The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

July 16, 2020

Serta Simmons Bedding Developing U.S.′ First Antiviral Mattress

today

ATLANTA, July 16, 2020 /PRNewswire/ — Serta Simmons Bedding (SSB) announced today that it is partnering with Switzerland-based HeiQ Group, a leader in textile innovation, to create the U.S. market’s first antiviral mattress.

The agreement gives SSB exclusive access within the U.S. bedding category to HeiQ Viroblock™ technology, which has previously been approved by the European Medical Device Directive for antiviral use in medical personal protective equipment such as N95 equivalent masks, and registered as an antiviral active by the German EPA. HeiQ Viroblock™ was recently independently tested as 99.99% effective in 30 minutes against SARS-CoV-2 by a leading Australian infection and immunity research institute. SSB plans to pursue any necessary approvals for its line of Serta and Beautyrest HeiQ Viroblock mattresses with the U.S. Food & Drug Administration and Environmental Protection Agency.

If approved, SSB plans to utilize HeiQ Viroblock across much of its industry-leading portfolio of brands, which includes Serta, Beautyrest and Tuft & Needle.

“We know that our partners in the hospitality and healthcare industries are doing everything they can to help provide the cleanest environment and reassure their guests,” said David Swift, chairman and CEO of Serta Simmons Bedding. “Antiviral and antibacterial mattresses will be an enormous asset in that effort.”

SSB, the largest provider of mattresses to the hospitality industry, has already received early interest to acquire HeiQ Viroblock-treated mattresses from several of the world’s largest hotel brands to bolster cleanliness and safety initiatives. Elie Khoury, EVP operations resources at Aimbridge Hospitality, the global leader in hotel management services said, “As the largest third-party manager we are proactively searching for the best opportunities to add value for our owners and enhance the experience for our guests. We are currently testing the new antiviral bedding and accessories from Serta Simmons and eager to understand the impact in helping our properties deliver the highest level of safety and cleanliness for guests.”

Here’s why HeiQ Viroblock represents such a breakthrough for the mattress industry: Virus particles and bacteria are invisible to the human eye (SARS-CoV-2 is only 90 nanometers large) and they easily pass through sheets. They can persist and stay infectious for days on textiles, such as traditional mattresses. HeiQ’s Viroblock technology solves that problem by using microsilver technology that attracts virus particles, combined with vesicle technology that breaks down the viral membrane within seconds. Tests conducted at the Peter Doherty Institute for Infection and Immunity showed that COVID-19-causing virus samples concentrated on fabric treated with HeiQ Viroblock were 99.99% reduced.

In accelerated aging tests, textiles infused with HeiQ Viroblock demonstrated the ability to retain their antiviral qualities for three years, and antibacterial qualities for 20 years.

Serta Simmons Bedding has been active in the fight against COVID-19 in other ways as well. In March, it announced it was donating 10,000 mattresses to hospitals in areas hard hit by the pandemic. A few weeks later it launched a platform in conjunction with Relief Bed International to facilitate further donations.

About Serta Simmons Bedding LLC

Serta Simmons Bedding, LLC is one of the largest manufacturers, marketers and suppliers of mattresses in North America. Based in Atlanta, SSB owns and manages two of the best-selling bedding brands in the mattress industry: Serta®, which has five other independent licensees, and Beautyrest®. The brands are distributed through national, hospitality, and regional and independent retail channels throughout North America. SSB also owns Simmons® and Tuft & Needle® direct-to-consumer mattress brands. SSB operates 27 plants in the U.S. and Canada. For more information about SSB and its brands, visit www.sertasimmons.com.

About HeiQ

Founded in 2005 as a spin-off from the Swiss Federal Institute of Technology Zurich (ETH), HeiQ is a leader in textile innovation creating some of the most effective, durable and high-performance textile technologies on the market today. HeiQ’s purpose is to improve the lives of billions of people by perfecting an everyday product: Textiles. Combining three areas of expertise – scientific research, specialty materials manufacturing and consumer ingredient branding – HeiQ is the ideal innovation partner to create differentiating and sustainable textile products and capture the added value at the point of sale. With a total capacity of 35,000 tons per year HeiQ manufactures in the USA, Switzerland and Australia serving its chemical specialties in over 60 countries worldwide. www.heiq.com

HeiQ & HeiQ Viroblock are trademark(s) or registered trademark(s) of HeiQ Materials AG.

View original content to download multimedia: http://www.prnewswire.com/news-releases/serta-simmons-bedding-developing-us-first-antiviral-mattress-301094461.html

SOURCE Serta Simmons Bedding, LLC

https://apnews.com/PR%20Newswire/7429fe85bf53e1fa936b550ad42e113c

July 16, 2020

US Retail Sales Soar In June Led By Clothing Demand

by Tyler Durden Thu, 07/16/2020 – 08:39

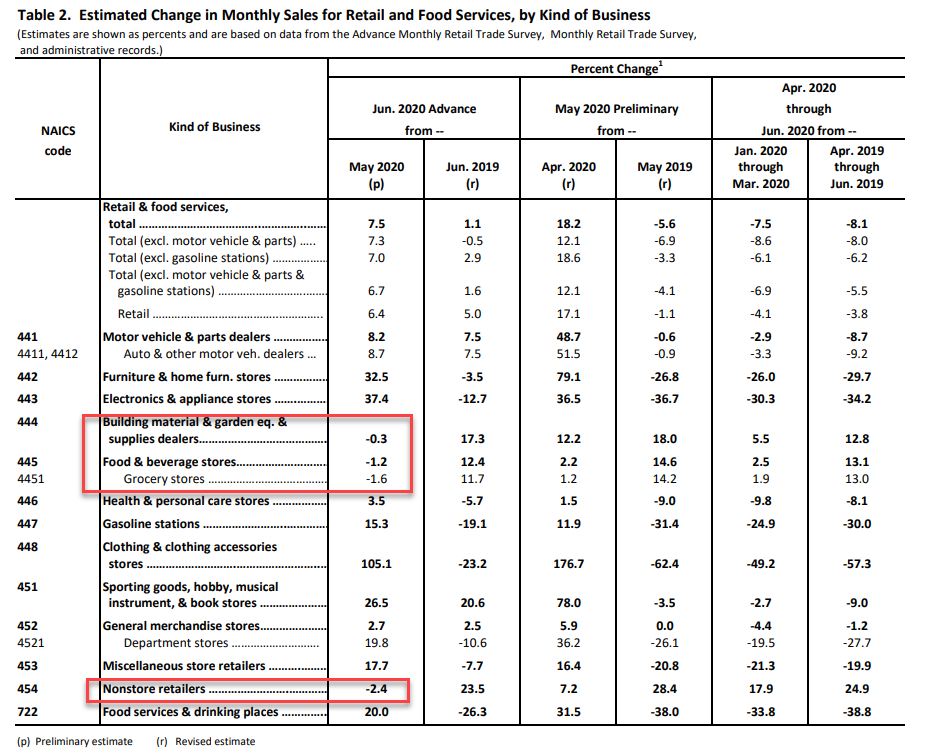

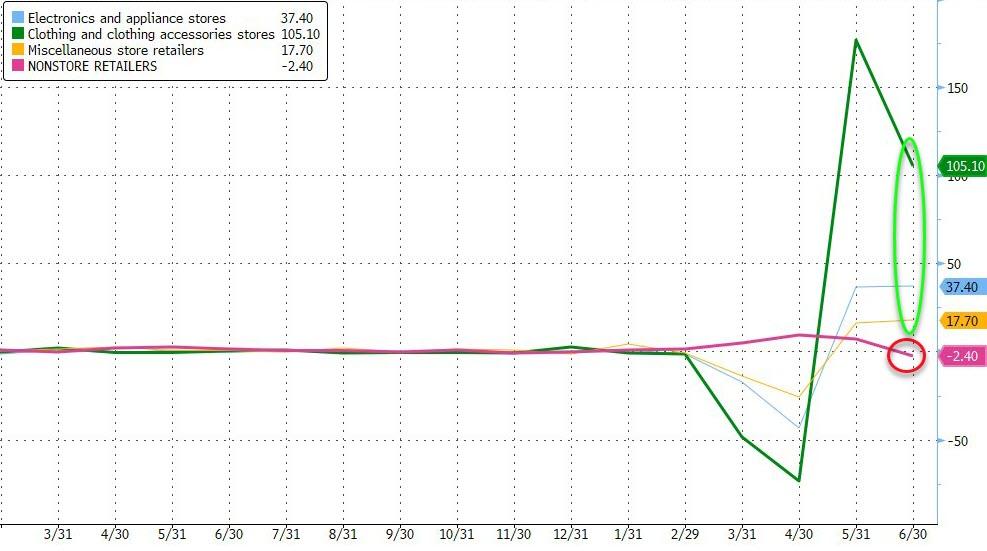

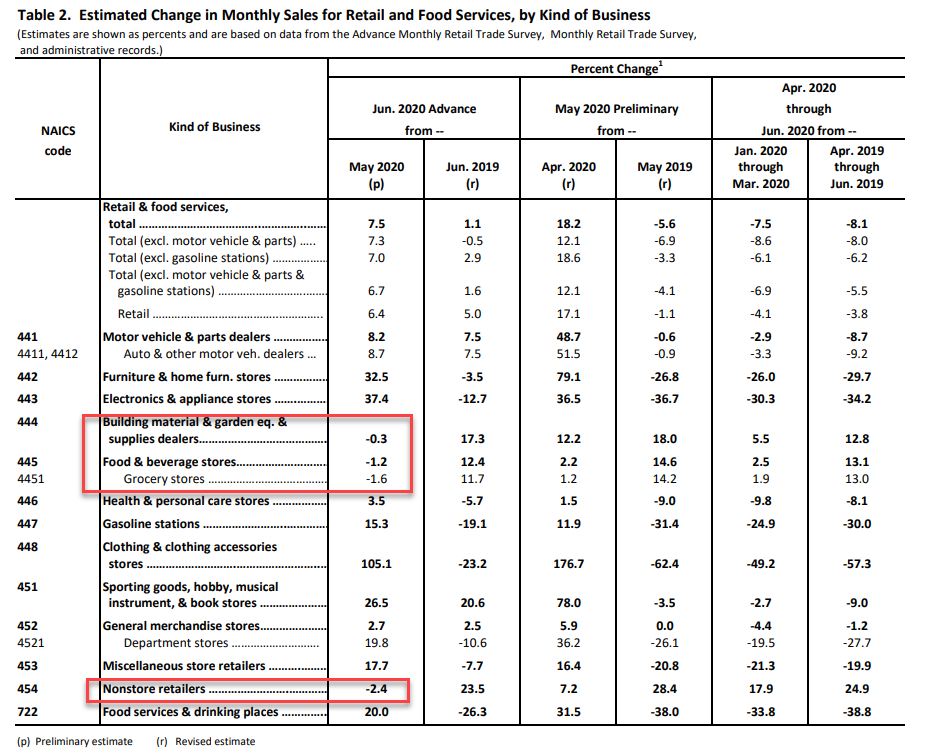

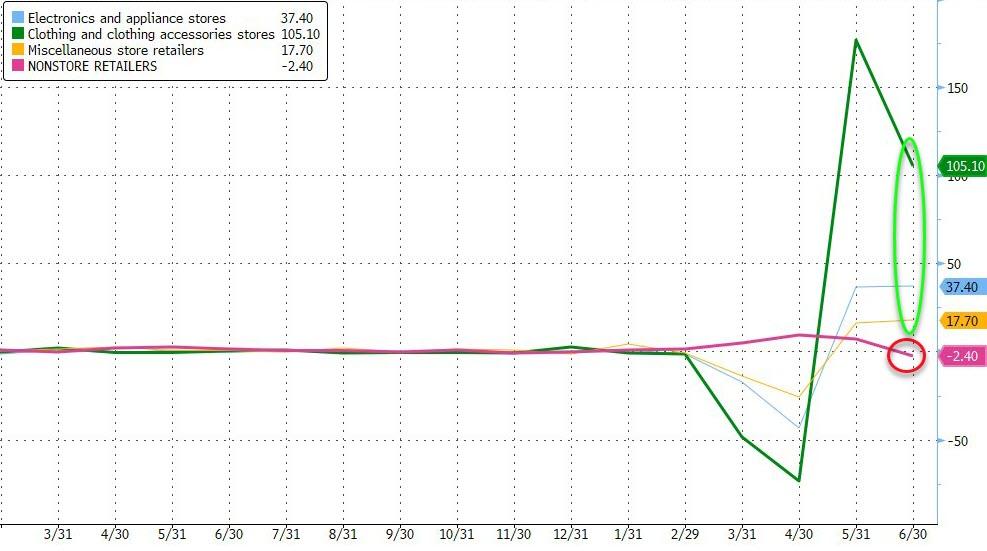

Following a disappointing contraction in Chinese retail sales overnight, US Retail Sales growth in June was expected to slow from its massive rebound spike in May and it did but still notably beat expectations (rising 7.5% MoM vs +5.0% MoM exp).

Source: Bloomberg

Everything was higher in retail sales with a 105% MoM spike in Clothing, except:

- Building materials and garden supplies -0.3%

- Food and beverage stores -1.2%

- Nonstore retailers -2.4%

This is the biggest drop in non-store retail sales (online) since Dec 2018’s collapse…

The “V” in Retail Sales is almost complete…

Source: Bloomberg

On a YoY basis, both the headline and GDP-driver Control Group are back into positive territory…

Source: Bloomberg

https://www.zerohedge.com/personal-finance/us-retail-sales-soar-june-led-clothing-demand

July 16, 2020

US Retail Sales Soar In June Led By Clothing Demand

by Tyler Durden Thu, 07/16/2020 – 08:39

Following a disappointing contraction in Chinese retail sales overnight, US Retail Sales growth in June was expected to slow from its massive rebound spike in May and it did but still notably beat expectations (rising 7.5% MoM vs +5.0% MoM exp).

Source: Bloomberg

Everything was higher in retail sales with a 105% MoM spike in Clothing, except:

- Building materials and garden supplies -0.3%

- Food and beverage stores -1.2%

- Nonstore retailers -2.4%

This is the biggest drop in non-store retail sales (online) since Dec 2018’s collapse…

The “V” in Retail Sales is almost complete…

Source: Bloomberg

On a YoY basis, both the headline and GDP-driver Control Group are back into positive territory…

Source: Bloomberg

https://www.zerohedge.com/personal-finance/us-retail-sales-soar-june-led-clothing-demand

July 15, 2020

US Industrial Output Surges by Most Since 1959 on Reopening

A worker welds a lawnmower frame. (Luke Sharrett/Bloomberg News)

A worker welds a lawnmower frame. (Luke Sharrett/Bloomberg News)

U.S. industrial production in June posted the largest monthly gain since 1959, indicating manufacturing is stirring to life after coronavirus-related shutdowns.

Total output at factories, mines and utilities increased 5.4% from the prior month after climbing 1.4% in May, Federal Reserve data showed July 15. The median projection in a Bloomberg survey of economists called for a 4.3% advance. Factory output jumped 7.2%, the biggest gain since 1946.

The outsize rebound in production still leaves the Fed’s index of industrial output 10.9% below pre-pandemic levels and the capacity utilization rate shows plenty of slack as demand builds only gradually. What’s more, sales may be tempered in coming months as reopenings have entered a more uncertain phase, with states like California imposing renewed lockdown measures.

Total production was boosted by a robust upturn in “manufacturing output as producers, particularly in the auto sector, reopened factories to catch up with the surprisingly strong initial rebound in consumption,” Michael Pearce, senior U.S. economist at Capital Economics, said in a note. “With high-frequency indicators suggesting the latter is now losing pace, future gains in production look set to be more muted too.”

In the second quarter, industrial production fell an annualized 42.6%, the biggest setback in the post World War II era.

Capacity utilization, which measures the amount of a plant in use, increased to 68.6% from a revised 65.1% in May; it was 76.8% in February. Extra capacity can weigh on corporate profits because business capital is underutilized, and it also signals a sluggish capital spending outlook.

The increase in factory output was led largely by vehicle and parts output, which surged 105%. Excluding auto production, factory output rose 3.9% as all major industries registered gains for the month.

The Fed’s report showed utility output increased 4.2%, while mining dropped 2.9%, the fifth straight monthly decrease. Oil and gas well drilling declined 18% after a 36.9% slide a month earlier. Drilling is down a whopping 70% from a year earlier after a slump in oil prices several months ago prompted cutbacks in exploration.

https://www.ttnews.com/articles/us-industrial-output-surges-most-1959-reopening

July 15, 2020

US Industrial Output Surges by Most Since 1959 on Reopening

A worker welds a lawnmower frame. (Luke Sharrett/Bloomberg News)

A worker welds a lawnmower frame. (Luke Sharrett/Bloomberg News)

U.S. industrial production in June posted the largest monthly gain since 1959, indicating manufacturing is stirring to life after coronavirus-related shutdowns.

Total output at factories, mines and utilities increased 5.4% from the prior month after climbing 1.4% in May, Federal Reserve data showed July 15. The median projection in a Bloomberg survey of economists called for a 4.3% advance. Factory output jumped 7.2%, the biggest gain since 1946.

The outsize rebound in production still leaves the Fed’s index of industrial output 10.9% below pre-pandemic levels and the capacity utilization rate shows plenty of slack as demand builds only gradually. What’s more, sales may be tempered in coming months as reopenings have entered a more uncertain phase, with states like California imposing renewed lockdown measures.

Total production was boosted by a robust upturn in “manufacturing output as producers, particularly in the auto sector, reopened factories to catch up with the surprisingly strong initial rebound in consumption,” Michael Pearce, senior U.S. economist at Capital Economics, said in a note. “With high-frequency indicators suggesting the latter is now losing pace, future gains in production look set to be more muted too.”

In the second quarter, industrial production fell an annualized 42.6%, the biggest setback in the post World War II era.

Capacity utilization, which measures the amount of a plant in use, increased to 68.6% from a revised 65.1% in May; it was 76.8% in February. Extra capacity can weigh on corporate profits because business capital is underutilized, and it also signals a sluggish capital spending outlook.

The increase in factory output was led largely by vehicle and parts output, which surged 105%. Excluding auto production, factory output rose 3.9% as all major industries registered gains for the month.

The Fed’s report showed utility output increased 4.2%, while mining dropped 2.9%, the fifth straight monthly decrease. Oil and gas well drilling declined 18% after a 36.9% slide a month earlier. Drilling is down a whopping 70% from a year earlier after a slump in oil prices several months ago prompted cutbacks in exploration.

https://www.ttnews.com/articles/us-industrial-output-surges-most-1959-reopening