The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

May 17, 2021

Port Of LA Volumes Are “Off The Charts”

by Tyler DurdenMonday, May 17, 2021 – 06:10 PM

By Kim Link-Wills of Freight Waves,

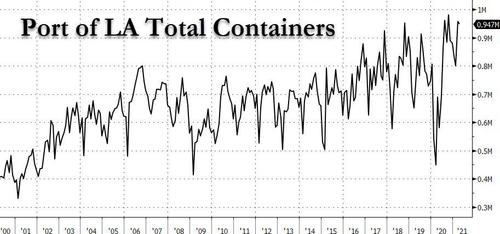

The Port of Los Angeles continued its record-setting streak, posting the busiest April in its 114-year history.

“It’s truly been an unprecedented run here in LA,” Executive Director Gene Seroka said during a media briefing Thursday.

The Port of LA handled 946,966 twenty-foot equivalent units (TEUs) in April. “That’s a 37% spike compared to last year, when global trade dropped with the onset of the pandemic,” Seroka said. “This was by far the busiest April in the port’s 114-year history, outpacing the previous record set just back in 2019 by a hefty 29%.”

He said the port has recorded nine consecutive months of year-over-year volume increases following 11 straight months of declines. “Remarkably, we have continued to average 900,000 TEUs per month dating all the way back to last July.”

The port handled 89 container ships last month, up from 76 in April 2020. And those vessels are being handled efficiently, Seroka said. “We averaged 16 container vessels per day at berth last month. Please remember, before the surge our average was only about 10.”

Port congestion also has eased, according to Seroka.

“We’ve seen as few as 13 container vessels at anchor in the San Pedro Bay over recent days,” he said, noting there were 17 ships at anchor, with eight of them bound for the Port of LA, as of late morning Thursday.

“Another encouraging sign: Fewer ships are going straight to the holding area. We’ve dropped from 90% in February to 65% of vessels heading straight to anchor in the month of April. Average wait time is now 6.7 days after peaking out at 7.9 days in March,” Seroka said.

He noted that nine vessels were at anchor on April 30, representing an additional 132,000 TEUs that will be included in the May numbers.

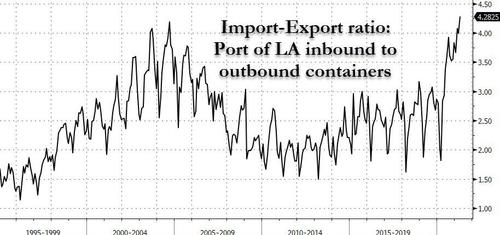

Although congestion has eased, imports haven’t let up, Seroka said, reporting April import volume totaled 490,127 TEUs, a 32.4% year-over-year increase.

“Exports, however, continue to drag, with less than 115,000 TEUs on that side of the ledger, down 12%. Exports have now dropped 27 of the last 30 months here at Los Angeles,” he said.

“April’s import-export ratio was almost 4.3-to-1, which unfortunately is the highest gap we’ve seen yet,” Seroka said. “And the scramble for empties continues, with over 342,000 empty container units repositioned back to Asia in April. That’s just a few thousand TEUs shy of last month’s all-time record” and an 81.6% increase from April 2020.

The figures for the first four months of 2021 are “off the charts,” he said. “We handled more than 3.5 million TEUs, a 42% increase compared to 2020.”

Seroka noted that total volume from Jan. 1 to April 30 was up 20% compared to the same period in “less-volatile” 2019.

https://www.zerohedge.com/markets/port-la-volumes-are-charts

May 17, 2021

Mitsui Chemicals net profit up 70.3% last year May 17/2021 MOSCOW (MRC) — Mitsui Chemicals’ net profit for the fiscal year ending March 2021 posted 70.3% growth despite lower sales, as profitability of its basic materials business benefited from better overseas markets, said the company.

Lower group sales were attributed to declines in product prices, dragged down by falls in values of naphtha and other raw materials and fuel amid the coronavirus pandemic. Its basic materials segment reported a 12.6% year-on-year decline in sales to Y541.4bn, but operating income before special items more than doubled to Y19.6bn from Y9.4bn in the previous fiscal year “due to improved overseas market”.

Mitsui Chemicals said that operating rates at its naphtha crackers were lower than the previous fiscal year due to decreased demand for downstream products, caused by the impact of the coronavirus. “Performance of polypropylene was affected by slowing demand for automotive products. For bisphenol A (BPA) and acetone, the overseas market was at a higher level than the previous fiscal year,” the Japanese producer said.

For the current fiscal year ending March 2022, Mitsui Chemicals is projecting higher earnings, in line with the global economic recovery from a pandemic-induced slump in 2020. Basic materials should be able to generate sales of Y635bn and yield an operating profit before special items of Y36bn, based on the company’s forecasts. “In the chemical industry, although demand is expected to expand due to signs of economic recovery, chemical companies should remain vigilant regarding fluctuations of raw materials and other chemical product markets,” it said.

As per MRC, Kumho Mitsui Chemicals Inc. said it will invest about 400 billion won (USD358.1 million) to expand its chemical manufacturing factory in South Korea’s southwestern region. The joint venture between Korean synthetic rubber maker Kumho Petrochemical and Mitsui Chemicals of Japan said its shareholders approved the investment plan to scale up a methylene diphenyl diisocyanate (MDI) factory in Yeosu, 455 kilometers southwest of Seoul.

Phenol is the main feedstock component for the production of bisphenol A (BPA), which, in its turn, is used to produce polycarbonate (PC).

According to MRC ScanPlast report, Russia’s overall estimated consumption of PC granules grew in the Russian market by 27% year on year in January-February 2021 (excluding imports and exports to/from Belarus) to 16,000 tonnes, compared to 12,600 tonnes a year earlier.

http://www.mrcplast.com/news-news_open-387766.html

May 17, 2021

Mitsui Chemicals net profit up 70.3% last year May 17/2021 MOSCOW (MRC) — Mitsui Chemicals’ net profit for the fiscal year ending March 2021 posted 70.3% growth despite lower sales, as profitability of its basic materials business benefited from better overseas markets, said the company.

Lower group sales were attributed to declines in product prices, dragged down by falls in values of naphtha and other raw materials and fuel amid the coronavirus pandemic. Its basic materials segment reported a 12.6% year-on-year decline in sales to Y541.4bn, but operating income before special items more than doubled to Y19.6bn from Y9.4bn in the previous fiscal year “due to improved overseas market”.

Mitsui Chemicals said that operating rates at its naphtha crackers were lower than the previous fiscal year due to decreased demand for downstream products, caused by the impact of the coronavirus. “Performance of polypropylene was affected by slowing demand for automotive products. For bisphenol A (BPA) and acetone, the overseas market was at a higher level than the previous fiscal year,” the Japanese producer said.

For the current fiscal year ending March 2022, Mitsui Chemicals is projecting higher earnings, in line with the global economic recovery from a pandemic-induced slump in 2020. Basic materials should be able to generate sales of Y635bn and yield an operating profit before special items of Y36bn, based on the company’s forecasts. “In the chemical industry, although demand is expected to expand due to signs of economic recovery, chemical companies should remain vigilant regarding fluctuations of raw materials and other chemical product markets,” it said.

As per MRC, Kumho Mitsui Chemicals Inc. said it will invest about 400 billion won (USD358.1 million) to expand its chemical manufacturing factory in South Korea’s southwestern region. The joint venture between Korean synthetic rubber maker Kumho Petrochemical and Mitsui Chemicals of Japan said its shareholders approved the investment plan to scale up a methylene diphenyl diisocyanate (MDI) factory in Yeosu, 455 kilometers southwest of Seoul.

Phenol is the main feedstock component for the production of bisphenol A (BPA), which, in its turn, is used to produce polycarbonate (PC).

According to MRC ScanPlast report, Russia’s overall estimated consumption of PC granules grew in the Russian market by 27% year on year in January-February 2021 (excluding imports and exports to/from Belarus) to 16,000 tonnes, compared to 12,600 tonnes a year earlier.

http://www.mrcplast.com/news-news_open-387766.html

May 15, 2021

Darkside Retreats to the Dark

After announcing that its criminal infrastructure has been taken down due to U.S. law enforcement pressure, the Darkside ransomware gang says it’s retreating. But is it?

| Kim Zetter | 4 hr ago |

The Darkside gang began last Friday with a bang; but they may be ending their operations a week later with a whimper. Or they may be pulling another scam — this time to cheat affiliates out of their share of the ransom take.

After pulling in at least $9 million from two victims — $5 million paid by Colonial Pipeline on May 8 and about $4.4 million paid by the chemical distribution company Brenntag on May 11 — the developers behind the Darkside ransomware went offline.

Their dark web site — previously accessible only through the Tor browser — became unavailable on Thursday, and someone from a rival ransomware gang posted a message to a forum that was purportedly from the developer of the Darkside ransomware code. The message said the Darkside founders had lost access to the site where they hosted and published data stolen from ransomware victims who refused to pay, and they also lost access to the payment server and other infrastructure they need to collect payment and run their operations.

“A few hours ago, we lost access to the public part of our infrastructure, namely : Blog, Payment server, DOS servers,” reads a since-deleted message from a user called Darksupp, according to The Record, a publication of Recorded Future. The service provider that hosted the infrastructure told the Darkside operators that the sites and servers were taken down “at the request of law enfocement [sic] agencies.” Darksupp also said that cryptocurrency had been withdraw from the wallet they used to store payments from ransomware victims.

There’s reason to believe that at least some of this is true. Reuters and Bloomberg reported earlier this week that companies assisting Colonial Pipeline in their response to the incident worked with the FBI to get a hosting provider in New York to shut down a server that was storing data stolen from Colonial Pipeline before the thieves could transfer it to Russia, where the perpetrators are believed to be based.

And on Friday, Elliptic, a blockchain analytics company which also makes compliance tools for cryptocurrency businesses to monitor transactions, reported that it had identified the Bitcoin wallet used by the Darkside gang. The company said that on Thursday, the wallet — which still held $5 million in Bitcoin — was emptied.

Some have suggested this could be a ruse on the part of the Darkside gang to avoid sharing ransom proceeds with their affiliates who carried out the ransomware operation against Colonial Pipeline. Without knowing where the funds went, however, it’s difficult to know if the FBI seized it or if the Darkside gang emptied the wallet themselves.

The wallet, according to Elliptic, became active on March 4th and received 57 payments from 21 other Bitcoin wallets, totalling $17.5 million.

“Some of these payments directly match ransoms known to have been paid to DarkSide by other victims, such as 78.29 BTC (worth $4.4 million) sent by chemical distribution company Brenntag on May 11,” the company noted.

If authorities did seize $5 million in Bitcoin that was still sitting in the Darkside wallet, it’s only a fraction of what the criminal syndicate had already laundered out of the wallet since March.

According to Elliptic, about 18% of the wallet’s contents was sent to a small group of cryptocurrency exchanges, where Bitcoin is traded among buyers and sellers. “This information will provide law enforcement with critical leads to identify the perpetrators of these attacks,” the company noted. “An additional 4% has been sent to Hydra, the world’s largest darknet marketplace, servicing customers in Russia and neighboring countries.”

Hydra allows users to cash out their Bitcoin by converting it to cash or loading sums onto prepaid debit or gift cards.

In addition to Darkside’s retreat, another top ransomware group known as REvil has announced that it plans to stop advertising its ransomware service and instead “go private” by working with only a small group of trusted affiliates, The Record reported.

Some are cautioning that the moves by Darkside and REvil don’t mean their activity will stop; just that the operators plan to become less flashy in order to attract less law enforcement attention.

“I sincerely hope the Infosec community and media don’t lose their minds over thinking DarkSide is actually shutting down when it’s almost certainly a rebranding attempt to avoid the heat,” Robert M. Lee, CEO of the security firm Dragos wrote on Twitter on Friday.

May 15, 2021

Darkside Retreats to the Dark

After announcing that its criminal infrastructure has been taken down due to U.S. law enforcement pressure, the Darkside ransomware gang says it’s retreating. But is it?

| Kim Zetter | 4 hr ago |

The Darkside gang began last Friday with a bang; but they may be ending their operations a week later with a whimper. Or they may be pulling another scam — this time to cheat affiliates out of their share of the ransom take.

After pulling in at least $9 million from two victims — $5 million paid by Colonial Pipeline on May 8 and about $4.4 million paid by the chemical distribution company Brenntag on May 11 — the developers behind the Darkside ransomware went offline.

Their dark web site — previously accessible only through the Tor browser — became unavailable on Thursday, and someone from a rival ransomware gang posted a message to a forum that was purportedly from the developer of the Darkside ransomware code. The message said the Darkside founders had lost access to the site where they hosted and published data stolen from ransomware victims who refused to pay, and they also lost access to the payment server and other infrastructure they need to collect payment and run their operations.

“A few hours ago, we lost access to the public part of our infrastructure, namely : Blog, Payment server, DOS servers,” reads a since-deleted message from a user called Darksupp, according to The Record, a publication of Recorded Future. The service provider that hosted the infrastructure told the Darkside operators that the sites and servers were taken down “at the request of law enfocement [sic] agencies.” Darksupp also said that cryptocurrency had been withdraw from the wallet they used to store payments from ransomware victims.

There’s reason to believe that at least some of this is true. Reuters and Bloomberg reported earlier this week that companies assisting Colonial Pipeline in their response to the incident worked with the FBI to get a hosting provider in New York to shut down a server that was storing data stolen from Colonial Pipeline before the thieves could transfer it to Russia, where the perpetrators are believed to be based.

And on Friday, Elliptic, a blockchain analytics company which also makes compliance tools for cryptocurrency businesses to monitor transactions, reported that it had identified the Bitcoin wallet used by the Darkside gang. The company said that on Thursday, the wallet — which still held $5 million in Bitcoin — was emptied.

Some have suggested this could be a ruse on the part of the Darkside gang to avoid sharing ransom proceeds with their affiliates who carried out the ransomware operation against Colonial Pipeline. Without knowing where the funds went, however, it’s difficult to know if the FBI seized it or if the Darkside gang emptied the wallet themselves.

The wallet, according to Elliptic, became active on March 4th and received 57 payments from 21 other Bitcoin wallets, totalling $17.5 million.

“Some of these payments directly match ransoms known to have been paid to DarkSide by other victims, such as 78.29 BTC (worth $4.4 million) sent by chemical distribution company Brenntag on May 11,” the company noted.

If authorities did seize $5 million in Bitcoin that was still sitting in the Darkside wallet, it’s only a fraction of what the criminal syndicate had already laundered out of the wallet since March.

According to Elliptic, about 18% of the wallet’s contents was sent to a small group of cryptocurrency exchanges, where Bitcoin is traded among buyers and sellers. “This information will provide law enforcement with critical leads to identify the perpetrators of these attacks,” the company noted. “An additional 4% has been sent to Hydra, the world’s largest darknet marketplace, servicing customers in Russia and neighboring countries.”

Hydra allows users to cash out their Bitcoin by converting it to cash or loading sums onto prepaid debit or gift cards.

In addition to Darkside’s retreat, another top ransomware group known as REvil has announced that it plans to stop advertising its ransomware service and instead “go private” by working with only a small group of trusted affiliates, The Record reported.

Some are cautioning that the moves by Darkside and REvil don’t mean their activity will stop; just that the operators plan to become less flashy in order to attract less law enforcement attention.

“I sincerely hope the Infosec community and media don’t lose their minds over thinking DarkSide is actually shutting down when it’s almost certainly a rebranding attempt to avoid the heat,” Robert M. Lee, CEO of the security firm Dragos wrote on Twitter on Friday.