The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

December 17, 2023

Saint-Gobain to Sell Majority of UK Foam Insulation Business to Soprema

Published: Dec. 7, 2023 at 1:33 a.m. ET

By David Sachs

Saint-Gobain said it would sell a majority stake in its U.K. foam insulation business to Soprema as part of its disposal plan.

The French construction supplier said late Wednesday that Celotex’s assets will be transferred to a new standalone company, which will be 75% owned by Soprema, a private French waterproofing and insulation firm. Saint-Gobain will retain a 25% minority stake, it said.

The move is part of Saint-Gobain’s streamlining strategy, which includes asset-disposals.

Celotex has two manufacturing facilities in the U.K. and employs 155 people, Saint-Gobain said. The transaction is expected to close early next year.

Financial details were not disclosed.

December 10, 2023

LyondellBasell Announces Sale of Ethylene Oxide & Derivatives Business and Production Facility to INEOS

HOUSTON, Dec. 8, 2023 /PRNewswire/ — LyondellBasell (LYB) today announced it has entered into an agreement to sell its Ethylene Oxide & Derivatives (EO&D) business along with the production facility located in Bayport, Texas to INEOS Oxide (INEOS).

“This transaction is evidence of our disciplined focus on value creation through the execution of a key pillar of our strategy – growing and upgrading our core,” said Peter Vanacker, LyondellBasell CEO. “Successful execution of this strategic pillar involves making difficult decisions to divest businesses which are not part of our core. We remain proud of the positive cash generation, access to advantaged feedstocks, reliability and highly skilled team that makes up the EO&D business and are excited to have reached an agreement with INEOS to enable the business to continue generating value under different ownership. We look forward to collaborating closely with INEOS on a seamless transition.”

The Ethylene Oxide & Derivatives business in Bayport produces high-quality ethylene oxide and various derivatives. The fully integrated platform with access to cost-advantaged feedstocks and logistics networks has excellent performance and reputation in the market.

Tobias Hannemann, CEO INEOS Oxide said, “We are pleased to announce this strategic acquisition. INEOS is a leading producer in Europe and this significant step expands its Ethylene Oxide & Derivatives business into the US, which is the world’s largest market. It also complements our existing Ethanolamines production facility in Plaquemine, Louisiana.”

The purchase price for the transaction is $700 million. The transaction is expected to close in the second quarter of 2024 following completion of the planned maintenance at the facility and is subject to regulatory and other customary closing conditions. J.P. Morgan acted as financial advisor and King & Spalding acted as legal counsel to LyondellBasell.

https://lyondellbasell.mediaroom.com/index.php?s=43&item=1470

December 10, 2023

“Winter Is Coming” For Leveraged Companies

by Tyler Durden

Friday, Dec 08, 2023 – 12:45 PM

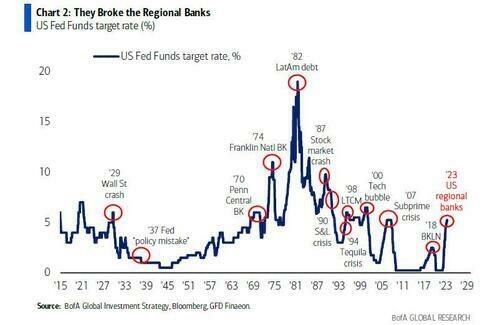

Earlier in the year, as regional banks faced a domino effect of failures, Bank of America strategist Michael Hartnett pointed out that every Fed tightening cycle has historically resulted in a crisis.

Given that the Federal Reserve hasn’t allowed a real credit cycle since the early 2000s, prolonged monetary tightening suggests that “winter is coming” for leveraged companies.

“The whole market and companies have been living in this la la land, this fake world of wealth of quantitative easing where you can borrow at 1% or 2%, you can buy anything, you can make lots of mistakes and you’re not going to get called out,” said Paul Horvath, chief executive officer at investment firm Orchard Global.

Horvath, speaking at the Milken Institute’s Middle East and Africa Summit in Abu Dhabi this week, was quoted by Bloomberg. He warned: “Winter is coming, and I don’t think people have enough parkas.”

The asset manager head said financial markets are holding up well so far, given the high rates. He noted corporates are levered up due to private equity firms buying up companies with cheap money, adding a global financial crisis might not be in the cards – but expects there will still be stress.

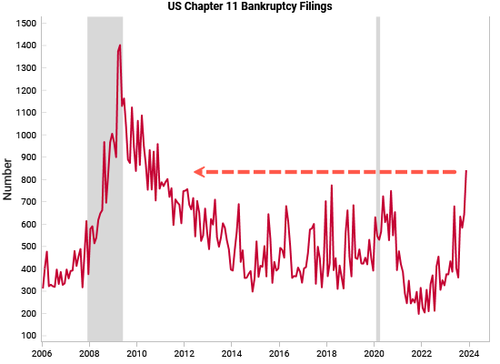

Bloomberg pointed out there were record levels of dealmaking during the pandemic era of cheap money. This led to a surge in private equity buyouts, backed by leveraged finance and the debt load placed on the target company. A large amount of that debt for junk-rated firms is coming due as large maturity walls approach.

Also speaking at the event was SLR Capital Partners co-founder Michael Gross, who said there is no easy solution for companies needing to refinance this debt.

“It’s going to take more than public markets coming back,” Gross said, adding, “It’s going to probably require private equity sponsors to find unique solutions like putting in more equity or finding preferred investors to step into the capital structures.”

Gross said managing portfolio companies with outdated debt structures will also face challenges for private credit funds.

He explained that funds were structured in a world of “perfection” based on an era of low interest rates, but that has all changed.

A higher for the longer environment with mounting macroeconomic headwinds only means over-leveraged firms are increasingly falling into distressed

The impact of this tightening cycle could be worse than the Great Recession – unless the Fed reverses course.

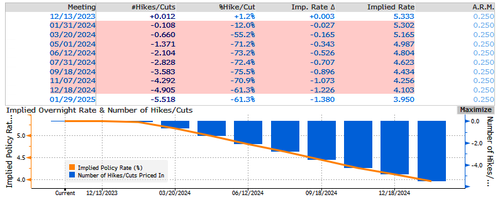

Rate traders are already pricing more than 100bps of rate cuts for 2024.

Meanwhile, Anne Walsh, chief investment officer of Guggenheim Partners Investment Management, said the US economy “hasn’t had a real corporate credit cycle since the early 2000s,” indicating a “purge is about to happen.”

https://www.zerohedge.com/markets/winter-coming-leveraged-companies

December 7, 2023

December 5, 2023

Woodbridge and TM Automotive Seating Systems Enter into a Joint Venture

MISSISSAUGA, Ontario, Canada & TROY, Mich., Dec. 5, 2023 – Today, Woodbridge announced it has entered into a joint venture (JV) with TM Automotive Seating Systems. The JV, to be called TMWB Foam Private Limited, will focus on delivering innovative seating systems to commercial vehicle manufacturers and buses.

“We are pleased to partner with TM Automotive Seating Systems to further strengthen our competitive position within the country,” said Bill Drury, Vice President and General Manager, Asia. “This JV combines Woodbridge’s expertise within the foam industry and TM Automotive Seating Systems’ knowledge of the Indian market to provide both companies an opportunity for growth in the commercial vehicle market.”

The JV will be located in Pune, Maharashtra, India.

About Woodbridge

With corporate headquarters in Mississauga, Ontario, Canada, and automotive headquarters in Troy, Michigan, USA, Woodbridge has more than 7,000 teammates in over 40 locations across nine countries. The company offers material technologies for automotive, commercial, recreational, packaging, healthcare, and building product applications. We provide a full complement of services, including prototyping, consulting, technical support, chemical R&D, and accredited laboratory testing.

December 6, 2023

Polyurethane Foam Association Elects New Officers, Names

Additions To Executive Committee for 2024

Philipe Knaub Takes Reins As President

LOUDON, TN (December 5, 2023)—The Polyurethane Foam Association (PFA) has named its

officers and Executive Committee for 2024. The slate of officers and committee members was

approved by attendees at the General Business Meeting on November 2, 2023 in Toronto.

Officers include:

Philippe Knaub, FXI, President

Rob Heller, Future Foam, 1st Vice President

Cam McLaughlin, Elite Comfort Solutions, 2nd Vice President

Hamdy Khalil, The Woodbridge Group, Treasurer

Bill Gollnitz, Immediate Past President.

Additional PFA Executive Committee members include:

Frank Donato of VPC

Karl Gust, BASF

Scott Skolnekovich, Covestro

Susan Kilpatrick, Evonik

Rob Einterz, Monument Chemical

Robert Smith, Wanhua

Barry Gabelman, Chemfoam.

Knaub takes over the presidency from Chip Holton of NCFI Polyurethanes, who had served in

the position since 2015.

Knaub is Senior Vice President and Chief Technology Officer of FXI, a

position he has held since 2016. He supervises all research and development projects, reporting

to the company’s Chief Executive Officer. He is accountable for all aspects of R&D and product

development, including project portfolio management, discovery, scale ups and

commercialization of new polyurethane foams.

Knaub earned a Ph.D. in Polymer Science from the Institut National des Sciences Appliquées de

Lyon. He holds multiple patents in polyol composition.

“PFA is a vital organization in the flexible polyurethane foam industry,” Knaub said. “I look

forward to working with my colleagues in the industry to further PFA’s programs in advocacy

and education.”

The Polyurethane Foam Association is a trade association founded in 1980 to help educate foam

users, allied industries and other stakeholders. PFA provides facts on environmental, health and

safety issues and technical information on the performance of flexible polyurethane foam (FPF)

in consumer and industrial products. FPF is used as a key comfort component in most

upholstered furniture and mattress products, along with automotive seating, carpet cushion,

packaging, and numerous other applications.

To learn more, visit www.pfa.org.