The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

July 31, 2020

Scott Thompson

Thank you, Aubrey. Good morning and thank you for joining us on our 2020 second quarter earnings call.

Our thoughts continue to be with all the people around the world whose lives have been impacted by the global health crisis. I’ll begin with providing an overview on how we’ve strengthened our competitive position. Then Bhaskar will review in detail our quarterly financial performance, discuss several second quarter highlights and review the balance sheet and liquidity. Finally, I’ll conclude with some thoughts about our long-term business outlook.

Our second quarter global operations were dramatically affected by COVID-19. The board of directors and I, are proud of the company’s swift response to the unprecedented challenges that the worldwide health crisis has presented. We focused on the safety of our employees who are working tirelessly to continue delivering on our commitments to our retailers and supplier partners.

It was definitely a quarter of lows and highs, ending clearly on a high note. Despite the remarkable amount of volatility and transformation within our industry, we’re reporting a second quarter net sales decrease of only 8%. In fact, U.S. sales grew 2%. We’re pleased to report adjusted EBITDA for our credit facility decreased only 3% compared to prior years. Our leverage ratio improved to a record low of 2.8 times adjusted EBITDA, down significantly from 3.7 times as of June 30, 2019. And short-term liquidity expanded to over $600 million.

I want to spend some time discussing how we’ve strengthened our competitive position in the marketplace, and how we see the opportunity to continue our momentum in future periods. Over the last five years, we’ve focused on finding problems and addressing them with an eye to creating long term value. This has kept us nimble and guided our decisions in making our investments in people, products, and processes. These decisions created a solid foundation which began to pay off in a big way last year. We saw this trend accelerate into the first quarter of 2020 and set the company up well to deal with the unforeseen worldwide health crisis.

I want to briefly touch some of the foundational elements that have improved our competitive position over the past five years. First, we’ve completed the largest launch of our all new innovative Tempur products in the U.S. in our history. These products have done well in the marketplace. Our product quality was evident when Tempur-Pedic was awarded number one in customer satisfaction for retail mattress segment in J.D. Power’s 2019 Mattress Satisfaction Report

Second, our multi-year investments in Sealy operations have resulted in high quality products, high levels of service for our customers, but also improving our profitability. After a strong year of growth in 2019, we believe Sealy is now the largest bedding producer in the United States.

Third, we expanded our relationship with new and existing third-party retailers through multiple new supply agreements. Retailers have recognized the investments we’ve made in our products, brands, customer service, and manufacturing operations. And we continue to receive inbound interest from retailers who want to lean more heavily into Tempur Sealy family of products and brands.

In addition, our Retail Edge program has allowed us to provide cutting edge market insights and sales tools to our third-party retailers. The majority of this program is focused on expanding retailer’s web-based business and their understanding of customer trends. The program is working well as our legacy-based retailers have ramped up their online business which provides us more share in the growing online market.

Fourth, our omni-channel focus resulted in rapid expansion in our direct channel, diversifying distribution and allowing product representation wherever customers want to shop. We’ve experienced tremendous success within the direct channel to-date. By the end of 2019, our full year global direct channel sales had nearly doubled during the two-year period.

More recently, this quarter has seen online growth rates of over 125% and solid brick-and-mortar store performance once the stores reopened. Our U.S. direct business is expected to be over $300 million this year, ranking it in the top 10% all U.S. bedding retailers on a standalone basis. Unlike many other DTC competitors, our direct-to-consumer business is highly profitable with decreasing customer acquisition cost and significant cash flow generation for the company.

Fifth, we’re a targeted product. We’ve rapidly expanded our presence within alternative distribution channels, particularly with online retailers, on time, only retailers. It is still very early in this rollout. We are pleased with the momentum and the profits that we’ve generated.

Sixth, we’ve pivoted our media strategy in the U.S. to include online channels as we follow customer trends. This change in our media mix allows us to optimize our strategies for consumers early and late in their shopping process, while continuing to drive high interest in our brands and products.

Seventh, we completed several opportunistic tucking acquisitions including Sherwood Bedding and Sleep Outfitters, which are expected to have high return on invested capital and further our vertical integration.

Eighth, we strengthened our balance sheet and improved our cash flow, and Bhaskar will discuss our financial strength in more detail shortly.

Finally, the ninth and most important component of our business, our committed, capable people who have strong shared values, we have a culture to deliver for our customer all over the world and from that, a gross shareholder value. The foundation we’ve built over the last five years is rooted in adaptability and prudent capital allocation. This positions us well to address unforeseen disruptions in the market due to COVID-19, which had a peak impact on our business in the early part of the second quarter. Our proactive response has maintained our functionality for our business in the fog of uncertainty.

Early in the second quarter, we took material actions to adapt to an expected depressed long-term sales outlook. However, we were met with a sudden surge in demand beginning in May, as consumers started to shop for bedding again, all over the world. We worked quickly to ramp up our operations to support the robust sales environment. The strong demand for bedding in general and our product specifically, has continued into the third quarter, unabated.

Second quarter sales could have been stronger. But both we and our suppliers had reduced capacity early in the quarter in response to the falling demand and our U.S. Sealy manufacturing operation was unable to keep up with the increased demand for our products as the quarter progressed. The Tempur-Pedic manufacturing process is less labor intense and has fewer components than the Sealy process and thus is not as impacted by the current issue.

Our U.S. order bank at the end of the second quarter was twice as large as compared to the prior year. We’re still in the process of ramping our U.S. production capabilities to meet the heightened demand, and we expect to continue experiencing capacity constraints on U.S. Sealy products through the third quarter. We believe an important driver of the robust sales wave is the recent shift in consumer spending habits, as consumers are focused on in-home products versus travel and entertainment. The duration and magnitude of this trend as well as the continued acceleration in sales we are seeing leads us to believe that our sales trends are not only due to pent-up demand or government stimulus, but that we are likely experiencing a new favorable long-term trend.

We’re well positioned to benefit from this new environment. Our research points to the fact that consumers have become omni-channel shoppers, and our powerful omni-channel platform is well positioned to capitalize on the current market, as consumers can find our products wherever they wish to shop. Our research shows that 90% of consumers shop online at some point in their mattress buying process.

You might find it also interesting that our research on consumers before the virus indicated that three out of four online buyers visit a brick-and-mortar store before buying a mattress online. The point is that our customers are omni-channel buyers and we are built to serve that kind of customer. We estimate about 25% of our U.S. sales are purchased directly online through either our own e-commerce or through existing third-party retailers, which is up from the time before COVID-19 reached the U.S.

We also continue to work with our third-party retailers to improve their online presence through our Retail Edge program, so that we can continue to help customers shop for our products, both online and offline.

During the second quarter, we saw a number of new customers on our own websites more than double versus prior year, but also see a healthy level of repeat sales. We believe our e-commerce business is truly best-in-class, with a high level of customer loyalty and engagement. One benefit of the current operating environment is more efficient spent for media.

Total advertising spend was down 16%. Our second quarter net sales were only down 8%. We believe, we’re getting more for our money in advertising on a national level and expect leverage on advertising to continue into the third quarter.

Additionally, our digital customer acquisition cost continues to fall. Our direct team continues to optimize for profit and are capitalizing on the recently reduced digital advertising costs in the marketplace. This makes the third quarter in a row of falling cost to acquire a customer, proving we’re not buying volume, we’re chasing unprofitable sales.

Our second quarter adjusted EBITDA shows how strong our competitive position is within the industry. We’re pleased with a quarter to achieve adjusted EBITDA for our credit facility of $110 million.

As we’ve discussed before, we see our financial strength as a powerful competitive advantage in a thinly capitalized industry that enhances our operating and strategic flexibility. The last six months have heightened the importance of this attribute. To this end, we’re lowering our targeted leverage ratio for the second time in the last 12 months. Our new revised ratio of net consolidated indebtedness-to-adjusted EBITDA, target is now two to three times.

Reduction in our leverage target is not due to any market concerns. It is a strategic move to provide us with industry leading flexibility. You can clearly see from our recent performance that the company’s business model and experienced executive team can handle economic volatility and still generate strong cash flow. We believe this lower leverage ratio will benefit our show shareholders over the long term.

Lastly, due to our strong adjusted EBITDA performance in the fourth quarter of 2019 and the first half of 2020, it is now possible that by the end of the third quarter 2020, we may achieve a trailing four quarter adjusted EBITDA in an amount equal to or greater than the $600 million needed to trigger the threshold payout under our aspirational long-term incentive comp plan.

As a reminder, the aspirational plan was put in place five years ago to motivate the company’s approximately 150 top leaders to turn around the business in a difficult and changing industry. The threshold target of $600 million represents a 44% improvement in trailing four quarter adjusted EBITDA from the time the plan was put in place.

The current aspirational plan will terminate December 31, 2020. And we do not anticipate adopting a similar plan in the future. If the plan is triggered, the company would incur non-cash stock compensation expense. In order to ensure that we have adequate time for the third quarter financials to undergo additional review, we plan to host our third quarter earnings calls slightly later than usual.

July 31, 2020

Scott Thompson

Thank you, Aubrey. Good morning and thank you for joining us on our 2020 second quarter earnings call.

Our thoughts continue to be with all the people around the world whose lives have been impacted by the global health crisis. I’ll begin with providing an overview on how we’ve strengthened our competitive position. Then Bhaskar will review in detail our quarterly financial performance, discuss several second quarter highlights and review the balance sheet and liquidity. Finally, I’ll conclude with some thoughts about our long-term business outlook.

Our second quarter global operations were dramatically affected by COVID-19. The board of directors and I, are proud of the company’s swift response to the unprecedented challenges that the worldwide health crisis has presented. We focused on the safety of our employees who are working tirelessly to continue delivering on our commitments to our retailers and supplier partners.

It was definitely a quarter of lows and highs, ending clearly on a high note. Despite the remarkable amount of volatility and transformation within our industry, we’re reporting a second quarter net sales decrease of only 8%. In fact, U.S. sales grew 2%. We’re pleased to report adjusted EBITDA for our credit facility decreased only 3% compared to prior years. Our leverage ratio improved to a record low of 2.8 times adjusted EBITDA, down significantly from 3.7 times as of June 30, 2019. And short-term liquidity expanded to over $600 million.

I want to spend some time discussing how we’ve strengthened our competitive position in the marketplace, and how we see the opportunity to continue our momentum in future periods. Over the last five years, we’ve focused on finding problems and addressing them with an eye to creating long term value. This has kept us nimble and guided our decisions in making our investments in people, products, and processes. These decisions created a solid foundation which began to pay off in a big way last year. We saw this trend accelerate into the first quarter of 2020 and set the company up well to deal with the unforeseen worldwide health crisis.

I want to briefly touch some of the foundational elements that have improved our competitive position over the past five years. First, we’ve completed the largest launch of our all new innovative Tempur products in the U.S. in our history. These products have done well in the marketplace. Our product quality was evident when Tempur-Pedic was awarded number one in customer satisfaction for retail mattress segment in J.D. Power’s 2019 Mattress Satisfaction Report

Second, our multi-year investments in Sealy operations have resulted in high quality products, high levels of service for our customers, but also improving our profitability. After a strong year of growth in 2019, we believe Sealy is now the largest bedding producer in the United States.

Third, we expanded our relationship with new and existing third-party retailers through multiple new supply agreements. Retailers have recognized the investments we’ve made in our products, brands, customer service, and manufacturing operations. And we continue to receive inbound interest from retailers who want to lean more heavily into Tempur Sealy family of products and brands.

In addition, our Retail Edge program has allowed us to provide cutting edge market insights and sales tools to our third-party retailers. The majority of this program is focused on expanding retailer’s web-based business and their understanding of customer trends. The program is working well as our legacy-based retailers have ramped up their online business which provides us more share in the growing online market.

Fourth, our omni-channel focus resulted in rapid expansion in our direct channel, diversifying distribution and allowing product representation wherever customers want to shop. We’ve experienced tremendous success within the direct channel to-date. By the end of 2019, our full year global direct channel sales had nearly doubled during the two-year period.

More recently, this quarter has seen online growth rates of over 125% and solid brick-and-mortar store performance once the stores reopened. Our U.S. direct business is expected to be over $300 million this year, ranking it in the top 10% all U.S. bedding retailers on a standalone basis. Unlike many other DTC competitors, our direct-to-consumer business is highly profitable with decreasing customer acquisition cost and significant cash flow generation for the company.

Fifth, we’re a targeted product. We’ve rapidly expanded our presence within alternative distribution channels, particularly with online retailers, on time, only retailers. It is still very early in this rollout. We are pleased with the momentum and the profits that we’ve generated.

Sixth, we’ve pivoted our media strategy in the U.S. to include online channels as we follow customer trends. This change in our media mix allows us to optimize our strategies for consumers early and late in their shopping process, while continuing to drive high interest in our brands and products.

Seventh, we completed several opportunistic tucking acquisitions including Sherwood Bedding and Sleep Outfitters, which are expected to have high return on invested capital and further our vertical integration.

Eighth, we strengthened our balance sheet and improved our cash flow, and Bhaskar will discuss our financial strength in more detail shortly.

Finally, the ninth and most important component of our business, our committed, capable people who have strong shared values, we have a culture to deliver for our customer all over the world and from that, a gross shareholder value. The foundation we’ve built over the last five years is rooted in adaptability and prudent capital allocation. This positions us well to address unforeseen disruptions in the market due to COVID-19, which had a peak impact on our business in the early part of the second quarter. Our proactive response has maintained our functionality for our business in the fog of uncertainty.

Early in the second quarter, we took material actions to adapt to an expected depressed long-term sales outlook. However, we were met with a sudden surge in demand beginning in May, as consumers started to shop for bedding again, all over the world. We worked quickly to ramp up our operations to support the robust sales environment. The strong demand for bedding in general and our product specifically, has continued into the third quarter, unabated.

Second quarter sales could have been stronger. But both we and our suppliers had reduced capacity early in the quarter in response to the falling demand and our U.S. Sealy manufacturing operation was unable to keep up with the increased demand for our products as the quarter progressed. The Tempur-Pedic manufacturing process is less labor intense and has fewer components than the Sealy process and thus is not as impacted by the current issue.

Our U.S. order bank at the end of the second quarter was twice as large as compared to the prior year. We’re still in the process of ramping our U.S. production capabilities to meet the heightened demand, and we expect to continue experiencing capacity constraints on U.S. Sealy products through the third quarter. We believe an important driver of the robust sales wave is the recent shift in consumer spending habits, as consumers are focused on in-home products versus travel and entertainment. The duration and magnitude of this trend as well as the continued acceleration in sales we are seeing leads us to believe that our sales trends are not only due to pent-up demand or government stimulus, but that we are likely experiencing a new favorable long-term trend.

We’re well positioned to benefit from this new environment. Our research points to the fact that consumers have become omni-channel shoppers, and our powerful omni-channel platform is well positioned to capitalize on the current market, as consumers can find our products wherever they wish to shop. Our research shows that 90% of consumers shop online at some point in their mattress buying process.

You might find it also interesting that our research on consumers before the virus indicated that three out of four online buyers visit a brick-and-mortar store before buying a mattress online. The point is that our customers are omni-channel buyers and we are built to serve that kind of customer. We estimate about 25% of our U.S. sales are purchased directly online through either our own e-commerce or through existing third-party retailers, which is up from the time before COVID-19 reached the U.S.

We also continue to work with our third-party retailers to improve their online presence through our Retail Edge program, so that we can continue to help customers shop for our products, both online and offline.

During the second quarter, we saw a number of new customers on our own websites more than double versus prior year, but also see a healthy level of repeat sales. We believe our e-commerce business is truly best-in-class, with a high level of customer loyalty and engagement. One benefit of the current operating environment is more efficient spent for media.

Total advertising spend was down 16%. Our second quarter net sales were only down 8%. We believe, we’re getting more for our money in advertising on a national level and expect leverage on advertising to continue into the third quarter.

Additionally, our digital customer acquisition cost continues to fall. Our direct team continues to optimize for profit and are capitalizing on the recently reduced digital advertising costs in the marketplace. This makes the third quarter in a row of falling cost to acquire a customer, proving we’re not buying volume, we’re chasing unprofitable sales.

Our second quarter adjusted EBITDA shows how strong our competitive position is within the industry. We’re pleased with a quarter to achieve adjusted EBITDA for our credit facility of $110 million.

As we’ve discussed before, we see our financial strength as a powerful competitive advantage in a thinly capitalized industry that enhances our operating and strategic flexibility. The last six months have heightened the importance of this attribute. To this end, we’re lowering our targeted leverage ratio for the second time in the last 12 months. Our new revised ratio of net consolidated indebtedness-to-adjusted EBITDA, target is now two to three times.

Reduction in our leverage target is not due to any market concerns. It is a strategic move to provide us with industry leading flexibility. You can clearly see from our recent performance that the company’s business model and experienced executive team can handle economic volatility and still generate strong cash flow. We believe this lower leverage ratio will benefit our show shareholders over the long term.

Lastly, due to our strong adjusted EBITDA performance in the fourth quarter of 2019 and the first half of 2020, it is now possible that by the end of the third quarter 2020, we may achieve a trailing four quarter adjusted EBITDA in an amount equal to or greater than the $600 million needed to trigger the threshold payout under our aspirational long-term incentive comp plan.

As a reminder, the aspirational plan was put in place five years ago to motivate the company’s approximately 150 top leaders to turn around the business in a difficult and changing industry. The threshold target of $600 million represents a 44% improvement in trailing four quarter adjusted EBITDA from the time the plan was put in place.

The current aspirational plan will terminate December 31, 2020. And we do not anticipate adopting a similar plan in the future. If the plan is triggered, the company would incur non-cash stock compensation expense. In order to ensure that we have adequate time for the third quarter financials to undergo additional review, we plan to host our third quarter earnings calls slightly later than usual.

July 31, 2020

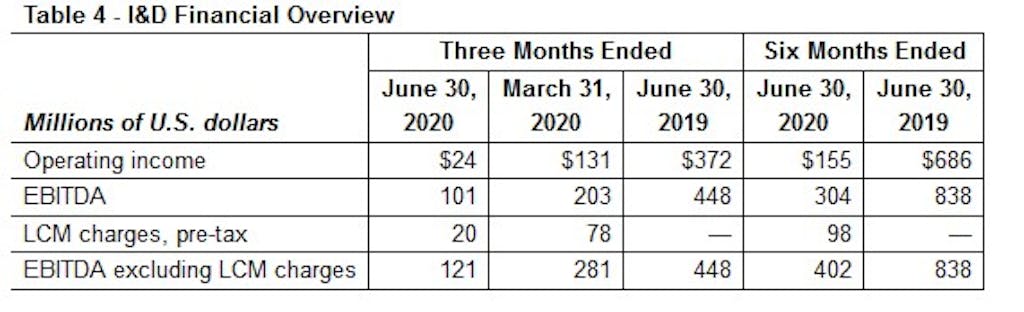

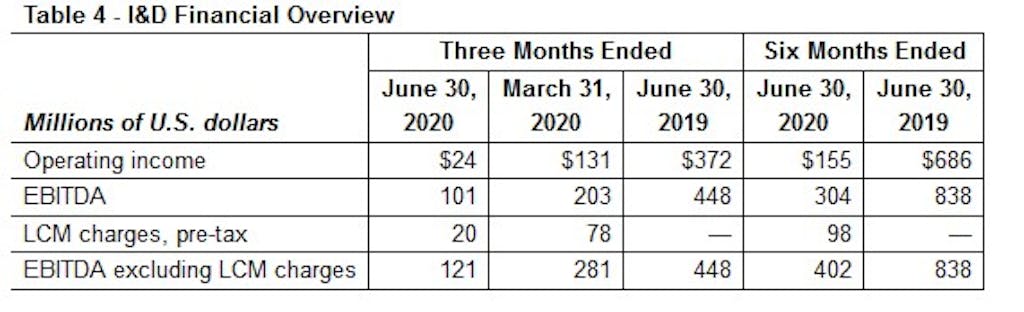

Intermediates & Derivatives (I&D)– Our I&D segment produces and markets Propylene Oxide & Derivatives, Oxyfuels & Related Products and Intermediate Chemicals, such as styrene monomer, acetyls, ethylene oxide and ethylene glycol.

Three months ended June 30, 2020 versus three months ended March 31, 2020 – EBITDA decreased $160 million versus the first quarter 2020, excluding a favorable variance of $58 million due to LCM inventory charges. Second quarter 2020 Propylene Oxide & Derivatives results decreased about $55 million due to lower volumes driven by reduced demand from automotive, construction and furniture end markets. Intermediate Chemicals results were relatively unchanged. Oxyfuels & Related Products results decreased approximately $95 million with oxyfuels margins compressed by lower gasoline prices and volume declines due to lower demand for automotive fuels and isobutylene.

Three months ended June 30, 2020 versus three months ended June 30, 2019 – EBITDA decreased $327 million versus the second quarter 2019, excluding an unfavorable variance of $20 million due to second quarter 2020 LCM inventory charges. Compared with the prior period, Propylene Oxide & Derivatives results decreased approximately $40 million driven by lower volumes due to reduced demand and lower margins. Intermediate Chemicals results decreased $130 million. Margin declined, primarily in styrene, and volumes were lower due to planned maintenance and reduced demand. Oxyfuels & Related Products results decreased about $145 million driven by lower margins due to lower gasoline prices. Volume declines due to reduced demand were muted by impacts from a third party terminal incident that reduced volumes during the first half of 2019.

https://lyondellbasell.mediaroom.com/index.php?s=43&item=1334

July 31, 2020

Intermediates & Derivatives (I&D)– Our I&D segment produces and markets Propylene Oxide & Derivatives, Oxyfuels & Related Products and Intermediate Chemicals, such as styrene monomer, acetyls, ethylene oxide and ethylene glycol.

Three months ended June 30, 2020 versus three months ended March 31, 2020 – EBITDA decreased $160 million versus the first quarter 2020, excluding a favorable variance of $58 million due to LCM inventory charges. Second quarter 2020 Propylene Oxide & Derivatives results decreased about $55 million due to lower volumes driven by reduced demand from automotive, construction and furniture end markets. Intermediate Chemicals results were relatively unchanged. Oxyfuels & Related Products results decreased approximately $95 million with oxyfuels margins compressed by lower gasoline prices and volume declines due to lower demand for automotive fuels and isobutylene.

Three months ended June 30, 2020 versus three months ended June 30, 2019 – EBITDA decreased $327 million versus the second quarter 2019, excluding an unfavorable variance of $20 million due to second quarter 2020 LCM inventory charges. Compared with the prior period, Propylene Oxide & Derivatives results decreased approximately $40 million driven by lower volumes due to reduced demand and lower margins. Intermediate Chemicals results decreased $130 million. Margin declined, primarily in styrene, and volumes were lower due to planned maintenance and reduced demand. Oxyfuels & Related Products results decreased about $145 million driven by lower margins due to lower gasoline prices. Volume declines due to reduced demand were muted by impacts from a third party terminal incident that reduced volumes during the first half of 2019.

https://lyondellbasell.mediaroom.com/index.php?s=43&item=1334

July 30, 2020

-Net Sales Decreased 8%, U.S. Sales Increased 2%

-Targeting 25% Net Sales Increase in Third Quarter 2020

-Leverage Ratio Lowest in Tempur Sealy History

PR Newswire

LEXINGTON, Ky., July 30, 2020 /PRNewswire/ — Tempur Sealy International, Inc. (TPX) announced financial results for the second quarter ended June 30, 2020.

SECOND QUARTER 2020 FINANCIAL SUMMARY

- Total net sales decreased 8.0% to $665.2 million as compared to $722.8 million in the second quarter of 2019. On a constant currency basis(1), total net sales decreased 7.3%, with a decrease of 2.9% in the North America business segment and a decrease of 26.9% in the International business segment.

- Gross margin was 40.0% as compared to 43.4% in the second quarter of 2019. Adjusted gross margin(1) was 40.6% in the second quarter of 2020. There were no adjustments to gross margin in the second quarter of 2019.

- Operating income decreased 34.1% to $53.4 million as compared to $81.0 million in the second quarter of 2019. Adjusted operating income(1) decreased 16.5% to $70.0 million as compared to $83.8 million in the second quarter of 2019. Operating income and adjusted operating income(1) in the second quarter of 2020 included $7.9 million of costs associated with temporarily closed company-owned retail stores and sales force retention costs as a result of the novel coronavirus (“COVID-19 charges”).

- Net income decreased 44.7% to $23.0 million as compared to $41.6 million in the second quarter of 2019. Adjusted net income(1) decreased 20.8% to $35.1 million as compared to $44.3 million in the second quarter of 2019.

- Earnings before interest, tax, depreciation and amortization (“EBITDA”)(1) decreased 21.8% to $85.2 million as compared to $109.0 million in the second quarter of 2019. Adjusted EBITDA (including COVID-19 charges)(1) decreased 10.0% to $101.7 million and adjusted EBITDA per credit facility(1) decreased 3.0% to $109.6 million as compared to $113.0 million in the second quarter of 2019.

- Adjusted EBITDA per credit facility(1) excluded $24.5 million of asset impairments, incremental operating costs due to the global pandemic, COVID-19 charges and other items in the second quarter of 2020.

- Earnings per diluted share (“EPS”) decreased 40.5% to $0.44 as compared to $0.74 in the second quarter of 2019. Adjusted EPS(1) decreased 13.9% to $0.68 as compared to $0.79 in the second quarter of 2019. Adjusted EPS(1) included $0.11 of COVID-19 charges in the second quarter of 2020.

- For the trailing twelve months ended June 30, 2020, leverage based on the ratio of consolidated indebtedness less netted cash(1) to Adjusted EBITDA per credit facility(1) was 2.83 times as compared to 3.65 times in the corresponding prior year period.

- Net cash provided by operating activities increased to a record $155.4 million as compared to $41.3 million in the second quarter of 2019.

| KEY HIGHLIGHTS | |||||||||||||

| (in millions, except percentages) | Three Months Ended | % Reported Change | % Constant Currency Change(1) | ||||||||||

| June 30, 2020 | June 30, 2019 | ||||||||||||

| Net sales | $ | 665.2 | $ | 722.8 | (8.0) | % | (7.3) | % | |||||

| Net income | $ | 23.0 | $ | 41.6 | (44.7) | % | (44.2) | % | |||||

| EBITDA(1) | $ | 85.2 | $ | 109.0 | (21.8) | % | (21.5) | % | |||||

| Adjusted EBITDA (including COVID-19 charges) (1) | $ | 101.7 | $ | 113.0 | (10.0) | % | (9.7) | % | |||||

| Adjusted EBITDA per credit facility (1) | $ | 109.6 | $ | 113.0 | (3.0) | % | (2.7) | % |

Company Chairman and CEO Scott Thompson commented, “It was definitely a quarter of lows and highs, ending clearly on a high note for the industry and our business. Sales trends through the quarter accelerated each month and have continued to accelerate into July unabated. We believe the category is benefiting from a shift in consumer spend of discretionary dollars into the home category in which our products and brands are well-aligned to meet those consumer needs. We are currently experiencing tremendous order volume in the U.S. that is broad-based with growth across both Tempur and Sealy brands. In fact, our sales have been constrained by our Sealy manufacturing capacity and our suppliers’ capacity to meet this increased demand. Over the past five years, we have worked diligently to strengthen the foundation of our company, and we are now benefiting from our powerful omni-channel presence and strong competitive position in the industry. While a level of uncertainty remains, we expect the industry tailwinds and our sales momentum to continue.”

Business Segment Highlights

The Company’s business segments include North America and International. Corporate operating expenses are not included in either of the business segments and are presented separately as a reconciling item to consolidated results.

North America net sales decreased 3.0% to $570.5 million as compared to $588.1 million in the second quarter of 2019. On a constant currency basis(1), North America net sales decreased 2.9% as compared to the second quarter of 2019. Gross margin was 37.9% as compared to 40.8% in the second quarter of 2019. Adjusted gross margin(1) was 38.6% as compared to 40.8% in the second quarter of 2019. Operating margin was 12.2% as compared to 13.6% in the second quarter of 2019. Adjusted operating margin(1) was 14.3% as compared to 13.9% in the second quarter of 2019. Operating income and adjusted operating income(1) included $6.0 million of COVID-19 charges in the second quarter of 2020.

North America net sales through the wholesale channel decreased $33.9 million, or 6.4%, to $494.6 million as compared to the second quarter of 2019. North America net sales through the direct channel increased $16.3 million, or 27.3%, to $75.9 million, primarily driven by an increase of more than 140% in web sales as compared to the second quarter of 2019.

North America adjusted gross margin(1) declined 220 basis points as compared to the second quarter of 2019. The decline was primarily driven by product and brand mix, partially offset by decreased floor model expenses and lower commodity costs. North America adjusted operating margin(1) improved 40 basis points as compared to the second quarter of 2019. The improvement was primarily driven by the lower operating expenses as a result of cost actions in the quarter, partially offset by the decline in gross margin and COVID-19 charges.

International net sales decreased 29.7% to $94.7 million as compared to $134.7 million in the second quarter of 2019. On a constant currency basis(1), International net sales decreased 26.9% as compared to the second quarter of 2019. Gross margin was 52.5% as compared to 54.5% in the second quarter of 2019. Adjusted gross margin(1) was 53.0% as compared to 54.5% in the second quarter of 2019. Operating margin was 10.1% as compared to 20.3% in the second quarter of 2019. Adjusted operating margin(1) was 14.6% in the second quarter of 2020. There were no adjustments to operating margin in the second quarter of 2019. Operating income and adjusted operating income(1) included $1.9 million of COVID-19 charges in the second quarter of 2020.

International net sales through the wholesale channel decreased $34.6 million, or 33.4%, to $69.1 million as compared to the second quarter of 2019. International net sales through the direct channel decreased $5.4 million, or 17.4%, to $25.6 million as compared to the second quarter of 2019.

International adjusted gross margin(1) declined 150 basis points as compared to the second quarter of 2019. The decline was primarily driven by fixed cost deleverage on lower unit volumes and decreased royalties, partially offset by favorable country mix. International adjusted operating margin(1) declined 570 basis points as compared to the second quarter of 2019. The decline was primarily driven by fixed cost deleverage on operating expenses, increased bad debt expense, COVID-19 charges and the decline in gross margin. These declines were partially offset by the performance of the Asia joint venture.

Corporate operating expense decreased to $25.6 million as compared to $26.5 million in the second quarter of 2019. Corporate adjusted operating expense(1) was $25.4 million in the second quarter of 2019. There were no adjustments to operating expense in the second quarter of 2020.

The Company ended the second quarter of 2020 with total debt of $1.8 billion and consolidated indebtedness less netted cash(1) of $1.6 billion. Leverage based on the ratio of consolidated indebtedness less netted cash(1) to adjusted EBITDA per credit facility(1) was 2.83 times for the trailing twelve months ended June 30, 2020, the lowest in Tempur Sealy history.

Company Chairman and CEO Scott Thompson commented, “We are lowering our target leverage ratio for the second time in the last 12 months. Our new revised target range is 2.0 to 3.0 times. The reduction in our leverage target is not due to any market concerns; it is a strategic move to provide optionality and lower market volatility. We have always seen our financial strength as a competitive advantage and part of our long-term strategy for the Company.”

Consolidated net income decreased 44.7% to $23.0 million as compared to $41.6 million in the second quarter of 2019. Adjusted net income(1) decreased 20.8% to $35.1 million as compared to $44.3 million in the second quarter of 2019. EPS decreased 40.5% to $0.44 as compared to $0.74 in the second quarter of 2019. Adjusted EPS(1), which included $0.11 of COVID-19 charges, decreased 13.9% to $0.68 as compared to $0.79 in the second quarter of 2019.

(1) This is a non-GAAP financial measure. Please refer to “Non-GAAP Financial Measures and Constant Currency Information” below.

Business Update

The Company continues to study, respond and optimize its operations related to the challenges from the COVID-19 crisis. The Company has taken, and continues to take precautionary measures to mitigate health risks during the evolving situation resulting from COVID-19.

The Company experienced a major reduction in total net sales when COVID-19 began materially impacting our North American business in mid-March. Order trends reached their lowest point in the second quarter when they were down 80% for a few days in early April and began to improve thereafter, with orders down approximately 55% for the full month of April as compared to the same month in 2019. The Company experienced significant and accelerating improvement in order trends throughout the remainder of the quarter, and the Company provided market updates in May and June as orders improved from previous expectations. This improvement was primarily due to the reopening of brick-and-mortar stores, the acceleration of e-commerce business trends, and a shift in consumer spending habits towards in-home purchases, including bedding products.

This unexpected and rapid increase in demand for bedding products has challenged the entire bedding industry and supply chain including the Company. The broad-based increase in demand coupled with supply chain constraints has resulted in longer order to delivery times for Sealy products in the second quarter and continue July to-date. The Tempur-Pedic manufacturing process is not as impacted by the current supply chain constraints as it is less labor-dependent and has fewer components than the Sealy process. The Company is in the process of ramping global production capabilities across its entire portfolio of products to meet heightened demand, but expects to continue experiencing capacity constraints on some Sealy bedding products in the U.S. through the third quarter of 2020.

https://seekingalpha.com/pr/17951765-tempur-sealy-reports-second-quarter-2020-results