The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

September 1, 2020

US Manufacturing Storms Ahead: ISM Smashes Expectations As New Orders Soar To 16 Year High

by Tyler Durden Tue, 09/01/2020 – 10:14

Following more rebounds in ‘soft’ manufacturing survey data in Europe and Asia (and LatAm – Brazil Manufacturing PMI exploded to a record in July), both ISM and Markit’s measures of US manufacturing sentiment were expected to continue their v-shaped recovery, and they did just that, when first the Markit PMI printed at 53.1, the highest level since January 2019, followed by the ISM Manufacturing, which smashed expectations, printing at 56.0, the highest since November 2018.

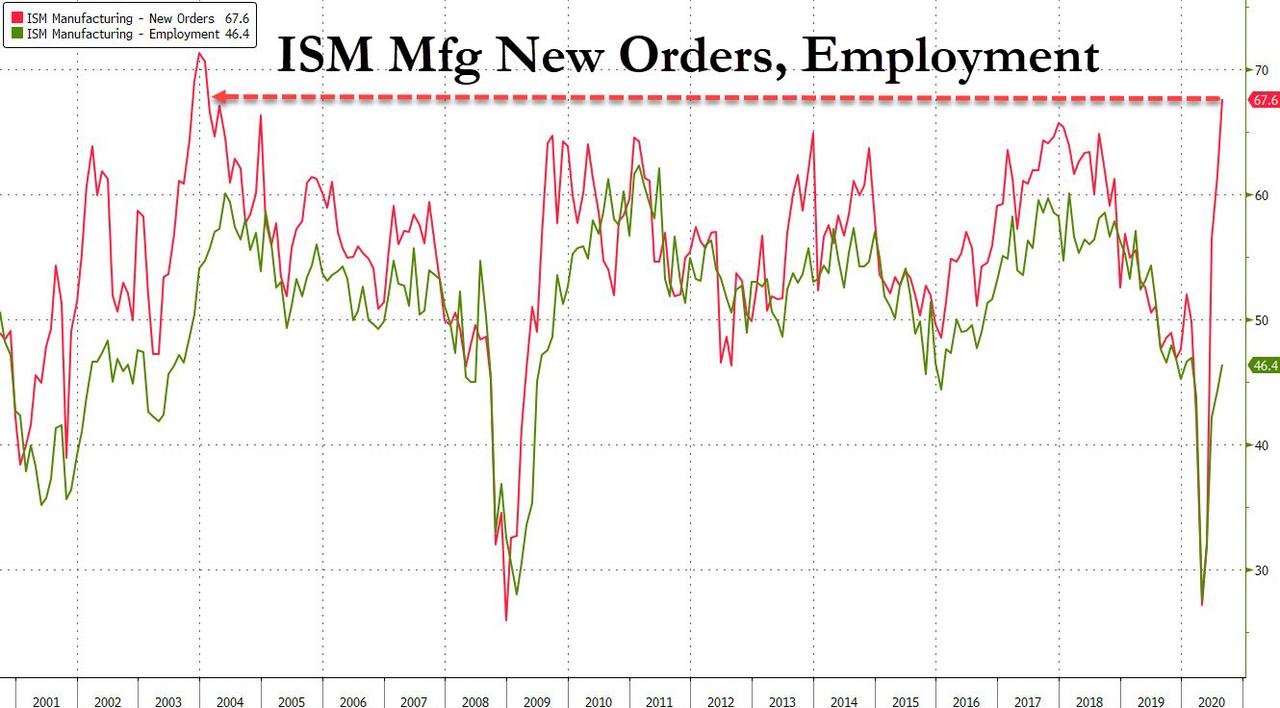

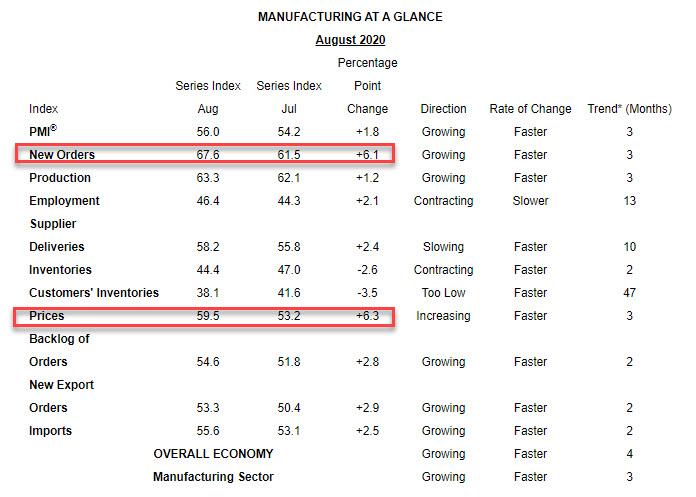

Just like last month, the ISM surge was driven largely by New Orders which spiked from 61.5 to 67.6, the highest level since Jan 2004, and while employment continued to rise, from 44.3 to 46.4, it remains in contraction territory.

Looking across the data, virtually all ISM components improved with the exception of Inventories which dipped for both producers and customers, a sign that destocking is taking place and which is actually bullish for even more future demand.

On ISM, Chair Timothy Fiore said that “The August PMI registered 56 percent, up 1.8 percentage points from the July reading of 54.2 percent. This figure indicates expansion in the overall economy for the fourth month in a row after a contraction in April, which ended a period of 131 consecutive months of growth. The New Orders Index registered 67.6 percent, an increase of 6.1 percentage points from the July reading of 61.5 percent. The Production Index registered 63.3 percent, up 1.2 percentage points compared to the July reading of 62.1 percent. The Backlog of Orders Index registered 54.6 percent, an increase of 2.8 percentage points compared to the July reading of 51.8 percent. The Employment Index registered 46.4 percent, an increase of 2.1 percentage points from the July reading of 44.3 percent. The Supplier Deliveries Index registered 58.2 percent, up 2.4 percentage points from the July figure of 55.8 percent.

Looking ahead, Fiore said : “Don’t see why this can’t continue, maybe not as strong, pretty good shape.”

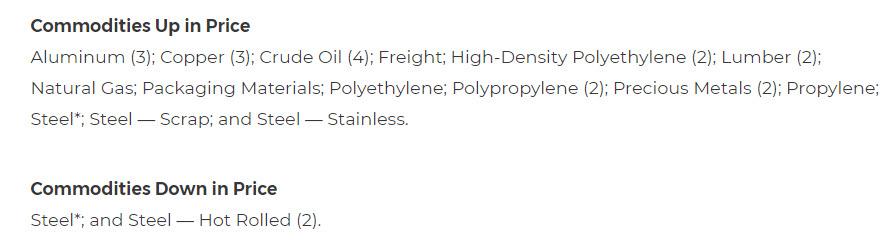

And while the Fed is desperate to average inflation higher, the ISM confirmed that at the commodity level, virtually everything was more expensive:

Meanwhile, unlike last month, when the Markit PMI unexpectedly missed, this time there was convergence between the two series, with Markit noting that the strongest Mfg PMI since Jan 2019 “was underpinned by stronger new order growth as exports rose at the quickest pace for four years.”

The ISM Survey respondents were mixed even as optimism about the future seemed to prevail (except for airlines), although some expressed concerns about the ongoing covid crisis, while others noted that some weakness is starting to emerge:

- “Watching COVID-19 situations in Mexico, Brazil, Philippines [and] Hong Kong. High rates of COVID-19 surging. Currently, lines of supply no longer impacted by COVID-19 related events.” (Computer & Electronic Products)

- “Business is very good. Production cannot keep up with demand. Some upstream supply chains are starting to have issues with raw material and/or transportation availability.” (Chemical Products)

- “Airline industry continues to be under great pressure.” (Transportation Equipment)

- “Current sales to domestic markets are substantially stronger than forecasted. We expected a recession, but it did not turn out that way. Retail and trade customer markets are very strong and driving shortages in raw material suppliers, increasing supplier orders.” (Fabricated Metal Products)

- “Homebuilder business continues to be robust, with month-over-month gains continuing since May. Business remains favorable and will only be held back by supply issues across the entire industry.” (Wood Products)

- “We are seeing solid month-over-month order improvement in all manufacturing sectors such as electrical, auto and industrial goods. Looking to add a few factory operators.” (Plastics & Rubber Products)

- “Rolling production forecasts are increasing each week compared to prior forecast.” (Primary Metals)

- “[Production ramp-up] has been a struggle. We have started and stopped lines numerous times at all 18 of our manufacturing plants due to COVID-19 issues. Surprisingly, our direct suppliers have done an excellent job on shipping ingredients and packaging on time.” (Food, Beverage & Tobacco Products)

- “Strong demand from existing and new customers for our products, stable-to-decreasing input costs for our operations, and record numbers of new business opportunities from prospective customers’ reshoring measures. All trends continuing from the first quarter of fiscal year 2017.” (Electrical Equipment, Appliances & Components)

- “Capital equipment new orders have slowed again. Quoting is active. Many customers waiting for the fourth quarter to make any commitments.” (Machinery)

- “We are starting to see parts of our business rebound in August, while other parts remained weak. Some of our export business has come back for the first time since the start of COVID-19; however, domestic portfolios remain mixed.” (Paper Products)

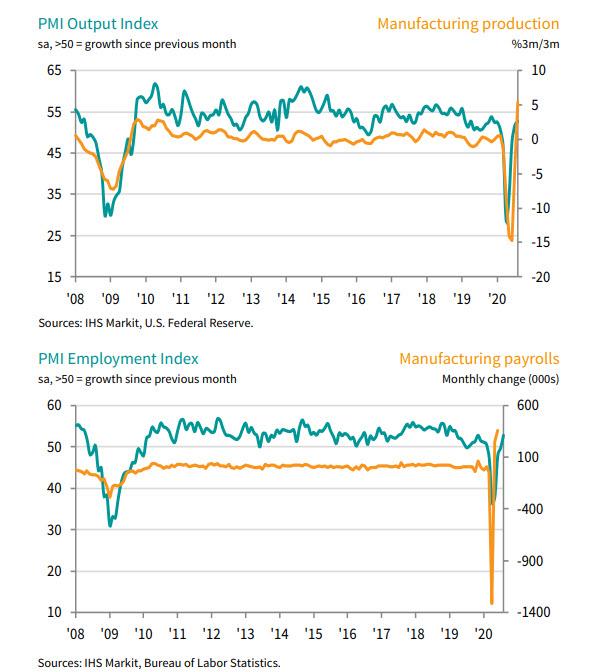

On PMI, Chris Williamson, Chief Business Economist at IHS Markit notes, made an interesting observation: while new export orders surged, “new orders and export sales at smaller manufacturers continued to fall, highlighting an unbalanced recovery in favor of larger firms.“

“The manufacturing upturn gained further ground in August, adding to indications that the third quarter should see a strong rebound in production from the steep decline suffered in the second quarter.

“Encouragingly, new order inflows improved markedly, outpacing production to leave many companies struggling to produce enough goods to meet demand, often due to a lack of operating capacity. Backlogs of uncompleted work consequently rose at the fastest rate since the early months of 2019, encouraging increasing numbers of firms to take on more staff.

“Key to the upturn was a jump in new export orders, which rose at the fastest rate for four years, reflecting improving demand in many foreign markets, and benefitting larger companies in particular. Disappointingly, new orders and export sales at smaller manufacturers continued to fall, highlighting an unbalanced recovery in favor of larger firms.

Overall a strong report for the month of August which may end up being a problem for the broader economy as it eliminates the need for an urgent intervention by Congress to reboot the fiscal spending that expired on July 31.

September 1, 2020

Emery Oleochemicals Extends Eco-Friendly Polyols Product Line with Ester Plasticizers & Showcases at CTT 2020 Virtual Week Event

CINCINNATI, OH, USA (September 1, 2020) – Emery Oleochemicals, a world leading, natural–based specialty chemicals manufacturer, is pleased to announce the release of its new EMEROX ® Ester Plasticizer product line.

As part of Emery’s Eco-Friendly Polyols business portfolio, EMEROX Ester Plasticizers offer low viscosity, low water solubility, excellent low temperature performance, and have excellent thermal stability.

These esters are designed to work with hydrophobic polyols for a broad range of applications to modify the cured systems properties and reduce system viscosity and system cost. In addition to improving the performance of your formulated polyurethane, EMEROX Ester Plasticizers have high bio-based content to help you achieve your sustainability objectives.

The Eco-Friendly Polyols business will be showcasing its EMEROX Ester Plasticizers at the Coatings Trends & Technology 2020 virtual event taking place September 8-11.

Visit Emery’s CTT Exhibition Booth to find out more or visit our website at

www.emeryoleo.com/polyols.

About Emery Oleochemicals’ Eco-Friendly Polyols

EMEROX ® Polyols provide formulators and end-users in the polyurethane industry with economical solutions that offer enhanced performance properties and easily integrate to improve formulations. Many of our EMEROX Polyols are also certified under the USDA BioPreferred ® Program and contain high bio-based content (50-99%) to help our customers achieve their sustainability objectives.

To learn about Emery Oleochemicals’ comprehensive portfolio of EMEROX Polyol grades that address a broad range of flexible foam, rigid foam and CASE industry application requirements, visit www.emeryoleo.com/polyols.

September 1, 2020

Emery Oleochemicals Extends Eco-Friendly Polyols Product Line with Ester Plasticizers & Showcases at CTT 2020 Virtual Week Event

CINCINNATI, OH, USA (September 1, 2020) – Emery Oleochemicals, a world leading, natural–based specialty chemicals manufacturer, is pleased to announce the release of its new EMEROX ® Ester Plasticizer product line.

As part of Emery’s Eco-Friendly Polyols business portfolio, EMEROX Ester Plasticizers offer low viscosity, low water solubility, excellent low temperature performance, and have excellent thermal stability.

These esters are designed to work with hydrophobic polyols for a broad range of applications to modify the cured systems properties and reduce system viscosity and system cost. In addition to improving the performance of your formulated polyurethane, EMEROX Ester Plasticizers have high bio-based content to help you achieve your sustainability objectives.

The Eco-Friendly Polyols business will be showcasing its EMEROX Ester Plasticizers at the Coatings Trends & Technology 2020 virtual event taking place September 8-11.

Visit Emery’s CTT Exhibition Booth to find out more or visit our website at

www.emeryoleo.com/polyols.

About Emery Oleochemicals’ Eco-Friendly Polyols

EMEROX ® Polyols provide formulators and end-users in the polyurethane industry with economical solutions that offer enhanced performance properties and easily integrate to improve formulations. Many of our EMEROX Polyols are also certified under the USDA BioPreferred ® Program and contain high bio-based content (50-99%) to help our customers achieve their sustainability objectives.

To learn about Emery Oleochemicals’ comprehensive portfolio of EMEROX Polyol grades that address a broad range of flexible foam, rigid foam and CASE industry application requirements, visit www.emeryoleo.com/polyols.

August 31, 2020

Europe September propylene contract price agreed at a rollover

Author: Nel Weddle

2020/08/31

LONDON (ICIS)–The European propylene September contract reference price has been set at €732.50/tonne, a rollover from August.

The settlement was confirmed by four producers and three consumers, two integrated, one non-integrated.

Primary driver naphtha values were slightly lower on average in August compared to July, while supply and demand fundamentals are largely steady overall, although there remains some disparity between grade and/or location.

Planned cracker maintenance is underway alongside the ongoing outage at Borealis’ Stenungsund, Sweden cracker. Prompt availability had been constrained by a couple of unexpected cracker issues earlier in August but these have been resolved. Refineries continue to run at reduced rates.

The demand outlook for September is mixed. Some players saw lower than expected demand in August and will be expecting some improvement in September. Others saw steady conditions July through August while others saw some pick up in derivatives for the automotive sector.

The contract reference price is fully established when a minimum of two producers and two consumers have directly confirmed.

It is agreed on a free delivered (FD) northwest Europe (NWE) basis.

August 31, 2020

Europe September propylene contract price agreed at a rollover

Author: Nel Weddle

2020/08/31

LONDON (ICIS)–The European propylene September contract reference price has been set at €732.50/tonne, a rollover from August.

The settlement was confirmed by four producers and three consumers, two integrated, one non-integrated.

Primary driver naphtha values were slightly lower on average in August compared to July, while supply and demand fundamentals are largely steady overall, although there remains some disparity between grade and/or location.

Planned cracker maintenance is underway alongside the ongoing outage at Borealis’ Stenungsund, Sweden cracker. Prompt availability had been constrained by a couple of unexpected cracker issues earlier in August but these have been resolved. Refineries continue to run at reduced rates.

The demand outlook for September is mixed. Some players saw lower than expected demand in August and will be expecting some improvement in September. Others saw steady conditions July through August while others saw some pick up in derivatives for the automotive sector.

The contract reference price is fully established when a minimum of two producers and two consumers have directly confirmed.

It is agreed on a free delivered (FD) northwest Europe (NWE) basis.