The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

September 30, 2022

BASF in Korea celebrates 30th anniversary of its Yeosu site operations, ‘a global key production base’

Petrochemical industry | 29 Sep 2022 IST | Polymerupdate.com • Yeosu site to consolidate its position through continued innovation, and producing & supplying of quality products for Korean and global customers

• A global key production base, site produces MDI, TDI, and CCD, which are essential raw materials in many value chains

• Only site equipped with its own environmental analysis facility in the Yeosu National Industrial Complex, continues its efforts for carbon neutrality

BASF Korea held a ceremony on September 29th to commemorate 30 years of operations of its Yeosu site. The event looked back at the various milestones of the Yeosu site over the last 30 years and shared the vision for a sustainable future. The event was attended by Dr. Ramkumar Dhruva, President of BASF’s Monomers Division along with executives of major customers and suppliers.

BASF in Korea Yeosu site was incorporated in 1988 and started its commercial production in 1992 with the completion of the MDI integrated production plant. As a result of expanding production facilities with continuous investments, its major products include Methylene Diphenyl Diisocyanate (MDI), Toluene Diisocyanate (TDI), Carbonyl Chloride Derivatives (CCD), Mononitrobenzene (MNB), Polyurethane Systems, Aniline, Ultrason®, and Ultra-pure NH4OH (electronic-grade ammonia water) for semiconductor. These products are widely used as raw materials in various industries for daily life, such as automotive, marine, construction, furniture, home appliances, sports, textile, medicine, and agriculture.

BASF aims to achieve net zero CO2 emissions by 2050 globally. Towards this journey of climate neutrality, Yeosu site is contributing actively by establishing a world-class quality management system, including environment, energy, safety, and health management systems, to meet its global scale production capacity. It will also continuously revamp its facility to minimize greenhouse gas emissions.

“BASF in Korea Yeosu site is an important production base supplying essential raw materials, including MDI, TDI, and CCD, to customers representing major industries in the Korean and global markets,” said Dr. David Im, Representative Director of BASF Korea. “Notably, it is the only site equipped with its own environmental analysis facility in the Yeosu National Industrial Complex. With continued R&D and investment for carbon neutrality, we will enhance our competitiveness and provide sustainable raw materials to the supply chain.”

Yeosu site – first MDI and TDI production facility in Asia Pacific, supplying core raw materials of PU to Korea and overseas

BASF in Korea Yeosu site was the first BASF production site in Asia Pacific region that started commercial production of MDI in 1992. With efficient production processes established through a series of strategic investments and production expansion, its annual MDI production capacity, which started with an annual capacity of 40,000 tons, has now increased to 250,000 tons. The facility is equipped with an integrated production system that produces raw materials such as MNB and Aniline to MDI products. MDI, a core raw material of polyurethane for the chemical industry, it plays an integral role in many industries such as construction, transportation, home appliance, and clothing.

In addition, the Yeosu site started the commercial production of TDI for the first time in the Asia-Pacific region in 2003 and currently has an annual production capacity of 160,000 tons. Along with MDI, TDI is also a key raw material for polyurethane products. The MDI and TDI produced at the Yeosu site is being stably supplied to major Korean customers in the electrical and electronics (E&E) and automotive industries. The site addresses most of the demand in the Asia Pacific region.

Only CCD production plant aside from BASF Ludwigshafen Verbund site the headquarters in Germany

This year, the CCD plant at Yeosu site celebrated 20 years of safe and reliable production. Since its commercial production in 2002, the plant has achieved an accumulative production of more than 200,000 tons of CCD. This is a significant achievement, as production of chemical specialties is highly sophisticated. Producing CCD in Korea creates an improved supply reliability for customers in the region. CCD products are also exported from Korea to other countries. Aside from BASF headquarters in Germany, Yeosu is the only CCD production plant of BASF in the world.

BASF in Korea Yeosu site has proved to be a well-accepted CCD supplier offering versatile high-quality products to many value chains. Customers value CCD as essential raw materials to make organic peroxides to produce polymers. CCD is also important to produce pharmaceuticals and plant protection agents. Further applications include cosmetics, personal care, polymer additives and electroplating chemicals.

About BASF in Korea

BASF has been a committed partner to Korea since 1954. As a leading foreign investor in the chemical industry in Korea, BASF operates eight world-scale production sites in the country. The company also maintains the regional headquarters of its Electronic Materials business and the Electronic Materials R&D Center Asia Pacific in Suwon. In addition, one R&D center for advanced material solutions and three technical development centers are located across Korea. In 2021, BASF posted sales of approximately € 1.8 billion to customers in Korea and employed 1,221 employees as of the end of the year.

https://www.polymerupdate.com/news/press-release-details.aspx?id=26450

September 30, 2022

Red-Hot European Inflation Hits A New Record, Rising By Double Digits For The First Time

by Tyler Durden

Friday, Sep 30, 2022 – 07:40 AM

Another month, another red hot inflation print in Europe.

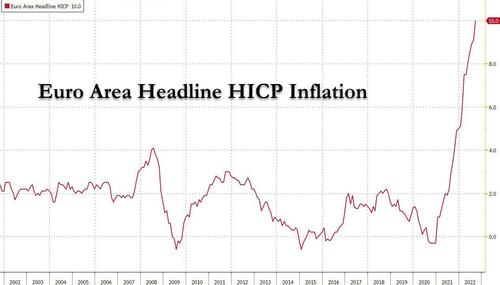

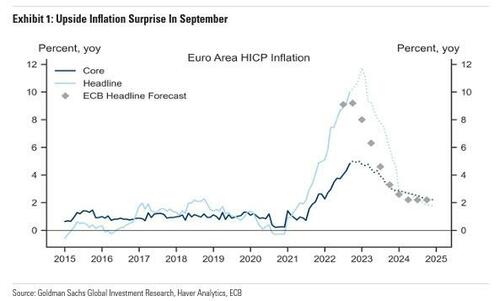

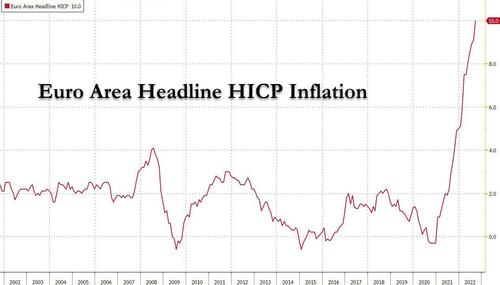

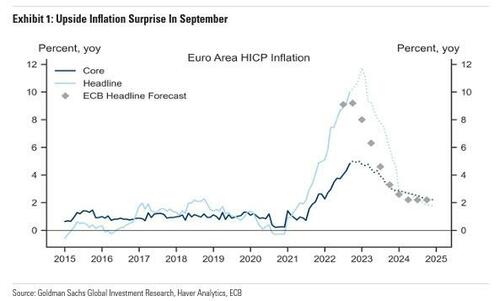

In the flash inflation release for September, Euro area headline HICP inflation rose 82bp to a record 10.0% (technically 9.96%), well above the median forecast of 9.7% and marks the fifth straight month the result has exceeded consensus. Before the inflation data, every one of the 40 economists surveyed by Bloomberg predicted a record outcome this month, with four reckoning on 10%.

While energy and food once again drove inflation, an underlying measure that excludes them also topped estimates to reach an all-time high of 4.8%, above expectations of 4.70%, and piling pressure on the European Central Bank to keep raising interest rates aggressively.

Here are the key flash numbers for September:

- Euro area Core HICP: 4.79% Y/Y vs. consensus 4.7%, last 4.3%

- Euro area Headline HICP: 9.96% Y/Y vs. consensus 9.7%, last 9.14%

- France Headline HICP: 6.23% vs consensus 6.6%, last 6.56%

- Italy Headline HICP: 9.46% vs consensus 9.4%, last 9.11%

Main points:

- Euro area headline HICP inflation rose 82bp in September to 9.96%yoy, above expectations. Core HICP inflation, excluding energy, food, alcohol and tobacco, rose 49bp to 4.79%yoy, also above expectations.

- The breakdown by main expenditure categories showed services inflation rose five-tenths of a percentage point to 4.3%yoy, and non-energy industrial goods inflation rose 0.5pp to 5.6%yoy. Of the non-core components, energy inflation rose 2.2pp to 40.8%yoy, while food, alcohol and tobacco inflation rose 1.2pp to 11.8%yoy.

- In a separate release , French HICP headline inflation was 6.2%yoy in September, below consensus expectations. The press release notes a more marked seasonal downturn in travel-related prices as one of the drivers of the decline in inflation in September. In Italy, headline inflation surprised to the upside at 9.5%yoy, and the press release notes strength in non-durable and semi-durable goods, and food prices as the primary drivers of the increase.

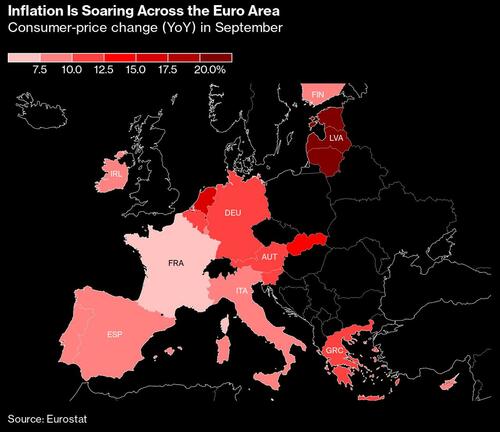

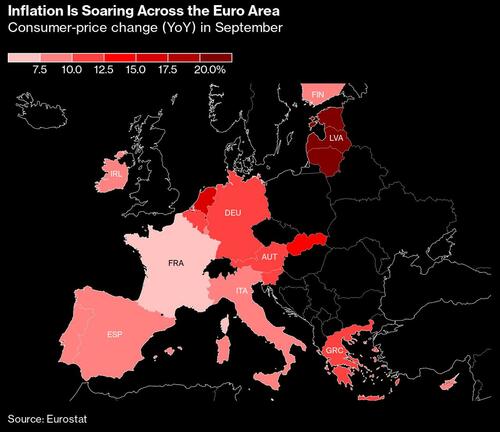

The actual result masked considerable divergence across the euro region. In Germany, Europe’s biggest economy, price growth surged much more than expected. The end of summer discounts on public transport and fuel helped drive a gain there to 10.9%, the highest headline rate seen in the Group-of-Seven industrialized economies since the energy crisis struck. Italy, the Netherlands and Belgium saw significant accelerations too. By contrast, price growth unexpectedly slowed in France and weakened much more than expected in Spain.

Europe’s inflation data have proven critical in driving momentum toward large rate hikes in previous months, and this result is likely to embolden calls for another large move at the next ECB decision on Oct. 27. Investors this week began pricing in a second straight 75 basis-point increase.

“The next step still has to be big because we are still far away from rates that are consistent with 2% inflation,” ECB Governing Council member Martins Kazaks, said Wednesday in an interview in Vilnius, Lithuania, where price growth was 22.5%. “I would side with 75 basis points.”

While officials ramped up their aggression with a move of that size on Sept. 8, they’ve also sought to differentiate the euro zone’s experience with that of the US, insisting that inflation in their own region is far more supply-driven than the demand-propelled consumer-price situation across the Atlantic.

Even so, Bloomberg notes that policy makers will be nervous at yet another record reading. Boris Vujcic, the Croatian central-bank governor who will join the ECB Governing Council in January, warned in an interview published this week that “when inflation is high, when it nears double-digit levels, it can become a disease in itself.”

With Russia starving Europe of gas supplies and winter approaching, policy makers are bracing for an even more difficult few months. Price increases may yet accelerate further in some countries, while recessions are becoming increasingly likely.

The latest OECD forecasts chime with that view. Officials on Monday raised their projection for euro-zone inflation next year by 1.6 percentage points to 6.2%, noticeably exceeding the ECB’s own outlook. Hours later, ECB President Christine Lagarde reiterated that her officials also see the danger of a higher outcome.

“The risks to the inflation outlook are primarily on the upside, mainly reflecting the possibility of further major disruptions in energy supplies,” she told lawmakers. “We expect to raise interest rates further over the next several meetings to dampen demand and guard against the risk of a persistent upward shift in inflation expectations.”

A relatively tight labor market may intensify such pressures. A separate report from Eurostat showed euro-zone unemployment held at a record-low 6.6% in August.

Looking ahead, Goldman now expects Euro area core inflation to peak at 5.0%yoy in December, and looks for headline inflation close to peak at 11.7%yoy in January.

https://www.zerohedge.com/economics/red-hot-european-inflation-hits-new-record-rising-double-digits-first-time

September 30, 2022

Red-Hot European Inflation Hits A New Record, Rising By Double Digits For The First Time

by Tyler Durden

Friday, Sep 30, 2022 – 07:40 AM

Another month, another red hot inflation print in Europe.

In the flash inflation release for September, Euro area headline HICP inflation rose 82bp to a record 10.0% (technically 9.96%), well above the median forecast of 9.7% and marks the fifth straight month the result has exceeded consensus. Before the inflation data, every one of the 40 economists surveyed by Bloomberg predicted a record outcome this month, with four reckoning on 10%.

While energy and food once again drove inflation, an underlying measure that excludes them also topped estimates to reach an all-time high of 4.8%, above expectations of 4.70%, and piling pressure on the European Central Bank to keep raising interest rates aggressively.

Here are the key flash numbers for September:

- Euro area Core HICP: 4.79% Y/Y vs. consensus 4.7%, last 4.3%

- Euro area Headline HICP: 9.96% Y/Y vs. consensus 9.7%, last 9.14%

- France Headline HICP: 6.23% vs consensus 6.6%, last 6.56%

- Italy Headline HICP: 9.46% vs consensus 9.4%, last 9.11%

Main points:

- Euro area headline HICP inflation rose 82bp in September to 9.96%yoy, above expectations. Core HICP inflation, excluding energy, food, alcohol and tobacco, rose 49bp to 4.79%yoy, also above expectations.

- The breakdown by main expenditure categories showed services inflation rose five-tenths of a percentage point to 4.3%yoy, and non-energy industrial goods inflation rose 0.5pp to 5.6%yoy. Of the non-core components, energy inflation rose 2.2pp to 40.8%yoy, while food, alcohol and tobacco inflation rose 1.2pp to 11.8%yoy.

- In a separate release , French HICP headline inflation was 6.2%yoy in September, below consensus expectations. The press release notes a more marked seasonal downturn in travel-related prices as one of the drivers of the decline in inflation in September. In Italy, headline inflation surprised to the upside at 9.5%yoy, and the press release notes strength in non-durable and semi-durable goods, and food prices as the primary drivers of the increase.

The actual result masked considerable divergence across the euro region. In Germany, Europe’s biggest economy, price growth surged much more than expected. The end of summer discounts on public transport and fuel helped drive a gain there to 10.9%, the highest headline rate seen in the Group-of-Seven industrialized economies since the energy crisis struck. Italy, the Netherlands and Belgium saw significant accelerations too. By contrast, price growth unexpectedly slowed in France and weakened much more than expected in Spain.

Europe’s inflation data have proven critical in driving momentum toward large rate hikes in previous months, and this result is likely to embolden calls for another large move at the next ECB decision on Oct. 27. Investors this week began pricing in a second straight 75 basis-point increase.

“The next step still has to be big because we are still far away from rates that are consistent with 2% inflation,” ECB Governing Council member Martins Kazaks, said Wednesday in an interview in Vilnius, Lithuania, where price growth was 22.5%. “I would side with 75 basis points.”

While officials ramped up their aggression with a move of that size on Sept. 8, they’ve also sought to differentiate the euro zone’s experience with that of the US, insisting that inflation in their own region is far more supply-driven than the demand-propelled consumer-price situation across the Atlantic.

Even so, Bloomberg notes that policy makers will be nervous at yet another record reading. Boris Vujcic, the Croatian central-bank governor who will join the ECB Governing Council in January, warned in an interview published this week that “when inflation is high, when it nears double-digit levels, it can become a disease in itself.”

With Russia starving Europe of gas supplies and winter approaching, policy makers are bracing for an even more difficult few months. Price increases may yet accelerate further in some countries, while recessions are becoming increasingly likely.

The latest OECD forecasts chime with that view. Officials on Monday raised their projection for euro-zone inflation next year by 1.6 percentage points to 6.2%, noticeably exceeding the ECB’s own outlook. Hours later, ECB President Christine Lagarde reiterated that her officials also see the danger of a higher outcome.

“The risks to the inflation outlook are primarily on the upside, mainly reflecting the possibility of further major disruptions in energy supplies,” she told lawmakers. “We expect to raise interest rates further over the next several meetings to dampen demand and guard against the risk of a persistent upward shift in inflation expectations.”

A relatively tight labor market may intensify such pressures. A separate report from Eurostat showed euro-zone unemployment held at a record-low 6.6% in August.

Looking ahead, Goldman now expects Euro area core inflation to peak at 5.0%yoy in December, and looks for headline inflation close to peak at 11.7%yoy in January.

https://www.zerohedge.com/economics/red-hot-european-inflation-hits-new-record-rising-double-digits-first-time

September 29, 2022

Multi-national companies have always had the option to move their primary production hubs as markets and costs shift, but what about small and medium enterprises? Bleak pricing realities of natural gas for manufacturing in European nations are forcing the hands of SMEs, and a new consideration has surfaced: Nearshoring.

The Everchem Update is a new biweekly publication of under-reported polyurethane industry news – insider views and conversation about the polyurethane market.

Interested in urethane prepolymers that are REACH approved? Contact Everchem today here.

September 27, 2022

Thank you to everyone in attendance! This was at the site of the former ARCO Chemical conference center in Newtown Square. Enjoy the full gallery: