Gone are the days of flopping onto mattress after mattress in a stuffy showroom floor.

Online mattress companies that ship to your front door say that finding the perfect bed might just take a few clicks. But experts warn that it’s important to look beneath the sheets. They say many mattresses being sold are actually very similar — despite how they’re marketed.

“The products that you’re buying — there are many similarities and only some minor differences,” said Seth Basham, an analyst at Wedbush Securities who covers the mattress industry. He said that the core of the mattresses at different companies often use the same foam. “The different layers — what goes on top of what, can differ. But the big difference is how they’re being sold and marketed.”

There are now around 175 bed-in-a-box companies in business, estimated Michael Magnuson, founder of mattress review site GoodBed.com. Their sales account for 12% of the $16.5 billion mattress industry, though only the top 10 companies make a significant dent, according to Basham. Among the major players are brands like Purple, Casper, Nectar, Leesa, and Tuft & Needle.

Mattress giants like Tempur Sealy and Serta Simmons should be nervous, said Peter Keith, an analyst at Piper Jaffray. Sales units on average at those companies have been down 5% over the past two years.

A survey by the International Sleep Products Association reported that 45% of mattresses purchased in last year were online, up from 35% for purchases in 2017.

Purple is the only public bed-in-a-box company, after it merged with a public investment shell company in 2018 at a valuation of $1.1 billion. Its stock has dropped 40% since the merger, and the company is currently valued at $355 million. Like many other bed-in-a-box companies, according to Basham, Purple has not yet seen a profit. In 2018, the company made $285 million in sales, and reported a net loss of $19.6 million.

Profit is hard to come by because the ease of forming an online mattress company makes the market competitive, according to Basham. “Barriers to entry are low, but barriers to profitability are high,” he said. “It doesn’t take that much to design a mattress, a marketing campaign, put up a website, and have one of these big companies like Carpenter do the fulfillment for you,” he said, referring to one of the key mattress manufacturing companies.

Manufacturing ease

The majority of bed-in-a-boxes outsource their manufacturing, according to Magnuson from GoodBed.com. “None of these guys, with a few rare exceptions, make their own mattresses,” he said. “They’re literally calling around to producers saying, ‘we need a finished product and here’s what we think it should look like.’ Sometimes, they don’t even know what they want it to look like.”

The companies that make their own mattresses include Brentwood Home, Brooklyn Bedding and Purple, Magnuson said. Many of the bigger bed-in-a-boxes do the research and development of the mattresses themselves, which differentiate how they feel. And companies like Tuft & Needle, Casper and Leesa have layers of foam with proprietary formulas, which means they’re not the same as others.

Most of the outsourcing is to just four major manufacturers, according to Dan Schecter, senior vice president of sales and marketing at Carpenter. He said his company makes mattresses for 40% of the mattress industry at 60 factories throughout the country. That includes including roughly 14 bed-in-a-box brands, along with all the traditional players like Tempur Sealy.

“The customer comes to us … they say they want a mattress that does these things against the body, and they would like to have these features and advantages as part of their marketing story. We then create the mattresses that dovetail with what their vision is,” he said.

Layla CEO Akrum Sheikh said companies that manufacture their own products are “at a disadvantage as they may find themselves being limited to the use of their own technologies and capabilities.”

“In order for Layla customers to truly benefit from the product, we believe in a business model that combines utilizing licensed technology and abilities from multiple manufactures combined with our own proprietary inventions bundled up into one superior product,” Sheikh said. “This model allows us to innovate and create without restrictions.”

Schecter said the mattresses produced by Carpenter do not have the same foam formulations, and that the company only agrees to design and manufacture mattresses that are backed by science.

Purple emphasizes the science behind its mattresses, especially its “Smart Comfort Grid” layer, which it says helps to relieve pressure on your body during sleep. Eight Sleep is another company that’s technology-oriented, and touts its mattresses’ dual temperature control and sleep tracking app.

Innovations like these are helping brands to differentiate themselves, according to Keith.

“For a while there were a lot of similarities, but you’re starting to see the bigger companies diversifying their offerings,” he said. For example, some brands are now selling luxury and cheaper versions, or hybrid models that include both foam and springs.

Marketing confusion

But all the different offerings might just overwhelm consumers, said David Srere, co-CEO of branding agency Siegel+Gale.

“It’s the amount of information. There’s just too much,” he said. “If you go online, not only do all of them look alike, but they’re all talking about their different products. If I tell you that my mattress is special because it’s infused with copper gel, does it mean anything to you?”

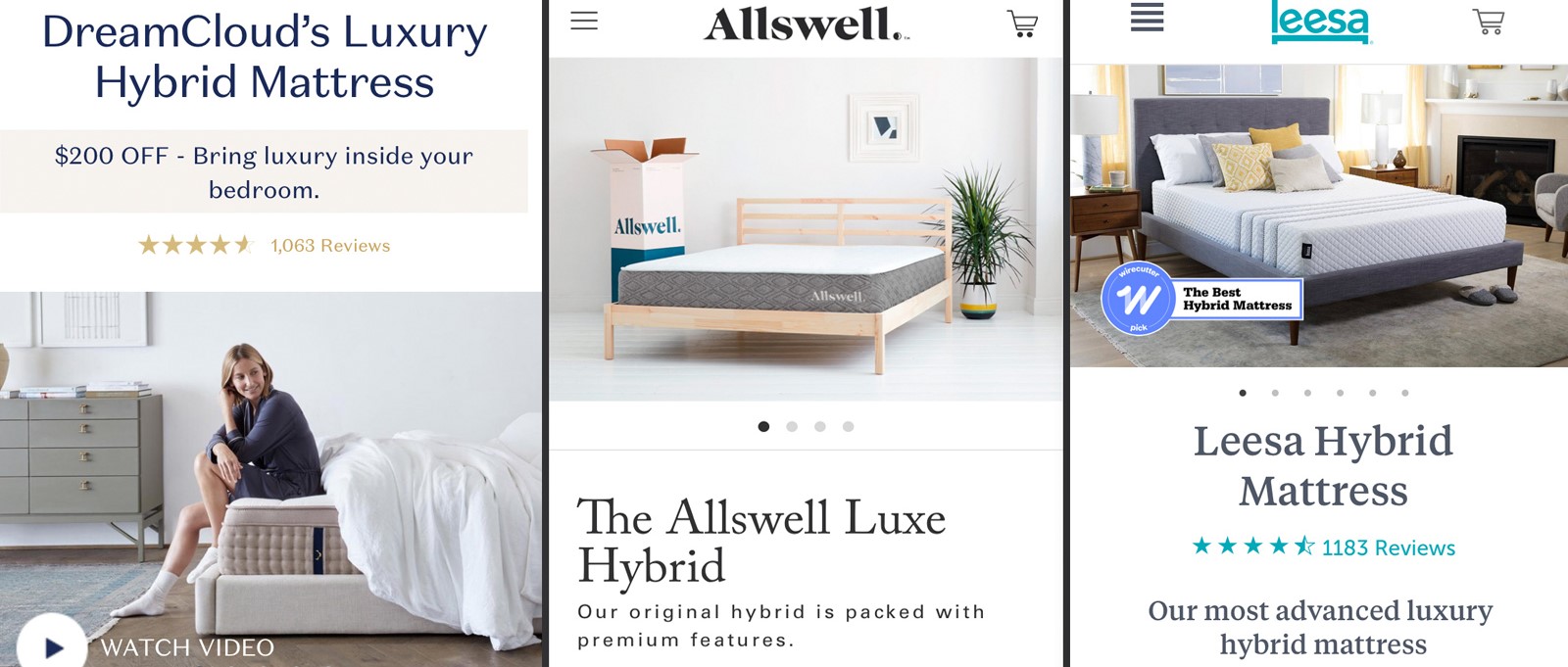

Layla, Sleep Science and Propel by Brooklyn Bedding all sell copper-infused mattresses. DreamCloud, Leesa, and Walmart-owned Allswell are just some of the brands offering hybrid mattresses.

Brentwood Home and Sleep Science were not immediately available for comment.

And the sameness between companies applies to their marketing and brand identities, too, according to Armin Vit, co-founder of graphic design firm UnderConsideration. He sees resemblances in the companies’ colors, fonts and advertising messages. “You can see a similar approach,” he said. “In my mind, Casper was the first, so I think they sort of set the tone. They did well, and others followed.”

Casper, which was founded in 2014, was among the first bed-in-a-box company to gain widespread recognition. Their logo, which is navy blue with a sans-serif font, has similarities with Leesa’s, launched in 2015, Nectar’s, which was founded in 2016, and Purple’s, also formed in 2016.

Vit said that the likeness of the logos and marketing might be intentional. “The goal is for something to look familiar,” he said, because there’s a chance consumers will mix up someone’s mattress recommendation with another company’s.

“It’s not ideal, it’s not the most creative or authentic thing to do, but it’s kind of like getting sales and getting customers with confusion in the marketplace.”

Each companies’ messaging isn’t much better. For example, Casper says its memory foam mattresses is for “those who want a ‘just right’ feel whether you sleep on your back, side or stomach,” while the Nectar’s mattress firmness is also “just right” and provides “optimal comfort and support — whether you sleep on your front, back, or side.”

Vit said, “There’s a certain comfort in doing what the successful company’s doing. Someone takes the lead and everyone else says, ‘Hey, that seems good, let’s go there.’ It’s not exciting, but it’s sort of smart.”

https://www.cnbc.com/2019/08/18/there-are-now-175-online-mattress-companiesand-you-cant-tell-them-apart.html