The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

May 19, 2021

May 14, 2021

Dear Valued Customer:

Effective July 1, 2021, or as contracts allow, Stepan will increase the price for STEPANPOL® and

TERATE® Rigid Polyester Polyols used in the Americas by $0.12 per pound. This increase is

necessary due to the continued rapid rise in raw material and transportation costs.

Due to the magnitude of cost increases in flame retardants, all STEPANPOL® and TERATE®

products containing flame retardant will increase by an additional $.03 per pound for a total of $.15

per pound.

We appreciate your support and value your continued business. Your Stepan sales representative

will be in contact with you to address any questions or concerns.

May 19, 2021

May 14, 2021

Dear Valued Customer:

Effective July 1, 2021, or as contracts allow, Stepan will increase the price for STEPANPOL® and

TERATE® Rigid Polyester Polyols used in the Americas by $0.12 per pound. This increase is

necessary due to the continued rapid rise in raw material and transportation costs.

Due to the magnitude of cost increases in flame retardants, all STEPANPOL® and TERATE®

products containing flame retardant will increase by an additional $.03 per pound for a total of $.15

per pound.

We appreciate your support and value your continued business. Your Stepan sales representative

will be in contact with you to address any questions or concerns.

May 19, 2021

Greiner Plans Recticel Bid Valuing Firm at $915 Million

By Aaron Kirchfeld May 14, 2021, 8:37 AM EDT Corrected May 14, 2021, 3:59 PM EDT

Greiner AG, an Austrian plastics maker, is preparing a takeover offer for Recticel SA valuing the Belgian foam company at about 754 million euros ($915 million), a person with knowledge of the matter said.

Greiner is buying Cie. du Bois Sauvage SA’s 27% stake in the company for 13.50 euros per share and plans to offer the same price to other investors, according to the person, who asked not to be identified because the information is private. The Austrian firm is seeking a majority stake in Recticel and aims to keep its listing on the Euronext Brussels exchange, the person said.

It’s seeking to gain acceptances from shareholders holding at least 50% of the company’s voting rights plus one share, according to the person.

Recticel shares have risen 41% in Brussels trading this year, giving the company a market value of 844 million euros. The planned offer represents a 10.7% discount to Recticel’s closing price of 15.12 euros on Thursday, when the shares rallied 14%.

Cie. du Bois Sauvage and Recticel were both halted from trading on Friday, pending statements. Representatives for Greiner, Cie. du Bois Sauvage and Recticel didn’t immediately respond to requests for comment.

Recticel makes foams for everything from construction to bedding and automotive. The company has received takeover interest before. In 2019, the Belgian company rejected an offer from Irish insulation maker Kingspan Group Plc for just two of its units. At the time, it signaled it would be open to considering an offer for the whole company.

Greiner and Recticel have been working together for decades. They formed a joint venture in 1992 called Eurofoam, which makes flexible foams. The Austrian company agreed to buy out the venture last year.

Recticel agreed in March to acquire the thermal PIR insulation board business of Poland’s Gor-Stal Sp. z o.o for 30 million euros including debt. Later that month, it completed its purchase of Conzzeta AG’s FoamPartner unit for an enterprise value of 270 million Swiss francs ($300 million).

May 19, 2021

Greiner Plans Recticel Bid Valuing Firm at $915 Million

By Aaron Kirchfeld May 14, 2021, 8:37 AM EDT Corrected May 14, 2021, 3:59 PM EDT

Greiner AG, an Austrian plastics maker, is preparing a takeover offer for Recticel SA valuing the Belgian foam company at about 754 million euros ($915 million), a person with knowledge of the matter said.

Greiner is buying Cie. du Bois Sauvage SA’s 27% stake in the company for 13.50 euros per share and plans to offer the same price to other investors, according to the person, who asked not to be identified because the information is private. The Austrian firm is seeking a majority stake in Recticel and aims to keep its listing on the Euronext Brussels exchange, the person said.

It’s seeking to gain acceptances from shareholders holding at least 50% of the company’s voting rights plus one share, according to the person.

Recticel shares have risen 41% in Brussels trading this year, giving the company a market value of 844 million euros. The planned offer represents a 10.7% discount to Recticel’s closing price of 15.12 euros on Thursday, when the shares rallied 14%.

Cie. du Bois Sauvage and Recticel were both halted from trading on Friday, pending statements. Representatives for Greiner, Cie. du Bois Sauvage and Recticel didn’t immediately respond to requests for comment.

Recticel makes foams for everything from construction to bedding and automotive. The company has received takeover interest before. In 2019, the Belgian company rejected an offer from Irish insulation maker Kingspan Group Plc for just two of its units. At the time, it signaled it would be open to considering an offer for the whole company.

Greiner and Recticel have been working together for decades. They formed a joint venture in 1992 called Eurofoam, which makes flexible foams. The Austrian company agreed to buy out the venture last year.

Recticel agreed in March to acquire the thermal PIR insulation board business of Poland’s Gor-Stal Sp. z o.o for 30 million euros including debt. Later that month, it completed its purchase of Conzzeta AG’s FoamPartner unit for an enterprise value of 270 million Swiss francs ($300 million).

May 17, 2021

Port Of LA Volumes Are “Off The Charts”

by Tyler DurdenMonday, May 17, 2021 – 06:10 PM

By Kim Link-Wills of Freight Waves,

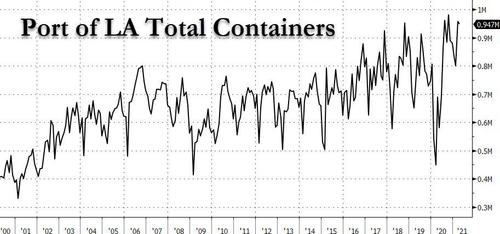

The Port of Los Angeles continued its record-setting streak, posting the busiest April in its 114-year history.

“It’s truly been an unprecedented run here in LA,” Executive Director Gene Seroka said during a media briefing Thursday.

The Port of LA handled 946,966 twenty-foot equivalent units (TEUs) in April. “That’s a 37% spike compared to last year, when global trade dropped with the onset of the pandemic,” Seroka said. “This was by far the busiest April in the port’s 114-year history, outpacing the previous record set just back in 2019 by a hefty 29%.”

He said the port has recorded nine consecutive months of year-over-year volume increases following 11 straight months of declines. “Remarkably, we have continued to average 900,000 TEUs per month dating all the way back to last July.”

The port handled 89 container ships last month, up from 76 in April 2020. And those vessels are being handled efficiently, Seroka said. “We averaged 16 container vessels per day at berth last month. Please remember, before the surge our average was only about 10.”

Port congestion also has eased, according to Seroka.

“We’ve seen as few as 13 container vessels at anchor in the San Pedro Bay over recent days,” he said, noting there were 17 ships at anchor, with eight of them bound for the Port of LA, as of late morning Thursday.

“Another encouraging sign: Fewer ships are going straight to the holding area. We’ve dropped from 90% in February to 65% of vessels heading straight to anchor in the month of April. Average wait time is now 6.7 days after peaking out at 7.9 days in March,” Seroka said.

He noted that nine vessels were at anchor on April 30, representing an additional 132,000 TEUs that will be included in the May numbers.

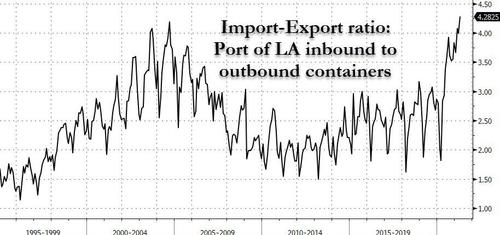

Although congestion has eased, imports haven’t let up, Seroka said, reporting April import volume totaled 490,127 TEUs, a 32.4% year-over-year increase.

“Exports, however, continue to drag, with less than 115,000 TEUs on that side of the ledger, down 12%. Exports have now dropped 27 of the last 30 months here at Los Angeles,” he said.

“April’s import-export ratio was almost 4.3-to-1, which unfortunately is the highest gap we’ve seen yet,” Seroka said. “And the scramble for empties continues, with over 342,000 empty container units repositioned back to Asia in April. That’s just a few thousand TEUs shy of last month’s all-time record” and an 81.6% increase from April 2020.

The figures for the first four months of 2021 are “off the charts,” he said. “We handled more than 3.5 million TEUs, a 42% increase compared to 2020.”

Seroka noted that total volume from Jan. 1 to April 30 was up 20% compared to the same period in “less-volatile” 2019.

https://www.zerohedge.com/markets/port-la-volumes-are-charts