The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

November 19, 2020

Existing Home Sales Soar To Highest In 15 Years

by Tyler Durden Thu, 11/19/2020 – 10:07

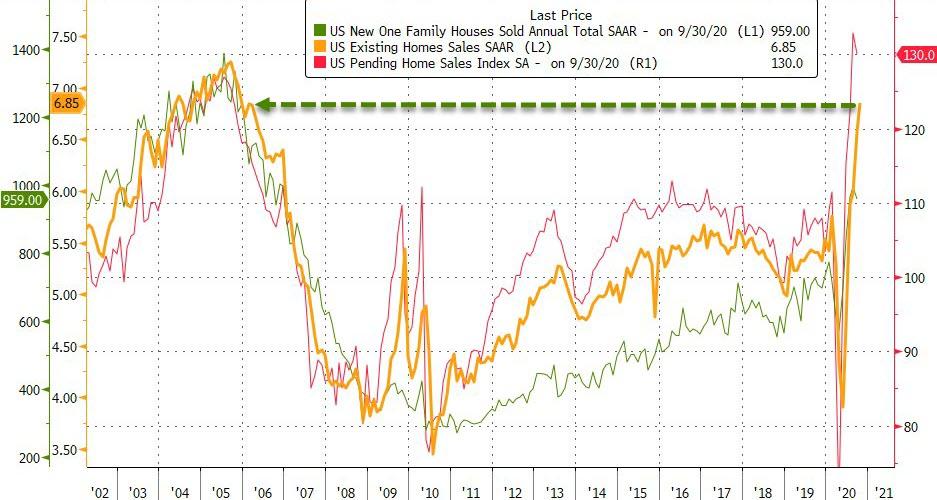

Existing home sales bucked the trend in September (rising to highest since May 2006 as new- and pending-home sales slipped) and analysts expect it too catch down a little in October, but yet again, it surprised to the upside, surging 4.3% MoM (vs a 1.1% MoM expected drop), and September’s jump was revised higher to a 9.9% spike…

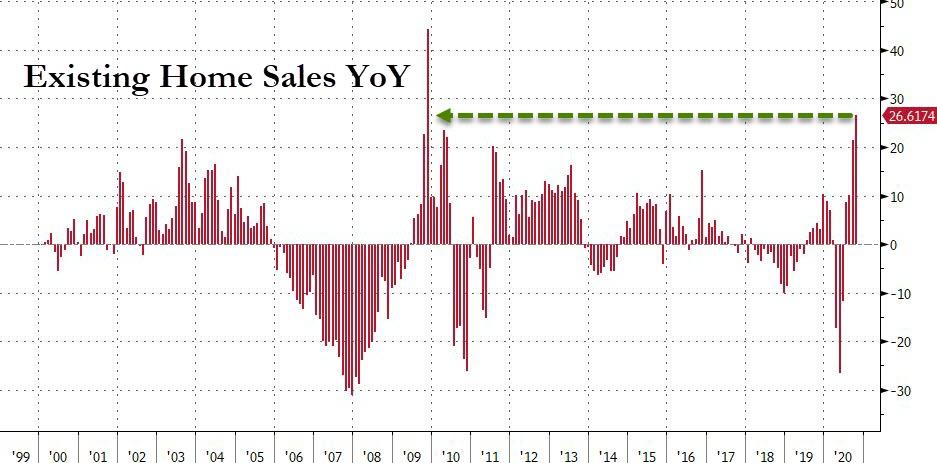

This surprise rise has pushed the YoY jump in sales to 26.6% – the biggest spike since Nov 2009

Source: Bloomberg

This is the highest existing home sales print since November 2005…

Source: Bloomberg

Christophe Barraud explains why the number was so ‘surprisingly’ good:

- Buyers continued to benefit from favorable market conditions in October with mortgage rates still close to the lowest level on record

- Local/state reports confirm that sales kept rising by more than 20% YoY (non-seasonally adjusted: NSA) in October, which should translate into a bounce on a MoM basis (seasonally adjusted: SA)

- Recent announcements from corporates suggest that home-improvement activity (correlated to existing home sales) is still booming

Median home price rose 15.5% from last year to $313,000, an all-time high, according to NAR.

“It’s quite amazing, and certainly surprising me,” Lawrence Yun, NAR’s chief economist, said on a call with reporters.

“It’s quite remarkable given that we’re still in the midst of the pandemic and the high unemployment rate.”

Finally, we note that while homebuilder sentiment is at record highs (but building permits stumbled?), homebuyer sentiment remains low and has rolled over…

Source: Bloomberg

And don’t expect The Fed to come to the rescue with ‘rate-cuts’ anytime soon.

https://www.zerohedge.com/personal-finance/existing-home-sales-soar-highest-15-years

November 16, 2020

Grenfell inquiry: Ex-employee describes ‘dishonest’ acts at firm that made flammable insulation used on tower

The ex-Celotex assistant product manager told the inquiry the firm had been dishonest when testing its Rs5000 insulation product.

By Aisha Zahid, news reporter

Monday 16 November 2020 20:05, UK

A former employee of the company that produced flammable insulation used on Grenfell Tower says he complied with “completely unethical” acts, the inquiry into the June 2017 disaster has heard.

Jonathan Roper, the ex-assistant product manager at Celotex, told proceedings the firm had been “dishonest” by “overengineering” a cladding fire safety test to enable its Rs5000 insulation product to pass.

After an initial test failure in January 2014, a second system passed in May 2014 – this was used to incorrectly market the combustible rigid foam boards as safe for use on high-rise buildings, the inquiry heard.

Celotex added a 6mm fire-resisting magnesium oxide board to a cladding test rig consisting of 12mm fibre cement panels for the second test, the hearing was told.

The inquiry heard 8mm fibre cement panels were added to “conceal” the presence of the magnesium oxide, making the whole system almost flush – but for the 2mm difference.

Mr Roper agreed with the inquiry’s chief lawyer Richard Millett QC that using “a thinner layer was to make it less noticeable there was something else behind it”, which would help “see off any prospect of anyone asking questions”, about how it had been made up.

Mr Roper answered “yes it did”, when Mr Millett had asked him the question: “Did that not strike you at the time as dishonest?”

Mr Roper also said: “I went along with a lot of actions at Celotex that, looking back on reflection, were completely unethical and that I probably didn’t potentially consider the impact of at the time.

“I was 22 or 23, first job, I thought this was standard practice albeit it did sit very uncomfortably with me.”

Mr Roper added that his superiors ordered the mention of magnesium oxide to be removed from any marketing, which he agreed was “misleading and intended to mislead”.

Mr Millett also asked: “Did you realise at the time that if this was how the test was to be described to the market it would be a fraud on the market?”

Mr Roper responded by saying: “Yes I did. I felt incredibly uncomfortable with it. I felt incredibly uncomfortable with what I was asked to do.”

He added that he could not voice his concerns to anyone else in the firm at the time.

Mr Roper also told the inquiry that the motivation for getting the Rs5000 product to market was to compete with a rival firm.

Celotex has released a statement, saying: “In the course of investigations carried out by Celotex after the Grenfell Tower fire, certain issues emerged concerning the testing, certification and marketing of Celotex’s products which were previously unknown to Celotex’s current management.”

It added: “Once established, they were promptly and publicly announced by notices on Celotex’s website and reported to the relevant testing and certification bodies, the Ministry of Housing, Communities and Local Government, Trading Standards, the Metropolitan Police and the Inquiry.

“These matters involved unacceptable conduct on the part of a number of employees. They should not have happened and Celotex has taken concerted steps to ensure that no such issues reoccur.

“Celotex is committed to cooperating fully with the Grenfell Tower Inquiry and related investigations, continuing to support the UK Government’s ongoing response to the tragedy.”

The company, part of the French multinational Saint-Gobain group, maintains that it promoted the use of Rs5000 on buildings higher than 18 metres only on a “rainscreen cladding system with the specific components”, used when it passed the fire safety test.

In its opening statement for module two of the inquiry, the firm said: “In the course of investigations carried out by Celotex after the Grenfell Tower fire, certain issues emerged concerning the testing, certification and marketing of Celotex’s products.

“These matters involved unacceptable conduct on the part of a number of employees.”

Module two of the inquiry will scrutinise the production, testing and sale of materials used in the tower’s refurbishment which saw 72 people killed in the 14 June 2017 fire.

November 16, 2020

Grenfell inquiry: Ex-employee describes ‘dishonest’ acts at firm that made flammable insulation used on tower

The ex-Celotex assistant product manager told the inquiry the firm had been dishonest when testing its Rs5000 insulation product.

By Aisha Zahid, news reporter

Monday 16 November 2020 20:05, UK

A former employee of the company that produced flammable insulation used on Grenfell Tower says he complied with “completely unethical” acts, the inquiry into the June 2017 disaster has heard.

Jonathan Roper, the ex-assistant product manager at Celotex, told proceedings the firm had been “dishonest” by “overengineering” a cladding fire safety test to enable its Rs5000 insulation product to pass.

After an initial test failure in January 2014, a second system passed in May 2014 – this was used to incorrectly market the combustible rigid foam boards as safe for use on high-rise buildings, the inquiry heard.

Celotex added a 6mm fire-resisting magnesium oxide board to a cladding test rig consisting of 12mm fibre cement panels for the second test, the hearing was told.

The inquiry heard 8mm fibre cement panels were added to “conceal” the presence of the magnesium oxide, making the whole system almost flush – but for the 2mm difference.

Mr Roper agreed with the inquiry’s chief lawyer Richard Millett QC that using “a thinner layer was to make it less noticeable there was something else behind it”, which would help “see off any prospect of anyone asking questions”, about how it had been made up.

Mr Roper answered “yes it did”, when Mr Millett had asked him the question: “Did that not strike you at the time as dishonest?”

Mr Roper also said: “I went along with a lot of actions at Celotex that, looking back on reflection, were completely unethical and that I probably didn’t potentially consider the impact of at the time.

“I was 22 or 23, first job, I thought this was standard practice albeit it did sit very uncomfortably with me.”

Mr Roper added that his superiors ordered the mention of magnesium oxide to be removed from any marketing, which he agreed was “misleading and intended to mislead”.

Mr Millett also asked: “Did you realise at the time that if this was how the test was to be described to the market it would be a fraud on the market?”

Mr Roper responded by saying: “Yes I did. I felt incredibly uncomfortable with it. I felt incredibly uncomfortable with what I was asked to do.”

He added that he could not voice his concerns to anyone else in the firm at the time.

Mr Roper also told the inquiry that the motivation for getting the Rs5000 product to market was to compete with a rival firm.

Celotex has released a statement, saying: “In the course of investigations carried out by Celotex after the Grenfell Tower fire, certain issues emerged concerning the testing, certification and marketing of Celotex’s products which were previously unknown to Celotex’s current management.”

It added: “Once established, they were promptly and publicly announced by notices on Celotex’s website and reported to the relevant testing and certification bodies, the Ministry of Housing, Communities and Local Government, Trading Standards, the Metropolitan Police and the Inquiry.

“These matters involved unacceptable conduct on the part of a number of employees. They should not have happened and Celotex has taken concerted steps to ensure that no such issues reoccur.

“Celotex is committed to cooperating fully with the Grenfell Tower Inquiry and related investigations, continuing to support the UK Government’s ongoing response to the tragedy.”

The company, part of the French multinational Saint-Gobain group, maintains that it promoted the use of Rs5000 on buildings higher than 18 metres only on a “rainscreen cladding system with the specific components”, used when it passed the fire safety test.

In its opening statement for module two of the inquiry, the firm said: “In the course of investigations carried out by Celotex after the Grenfell Tower fire, certain issues emerged concerning the testing, certification and marketing of Celotex’s products.

“These matters involved unacceptable conduct on the part of a number of employees.”

Module two of the inquiry will scrutinise the production, testing and sale of materials used in the tower’s refurbishment which saw 72 people killed in the 14 June 2017 fire.

November 16, 2020

Casper Reports Third Quarter 2020 Results

Mon November 16, 2020 6:30 AM|Business Wire|About: CSPR

COVID-19 and Supply Chain Impacted Third Quarter 2020 Revenue of $123.5 million

Continued Strength in Retail Partnership Channel, up 28% YoY

Gross Margins of 55.5%, up 480 basis points YoY

NEW YORK–(BUSINESS WIRE)– Casper Sleep Inc. (CSPR) (“Casper” or the “Company”) (NYSE: CSPR) today announced financial results for the quarter ended September 30, 2020 (the “third quarter 2020” or “third quarter”).

Third Quarter 2020 Financial Highlights (as compared to the quarter ended September 30, 2019)

- Revenue decreased 3.3% to $123.5 million;

- North America revenue increased $2.2 million or 1.8%;

- European revenue was negligible due to the closure of our European operations in the second quarter of 2020, compared to approximately $6 million in the quarter ended September 30, 2019;

- Direct-to-Consumer Revenue decreased 11.4% to $89.9 million;

- Retail Partnership Revenue increased 28.3% to $33.6 million;

- Gross Profit increased 5.9% to $68.5 million with gross margin of 55.5%, up 480 basis points;

- Net Loss improved $7.2 million or 31.1% to $15.9 million;

- Adjusted EBITDA loss improved by $9.3 million or 55% to $7.5 million; and

- Cash and cash equivalents of $96.1 million at quarter end.

Philip Krim, Chief Executive Officer, comments: “Casper’s third quarter was highly productive but unfortunately we believe the results don’t fully reflect the health and potential of our business. We saw record interest for our products evidenced by record website traffic, continued to drive gross margin expansion and progress towards profitability, and had another sequential quarter of growth; however, our top-line growth was disappointing based on the initial demand signals. Challenges in our supply chain, including industry-wide shortages in textiles and chemicals critical to foam production, led to significant out-of-stock inventory both in our direct-to-consumer and retail partnership channels. Many of our core mattresses were out of stock on our website for weeks at time and we were unable to monetize the full demand from retail partners leading to cancelled orders.

We have made significant progress addressing some of our supply chain challenges. Specifically, we have on-boarded new Tier 1 and Tier 2 suppliers and vendors; we are putting in place redundancies across key supply chain points and implementing improved inventory planning; and we are actively building up our safety stock which will help protect against further disruptions. We believe the worst of our supply chain disruptions are behind us, and we are well-positioned going forward.”

Mr. Krim continued: “We are actively managing the business to best position Casper for the future and are excited about the many opportunities in front of us to enhance shareholder value as we continue to leverage our leading brand and scale our multi-channel distribution. Our organization is focused on long-term, sustainable growth and we believe our expanded distribution, current growing product offering and pipeline, strong brand awareness, refined marketing expertise and healthy balance sheet position us well to achieve our goal of sustainable Adjusted EBITDA profitability starting in mid-2021.”

https://seekingalpha.com/pr/18086377-casper-reports-third-quarter-2020-results

November 16, 2020

Casper Reports Third Quarter 2020 Results

Mon November 16, 2020 6:30 AM|Business Wire|About: CSPR

COVID-19 and Supply Chain Impacted Third Quarter 2020 Revenue of $123.5 million

Continued Strength in Retail Partnership Channel, up 28% YoY

Gross Margins of 55.5%, up 480 basis points YoY

NEW YORK–(BUSINESS WIRE)– Casper Sleep Inc. (CSPR) (“Casper” or the “Company”) (NYSE: CSPR) today announced financial results for the quarter ended September 30, 2020 (the “third quarter 2020” or “third quarter”).

Third Quarter 2020 Financial Highlights (as compared to the quarter ended September 30, 2019)

- Revenue decreased 3.3% to $123.5 million;

- North America revenue increased $2.2 million or 1.8%;

- European revenue was negligible due to the closure of our European operations in the second quarter of 2020, compared to approximately $6 million in the quarter ended September 30, 2019;

- Direct-to-Consumer Revenue decreased 11.4% to $89.9 million;

- Retail Partnership Revenue increased 28.3% to $33.6 million;

- Gross Profit increased 5.9% to $68.5 million with gross margin of 55.5%, up 480 basis points;

- Net Loss improved $7.2 million or 31.1% to $15.9 million;

- Adjusted EBITDA loss improved by $9.3 million or 55% to $7.5 million; and

- Cash and cash equivalents of $96.1 million at quarter end.

Philip Krim, Chief Executive Officer, comments: “Casper’s third quarter was highly productive but unfortunately we believe the results don’t fully reflect the health and potential of our business. We saw record interest for our products evidenced by record website traffic, continued to drive gross margin expansion and progress towards profitability, and had another sequential quarter of growth; however, our top-line growth was disappointing based on the initial demand signals. Challenges in our supply chain, including industry-wide shortages in textiles and chemicals critical to foam production, led to significant out-of-stock inventory both in our direct-to-consumer and retail partnership channels. Many of our core mattresses were out of stock on our website for weeks at time and we were unable to monetize the full demand from retail partners leading to cancelled orders.

We have made significant progress addressing some of our supply chain challenges. Specifically, we have on-boarded new Tier 1 and Tier 2 suppliers and vendors; we are putting in place redundancies across key supply chain points and implementing improved inventory planning; and we are actively building up our safety stock which will help protect against further disruptions. We believe the worst of our supply chain disruptions are behind us, and we are well-positioned going forward.”

Mr. Krim continued: “We are actively managing the business to best position Casper for the future and are excited about the many opportunities in front of us to enhance shareholder value as we continue to leverage our leading brand and scale our multi-channel distribution. Our organization is focused on long-term, sustainable growth and we believe our expanded distribution, current growing product offering and pipeline, strong brand awareness, refined marketing expertise and healthy balance sheet position us well to achieve our goal of sustainable Adjusted EBITDA profitability starting in mid-2021.”

https://seekingalpha.com/pr/18086377-casper-reports-third-quarter-2020-results