “demand got even more challenging in October”.

October 25, 2022

Covestro cuts profit outlook again on rising energy, raw material costs

Reuters | Posted: 8 hours ago | Updated: 5 hours ago | 2 Min Read

By Bartosz Dabrowski

(Reuters) – German chemicals maker Covestro cut its 2022 earnings guidance for the third time this year on Tuesday as it reported weaker-than-expected quarterly profits, blaming soaring gas and raw material prices.

The company’s shares were down around 2% by 0810 GMT after it said it was only able to offset the sharp rise in raw material and energy prices to a small extent by higher prices.

The group, whose main products include foam chemicals used in mattresses, car seats and insulation for buildings, sees full-year earnings before interests, taxes, depreciation and amortisation (EBITDA) in a range of 1.7 billion euros and 1.8 billion euros ($1.7 billion-$1.8 billion), compared with a previous forecast of 1.7 billions euros-2.2 billion euros.

It lowered its free operating cash flow (FOCF) forecast to a range of 0 and 100 million euros from a previous range of 0 to 500 million euros.

Covestro said third-quarter EBITDA fell 65% to 302 million euros, below the analysts’ average estimate of 320 million euros in a company-provided poll.

“The company’s fourth-quarter guidance is broadly aligned with our estimate, but somewhat below consensus,” J.P. Morgan says, adding that this might disappoint given the recent rise in Toluene Diisocyanate (TDI) prices and moderation in EU energy prices.

The profit warning and results come after Germany outlined plans earlier this month to spend almost 100 billion euros to try and ease pressure on consumers, including industrial customers, from surging gas prices.

Chemical companies are among the hardest hit by the energy crisis because they use gas both as a raw material for production and as an energy source.

Covestro said in August that replacing gas as a raw material was not yet possible, and options for replacing it as an energy source were also limited, though the company was testing where it could replace the fuel with oil.

($1 = 1.0121 euros)