The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

February 19, 2021

Indian ministry says petrochemical, polymer sectors to witness growth

20

Feb ’21

Pic: Shutterstock The increased outlay for healthcare and the fund for vaccination in the budget will boost polymer consumption with requirements of syringes and other polymer based healthcare products, and in general, the requirement of petrochemicals and polymers, required in a range of sectors, will also increase and boost domestic demand with increased government spending.

The roll out of the production-linked incentive (PLI) schemes for key end-use sectors will boost petrochemical consumption in the country, the ministry of chemical and fertilizers said in a press release.

Among the sectors earmarked, seven sectors—including mobile phone manufacturing, auto and components, medical devices, textile products—use significant quantity of petrochemicals. The estimated outlay of ₹1.41 lakh crores augurs well for the petrochemical industry growth, the ministry said.

The massive emphasis on infrastructure spending is expected to result in additional consumption of petrochemicals like polymers and specialty chemicals. Also, Agriculture focused measure like doubling of outlay for micro-irrigation to ₹10,000 crores will further fuel demand for polymer based irrigation products and services.

The synthetic industry has welcomed increase in import duty on raw cotton. This will support farmers to get better remuneration on cotton production and also eliminate cheap imports coming from neighboring countries. As such India is surplus of cotton and rather than exporting cotton.

Industry also welcomes increase in basic customs duty on silk and silk products. Synthetic Industry will be able to substitute silk products silk products by supplying silk like products out of synthetic fibres.

On methylene diphenyl diisocyanate (MDI), duty has been increased from zero to 7.5 per cent. It is used in the production of polyurethanes for many applications, like spandex yarn. The revised custom duty will attract investments in India given the rising demand of polyurethanes and presence of no domestic players.

February 19, 2021

Great Summary of Where We Are–It’s Going to be a Rough Few Weeks

U.S. Gulf Coast storm outages rise, send ripples round global markets; Area plant status list update included

by WILL BEACHAM, Deputy Editor, ICIS Chemical Business

February 19, 2021

The US polar storm has now shut down 90% of US polypropylene (PP) capacity, 67% of ethylene and devastated other important products, sending ripples around global chemical markets prices soaring.

More chemical plants and refineries across the Gulf Coast region have been hit by prolonged power and feedstock outages caused by freezing weather, snow and ice which have also halted logistics networks. More bad weather, forecast for later in the week, may prolong the disruption.

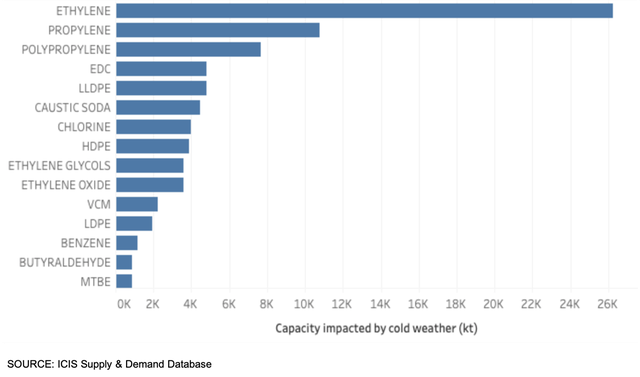

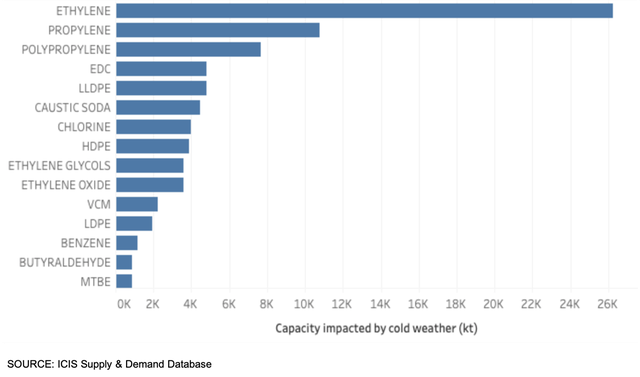

So far, ICIS has reported more than 60 plant outages as a result of the storm, with analysis using data from the ICIS Supply & Demand database showing that a wide swathe of the Gulf petrochemical sector has now been severely impacted.

Worst hit in volume terms is ethylene, with 26m tonnes of capacity offline, representing 67% of the US total. Around 11m tonnes, or 50%, of propylene capacity is also offline, with many of the region’s oil refineries also seeing curtailed production. More than 2m bbl/day of US oil refining capacity is shut down.

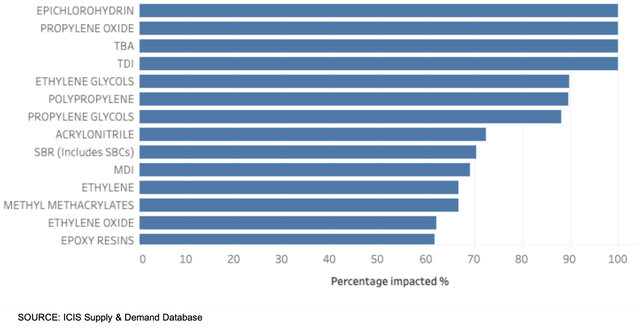

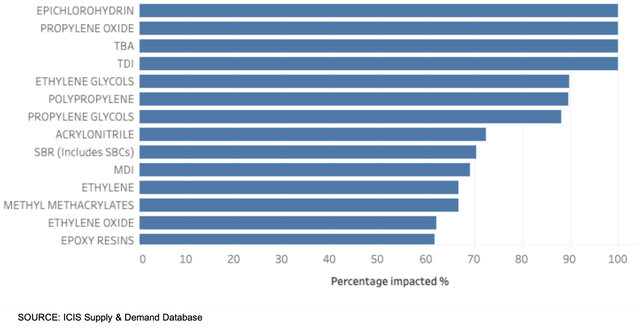

In percentage terms, the major commodities worst affected are epichlorohydrin (ECH) (100% of US capacity offline), propylene oxide (PO) (100%), toluene diisocyanate (TDI) (100%), ethylene glycol (EG) (90%), polypropylene (PP) (90%), propylene glycol (88%), acrylonitrile (ACN) (73%) and styrene butadiene rubber (SBR) (71%).

The outages are tightening global markets which were already suffering shortages of material and rising prices. Problems with the global container shipping system, plant outages plus healthy downstream demand have caused tightness, notably down the propylene and polyethylene (PE) chains.

Propylene and PP are likely to be one of the hardest-hit by the storms because the market was already in turmoil. The coronavirus pandemic has reduced demand for transport fuels, and led to oil refineries closing or cutting production, particularly in Europe and the US.

These closures had a knock-on effect on the supply of propylene and PP, leading to price spikes. With US PP production capacity so highly concentrated on the Gulf Coast, even temporarily constrained production capabilities will have a massive effect on an already tightly supplied market.

US propylene prices are at 10-year highs and inventories are roughly half of what they were a year ago. Consumption has outpaced production due to reduced propylene production over the last year.

PP inventories in the US hit seven-year lows in late 2020, partially driven by rebounding demand and partially driven by limited monomer availability. Some PP production issues also preceded this weather event.

The situation is less dramatic in PE. Constrained supply and demand for packaging has sustained global markets through the pandemic, with logistics challenges and outages causing shortages and price spikes in 2021.

With almost two thirds of US ethylene capacity now offline, global PE markets are likely to tighten further.

US methyl methacrylate (MMA) supply is also expected to be further constrained thanks to the storm, as Lucite has taken down its plant in Beaumont, Texas. Severe constraints in feedstock acetone continue to limit production. Due to high costs, a producer is heard to be levying a temporary acetone surcharge on orders starting this month.Expand

With the Chinese New Year holidays coming to an end from 17 February, demand is picking back up in the world’s largest chemicals market. ICIS reported today that a supply shortage and improving demand after the holidays, supported China’s polyolefins market, leading to a surge in futures and spot prices.

Futures prices in China also rose sharply for styrene, mono ethylene glycol (MEG), polyester and polypropylene.

Prior to the holiday, domestic petrochemical trading had been robust accompanied by sharp price increases as market players anticipated strong post-holiday demand. Surging oil prices provided additional impetus for the uptrend.

In Africa, PE and PP sellers, from all origins, have withdrawn their offers in anticipation of disruption to US exports and a strong return post-holiday market.

Asia’s monoethylene glycol (MEG) prices surged on Thursday by 11% – the biggest daily gain on record – underpinned by tightening global supply, as the Chinese markets re-opened after a week-long holiday.

There are fears that US exports to Asia of key commodities such as ethylene could be disrupted by the storm-related outages.

Europe prices have also been buoyed by the storms. Rising upstream prices and bullish sentiment sent benzene prices up, and styrene prices are now at highs not seen since April 2018.Expand

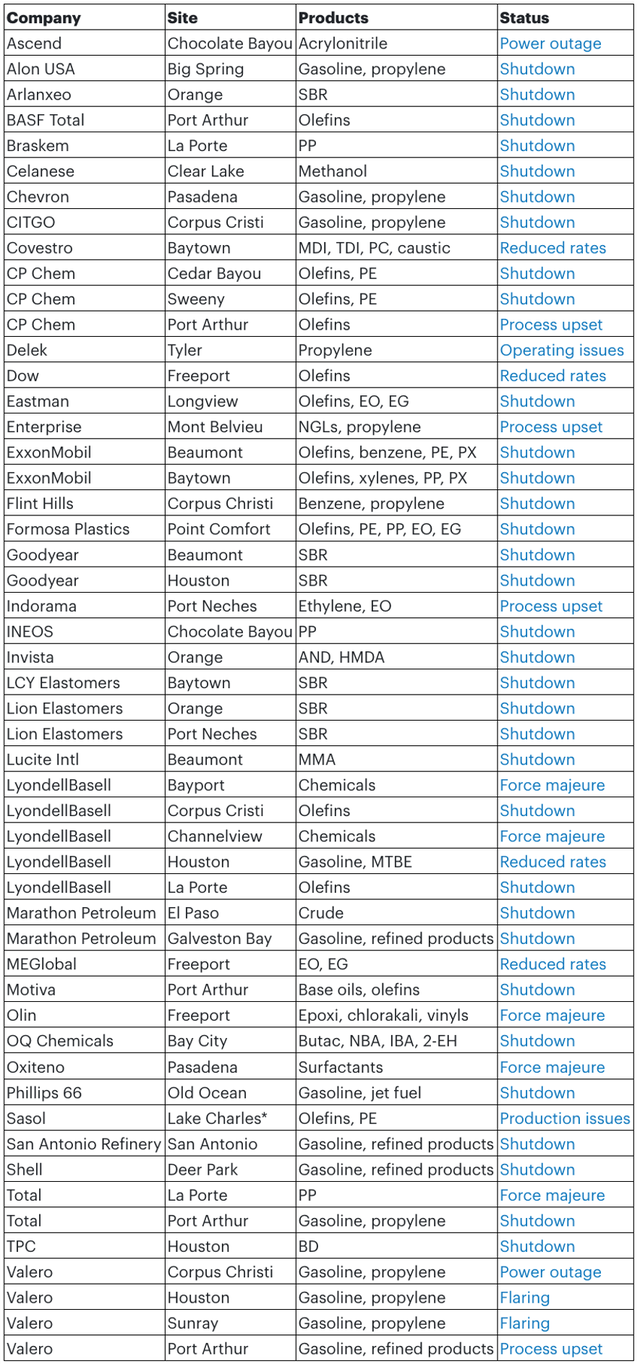

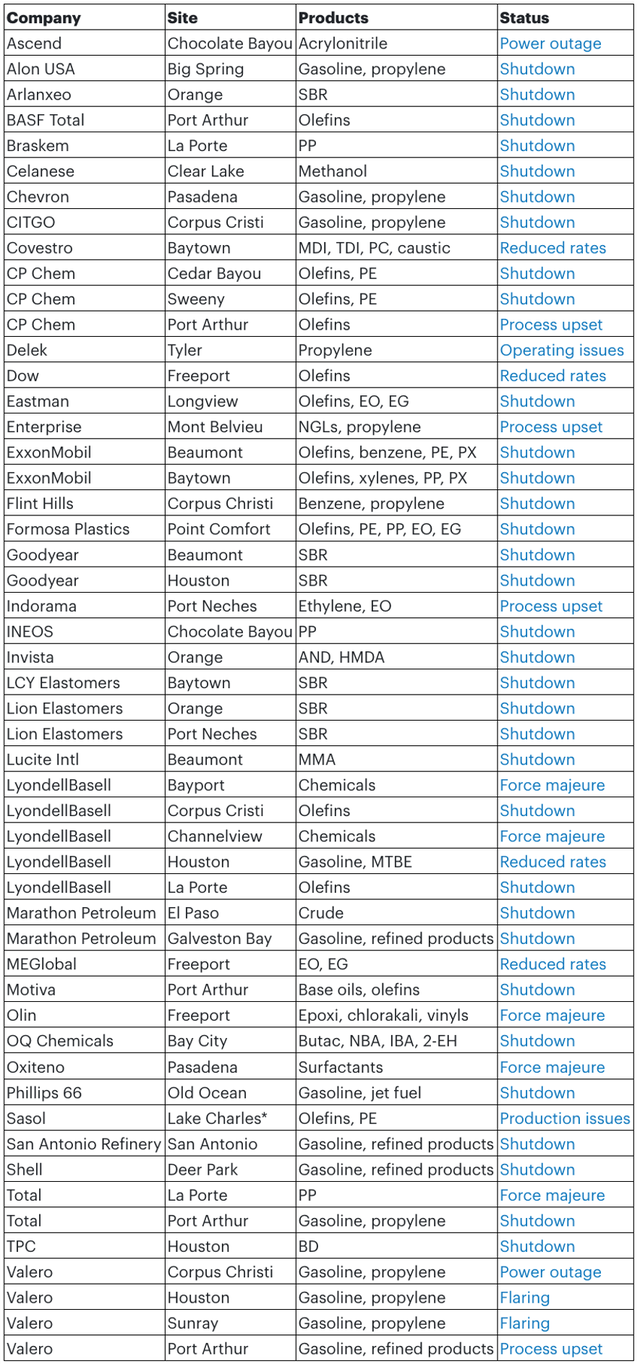

Area plant status

Additional reporting by: Lucy Shuai, Pearl Bantillo, Ben Lake, Judith Wang, Felicia Loo, Nurluqman Suratman, Amanda Hay, Tom Brown, Yashas Mudumbai, Helena Strathearn and Tarun Raizada,

https://www.bicmagazine.com/departments/operations/us-gulf-coast-storm-outages-rise-send-ripples/

February 19, 2021

Great Summary of Where We Are–It’s Going to be a Rough Few Weeks

U.S. Gulf Coast storm outages rise, send ripples round global markets; Area plant status list update included

by WILL BEACHAM, Deputy Editor, ICIS Chemical Business

February 19, 2021

The US polar storm has now shut down 90% of US polypropylene (PP) capacity, 67% of ethylene and devastated other important products, sending ripples around global chemical markets prices soaring.

More chemical plants and refineries across the Gulf Coast region have been hit by prolonged power and feedstock outages caused by freezing weather, snow and ice which have also halted logistics networks. More bad weather, forecast for later in the week, may prolong the disruption.

So far, ICIS has reported more than 60 plant outages as a result of the storm, with analysis using data from the ICIS Supply & Demand database showing that a wide swathe of the Gulf petrochemical sector has now been severely impacted.

Worst hit in volume terms is ethylene, with 26m tonnes of capacity offline, representing 67% of the US total. Around 11m tonnes, or 50%, of propylene capacity is also offline, with many of the region’s oil refineries also seeing curtailed production. More than 2m bbl/day of US oil refining capacity is shut down.

In percentage terms, the major commodities worst affected are epichlorohydrin (ECH) (100% of US capacity offline), propylene oxide (PO) (100%), toluene diisocyanate (TDI) (100%), ethylene glycol (EG) (90%), polypropylene (PP) (90%), propylene glycol (88%), acrylonitrile (ACN) (73%) and styrene butadiene rubber (SBR) (71%).

The outages are tightening global markets which were already suffering shortages of material and rising prices. Problems with the global container shipping system, plant outages plus healthy downstream demand have caused tightness, notably down the propylene and polyethylene (PE) chains.

Propylene and PP are likely to be one of the hardest-hit by the storms because the market was already in turmoil. The coronavirus pandemic has reduced demand for transport fuels, and led to oil refineries closing or cutting production, particularly in Europe and the US.

These closures had a knock-on effect on the supply of propylene and PP, leading to price spikes. With US PP production capacity so highly concentrated on the Gulf Coast, even temporarily constrained production capabilities will have a massive effect on an already tightly supplied market.

US propylene prices are at 10-year highs and inventories are roughly half of what they were a year ago. Consumption has outpaced production due to reduced propylene production over the last year.

PP inventories in the US hit seven-year lows in late 2020, partially driven by rebounding demand and partially driven by limited monomer availability. Some PP production issues also preceded this weather event.

The situation is less dramatic in PE. Constrained supply and demand for packaging has sustained global markets through the pandemic, with logistics challenges and outages causing shortages and price spikes in 2021.

With almost two thirds of US ethylene capacity now offline, global PE markets are likely to tighten further.

US methyl methacrylate (MMA) supply is also expected to be further constrained thanks to the storm, as Lucite has taken down its plant in Beaumont, Texas. Severe constraints in feedstock acetone continue to limit production. Due to high costs, a producer is heard to be levying a temporary acetone surcharge on orders starting this month.Expand

With the Chinese New Year holidays coming to an end from 17 February, demand is picking back up in the world’s largest chemicals market. ICIS reported today that a supply shortage and improving demand after the holidays, supported China’s polyolefins market, leading to a surge in futures and spot prices.

Futures prices in China also rose sharply for styrene, mono ethylene glycol (MEG), polyester and polypropylene.

Prior to the holiday, domestic petrochemical trading had been robust accompanied by sharp price increases as market players anticipated strong post-holiday demand. Surging oil prices provided additional impetus for the uptrend.

In Africa, PE and PP sellers, from all origins, have withdrawn their offers in anticipation of disruption to US exports and a strong return post-holiday market.

Asia’s monoethylene glycol (MEG) prices surged on Thursday by 11% – the biggest daily gain on record – underpinned by tightening global supply, as the Chinese markets re-opened after a week-long holiday.

There are fears that US exports to Asia of key commodities such as ethylene could be disrupted by the storm-related outages.

Europe prices have also been buoyed by the storms. Rising upstream prices and bullish sentiment sent benzene prices up, and styrene prices are now at highs not seen since April 2018.Expand

Area plant status

Additional reporting by: Lucy Shuai, Pearl Bantillo, Ben Lake, Judith Wang, Felicia Loo, Nurluqman Suratman, Amanda Hay, Tom Brown, Yashas Mudumbai, Helena Strathearn and Tarun Raizada,

https://www.bicmagazine.com/departments/operations/us-gulf-coast-storm-outages-rise-send-ripples/

February 19, 2021

The oversupply of the aniline industry will ease in the next three years

Echemi 2021-02-18

A few days ago, the first aniline and upstream and downstream industry summit was held in Nanjing. The participating experts analyzed the future trend of the market and believed that the oversupply situation of the aniline industry in the next three years would ease.

Longzhong Consulting analysts said that in recent years, my country’s aniline industry has shown prominent contradictions in oversupply, survival of the fittest, and going overseas. The industry’s operating rate has been maintained at 50% to 70% for a long time.

The main raw materials of aniline are pure benzene and nitric acid. The price of nitric acid is relatively low and its impact on the market is limited. The downstream of aniline mainly includes MDI (diphenylmethane diisocyanate), rubber additives and other products. At present, domestic MDI production enterprises have fully realized the independent production capacity of aniline, and have surplus output on the market.

In recent years, the aniline industry has relied on exports to ease the contradiction of oversupply. From 2016 to 2018, the export volume has increased year by year, and the export volume has declined from 2019 to 2020. The main export destinations are India, the United States, Spain, Hungary and other countries.

Experts predict that in the next three years, the new production capacity of aniline will be mainly concentrated in MDI co-production enterprises, and the expansion of rubber additives will be very small, and the contradiction of oversupply will be eased. The development of the aniline industry still faces two major problems. One is the oversupply, and the other is the single development of downstream products, and the growth point of demand is still on MDI products.

Research on the aniline market must focus on crude oil prices. Longzhong Consulting analysts pointed out that the main factors affecting crude oil prices in 2020 are geopolitics, epidemics, economic demand and inventories. It is a very unstable quadrilateral, and the impact of individual factors cannot be overstated. It is expected that it will take about 100 weeks to fully recover after the international oil price plummet, and the reasonable range is between 55 and 60 US dollars per barrel.

Experts pointed out that because only one set of pure benzene plants was put into operation in Zhejiang Petrochemical in the first half of 2021, and many pure benzene plants were overhauled, the domestic supply of pure benzene would be tight.

In the long run, my country has built seven major petrochemical industrial bases. These projects have relatively high chemical production capacity. The production capacity of pure benzene plants is mostly at the million-ton level. At the same time, due to the misalignment of upstream and downstream production time, the surplus pure benzene may impact the market in the short term.

Experts pointed out that in the context of the transformation and upgrading of my country’s industrial structure, the elimination of backward production capacity and intensive development are the general trend, and the pure benzene industry chain will also be reshaped from the top down. It is expected that in the next two years, the downstream expansion of the pure benzene industry chain will be faster than that of the upstream. However, due to the clearing of downstream backward production capacity and the supplement of foreign pure benzene imports, the domestic pure benzene market is expected to maintain a tight balance.

February 19, 2021

The oversupply of the aniline industry will ease in the next three years

Echemi 2021-02-18

A few days ago, the first aniline and upstream and downstream industry summit was held in Nanjing. The participating experts analyzed the future trend of the market and believed that the oversupply situation of the aniline industry in the next three years would ease.

Longzhong Consulting analysts said that in recent years, my country’s aniline industry has shown prominent contradictions in oversupply, survival of the fittest, and going overseas. The industry’s operating rate has been maintained at 50% to 70% for a long time.

The main raw materials of aniline are pure benzene and nitric acid. The price of nitric acid is relatively low and its impact on the market is limited. The downstream of aniline mainly includes MDI (diphenylmethane diisocyanate), rubber additives and other products. At present, domestic MDI production enterprises have fully realized the independent production capacity of aniline, and have surplus output on the market.

In recent years, the aniline industry has relied on exports to ease the contradiction of oversupply. From 2016 to 2018, the export volume has increased year by year, and the export volume has declined from 2019 to 2020. The main export destinations are India, the United States, Spain, Hungary and other countries.

Experts predict that in the next three years, the new production capacity of aniline will be mainly concentrated in MDI co-production enterprises, and the expansion of rubber additives will be very small, and the contradiction of oversupply will be eased. The development of the aniline industry still faces two major problems. One is the oversupply, and the other is the single development of downstream products, and the growth point of demand is still on MDI products.

Research on the aniline market must focus on crude oil prices. Longzhong Consulting analysts pointed out that the main factors affecting crude oil prices in 2020 are geopolitics, epidemics, economic demand and inventories. It is a very unstable quadrilateral, and the impact of individual factors cannot be overstated. It is expected that it will take about 100 weeks to fully recover after the international oil price plummet, and the reasonable range is between 55 and 60 US dollars per barrel.

Experts pointed out that because only one set of pure benzene plants was put into operation in Zhejiang Petrochemical in the first half of 2021, and many pure benzene plants were overhauled, the domestic supply of pure benzene would be tight.

In the long run, my country has built seven major petrochemical industrial bases. These projects have relatively high chemical production capacity. The production capacity of pure benzene plants is mostly at the million-ton level. At the same time, due to the misalignment of upstream and downstream production time, the surplus pure benzene may impact the market in the short term.

Experts pointed out that in the context of the transformation and upgrading of my country’s industrial structure, the elimination of backward production capacity and intensive development are the general trend, and the pure benzene industry chain will also be reshaped from the top down. It is expected that in the next two years, the downstream expansion of the pure benzene industry chain will be faster than that of the upstream. However, due to the clearing of downstream backward production capacity and the supplement of foreign pure benzene imports, the domestic pure benzene market is expected to maintain a tight balance.