The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

October 28, 2021

Shippers Fear “Catastrophic” Fallout From “Crazy” California Port Fees

by Tyler DurdenThursday, Oct 28, 2021 – 03:01 PM

By Greg Miller of FreightWaves,

The cure is worse than the disease, say critics of an emergency plan of the ports of Los Angeles and Long Beach backed by the Biden administration. If you think port congestion is bad now, just wait for what comes next.

On Wednesday, two days after the ports of Los Angeles and Long Beach announced a surprise emergency fee for containers lingering too long at terminals, the National Shippers Advisory Council (NSAC) held its inaugural meeting. NSAC, created to advise the Federal Maritime Commission, is composed of 12 U.S. importers and 12 exporters. Members include heavy hitters like Amazon, Walmart, Target, Office Depot and Ikea.

Council members had a lot to say about the California port fees — none of it good.Port of Long Beach

‘I think it will be catastrophic’

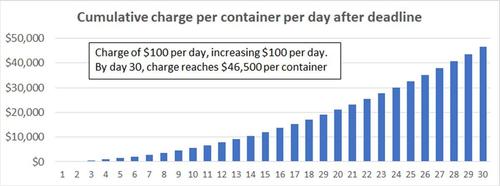

Starting Nov. 1, the ports of Los Angeles and Long Beach will charge $100 per container for boxes dwelling nine or more days that move by truck and those dwelling six days or more that move by rail.

The fee will increase $100 every day. It will be charged to carriers, which will then almost certainly pass the fee along to shippers, meaning it will be the equivalent of an escalating demurrage charge.

“As far as the ‘hyper-demurrage’ announced in Los Angeles/Long Beach, I think it will be catastrophic,” said Rich Roche, vice president of international transportation at Mohawk Global Logistics, during the NSAC meeting.

“Chassis are already in short supply and this will artificially suck out the rest of the containers that may be sitting in there [at terminals] that didn’t need to be on a chassis and now they’re going to be parked somewhere. It’s probably going to wipe out whatever’s left in terms of chassis,” predicted Roche.

According to Steve Hughes, representing the Motor Equipment & Manufacturing Association, “I’m concerned that this new fee is going to cause even more problems than it’s going to solve. I understand the logic behind it and it makes some sense, but unfortunately, because we don’t have the throughput at the front gate, I think this can cause us more problems than we have already.”

Bob Connor, executive vice president of global transportation at Mallory Alexander International Logistics, said, “This absolutely came out of left field. I don’t see this charge doing anything but adding more cost, and freight rates being what they are, this is the last thing we need.”

Both Connor and Roche urged that someone in government “step in and put the brakes on this.”

Carriers to pass along fees to shippers

NSAC members speaking during Wednesday’s meeting emphasized that the Los Angeles/Long Beach charges will ultimately be paid by shippers.

Daniel Miller, global container lead at Cargill, dubbed California’s emergency charges “crazy fees” and said, “We know this is all going to come back to us. I had a couple of calls with carriers yesterday and they’ve already admitted that yes, they are going to come back to us.”

Rick DiMaio, senior vice president of supply chain operations for Office Depot, said, “All fines and fees flow to us, to the beneficial cargo owner.”

According to Ken O’Brien, president of Gemini Shippers Group, “What was done this week at the ports of Los Angeles and Long Beach is effectively an indirect tax on the American consumer.”

Connor reported, “When we heard about the new charge, we immediately reached out to some of our contacts at the FMC. From the conversation we had, it was pretty obvious that the FMC was not forewarned that this thing was coming.”

Connor said that his company asked its FMC contacts whether the ports had to give 30-day notice to carriers before implementing the charge, and whether carriers had to give 30-day notice to pass the charge along to shippers. Connor said that it was his understanding that the ports could implement the charge without that notice, but carriers would have to give 30-day notice to shippers.

However, that’s not the case if carriers already have language in tariffs allowing them to pass along port charges immediately. Ocean carrier HMM’s current tariff includes a clause that states, “The shipper shall be liable for payment of any charges or surcharges imposed on the carrier by any marine terminal, port authority, government authorities or other third party.”

In an online post explaining the clause, Stephen Nothdurft, vice president of the Midwest region at HMM, said, “This new charge [by Los Angeles/Long Beach] is going to be a pass-through for all of the ocean carriers. The carriers will hit the mark with the invoices. As it relates to HMM specifically, this was created based on the strong chance of such surcharges. Such fees have been blowing in the wind for quite some time, so any carrier would be astute to protect their interests.”

Do fees incentivize faster moves?

The point of the “Hail Mary” Los Angeles/Long Beach fee plan is to forcibly unclog the terminals and get containers moving faster. The members of NSAC argued that these emergency port fees — as with traditional demurrage and detention fees — are not increasing container velocity given the current supply chain situation.

According to Miller, “I don’t think anybody on this committee would admit to using the port to let containers sit there because they want to. Everybody has the full intention to get these containers out, but they physically can’t.”

Adnan Qadri, director of global imports at Amazon, said, “In the past, the whole idea of detention and demurrage was incentivizing faster turns, returning of equipment and bringing fluidity into the network and the supply chain. But in its current state, the way supply chains are moving right now, I don’t think detention and demurrage are incentivizing anything.

“Folks are not sitting on returns because they want to. They’re sitting on them because they can’t get those containers returned. It is very difficult for us [Amazon] to wrap our heads around the idea of these detention and demurrage charges, which don’t drive any kind of positive behavior [given] the way the supply chain is currently set up.

“What concerns me is that these charges aren’t driving any benefit to the current state we’re in,” said the Amazon executive.

Carriers’ demurrage and detention fees have faced heavy criticism over the past year. They are a focus of FMC regulators as well as proposed legislation to reform the Ocean Shipping Act. And yet, the Los Angeles/Long Beach plan, with the explicit blessing of the Biden administration, will have the same effect as demurrage.

Nothdurft said in his online post, “It’s ironic that the international community has been pleading to the government about the absurdity of demurrage/detention charges only to have said government administer more of the same.”

https://www.zerohedge.com/markets/shippers-fear-catastrophic-fallout-crazy-california-port-fees

October 28, 2021

Shippers Fear “Catastrophic” Fallout From “Crazy” California Port Fees

by Tyler DurdenThursday, Oct 28, 2021 – 03:01 PM

By Greg Miller of FreightWaves,

The cure is worse than the disease, say critics of an emergency plan of the ports of Los Angeles and Long Beach backed by the Biden administration. If you think port congestion is bad now, just wait for what comes next.

On Wednesday, two days after the ports of Los Angeles and Long Beach announced a surprise emergency fee for containers lingering too long at terminals, the National Shippers Advisory Council (NSAC) held its inaugural meeting. NSAC, created to advise the Federal Maritime Commission, is composed of 12 U.S. importers and 12 exporters. Members include heavy hitters like Amazon, Walmart, Target, Office Depot and Ikea.

Council members had a lot to say about the California port fees — none of it good.Port of Long Beach

‘I think it will be catastrophic’

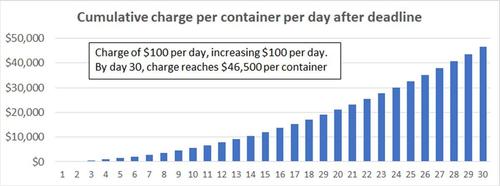

Starting Nov. 1, the ports of Los Angeles and Long Beach will charge $100 per container for boxes dwelling nine or more days that move by truck and those dwelling six days or more that move by rail.

The fee will increase $100 every day. It will be charged to carriers, which will then almost certainly pass the fee along to shippers, meaning it will be the equivalent of an escalating demurrage charge.

“As far as the ‘hyper-demurrage’ announced in Los Angeles/Long Beach, I think it will be catastrophic,” said Rich Roche, vice president of international transportation at Mohawk Global Logistics, during the NSAC meeting.

“Chassis are already in short supply and this will artificially suck out the rest of the containers that may be sitting in there [at terminals] that didn’t need to be on a chassis and now they’re going to be parked somewhere. It’s probably going to wipe out whatever’s left in terms of chassis,” predicted Roche.

According to Steve Hughes, representing the Motor Equipment & Manufacturing Association, “I’m concerned that this new fee is going to cause even more problems than it’s going to solve. I understand the logic behind it and it makes some sense, but unfortunately, because we don’t have the throughput at the front gate, I think this can cause us more problems than we have already.”

Bob Connor, executive vice president of global transportation at Mallory Alexander International Logistics, said, “This absolutely came out of left field. I don’t see this charge doing anything but adding more cost, and freight rates being what they are, this is the last thing we need.”

Both Connor and Roche urged that someone in government “step in and put the brakes on this.”

Carriers to pass along fees to shippers

NSAC members speaking during Wednesday’s meeting emphasized that the Los Angeles/Long Beach charges will ultimately be paid by shippers.

Daniel Miller, global container lead at Cargill, dubbed California’s emergency charges “crazy fees” and said, “We know this is all going to come back to us. I had a couple of calls with carriers yesterday and they’ve already admitted that yes, they are going to come back to us.”

Rick DiMaio, senior vice president of supply chain operations for Office Depot, said, “All fines and fees flow to us, to the beneficial cargo owner.”

According to Ken O’Brien, president of Gemini Shippers Group, “What was done this week at the ports of Los Angeles and Long Beach is effectively an indirect tax on the American consumer.”

Connor reported, “When we heard about the new charge, we immediately reached out to some of our contacts at the FMC. From the conversation we had, it was pretty obvious that the FMC was not forewarned that this thing was coming.”

Connor said that his company asked its FMC contacts whether the ports had to give 30-day notice to carriers before implementing the charge, and whether carriers had to give 30-day notice to pass the charge along to shippers. Connor said that it was his understanding that the ports could implement the charge without that notice, but carriers would have to give 30-day notice to shippers.

However, that’s not the case if carriers already have language in tariffs allowing them to pass along port charges immediately. Ocean carrier HMM’s current tariff includes a clause that states, “The shipper shall be liable for payment of any charges or surcharges imposed on the carrier by any marine terminal, port authority, government authorities or other third party.”

In an online post explaining the clause, Stephen Nothdurft, vice president of the Midwest region at HMM, said, “This new charge [by Los Angeles/Long Beach] is going to be a pass-through for all of the ocean carriers. The carriers will hit the mark with the invoices. As it relates to HMM specifically, this was created based on the strong chance of such surcharges. Such fees have been blowing in the wind for quite some time, so any carrier would be astute to protect their interests.”

Do fees incentivize faster moves?

The point of the “Hail Mary” Los Angeles/Long Beach fee plan is to forcibly unclog the terminals and get containers moving faster. The members of NSAC argued that these emergency port fees — as with traditional demurrage and detention fees — are not increasing container velocity given the current supply chain situation.

According to Miller, “I don’t think anybody on this committee would admit to using the port to let containers sit there because they want to. Everybody has the full intention to get these containers out, but they physically can’t.”

Adnan Qadri, director of global imports at Amazon, said, “In the past, the whole idea of detention and demurrage was incentivizing faster turns, returning of equipment and bringing fluidity into the network and the supply chain. But in its current state, the way supply chains are moving right now, I don’t think detention and demurrage are incentivizing anything.

“Folks are not sitting on returns because they want to. They’re sitting on them because they can’t get those containers returned. It is very difficult for us [Amazon] to wrap our heads around the idea of these detention and demurrage charges, which don’t drive any kind of positive behavior [given] the way the supply chain is currently set up.

“What concerns me is that these charges aren’t driving any benefit to the current state we’re in,” said the Amazon executive.

Carriers’ demurrage and detention fees have faced heavy criticism over the past year. They are a focus of FMC regulators as well as proposed legislation to reform the Ocean Shipping Act. And yet, the Los Angeles/Long Beach plan, with the explicit blessing of the Biden administration, will have the same effect as demurrage.

Nothdurft said in his online post, “It’s ironic that the international community has been pleading to the government about the absurdity of demurrage/detention charges only to have said government administer more of the same.”

https://www.zerohedge.com/markets/shippers-fear-catastrophic-fallout-crazy-california-port-fees

October 28, 2021

Furniture shipments are still delayed due to a foam shortage that’s slowly improving – as long as car production doesn’t ramp back up

ahartmans@businessinsider.com (Avery Hartmans) 1 day ago 1 Comment|

|

- Furniture shipments are still delayed due to a shortage of foam used in mattresses and couches.

- The Texas freeze impacted foam manufacturing, and consumer demand for furniture remains high.

- Production is now at normal levels, but furniture-makers could face competition from automakers.

Foam shortages are continuing to hamper the furniture industry, leading to delays that likely won’t be resolved until next year. https://products.gobankingrates.com/pub/84d1cf40-924a-11eb-a8c2-0e0b1012e14d

Consumer demand for products that include foam, like couches and mattresses, remains so high that the foam industry is struggling to keep up. The shortage, combined with shipping backlogs that are holding up raw materials and a truck driver shortage that’s delaying deliveries, means that some furniture that’s ordered now won’t even ship until 2022.

Russ Batson, executive director of the Polyurethane Foam Association, an industry group that represents foam manufacturers, told Insider in an email on Monday that while foam production has now returned to pre-pandemic levels, it’s “inadequate to meet strong consumer demand” for products, demand that spiked due to a rush in home-buying during the pandemic and a desire to trick out our spaces after spending so many months at home.

The foam industry has faced other challenges in 2021 aside from consumers clamoring for furniture. When unprecedented winter storms hit Texas in February 2021, the region experienced a deep freeze that damaged homes nad businesses and caused pipes to burst.

That weather also shut down the chemical plants that make propylene oxide, a key chemical in polyurethane foam – the same foam that’s used in mattresses, couch cushions, and seats in cars, the Houston Chronicle’s Diane Cowen reported earlier this year.

Bob Patell, the CEO of LyondellBasell, which produces propylene oxide along the Gulf Coast, said at a JPMorgan conference in March that the Texas freeze wiped out 10% to 14% of its annual petrochemical supply, according to the Chronicle.

As a result of the short foam supply, furniture makers in across the US were forced to cut production hours or raise prices. One San Francisco-based furniture manufacturer told Slate’s Aaron Mak in July that foam manufacturers were rationing in an attempt to give furniture-makers “something versus nothing.”

But now, even though production levels have stabilized, the furniture industry could soon face another challenge: increased competition for foam.

Batson of the PFA warned earlier this year that couch and mattress companies are lucky, in a way, that they’re not seeing foam diverted to automakers. As car companies grapple with an ongoing semiconductor shortage, they’re making fewer vehicles – consulting firm AlixPartners estimated last month that as many as 7.7 million fewer vehicles will be made this year. Fewer cars means automakers require less foam to put in vehicle seats.

But Batson told Insider this week that furniture-makers may need to brace for an even tighter supply of foam.

“When the auto industry sorts out its more complex supply chain challenges,” he said, “that will exert additional pressure on foam supplies.”

October 28, 2021

Furniture shipments are still delayed due to a foam shortage that’s slowly improving – as long as car production doesn’t ramp back up

ahartmans@businessinsider.com (Avery Hartmans) 1 day ago 1 Comment|

|

- Furniture shipments are still delayed due to a shortage of foam used in mattresses and couches.

- The Texas freeze impacted foam manufacturing, and consumer demand for furniture remains high.

- Production is now at normal levels, but furniture-makers could face competition from automakers.

Foam shortages are continuing to hamper the furniture industry, leading to delays that likely won’t be resolved until next year. https://products.gobankingrates.com/pub/84d1cf40-924a-11eb-a8c2-0e0b1012e14d

Consumer demand for products that include foam, like couches and mattresses, remains so high that the foam industry is struggling to keep up. The shortage, combined with shipping backlogs that are holding up raw materials and a truck driver shortage that’s delaying deliveries, means that some furniture that’s ordered now won’t even ship until 2022.

Russ Batson, executive director of the Polyurethane Foam Association, an industry group that represents foam manufacturers, told Insider in an email on Monday that while foam production has now returned to pre-pandemic levels, it’s “inadequate to meet strong consumer demand” for products, demand that spiked due to a rush in home-buying during the pandemic and a desire to trick out our spaces after spending so many months at home.

The foam industry has faced other challenges in 2021 aside from consumers clamoring for furniture. When unprecedented winter storms hit Texas in February 2021, the region experienced a deep freeze that damaged homes nad businesses and caused pipes to burst.

That weather also shut down the chemical plants that make propylene oxide, a key chemical in polyurethane foam – the same foam that’s used in mattresses, couch cushions, and seats in cars, the Houston Chronicle’s Diane Cowen reported earlier this year.

Bob Patell, the CEO of LyondellBasell, which produces propylene oxide along the Gulf Coast, said at a JPMorgan conference in March that the Texas freeze wiped out 10% to 14% of its annual petrochemical supply, according to the Chronicle.

As a result of the short foam supply, furniture makers in across the US were forced to cut production hours or raise prices. One San Francisco-based furniture manufacturer told Slate’s Aaron Mak in July that foam manufacturers were rationing in an attempt to give furniture-makers “something versus nothing.”

But now, even though production levels have stabilized, the furniture industry could soon face another challenge: increased competition for foam.

Batson of the PFA warned earlier this year that couch and mattress companies are lucky, in a way, that they’re not seeing foam diverted to automakers. As car companies grapple with an ongoing semiconductor shortage, they’re making fewer vehicles – consulting firm AlixPartners estimated last month that as many as 7.7 million fewer vehicles will be made this year. Fewer cars means automakers require less foam to put in vehicle seats.

But Batson told Insider this week that furniture-makers may need to brace for an even tighter supply of foam.

“When the auto industry sorts out its more complex supply chain challenges,” he said, “that will exert additional pressure on foam supplies.”

October 28, 2021

Tempur Sealy Reports Record Third Quarter Results

-Net Sales Increased 20% Compared to the Third Quarter of 2020, Direct Sales Increased 79%

-EPS Increased 52.6% to $0.87, Adjusted EPS Increased 18.9% to $0.88

-Raises 2021 Adjusted EPS Guidance Range to $3.20 to $3.30

LEXINGTON, Ky., Oct. 28, 2021 /PRNewswire/ — Tempur Sealy International, Inc. (NYSE: TPX) announced financial results for the third quarter ended September 30, 2021. The Company also issued updated financial guidance for the full year 2021 that reflects the improved business performance.

THIRD QUARTER 2021 FINANCIAL SUMMARY

- Total net sales increased 20.0% to $1,358.3 million as compared to $1,132.3 million in the third quarter of 2020. On a constant currency basis(1), total net sales increased 19.2%, with an increase of 11.9% in the North America business segment and an increase of 71.6% in the International business segment.

- Gross margin was 42.5% as compared to 46.8% in the third quarter of 2020. Adjusted gross margin(1) was 46.9% in the third quarter of 2020. There were no adjustments to gross margin in the third quarter of 2021.

- Operating income increased 38.6% to $249.8 million as compared to $180.2 million in the third quarter of 2020. Operating income in the third quarter of 2020 included $45.2 million of amortization for aspirational plan stock-based compensation. Adjusted operating income(1) increased 11.0% to $252.1 million as compared to $227.2 million in the third quarter of 2020.

- Net income increased 46.1% to $177.4 million as compared to $121.4 million in the third quarter of 2020. Adjusted net income(1) increased 15.6% to $179.6 million as compared to $155.4 million in the third quarter of 2020.

- Earnings before interest, tax, depreciation and amortization (“EBITDA”)(1) increased 5.5% to $295.2 million as compared to $279.9 million in the third quarter of 2020. Adjusted EBITDA(1) increased 6.6% to $297.6 million as compared to $279.3 million in the third quarter of 2020.

- Earnings per diluted share (“EPS”) increased 52.6% to $0.87 as compared to $0.57 in the third quarter of 2020. Adjusted EPS(1) increased 18.9% to $0.88 as compared to $0.74 in the third quarter of 2020.

KEY HIGHLIGHTS

| (in millions, except percentages and per common share amounts) | Three Months Ended | % Reported Change | % Constant Currency Change(1) | ||||||||||

| September 30, 2021 | September 30, 2020 | ||||||||||||

| Net sales | $ | 1,358.3 | $ | 1,132.3 | 20.0 | % | 19.2 | % | |||||

| Net income | $ | 177.4 | $ | 121.4 | 46.1 | % | 44.2 | % | |||||

| Adjusted net income (1) | $ | 179.6 | $ | 155.4 | 15.6 | % | 14.0 | % | |||||

| EBITDA(1) | $ | 295.2 | $ | 279.9 | 5.5 | % | 4.3 | % | |||||

| Adjusted EBITDA(1) | $ | 297.6 | $ | 279.3 | 6.6 | % | 5.4 | % | |||||

| EPS | $ | 0.87 | $ | 0.57 | 52.6 | % | 50.9 | % | |||||

| Adjusted EPS (1) | $ | 0.88 | $ | 0.74 | 18.9 | % | 17.6 | % |

Company Chairman and CEO Scott Thompson commented, “Our strong third quarter sales performance was driven by growth across all brands, products, channels and segments. Our broad-based performance is especially notable given the strong prior year comparative period and our inability to fully meet market demand in the quarter due to continued supply chain constraints. We continue to see opportunity to further grow our business and extend our lead in the design, manufacture and distribution of bedding products over the long term. Our key building blocks to future growth include the meaningful expansion of our total global addressable market via our OEM initiative and our TEMPUR international product launch, our industry-leading innovation capabilities and our balanced capital allocation philosophy. In 2022 and beyond, we expect to leverage these complementary building blocks to deliver double-digit sales and EPS growth.”

Business Segment Highlights

The Company’s business segments include North America and International. Corporate operating expenses are not included in either of the business segments and are presented separately as a reconciling item to consolidated results.

North America net sales increased 12.6% to $1,120.0 million as compared to $994.7 million in the third quarter of 2020. On a constant currency basis(1), North America net sales increased 11.9% as compared to the third quarter of 2020. Gross margin was 39.9% as compared to 44.7% in the third quarter of 2020. Adjusted gross margin(1) was 44.8% in the third quarter of 2020. There were no adjustments to gross margin in the third quarter of 2021. Operating margin was 21.2% as compared to 23.6% in the third quarter of 2020. Adjusted operating margin(1) was 23.8% in the third quarter of 2020. There were no adjustments to operating margin in the third quarter of 2021.

North America net sales through the wholesale channel increased $104.1 million, or 11.7%, to $991.2 million, as compared to the third quarter of 2020, primarily driven by broad-based demand across our retail partners. North America net sales through the direct channel increased $21.2 million, or 19.7%, to $128.8 million, primarily driven by strong company-owned stores sales growth, as compared to the third quarter of 2020.

North America gross margin declined 490 basis points as compared to adjusted gross margin(1) in the third quarter of 2020. The decline was driven by pricing benefit to sales with no improvement in gross margin, operational inefficiencies and unfavorable brand mix driven by supply chain issues. North America operating margin declined 260 basis points as compared to adjusted operating margin(1) in the third quarter of 2020. The decline was primarily driven by gross margin, partially offset by operating expense leverage.

International net sales increased 73.2% to $238.3 million as compared to $137.6 million in the third quarter of 2020. On a constant currency basis(1), International net sales increased 71.6% as compared to the third quarter of 2020. Gross margin was 54.6% as compared to 61.9% in the third quarter of 2020. Operating margin was 21.1% as compared to 29.9% in the third quarter of 2020. Adjusted operating margin(1) was 22.1% as compared to 30.2% in the third quarter of 2020.

International net sales through the wholesale channel increased $7.9 million, or 7.9%, to $108.0 million as compared to the third quarter of 2020. International net sales through the direct channel increased $92.8 million, or 247.5%, to $130.3 million, primarily driven by the acquisition of Dreams Topco Limited (“Dreams”) on August 2, 2021, as compared to the third quarter of 2020.

International gross margin declined 730 basis points as compared to the third quarter of 2020. The decline was primarily driven by the acquisition of Dreams and pricing benefit to sales with no improvement in gross margin. Dreams’ margin profile is lower than our historical international margins as they sell a variety of products across a range of price points. International adjusted operating margin(1) declined 810 basis points as compared to the third quarter of 2020. The decline was primarily driven by the acquisition of Dreams, the decline in gross margin and operating expense deleverage.