The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

December 3, 2021

Lee Hanson • 2nd President at Guardian Innovations (Guardian Caps & Pearl by Guardian) 2d • 2 days ago I’m happy to announce that after growing Aragon Elastomers, a Hanson Group company by 8X and established it as the #1 Rock Climbing Hold manufacturer in the world, we have sold the assets to PlayCore the #1 playground and recreational manufacturer. I expect great things from this union and good group of people. Aragon manufacturing will remain in Colorado and our great family there will prosper with Playcore. The brands that we manufacture will continue to be the best.

#manufacturing#climbing#rockhold#recreation Activate to view larger image

- https://www.linkedin.com/in/leehansonjohnscreekga/detail/recent-activity/

December 3, 2021

Lee Hanson • 2nd President at Guardian Innovations (Guardian Caps & Pearl by Guardian) 2d • 2 days ago I’m happy to announce that after growing Aragon Elastomers, a Hanson Group company by 8X and established it as the #1 Rock Climbing Hold manufacturer in the world, we have sold the assets to PlayCore the #1 playground and recreational manufacturer. I expect great things from this union and good group of people. Aragon manufacturing will remain in Colorado and our great family there will prosper with Playcore. The brands that we manufacture will continue to be the best.

#manufacturing#climbing#rockhold#recreation Activate to view larger image

- https://www.linkedin.com/in/leehansonjohnscreekga/detail/recent-activity/

December 2, 2021

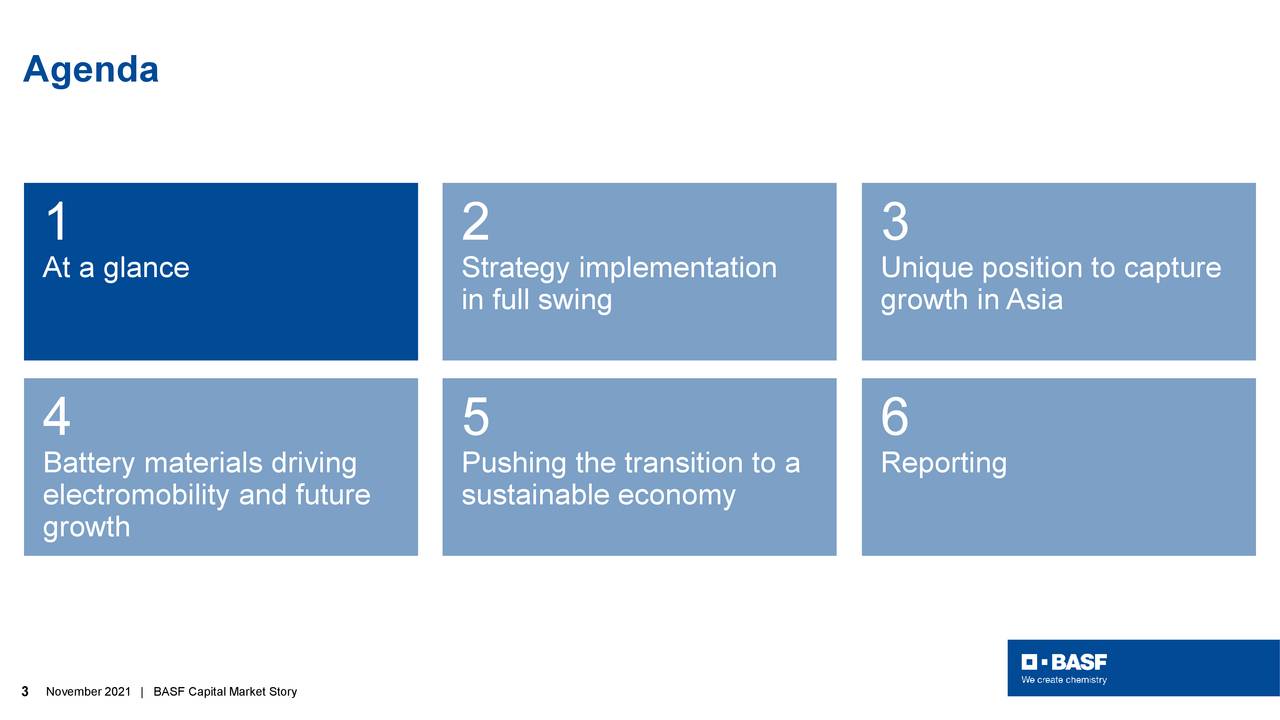

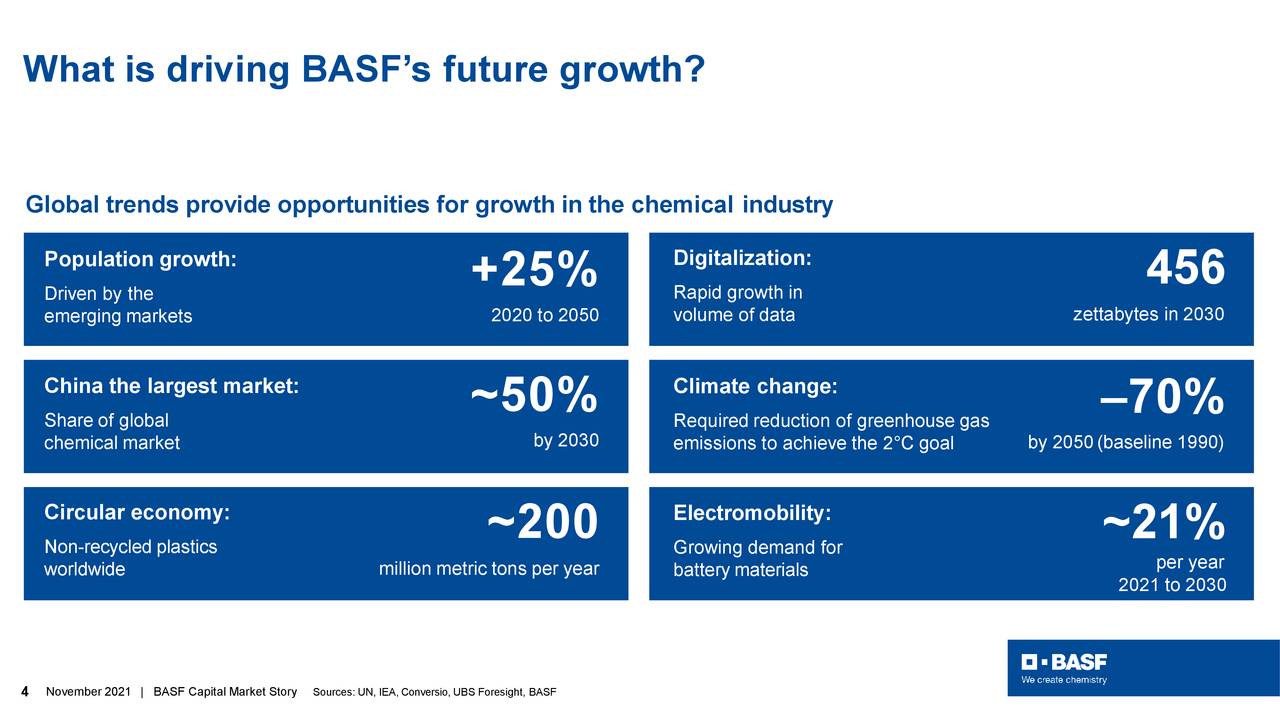

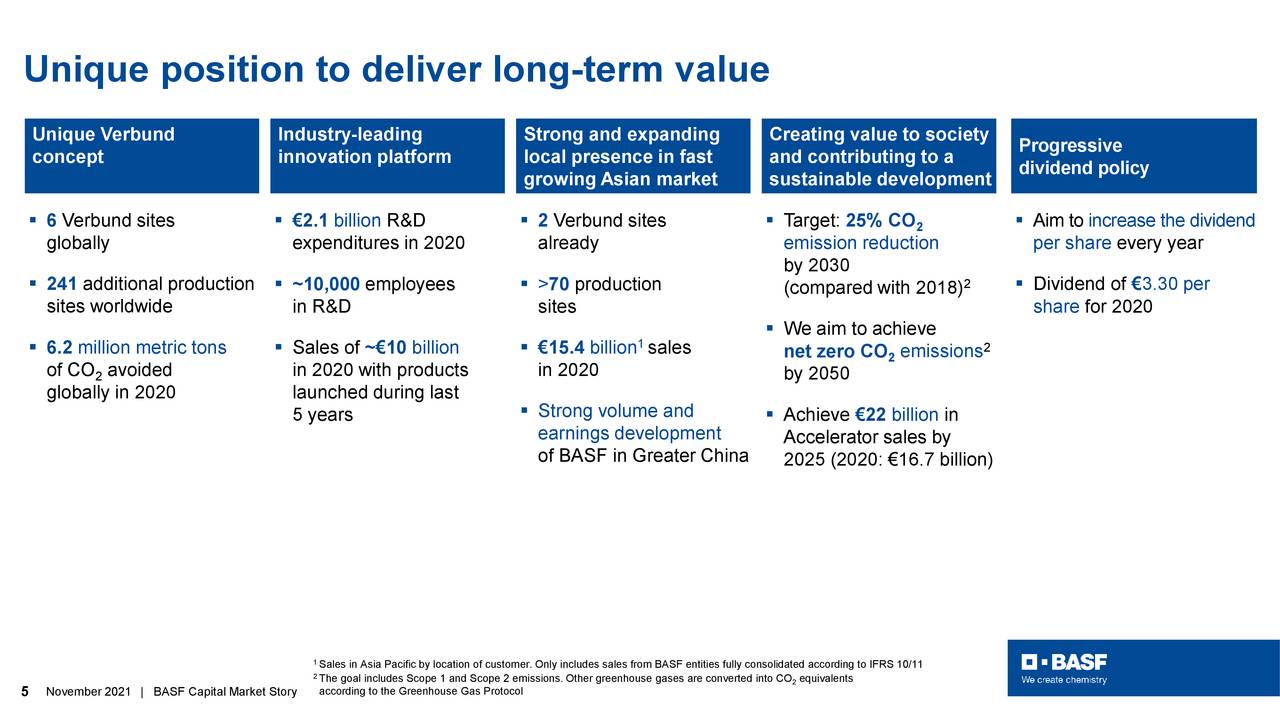

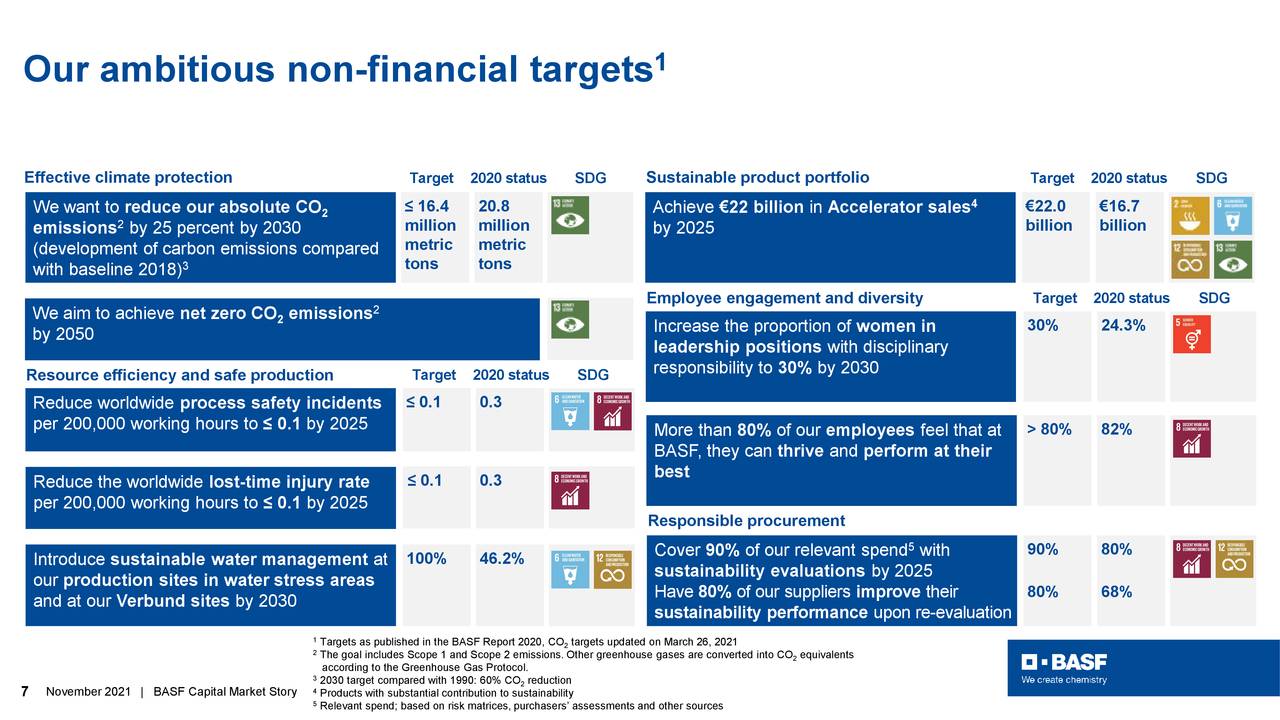

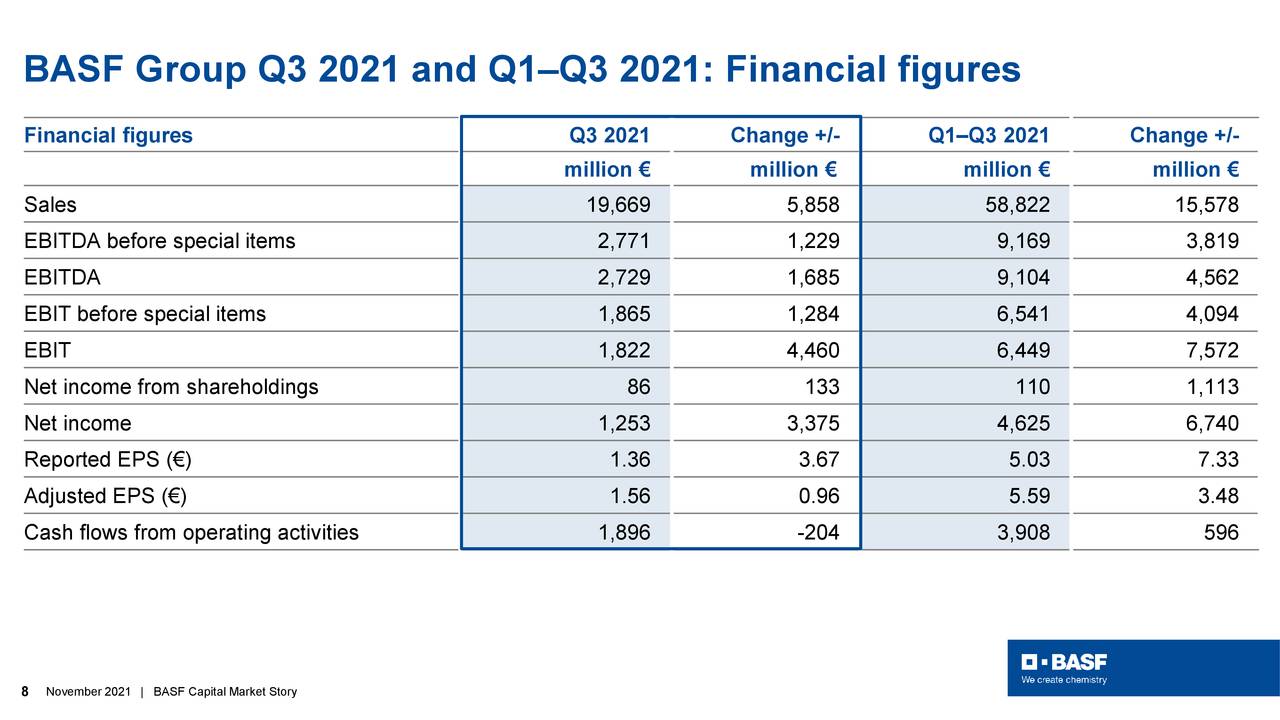

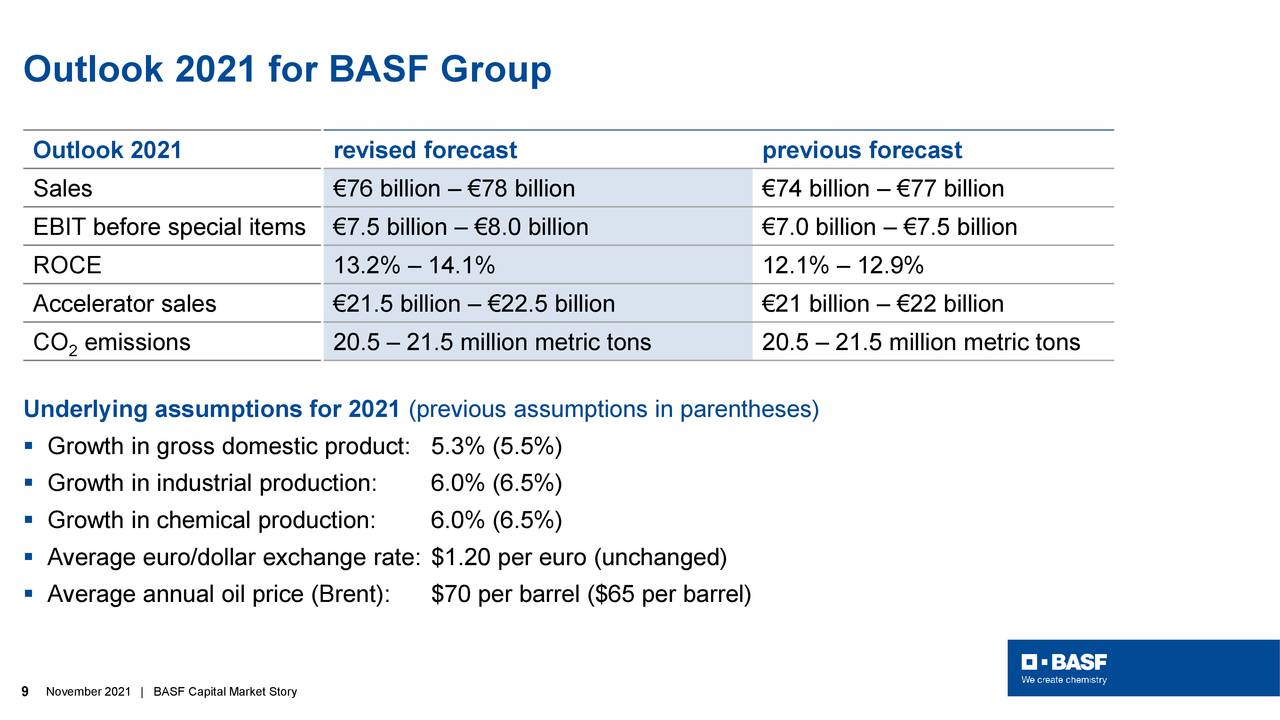

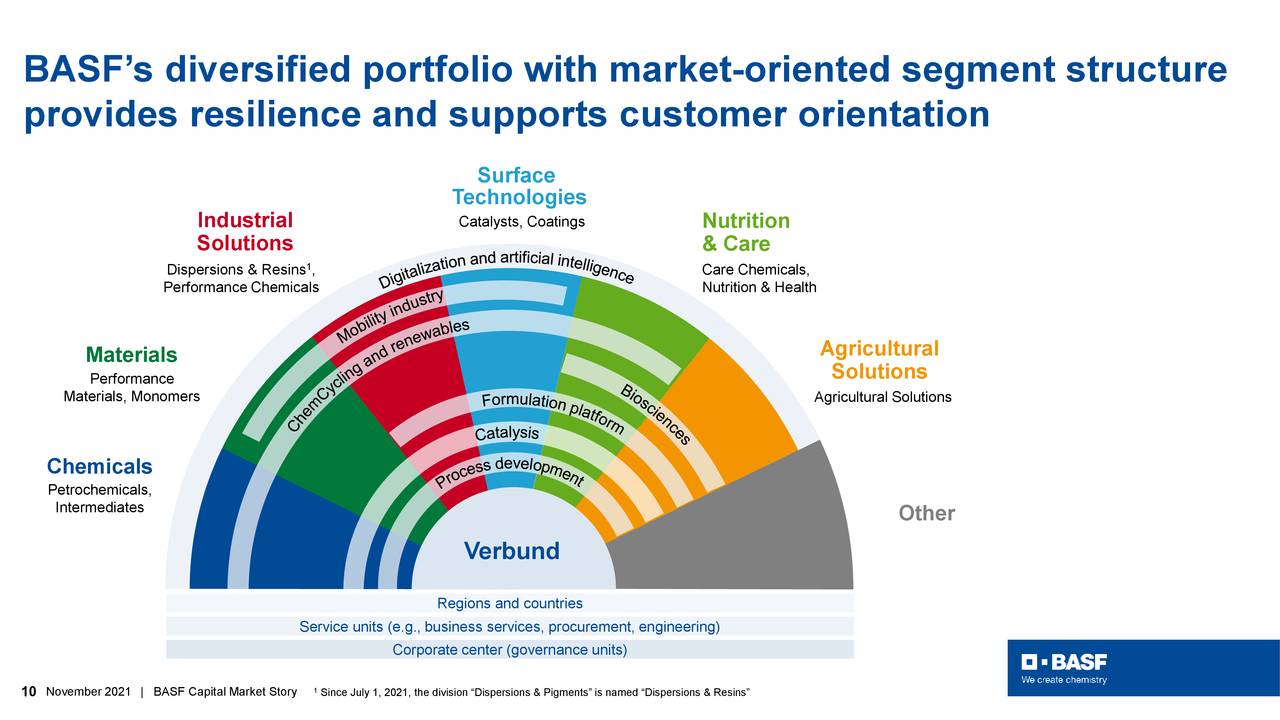

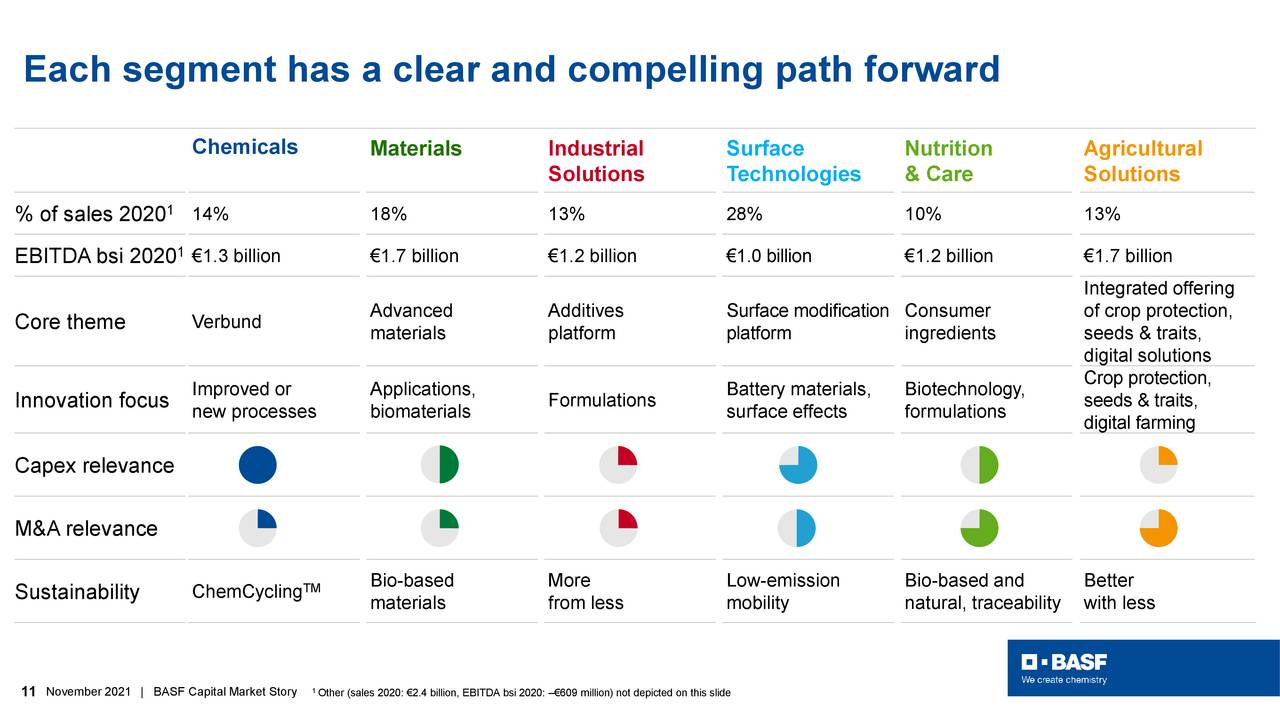

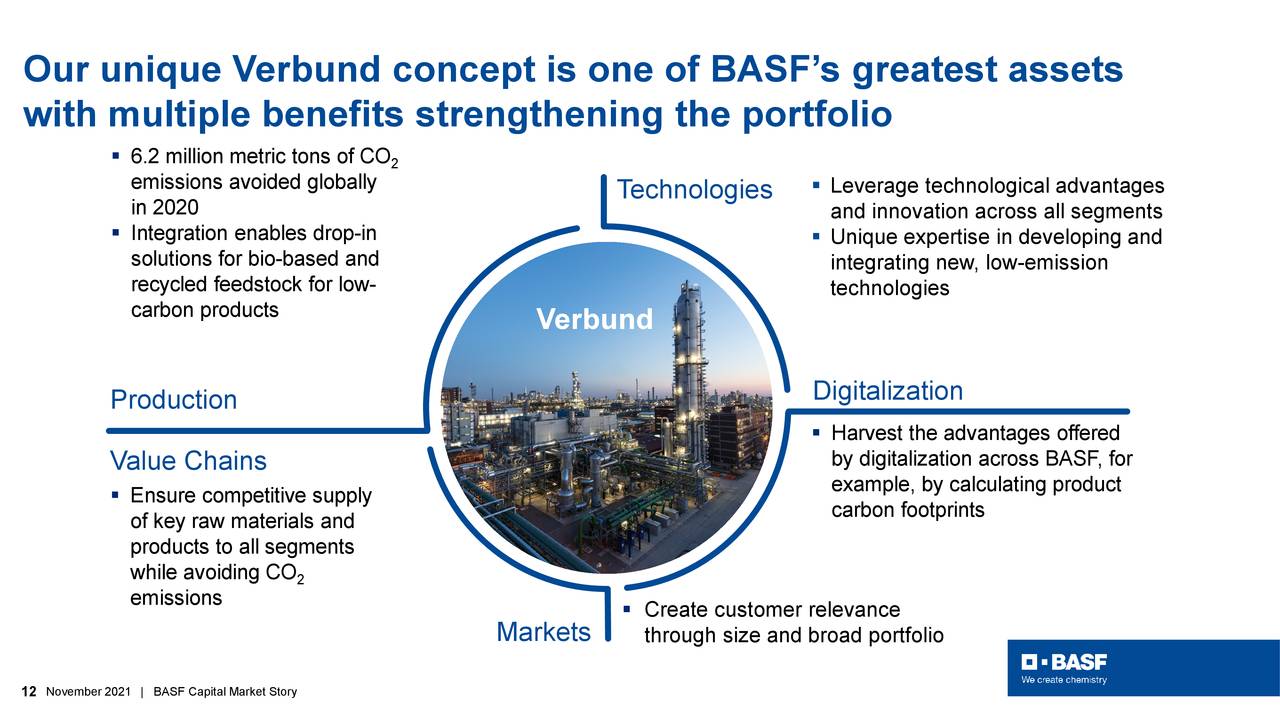

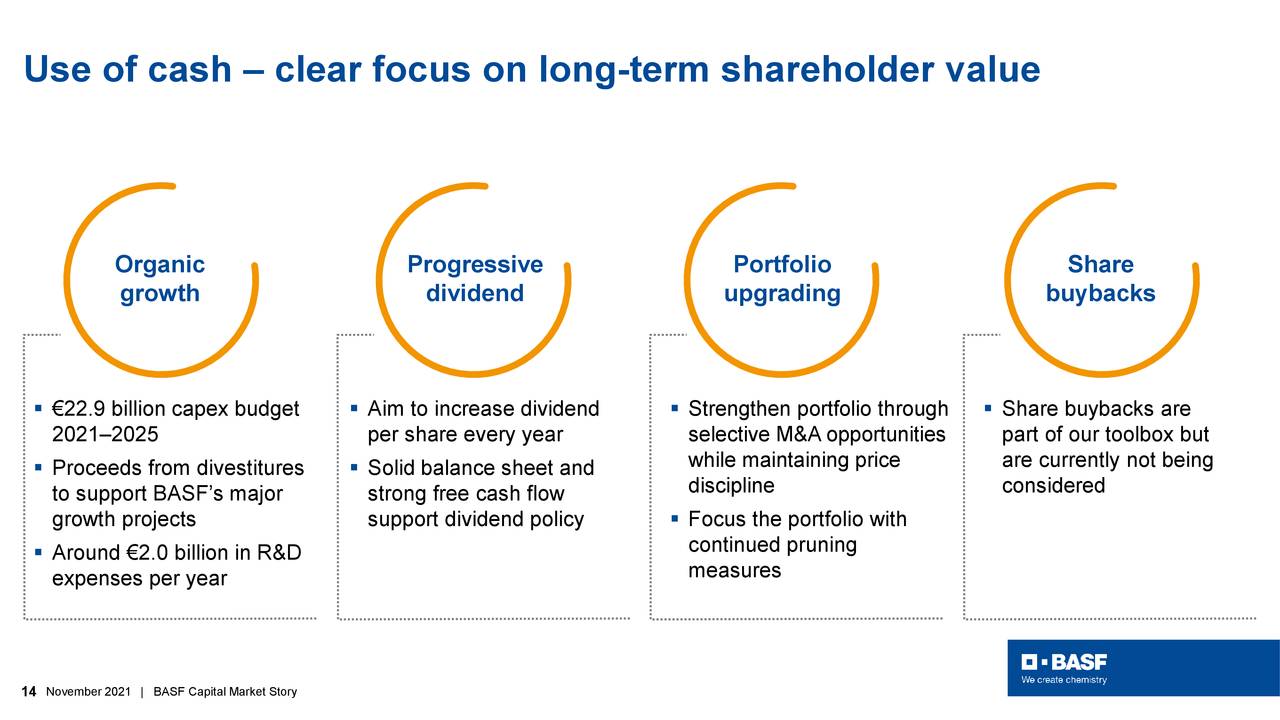

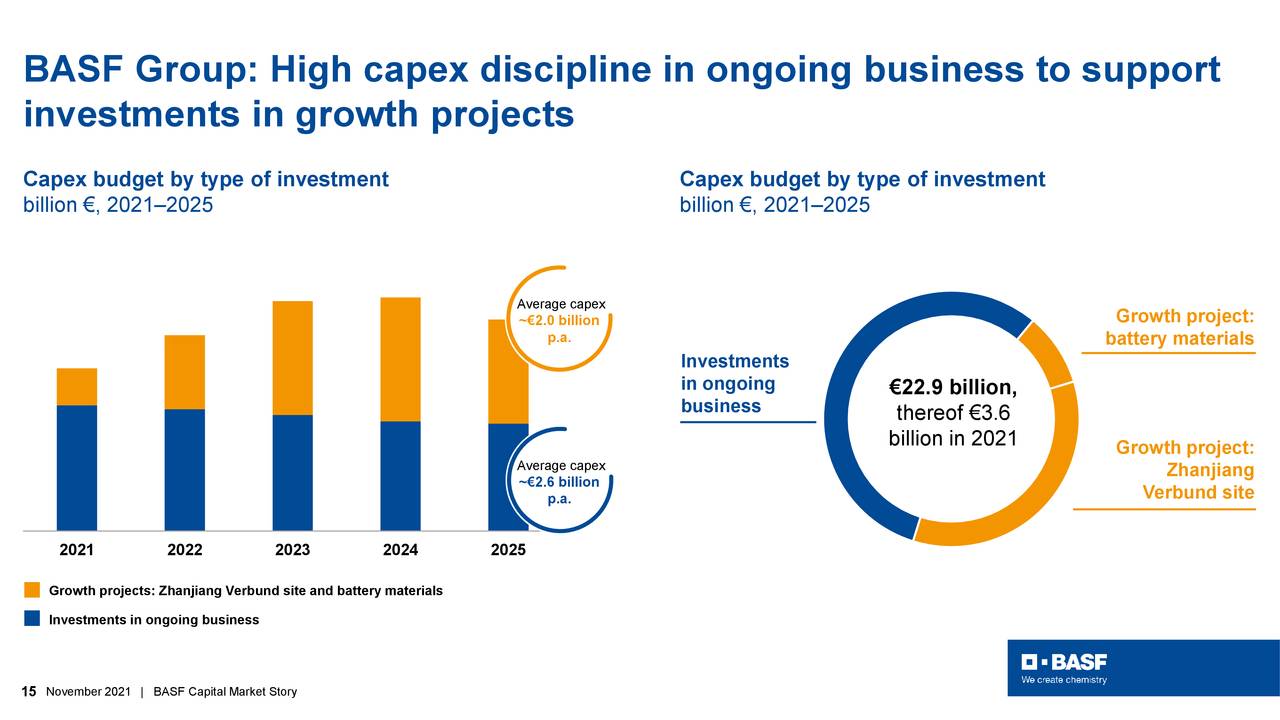

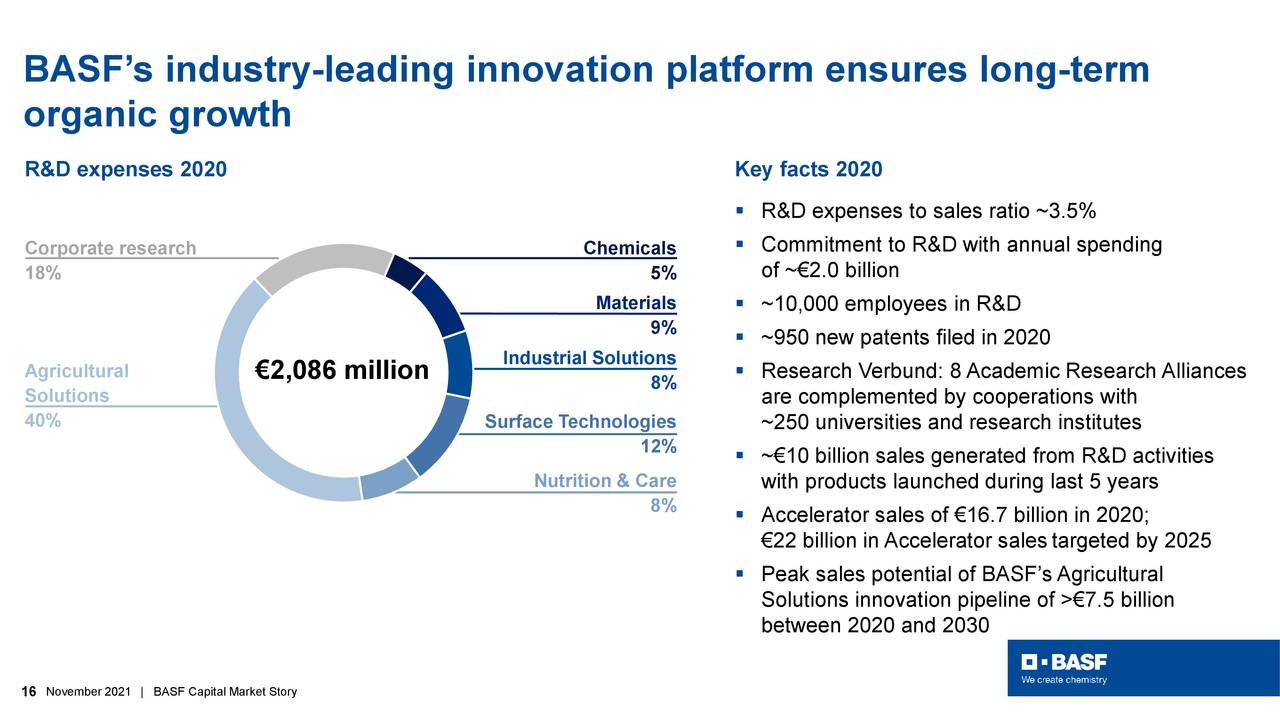

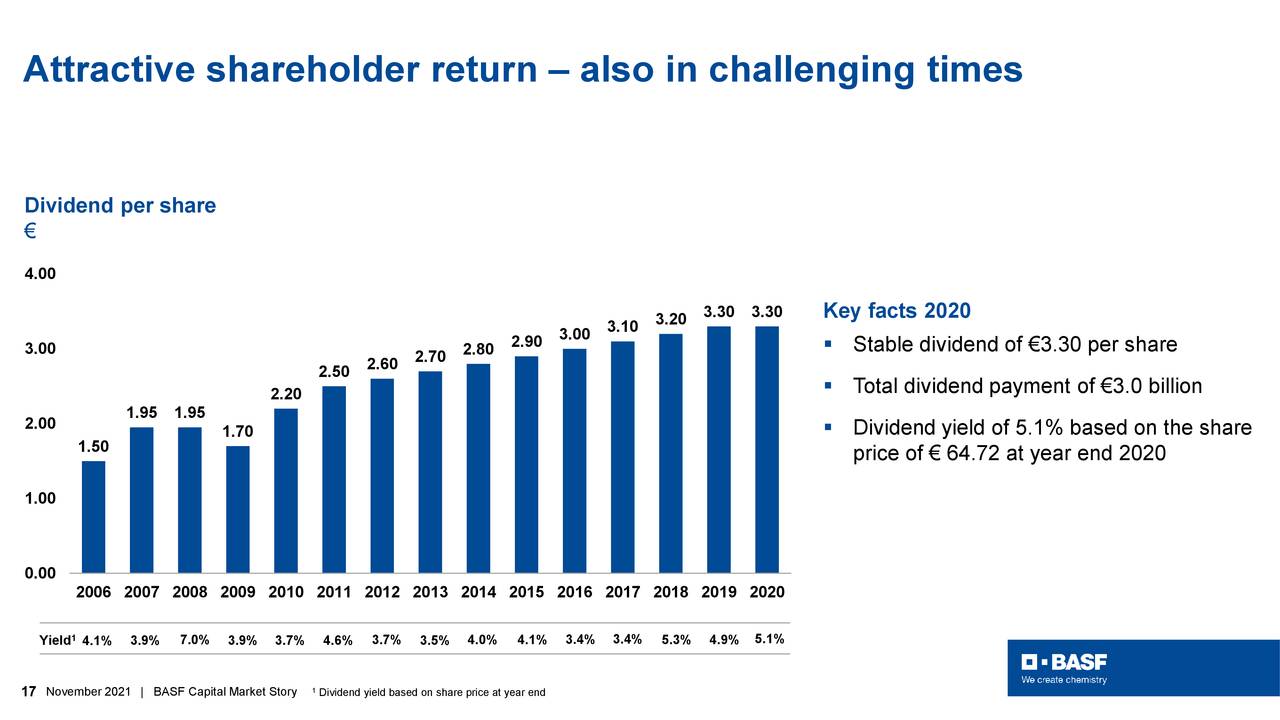

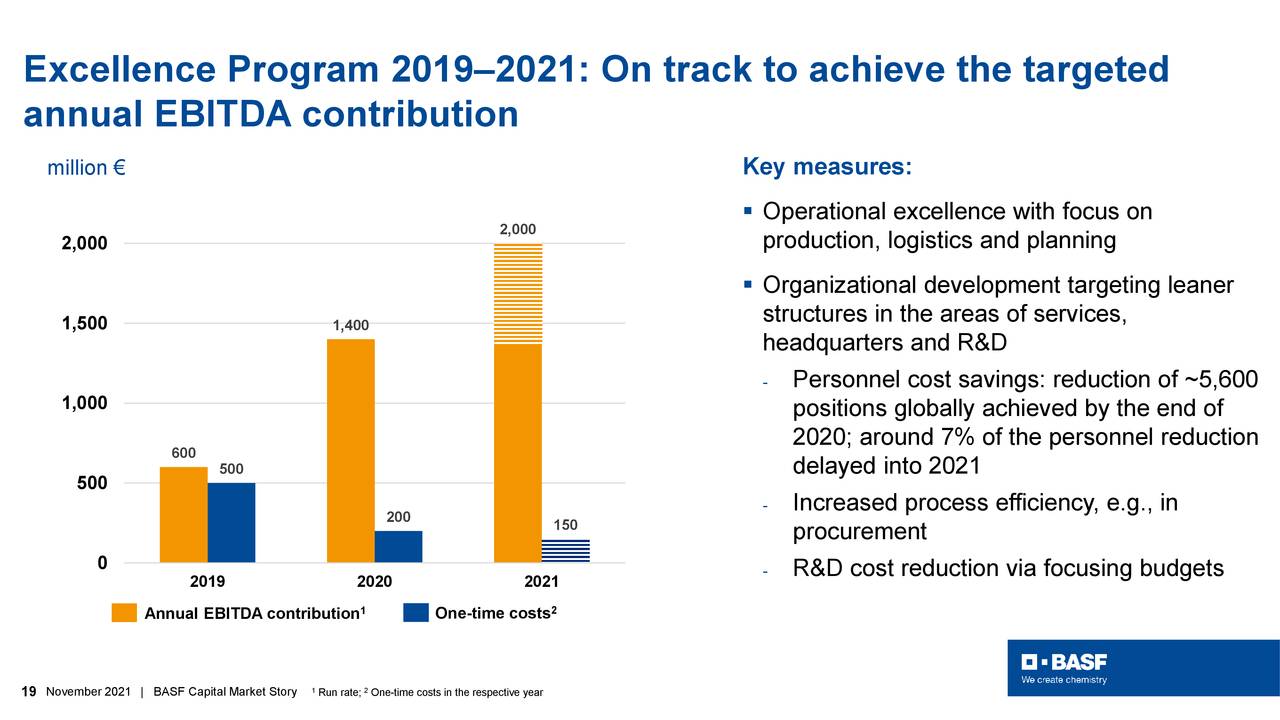

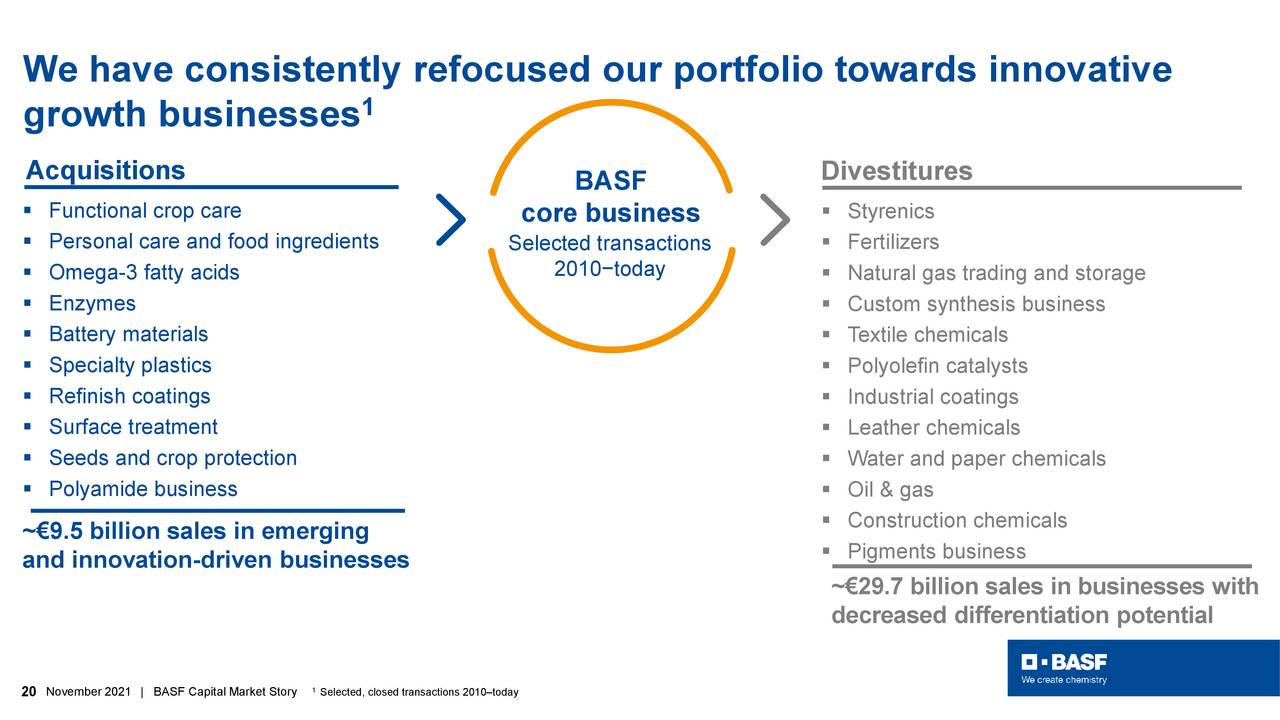

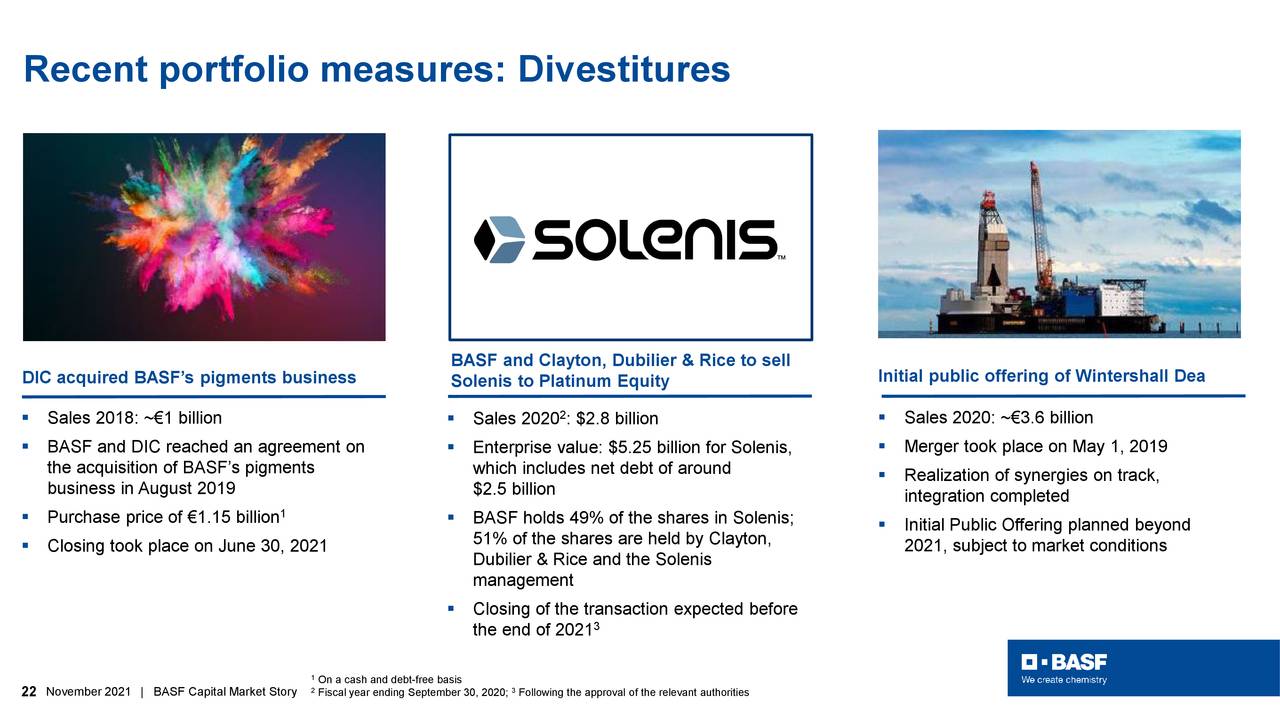

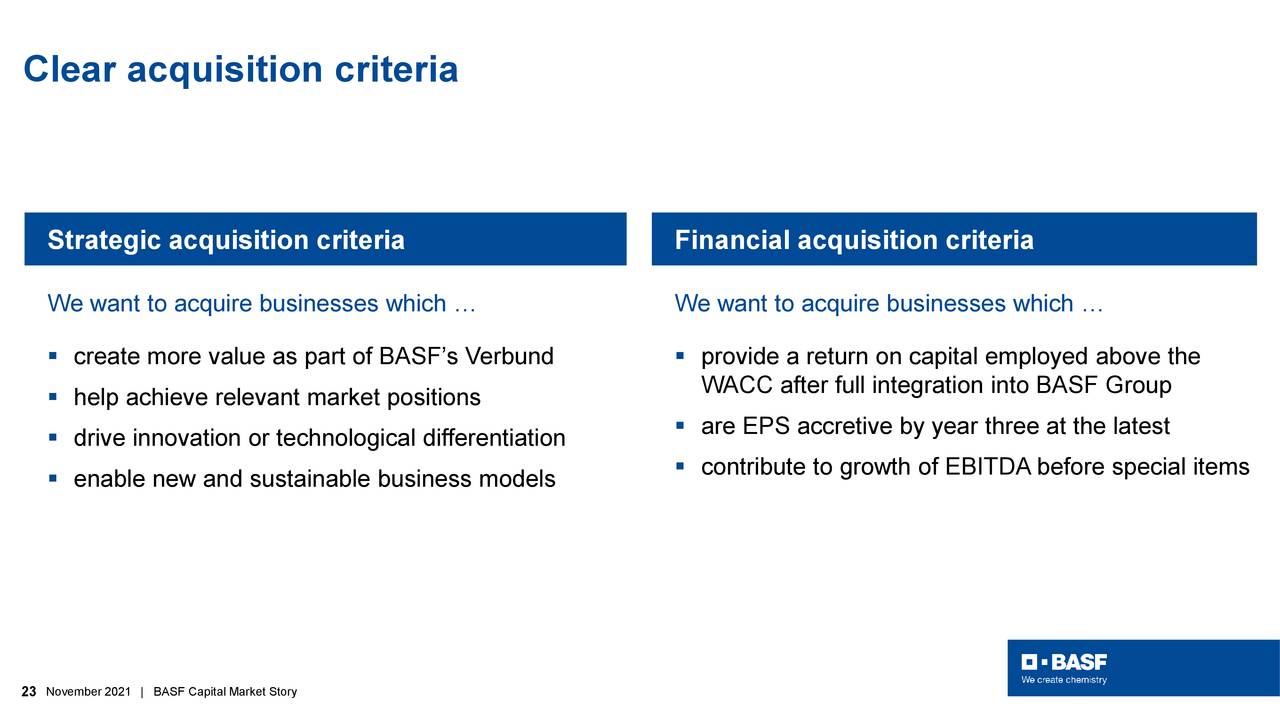

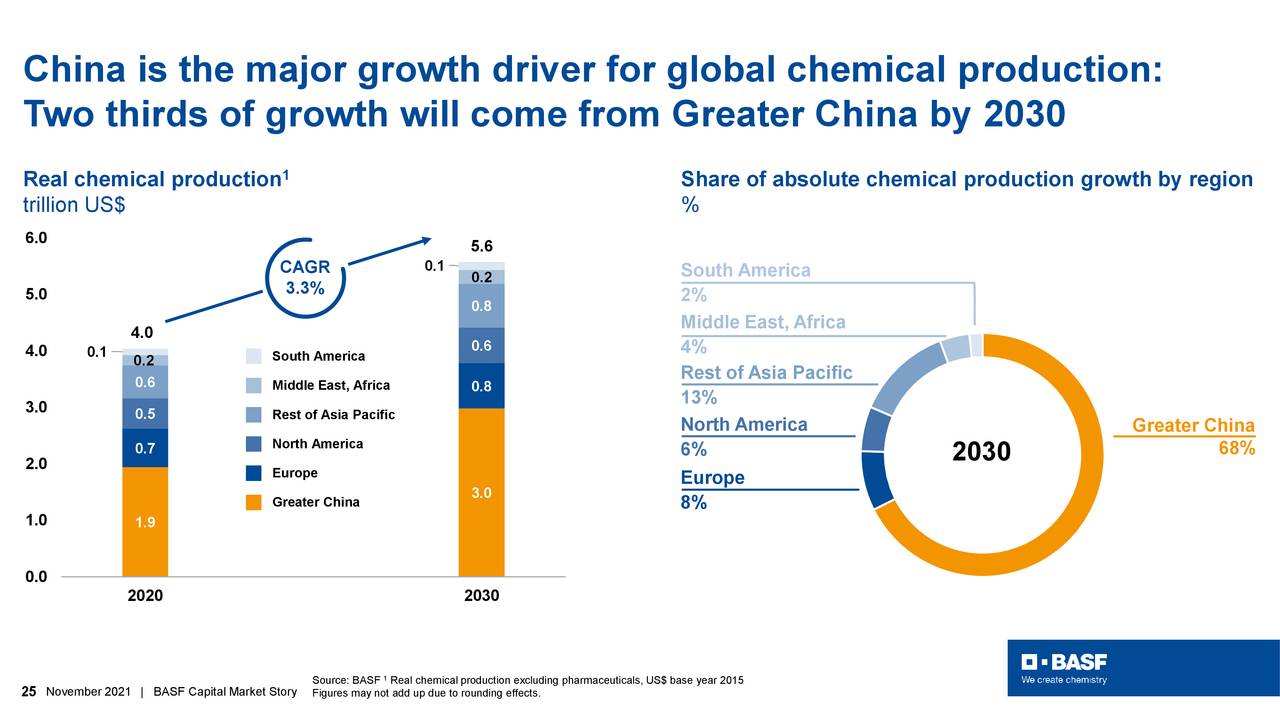

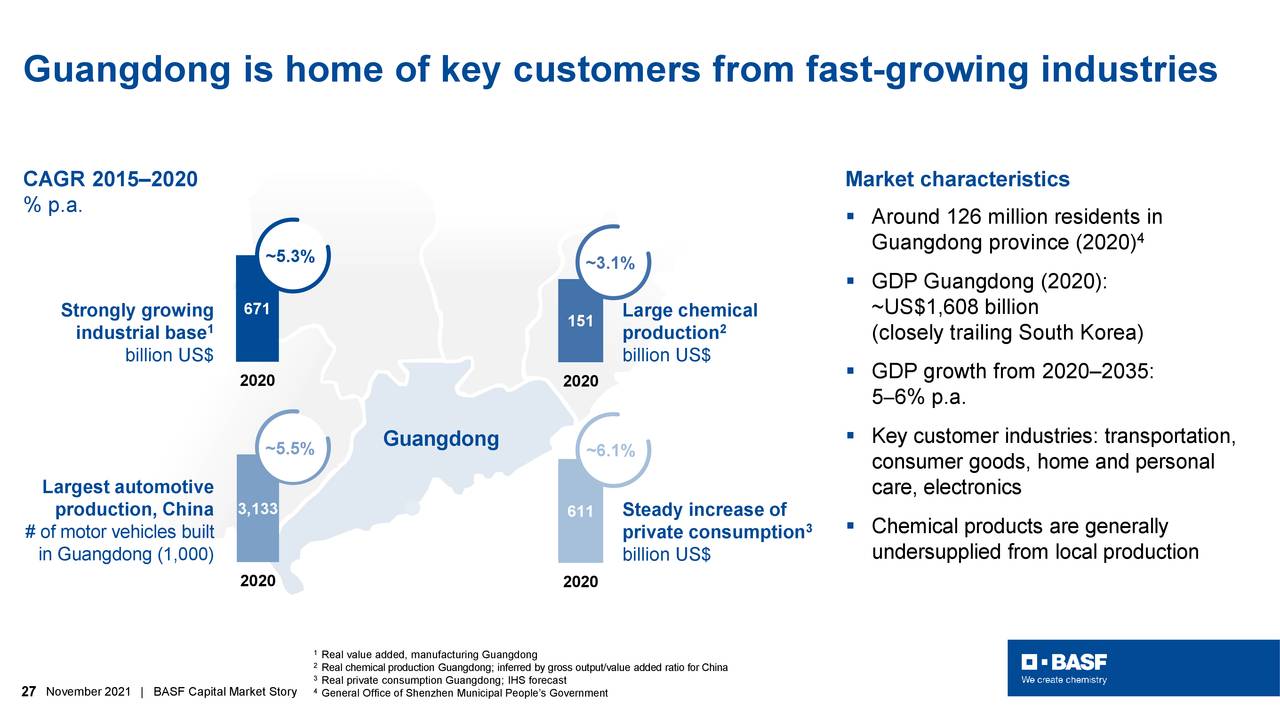

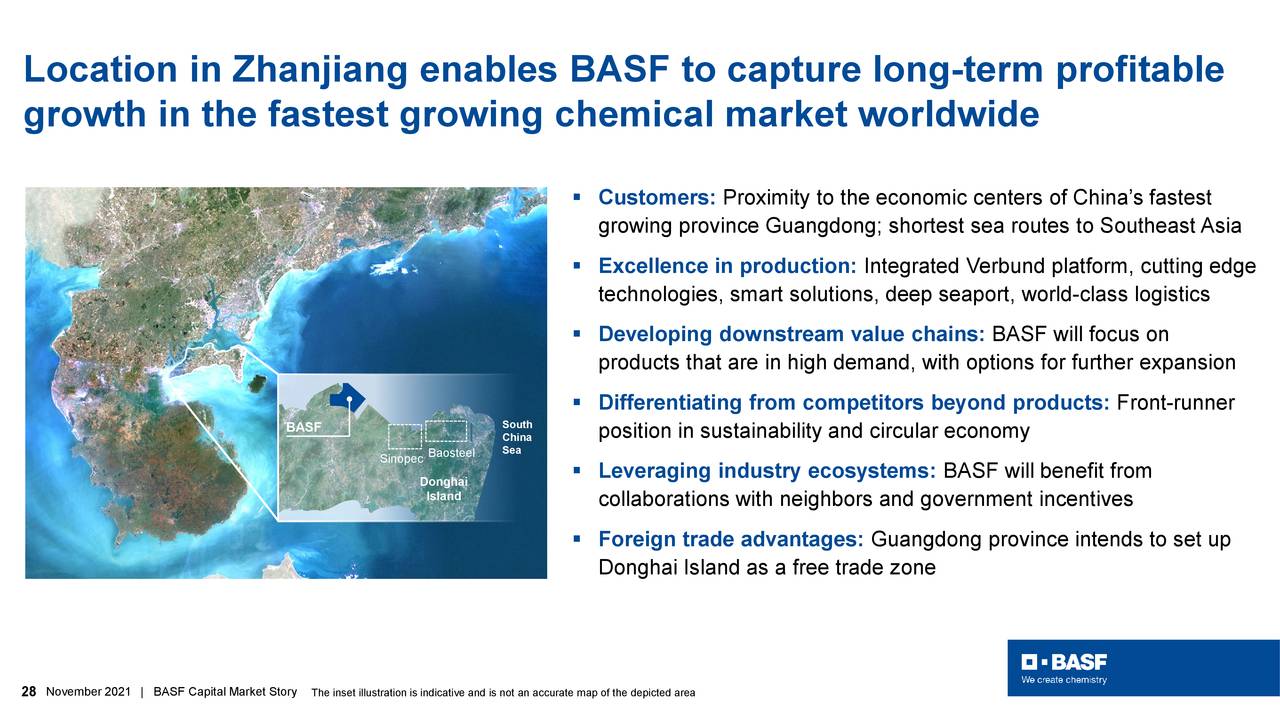

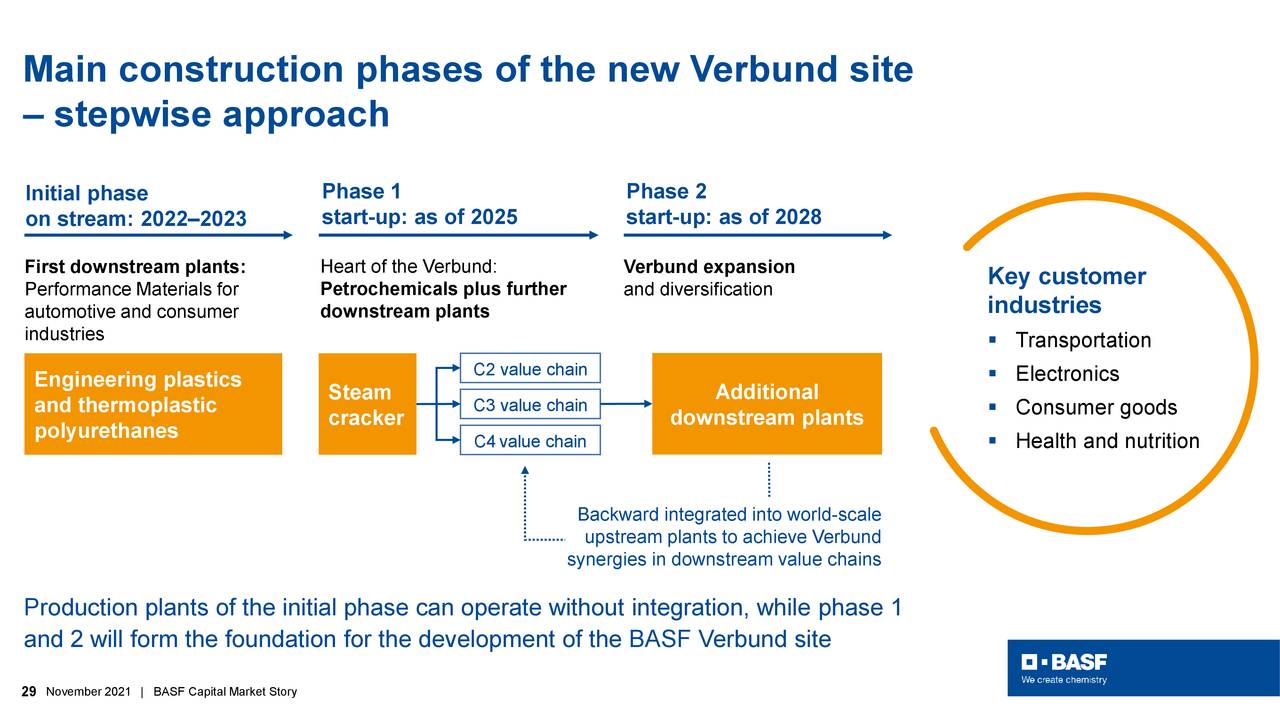

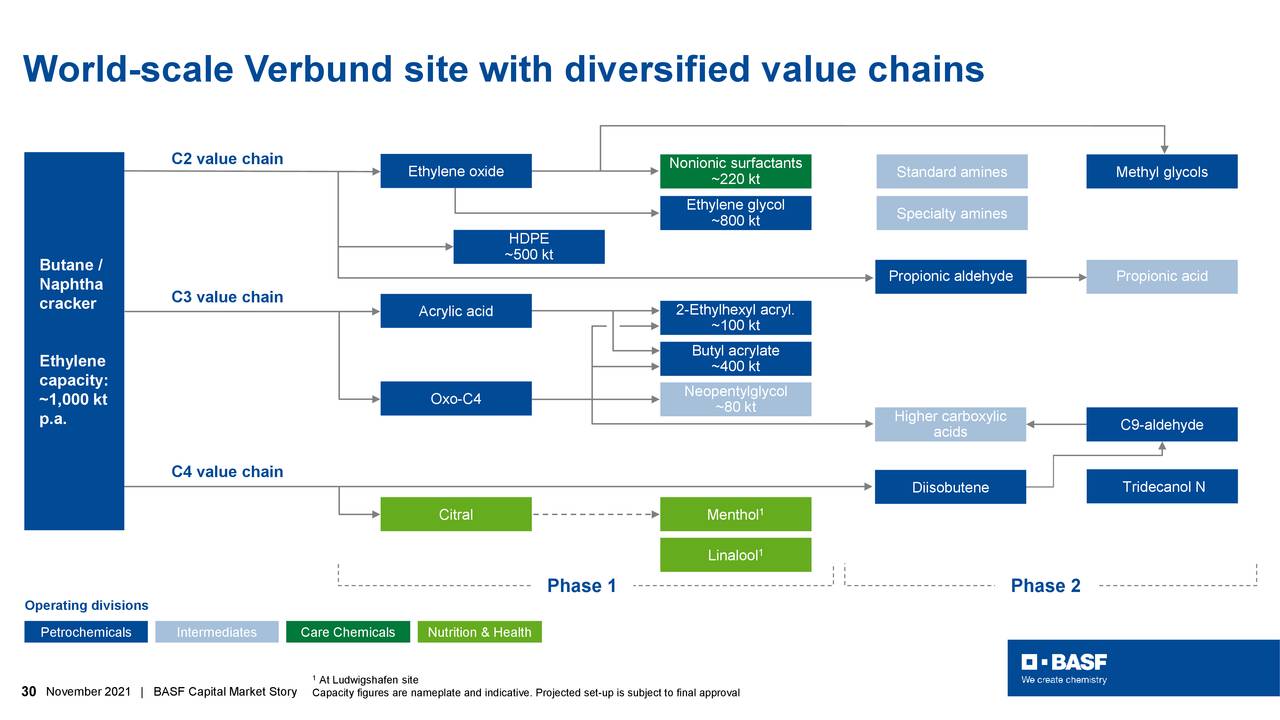

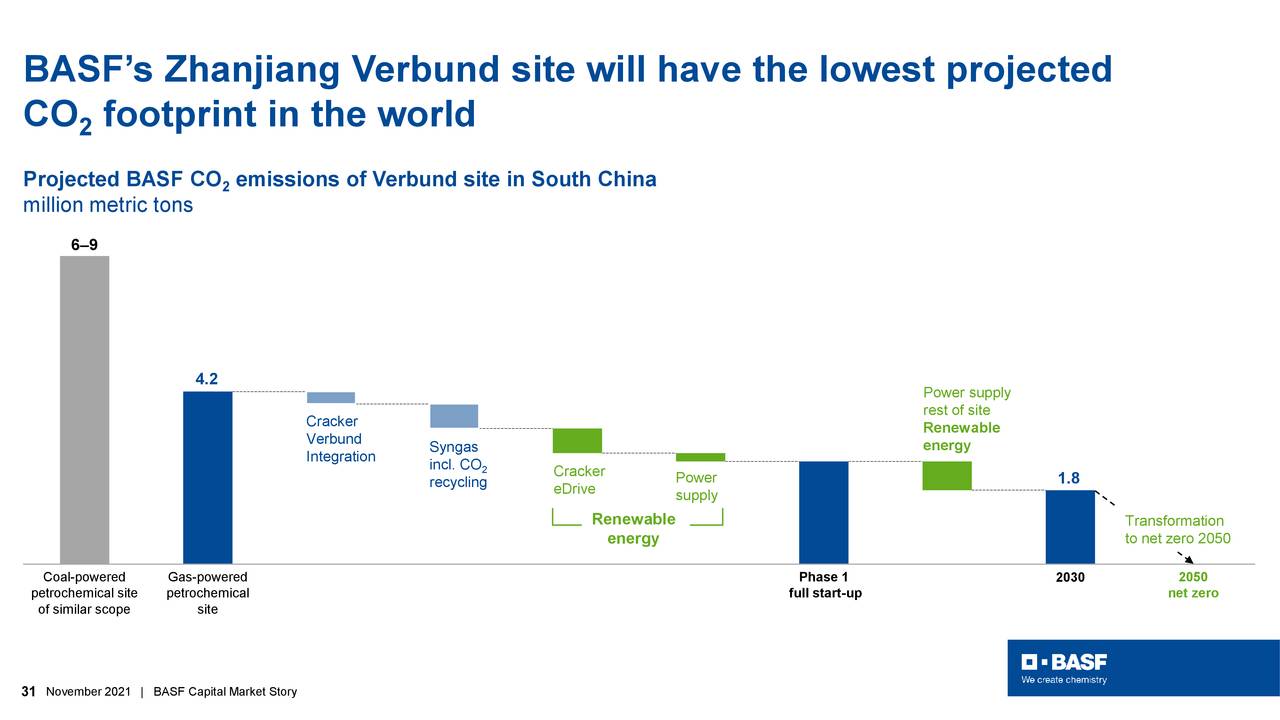

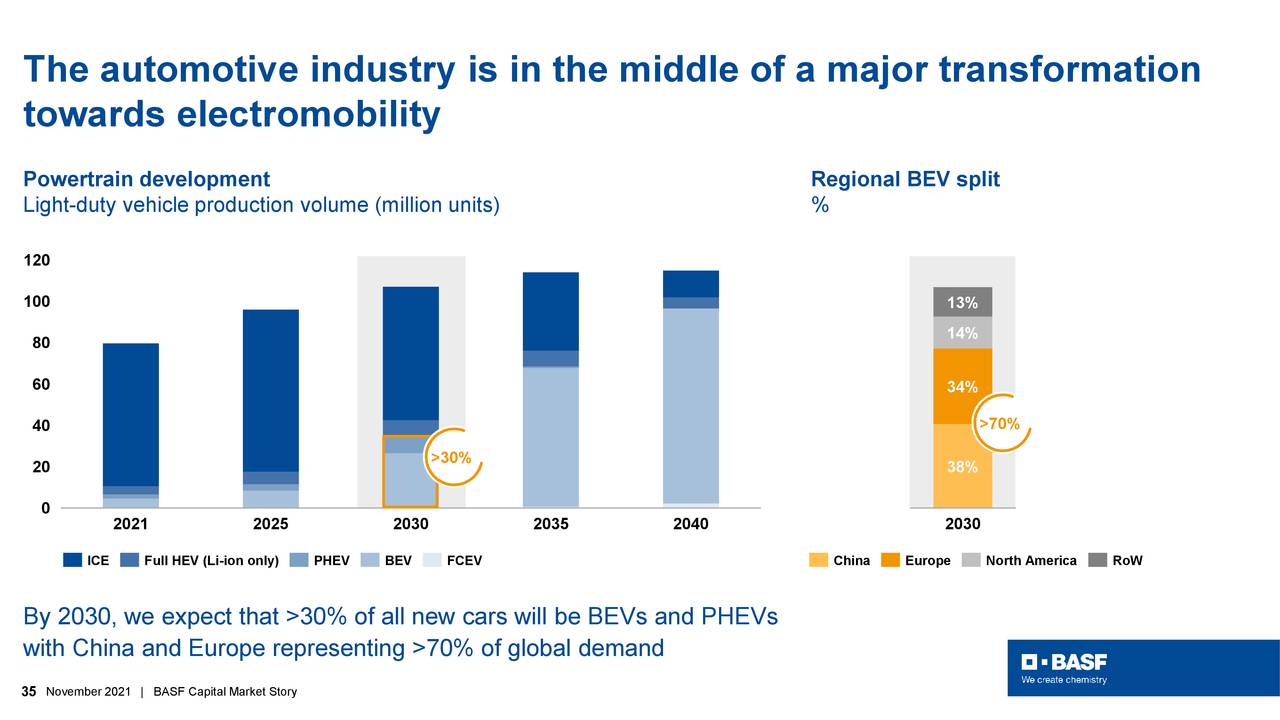

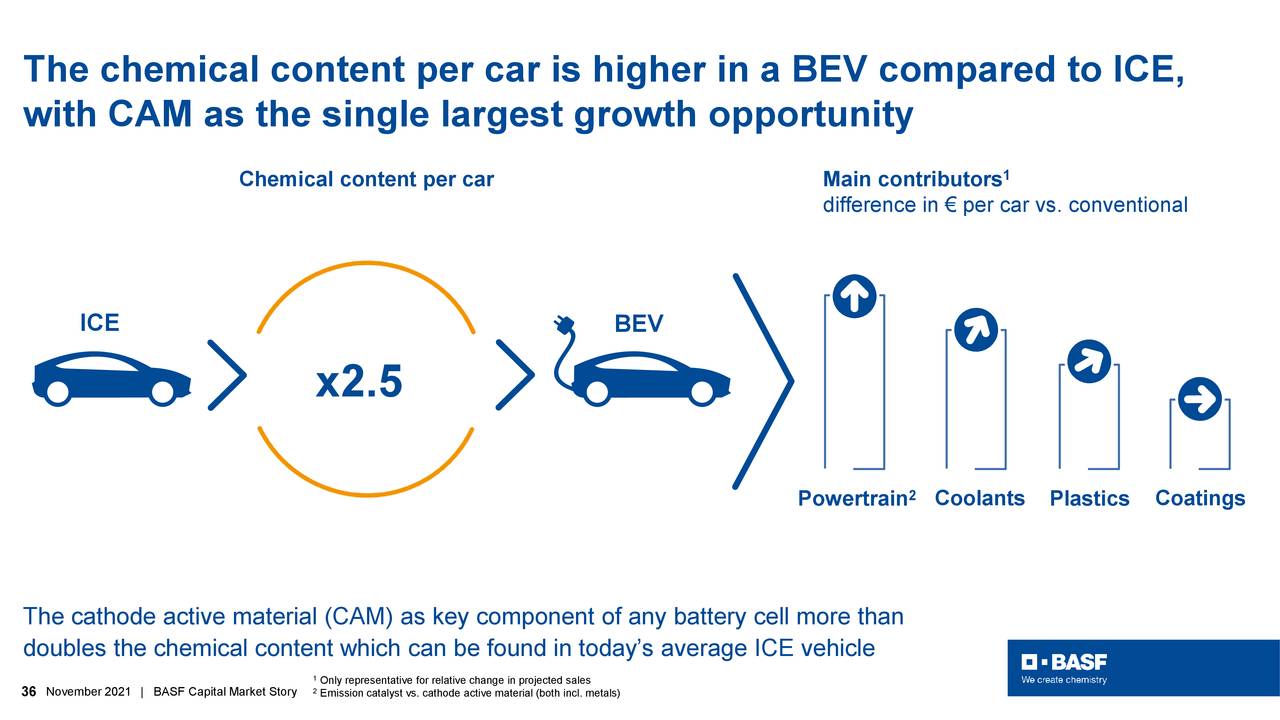

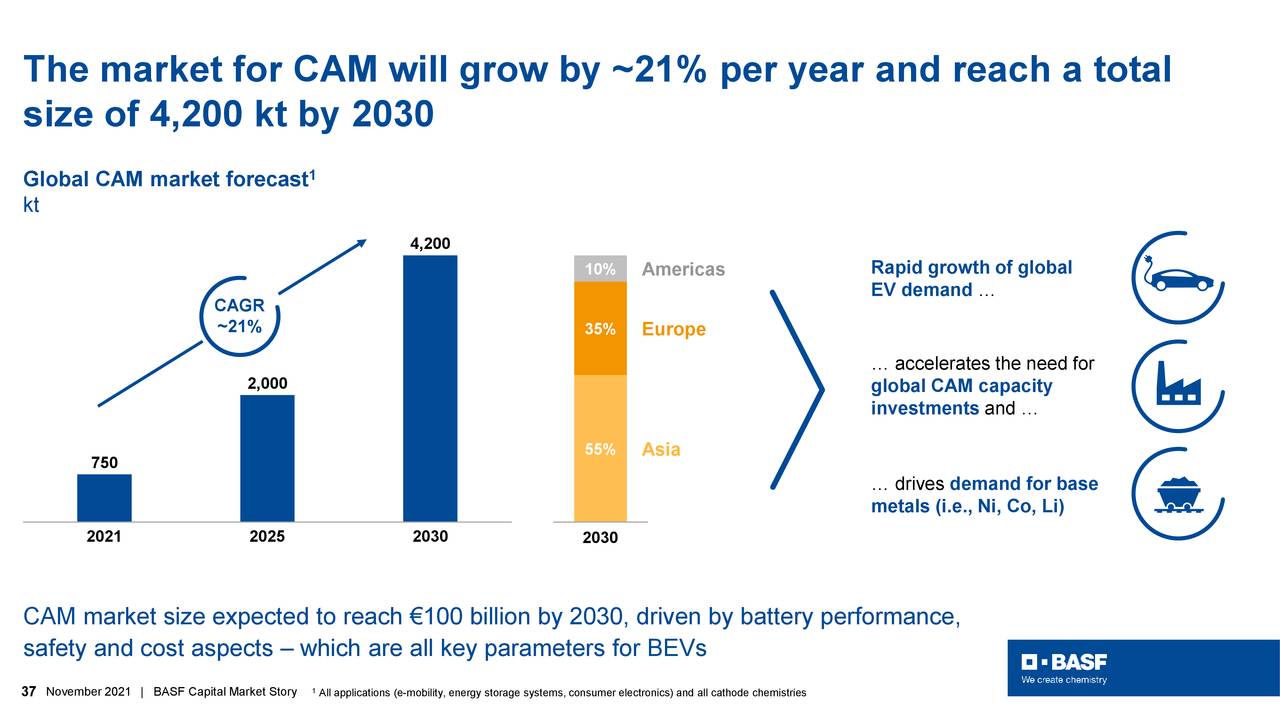

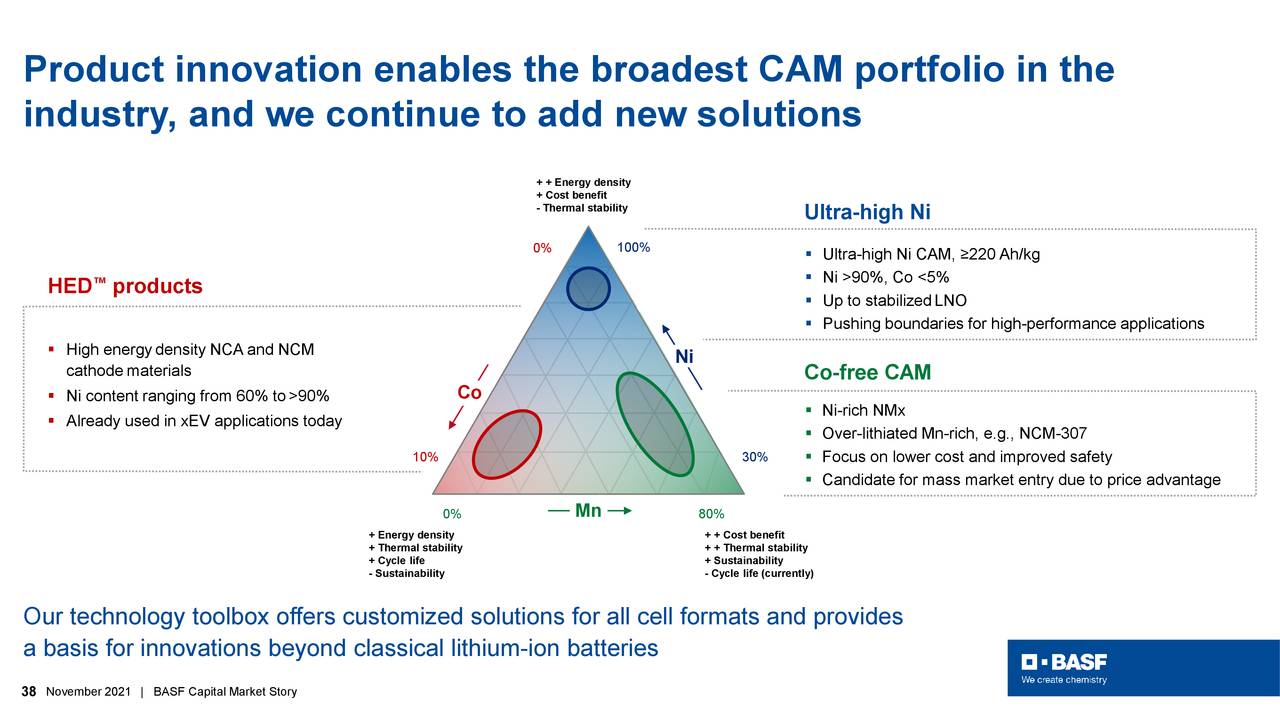

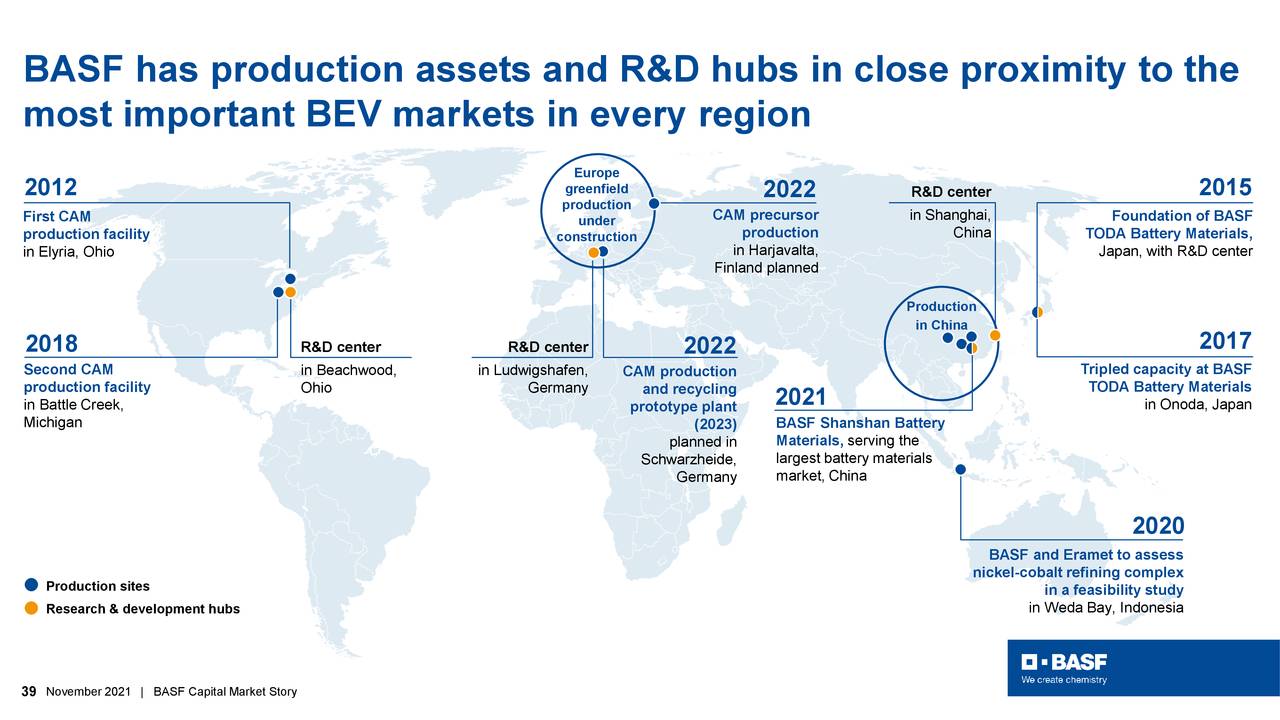

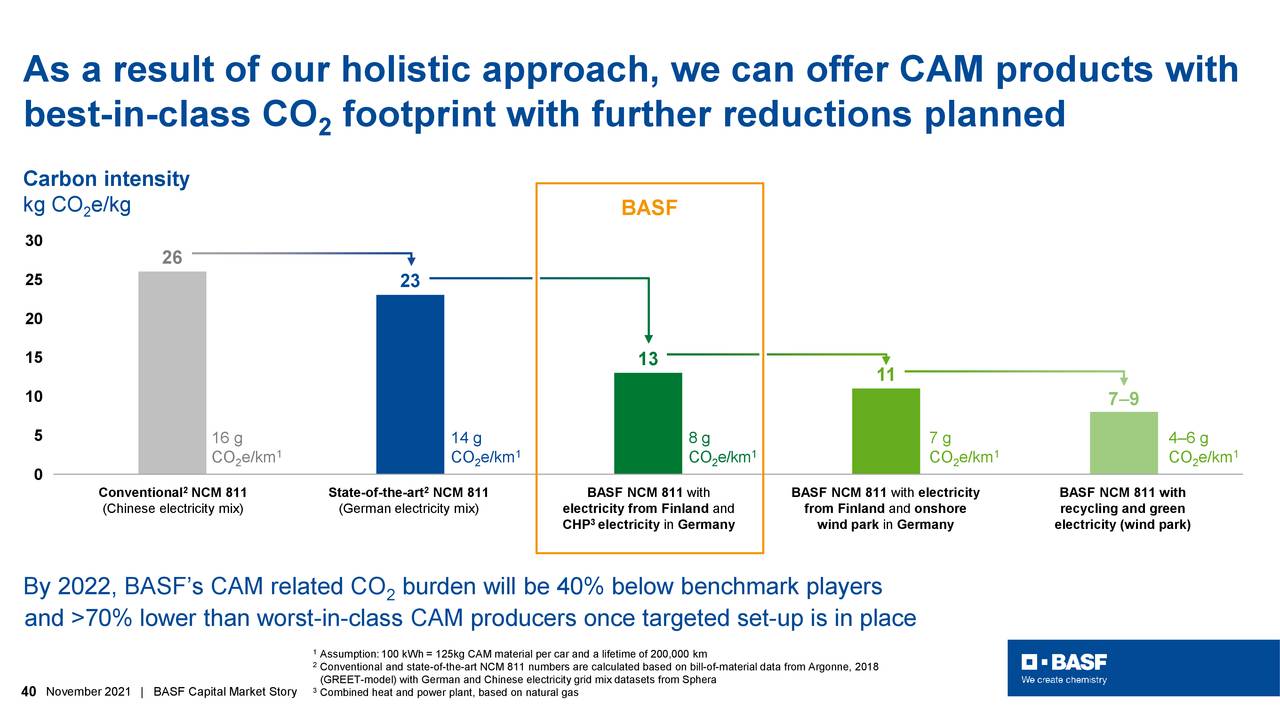

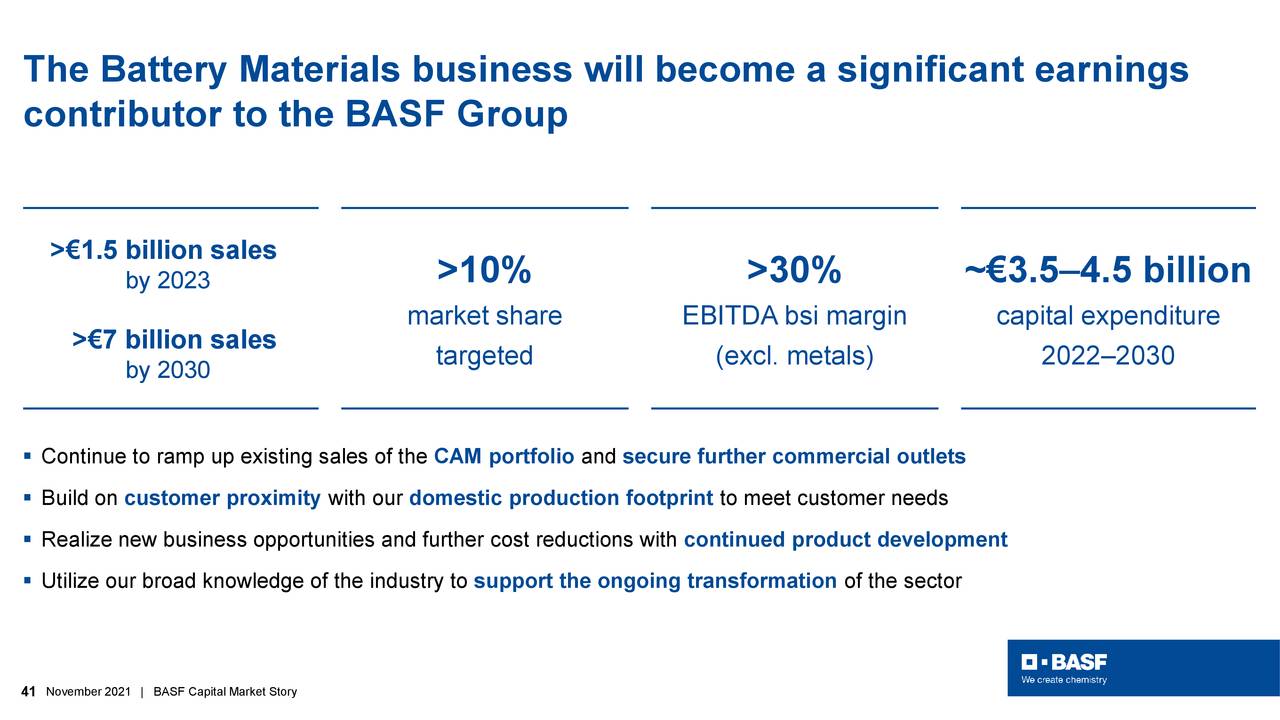

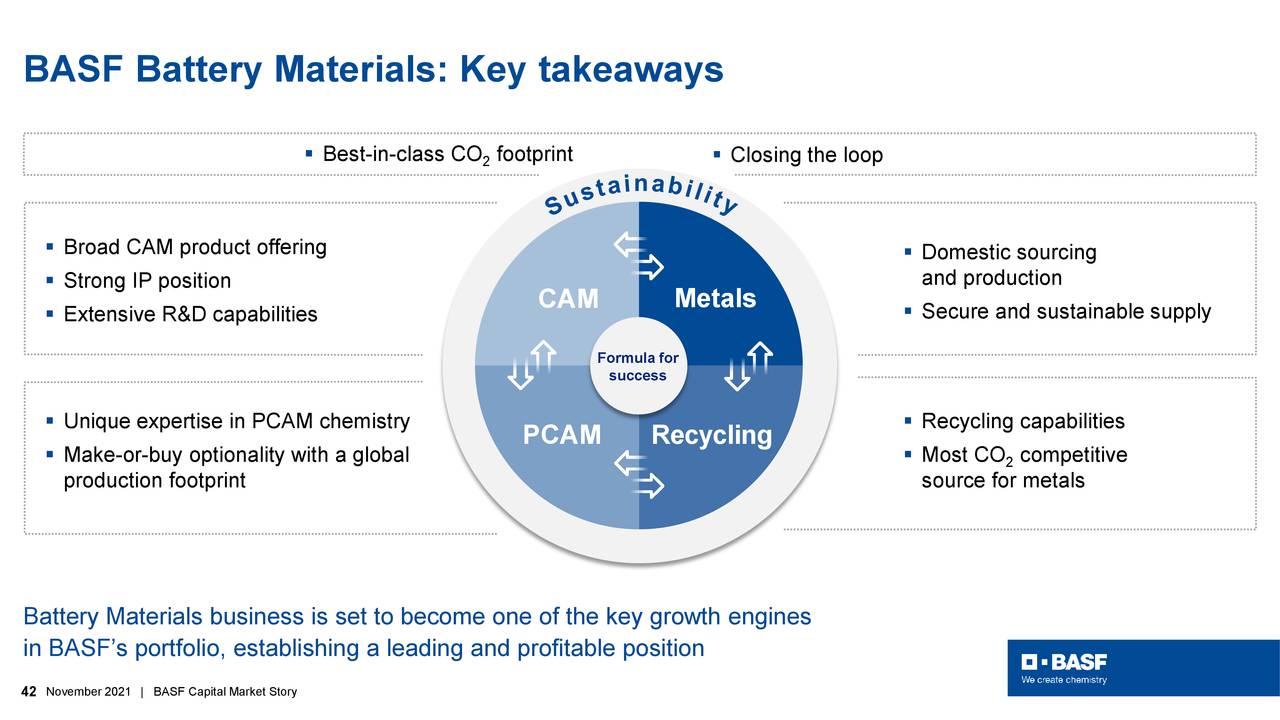

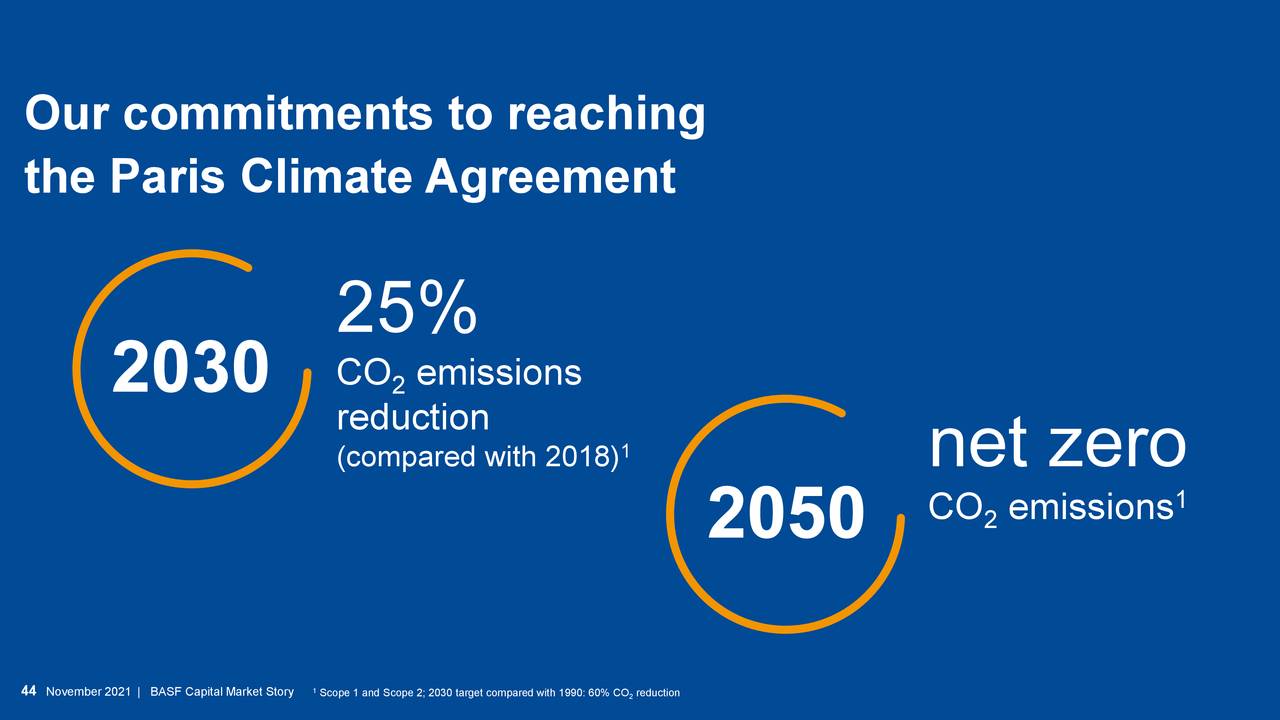

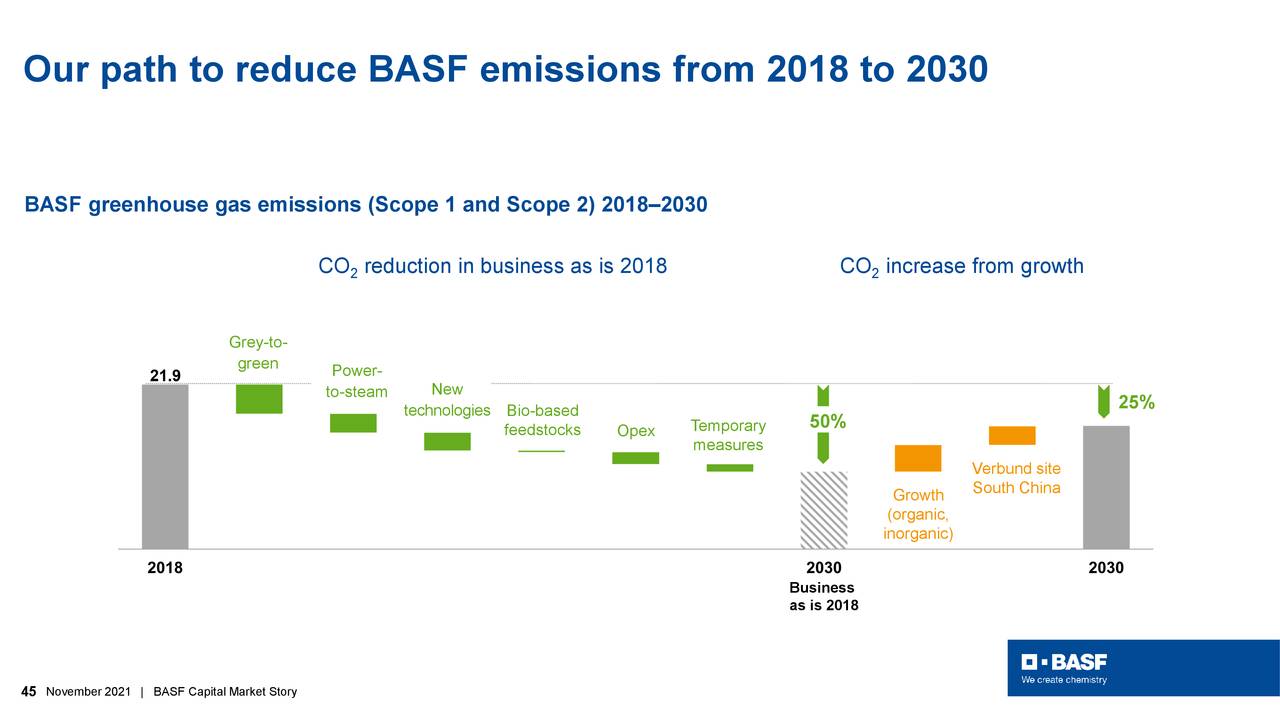

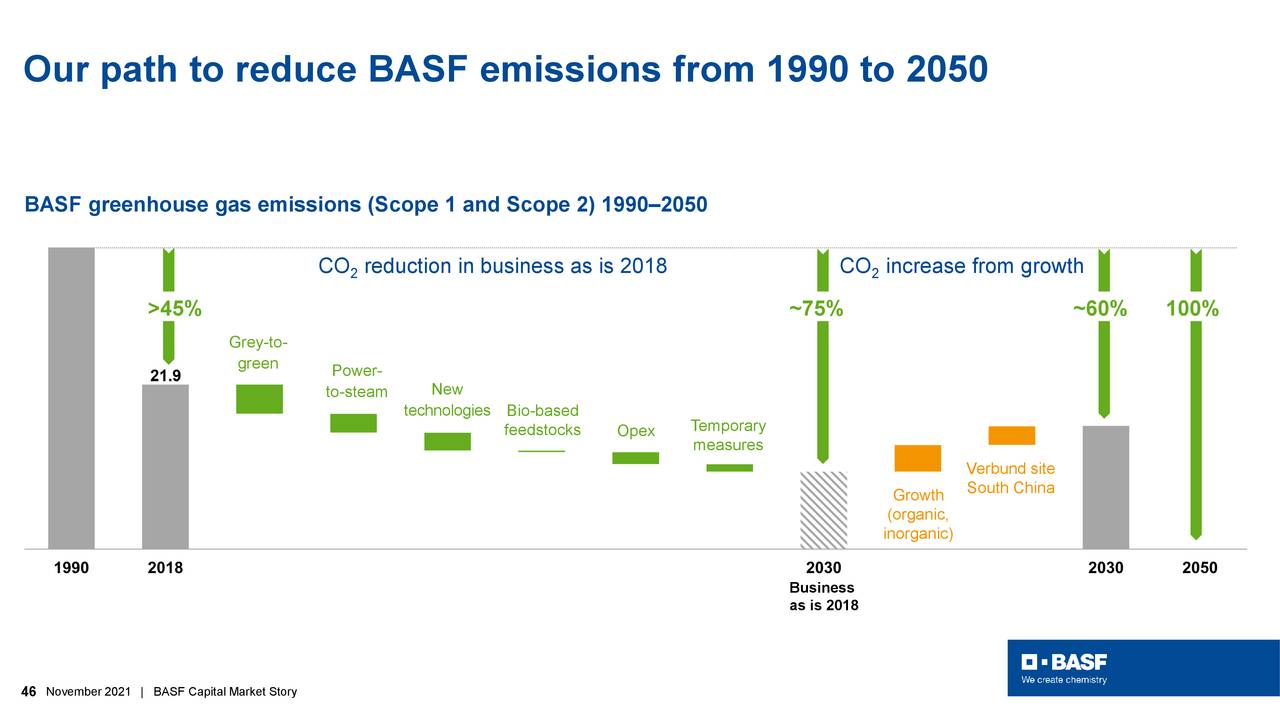

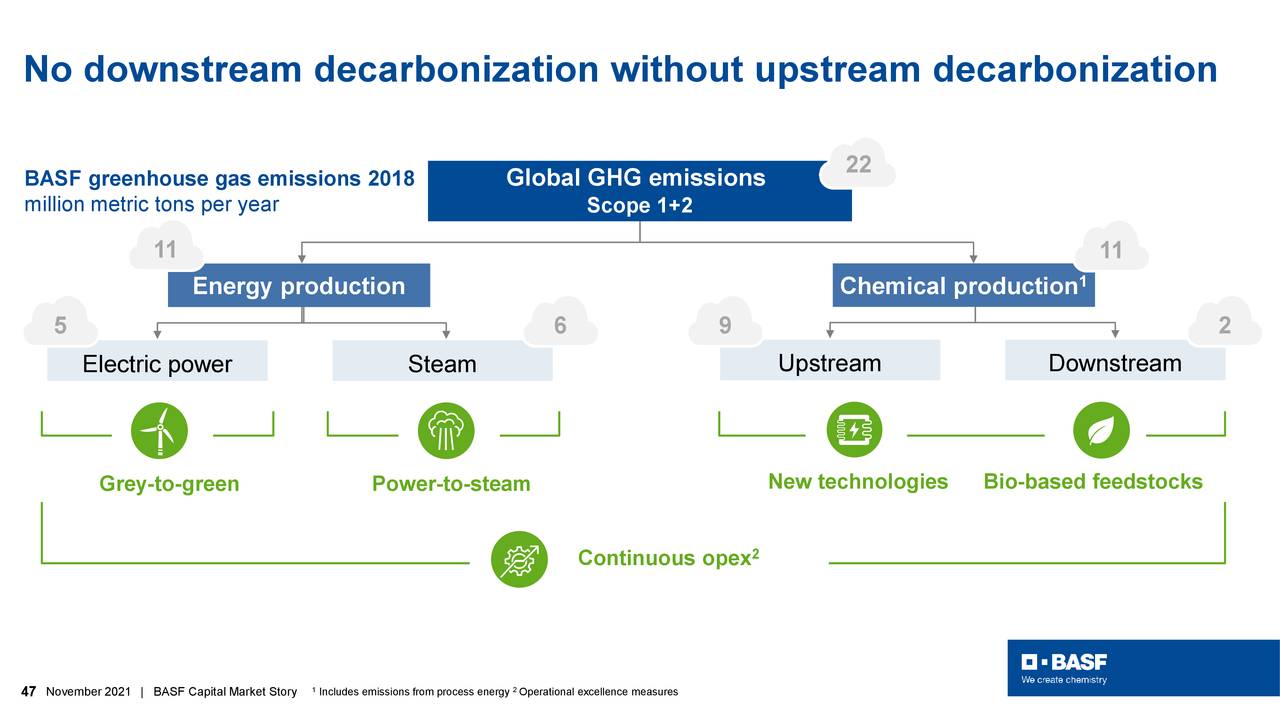

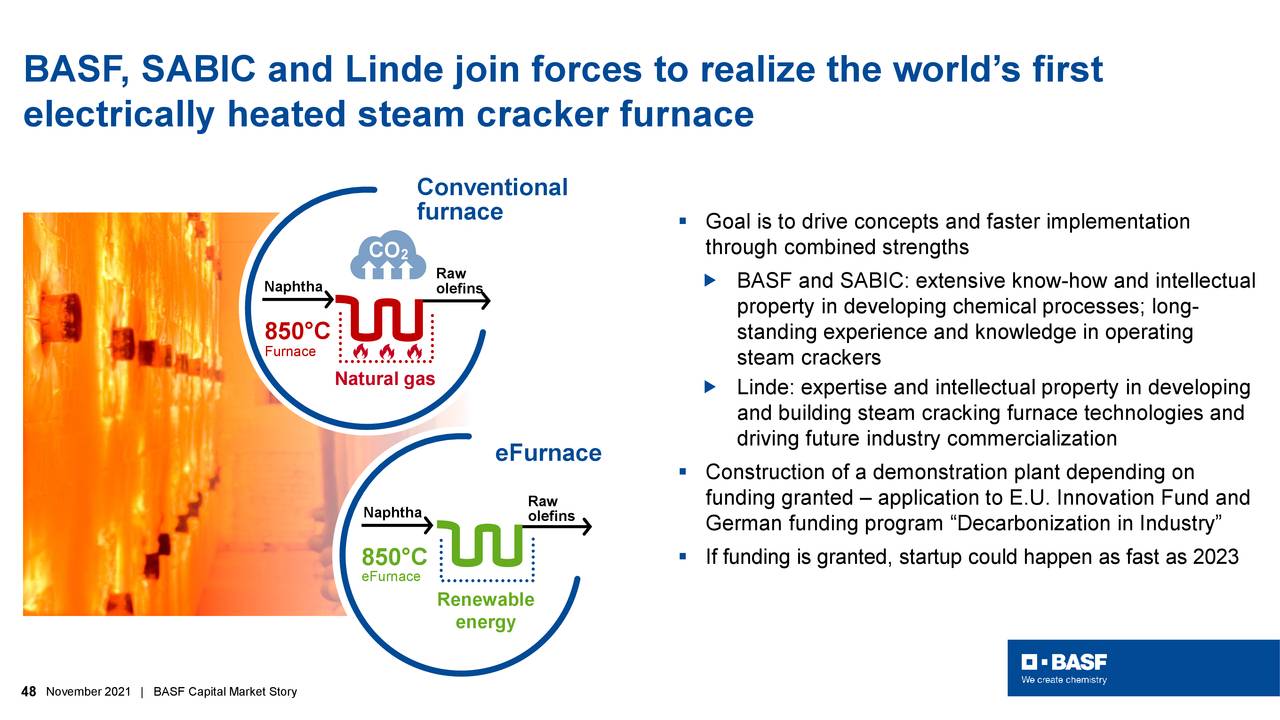

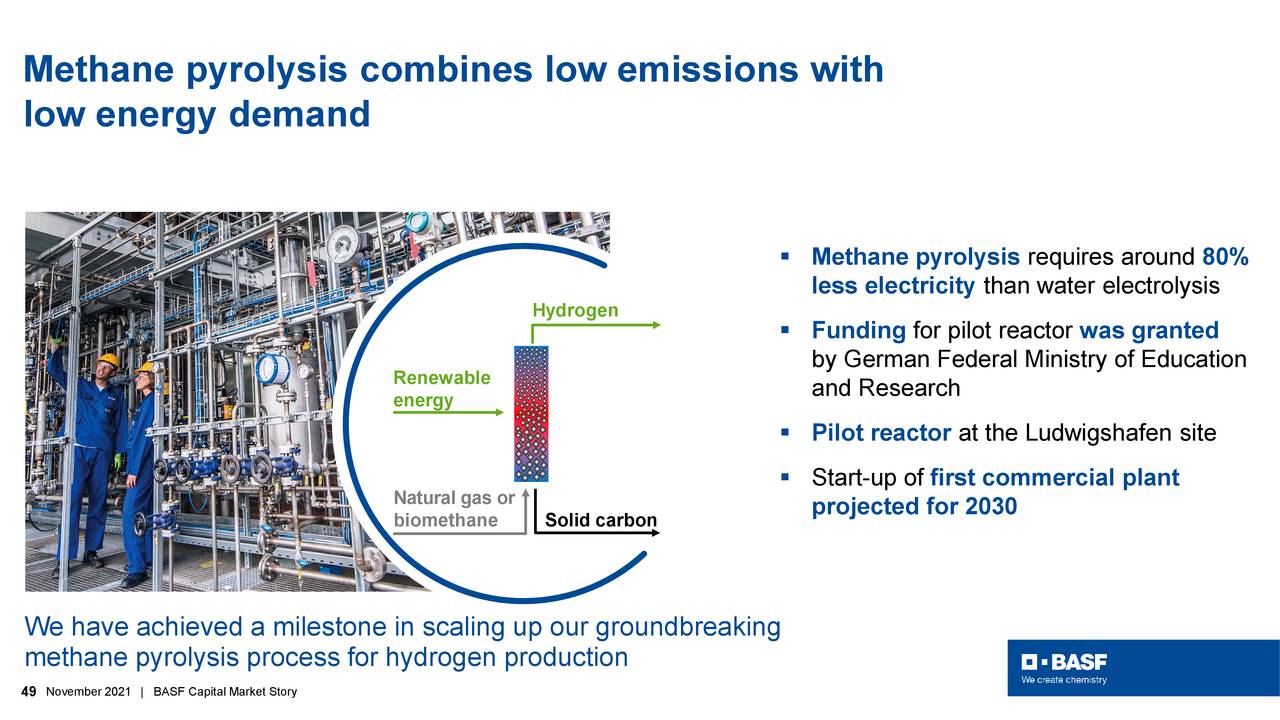

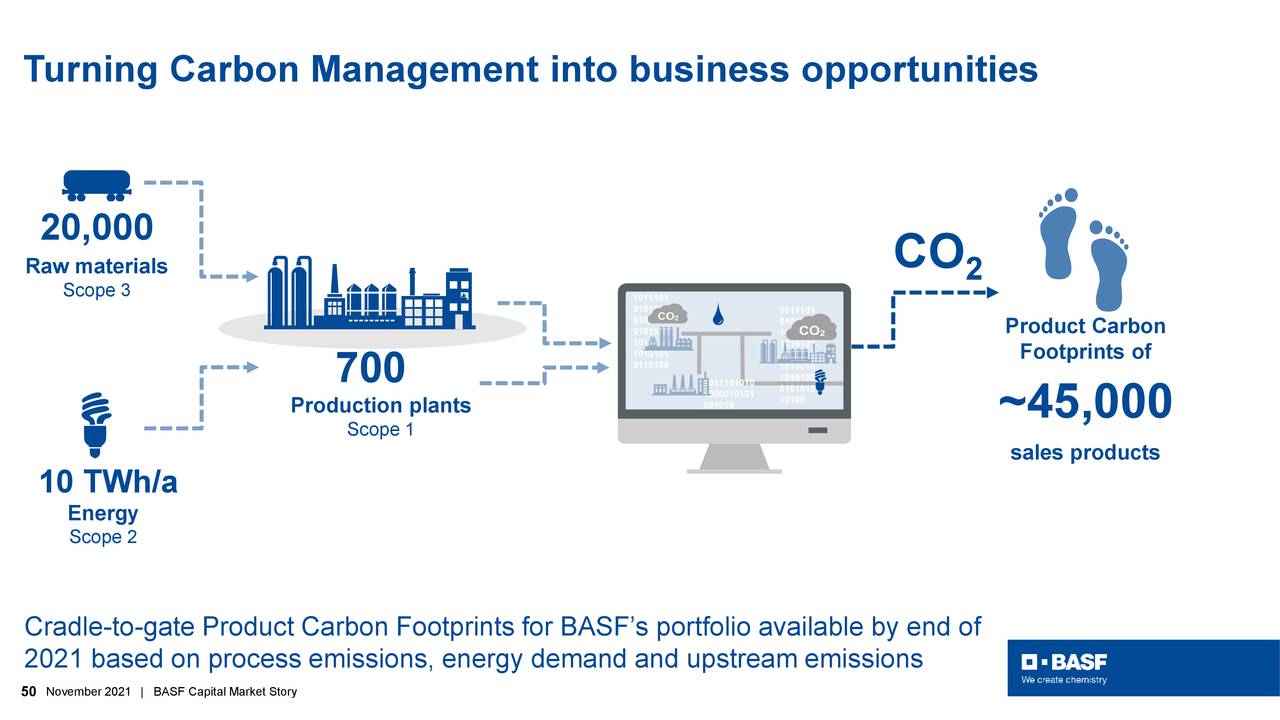

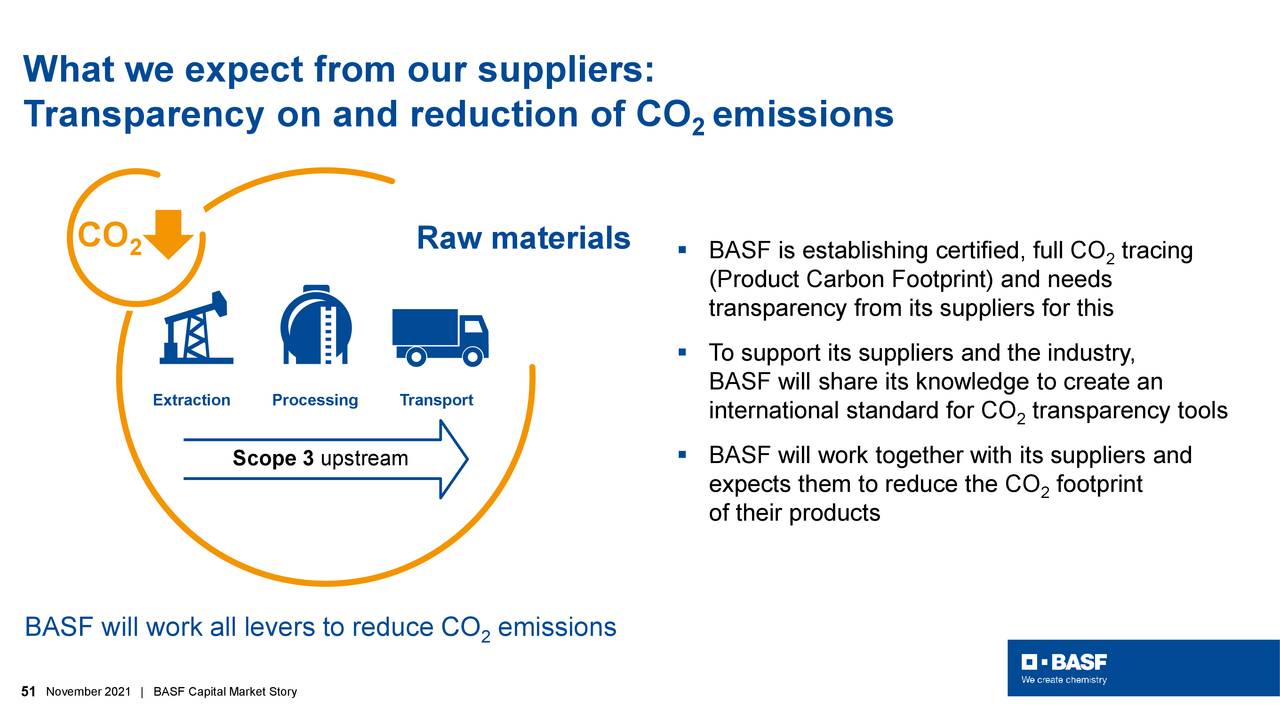

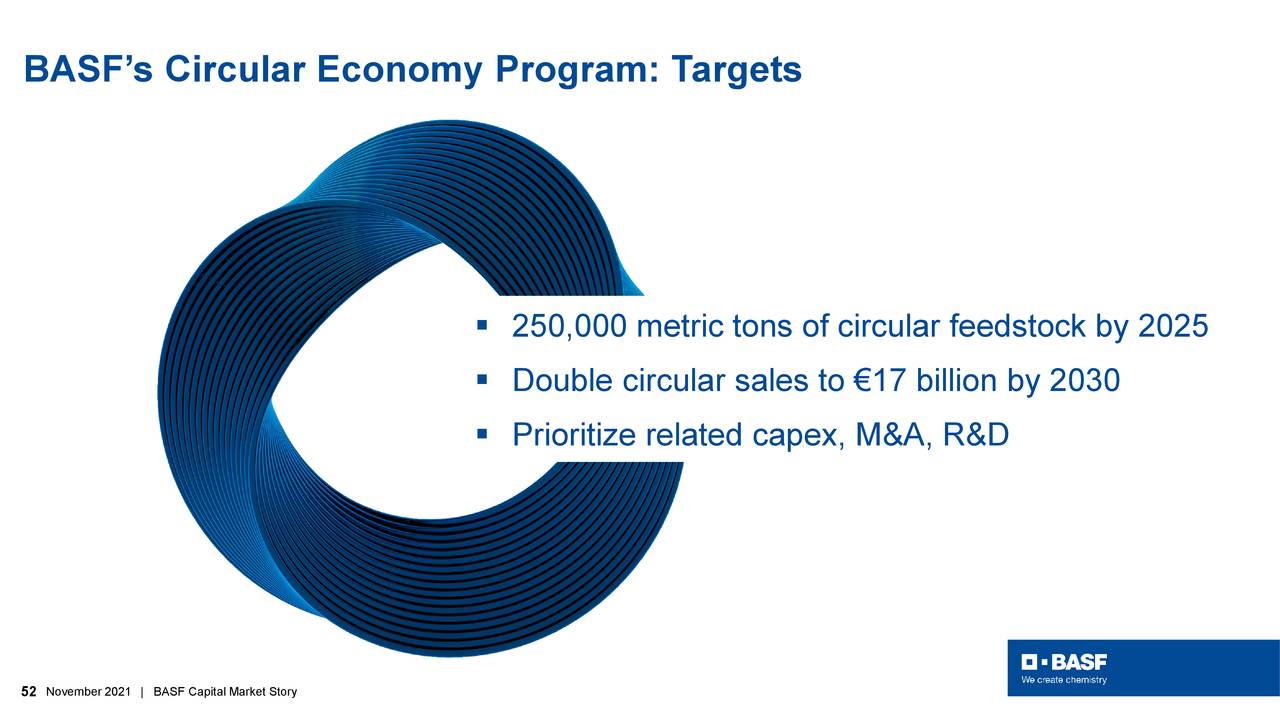

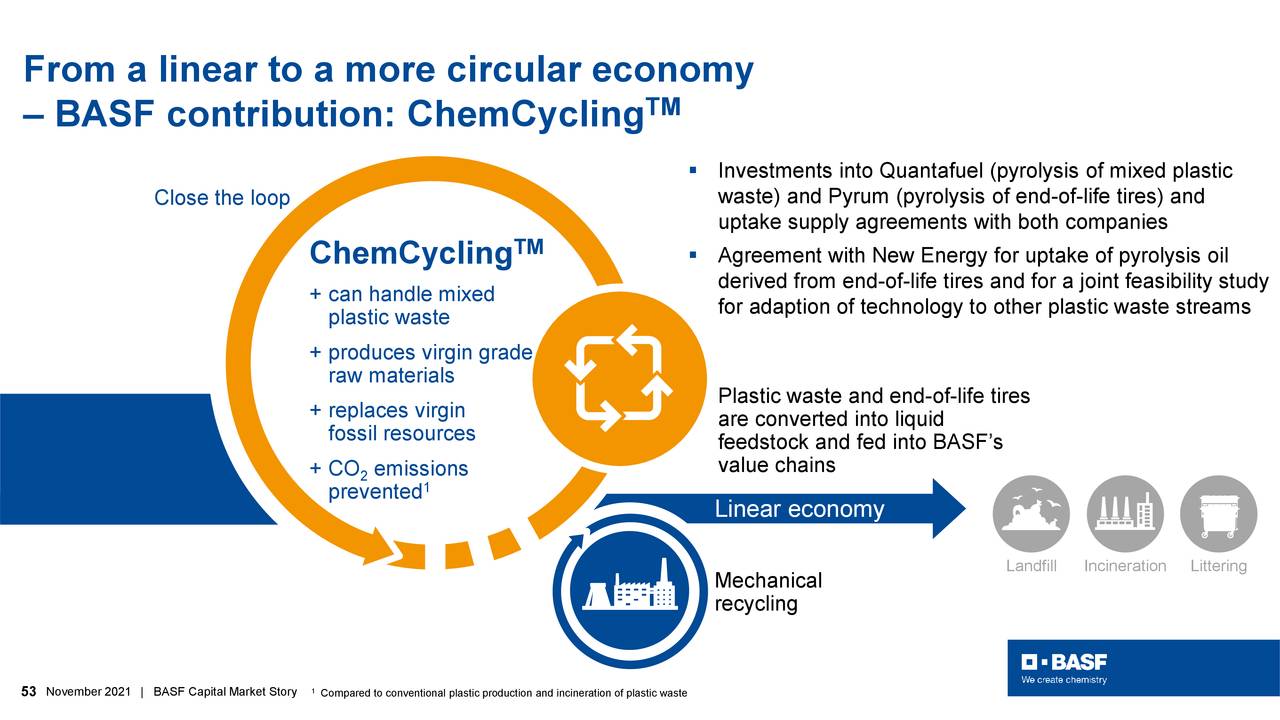

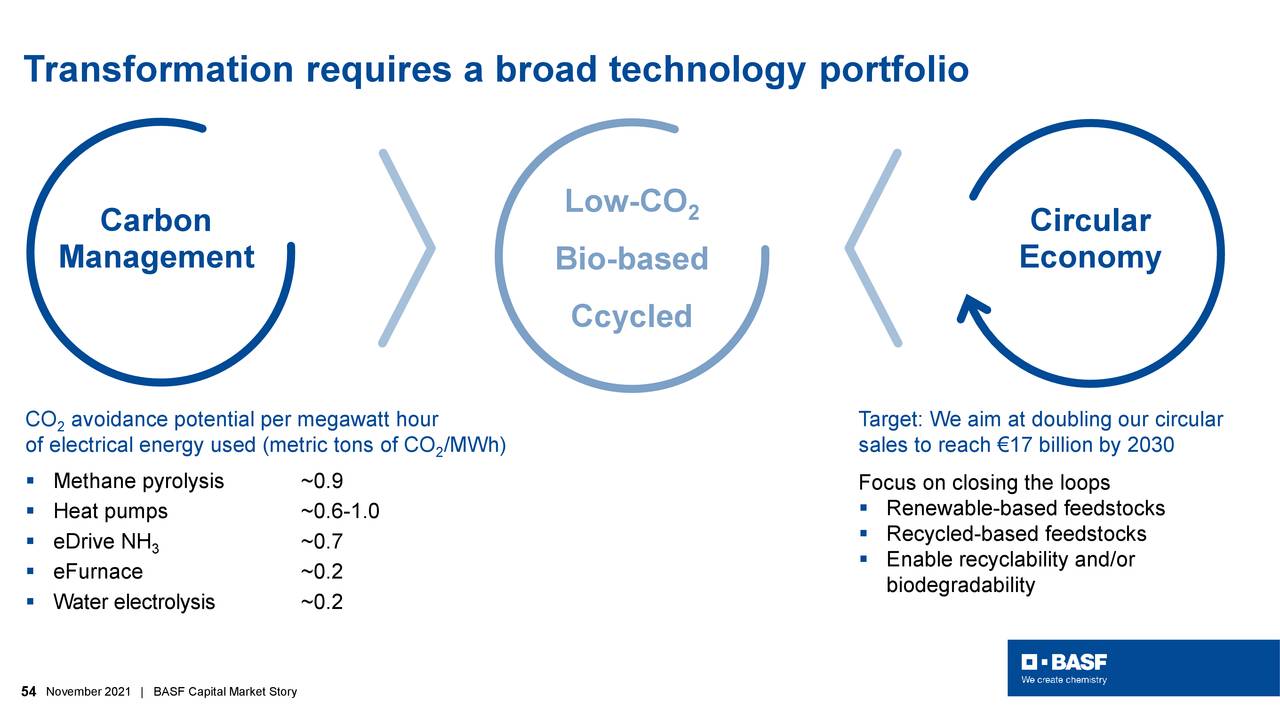

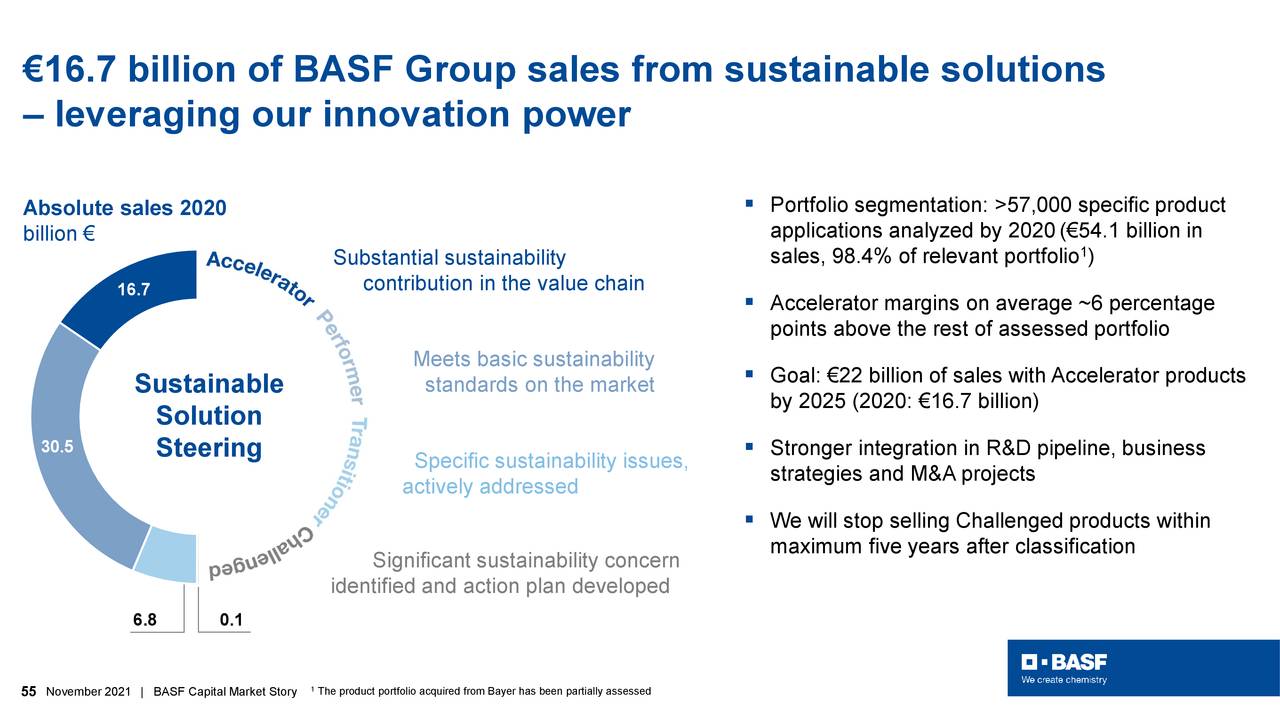

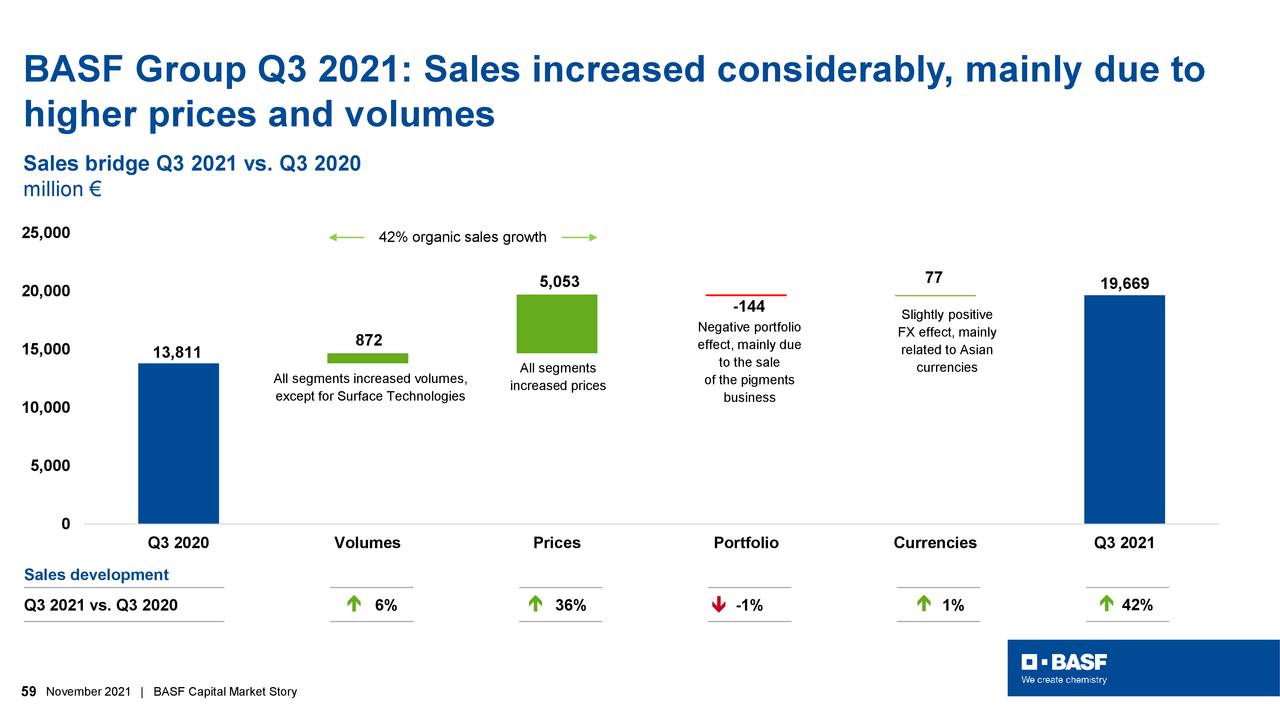

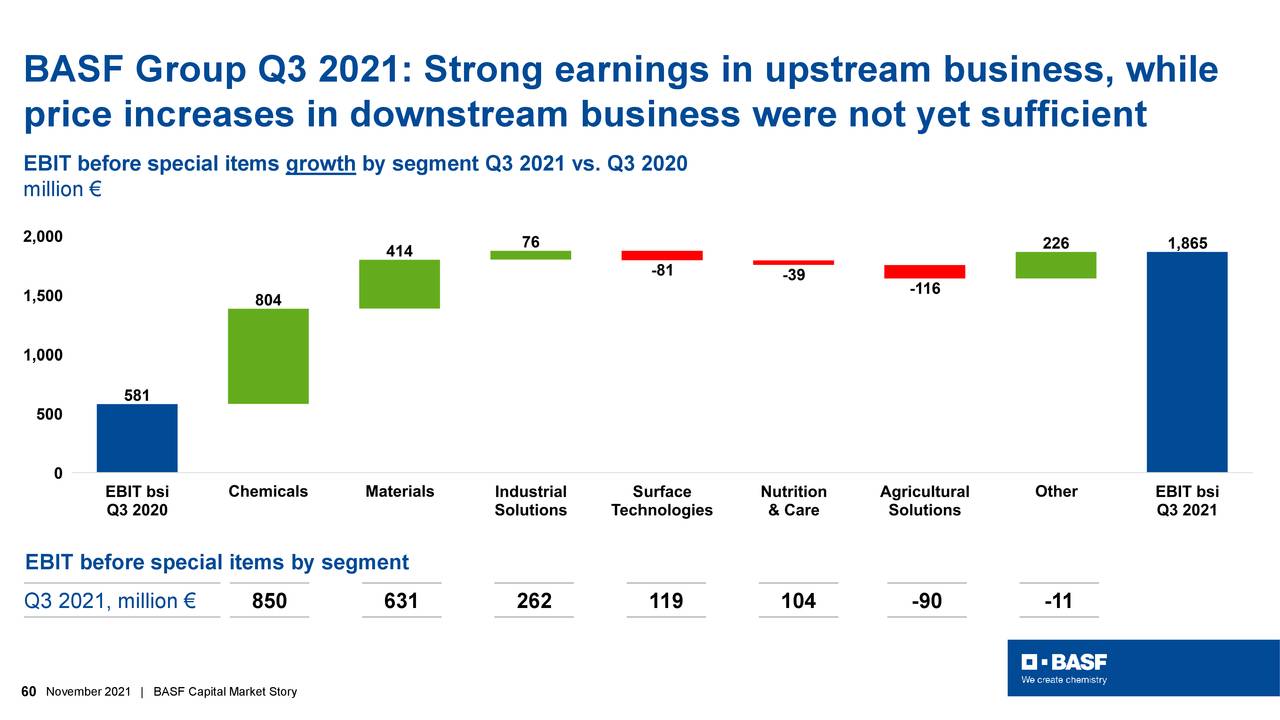

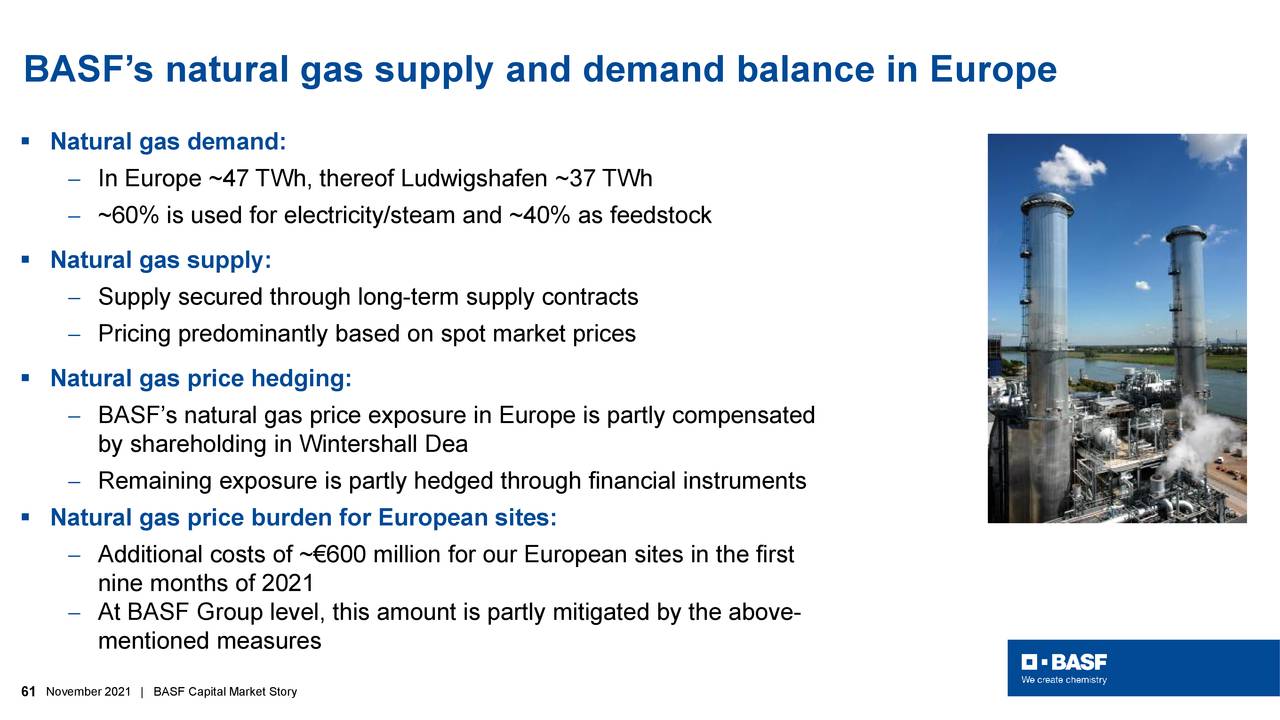

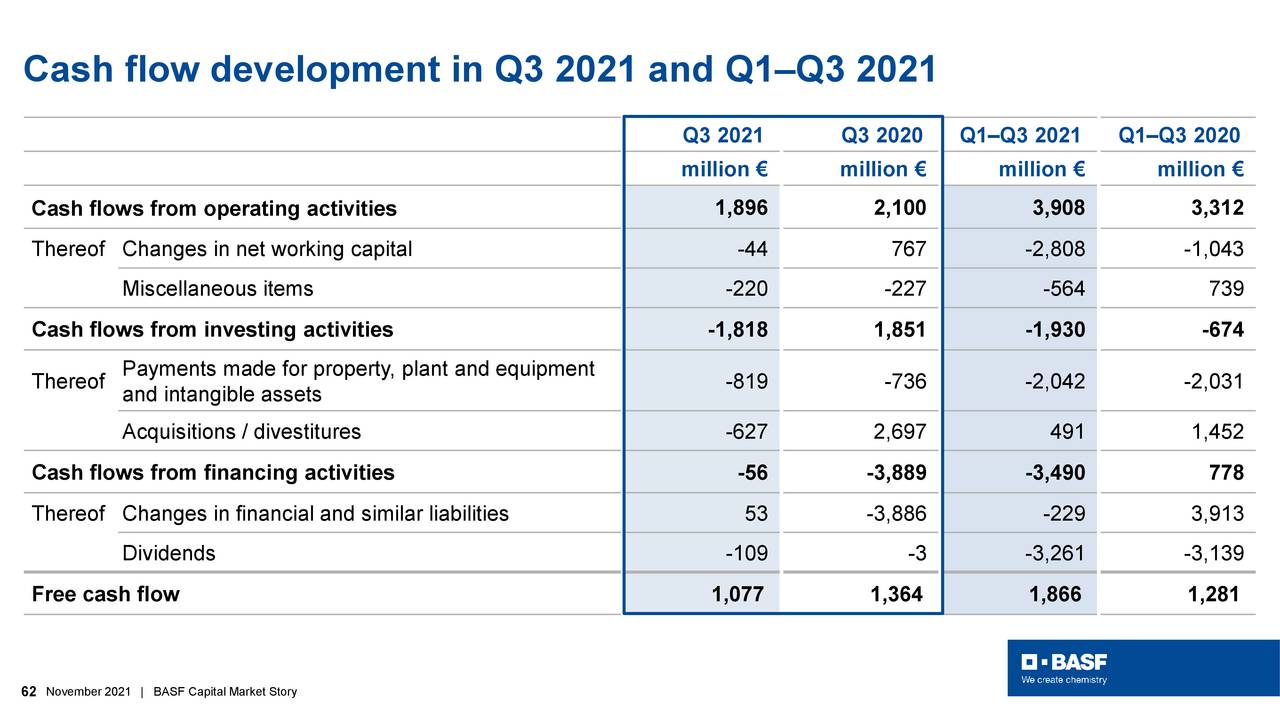

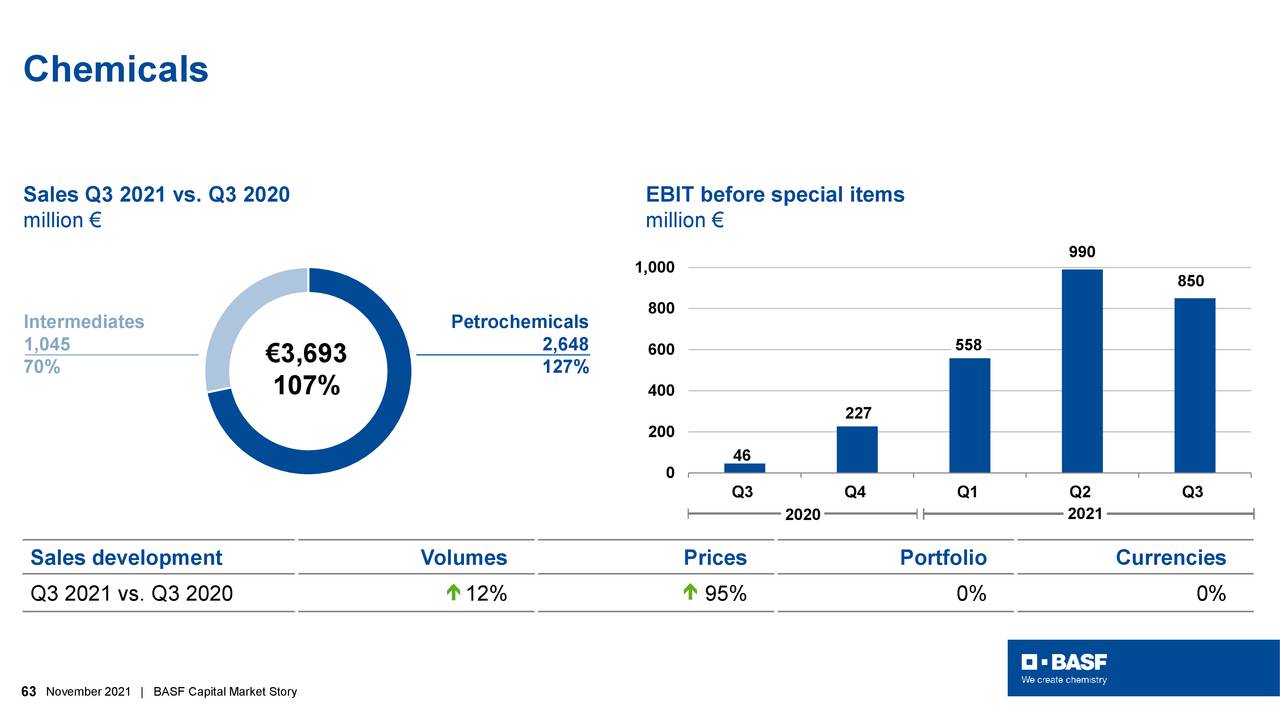

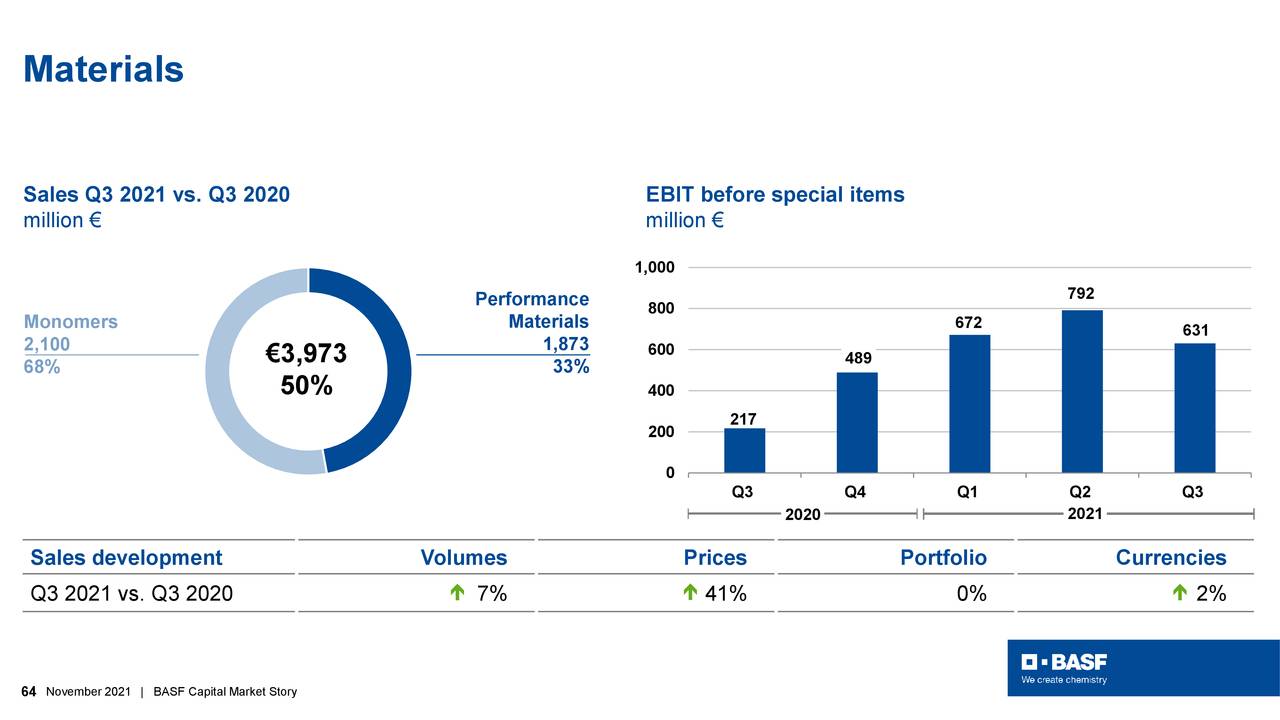

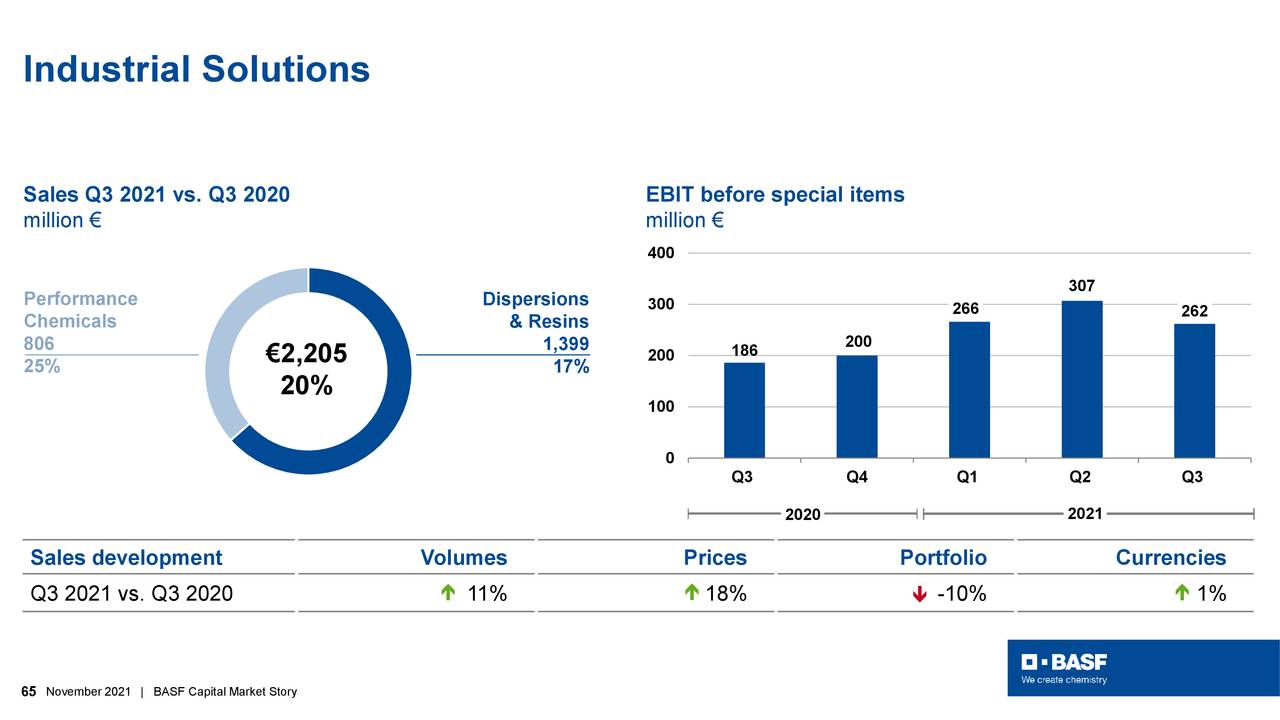

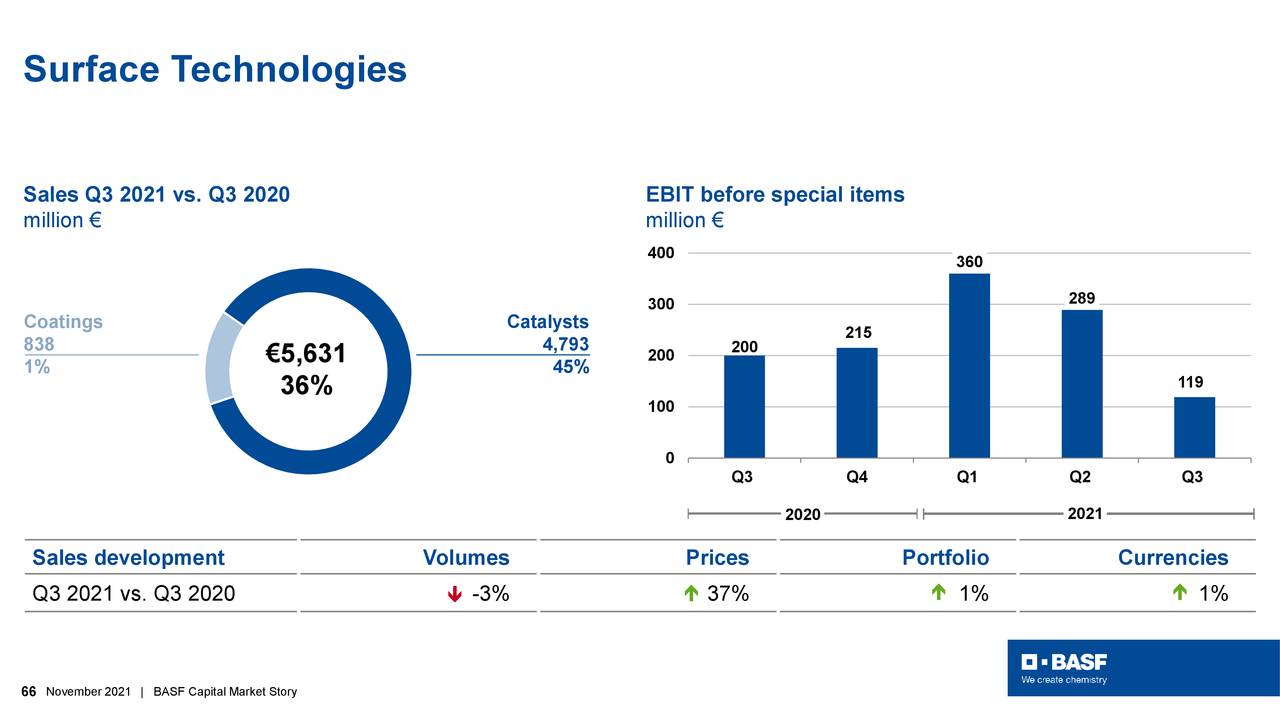

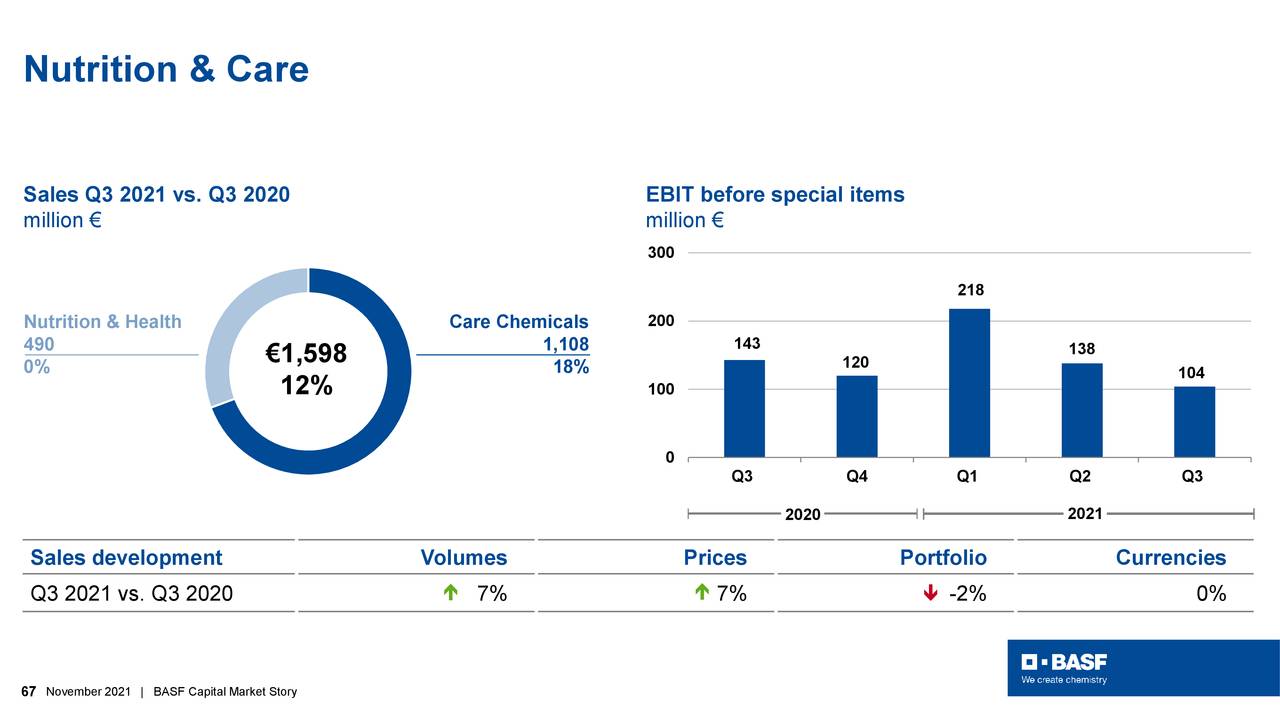

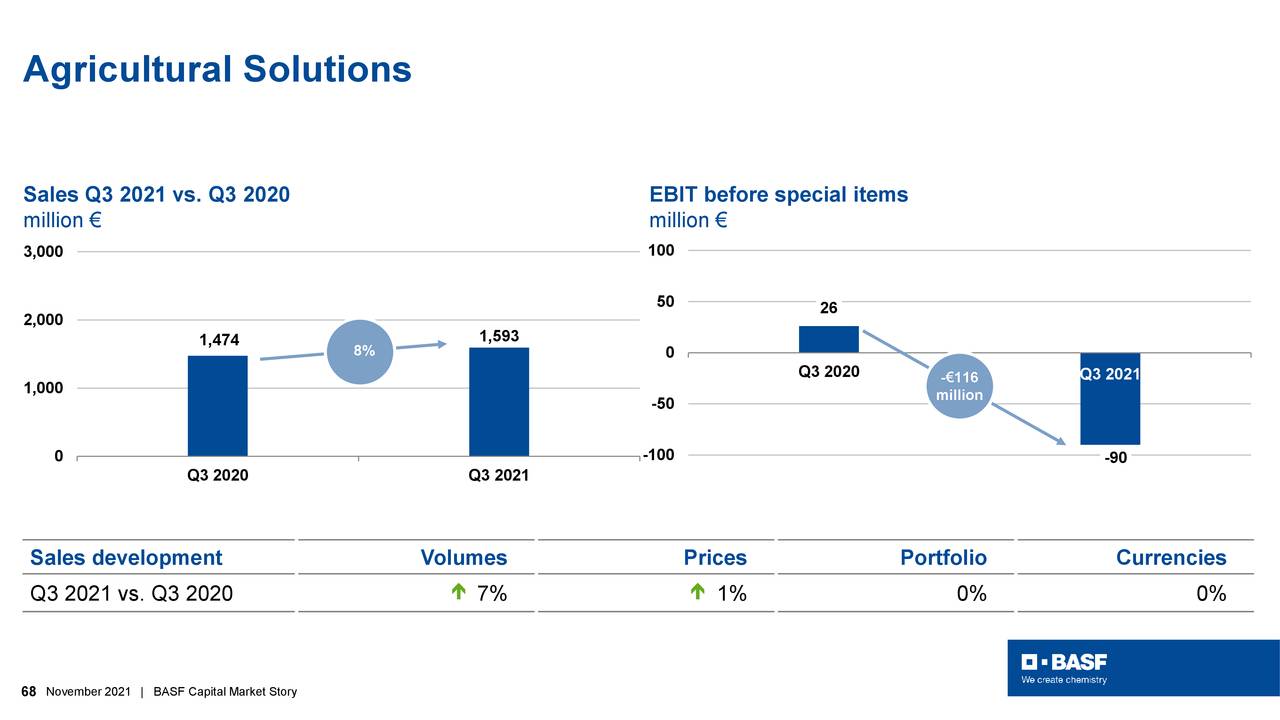

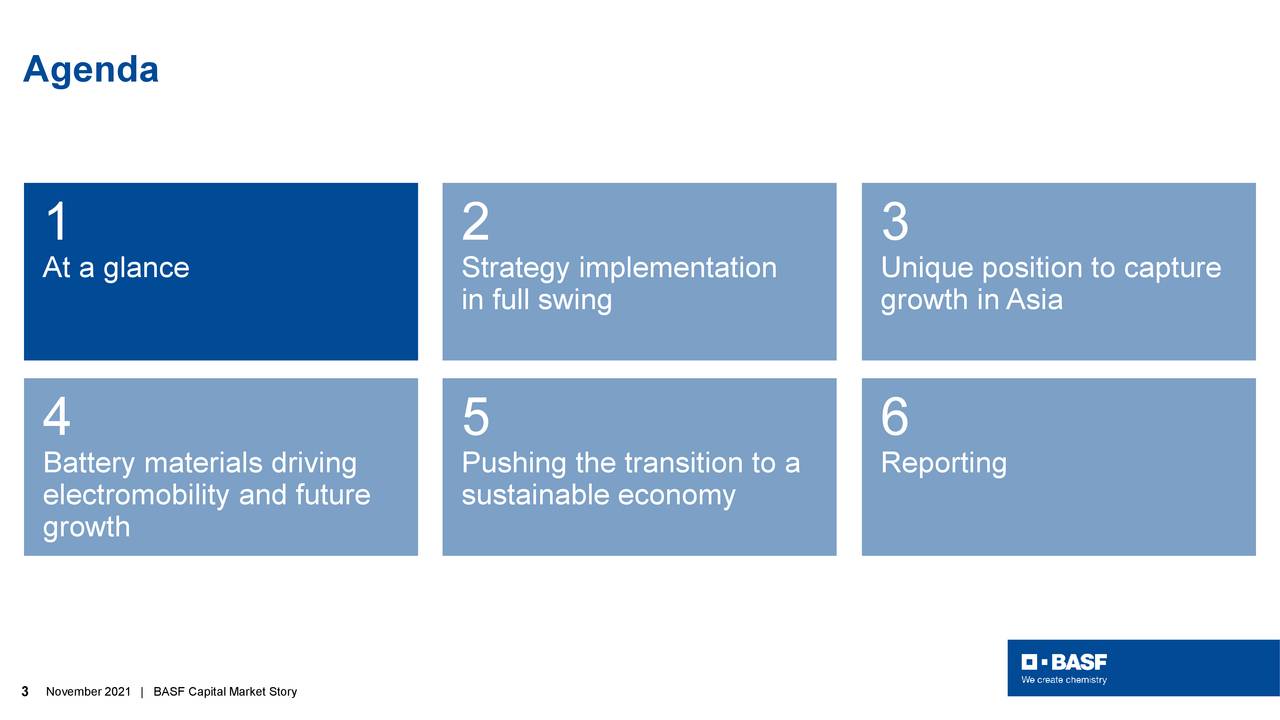

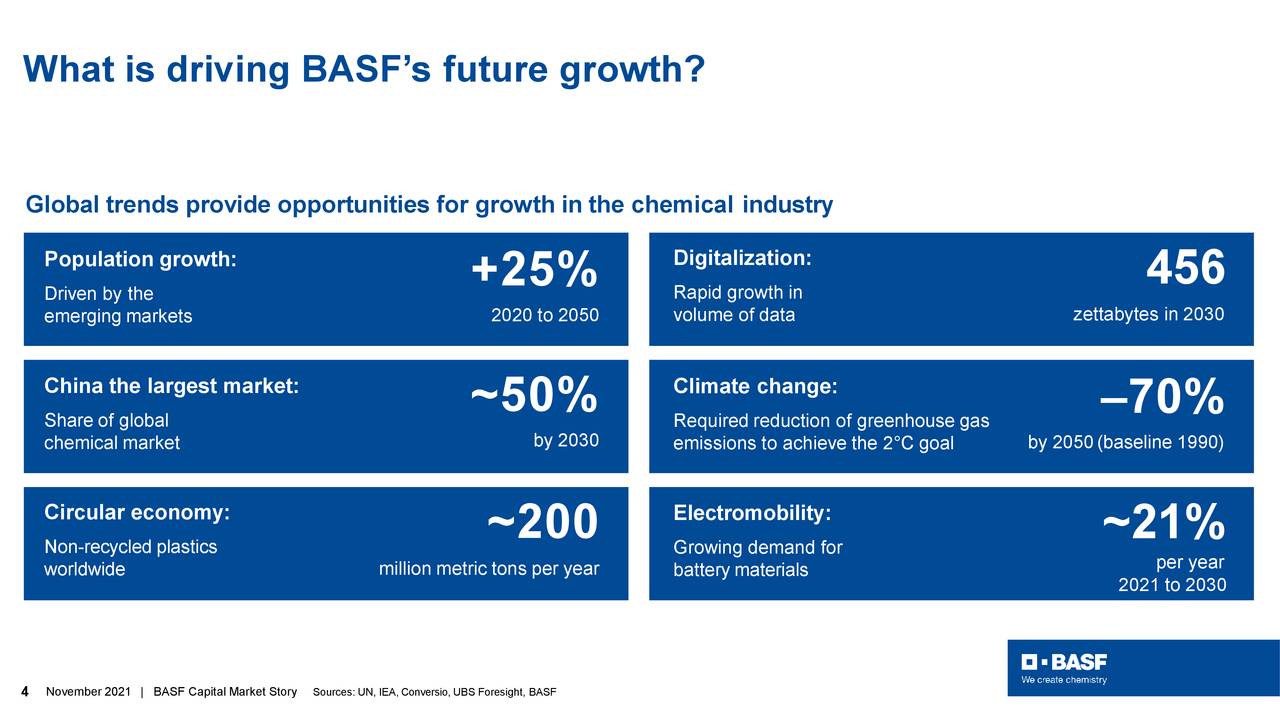

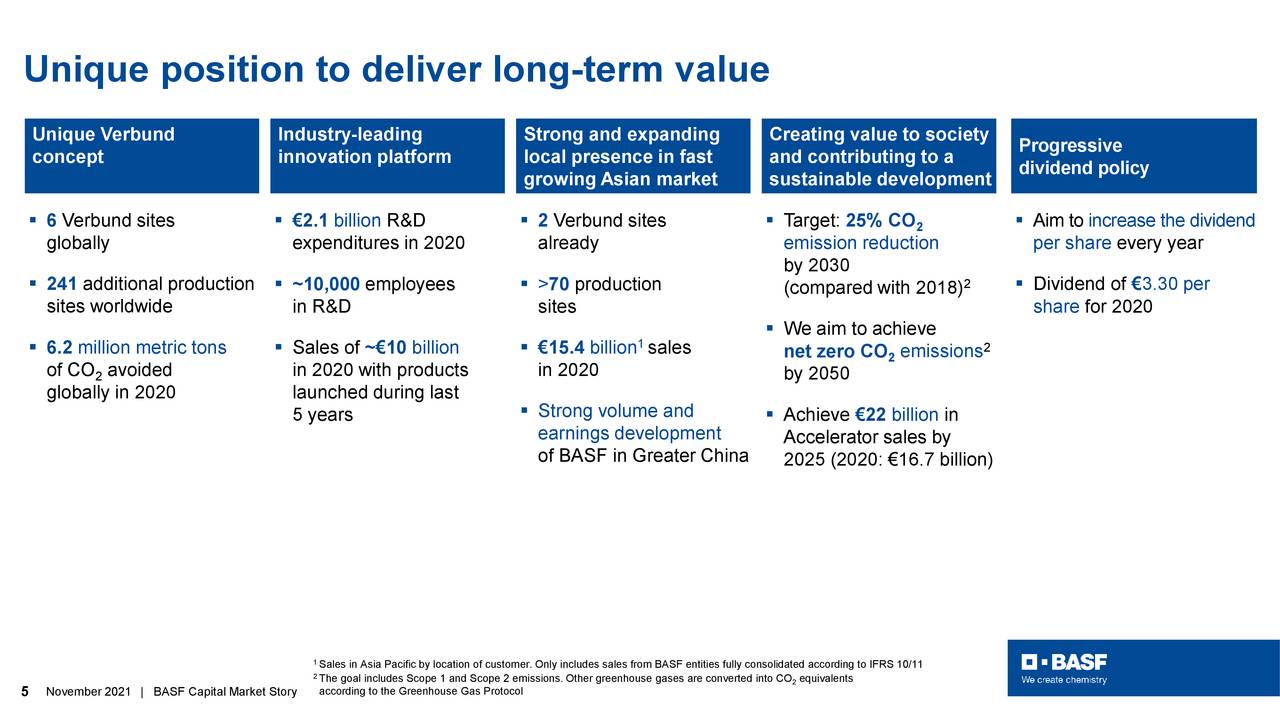

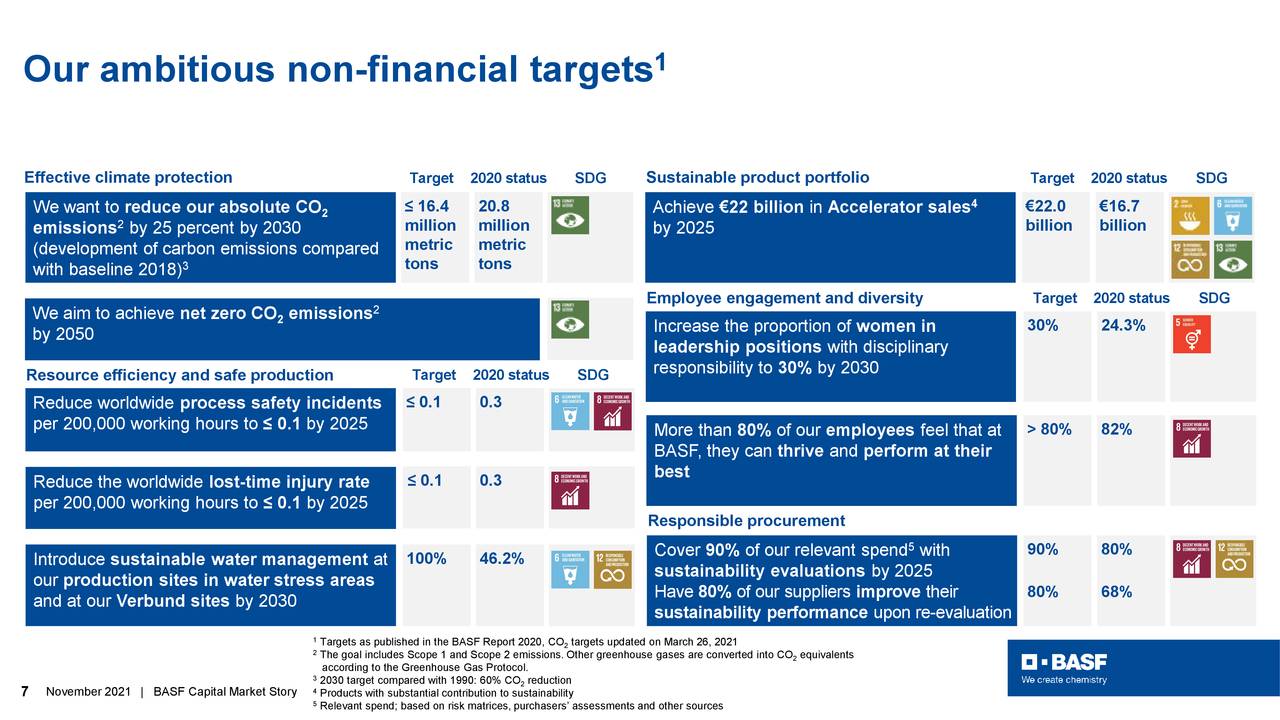

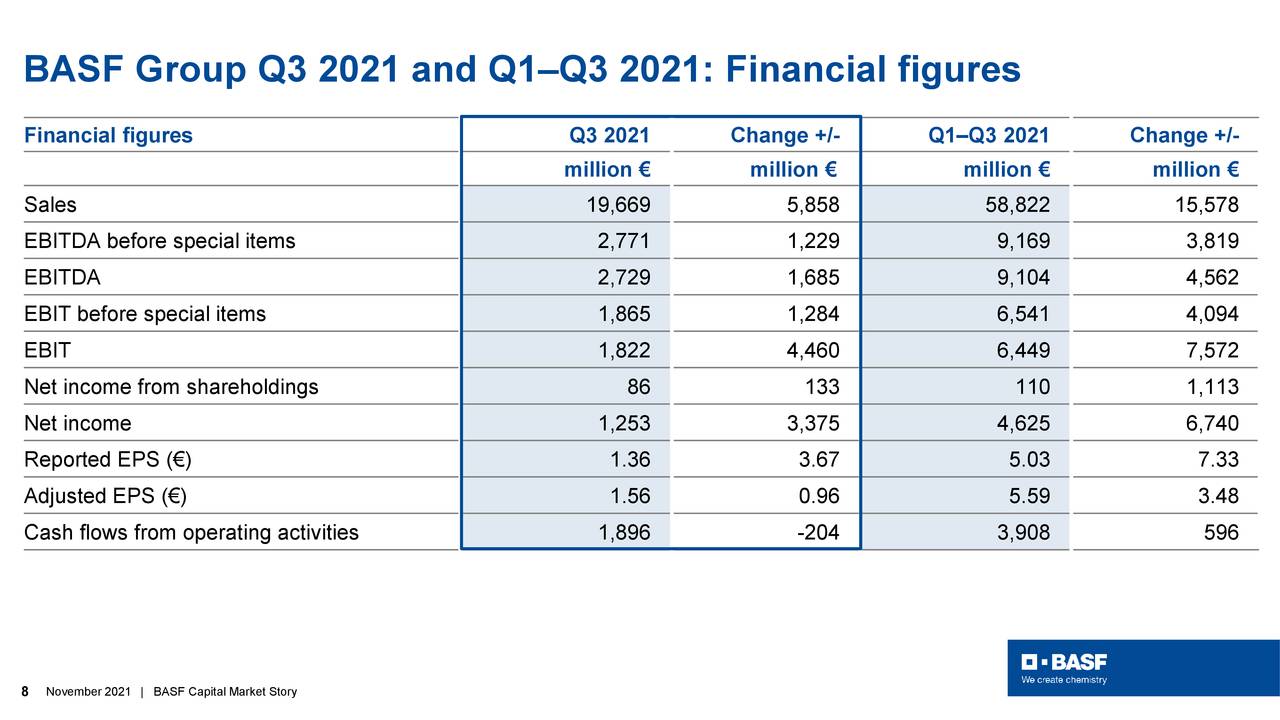

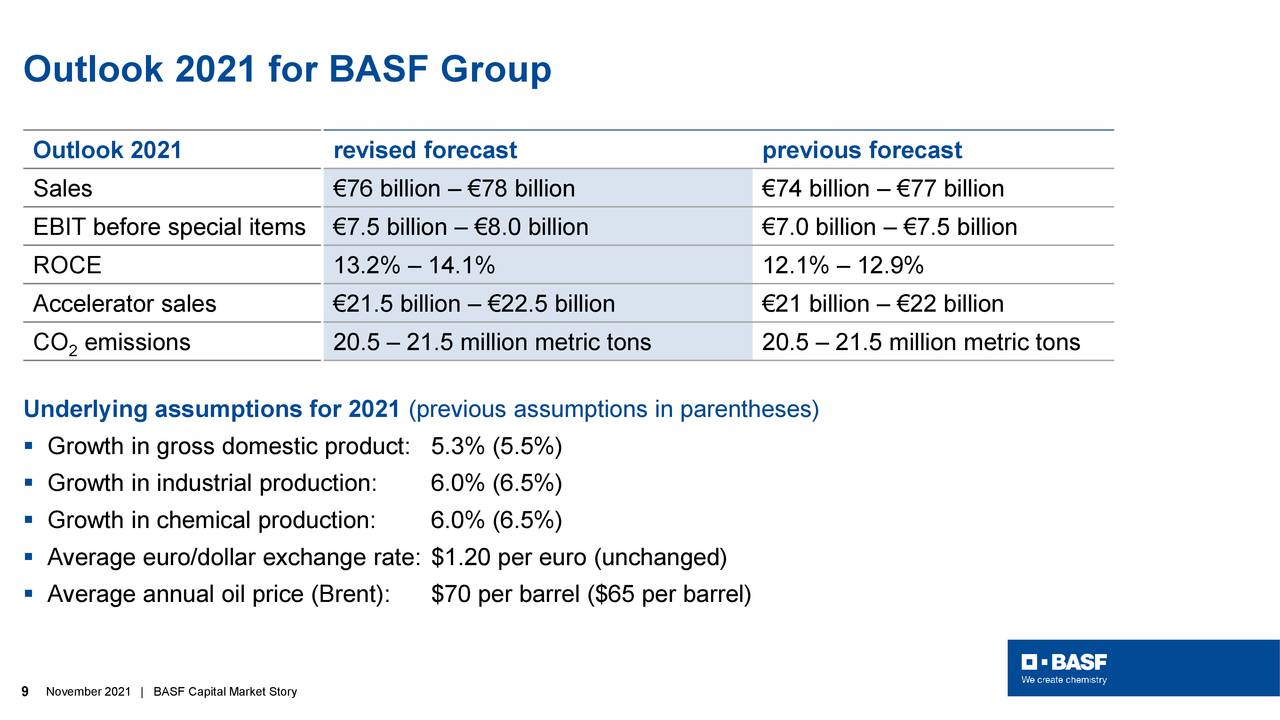

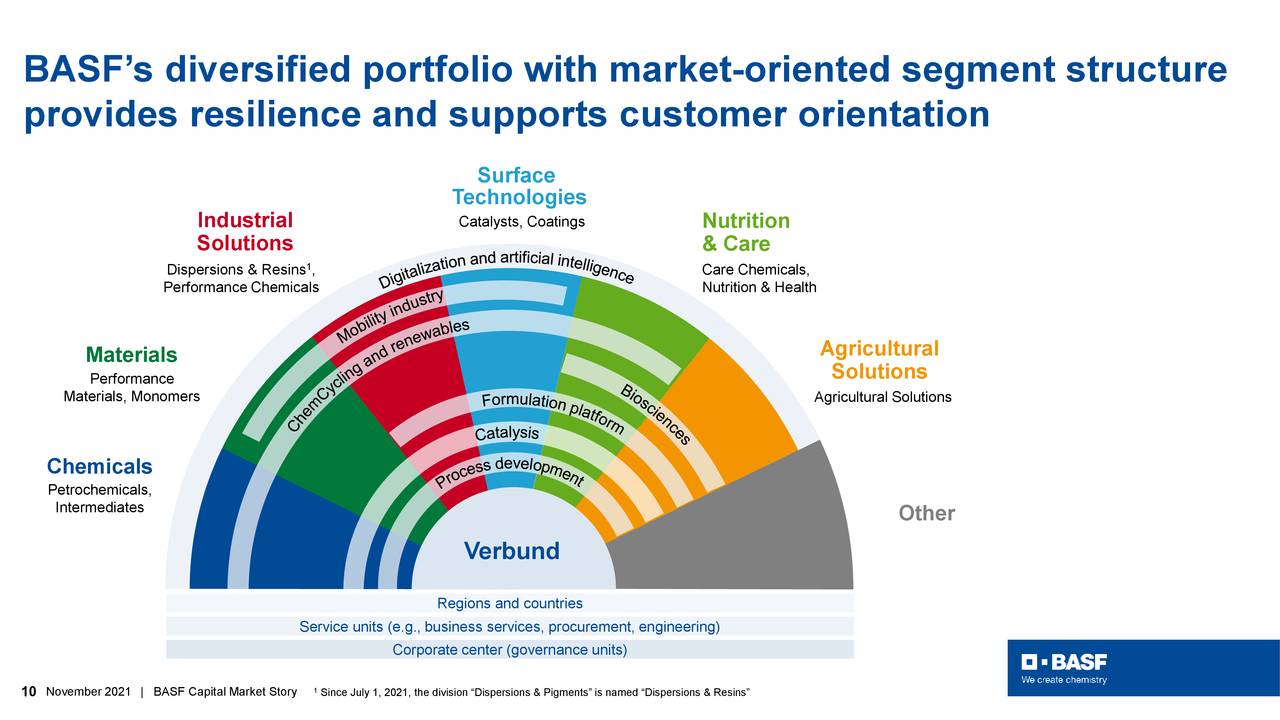

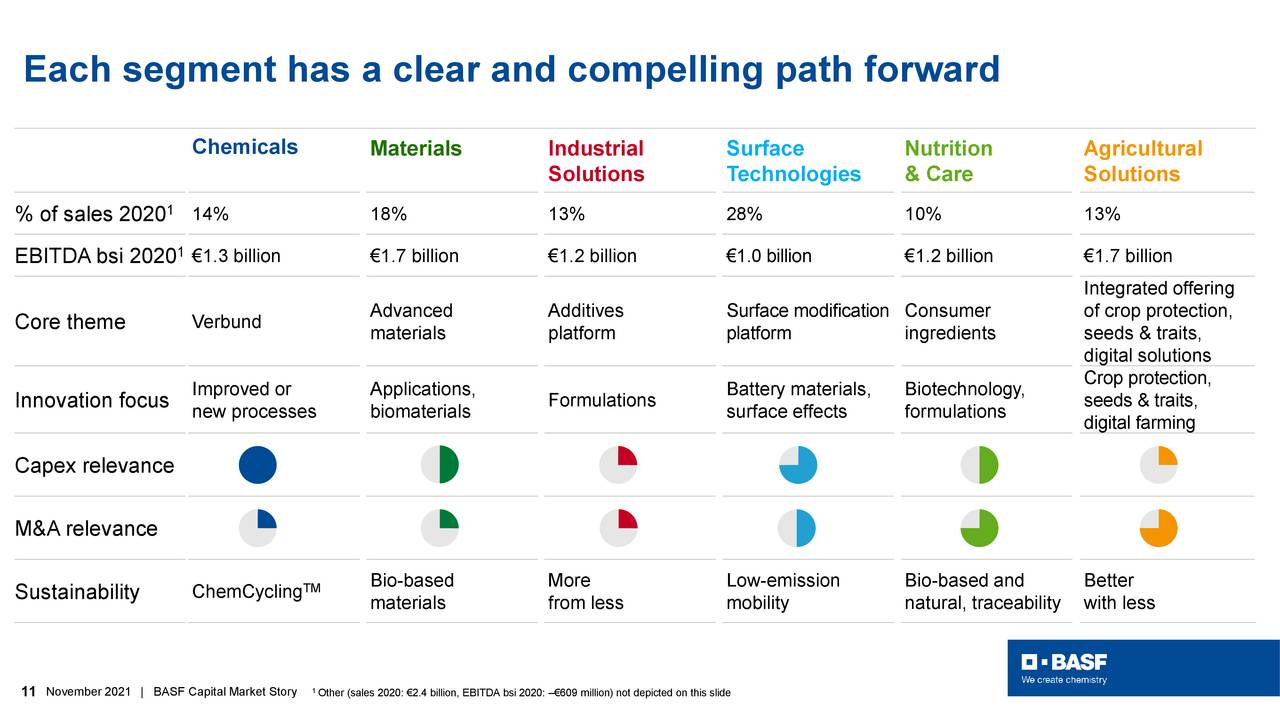

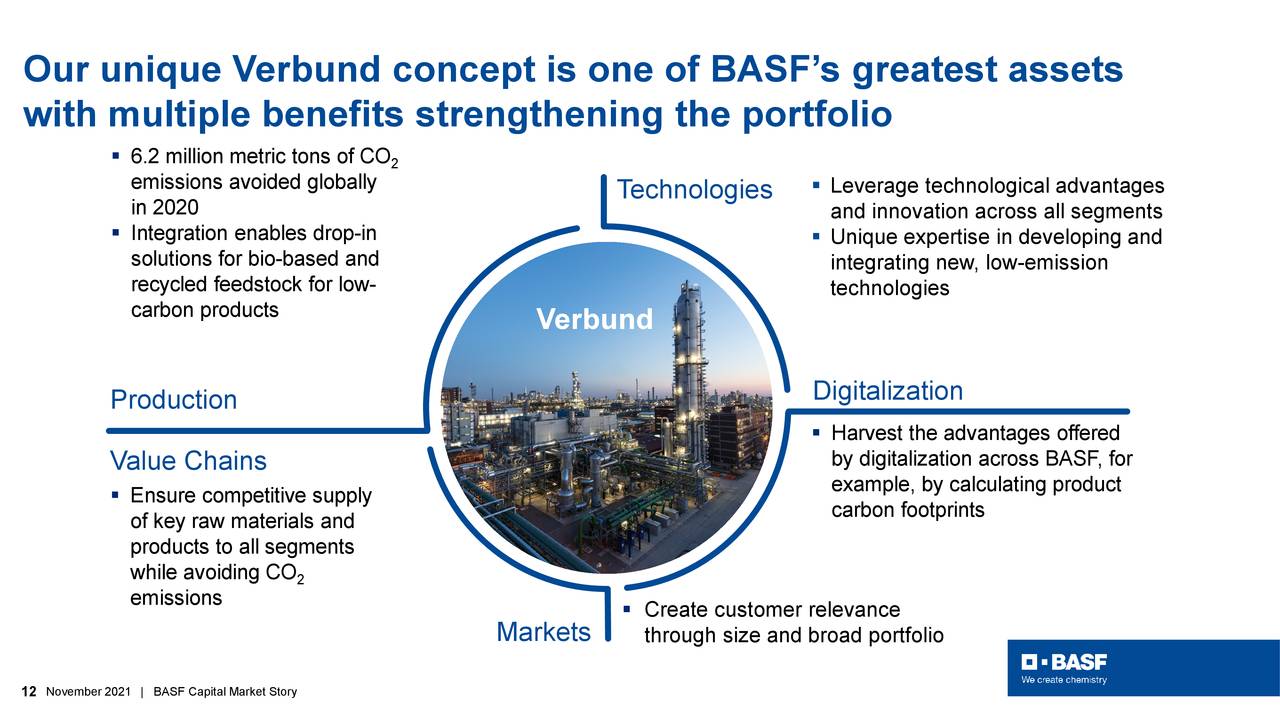

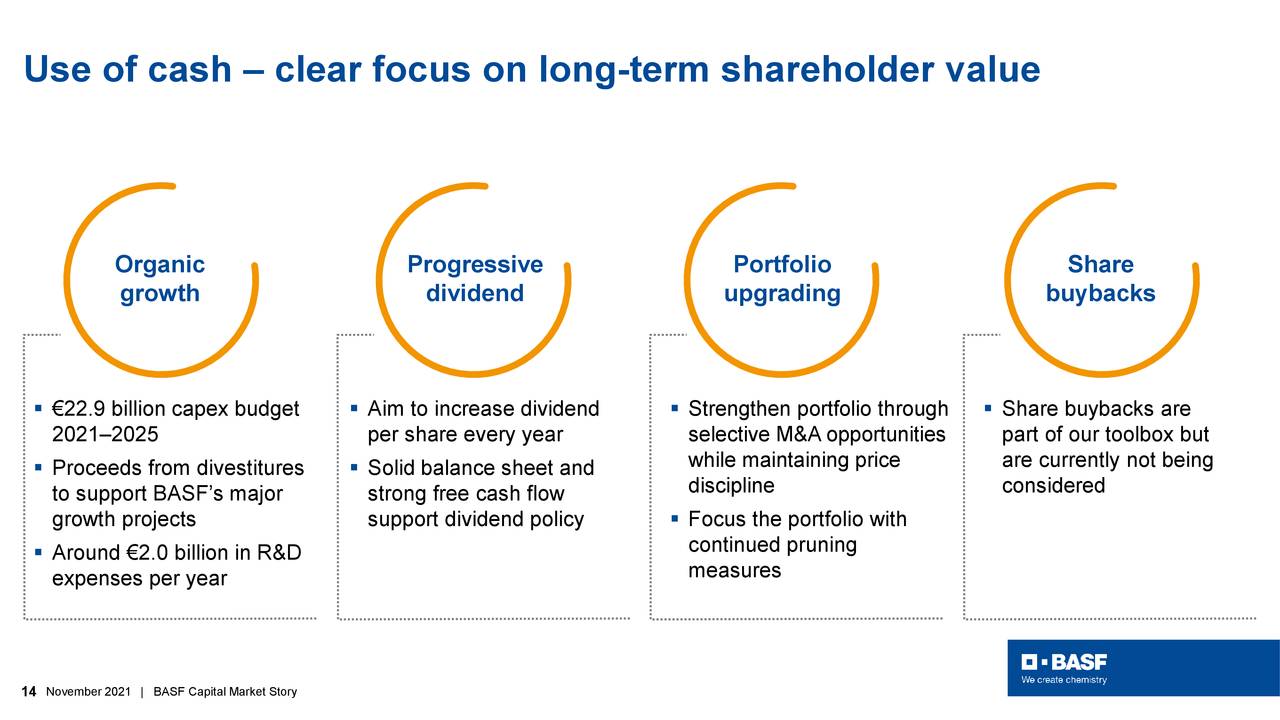

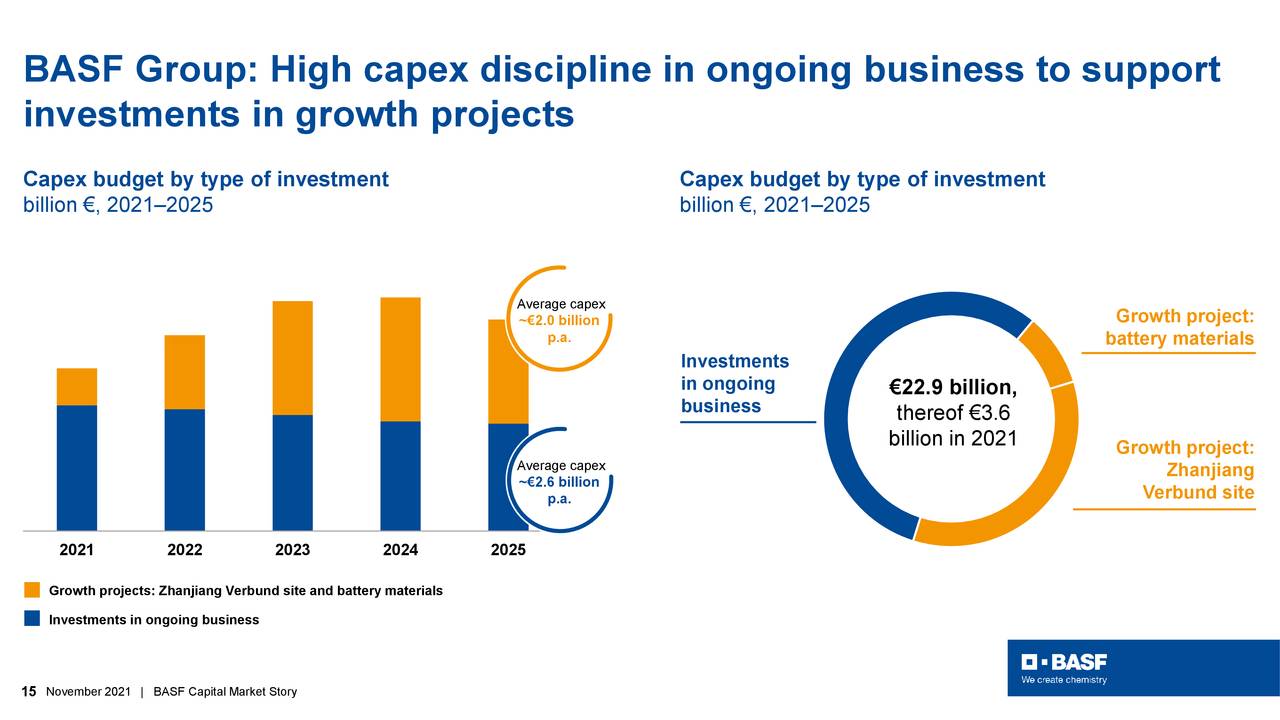

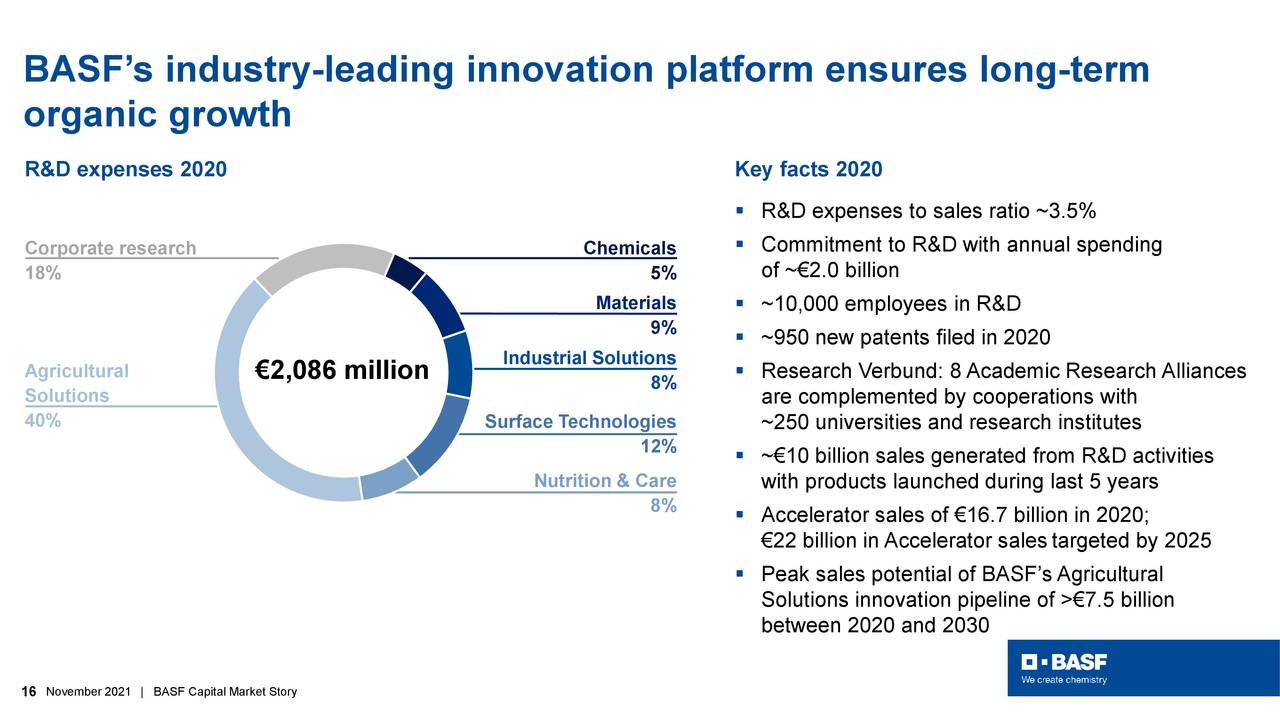

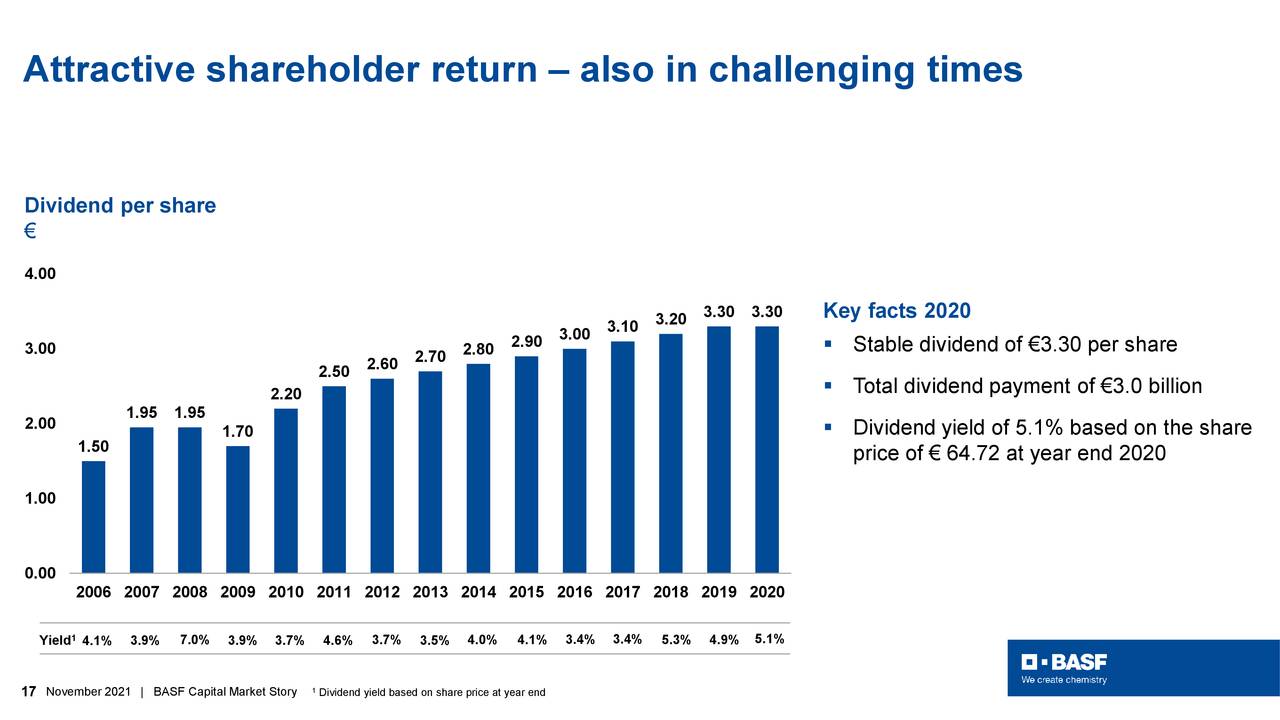

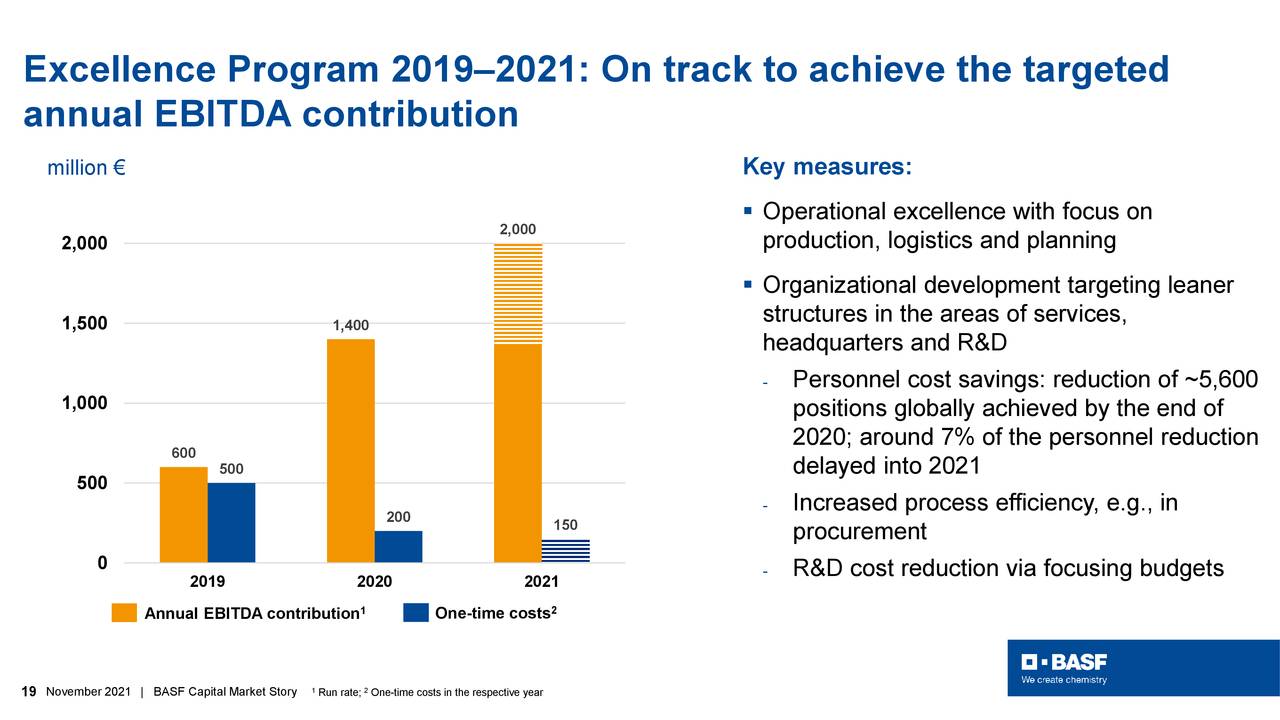

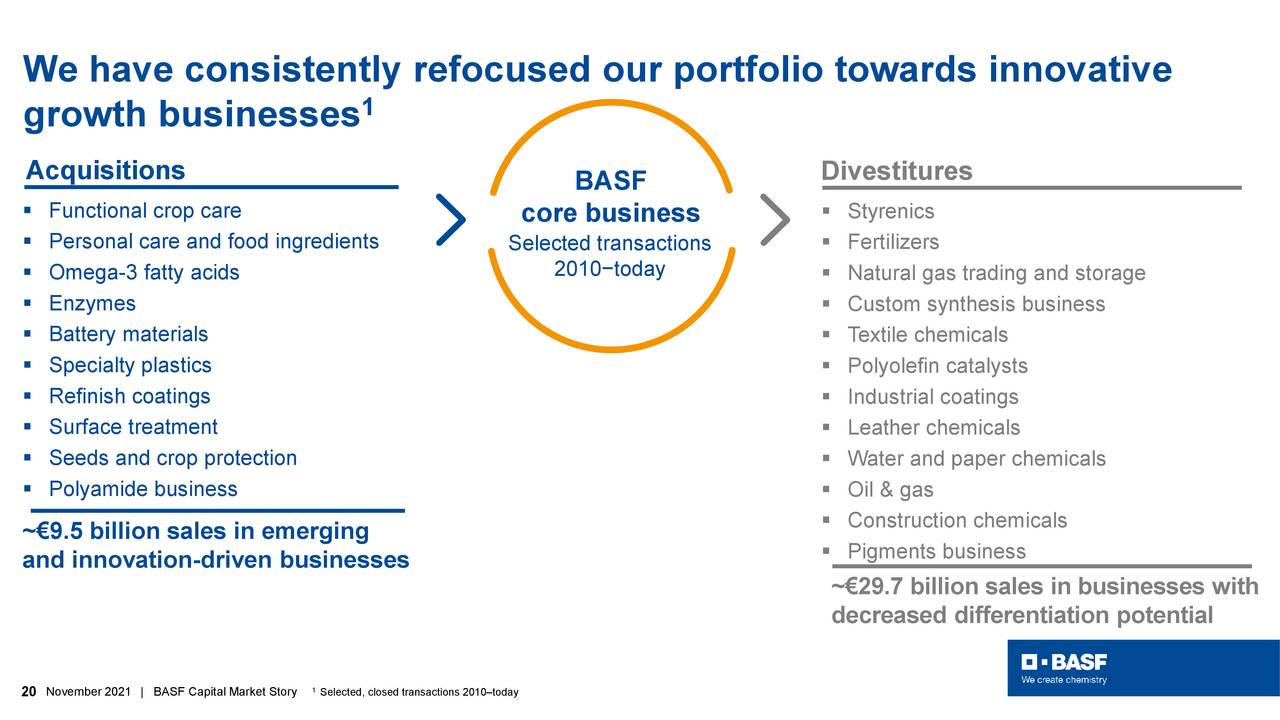

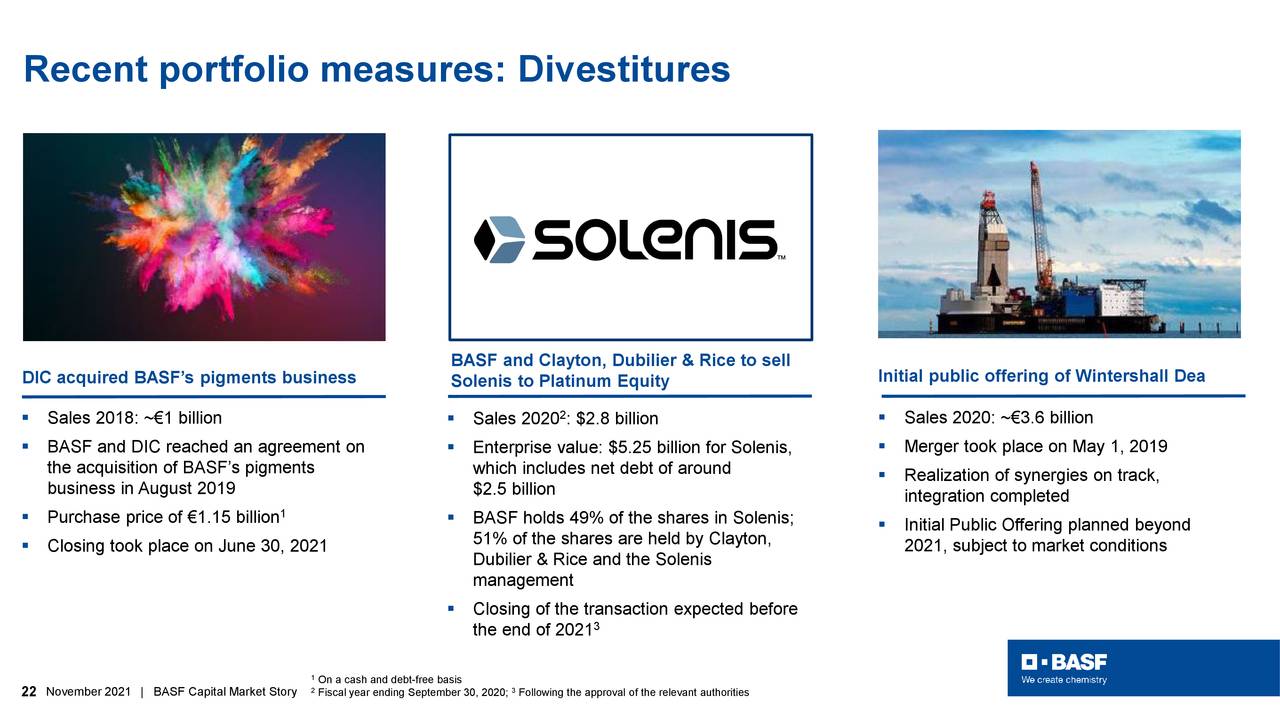

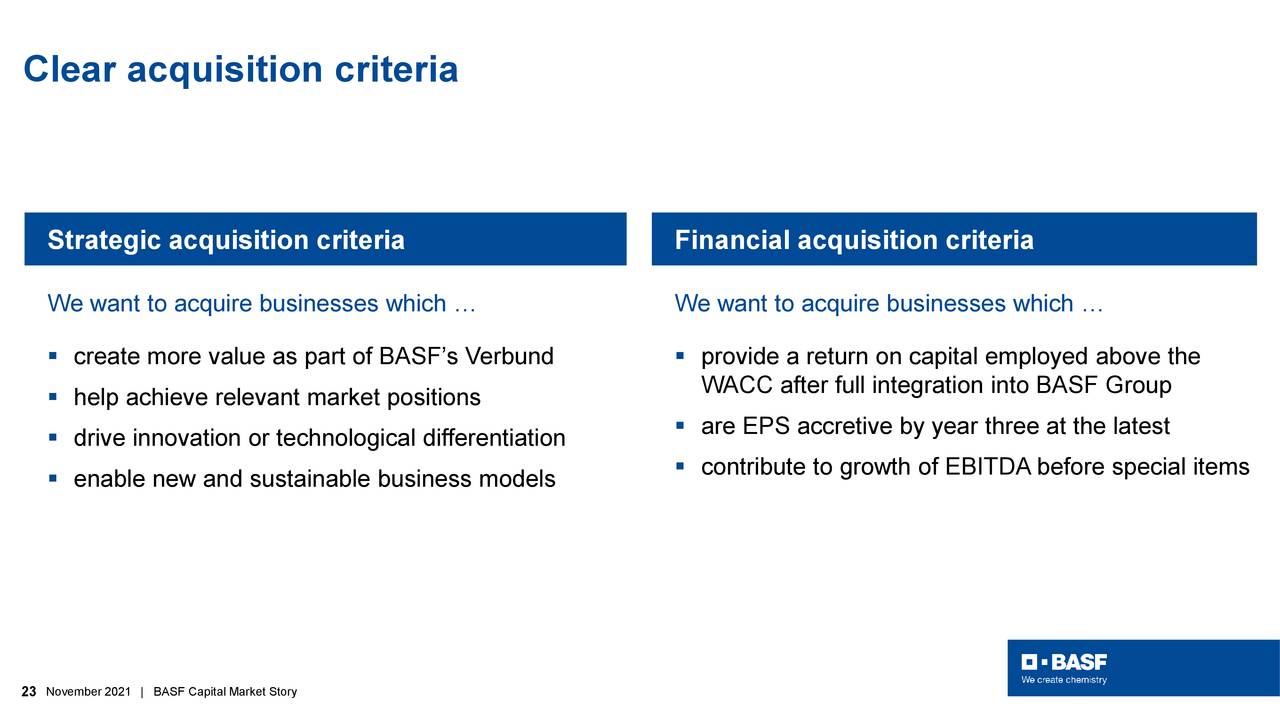

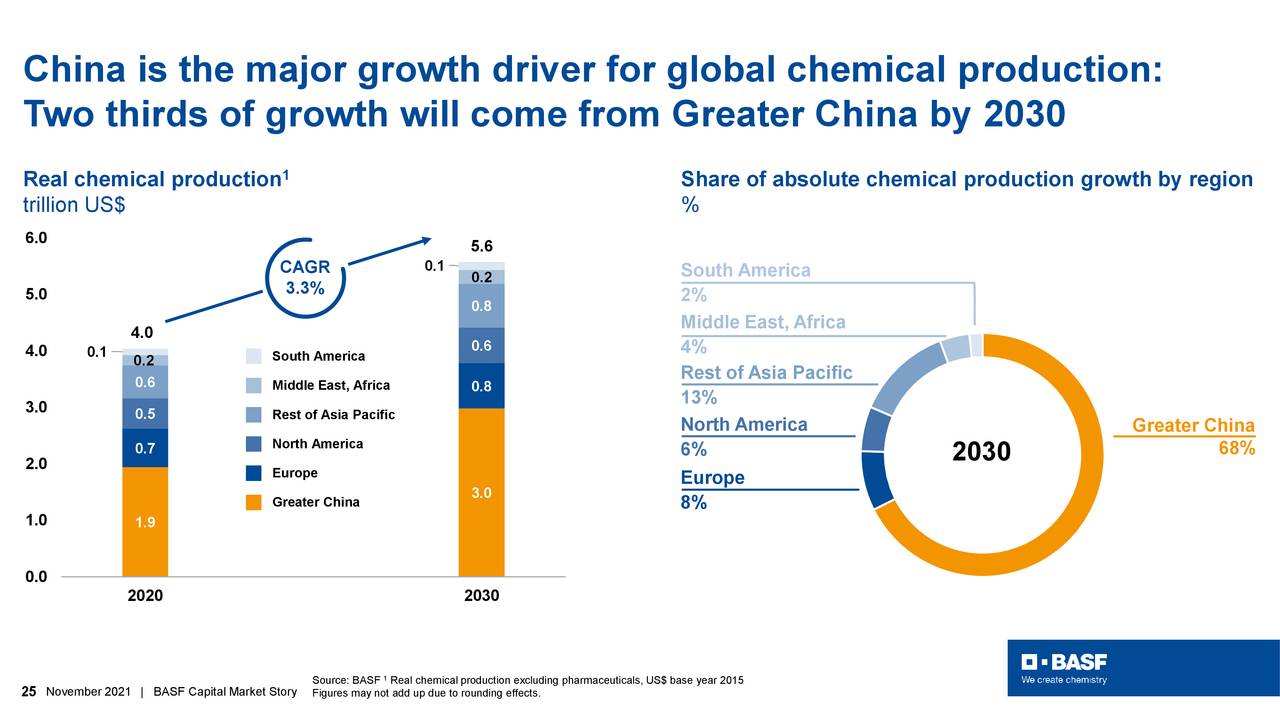

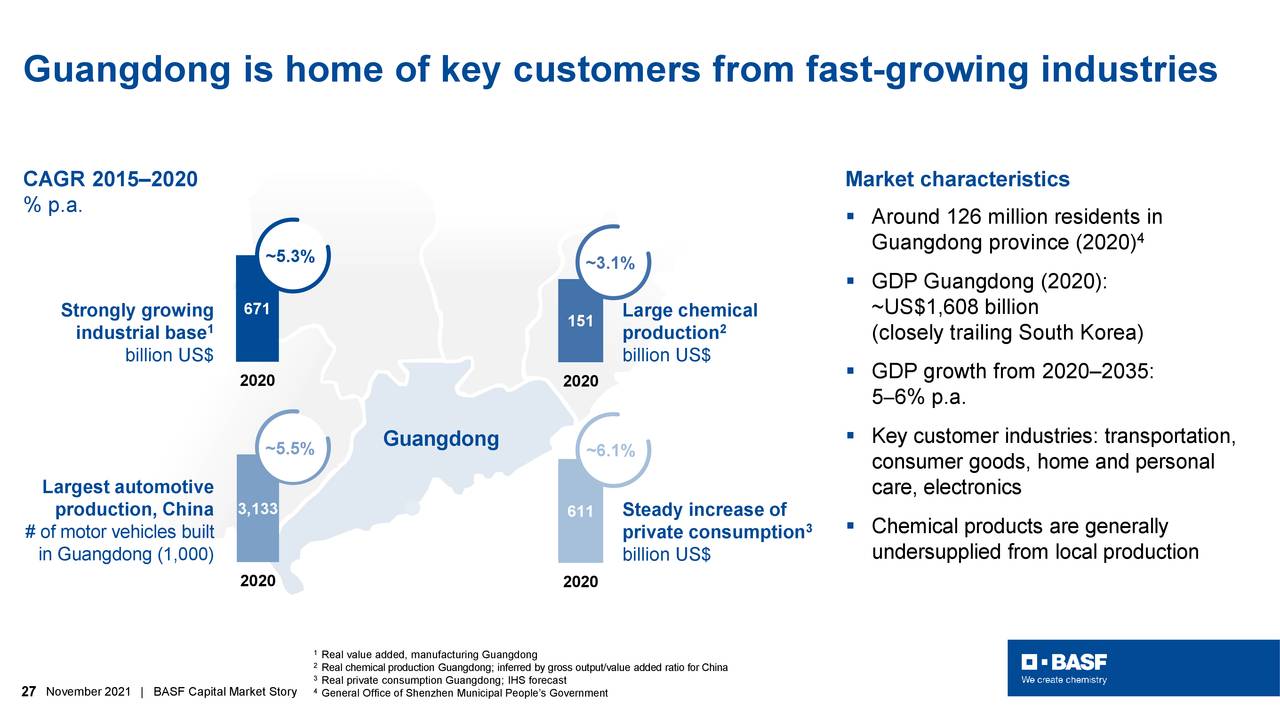

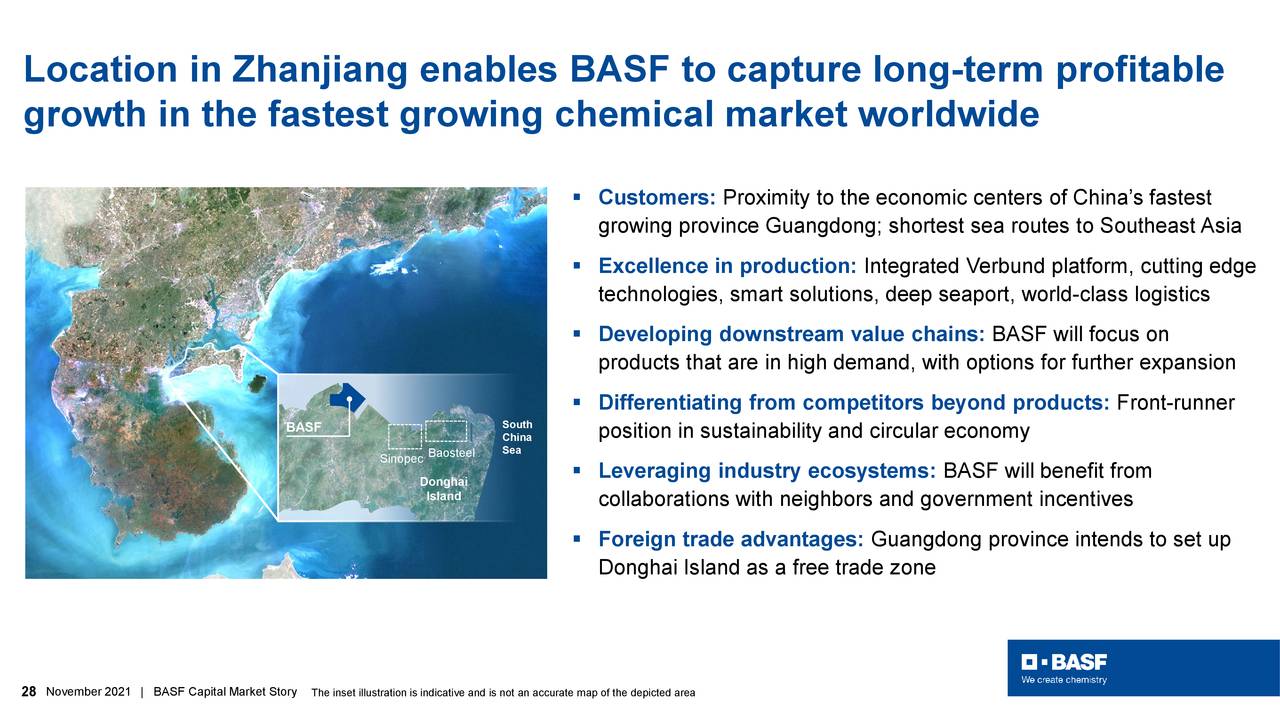

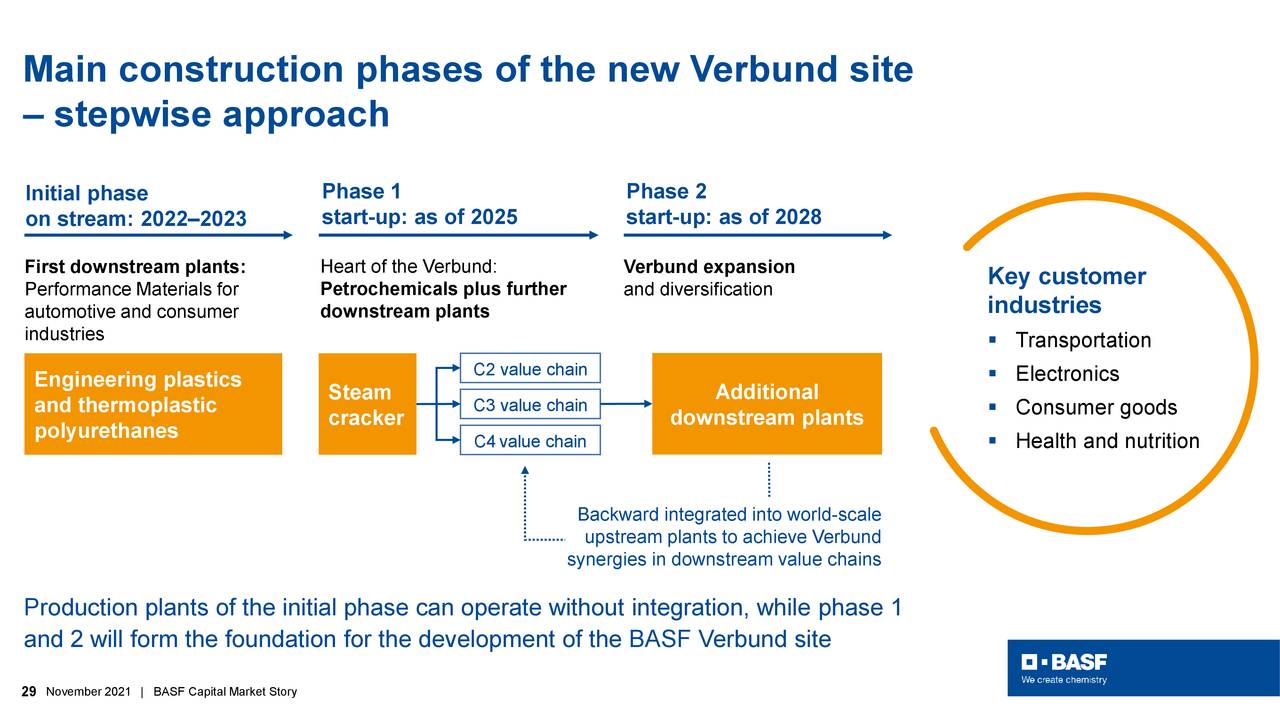

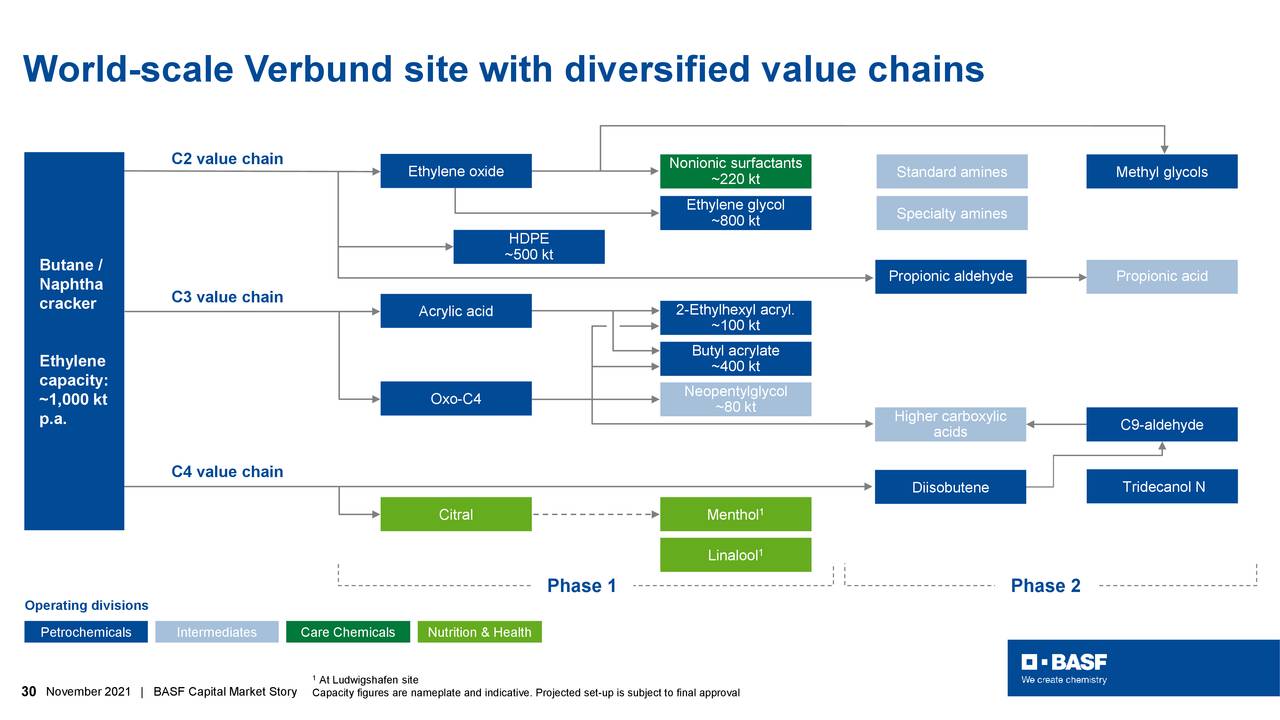

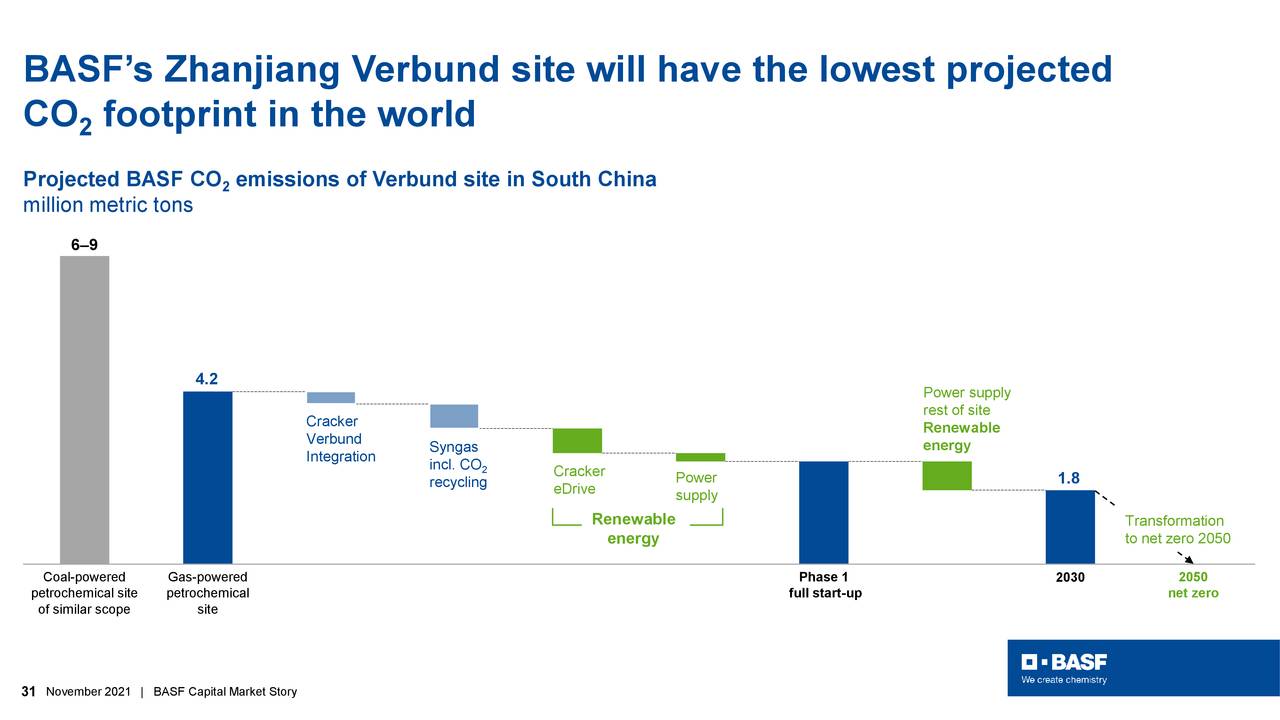

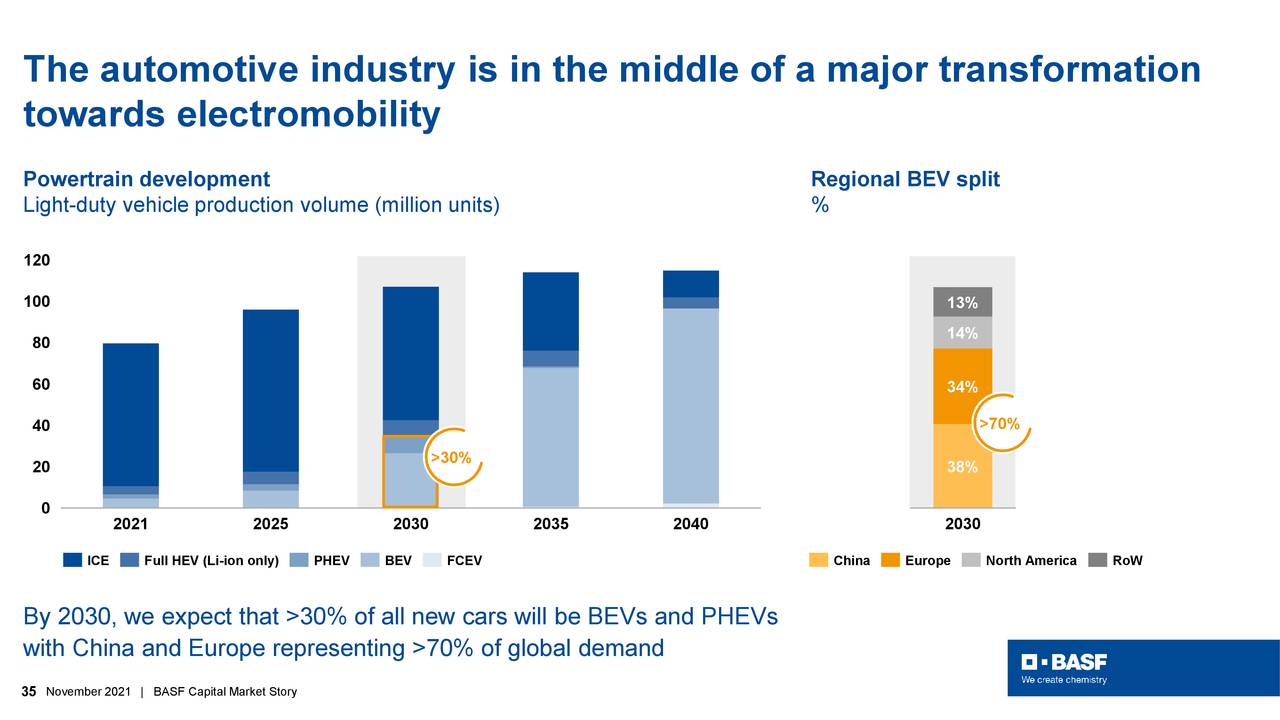

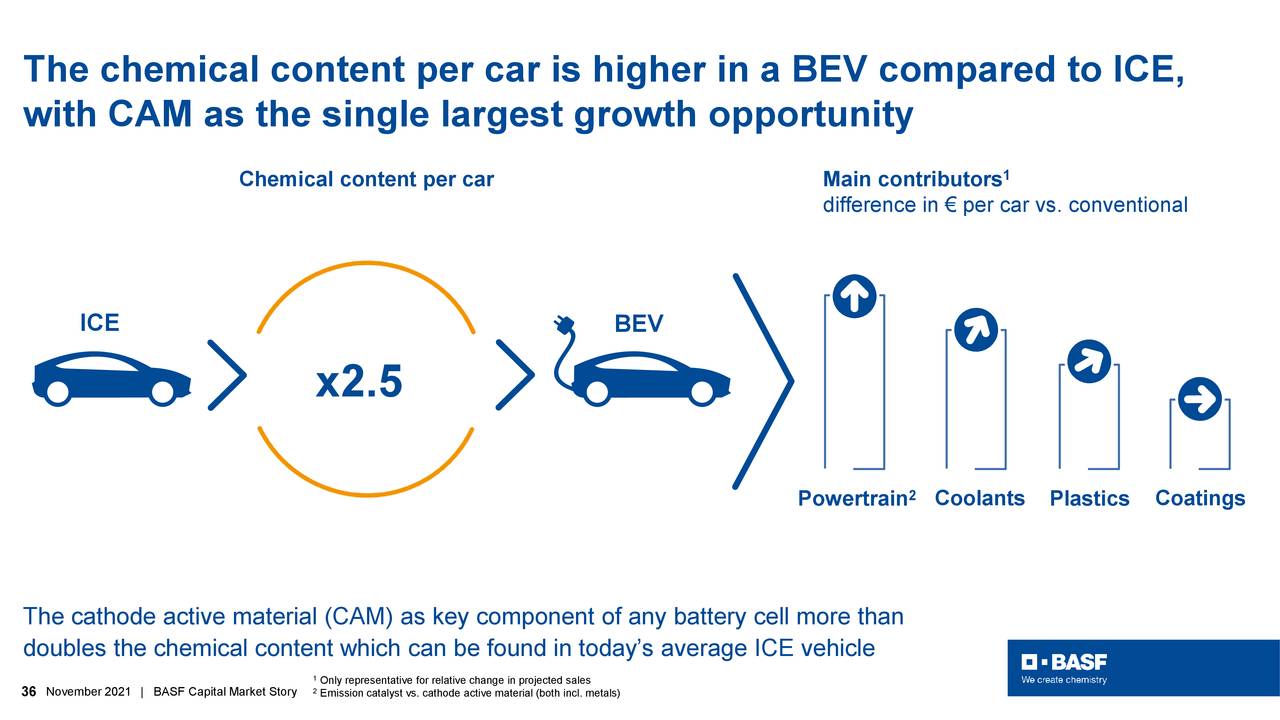

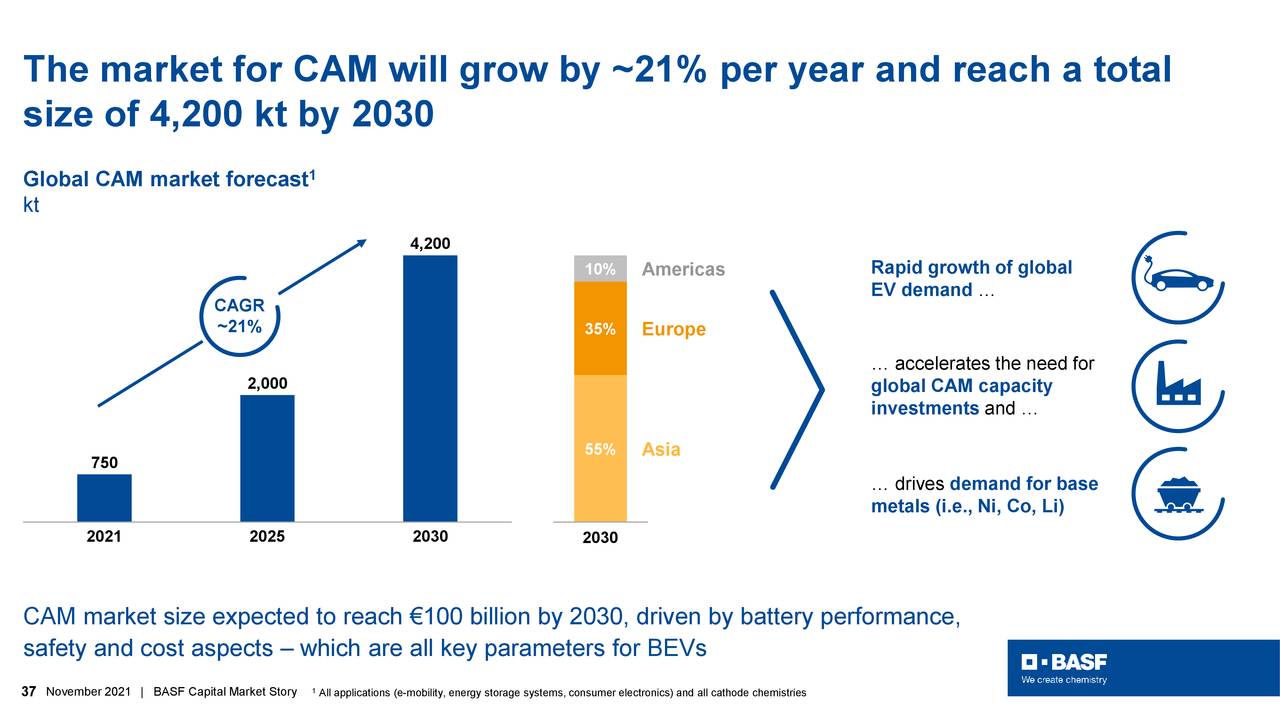

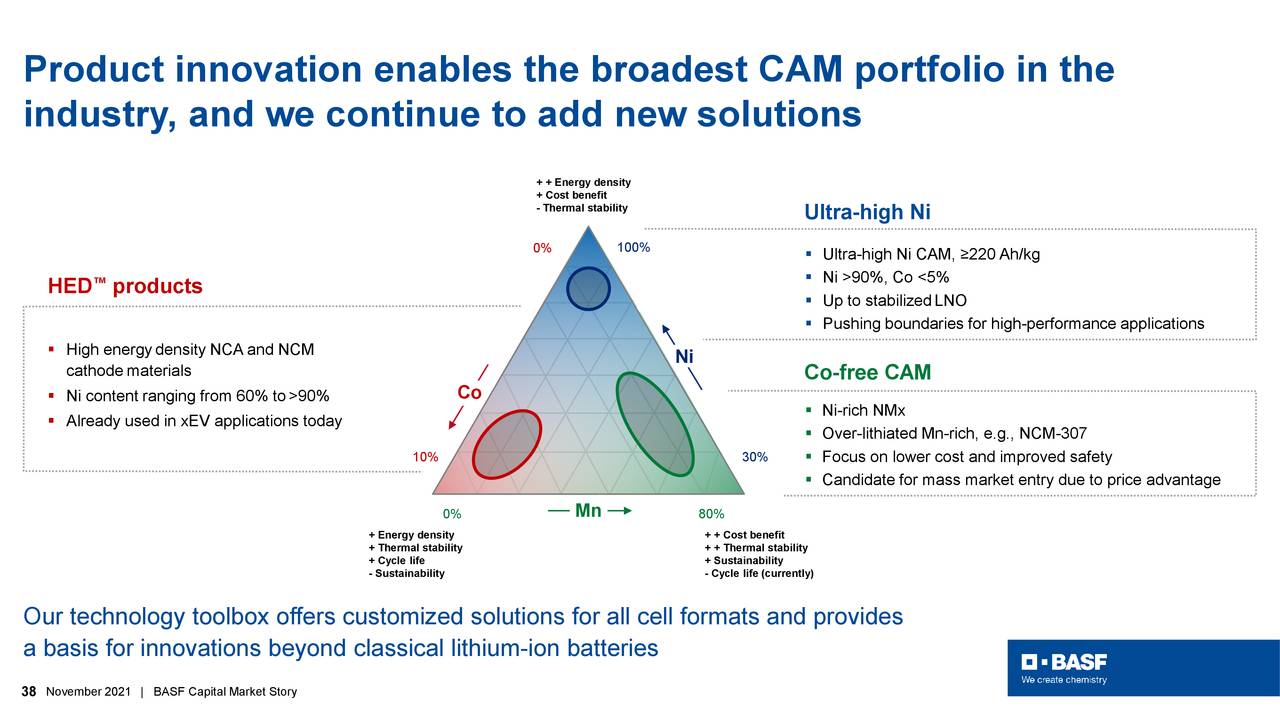

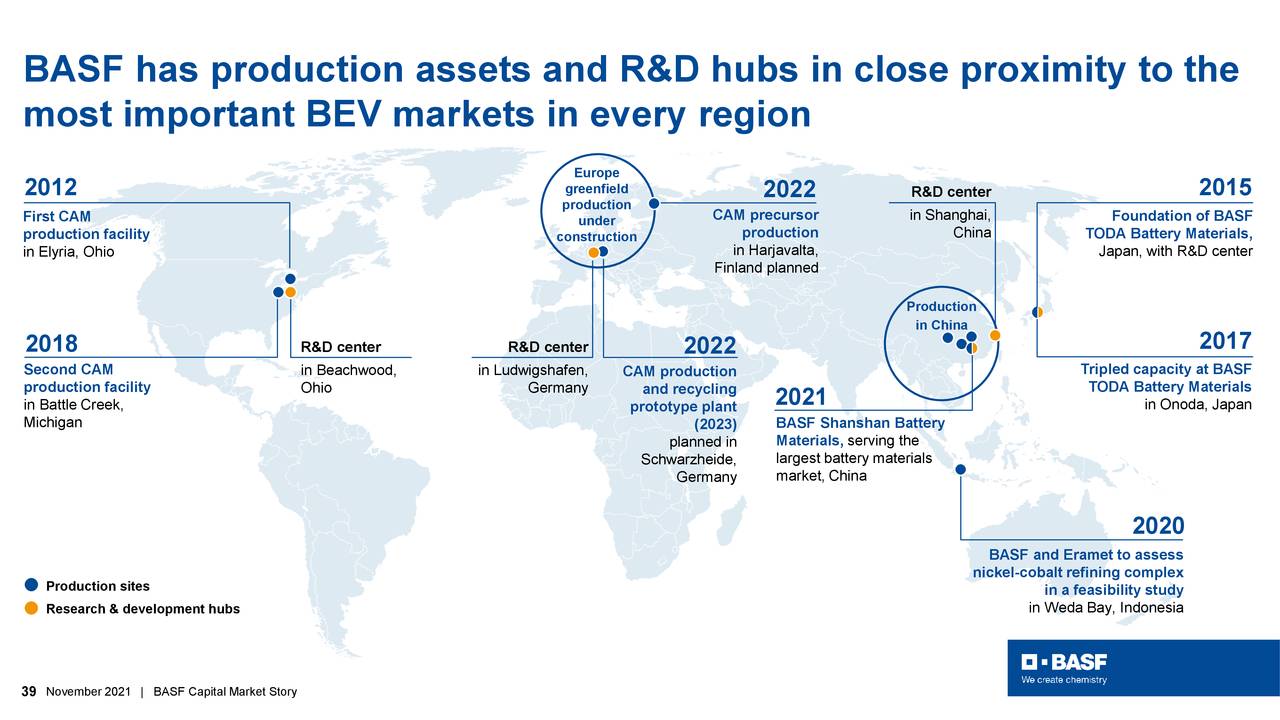

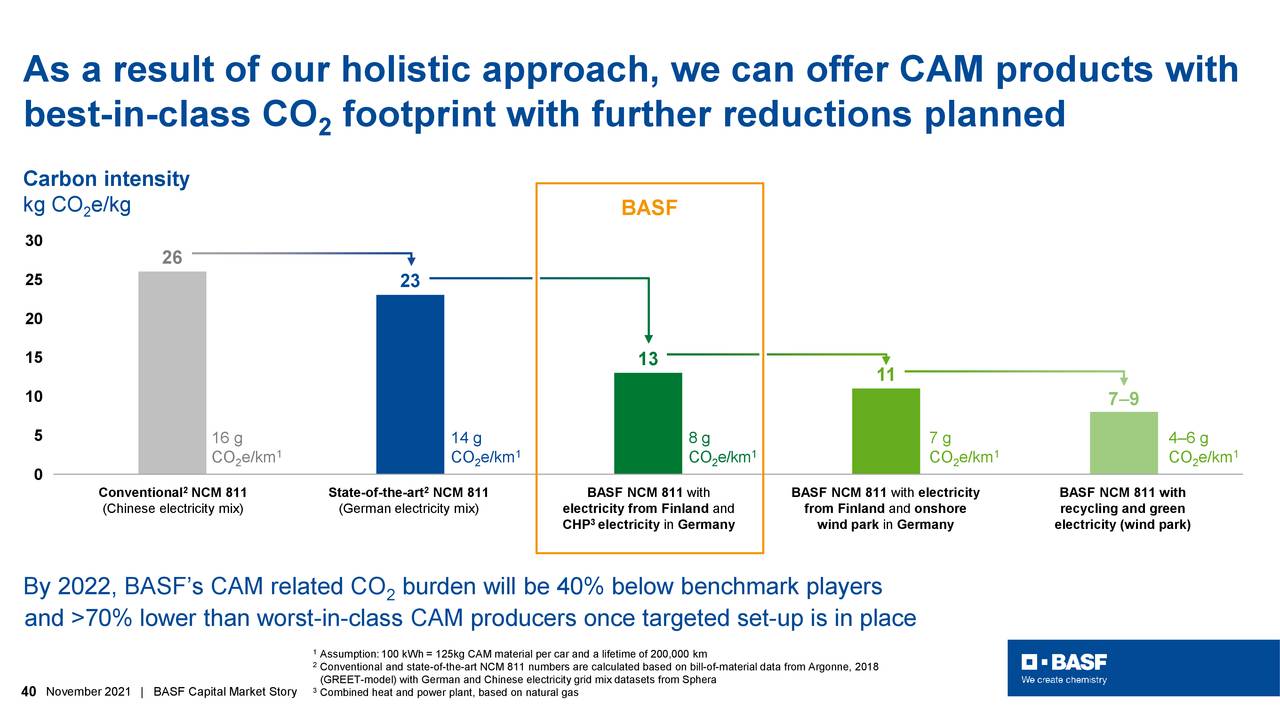

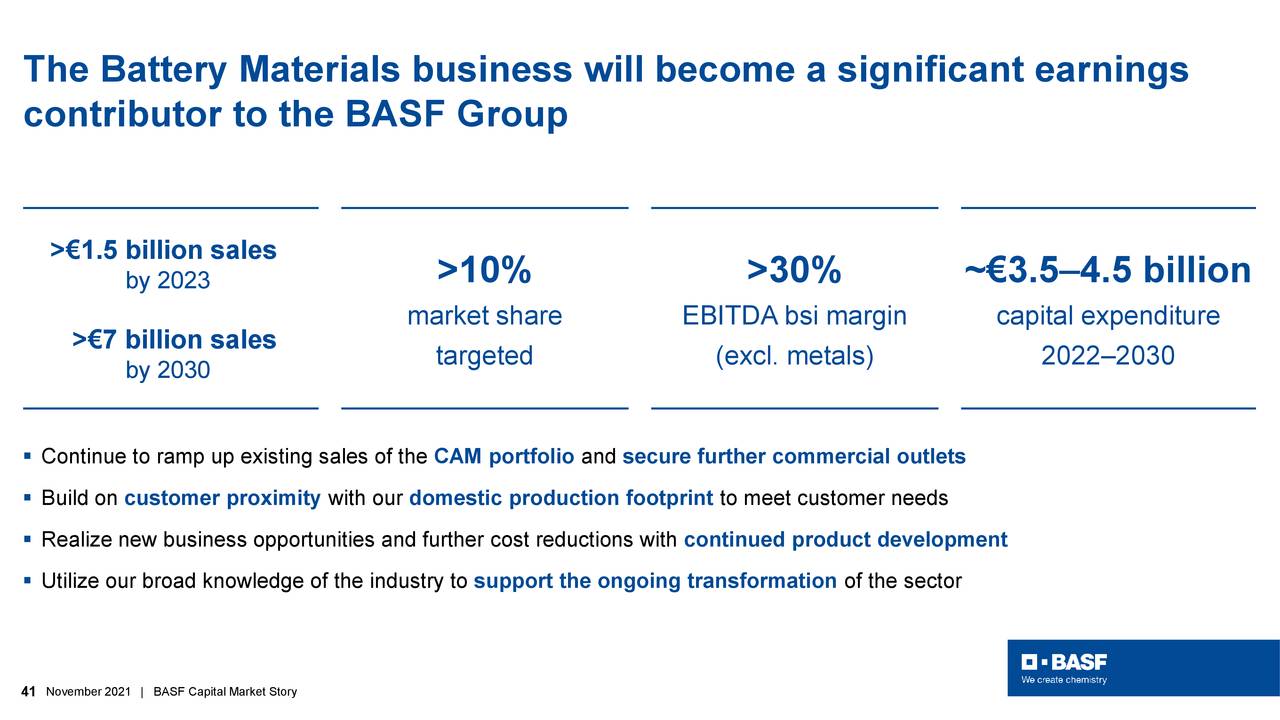

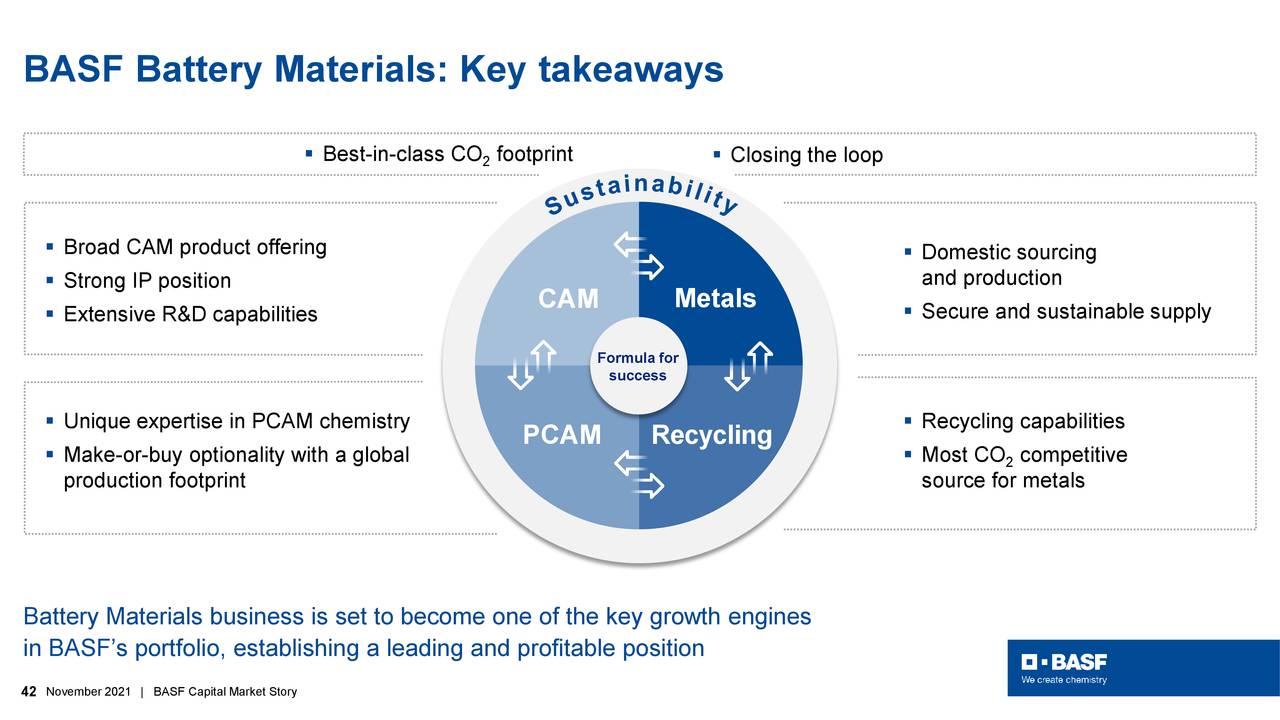

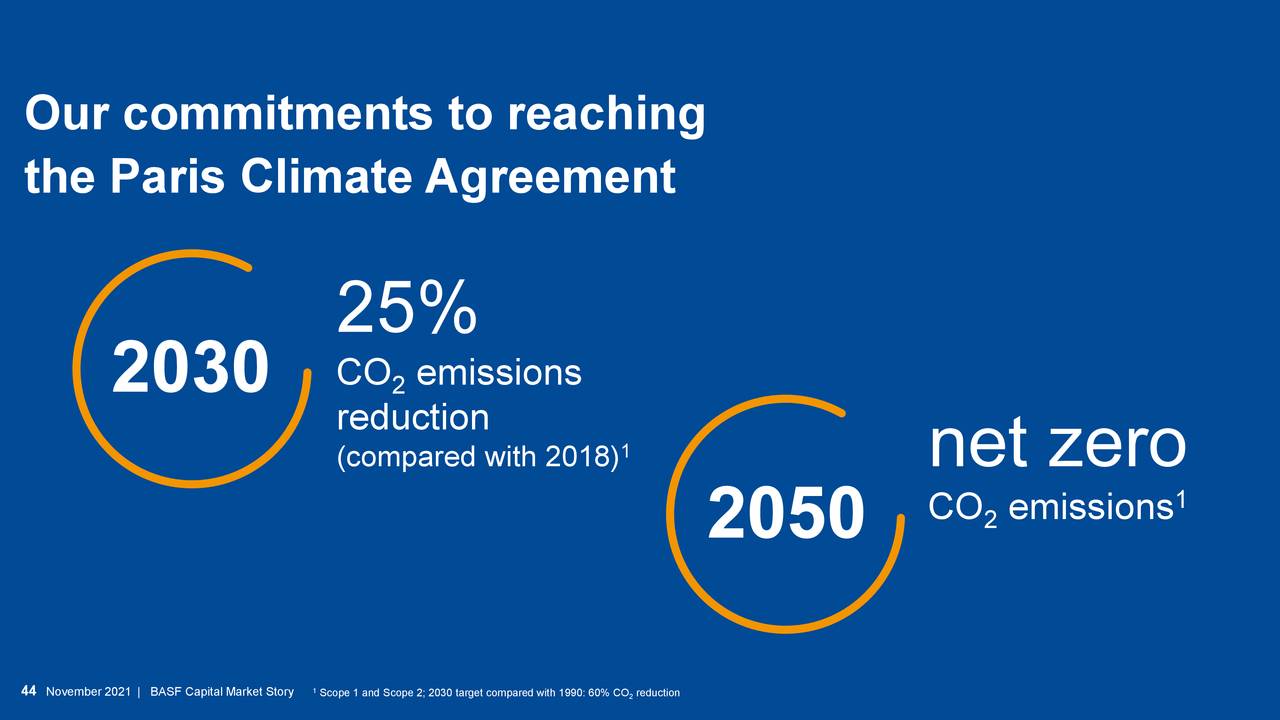

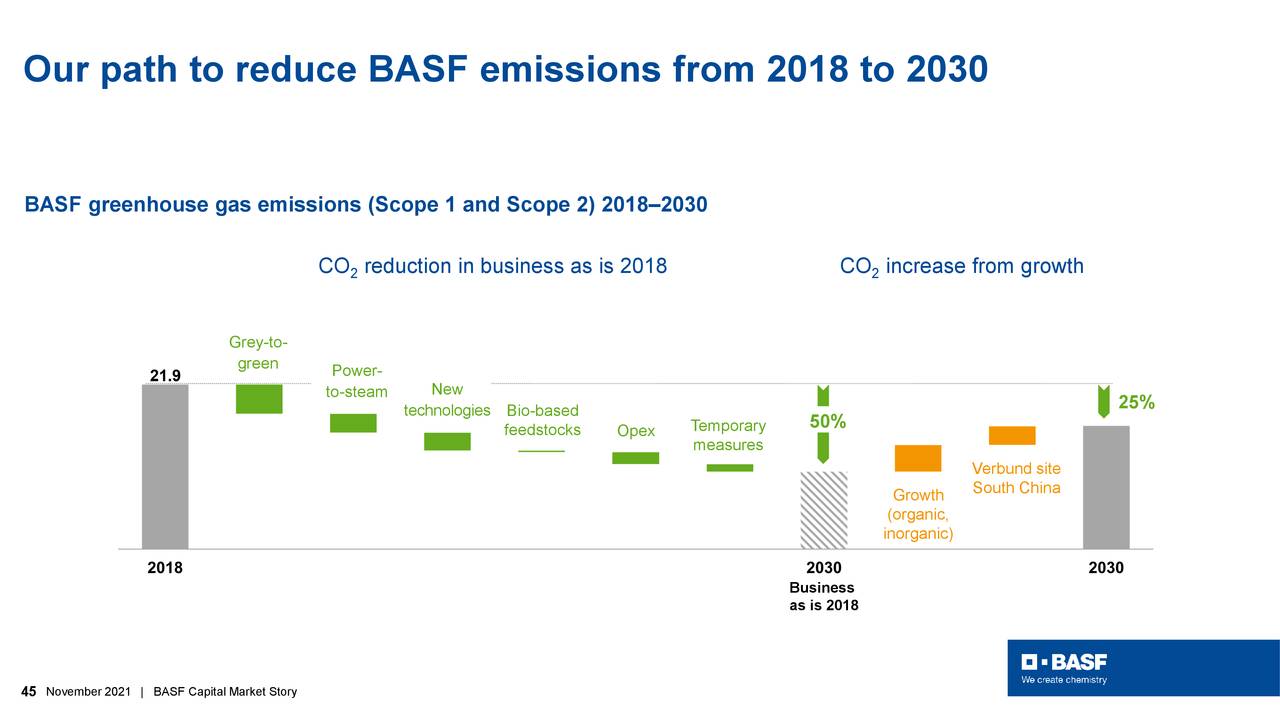

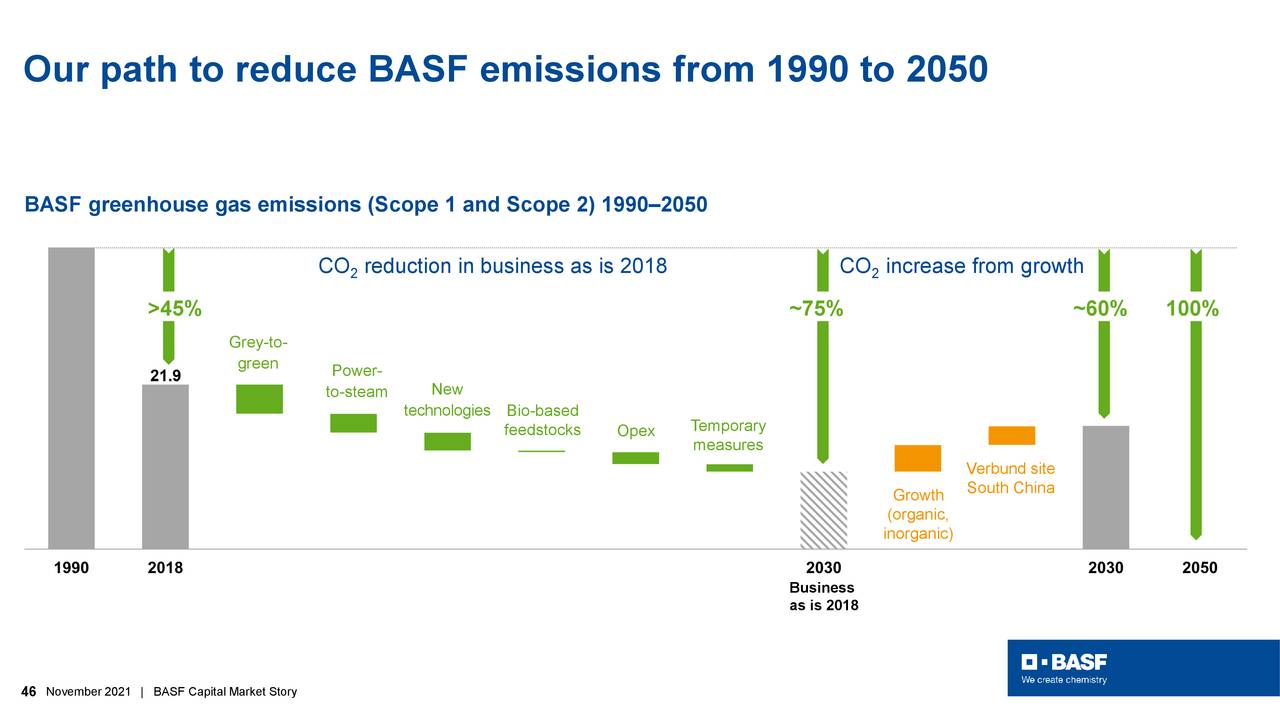

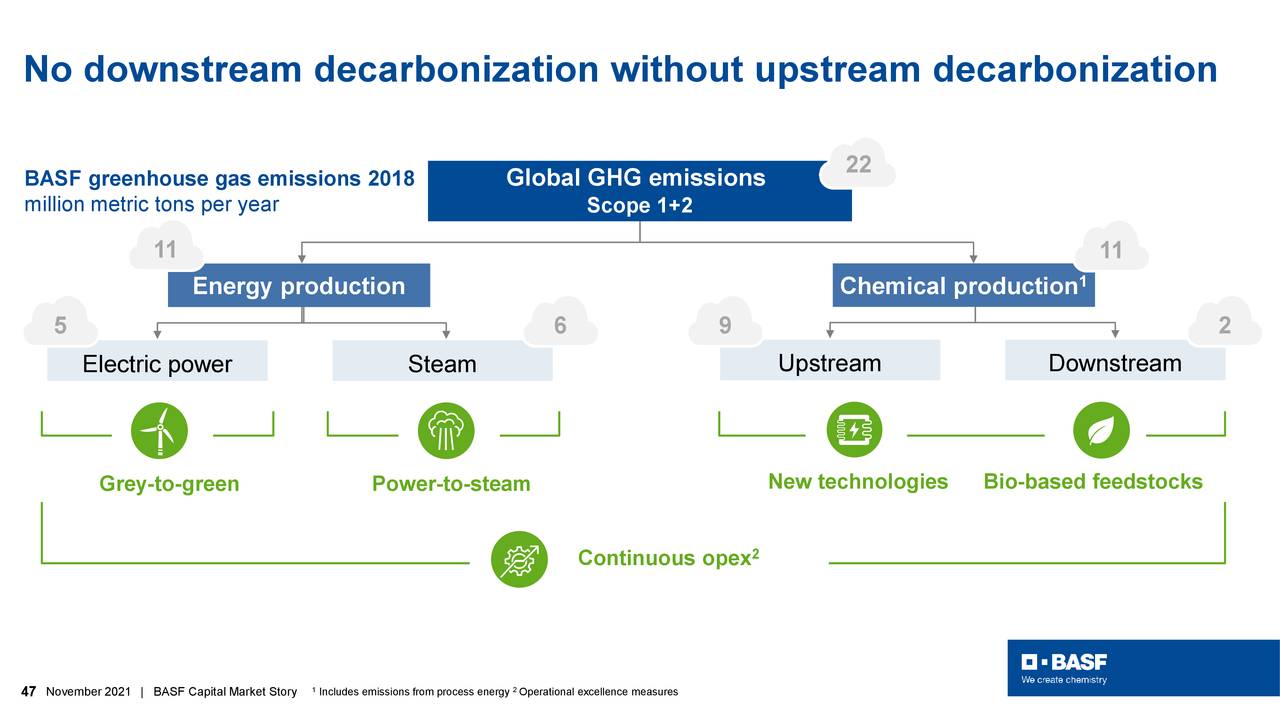

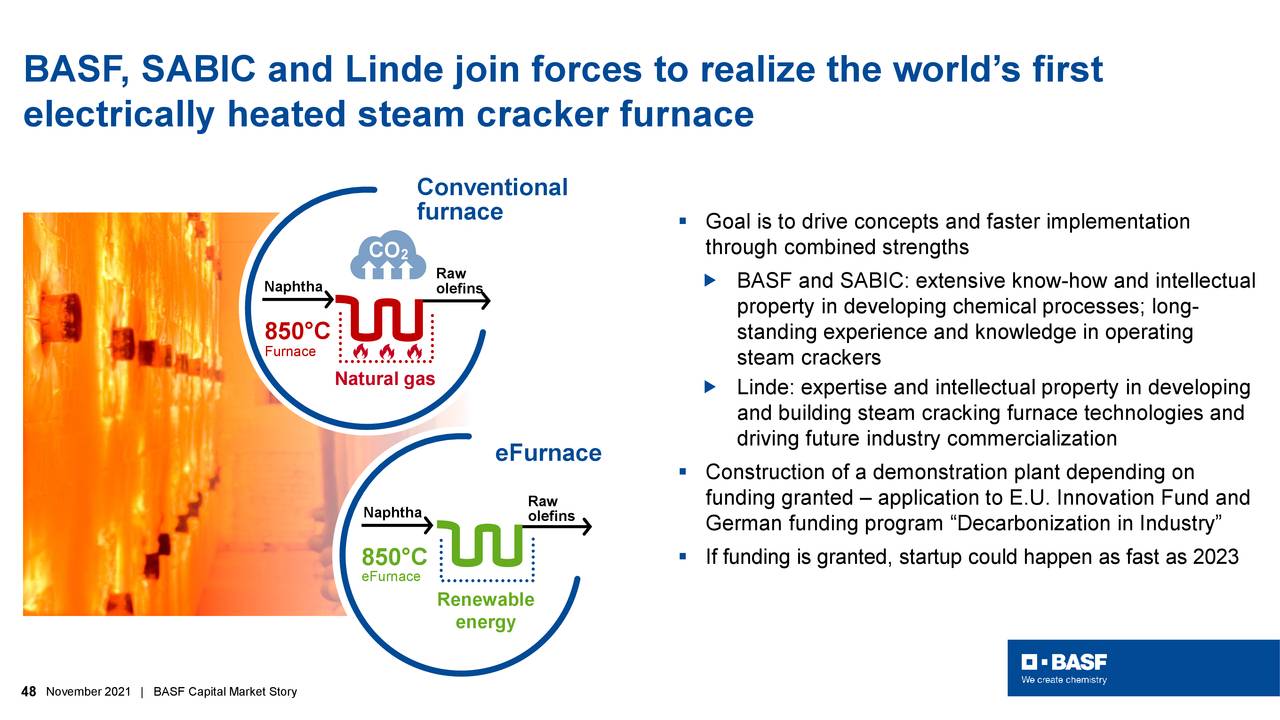

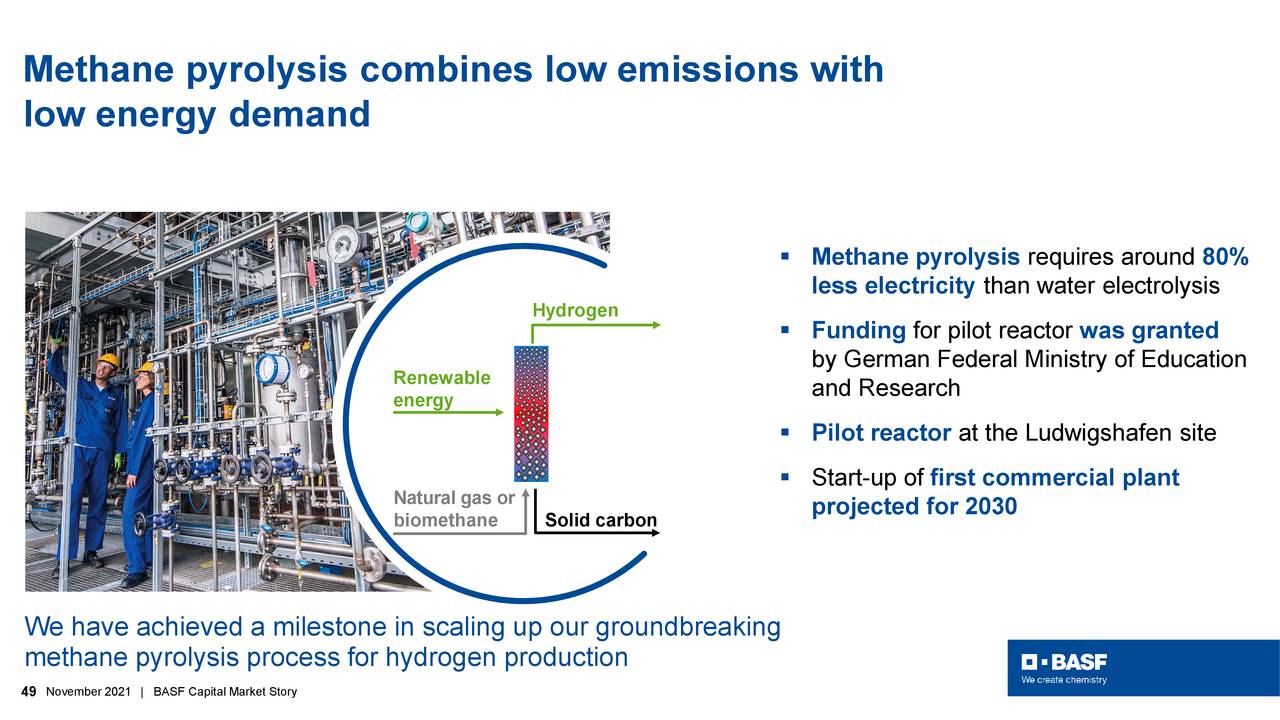

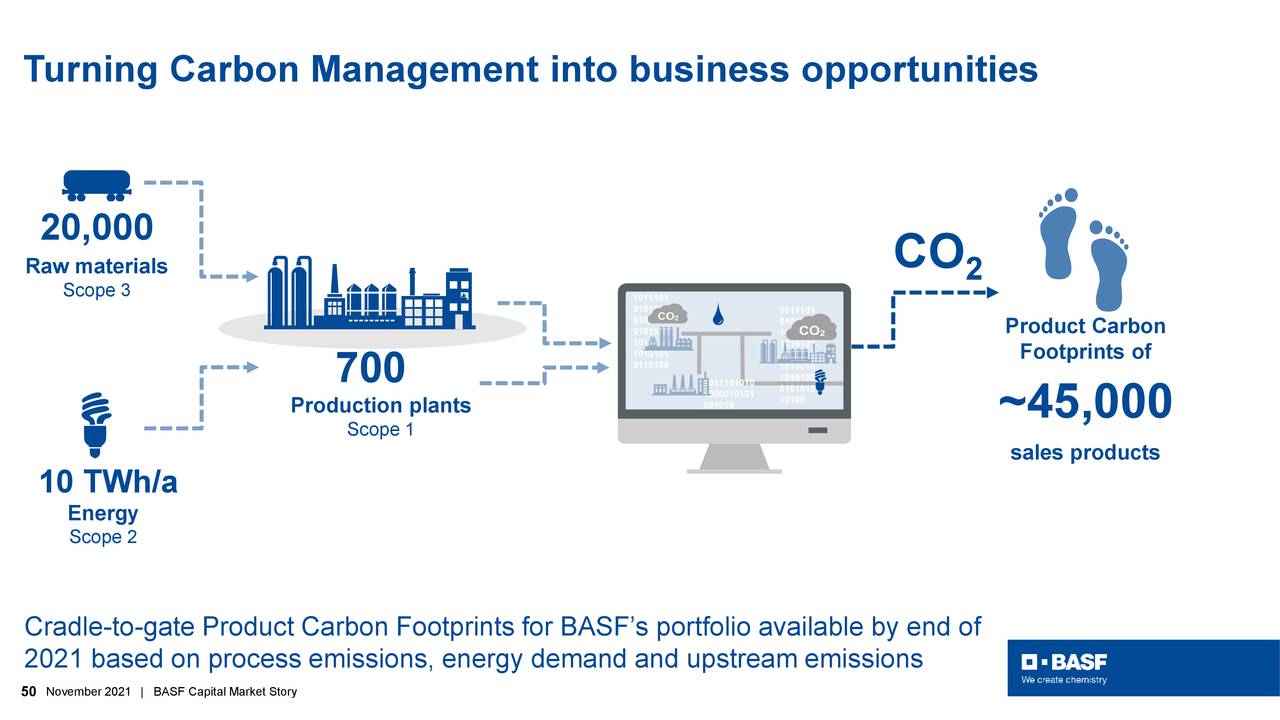

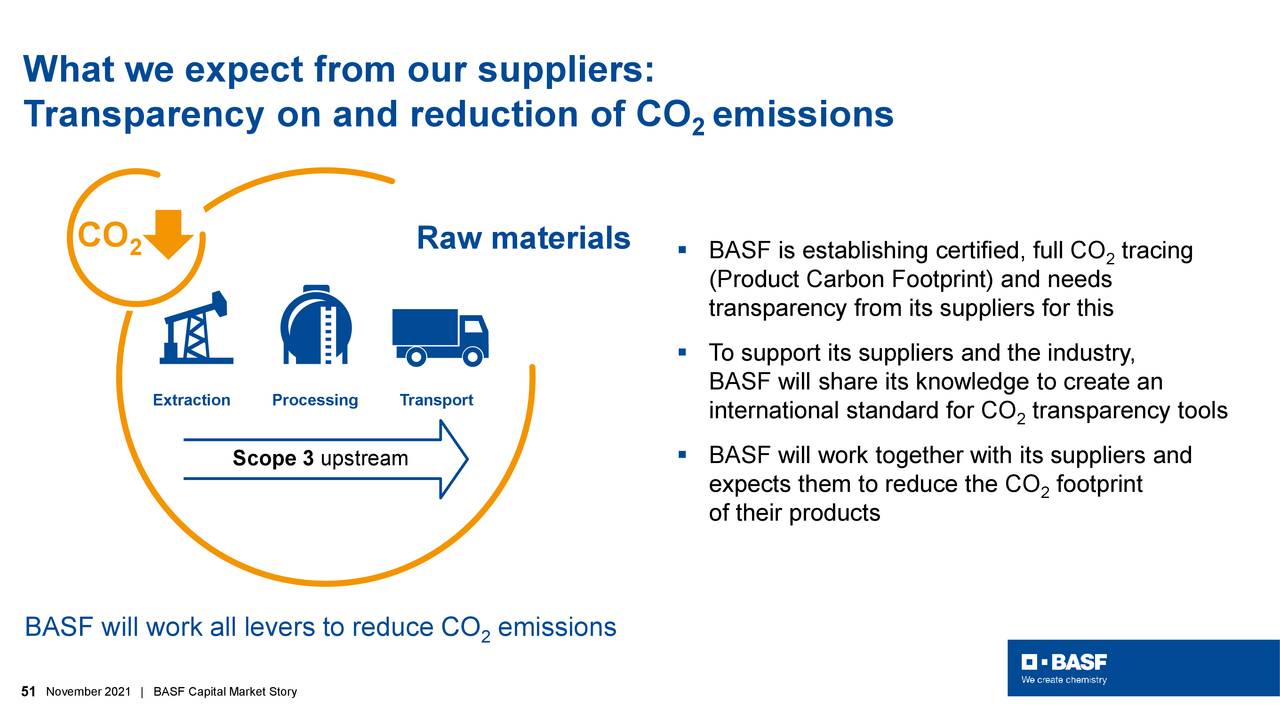

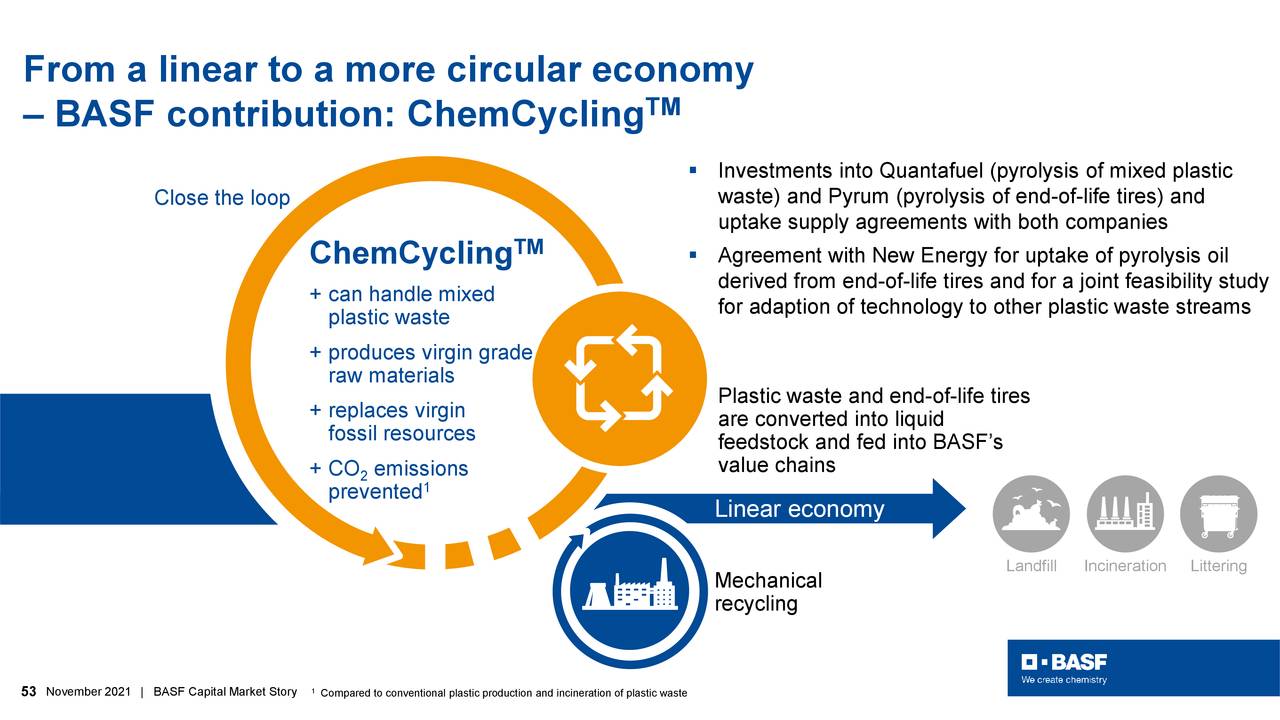

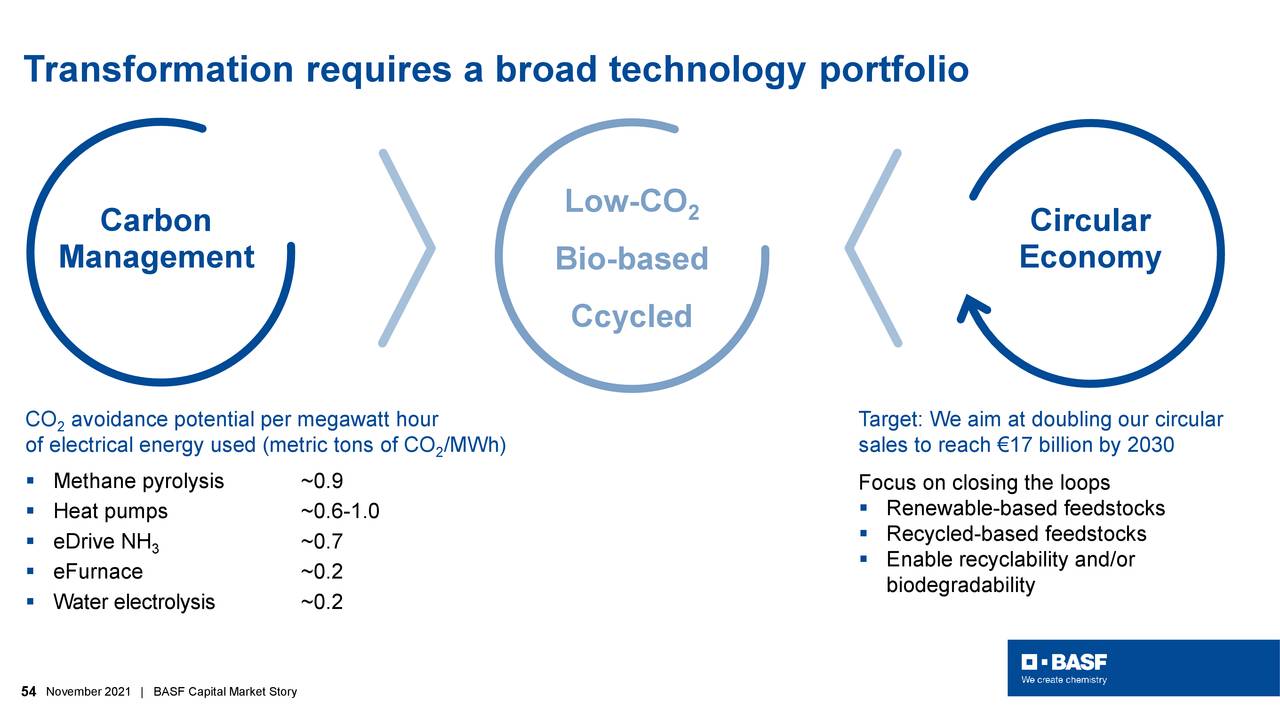

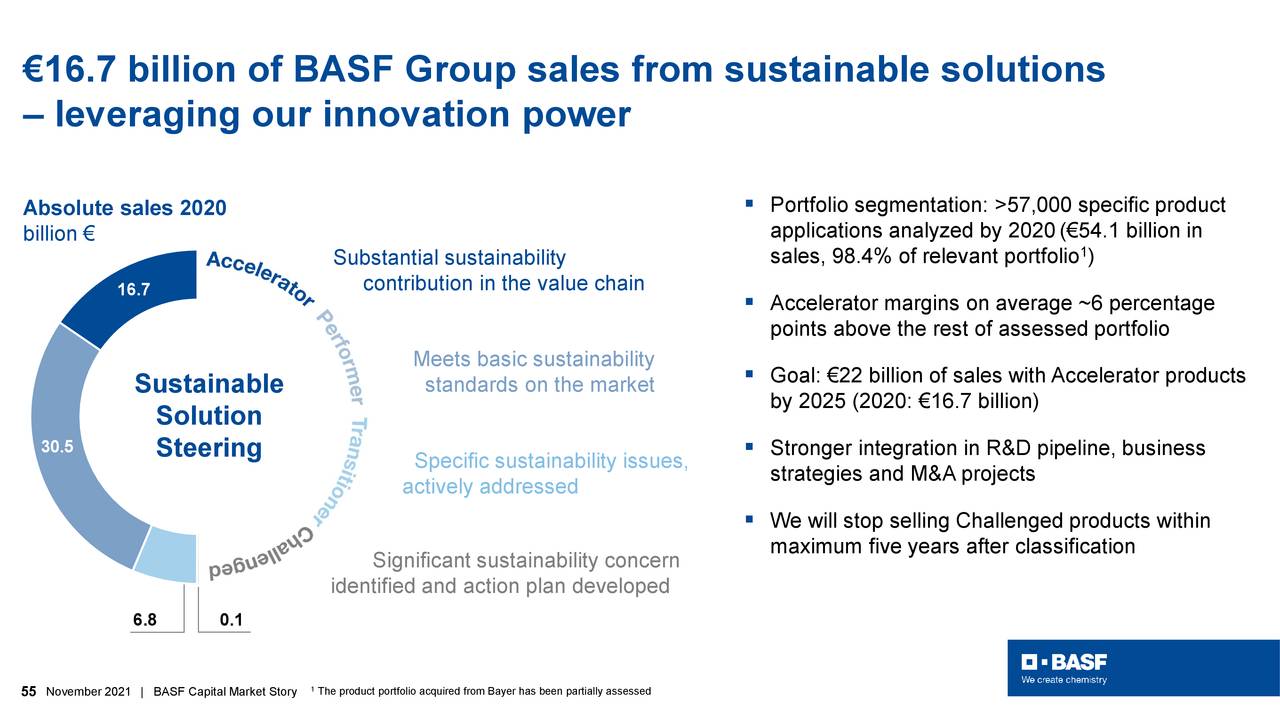

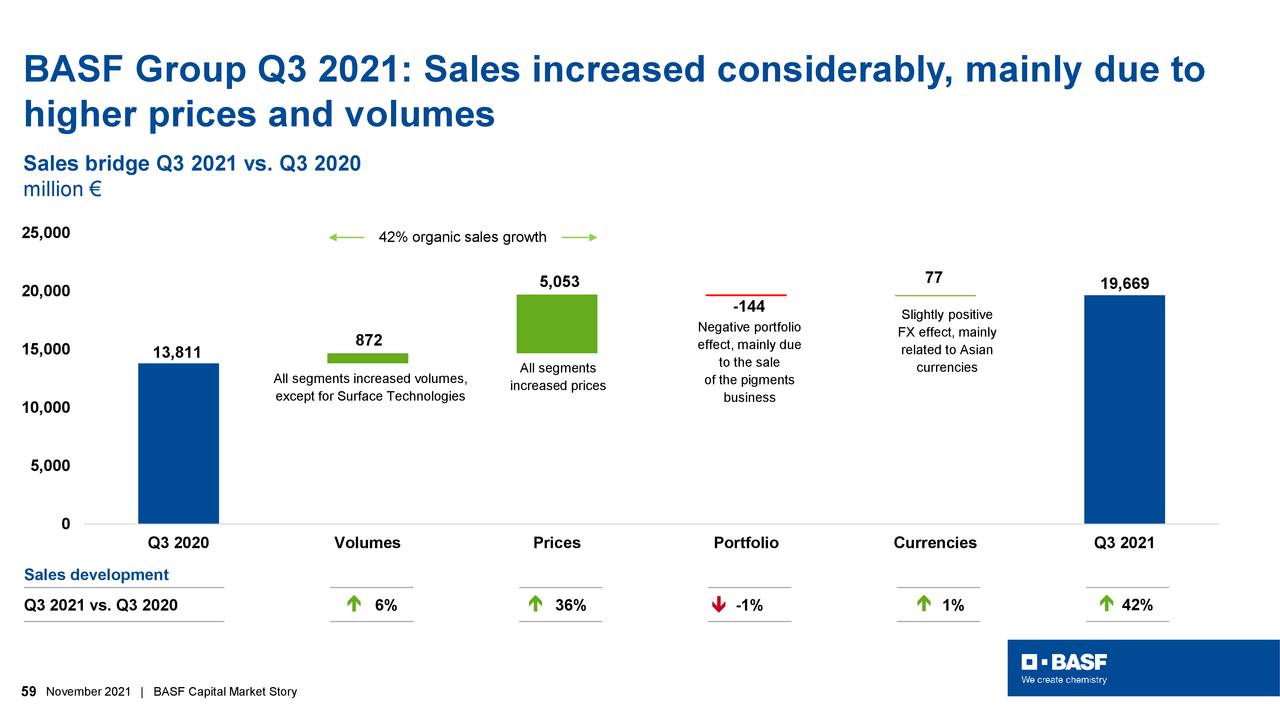

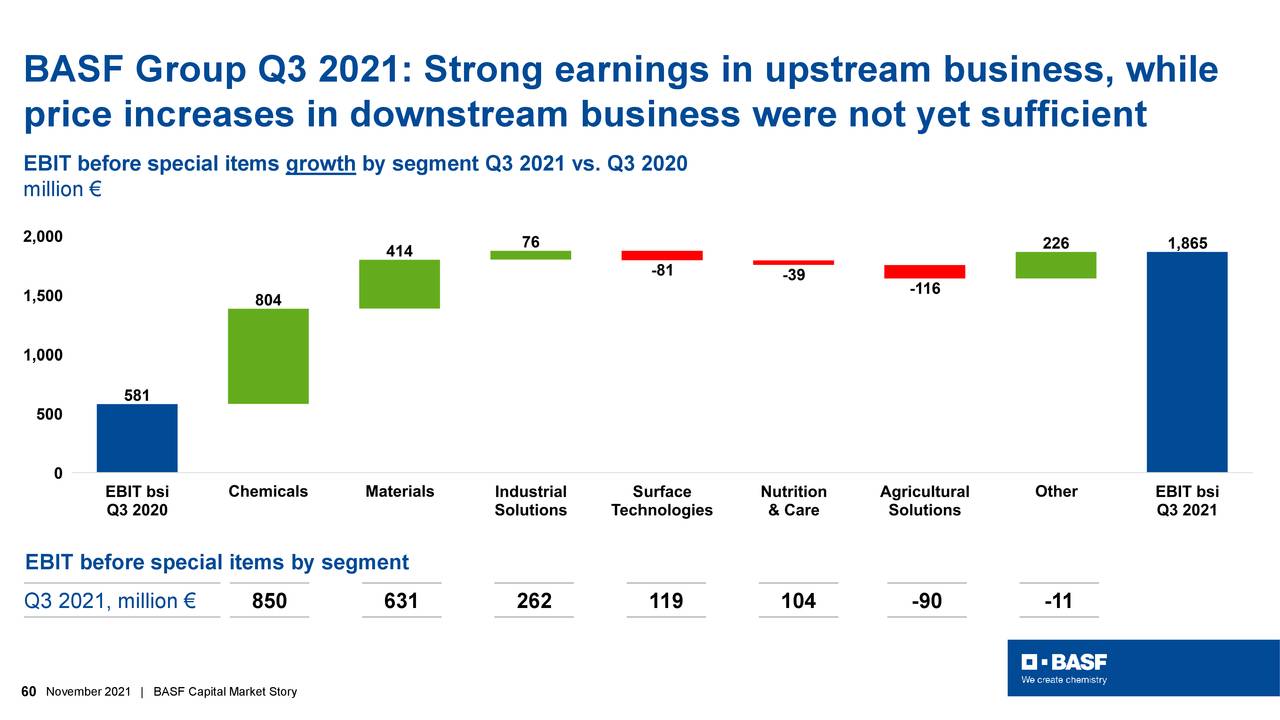

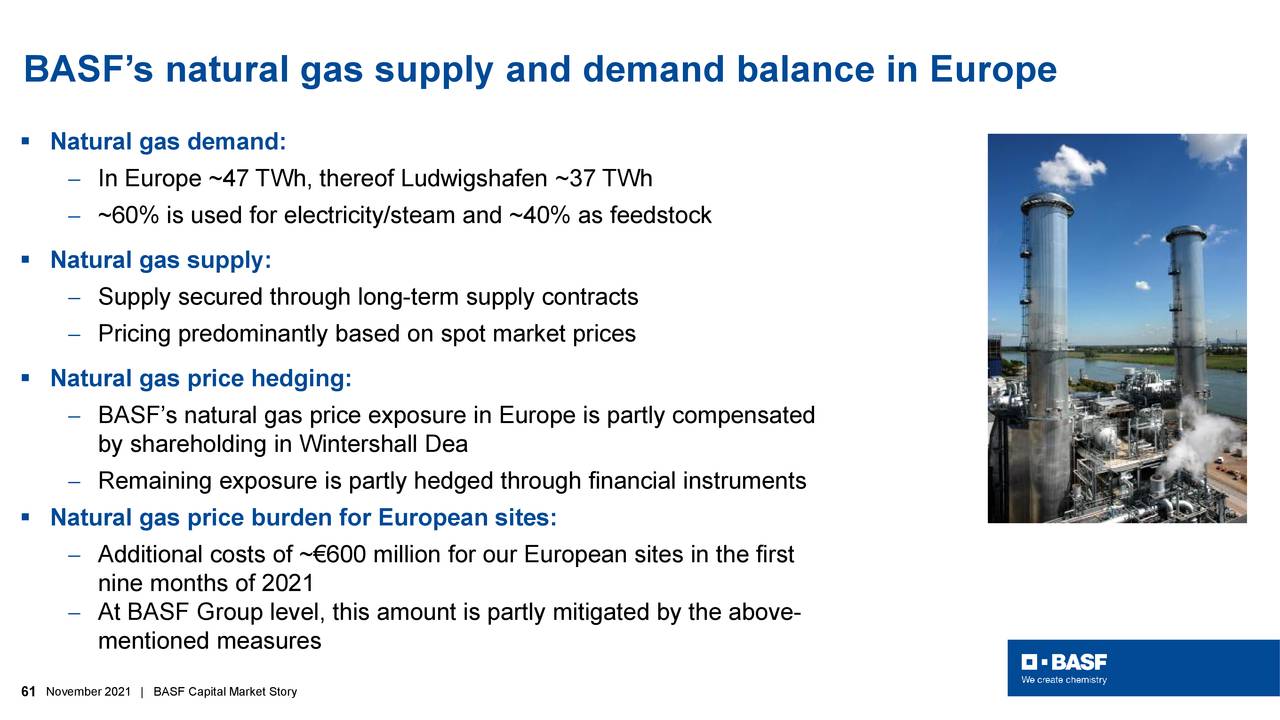

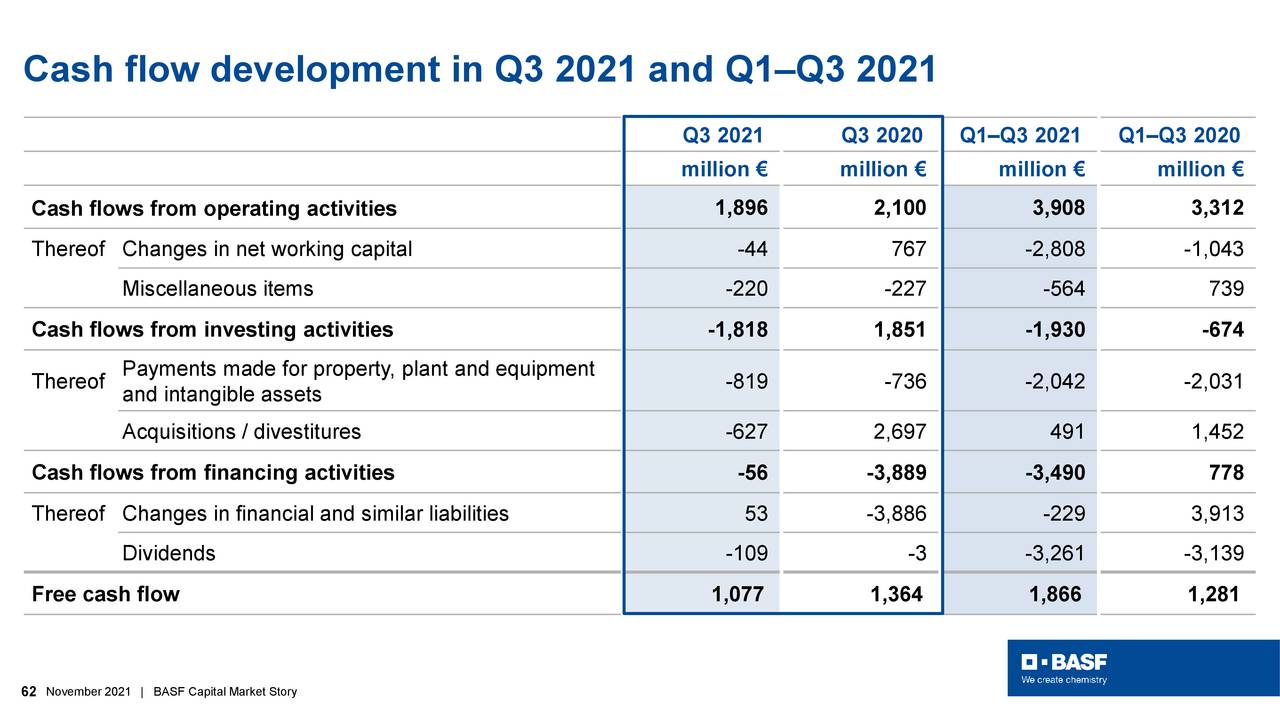

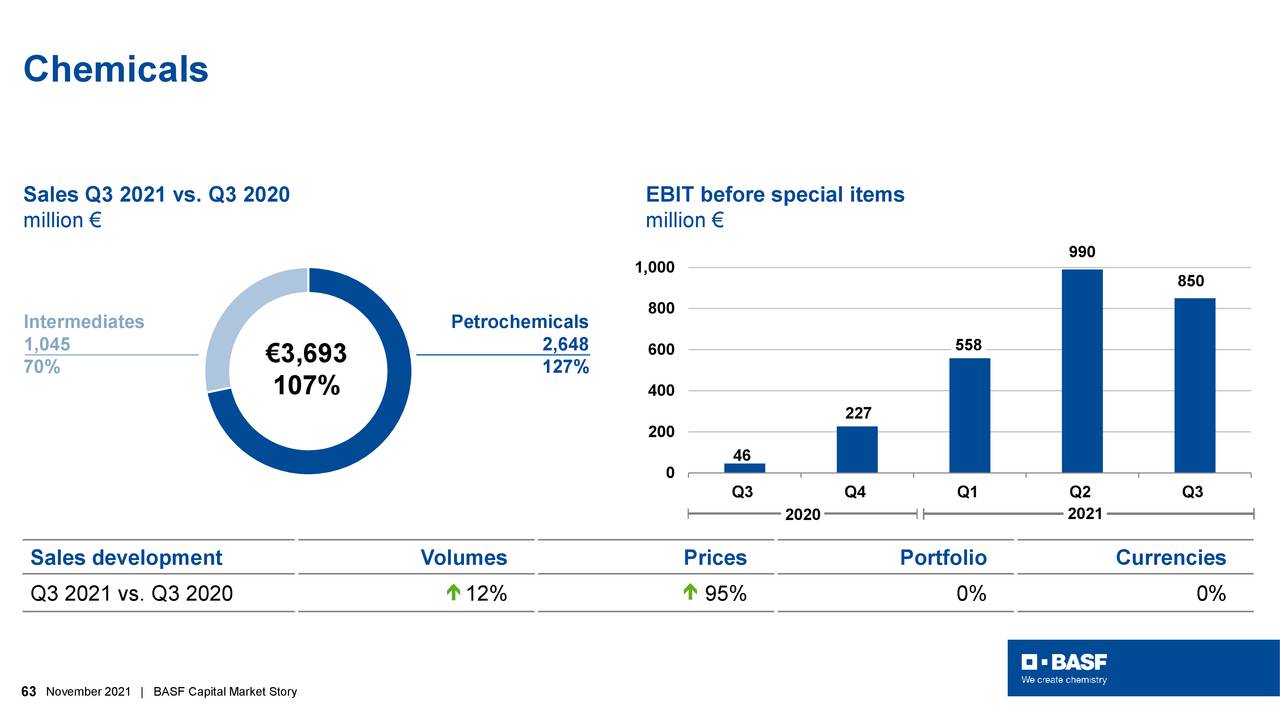

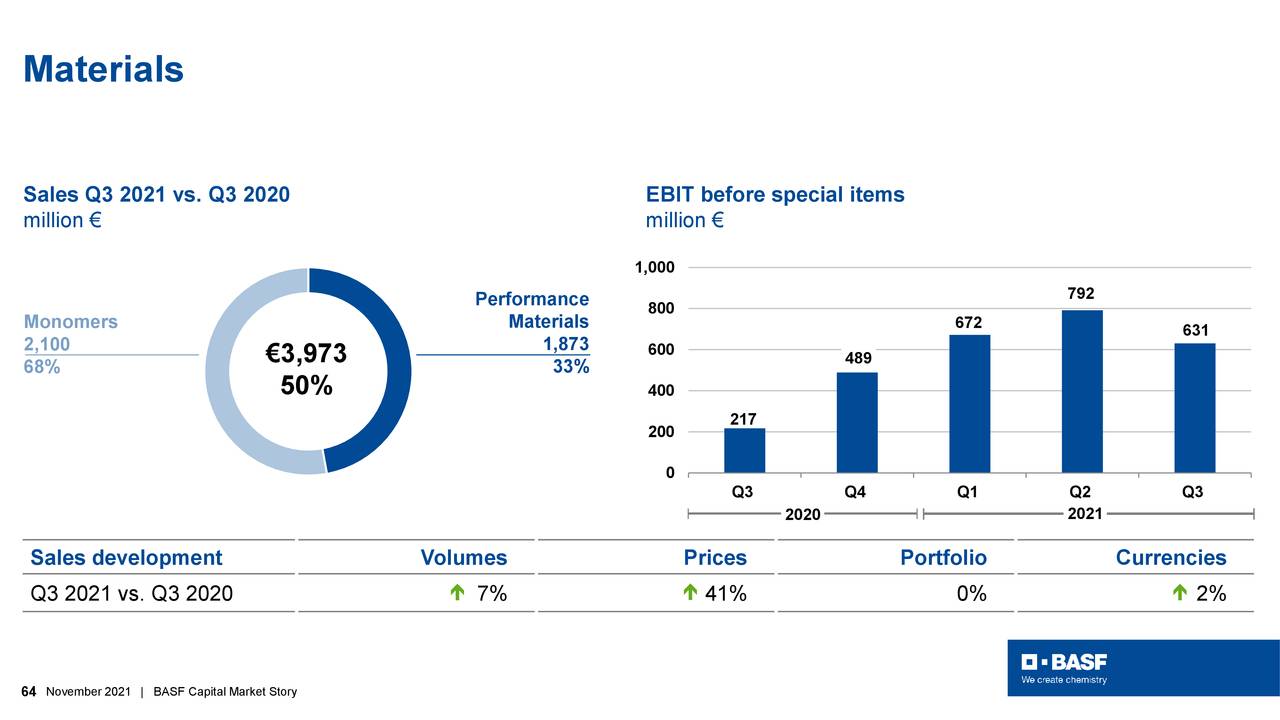

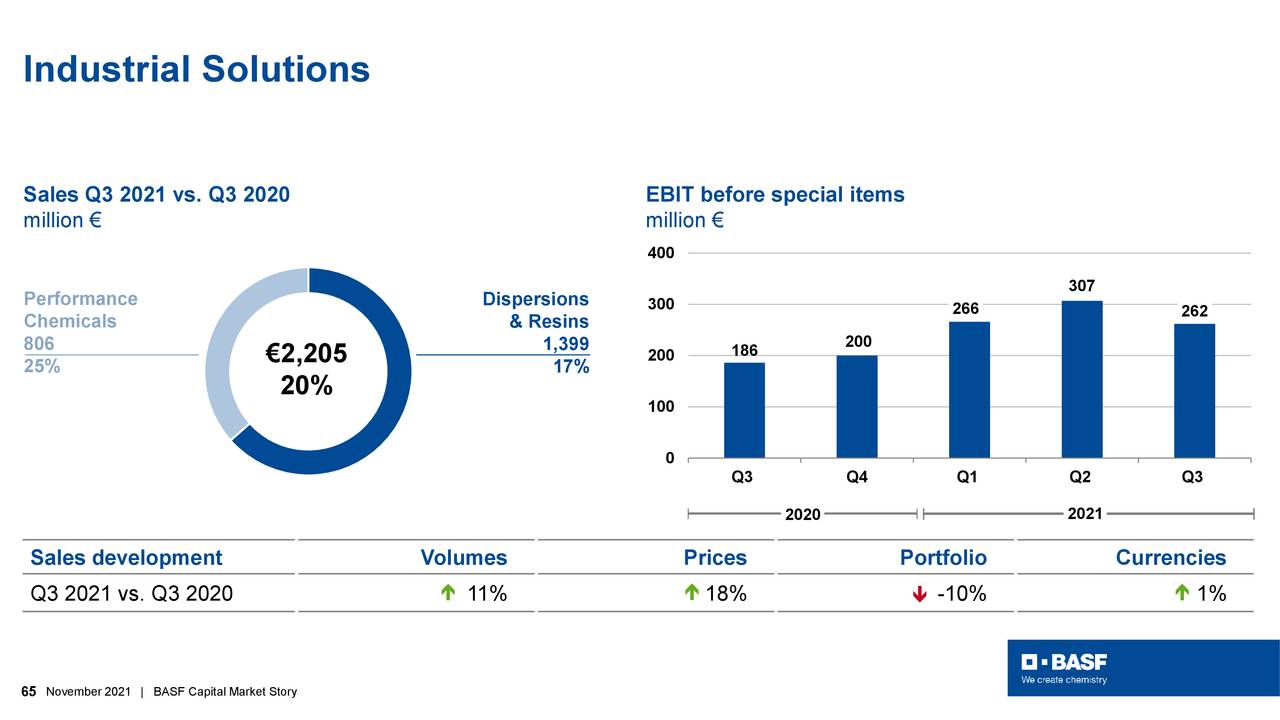

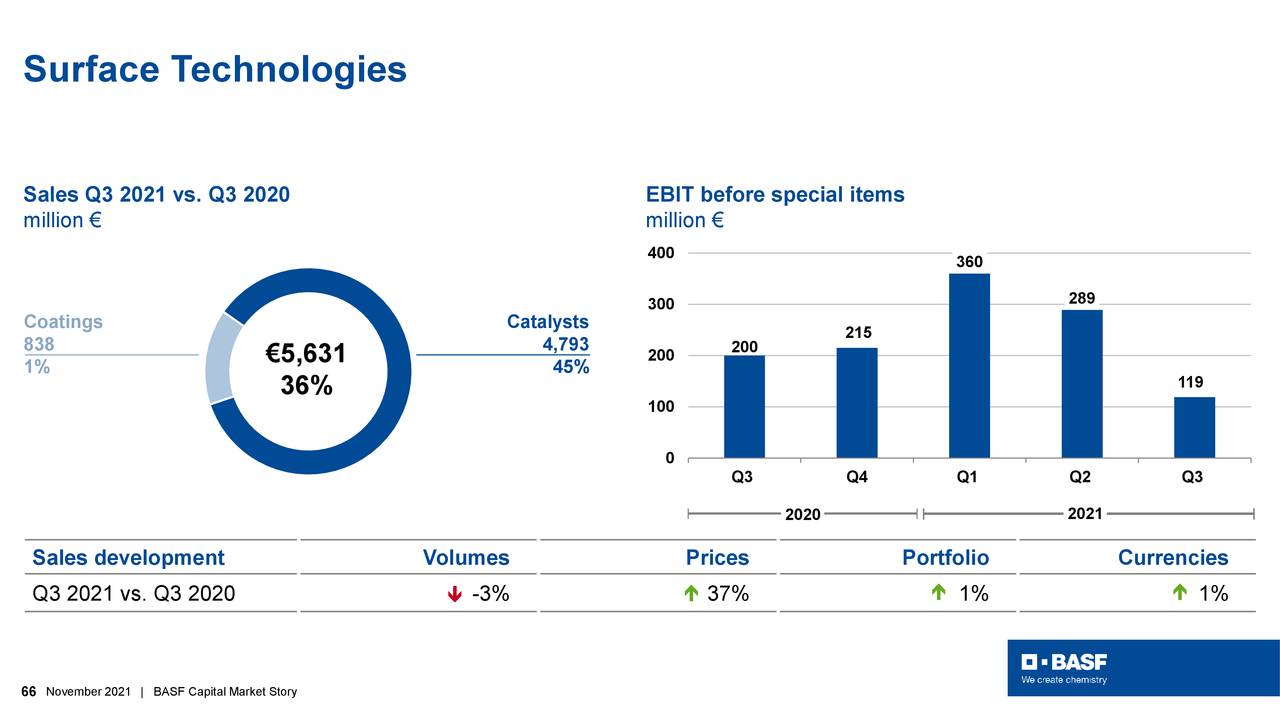

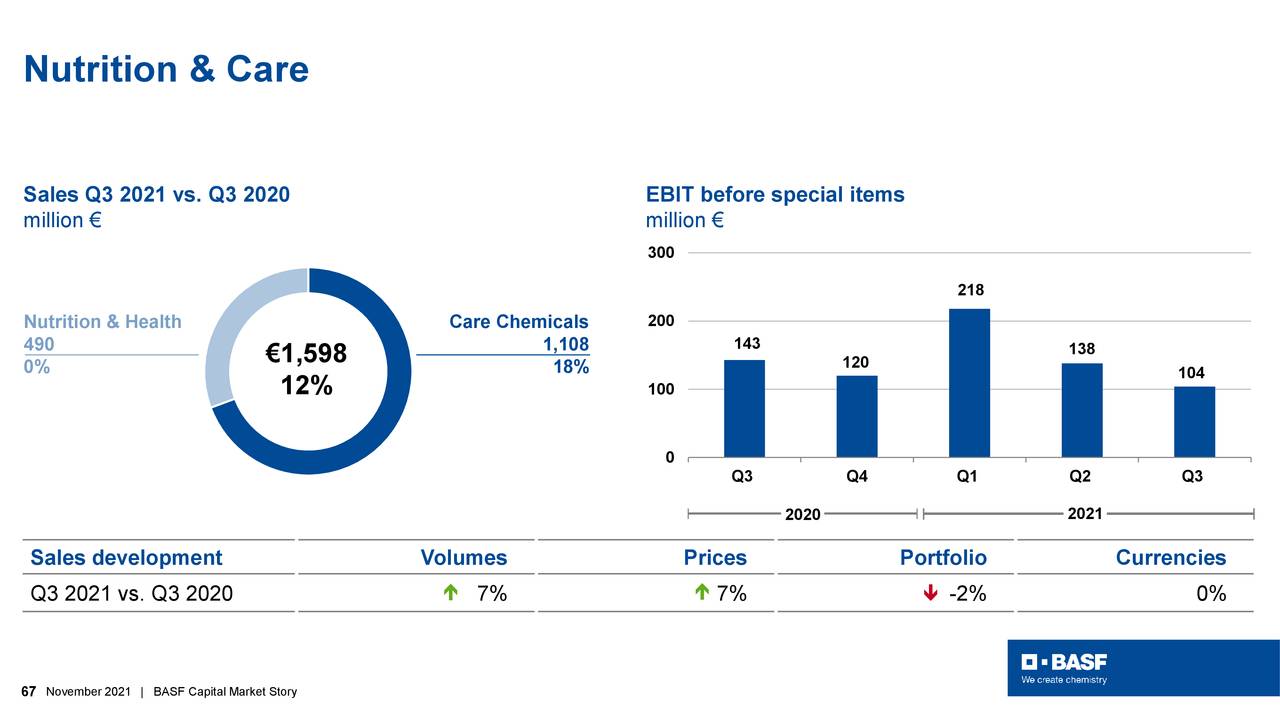

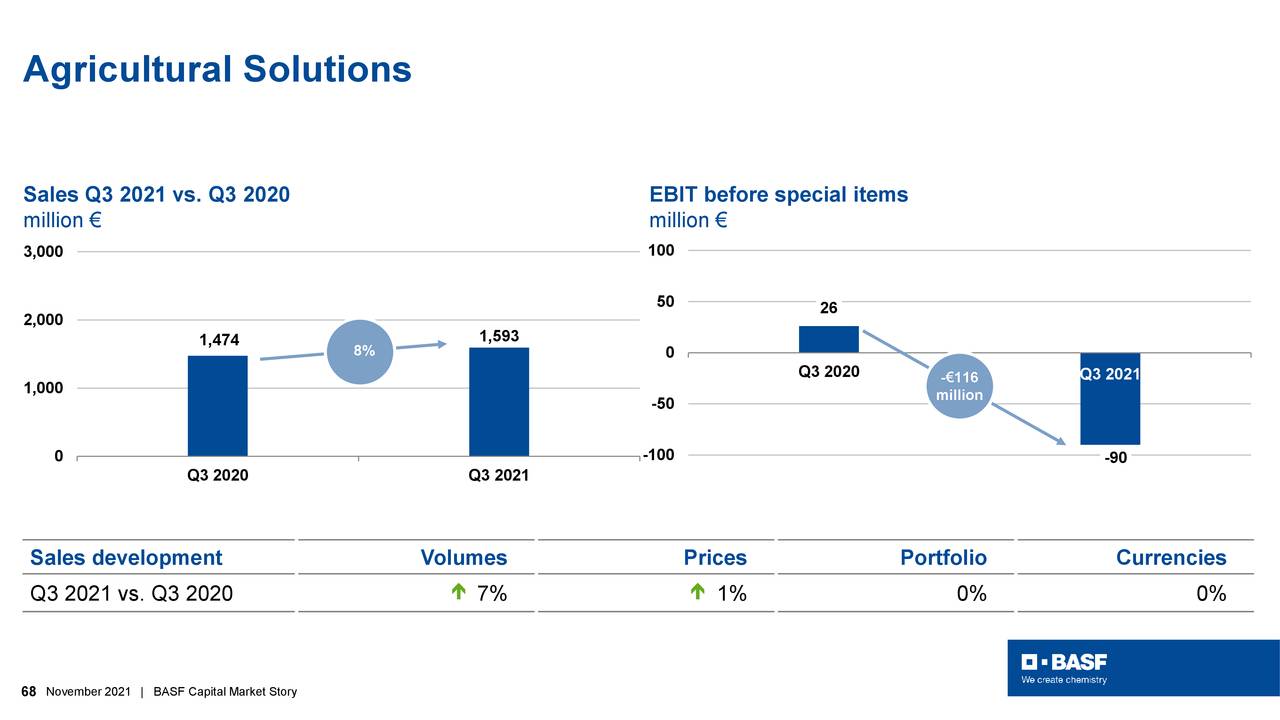

BASF (BASFY) Investor Presentation – Slideshow

Dec. 02, 2021 4:57 PM ETBASF SE (BASFY), BFFAF

The following slide deck was published by BASF SE in conjunction with this event.

169

December 2, 2021

BASF (BASFY) Investor Presentation – Slideshow

Dec. 02, 2021 4:57 PM ETBASF SE (BASFY), BFFAF

The following slide deck was published by BASF SE in conjunction with this event.

169

December 2, 2021

BASF to increase prices for select polyetheramines in North America

FLORHAM PARK, NJ, December 1, 2021 – Effective December 11, 2021 or as existing contracts permit, BASF will increase its prices in North America for select polyetheramines sold under the brand name Baxxodur®.

Product Price Increase

Polyetheramine D230 (Baxxodur® EC 301) $0.36 / lb.

Polyetheramine D2000 (Baxxodur® EC 303) $0.46 / lb.

Polyetheramine T403 (Baxxodur® EC 310) $0.37 / lb.

Under the brand name Baxxodur, BASF markets a diversified portfolio of amine-based curing components for the professional and application-oriented processing of epoxy resins. BASF’s Baxxodur products are featured in many applications as highly efficient curing agents in various coating applications and sealing compounds, for the wind energy, electrical industry as well as in composites, adhesives and flooring.