The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

August 25, 2020

USGC refiners, petchems shut down as Laura approaches

17:02 PM | August 25, 2020 | Clay Boswell

US Gulf Coast refiners and petrochemical producers are battening down the hatches in preparation for Hurricane Laura, which is forecast to make landfall near the Texas-Louisiana border Wednesday night or Thursday (map).

The National Hurricane Center has declared a hurricane watch for the stretch of coast extending from San Luis Pass, Texas, just south of Houston, to Intracoastal City, Louisiana, east of Lake Charles, a region that includes almost 70% of US olefins production capacity.

Several chemical producers are shutting down in advance of the hurricane, according to air emission event reports submitted to the Texas Commission on Environmental Quality (TCEQ). CPChem intends to shut down its Pasadena plastics complex, where the company has about 1 million metric tons/year (MMt/y) of polyethylene capacity. Motiva Chemicals is shutting down its steam cracker at Port Arthur, which has 0.7 MMt/y of ethylene capacity and 0.2 MMt/y of polymer-grade propylene (PGP) capacity. INEOS is shutting down its Olefins 1 steam cracker at Chocolate Bayou, which has 0.9 MMt/y of ethylene capacity and 0.3 MMt/y of PGP capacity.

Port Arthur-Beaumont, Texas, has more than 1.6 million b/d of refining capacity. OPIS reported on Monday that Motiva has filed a shutdown report with the Texas Commission on Environmental Quality for its 607,000-b/d refinery as well as its chemical plant. Total’s 225,000-b/d Port Arthur facility was reportedly reducing runs to minimum levels.

ExxonMobil said it was preparing for severe weather at its 384,400-b/d Beaumont refinery, but as of late Monday afternoon the company said operations were normal. Market sources say Valero’s 415,000-b/d Port Arthur refinery is also shutting down, but the company has not yet offered confirmation. Calcasieu has idled its 137,000-b/d refinery.

Tuesday the Port of Houston said it expects to be fully closed Wednesday and possibly Thursday, depending on the storm track.

August 25, 2020

USGC refiners, petchems shut down as Laura approaches

17:02 PM | August 25, 2020 | Clay Boswell

US Gulf Coast refiners and petrochemical producers are battening down the hatches in preparation for Hurricane Laura, which is forecast to make landfall near the Texas-Louisiana border Wednesday night or Thursday (map).

The National Hurricane Center has declared a hurricane watch for the stretch of coast extending from San Luis Pass, Texas, just south of Houston, to Intracoastal City, Louisiana, east of Lake Charles, a region that includes almost 70% of US olefins production capacity.

Several chemical producers are shutting down in advance of the hurricane, according to air emission event reports submitted to the Texas Commission on Environmental Quality (TCEQ). CPChem intends to shut down its Pasadena plastics complex, where the company has about 1 million metric tons/year (MMt/y) of polyethylene capacity. Motiva Chemicals is shutting down its steam cracker at Port Arthur, which has 0.7 MMt/y of ethylene capacity and 0.2 MMt/y of polymer-grade propylene (PGP) capacity. INEOS is shutting down its Olefins 1 steam cracker at Chocolate Bayou, which has 0.9 MMt/y of ethylene capacity and 0.3 MMt/y of PGP capacity.

Port Arthur-Beaumont, Texas, has more than 1.6 million b/d of refining capacity. OPIS reported on Monday that Motiva has filed a shutdown report with the Texas Commission on Environmental Quality for its 607,000-b/d refinery as well as its chemical plant. Total’s 225,000-b/d Port Arthur facility was reportedly reducing runs to minimum levels.

ExxonMobil said it was preparing for severe weather at its 384,400-b/d Beaumont refinery, but as of late Monday afternoon the company said operations were normal. Market sources say Valero’s 415,000-b/d Port Arthur refinery is also shutting down, but the company has not yet offered confirmation. Calcasieu has idled its 137,000-b/d refinery.

Tuesday the Port of Houston said it expects to be fully closed Wednesday and possibly Thursday, depending on the storm track.

August 25, 2020

US New Home Sales Surge In July, Highest Annual Spike Since 1996

by Tyler Durden Tue, 08/25/2020 – 10:07

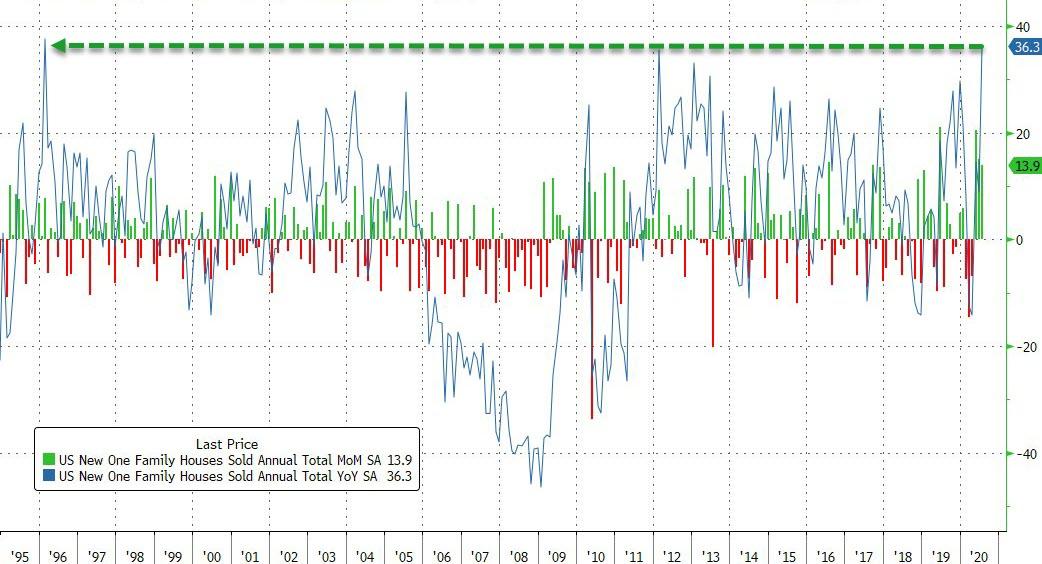

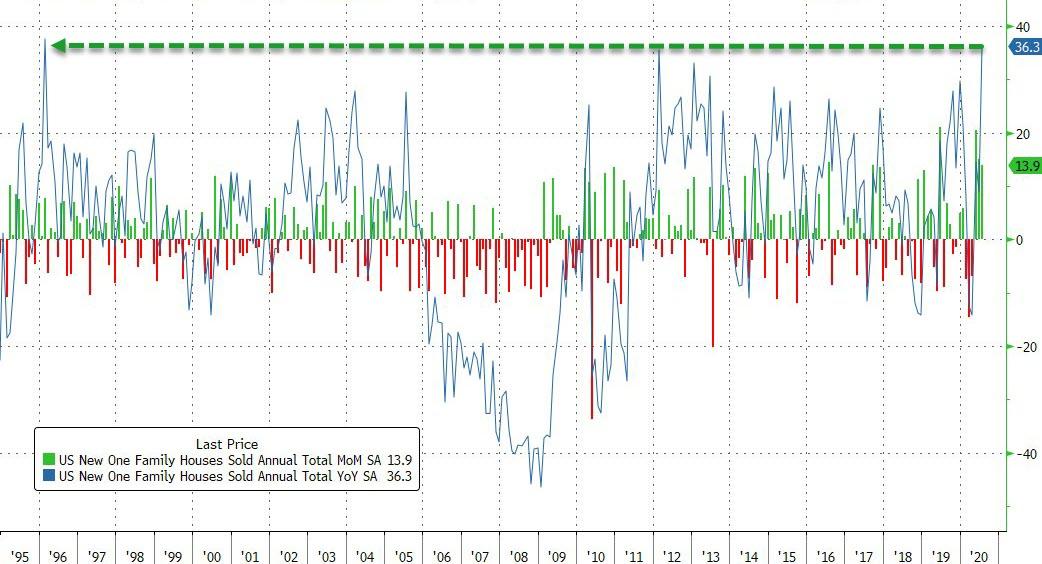

After June’s continued resurgence in US home sales, July is expected to see a significant slowdown in that recovery, with new home sales expected to rise 1.8% MoM. Instead, new home sales soared a stunning 13.9% MoM. This means new home sales in the US rose 36.3% YoY – the most since 1996…

Source: Bloomberg

Driven by and 81.4% increase in Midwest New home sales, highest since Jan 1992

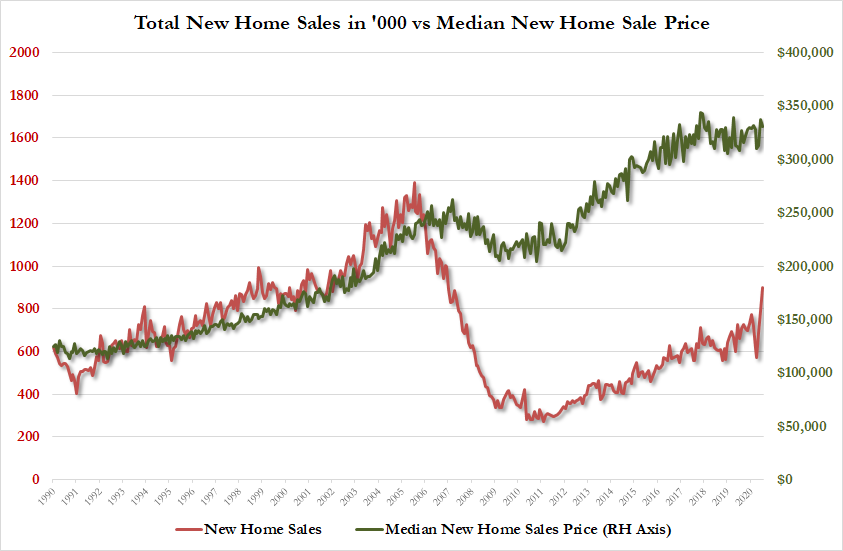

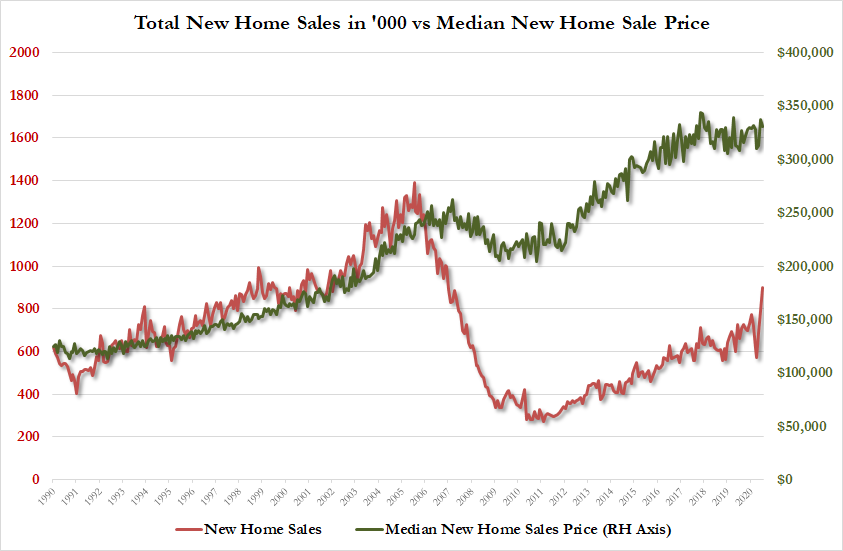

New Home Sales SAAR is 901k (against expectations of 790k), the most since Jan 2007…

Source: Bloomberg

Median new home price rose 7.2% y/y to $330,600; average selling price at $391,300

https://www.zerohedge.com/markets/us-new-home-sales-surge-july-highest-annual-spike-1996

August 25, 2020

US New Home Sales Surge In July, Highest Annual Spike Since 1996

by Tyler Durden Tue, 08/25/2020 – 10:07

After June’s continued resurgence in US home sales, July is expected to see a significant slowdown in that recovery, with new home sales expected to rise 1.8% MoM. Instead, new home sales soared a stunning 13.9% MoM. This means new home sales in the US rose 36.3% YoY – the most since 1996…

Source: Bloomberg

Driven by and 81.4% increase in Midwest New home sales, highest since Jan 1992

New Home Sales SAAR is 901k (against expectations of 790k), the most since Jan 2007…

Source: Bloomberg

Median new home price rose 7.2% y/y to $330,600; average selling price at $391,300

https://www.zerohedge.com/markets/us-new-home-sales-surge-july-highest-annual-spike-1996

August 24, 2020

US PDH margins reach 10-month high amid reduced propylene supply

Author: Michael Sims

2020/08/21

HOUSTON (ICIS)–US propane hydrogenation (PDH) margins have reached 10-month highs as production issues have elevated polymer-grade propylene (PGP) prices.

PDH margins have more than quadrupled since early June after plunging 72% in March-May.

US PDH margins

Source: ICIS Margin Analytics

PDH margins were compressed following the onset of the coronavirus crisis in the US as containment efforts curbed demand for most propylene derivatives.

This effect was amplified by rising feedstock natural gas liquids (NGLs) prices caused by concerns about reduced oil and gas production.

The result has been a rapid narrowing, followed by widening, of the US propane-propylene price spread.

NGLs have outpaced the recovery in crude prices, which has been attributed to speculation among market participants that less oil and gas production would tighten NGL supply.

Production data on NGLs has not supported these concerns, and the growth rate of propane prices has slowed accordingly.

The US chemical industry relies predominantly on NGLs including ethane, propane and butane as feedstock.

In addition to rising feedstock costs, production issues have curbed PGP supply, pressuring spot prices to a one-year high.

US propylene production in June decreased by 6.9% month on month, according to Advisian.

Margin outlook

Once the spate of outages is resolved, the outlook for US on-purpose propylene margins ultimately will depend on market confidence in feedstock supply and on the world’s success at containing the coronavirus.

While NGLs supply is not expected to fall short in the near-to-medium term, the propylene demand recovery will be gradual, which could pressure PDH margins.

Greater heating demand for propane during the northern hemisphere winter will also pressure PDH feedstock costs and could contribute to margin compression.

“PDH margins have recovered nicely over the past few months with the recent increase in propylene prices. However, they are expected to decrease into the first quarter of 2021 as propane prices rise faster than propylene with increasing propane demand during the winter heating season,” said Kimberly Haberkost, director of olefins at Chemical Data.

The main outlet for propylene is as a feedstock for polypropylene (PP). Propylene is also used to produce acrylonitrile (ACN), propylene oxide (PO), a number of alcohols, cumene and acrylic acid.

Major US propylene producers include Chevron Phillips Chemical, Enterprise Products, ExxonMobil, Flint Hills Resources and Shell Chemical.

Focus article by Michael Sims