The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

November 19, 2023

The Best and Worst U.S. Airports of 2023

The Journal’s ranking of the 50 largest U.S. airports finds fliers in the West have lots to brag about, while New Yorkers settle for ‘works in progress’

There’s enough that’s easy about traveling through Phoenix Sky Harbor International Airport to land it first among the 20 largest airports in this year’s rankings.

By Dawn Gilbertson| Photographs by Adam Riding for The Wall Street Journal

Nov. 14, 2023 9:00 pm ET

PHOENIX—Searing heat. Erratic sports teams. An unending influx of Californians.

Residents of this desert city have plenty of gripes. One thing you’ll hear few complaints about: the airport. Phoenix Sky Harbor International Airport is a breeze to get to. It offers a solid lineup of airlines and flights. And travelers rarely fret about flight delays and cancellations given the never-have-to-look-at-the-forecast weather.

It’s a combination that helped land the airport atop The Wall Street Journal’s annual ranking of the country’s busiest airports—again. Sky Harbor took the crown in 2019, before a pandemic pause in the rankings.

Top Five Large U.S. Airports

| Overall Rank | Airport | Overall Score |

|---|---|---|

| 1 | Phoenix (PHX) | 63.4 |

| 2 | Minneapolis (MSP) | 63.2 |

| 3 | Los Angeles (LAX) | 62.9 |

| 4 | Atlanta (ATL) | 62.7 |

| 5 | Detroit (DTW) | 61.4 |

Click to see where every airport landed in the full ranking.

Source: 2023 WSJ Airport Rankings

Minneapolis-St. Paul International Airport finished a hair behind Phoenix among the 20 busiest U.S. airports on this year’s list. Los Angeles International Airport took third, just behind them.

The Journal’s report card ranks the 50 largest U.S. airports on 30 measures divided into two categories important to travelers: The first group measures reliability, the second value and convenience.

Each accounted for half of an airport’s overall score, with 10 reliability measures, from Transportation Security Administration waits to time on the tarmac, carrying the most weight overall. After all, the thing we care most about in our travels is getting there on time.

New this year as a measure of customer satisfaction: a survey of travelers done by Dynata for the Journal on amenities that airports get right and wrong, from food and drink to bathrooms to parking.

(See the full results of this year’s large-airport and midsize-airport rankings.)

Good, not great

No airport had a perfect score or anything close to it, a sign of the never-ending stresses on these complex, 24-hour businesses. Sky Harbor, my second home as a Phoenix resident, scored 63.4 out of 100. That wouldn’t earn report-card bonuses in any household.

Top Five Midsize U.S. Airports

| Overall Rank | Airport | Overall Score |

|---|---|---|

| 1 | San Jose (SJC) | 71.2 |

| 2 | San Antonio (SAT) | 70.4 |

| 3 | Sacramento (SMF) | 70.0 |

| 4 | Indianapolis (IND) | 69.9 |

| 5 | Houston (HOU) | 69.0 |

Click to see where every airport landed in the full ranking.

Source: WSJ Airport Rankings

San Jose Mineta International Airport in California, the winner in the midsize category, topped all airports with a score of 71.2. San Antonio finished second (70.4), followed by last year’s midsize winner, Sacramento (70).

San Jose shined in reliability, as well as value and convenience. The Silicon Valley airport prides itself on its short walks—you can still walk to the rental-car center—short security lines, on-time performance and therapy dog and cat programs. Earlier this year it introduced a new tagline: Fly Simple.

“We’ve worked really hard to concentrate on the things that we can control,” says Scott Wintner, deputy director.

San Jose Mineta International Airport topped the list of 30 midsize airports. Photo: Markus Mainka/Alamy

The worst-performing large airports won’t surprise anyone, especially given the nonstop headlines on congestion issues in the Northeast: Newark Liberty International Airport and New York’s John F. Kennedy. Dallas/Fort Worth International finished third-worst in our scorecard, dragged down by measures of reliability like heavy arrival and departure delays.

Rick Cotton, executive director of the Port Authority of New York and New Jersey, which oversees the region’s airports, describes Newark and JFK as “works in progress.” Newark’s redesigned Terminal A opened this year, and the Port Authority plans to overhaul the airport’s other two terminals. JFK is also in the midst of a revamp that will cost billions of dollars and take years to complete.

“We’re committed to a trajectory where Newark and JFK are world-class,” Cotton says.

Phoenix, where American and Southwest carry nearly three out of four passengers, was solidly reliable. It also performed well on money matters like airfares and Uber costs to downtown, plus amenities including baggage claim and car-rental facilities, though it fared poorly in rental-car costs on the November weekend we priced.

American and Southwest combine to fly by far the most passengers in and out of PHX.

Sky Harbor had among the fewest flight cancellations of any large airport, shorter delays than most and far shorter time on the tarmac awaiting takeoff or getting to the gate. The average taxi-out time—the time from when a plane leaves the gate until takeoff—was under 15 minutes, compared with 26 minutes at JFK.

Weather helps a lot, of course. Airport director Chad Makovsky also credits the takeoff and landing choreography the airport, airlines, FAA and others have worked to perfect over the years. It’s essential, given the airport’s compact size.

The Sky’s the Limit

Phoenix Sky Harbor International Airport finished first in the WSJ Airport Rankings. Below are some of its highlights and new features.

Sources: WSJ Airport survey; the airport

The city-owned airport near downtown Phoenix sits on 3,400 acres and has just three runways. That compares with 17,000 acres and seven runways at Dallas/Fort Worth, where Makovsky came from in 2021. PHX passenger traffic, fueled by the region’s explosive growth, is up nearly 10% from a year ago and about 4% from 2019 through September.

“We have to be very efficient,” he says.

Upgrades go live

Sky Harbor completed some major projects in the past 18 months that are already a hit with travelers, Makovsky says. Nearly 75% of the airport’s passengers are local. Contrast that with an airport like Charlotte, N.C., where 70% of the passengers are connecting.

In December, a couple months before metro Phoenix hosted the Super Bowl, the airport extended its PHX Sky Train service 2.5 miles to the rental-car center. Travelers previously had to schlep bags to the curb and board a shuttle bus that wound through clogged airport roadways. The airport’s bus fleet went from 120 to a dozen backup buses.

“Being able to connect from any of our terminals to the rental-car center in like five minutes is pretty cool compared to what we used to have,” Makovsky says.

Fliers appreciate features like the airport’s Sky Train and sun-blocking windows.

The airport opened a new concourse, for

Southwest Airlines, in summer 2022. It’s now coming to life as restaurants and bars start to open. A Bobby Flay outlet opened in the food court and a Guy Fieri sit-down restaurant is on the menu by the end of next year. Also on tap: a PGA Tour store with a simulator of the infamous 16th hole at the Phoenix Open. A Chase Sapphire Reserve lounge is due to boost the airport’s weak lounge lineup by next spring.

Makovsky says the new gates in Terminal 4, the airport’s busiest, provide a glimpse into PHX’s future as it builds another concourse in neighboring Terminal 3 and renovates existing concourses in Terminal 4. Many areas of Terminal 4, which opened 33 years ago, are showing their age.

The walkway to the new gates is significantly wider than other concourses at the airport, so there’s less passenger congestion. (Some passengers ding that area for the lack of moving walkways.) The gate areas are larger and windows have dynamic tinting so passengers can look out at the mountains even in the glare of the afternoon sun.

“At the end of the day, we’re trying to keep the stress down for customers,” Makovsky says.

Some fliers have suggested that Sky Harbor could have better signage, shorter walks and more long-haul international flights. (American and

British Airways offer nonstops to London and Condor has seasonal flights to Frankfurt.)

Richard Factor can’t find any fault with the airport. The inventor moved from New York to Sedona, Ariz., a tourist hot spot two hours north of Phoenix, about a decade ago. He and his wife travel frequently.

“The experience there compared to what it used to be back East is so much more pleasant that sometimes I think the airport itself should have a tip jar,” he says.

PHX ranked third in baggage-claim facilities in the traveler survey, trailing only New York’s LaGuardia and Minneapolis-St. Paul. The survey, done by Dynata for the Journal, is on amenities that airports get right and wrong, from food and drink to bathrooms and parking.

(See the full results of this year’s large-airport and midsize-airport rankings.)

—Jacob Passy, Allison Pohle and Kevin McAllister contributed to this article.

—Sign up for the WSJ Travel newsletter for more tips and insights from Dawn Gilbertson and the rest of the Journal’s travel team.

Write to Dawn Gilbertson at dawn.gilbertson@wsj.com

https://www.wsj.com/lifestyle/travel/best-worst-airports-2023-rankings-96d6b945

November 15, 2023

Carpenter Signs Agreement to Purchase NCFI’s Consumer Products Division

Carpenter Signs Agreement to Purchase NCFI’s Consumer Products Division

Carpenter Co., the world’s largest vertically integrated manufacturer of polyurethane foams, has signed an agreement to acquire the flexible foam assets of NCFI’s Consumer Products Division. The Division, based in Mount Airy, North Carolina, features scientifically-engineered foams for the furniture, mattress, aircraft, aerospace, marine, medical industries, and several additional market segments.

Brad Beauchamp, CEO of Carpenter Co., said, “We are excited to bring the world class products and people of NCFI to Carpenter. This acquisition will further our integration and growth of the Engineered Foams business that we acquired from Recticel earlier this year. The Mt. Airy location and the diverse set of products made therein will complement our current business portfolio.”

The NCFI Consumer Products Division site in Mount Airy will complement Carpenter’s existing operations in Conover, North Carolina, as well as provide additional capacity to make select foam grades offered by the former Recticel Engineered Foams business. Moreover, NCFI’s commitment to sustainability and innovation supports Carpenter’s vision: to be admired for creating products and delivering solutions that help make the world more comfortable, safer, and healthier.

November 14, 2023

Polyurethane Foam Association Fall Meeting Addresses

Sustainability, Industry Innovation

Gollnitz and Khalil Inducted Into Flexible Polyurethane Foam Hall Of Fame

TORONTO, ONTARIO (November 14, 2023)— Sustainability was at the forefront of the

Polyurethane Foam Association’s Fall

Meeting recently in Toronto.

Top industry executives, EHS specialists,

scientists, marketers, and regulatory analysts

met at the Omni King Edward Hotel for

networking sessions and presentations

covering everything from European end-of-

life requirements to irradiation of

polyurethane foam to yield 3-D printing

resins.

PFA’s Industry Issues Session provided

updates on key markets in the flexible foam

industry, including bedding and carpet

cushion. Additional presentations addressed

legal and regulatory developments,

isocyanate research projects, trade

remedies, and more.

In the Technical Program on the following day, presentations covered foam making equipment

and process controls, biocontent and recycling of automotive foam in Europe, inclusion of lignin

and soy polyols into foam formulations, upcycling of EOL foam into 3-D printing resins, and the

Virginia Tech/Arizona State closed loop recycling project.

Awards: Bill Gollnitz of Plastomer Corporation (L) and Dr. Hamdy

Khalil of Woodbridge Group (R) were inducted into the Flexible

Polyurethane Foam Hall of Fame.

Chip Holton of NCFI

Polyurethanes (Center) was presented with PFA’s Lifetime

Achievement Award.

Chip Holton of NCFI Polyurethanes, PFA’s President, recognized new PFA members including

Reticulatus, Ingenieria Del Poliuretano Flexible, S.L., and PCC Rokita. He noted that since the

lifting of pandemic restrictions, 23 new companies have joined PFA.

“PFA continues to be a very effective voice for the flexible polyurethane foam industry,” Holton

noted. “PFA frequently reminds us that industry advocacy is much stronger as a group rather

than as individual companies; PFA also provides an exceptional forum for the exchange of

knowledge and critical industry information.”

As a highlight of the meeting, two long-term veterans of the industry were inducted into the

Flexible Polyurethane Foam Hall of Fame. The Hall of Fame was established to honor the

leaders and innovators. It serves as an information source for future industry members and

researchers regarding the contributions of individuals and companies who have led the growth

and betterment of the flexible polyurethane foam industry in North America.

Bill Gollnitz, Technical Director of Plastomer Corporation, and Dr. Hamdy Khali, Senior

Technology Advisor for Advanced Technologies and Innovation at Woodbridge Foam

Corporation, became the latest inductees, making a total of 35 individuals and companies

honored.

Gollnitz has more than 51 years’ experience in the flexible polyurethane foam industry. For

nearly 30 years, he has been Technical Director at Plastomer Corporation. Prior to that, he held

group management positions at ARCO Chemical Company and Olin Chemical. He began his

career in the foam industry with Firestone Foam, working as a special assistant to Firestone

President Bob Hay, a founding member of PFA and also a member of the Flexible Polyurethane

Foam Hall of Fame.

He has a deep understanding of how chemistry, manufacturing and suppliers can work together

to advance the polyurethanes industry, and developed a reputation for being able to oversee the

construction of flexible foam manufacturing plants from concept to full scale production. He is a

Past President of PFA, and currently serves on PFA’s Executive and Technical Committees.

“Every time there’s a threat to the industry, be it technical or regulatory, PFA has met it head on.

And I’m sure that’s going to continue in the future,” Gollnitz said in his acceptance speech. He

also expressed gratitude for the education tools PFA has developed to attract young professionals

to the industry, and to assist in continuing education of those who have made flexible foam their

careers.

Dr. Khalil pioneered the introduction and commercialization of renewable materials into the

polyurethane chemistry used in interior automotive parts manufacturing. Under his guidance,

Woodbridge became one of the early adopters of green technologies using biobased polyols.

Khalil also played a leading role in ongoing efforts to harmonize OEM specifications for VOC

emissions from plastics in auto interiors.

He served on the Board of Directors of the Ontario Bio Auto Council, and the Center for

Research and Innovation in the Bio Economy (CRiBE). He acted as an advisor to the National

Research Council of Canada on renewable and sustainable materials technology. Dr. Khalil

received the Outstanding Leadership from the Center For the Polyurethane Industry (CPI), and

the Technical Leadership Award from The Nano Division of the Technical Association for the

Pulp and Paper Industry (TAPPI). He was selected to the Advisory Panel For Arbora Nano for

the Advancement of Lignocellulosic Products. Dr. Khalil received the “Le Sueur Memorial

Award” from the Society of Chemical Industry for Outstanding Industrial Contribution.

His passion is in mentoring a new generation of scientists and engineers.

“Polyurethane is the most versatile polymeric system, and it has been serving humanity in more

applications than any other material known to mankind,” Khalil noted. “However, we have many

challenges. Our industry needs to be aggressive in innovation and building partnerships with

institutions and universities. There is much yet to discover about the potential of polyurethanes.”

After the Hall of Fame inductions, outgoing PFA President Holton was presented with PFA’s

Lifetime Achievement Award.

“All of us in the association appreciate Chip’s leadership over the last seven years,” said Russ

Batson, PFA Executive Director. “Chip has the unique ability to analyze a challenge and focus

everyone on the critical elements, so that we can decide on the most sensible pathways forward.”

Dr. Mojgan Nejad won the Dr. Herman Stone Technical Excellence Award. Her presentation,

“Sustainable PU Flexible Foams: Utilizing Renewable Materials from Biomass and Soy,” was

voted best by those attending the Technical Program. The award is named for Dr. Herman T.

Stone, who served as PFA’s first Technical Director. In 2007, Dr. Stone was inducted into the

Flexible Polyurethane Foam Hall of Fame.

The Polyurethane Foam Association is a trade association founded in 1980 to help educate foam

users, allied industries and other stakeholders. PFA provides facts on environmental, health and

safety issues and technical information on the performance of flexible polyurethane foam (FPF)

in consumer and industrial products. FPF is used as a key comfort component in most

upholstered furniture and mattress products, along with automotive seating, carpet cushion,

packaging, and numerous other applications.

To learn more, visit www.pfa.org.

November 13, 2023

Sinochem International 400kT PO Facility Set to Produce Qualified Products in December

PUdaily | Updated: November 8, 2023

Since 2022, Sinochem International has successively completed and put into operation major facilities such as phenol acetone, bisphenol A, epoxy chloropropane, and epoxy resin as part of its first-phase C3 project. The 600 ktpa propane dehydrogenation (PDH) facility was recently commissioned for trial production, marking the complete integration of the entire epoxy resin industry chain at Sinochem International’s site in Lianyungang.

Over the years, Sinochem International has undergone a strategic transformation, evolving from a trading-oriented company into an internationally operated conglomerate primarily focused on fine chemical production. Through investments and acquisitions, the company has acquired a significant number of high-quality assets, including majority stakes in companies like Sennics, Yangnong Chemical, Elix Polymers, among others, laying a strong foundation for a successful industrial transformation. The company’s business encompasses chemical intermediates, polymer additives, new materials, new energy, and other traditional sectors, with complementary advantages between industries. Leveraging a green and circular economy industrial chain, Sinochem International has achieved continuous product diversification and efficient resource utilization, establishing a core competitive edge. The products offered include chlorobenzene series, nitrochlorobenzene series, widely used in industries such as pharmaceuticals, agrochemicals, and dyes. In the field of new materials, the company deals with high-performance fiber materials like aramid and high-strength polyethylene, as well as materials like epoxy chloropropane and epoxy resin used in industries such as coatings and electronics. They also handle lightweight materials such as PU, PC, PS, ABS, and others.

It’s worth mentioning that Sinochem International’s C3 project, with a production capacity of 400 ktpa of propylene oxide (PO), is expected to start commissioning on November 8 and is projected to produce qualified products in early December.

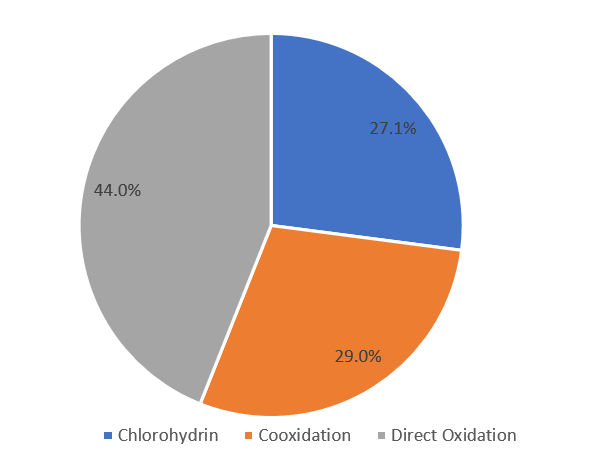

In the context of increasingly stringent environmental regulations, traditional chlorohydrin processes, which have not effectively addressed the “three wastes” issue, are gradually being phased out. In the draft of China’s 2023 Catalogue for Guiding Industry Restructuring, issued by National Development and Reform Commission on July 14, 2023, the calcium saponification chlorohydrin process should be eliminated by December 31, 2025. Following the elimination of a 50 ktpa chlorohydrin-based facility in Shandong, in recent years, chlorohydrin-based PO facilities, such as those in Jinpu, Tianjin, and Fujian, have successively ceased operations. As a result, the proportion of chlorohydrin processes has decreased from 55.9% in 2018 to 27.1% in 2022.

Currently, new PO facilities primarily use direct oxidation (HPPO) and cooxidation (PO/SM, PO/TBA) processes.

Sinochem International is expanding its capacity by 400 ktpa using the direct oxidation process for PO production, and its scale and technology are at the forefront domestically. The C3 project includes a 400 ktpa HPPO facility with supporting facilities, in line with national environmental protection policies. As an environmentally encouraged process, the direct oxidation process can overcome the drawbacks of severe equipment corrosion and high waste generation associated with chlorohydrin processes. This method features a simple process, high product yield, and only generates PO and water during production. Raw materials and auxiliary agents can be recycled, resulting in lower raw material and energy consumption and a significant reduction in production costs. It is also environmentally friendly and non-polluting. Furthermore, the direct oxidation process is expensive and challenging to acquire, with a high entry barrier. Once the facility is operational, Sinochem International will hold a leading position in terms of production capacity and technology in the domestic market.

Dimethyl carbonate (DMC) is a co-product produced by ester exchange in the production of propylene glycol. Thanks to green chemistry, new energy promotion, and sustainable development, DMC has gained attention due to its low toxicity and excellent environmental performance. It finds wide applications in various industrial fields. Apart from its traditional uses in adhesives, coatings, developers, and polycarbonates, DMC has seen significant growth in the downstream applications of lithium-ion battery electrolyte solvents, which now account for 30% of its usage. High purity is crucial for these applications, with industrial-grade DMC primarily used in traditional downstream applications and polycarbonates (PC), while battery-grade DMC requires higher purity. Currently, suppliers of battery-grade DMC include Shida Shenghua (75 ktpa), Oxiranchem (20 ktpa), etc. New entrants in this market include Capchem, Sinochem Quanzhou, Zhejiang Petrochemical, and Hualu Hengsheng. In the next 3-5 years, the newly established production capacity for carbonates in China is expected to exceed 4 mtpa, contributing to the increased demand for PO.

November 13, 2023

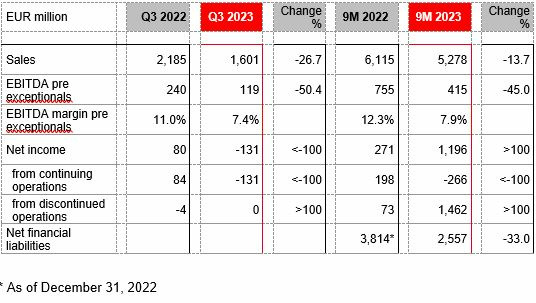

Persistently weak demand impacts third quarter

- Sales down 26.7 percent to EUR 1.601 billion in the third quarter of 2023

- EBITDA pre exceptionals down 50.4 percent year-on-year at EUR 119 million

- Further significant reduction of net financial liabilities to EUR 2.557 billion

- Guidance for fiscal year 2023: EBITDA pre exceptionals expected to be between EUR 500 and 550 million

- Board of Management plans dividend reduction to EUR 0.10

- Sale of Urethane Systems business unit initiated

- “FORWARD!” action plan: structural measures to permanently reduce costs by EUR 150 million

CologneNovember 08, 2023

In the third quarter of 2023, LANXESS’ business figures were again influenced by the persistently weak economy. Sales amounted to EUR 1.601 billion, down 26.7 percent on the previous year’s figure of EUR 2.185 million. EBITDA pre exceptionals fell by 50.4 percent from EUR 240 million to EUR 119 million.

The main reasons for this development were the low demand from nearly all industries and customers’ ongoing albeit diminishing inventory reduction. The associated reduction in sales volumes and high idle costs led to declining earnings, especially in the Specialty Additives and Advanced Intermediates segments. The Consumer Protection segment saw only a comparatively moderate earnings decline.

The Group’s EBITDA margin pre exceptionals was 7.4 percent, against 11.0 percent in the prior-year quarter. Net income declined to minus EUR 131 million in the third quarter compared with EUR 80 million in the prior-year quarter.

“The weak demand in the global chemicals industry persists, and we see no signs of recovery for the rest of the year. On the contrary, demand in the fourth quarter to date seems to be even weaker than expected,” said Matthias Zachert, Chairman of the Board of Management at LANXESS AG.

LANXESS had already announced the unexpectedly weak start to the fourth quarter on November 6. Initiated destocking of customers in the agroindustry and a supplier-related production limitation for the Business Unit Flavors & Fragrances at its production site in Botlek (NL) impact results additionally. LANXESS therefore expects EBITDA pre exceptionals for the full year 2023 to be between EUR 500 and 550 million. LANXESS’ previous guidance was EUR 600 to 650 million for EBITDA pre exceptionals for the total year.

Dividend cut and sale of Urethane Systems

Given the weak business development, the Board of Management intends to propose a reduction of the full year 2023 dividend to EUR 0.10. The hereby avoided cash outflow would result in a further reduction of net financial debt. Expected proceeds from the now initiated sale of the Business Unit Urethane Systems would contribute as well.

As the last remaining polymer business at LANXESS, the business unit no longer fits in with the strategic orientation of the Group, which has systematically realigned its portfolio in recent years. The business unit has a global presence with six production sites and employs around 400 staff.

https://lanxess.com/en/Media/Press-Releases/2023/11/Persistently-weak-demand-impacts-third-quarter